Rates

Fairly Volatile Week In US Rates, With Squeezy Moves Higher In Yields On Mostly Stronger Data

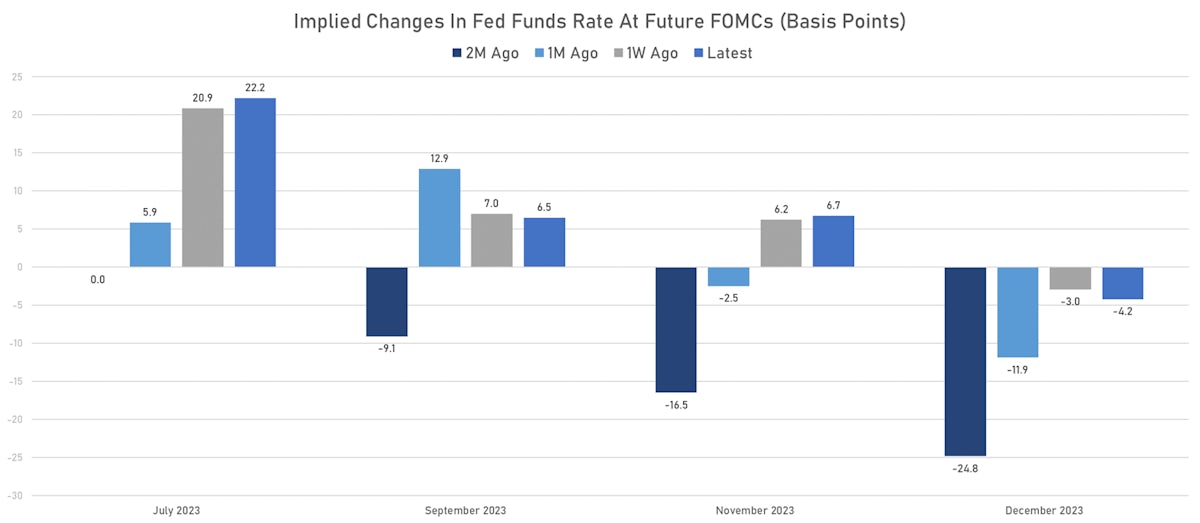

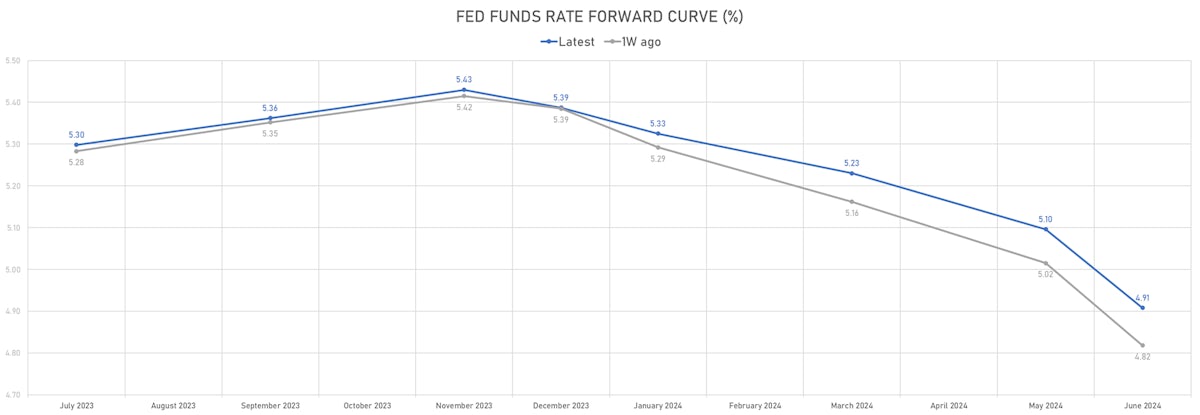

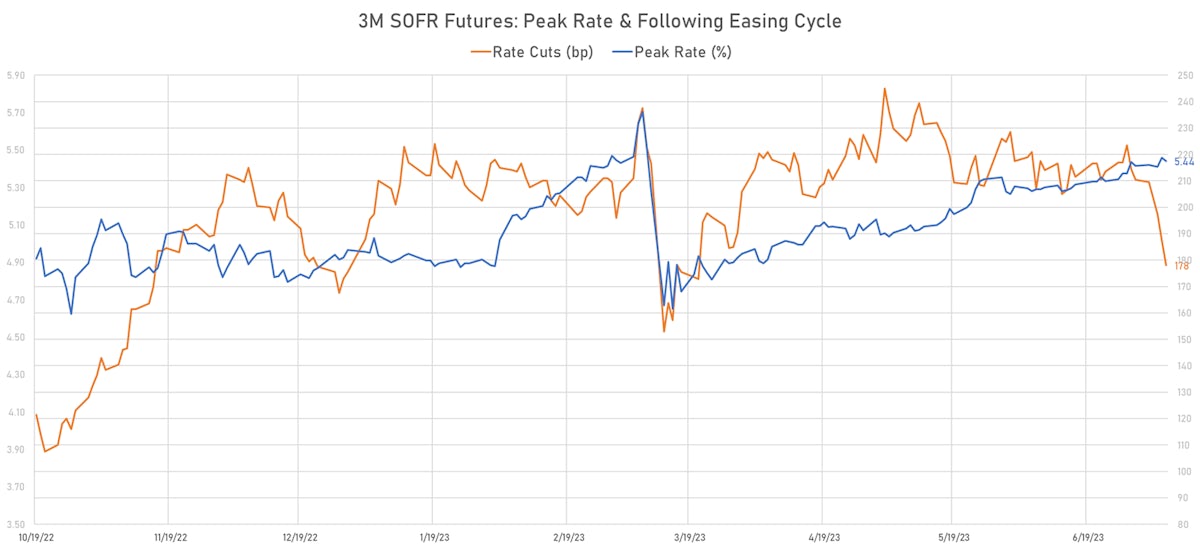

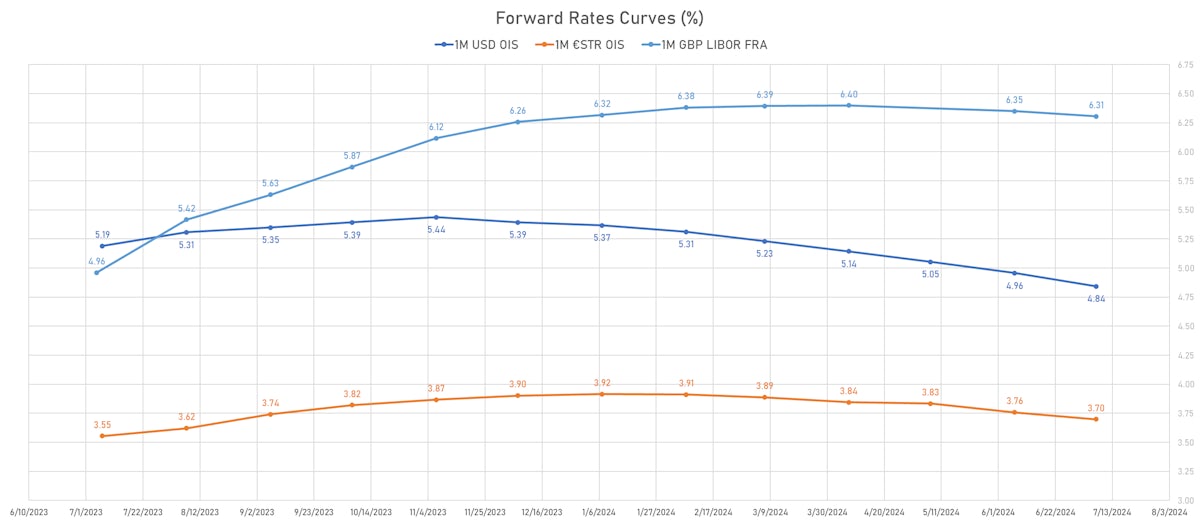

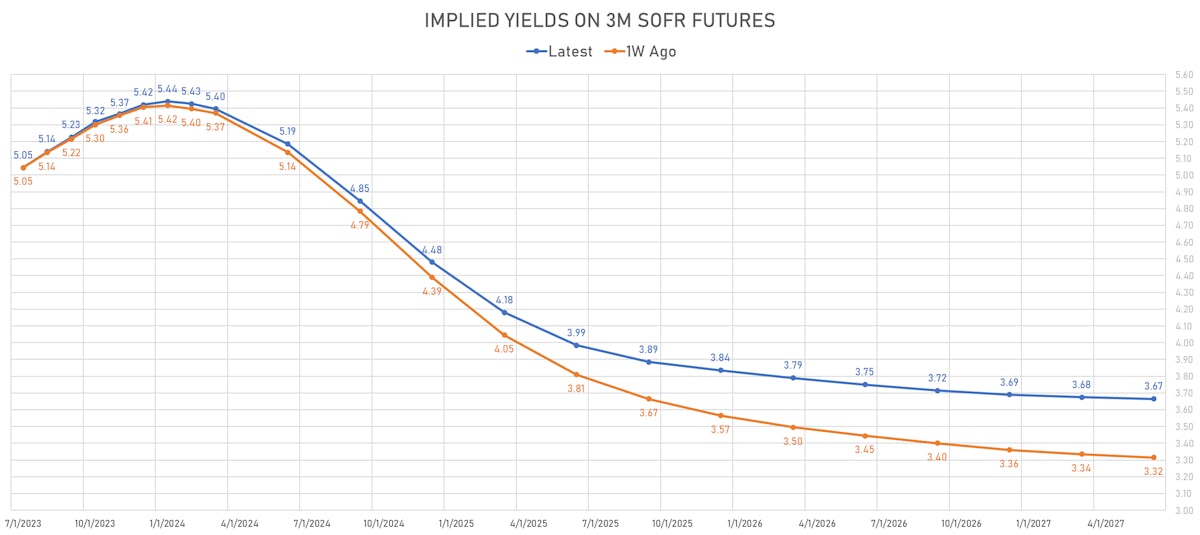

Recession pricing has been taken down, with a marked steepening in the USD forward curve: 3M SOFR 3 years forward rising by over 30bp over the week. The peak FF rate is not moving higher but the magnitude of the subsequent easing has been significantly marked down

Published ET

Implied yields on 3M SOFR Futures | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK

- Fed Funds futures now price in a 90% probability of a hike at the next FOMC, which looks right to us

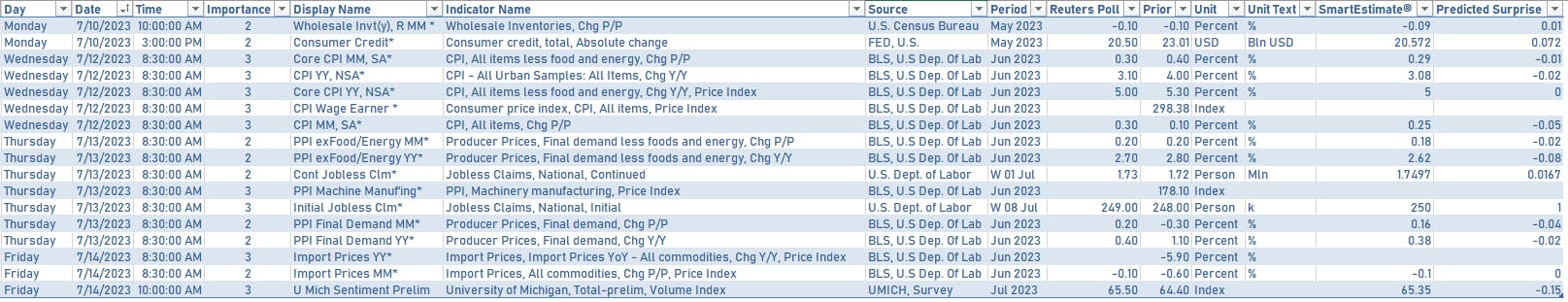

- We will get a few important data points in the coming week, including the latest iterations of the PPI and CPI

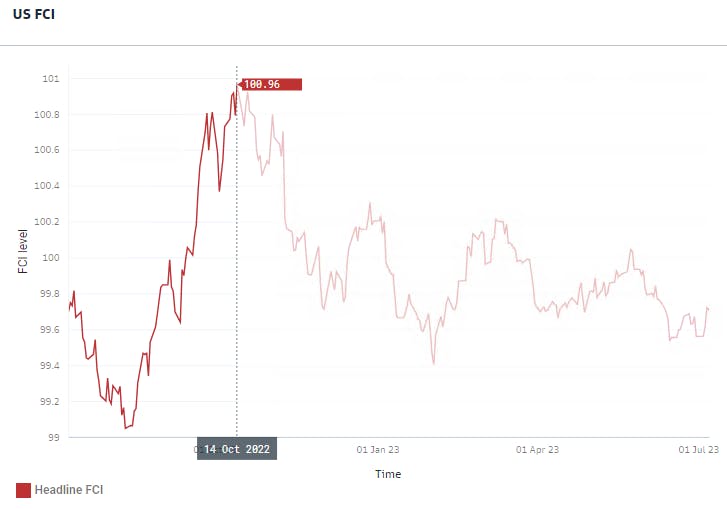

- After a week of tightening financial conditions, Goldman's US FCI index remains much looser than it was at peak tightness in October 2022

- In this context, after a string of fairly strong US economic data, and considering the Fed communication after the June FOMC, it's very clear that the July FOMC will bring a 25bp hike

- Now that 1H23 worries about a possible recession, regional banks, and the debt ceiling have unwound, demand reacceleration in 2H23 is a key risk for the Fed

- The CPI data this week is unlikely to change any of that, but if the print were to come in hotter than expected, it could help for some hawks to mention casually that a 6% Fed Funds rate is not inconceivable (just to leave the right hand of the distribution firmly on the table)

WEEKLY US RATES SUMMARY

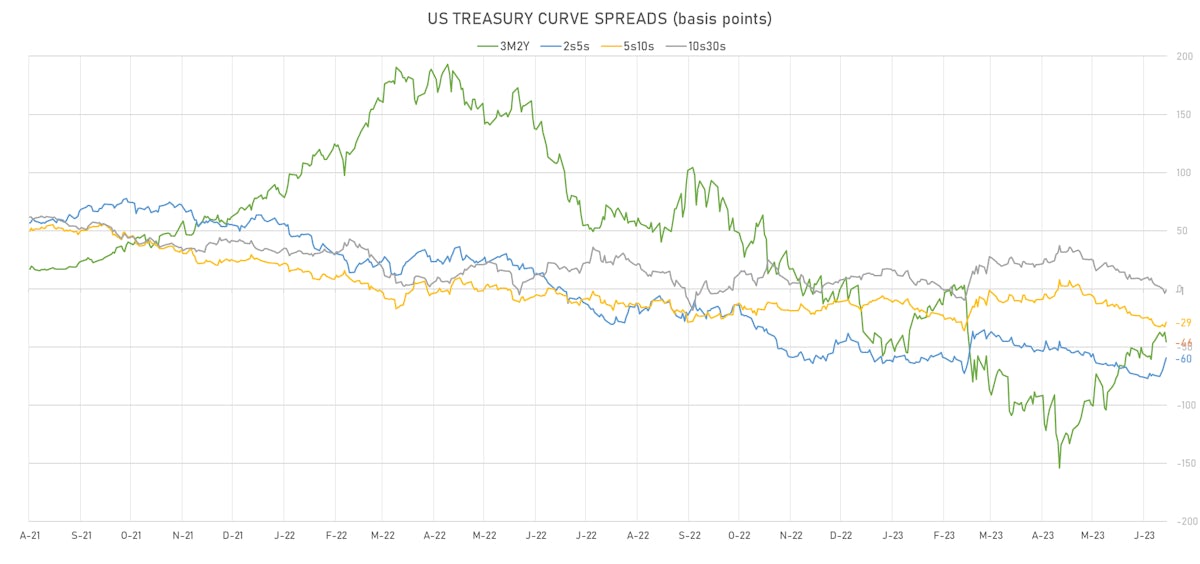

- The treasury yield curve steepened, with the 1s10s spread widening 21.7 bp, now at -135.1 bp (YTD change: -51.7bp)

- 1Y: 5.4142% (up 0.7 bp)

- 2Y: 4.9491% (up 8.7 bp)

- 5Y: 4.3562% (up 22.7 bp)

- 7Y: 4.2290% (up 24.8 bp)

- 10Y: 4.0636% (up 22.3 bp)

- 30Y: 4.0458% (up 14.8 bp)

- US treasury curve spreads: 3m2Y at -43.7bp (up 4.5bp this week), 2s5s at -59.3bp (up 14.1bp), 5s10s at -29.3bp (down -0.4bp), 10s30s at -1.8bp (down -8.3bp)

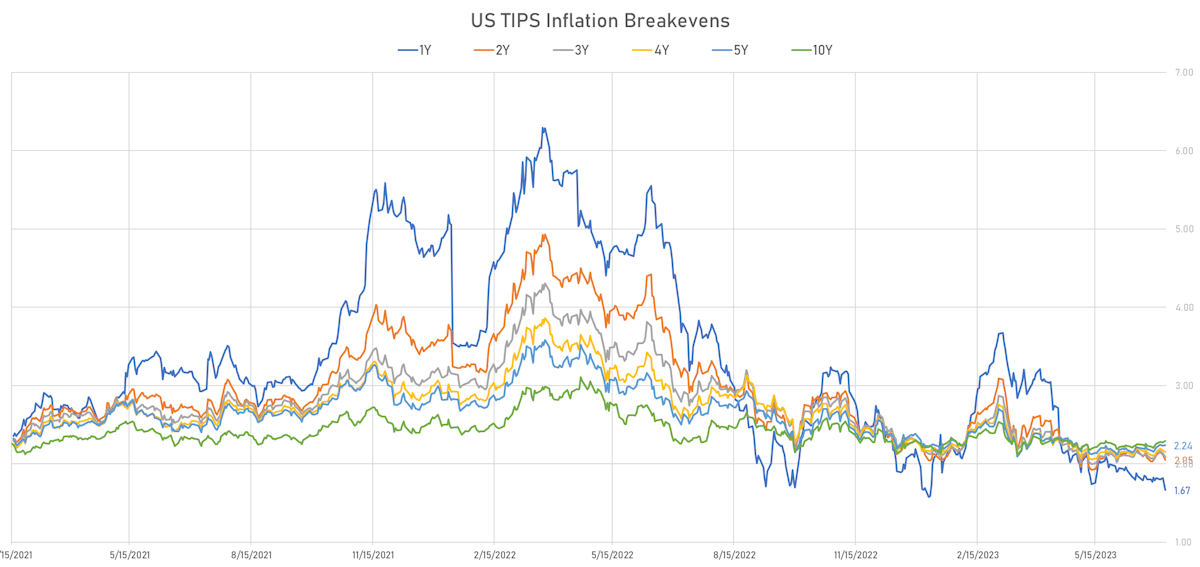

- US 5Y TIPS inflation breakeven at 2.23% up 2.9bp; 10Y breakeven at 2.28% up 5.2bp; 30Y breakeven at 2.27% up 3.3bp

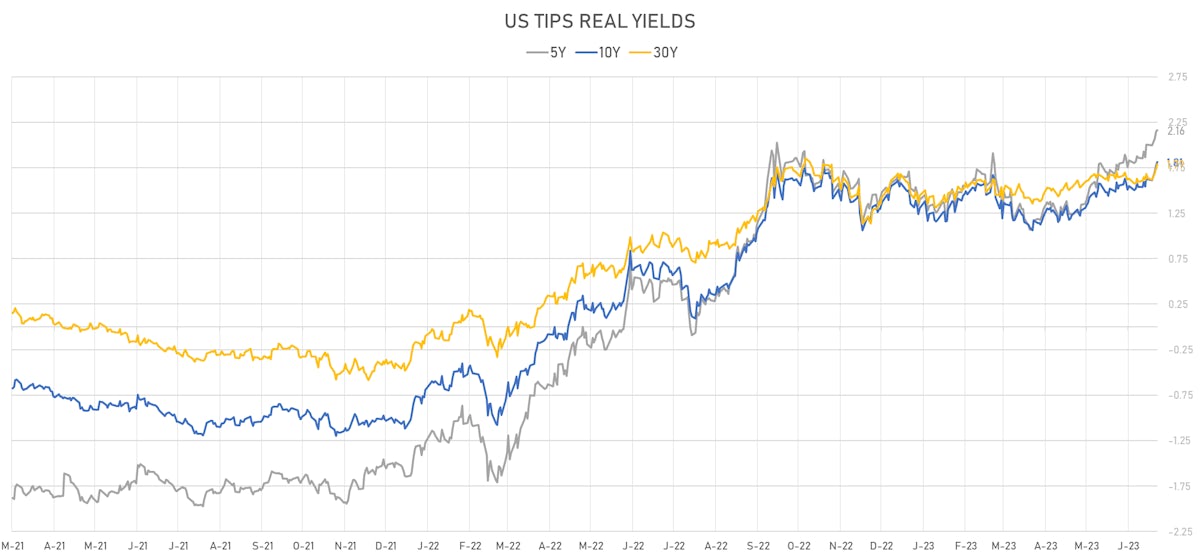

- US 5-Year TIPS Real Yield: +16.4 bp at 2.1640%; 10-Year TIPS Real Yield: +16.5 bp at 1.8110%; 30-Year TIPS Real Yield: +11.1 bp at 1.7910%

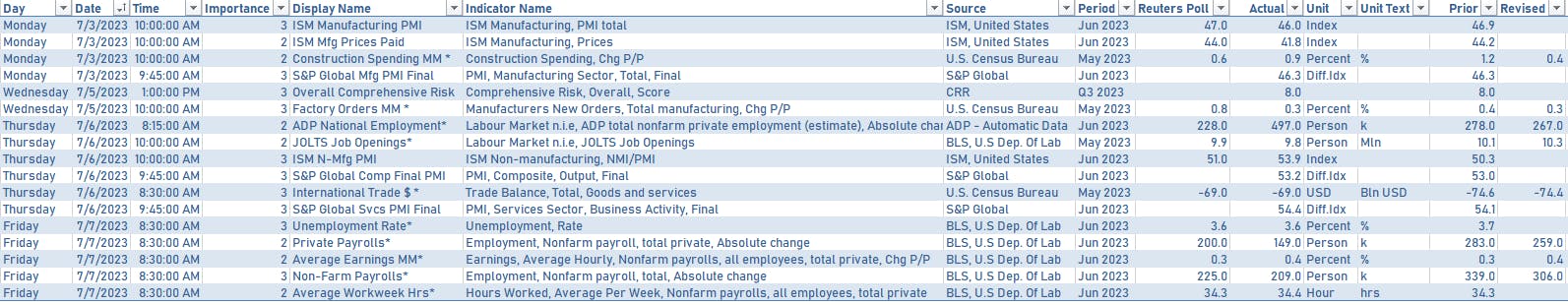

US ECONOMIC DATA OVER THE PAST WEEK

US MACRO RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Tuesday 11 July: $40bn in 3Y notes

- Wednesday 12 July: $32bn in 10Y notes

- Thursday 13July: $18bn in 30Y bonds

FED SPEAKERS IN THE WEEK AHEAD

- Monday 10:00AM: Fed Vice Chair for Supervision Michael Barr

- Monday 11:00AM: San Francisco Fed President Mary Daly

- Monday 12:00PM: Atlanta Fed President Raphael Bostic

- Wednesday 8:30AM: Richmond Fed President Barkin

- Wednesday 9:45AM: Minneapolis Fed President Kashkari

- Wednesday 1:00PM: Atlanta Fed President Bostic

- Wednesday 4:00PM: Cleveland Fed President Mester

- Thursday 6:45PM: Fed Governor Waller

US FORWARD RATES

- Fed Funds futures now price in 22.2bp of Fed hikes by the end of July 2023, 28.7bp (1.1 x 25bp hikes) by the end of September 2023, and 1.4 hikes by the end of November 2023

- Implied yields on 3-month SOFR futures top out at 5.44% for the January 2024 expiry and price in 178bp of rate cuts over the following easing cycle

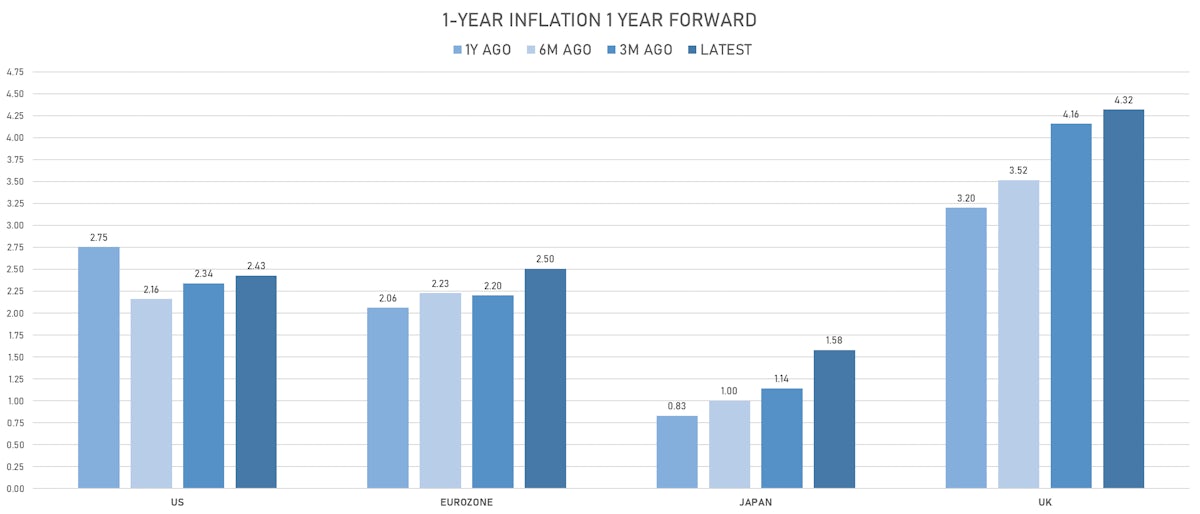

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 1.67% (down -11.4bp); 2Y at 2.05% (down -2.8bp); 5Y at 2.24% (down -1.1bp); 10Y at 2.29% (down -0.1bp); 30Y at 2.27% (up 0.7bp)

- 6-month spot US CPI swap down -2.4bp to 2.661%, with a flattening of the forward curve

- US Real Rates: 5Y at 2.1640%, +1.2 bp today; 10Y at 1.8110%, +3.3 bp today; 30Y at 1.7910%, +4.9 bp today

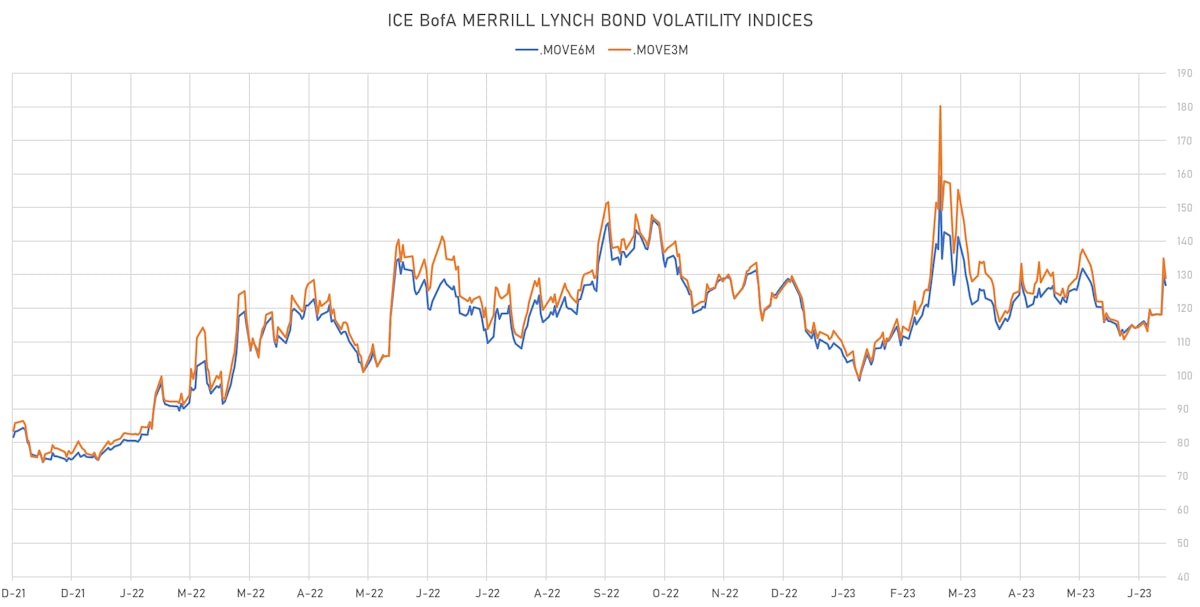

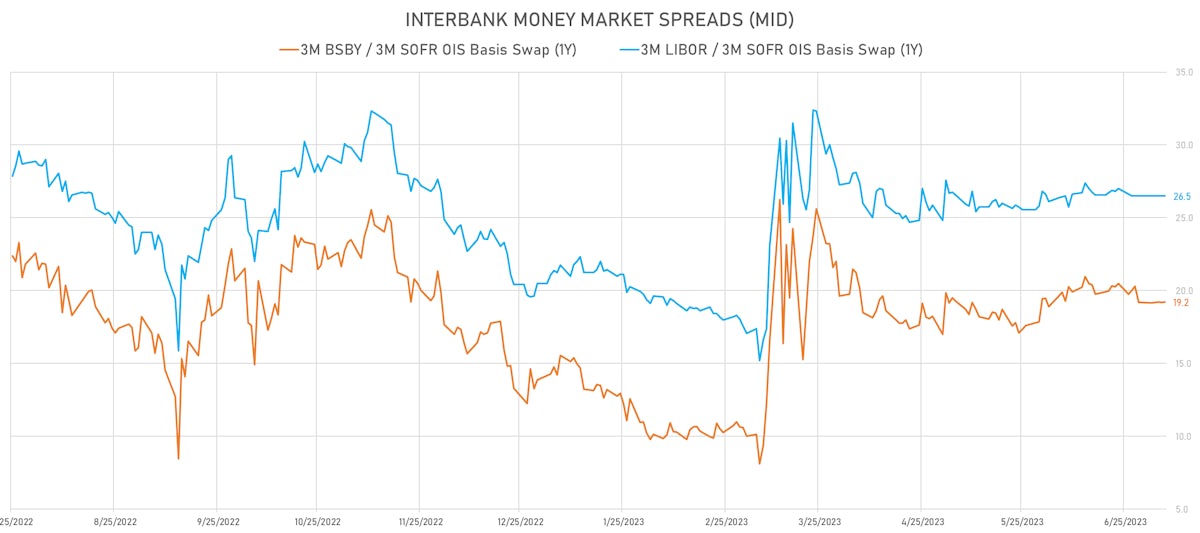

RATES VOLATILITY & LIQUIDITY TODAY

- Despite a decline from highs, US rates volatility remains elevated

- Liquidity conditions in money markets are stable

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.766% (down -3.1 bp); the German 1Y-10Y curve is 6.2 bp steeper at -103.8bp (YTD change: -100.7 bp)

- Japan 5Y: 0.103% (up 3.0 bp); the Japanese 1Y-10Y curve is 3.0 bp steeper at 55.9bp (YTD change: +14.2 bp)

- China 5Y: 2.425% (up 0.4 bp); the Chinese 1Y-10Y curve is 0.6 bp steeper at 87.3bp (YTD change: +13.7 bp)

- Switzerland 5Y: 1.121% (down -0.7 bp); the Swiss 1Y-10Y curve is 6.2 bp steeper at -89.8bp (YTD change: -98.4 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -8.9 bp at 169.0 bp (Weekly change: -0.7 bp; YTD change: -4.6 bp)

- US-JAPAN: -11.7 bp at 498.0 bp (Weekly change: +2.0 bp; YTD change: +58.7 bp)

- US-CHINA: -4.4 bp at 287.3 bp (Weekly change: +4.7 bp; YTD change: +69.0 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +3.8 bp at 155.1 bp (Weekly change: -1.1bp; YTD change: +26.3bp)

- US-JAPAN: +7.8 bp at 251.4 bp (Weekly change: +11.3bp; YTD change: +47.5bp)

- GERMANY-JAPAN: +4.0 bp at 96.3 bp (Weekly change: +14.4bp; YTD change: +21.2bp)