The FOMC This Week Should Show A Patient Fed, Willing To Wait Until July For The Next Hike

US economic data has been consistently better than expected, and so far the credit impact from the regional financial crisis has been mininal, but Fed's leaders have expressed a desire to wait for more clarity before hiking further

Published ET

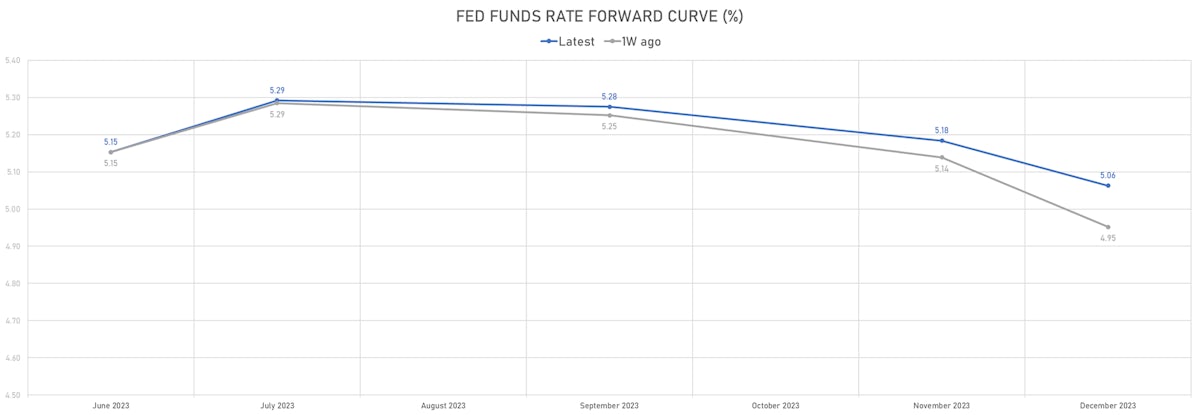

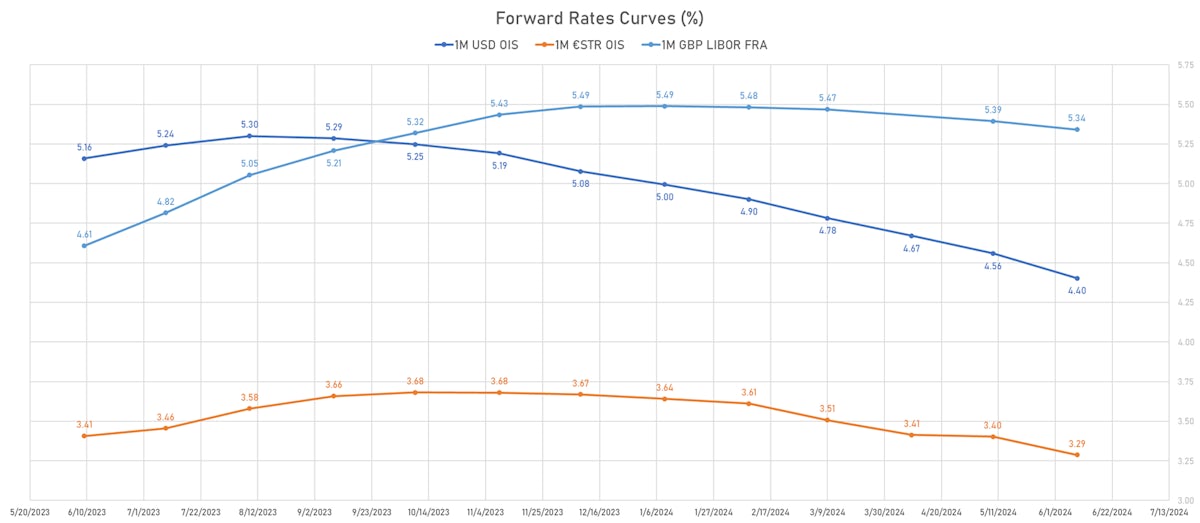

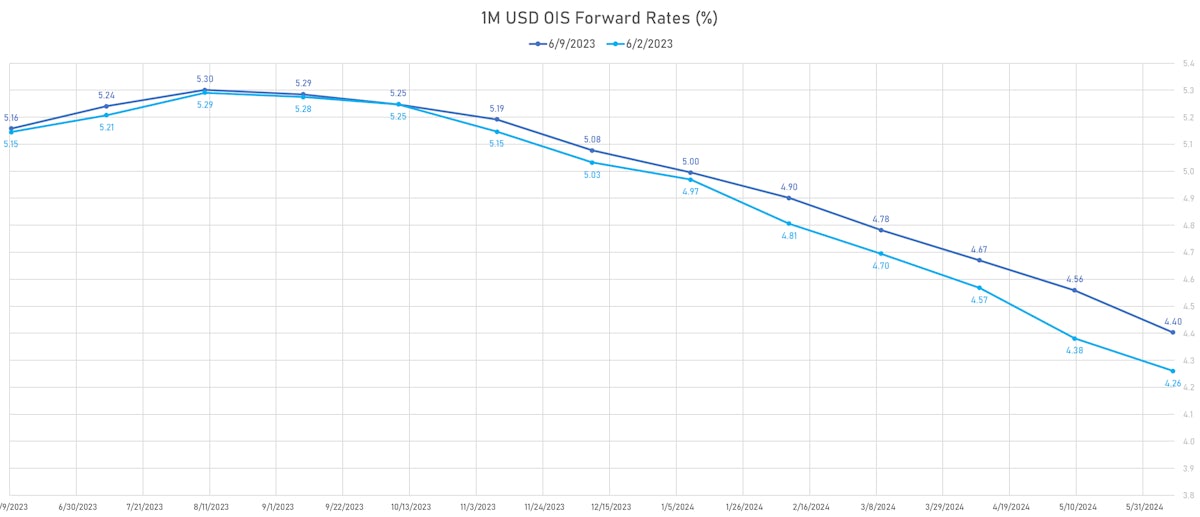

1M USD OIS Forward Rates | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK: JUNE '23 FOMC PREVIEW

- The outcome of this week's FOMC has been well telegraphed by the Fed leadership: a hold / skip

- There is about a 30% chance of a 25bp hike priced in, a premium that is unlikely to pay unless we see an extremely strong CPI surprise on Tuesday

- With 21bp priced in June & July cumulatively, a hike in July is currently the clear market expectation, and the Fed will need to be careful not to sound too dovish

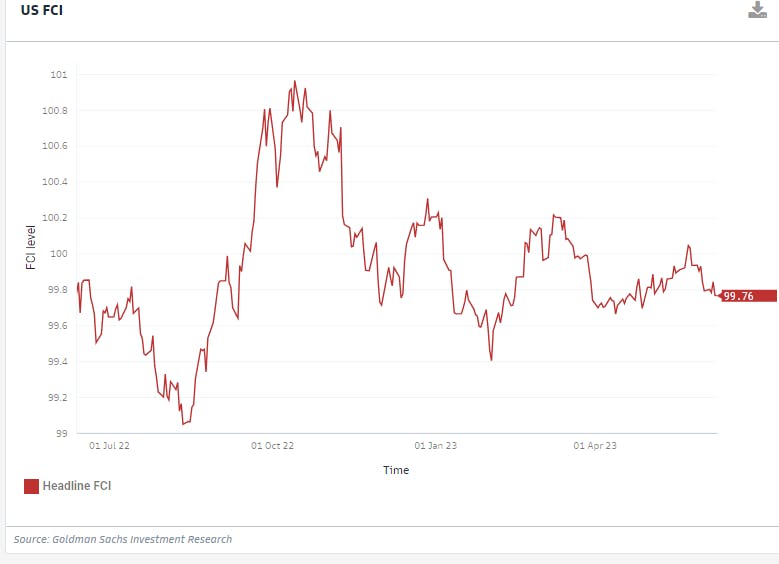

- Despite continued strength in economic data, and elevated inflation, US financial conditions have loosened since the previous FOMC, and the Fed may want to indicate that further loosening is unwarranted / unwanted

- In this context, the market will be mostly focused on forward guidance in the official statement, the dot plot and Powell's presser

- The dot plot will be particularly useful if they want to be more credible about the need to keep rates higher for longer: the previous iteration showed 75bp of cuts in 2024, and the market is still pricing 150bp of cuts next year

WEEKLY US RATES SUMMARY

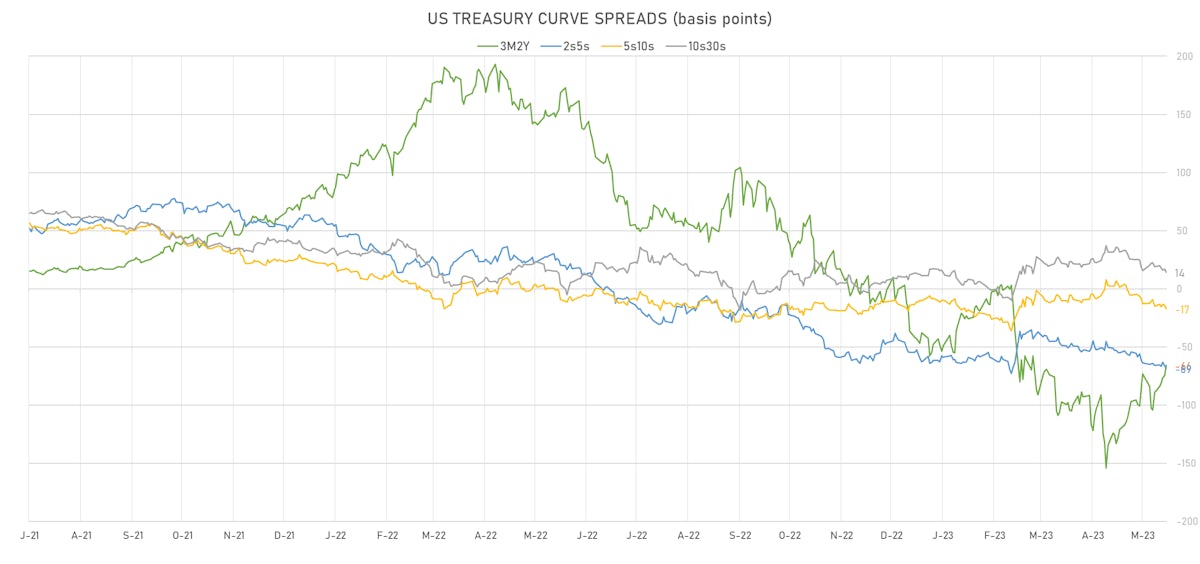

- The treasury yield curve steepened, with the 1s10s spread widening 8.0 bp, now at -146.1 bp (YTD change: -62.8bp)

- 1Y: 5.2037% (down 3.5 bp)

- 2Y: 4.5946% (up 8.4 bp)

- 5Y: 3.9137% (up 6.4 bp)

- 7Y: 3.8362% (up 4.9 bp)

- 10Y: 3.7423% (up 4.5 bp)

- 30Y: 3.8818% (down 0.6 bp)

- US treasury curve spreads: 3m2Y at -67.2bp (up 21.4bp this week), 2s5s at -68.1bp (down -2.6bp), 5s10s at -17.1bp (down -2.2bp), 10s30s at 13.9bp (down -5.6bp)

- US 5Y TIPS inflation breakeven at 2.16% down 0.7bp; 10Y breakeven at 2.21% up 1.6bp; 30Y breakeven at 2.25% up 2.4bp

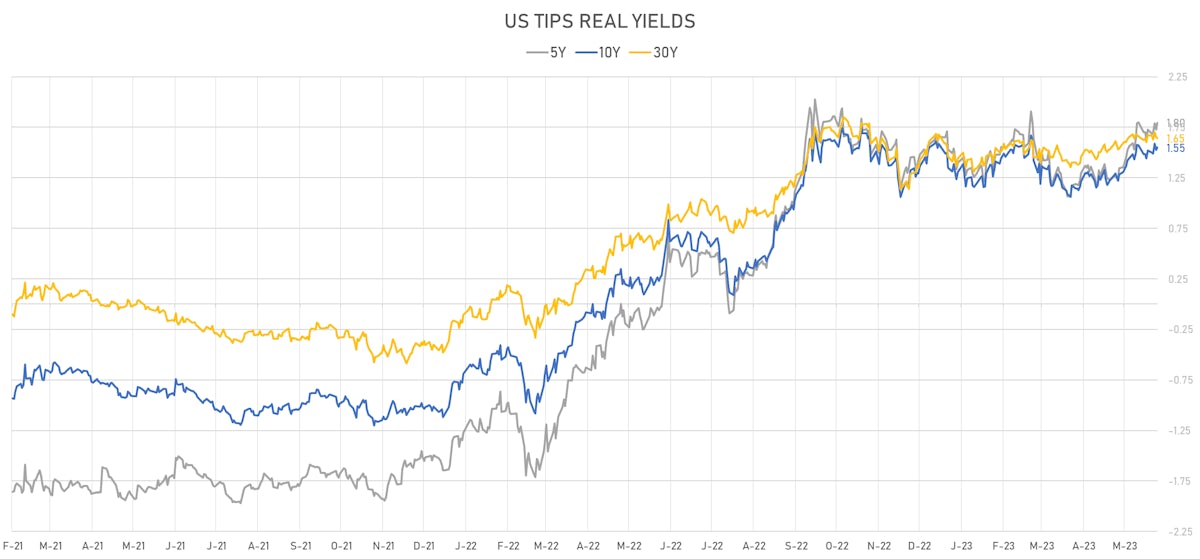

- US 5-Year TIPS Real Yield: +6.8 bp at 1.7960%; 10-Year TIPS Real Yield: +3.1 bp at 1.5530%; 30-Year TIPS Real Yield: -2.7 bp at 1.6460%

US ECONOMIC DATA OVER THE PAST WEEK

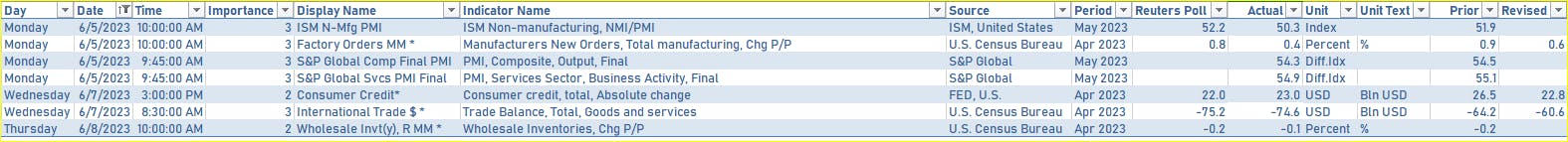

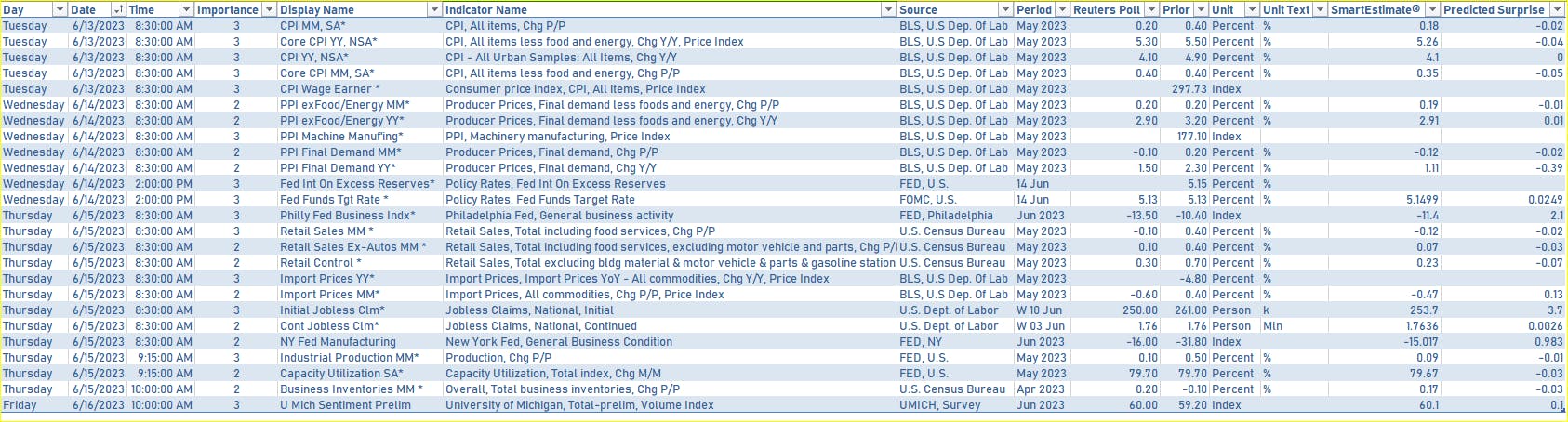

US MACRO RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Monday 11.30AM: $40bn in 3Y notes

- Monday 1PM: $32bn in 10Y notes

- Tuesday 1PM: $18bn in 30Y bonds

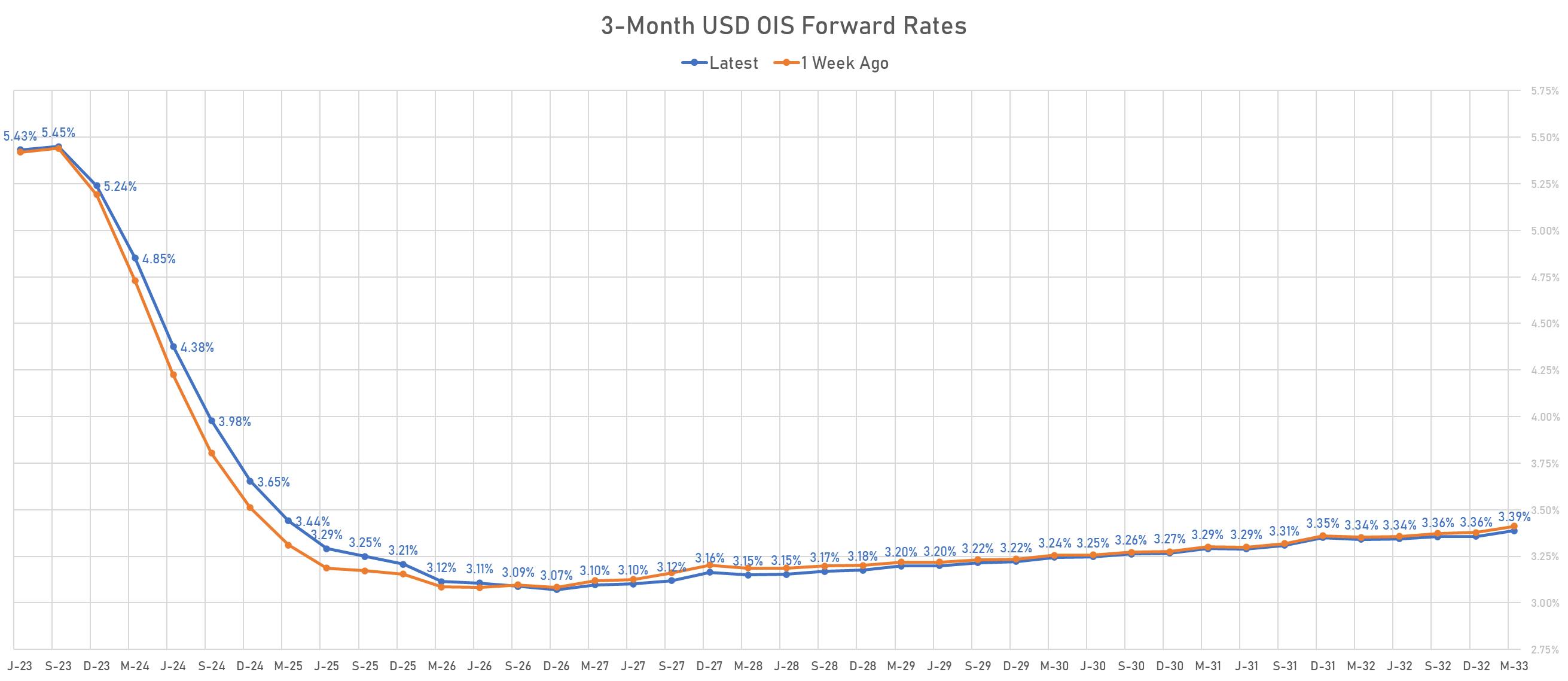

US FORWARD RATES

- Fed Funds futures now price in 7.3bp of Fed hikes by the end of June 2023, and 21.3bp (0.9 x 25bp hikes) by the end of July 2023

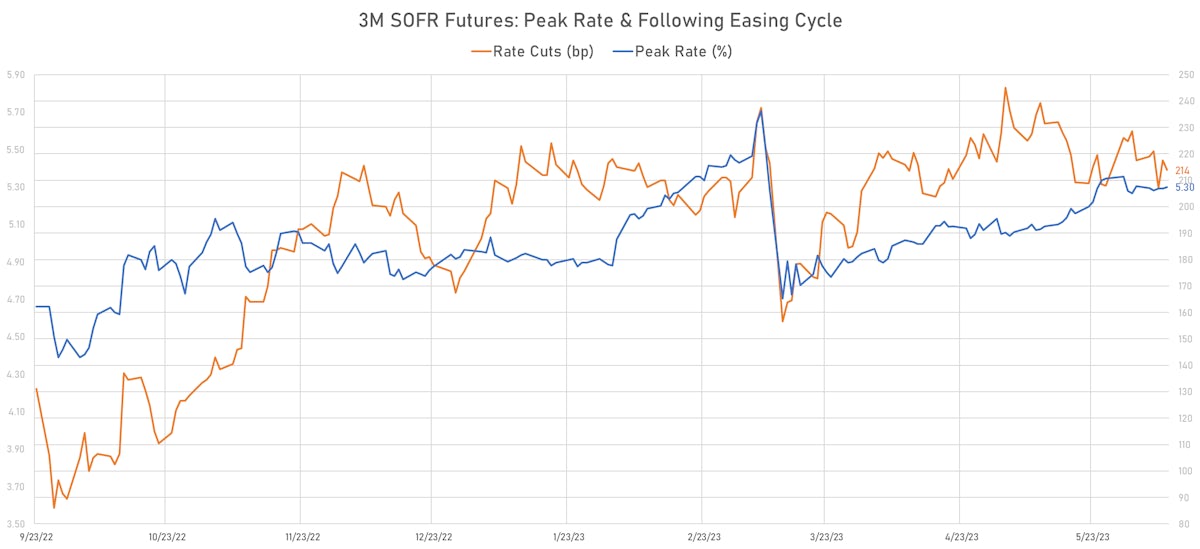

- Implied yields on 3-month SOFR futures top out at 5.30% for the October 2023 expiry and price in 213bp of rate cuts over the following easing cycle

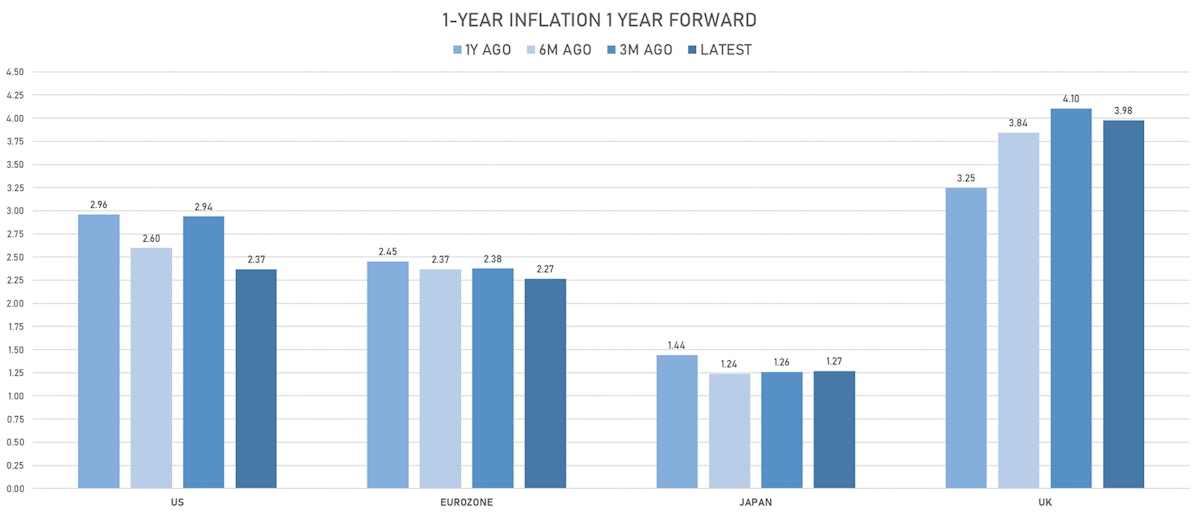

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 1.89% (down -2.4bp); 2Y at 2.16% (up 0.7bp); 5Y at 2.17% (down -0.9bp); 10Y at 2.22% (down -0.3bp); 30Y at 2.25% (down -0.1bp)

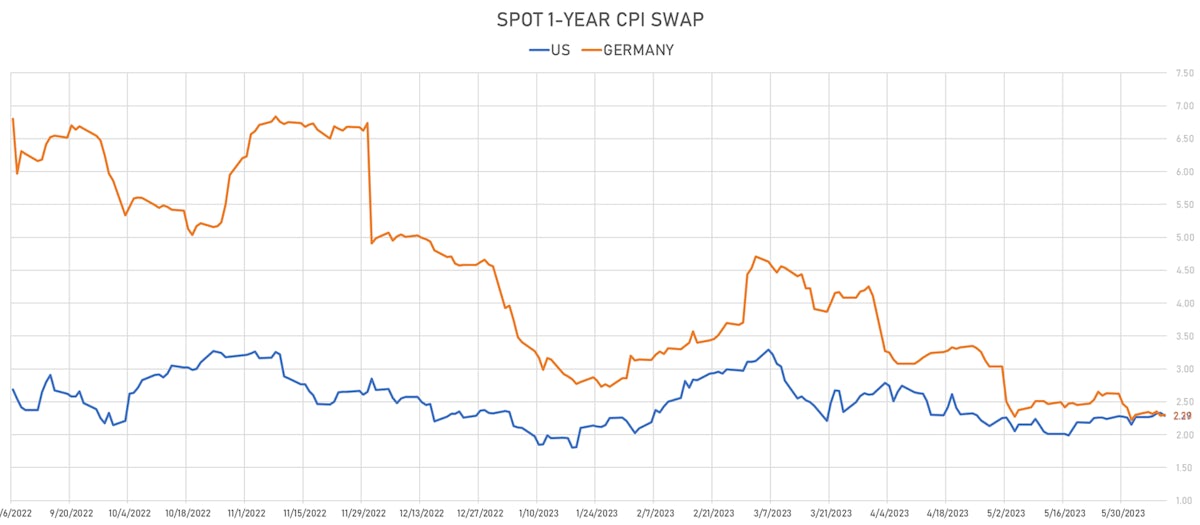

- 6-month spot US CPI swap down -2.1 bp to 2.879%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.7960%, +6.7 bp today; 10Y at 1.5530%, +3.0 bp today; 30Y at 1.6460%, -0.1 bp today

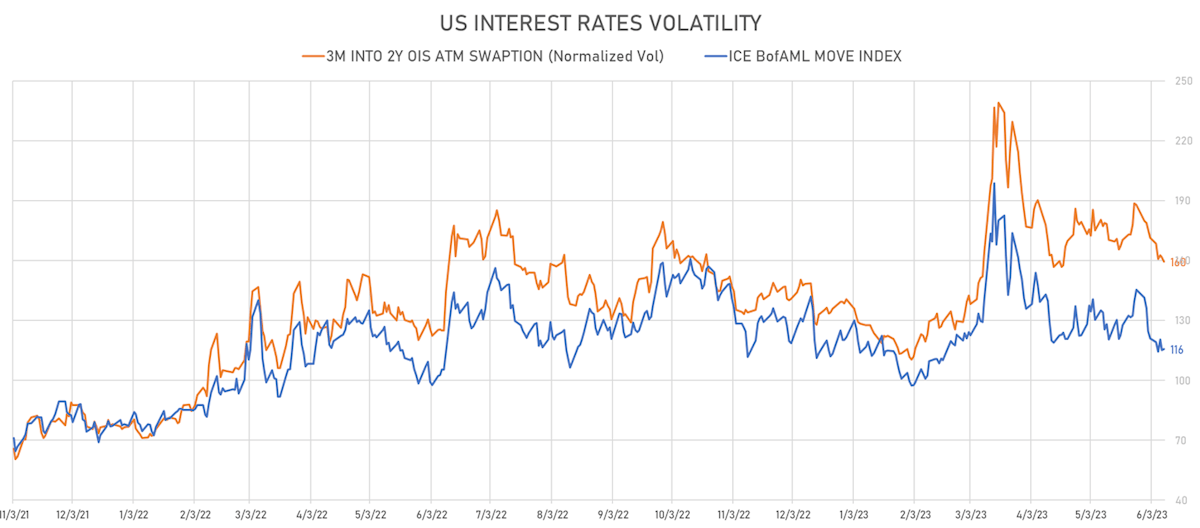

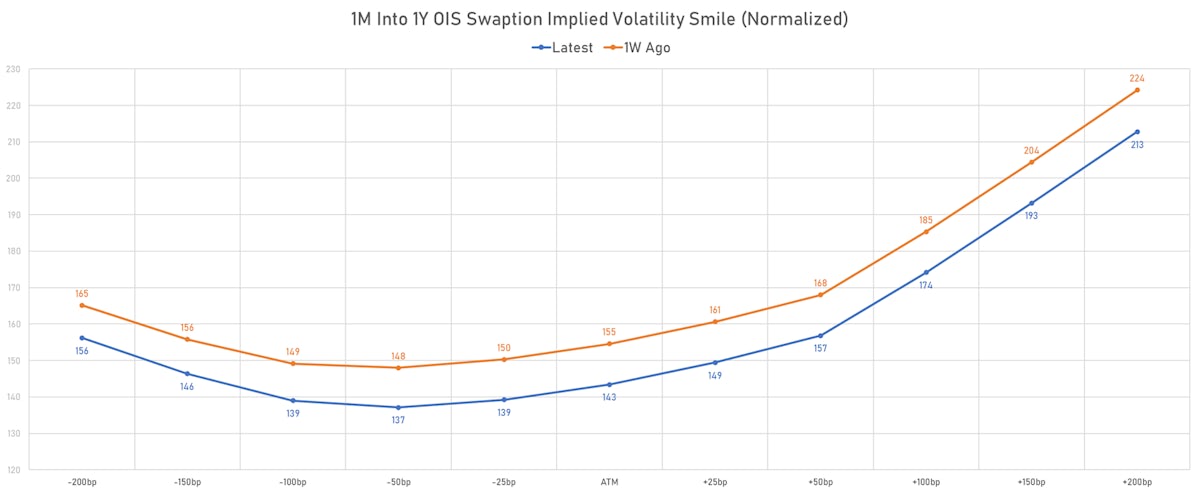

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.5 vols at 143.4 normals

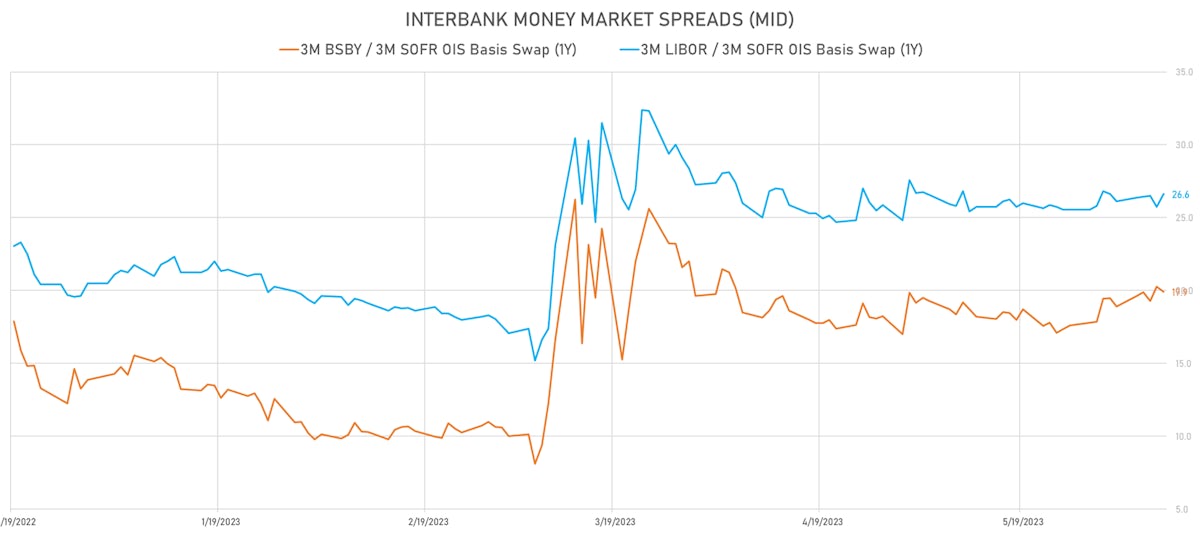

- 3-Month LIBOR-OIS spread down -0.7 bp at 28.7 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

Germany 5Y: 2.420% (down -1.6 bp); the German 1Y-10Y curve is 4.2 bp flatter at -98.2bp (YTD change: -94.3 bp)

Japan 5Y: 0.082% (unchanged 0.0 bp); the Japanese 1Y-10Y curve is 0.7 bp flatter at 57.3bp (YTD change: +16.5 bp)

China 5Y: 2.422% (down -2.6 bp); the Chinese 1Y-10Y curve is 1.2 bp steeper at 83.9bp (YTD change: +10.3 bp)

Switzerland 5Y: 1.010% (down -2.1 bp); the Swiss 1Y-10Y curve is 20.3 bp flatter at -93.1bp (YTD change: -99.4 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +7.7 bp at 164.6 bp (Weekly change: -0.7 bp; YTD change: -9.0 bp)

- US-JAPAN: +7.1 bp at 466.6 bp (Weekly change: +9.5 bp; YTD change: +27.3 bp)

- US-CHINA: +8.3 bp at 250.4 bp (Weekly change: +13.2 bp; YTD change: +32.1 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +4.1 bp at 147.2 bp (Weekly change: -5.8bp; YTD change: +18.4bp)

- US-JAPAN: +7.8 bp at 242.1 bp (Weekly change: +12.8bp; YTD change: +38.2bp)

- GERMANY-JAPAN: +3.7 bp at 94.9 bp (Weekly change: +18.6bp; YTD change: +19.8bp)