Rates

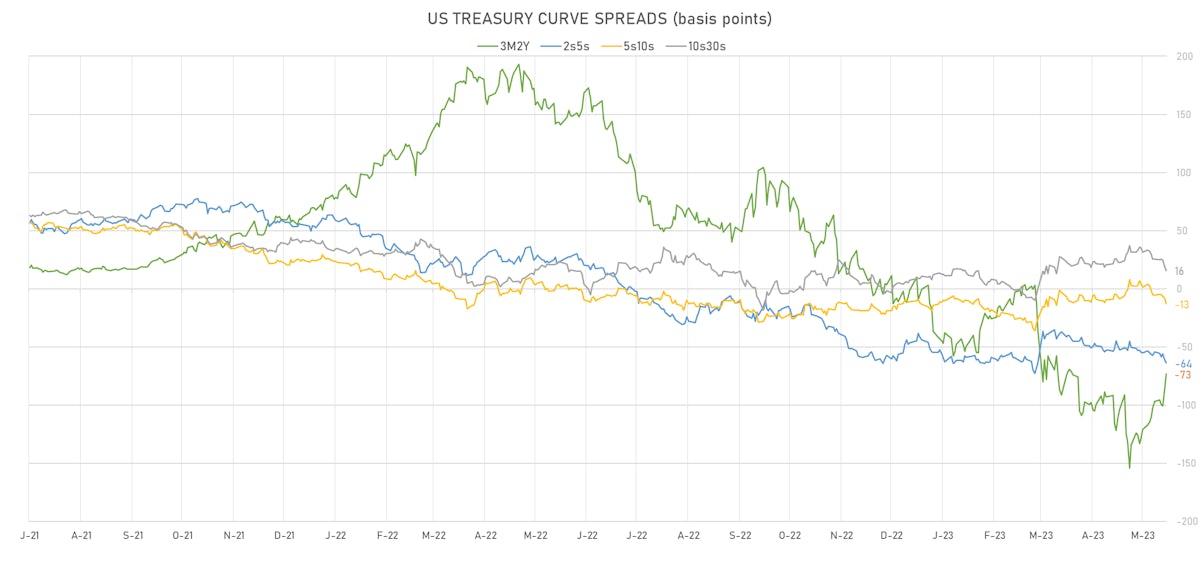

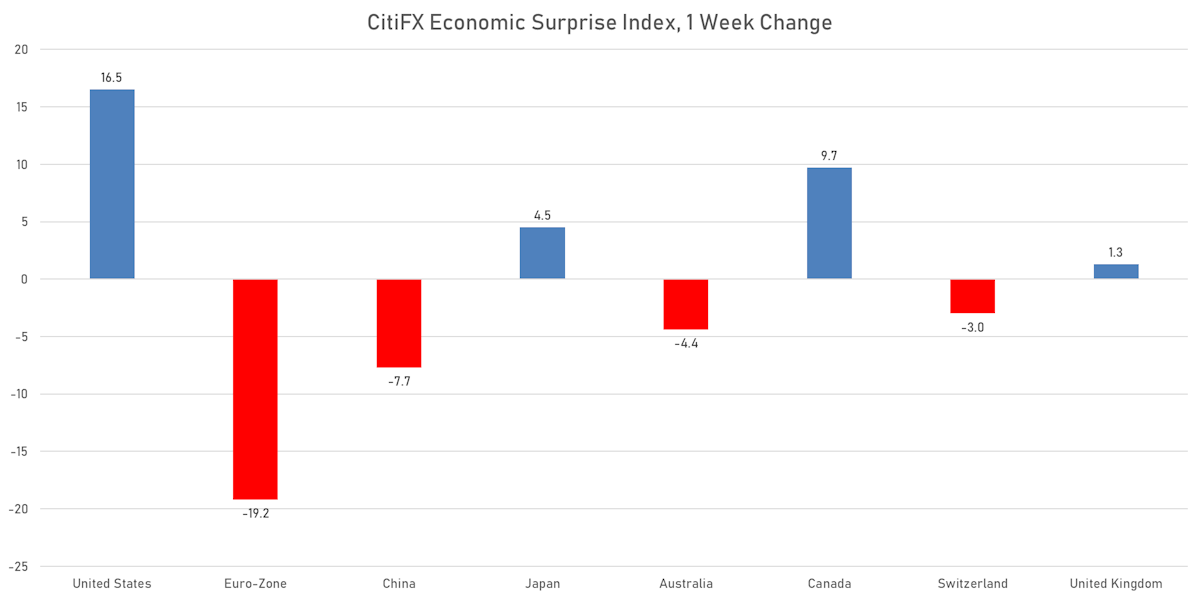

Sizable Bear Flattening Of US Yield Curve Over The Past Week, As Economic Data Surprises To The Upside

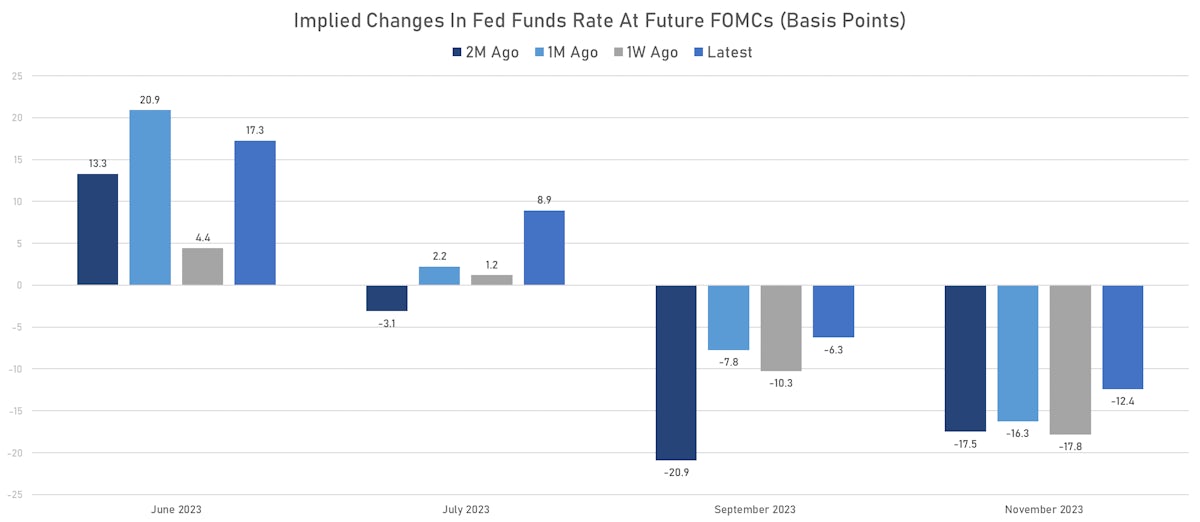

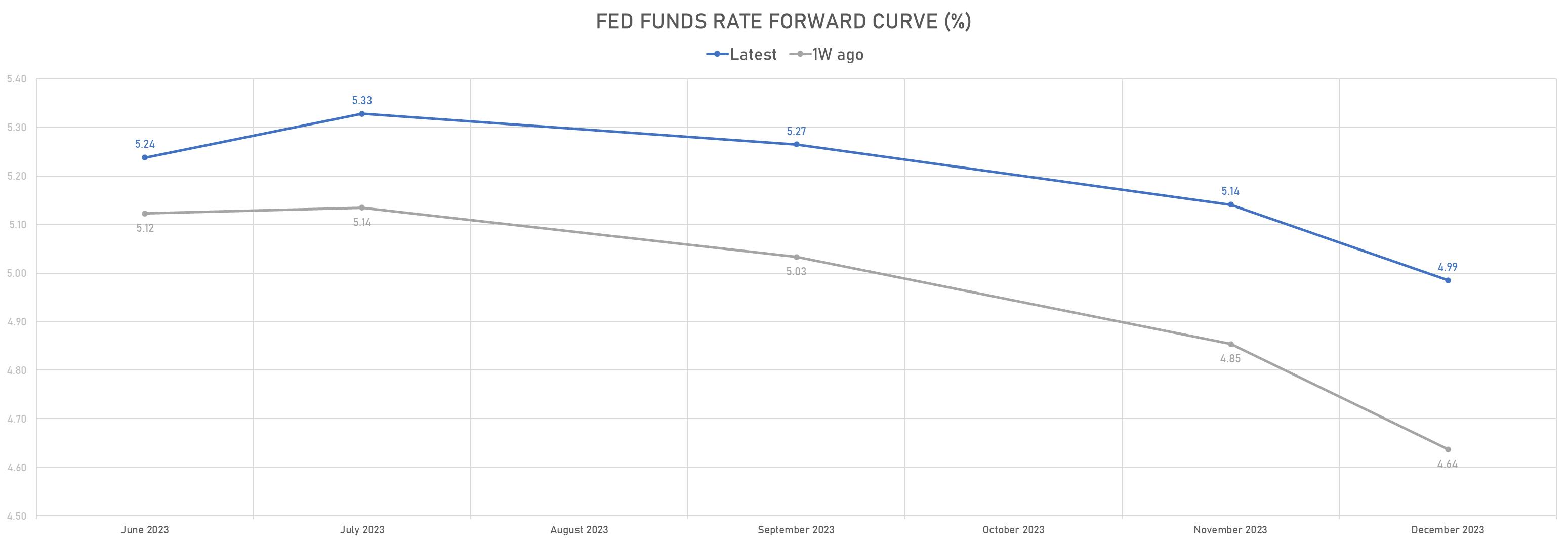

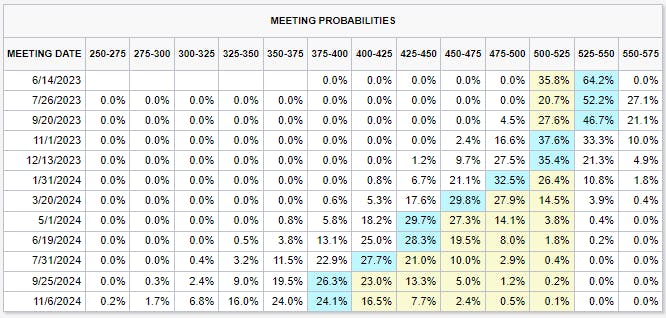

Against market expectations (based on the Fed's dovish forward guidance), the June FOMC is back in play, with about 2/3 chance of a 25bp hike now priced in

Published ET

Weekly Changes in CitiFX Economic Surprise Indices | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK

- June and July are firmly back in play, with one hike priced in for both meetings (cumulatively)

- The forward inversion is getting smaller, with just 35bp of cuts now priced in (vs 50bp last week)

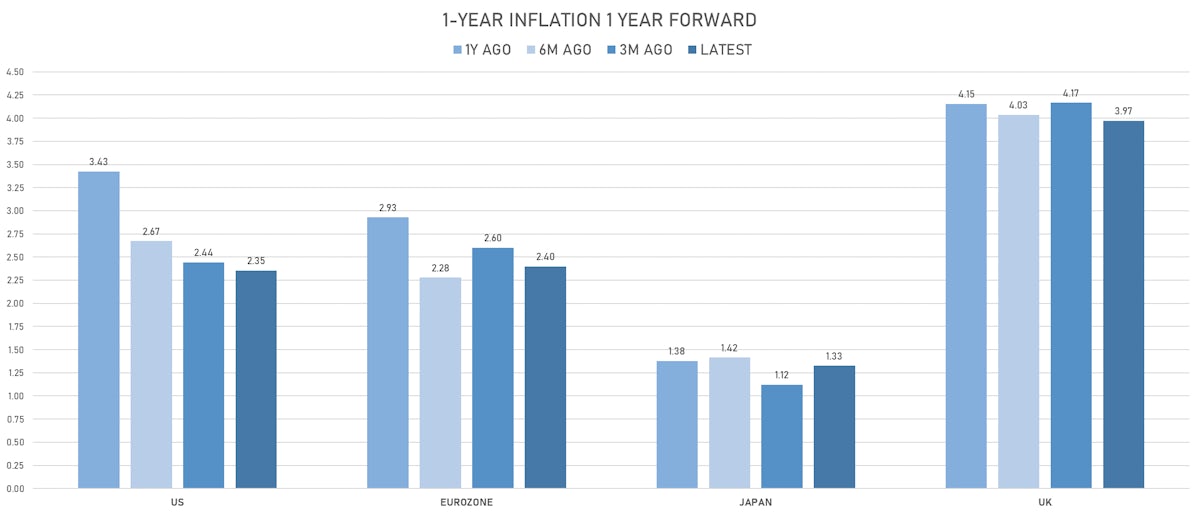

- US economic data has proved much more resilient than expected: 1Q GDP revised upward, core PCE inflation revised upward, April core PCE hotter than consensus expectations, home builders and home sales at strongest levels in a year, CAPEX stronger than expected, jobless claims and continuing claims are falling

- Bullard reset expectations by putting 2 more hikes on the table, with Mester adding that "progress on inflation is slow, concerning" after the PCE print on Friday

- With critical data still to come before the June FOMC (NFP on Friday this week and CPI on 13 June), we could see some more volatility, but the market feels fairly priced: now that the debt ceiling deal is done, a beat in nonfarm payrolls would solidify a June hike

Implied probabilities for Fed Funds rate at future FOMCs | Source: CME Quickstrike

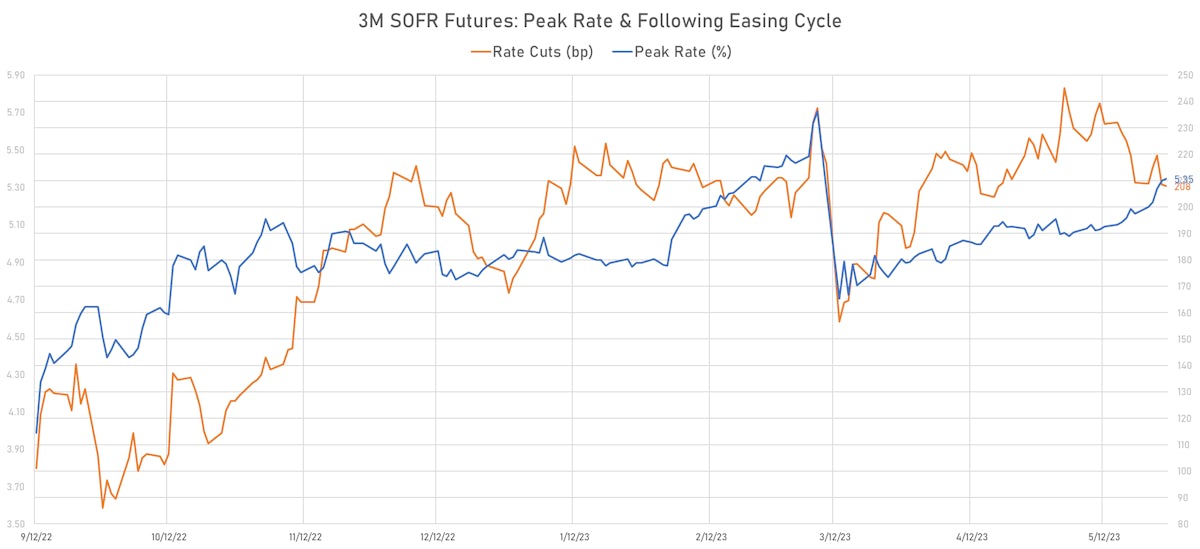

- Looking towards the actual meeting, the important thing is that we will get updated economic projections, which could change the end game priced in the market. When all is said and done, it wouldn't be too surprising to see a 6 handle on the peak Fed Funds rate later this year (people like Jason Furman or Larry Summers have been talking about that for a while).

- The projections obviously won't show anything that high, but they should be much less pessimistic about a recession than the ones we saw in March during the regional banking crisis

- For now, the pain trade is still for rates to reprice higher, with much of the market still focused on the timing of the next recession (rather than the possibility that we could avoid one, with the neutral rate perhaps much higher than currently believed)

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -10.6 bp, now at -143.6 bp (YTD change: -60.2bp)

- 1Y: 5.2449% (up 23.4 bp)

- 2Y: 4.5672% (up 29.1 bp)

- 5Y: 3.9359% (up 19.8 bp)

- 7Y: 3.8760% (up 15.9 bp)

- 10Y: 3.8090% (up 12.8 bp)

- 30Y: 3.9687% (up 3.4 bp)

- US treasury curve spreads: 3m2Y at -75.1bp (up 25.6bp this week), 2s5s at -63.1bp (down -9.7bp), 5s10s at -12.7bp (down -7.2bp), 10s30s at 16.0bp (down -9.3bp)

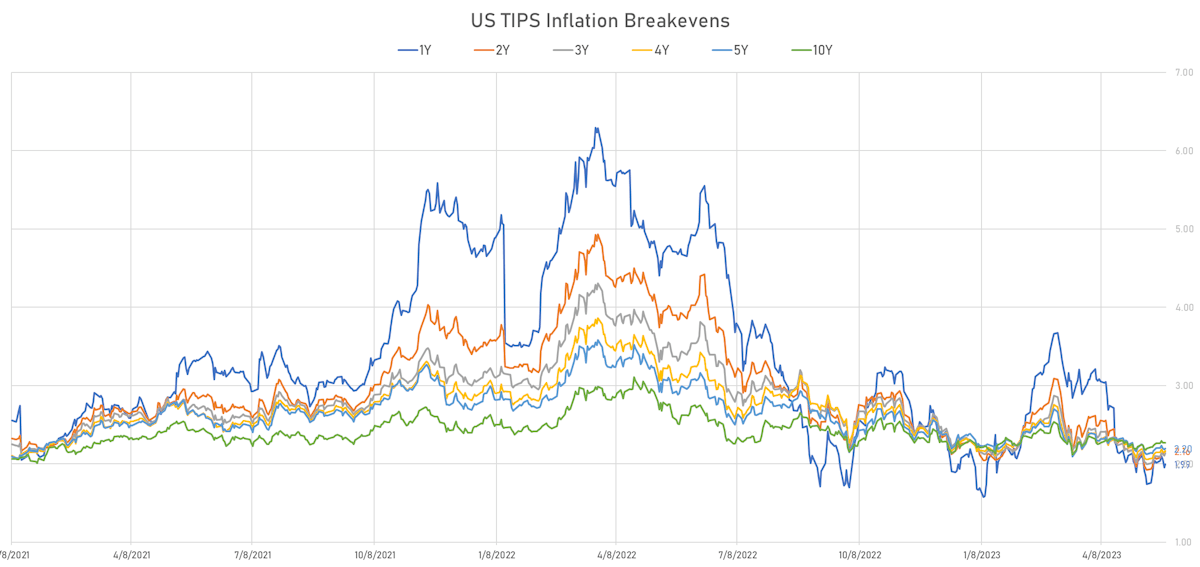

- US 5Y TIPS inflation breakeven at 2.19% down 0.2bp; 10Y breakeven at 2.26% up 1.3bp; 30Y breakeven at 2.33% up 3.7bp

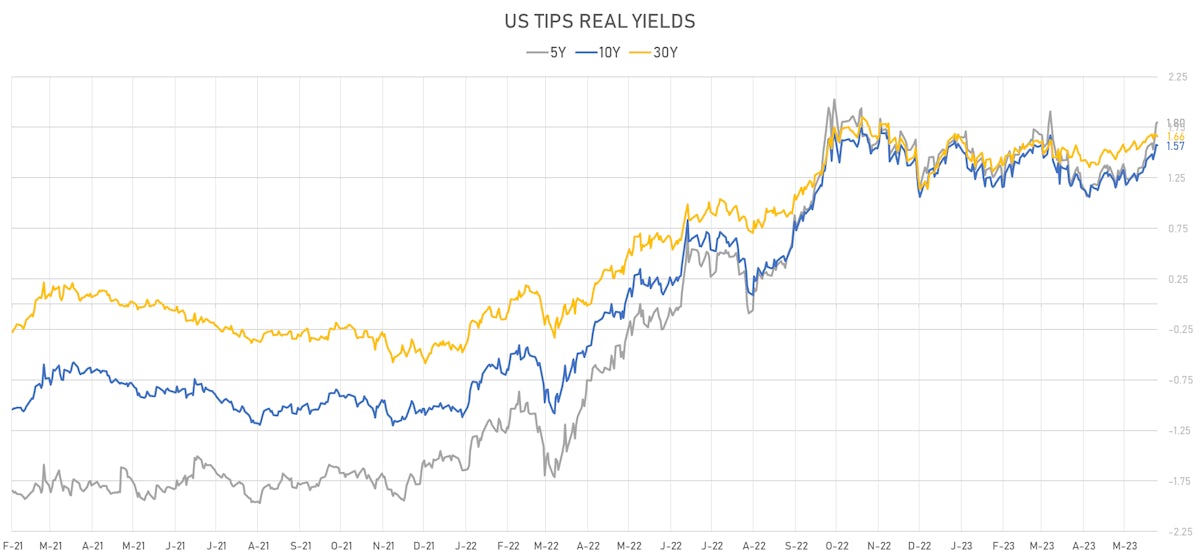

- US 5-Year TIPS Real Yield: +23.8 bp at 1.7990%; 10-Year TIPS Real Yield: +12.6 bp at 1.5710%; 30-Year TIPS Real Yield: +0.9 bp at 1.6620%

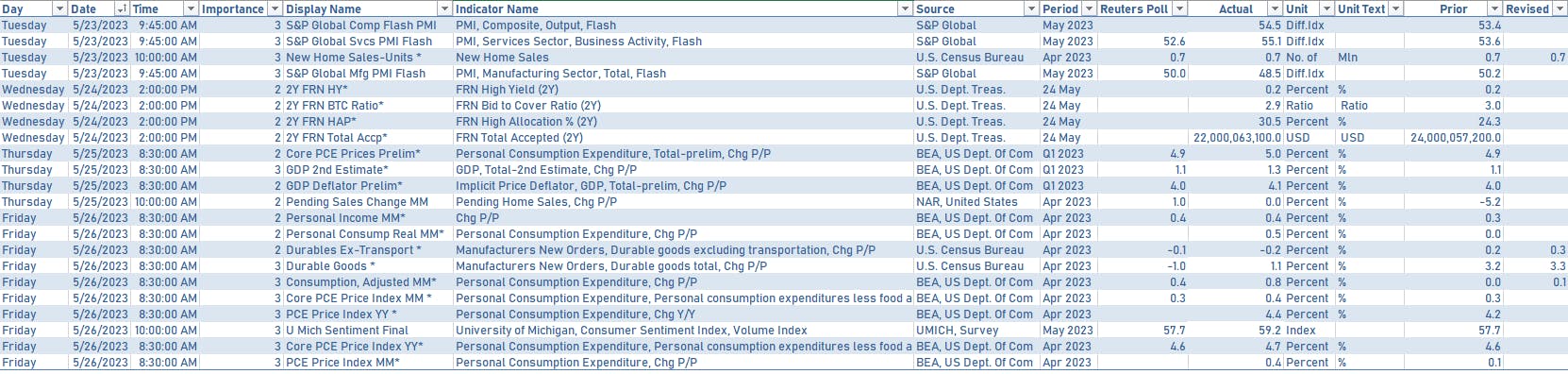

US ECONOMIC DATA OVER THE PAST WEEK

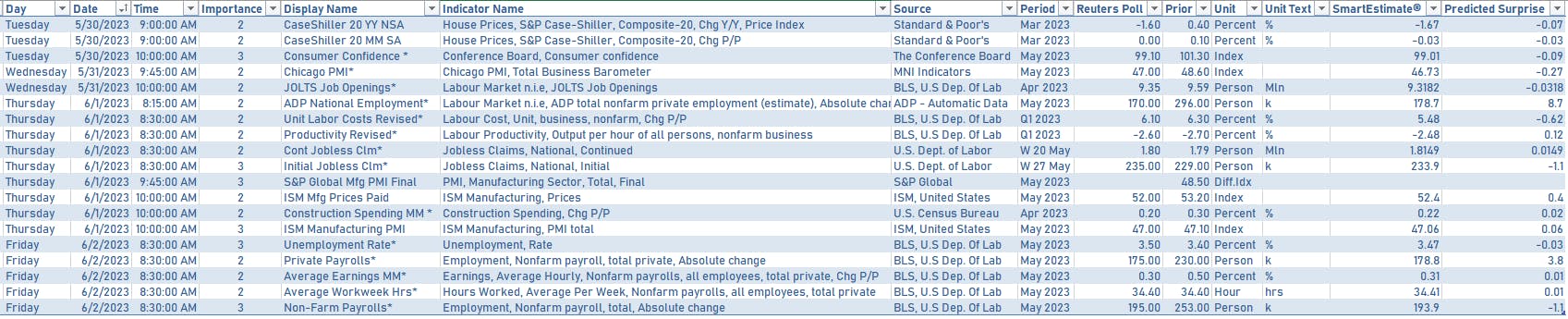

US MACRO RELEASES IN THE WEEK AHEAD

- Focus next week will be on the May employment report, ISM manufacturing, consumer confidence, and on scheduled remarks from several FOMC voting members

FED SPEAKERS IN THE WEEK AHEAD

- Tuesday 1:00PM: Richmond Fed President Barkin

- Wednesday 8:50AM: Boston Fed President Collins and Fed Governor Bowman

- Wednesday 12:30PM: Boston Fed President Collins

- Wednesday 12:30PM: Philadelphia Fed President Harker

- Wednesday 1:30PM: Fed Governor Jefferson

- Thursday 1:00PM: Philadelphia Fed President Harker

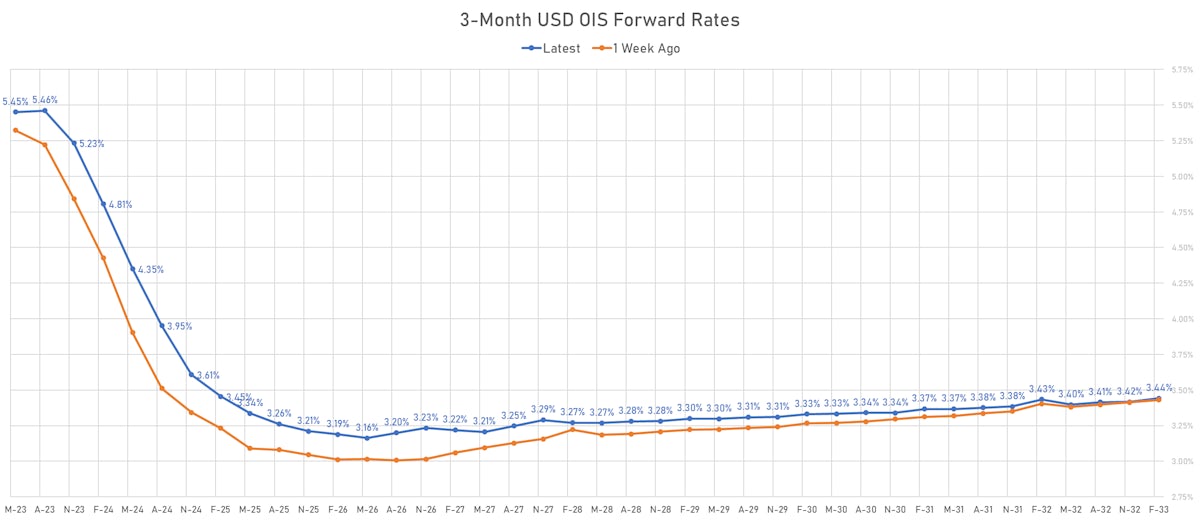

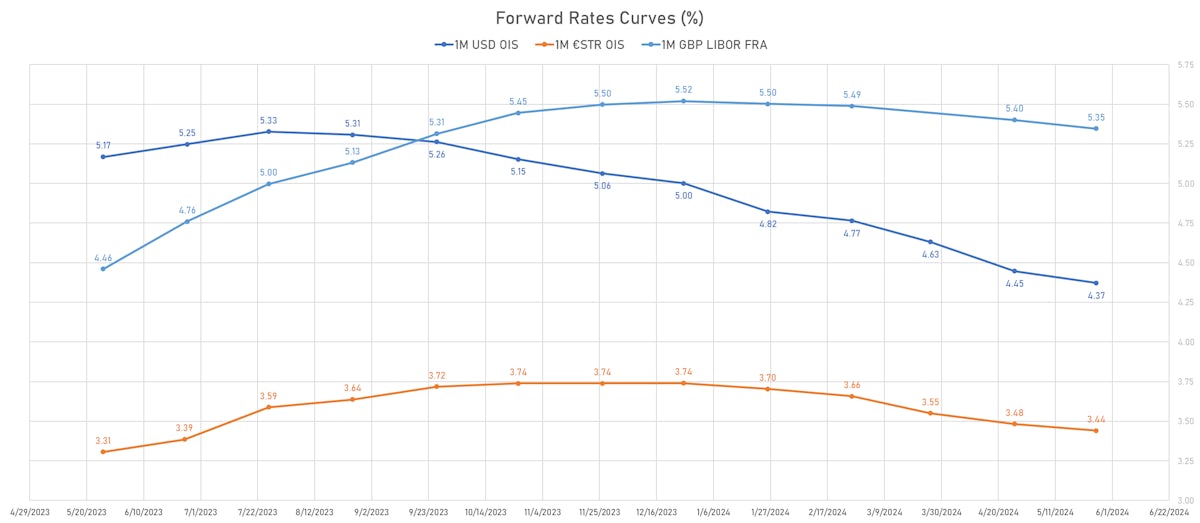

US FORWARD RATES

- Fed Funds futures now price in 17.3bp of Fed hikes by the end of June 2023, 26.2bp (1.0 x 25bp hikes) by the end of July 2023, and rate cuts starting in September 2023

- Implied yields on 3-month SOFR futures top out at 5.35% for the October 2023 expiry and price in 206bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 1.99% (up 4.4bp); 2Y at 2.16% (up 3.6bp); 5Y at 2.20% (up 1.3bp); 10Y at 2.27% (down -0.4bp); 30Y at 2.33% (down -1.0bp)

- 6-month spot US CPI swap up 3.7 bp to 2.601%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.7990%, +1.1 bp today; 10Y at 1.5710%, -0.6 bp today; 30Y at 1.6620%, -1.3 bp today

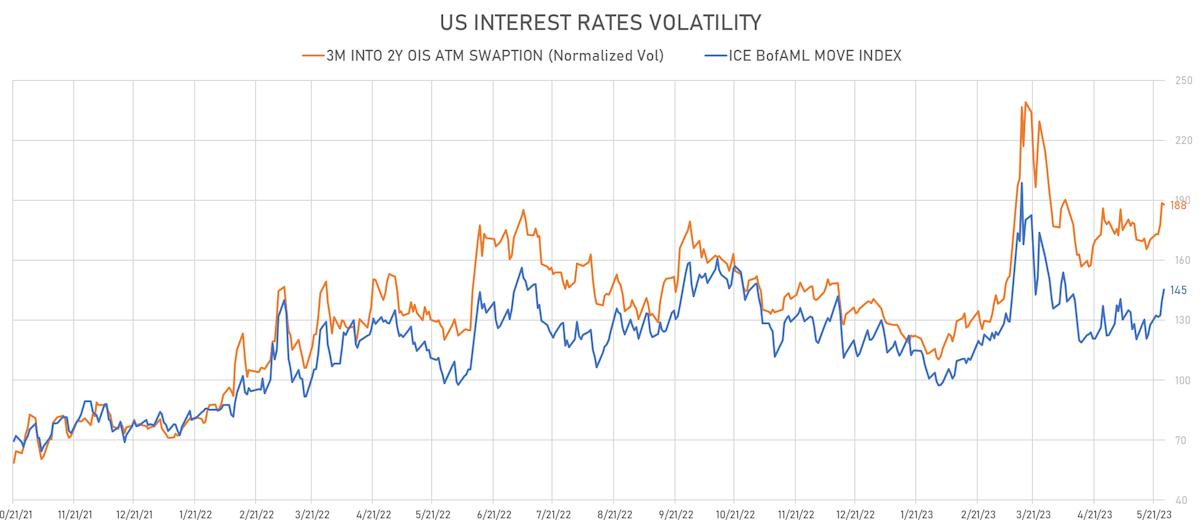

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 5.5 vols at 184.9 normals

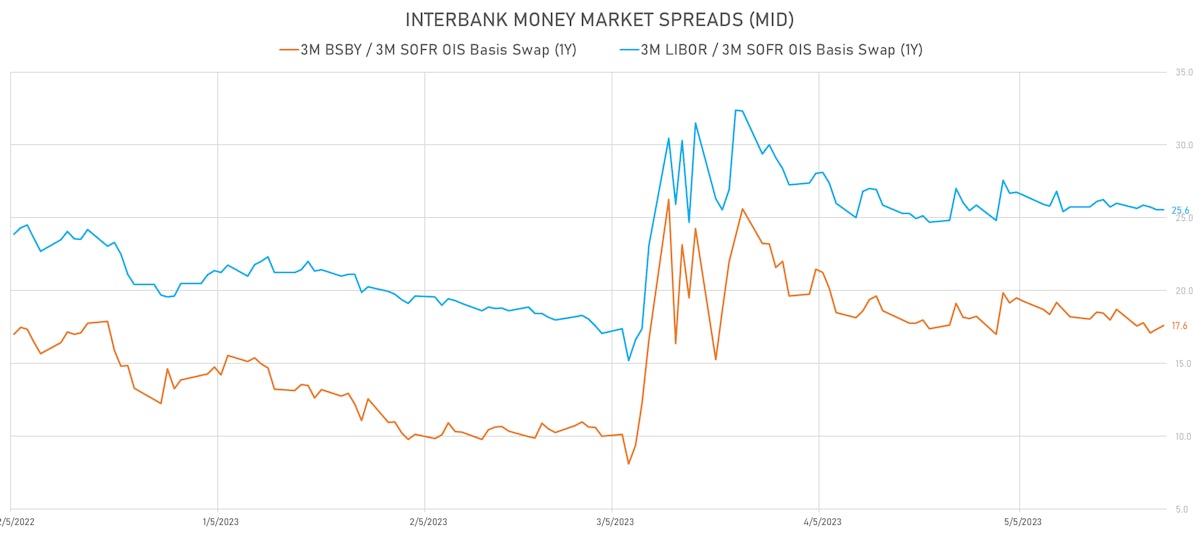

- 3-Month LIBOR-OIS spread down -0.3 bp at 19.5 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.531% (up 5.5 bp); the German 1Y-10Y curve is 2.8 bp steeper at -72.3bp (YTD change: -69.4 bp)

- Japan 5Y: 0.105% (down -1.1 bp); the Japanese 1Y-10Y curve is 0.7 bp flatter at 54.3bp (YTD change: +13.6 bp)

- China 5Y: 2.506% (up 1.7 bp); the Chinese 1Y-10Y curve is 1.5 bp steeper at 77.2bp (YTD change: +3.6 bp)

- Switzerland 5Y: 1.057% (up 2.6 bp); the Swiss 1Y-10Y curve is 8.3 bp steeper at -64.2bp (YTD change: -70.5 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +11.3 bp at 164.7 bp (Weekly change: +16.3 bp; YTD change: -8.9 bp)

- US-JAPAN: +10.6 bp at 465.4 bp (Weekly change: +32.2 bp; YTD change: +26.1 bp)

- US-CHINA: +2.5 bp at 235.1 bp (Weekly change: +32.5 bp; YTD change: +16.8 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: unchanged at 147.4 bp (Weekly change: +12.6bp; YTD change: +18.6bp)

- US-JAPAN: +3.9 bp at 226.6 bp (Weekly change: +30.6bp; YTD change: +22.7bp)

- GERMANY-JAPAN: +3.9 bp at 79.2 bp (Weekly change: +18.0bp; YTD change: +4.1bp)