Rates

Soft CPI Surprise Pushes Down USD Forward Curves, Encourages Flows Into Carry Trades

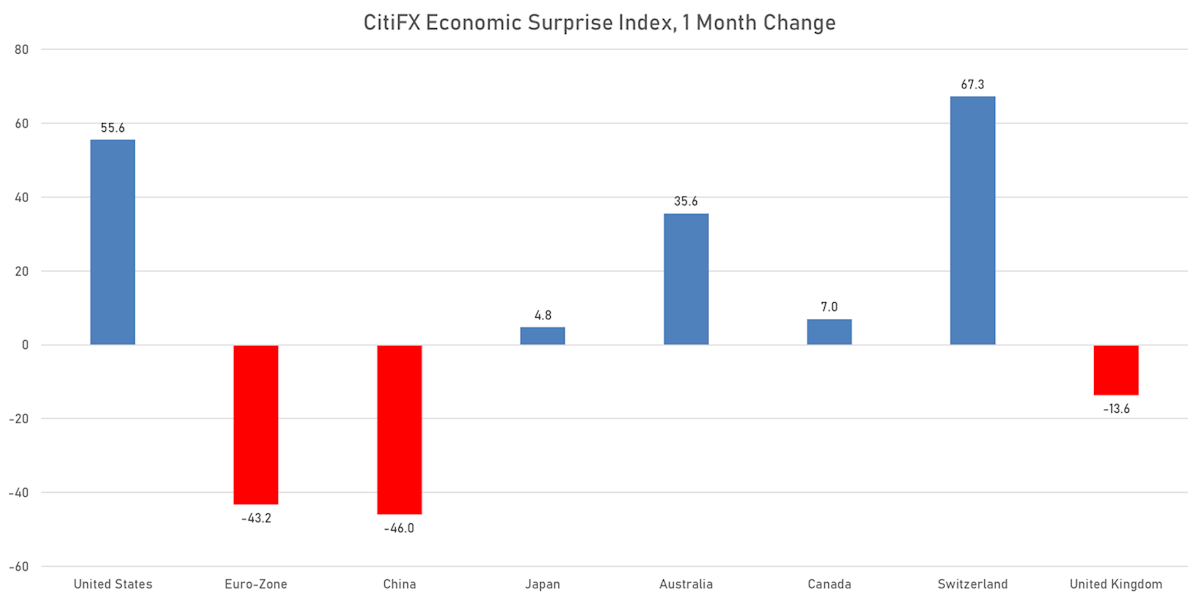

It would be prudent for the Fed not to relax too much on the inflation front, as economic surprises have been mostly positive in the US over the past month, and it could take more efforts to win out this fight

Published ET

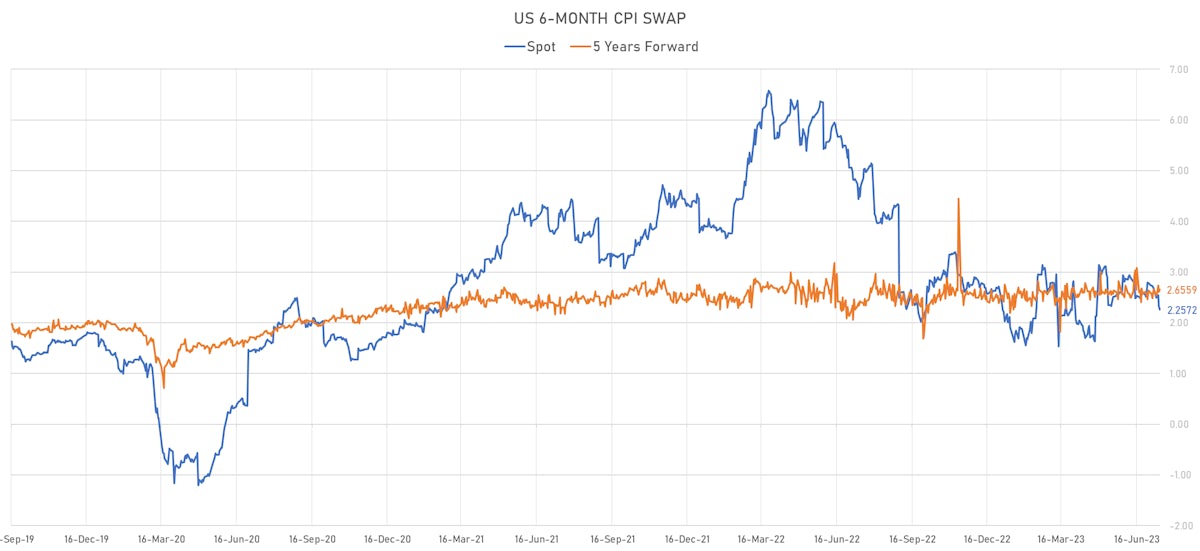

US 6-Month CPI swap Spot & 5Y Forward | Sources: phipost.com, Refinitiv data

MACRO OUTLOOK

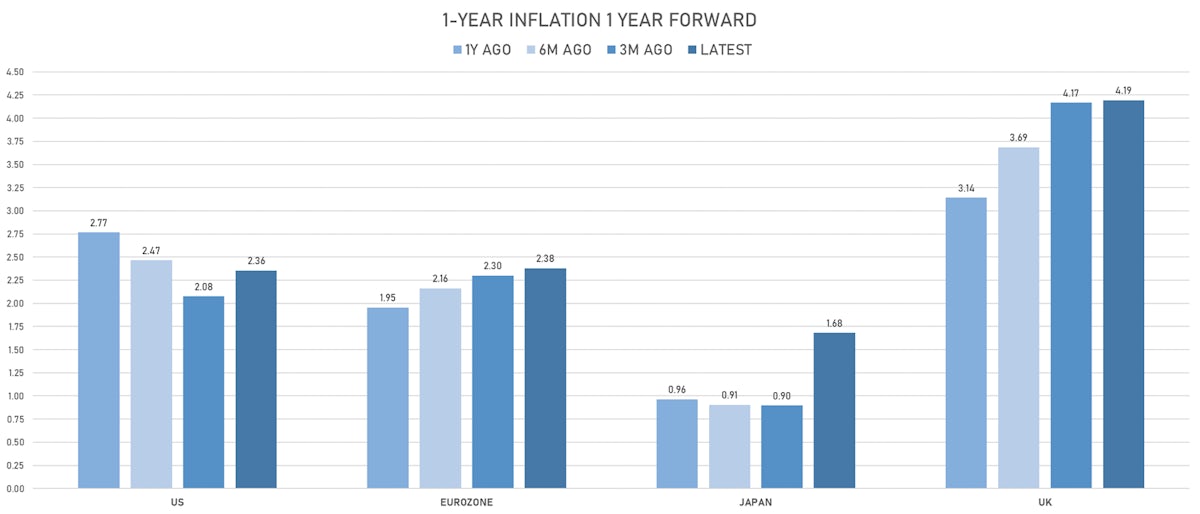

- The direction of travel for inflation should be down for a few more months at least, with important categories like cars and shelter expected to keep moderating

- It looks like the Fed is on the right path, but it would be a mistake to ignore the recent loosening in financial conditions

- If anything the Fed should keep markets guessing whether additional policy tightening is coming after the July hike

- If things go well, July will prove to be the last hike.. If not, September will likely be skipped, with November fully in play

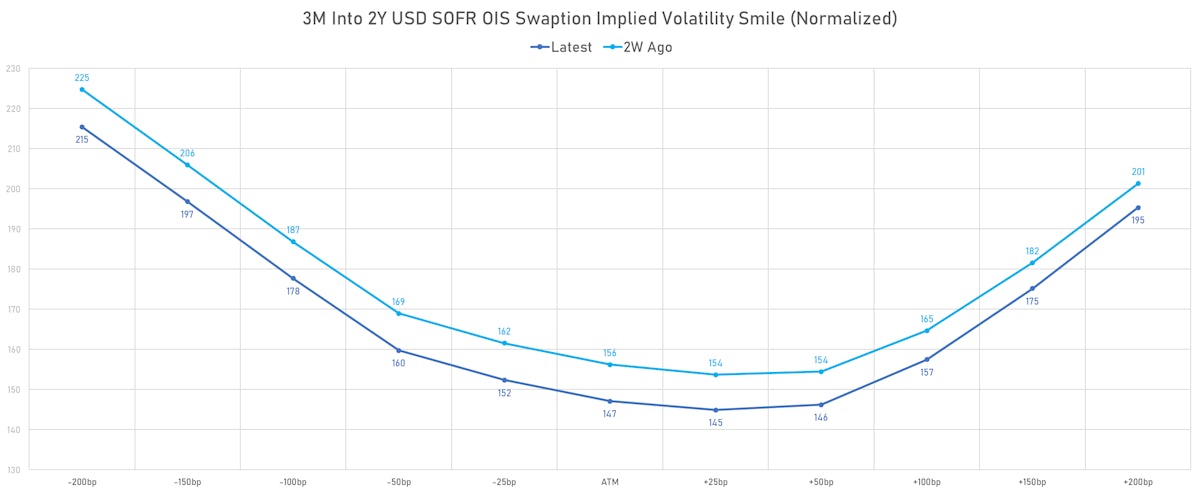

- With high sensitivity to short-term indicators, we would expect front-end rates volatility to stay high for a while longer, even though we are seeing market appetite for carry / short vol strategies

- In this context, we would favor trades taking advantage of pure carry (rates differentials) like the HUF or GBP in G10 rather than being outright short volatility

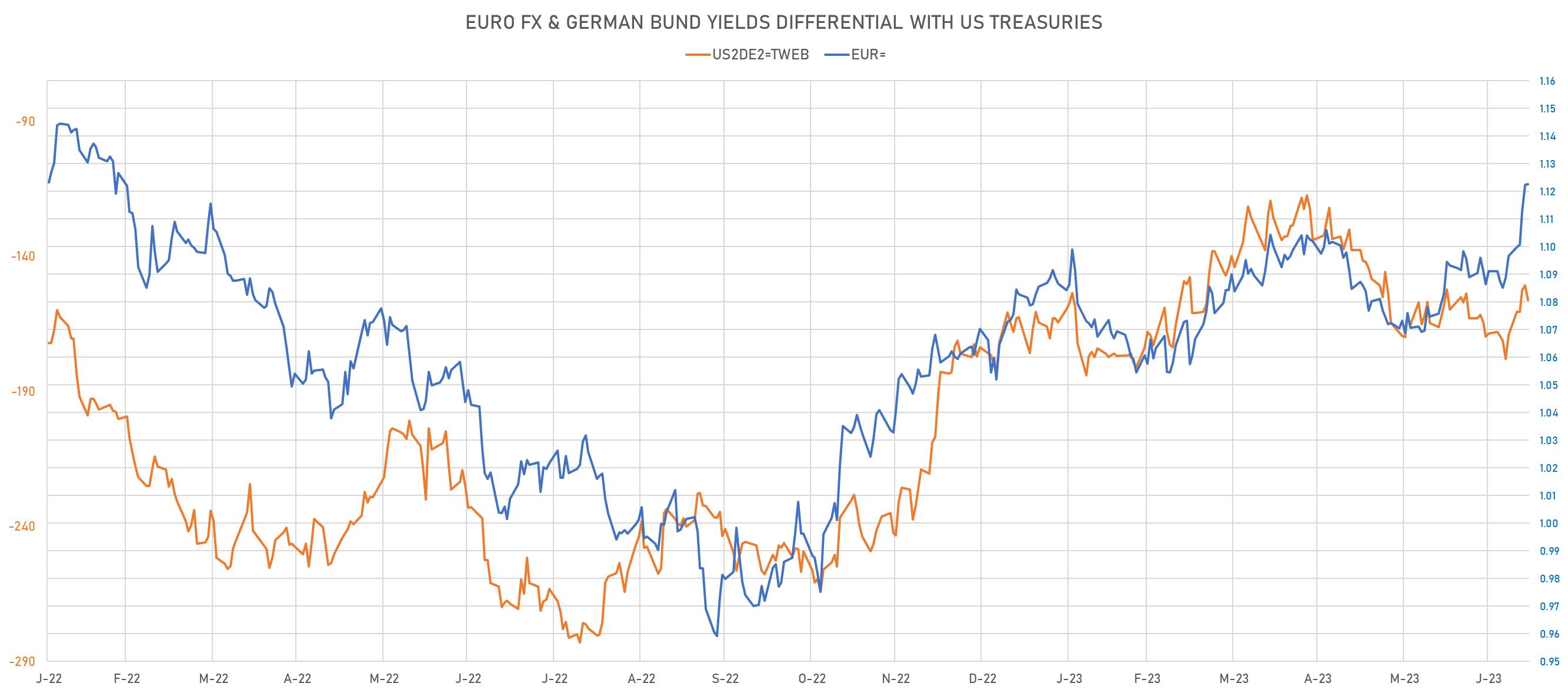

- The euro looks more vulnerable after the recent rise, as it's no longer supported by positive dynamics in rates differentials (with economic conditions in the eurozone deteriorating)

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -14.6 bp, now at -149.7 bp (YTD change: -66.3bp)

- 1Y: 5.3262% (down 8.8 bp)

- 2Y: 4.7656% (down 18.4 bp)

- 5Y: 4.0444% (down 31.2 bp)

- 7Y: 3.9376% (down 29.1 bp)

- 10Y: 3.8293% (down 23.4 bp)

- 30Y: 3.9255% (down 12.0 bp)

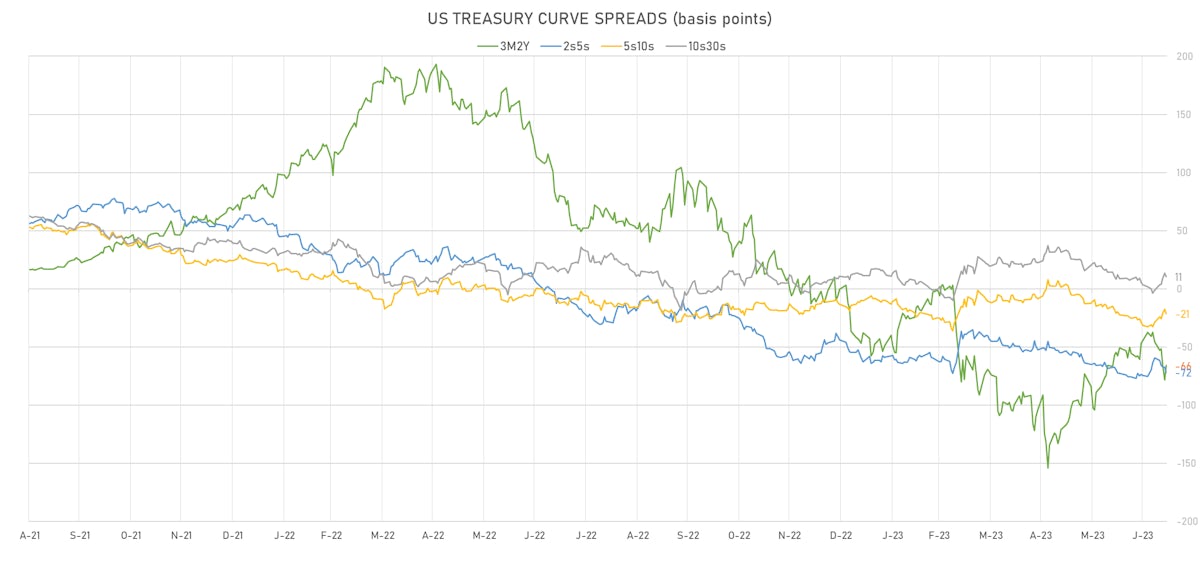

- US treasury curve spreads: 3m2Y at -63.3bp (down -19.6bp this week), 2s5s at -72.1bp (down -13.3bp), 5s10s at -21.5bp (up 8.2bp), 10s30s at 9.6bp (up 11.7bp)

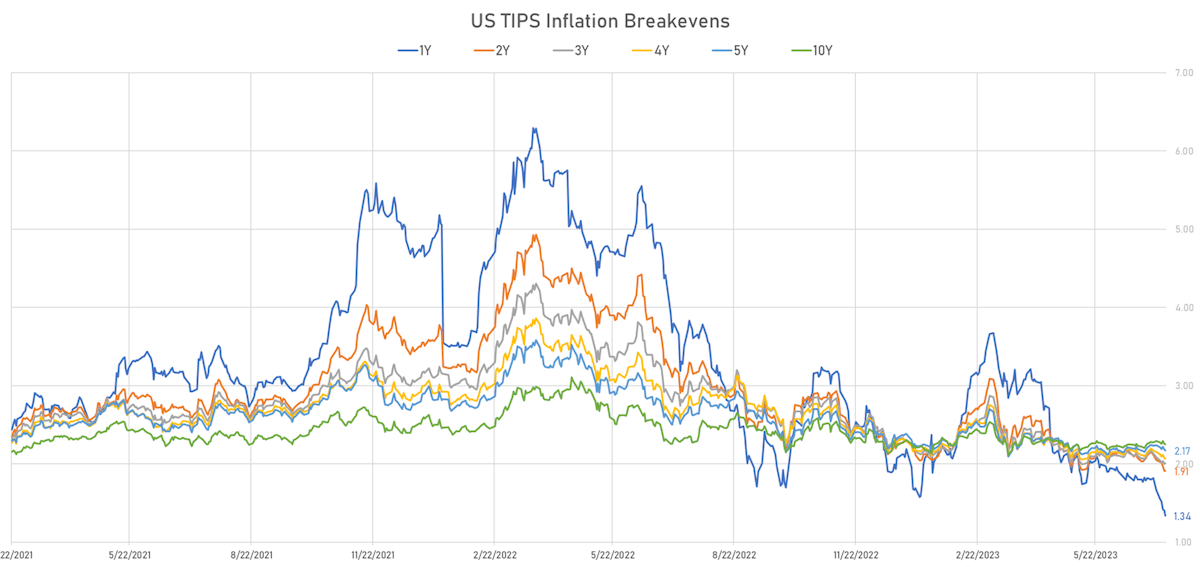

- US 5Y TIPS inflation breakeven at 2.17% down 6.7bp; 10Y breakeven at 2.24% down 2.7bp; 30Y breakeven at 2.26% down 0.3bp

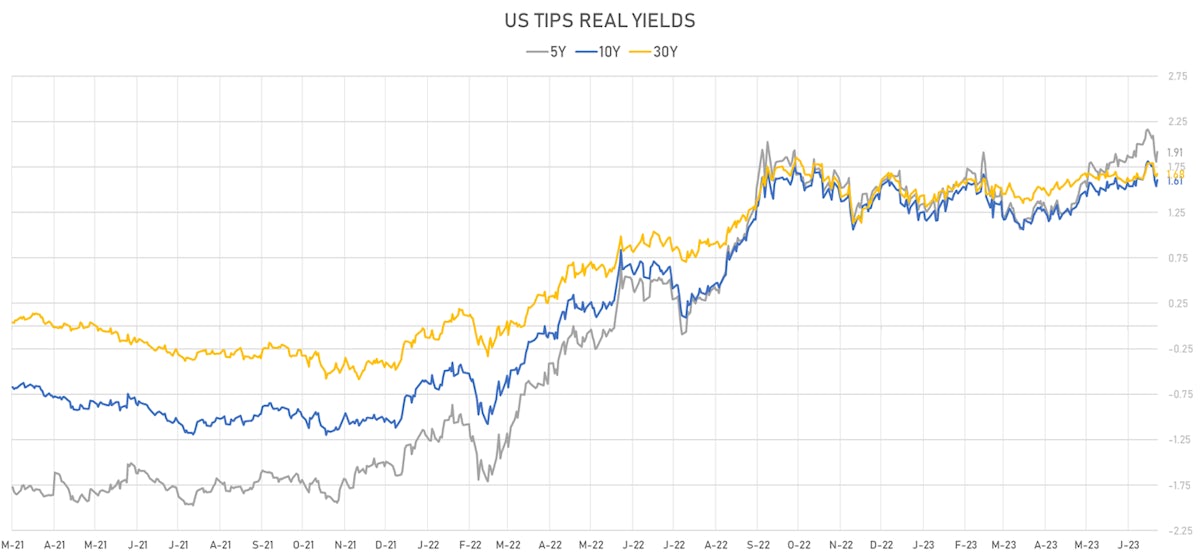

- US 5-Year TIPS Real Yield: -25.0 bp at 1.9140%; 10-Year TIPS Real Yield: -20.6 bp at 1.6050%; 30-Year TIPS Real Yield: -11.6 bp at 1.6750%

US ECONOMIC DATA OVER THE PAST WEEK

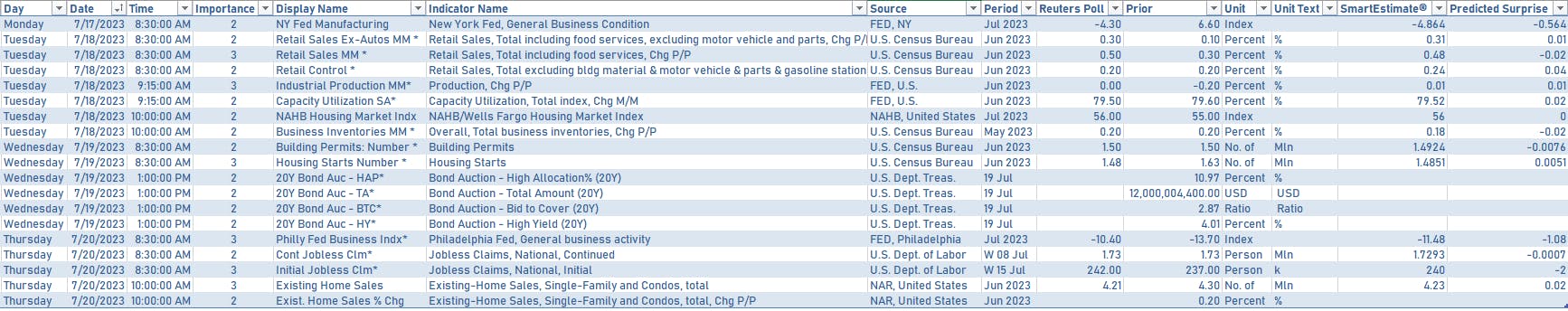

US MACRO RELEASES IN THE WEEK AHEAD

- The focus will be on retail sales and housing data, with a fairly light schedule next week

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Wednesday: $12bn in 20Y bonds

- Thursday: $17bn in 10Y TIPS

FED SPEAKERS IN THE WEEK AHEAD

- None as we're entering the quiet period ahead of the July 25-26 FOMC meeting

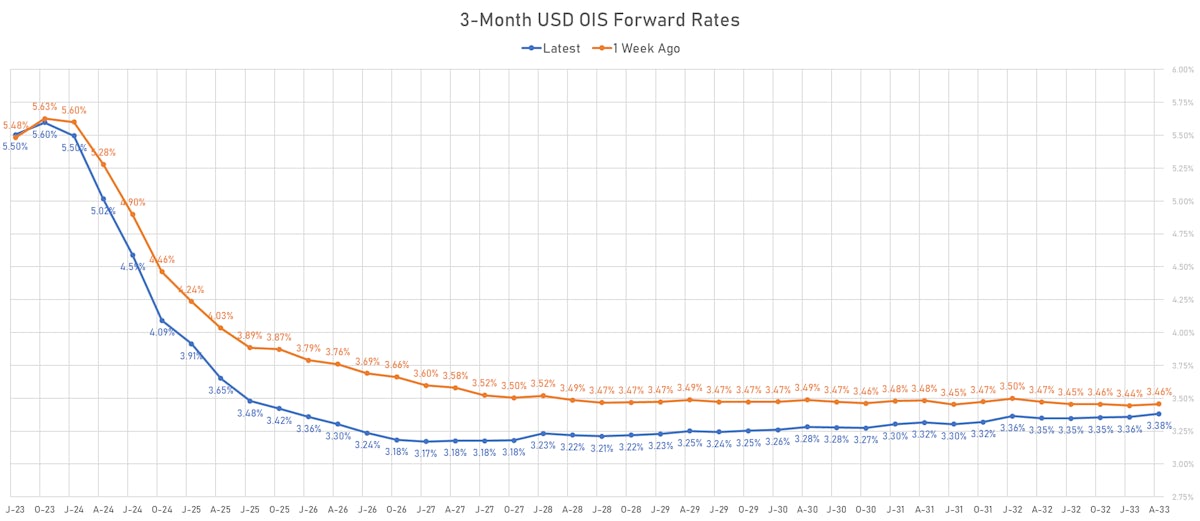

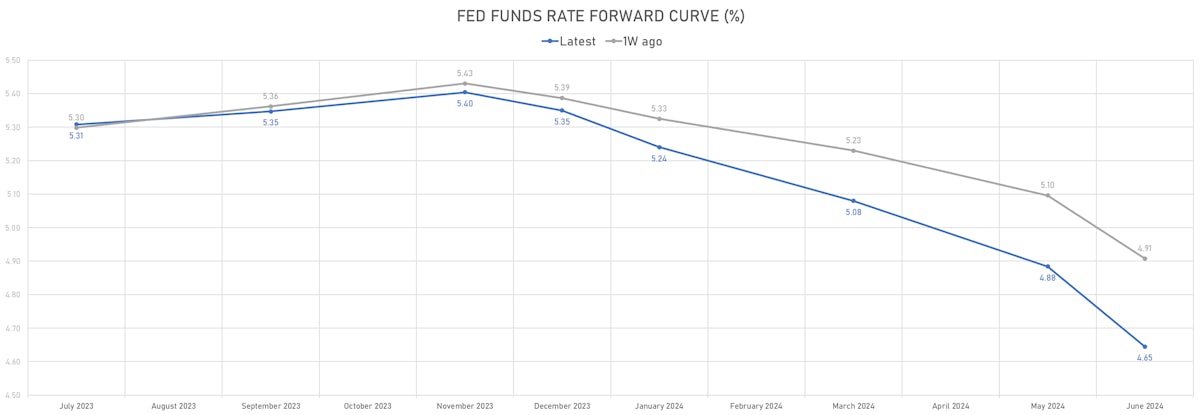

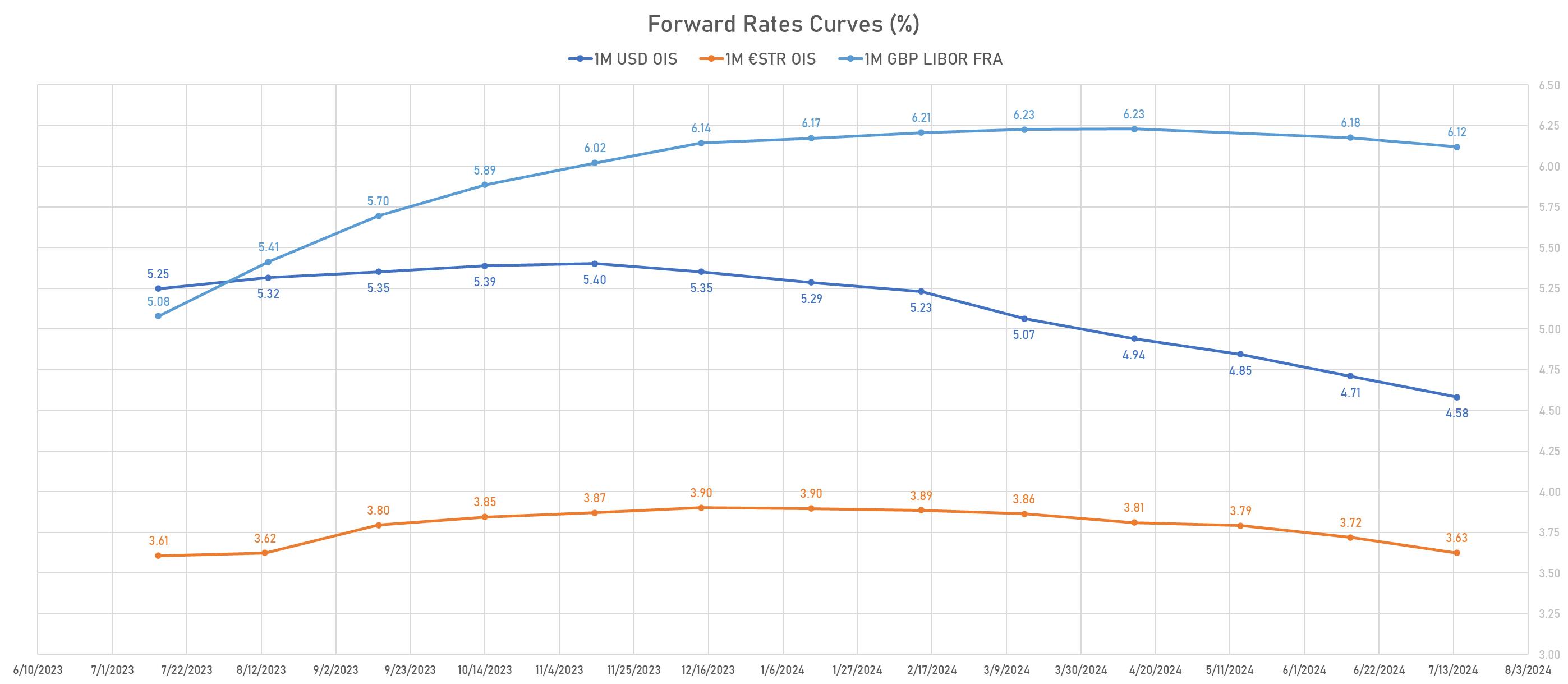

US FORWARD RATES

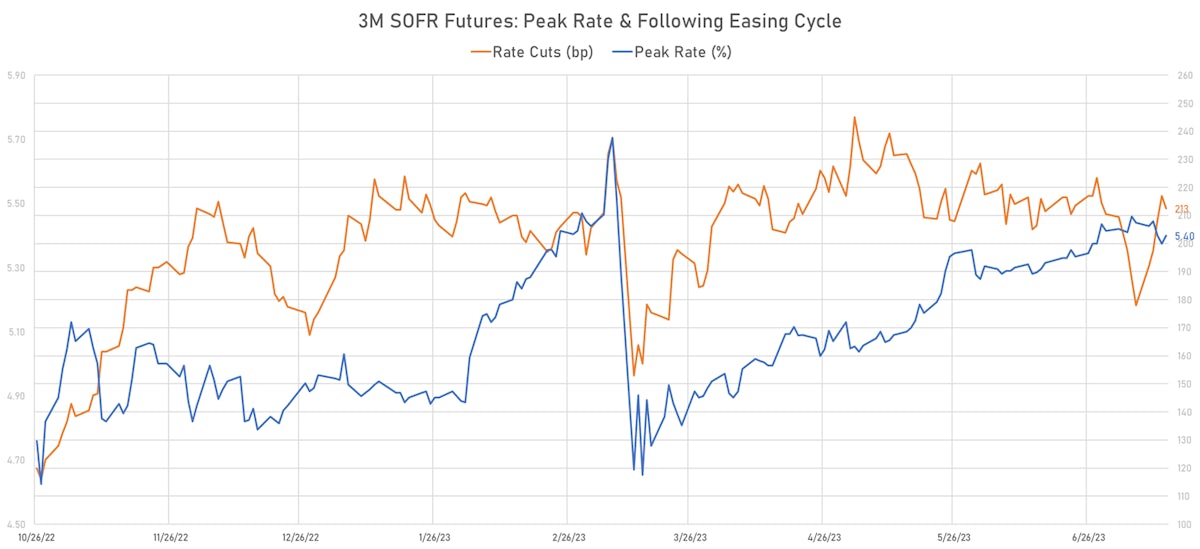

- Fed Funds futures now price in 23.1bp of Fed hikes by the end of July 2023, 27.1bp (1.1 x 25bp hikes) by the end of September 2023, and 1.3 hikes by the end of November 2023

- Implied yields on 3-month SOFR futures top out at 5.40% for the December 2023 expiry and price in 213bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 1.34% (down -6.5bp); 2Y at 1.91% (up 0.2bp); 5Y at 2.17% (down -1.1bp); 10Y at 2.25% (down -0.4bp); 30Y at 2.26% (down -1.0bp)

- 6-month spot US CPI swap down -7.3 bp to 2.257%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.9140%, +10.8 bp today; 10Y at 1.6050%, +6.8 bp today; 30Y at 1.6750%, +2.9 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD SOFR OIS 1 Month by 1 Year ATM Swaption) up 5.2 vols at 119.7 normals (down 15.2 normals from a week ago)

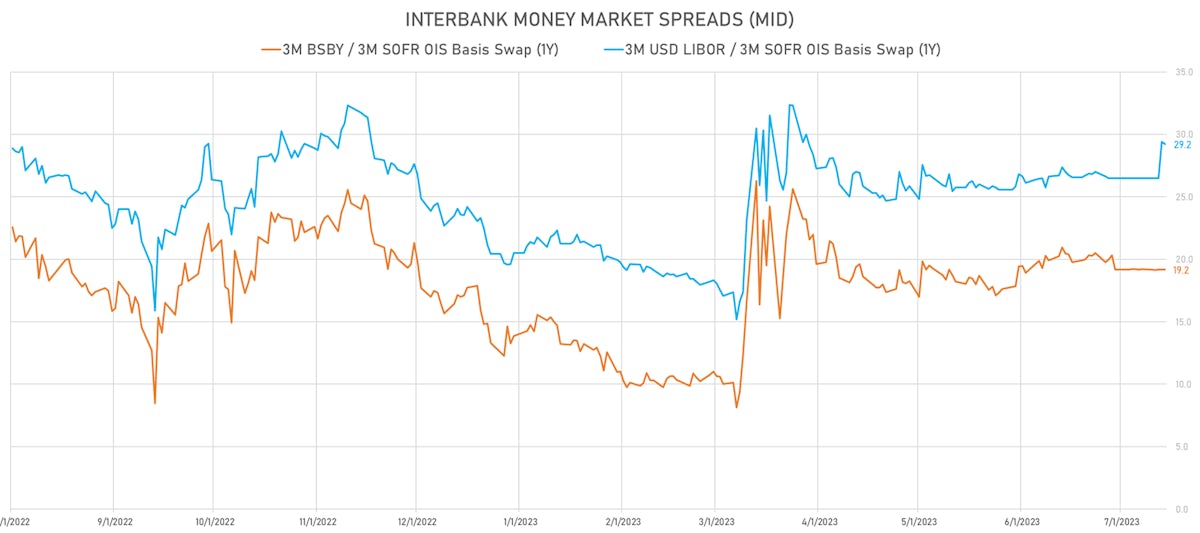

- SOFR-BSBY basis swaps are very stable and there is no sign of tension in money markets, although spreads are still more elevated than they were prior to the regional banking crisis

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.632% (up 2.2 bp); the German 1Y-10Y curve is 1.2 bp flatter at -124.3bp (YTD change: -122.4 bp)

- Japan 5Y: 0.131% (up 0.1 bp); the Japanese 1Y-10Y curve is 1.5 bp steeper at 60.6bp (YTD change: +19.6 bp)

- China 5Y: 2.436% (up 0.3 bp); the Chinese 1Y-10Y curve is 0.4 bp steeper at 86.7bp (YTD change: +13.1 bp)

- Switzerland 5Y: 1.041% (up 1.0 bp); the Swiss 1Y-10Y curve is 2.3 bp flatter at -95.9bp (YTD change: -102.2 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +5.5 bp at 156.3 bp (Weekly change: -12.7 bp; YTD change: -17.3 bp)

- US-JAPAN: +10.8 bp at 478.0 bp (Weekly change: -20.0 bp; YTD change: +38.7 bp)

- US-CHINA: +14.9 bp at 268.7 bp (Weekly change: -18.7 bp; YTD change: +50.4 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +0.8 bp at 140.2 bp (Weekly change: -14.9bp; YTD change: +11.4bp)

- US-JAPAN: +7.8 bp at 230.1 bp (Weekly change: -21.3bp; YTD change: +26.2bp)

- GERMANY-JAPAN: +7.0 bp at 89.9 bp (Weekly change: -6.4bp; YTD change: +14.8bp)