Rates

Well-Telegraphed 25bp Hike Will Surprise No One, But The Fed Is Likely To Highlight Strength In US Data

In the triple whopper of monetary decisions macro markets will have to digest this week, the BoJ is probably the most interesting, as even a baby step towards ending YCC would have huge repercussions across the complex

Published ET

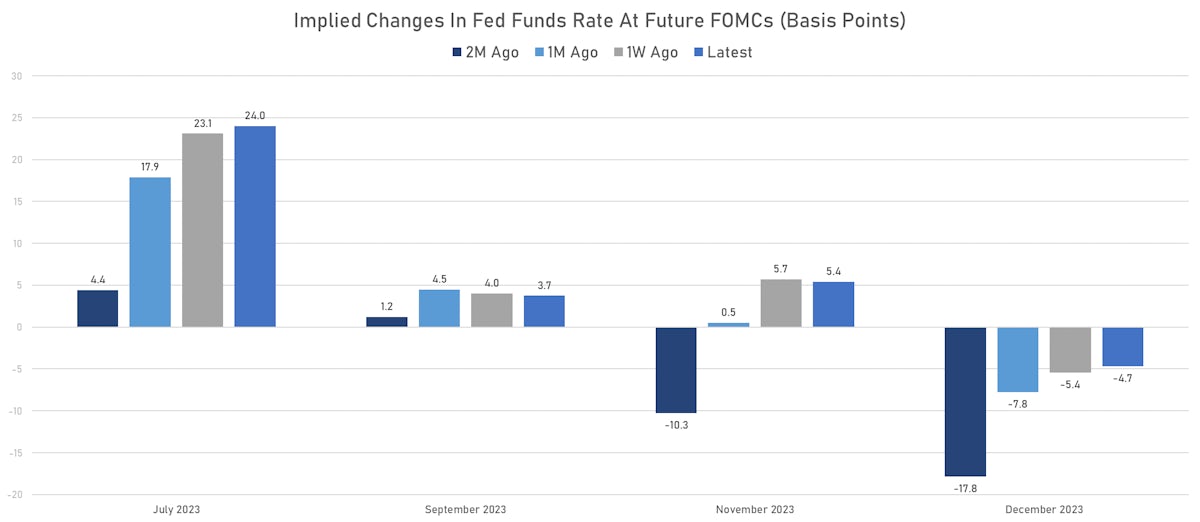

Current FOMC Pricing | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK: FOMC PREVIEW

- The Fed will raise rates by 25bp this week, and markets will focus on forward guidance (if any)

- Putting ourselves in the shoes of the Fed for a second, it's clear that they don't want to cause a premature easing in financial conditions

- So if they provide any guidance, it will have to be on the hawkish side of expectations, considering what USD markets ares pricing in forward curves

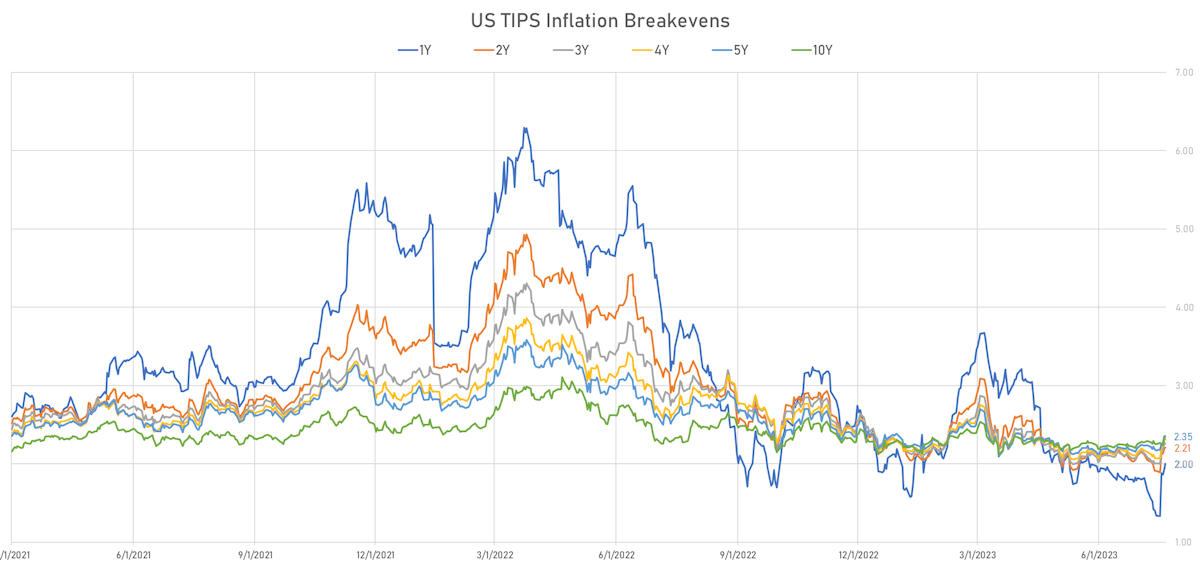

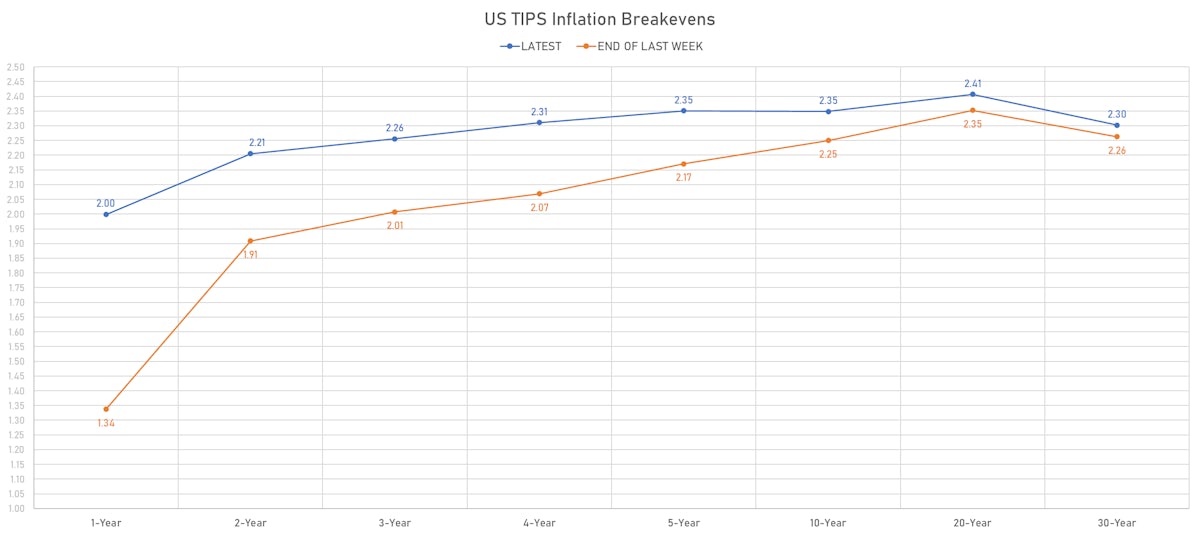

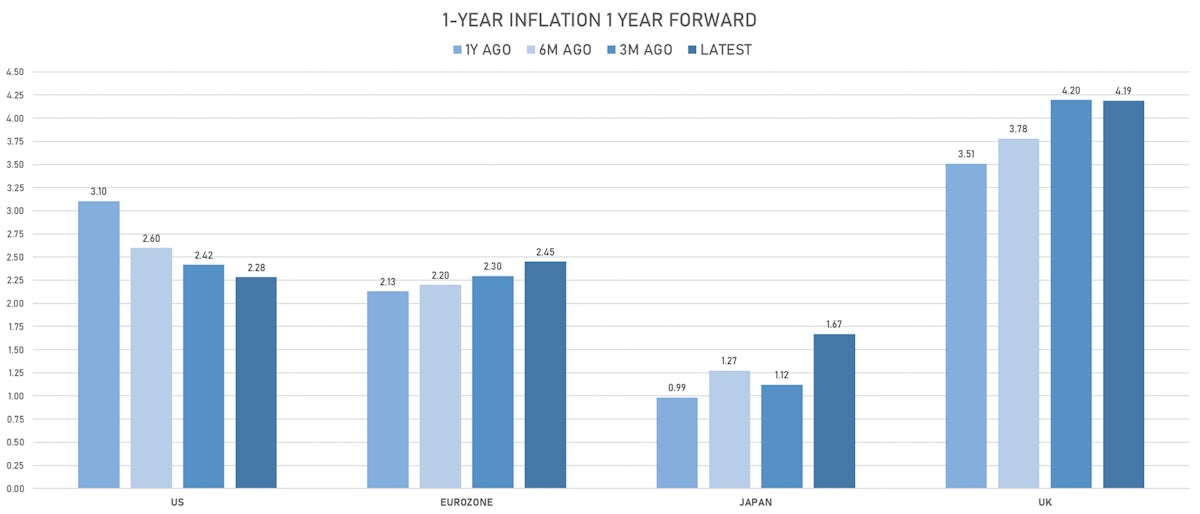

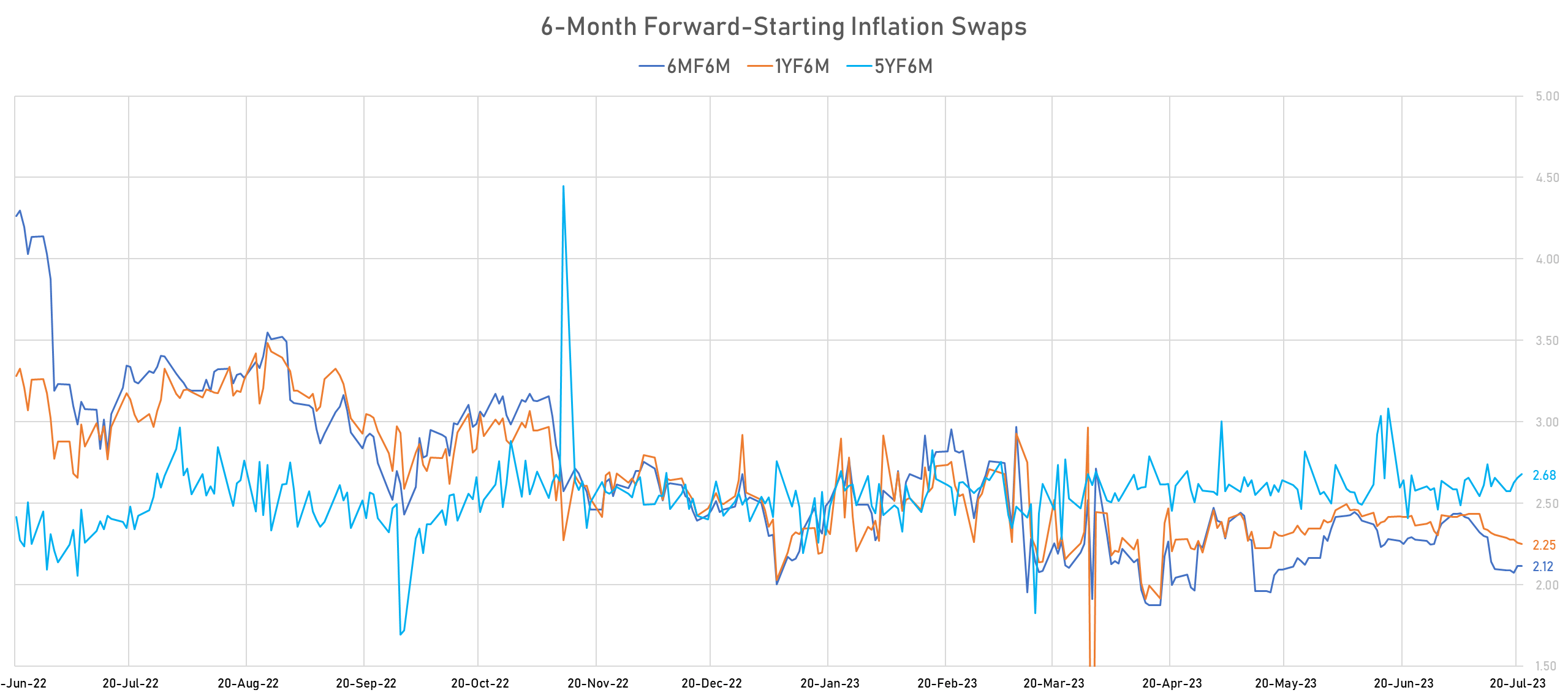

- US TIPS breakevens and forward-starting inflation swaps look very lightly priced and imply a very optimistic disinflationary path (1Y forward 1Y at 2.28%). Even the most positive economists struggle to see inflation return below 3% over the next 18 months

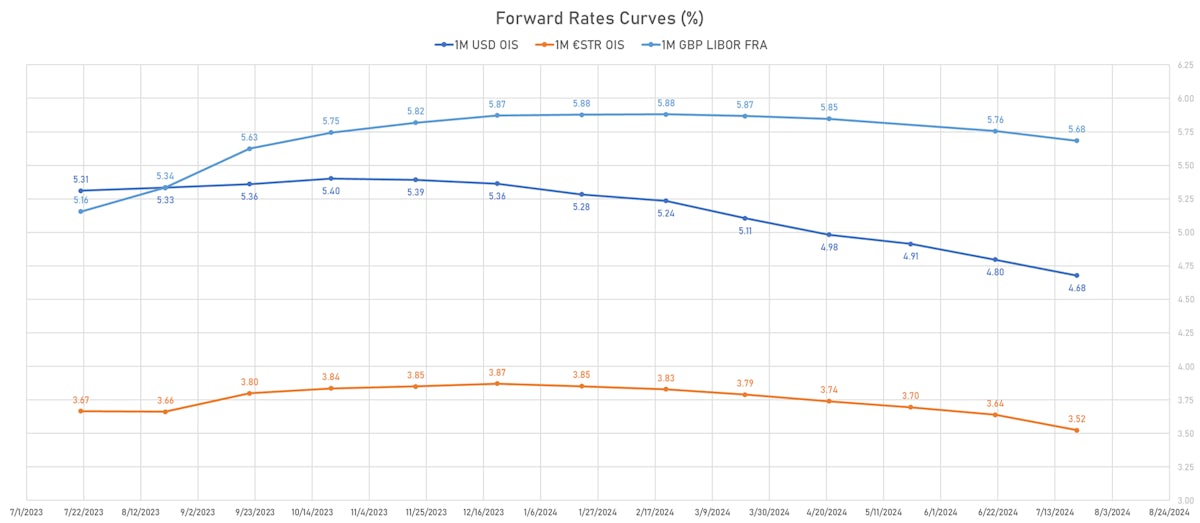

- This goes hand in hand with a high level of recession pricing: despite the recent positive surprises in US economic data the USD OIS forward rates curve still prices in over 2 rate cuts in the first half of next year (58bp between December 23 and June 24)

- In other, the risk for the market (and for the Fed) is currently that the US economy keeps overperforming low expectations, which would force a repricing of inflation and the policy path

WEEKLY US RATES SUMMARY

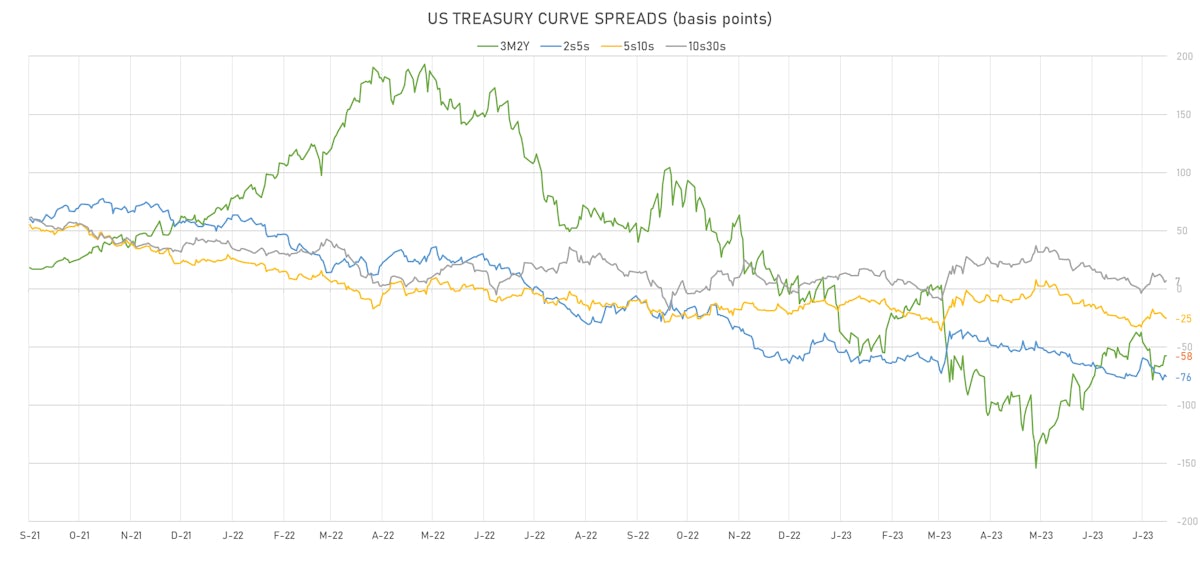

- The treasury yield curve flattened, with the 1s10s spread tightening -0.6 bp, now at -150.3 bp (YTD change: -66.9bp)

- 1Y: 5.3387% (up 1.2 bp)

- 2Y: 4.8447% (up 7.9 bp)

- 5Y: 4.0930% (up 4.9 bp)

- 7Y: 3.9693% (up 3.2 bp)

- 10Y: 3.8359% (up 0.7 bp)

- 30Y: 3.8988% (down 2.7 bp)

- US treasury curve spreads: 3m2Y at -58.0bp (up 5.3bp this week), 2s5s at -75.2bp (down -3.0bp), 5s10s at -25.7bp (down -4.5bp), 10s30s at 6.3bp (down -3.3bp)

- US 5Y TIPS inflation breakeven at 2.24% up 7.7bp; 10Y breakeven at 2.34% up 10.9bp; 30Y breakeven at 2.30% up 4.3bp

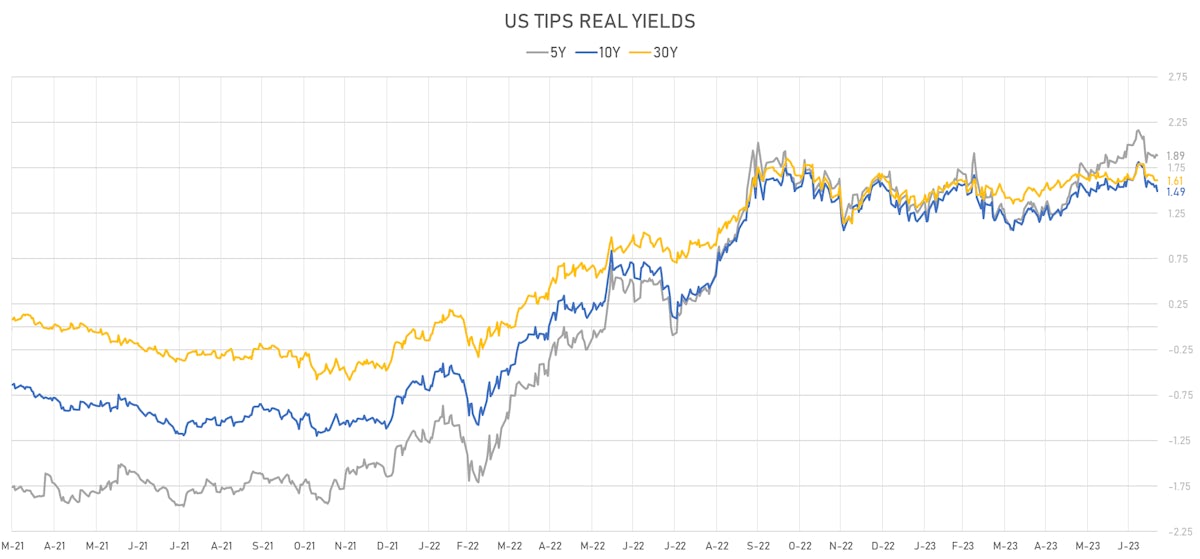

- US 5-Year TIPS Real Yield: -2.7 bp at 1.8870%; 10-Year TIPS Real Yield: -11.2 bp at 1.4930%; 30-Year TIPS Real Yield: -6.4 bp at 1.6110%

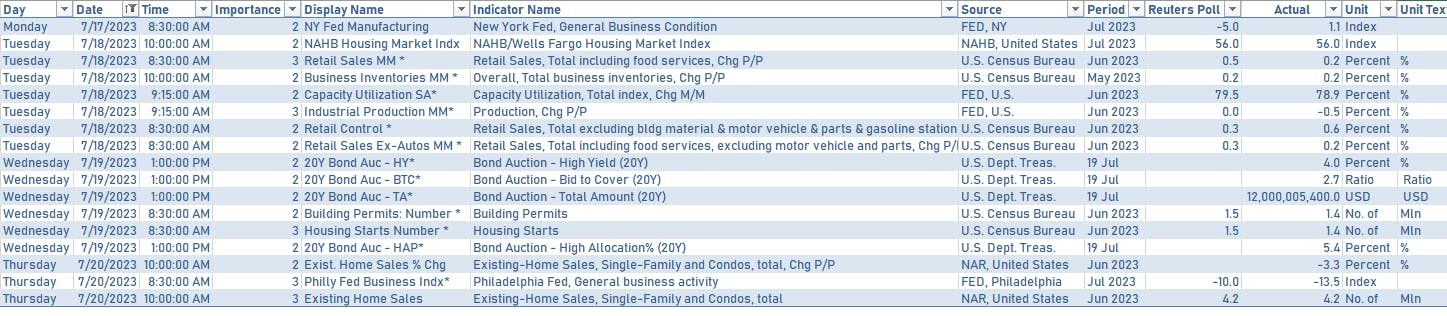

US ECONOMIC DATA OVER THE PAST WEEK

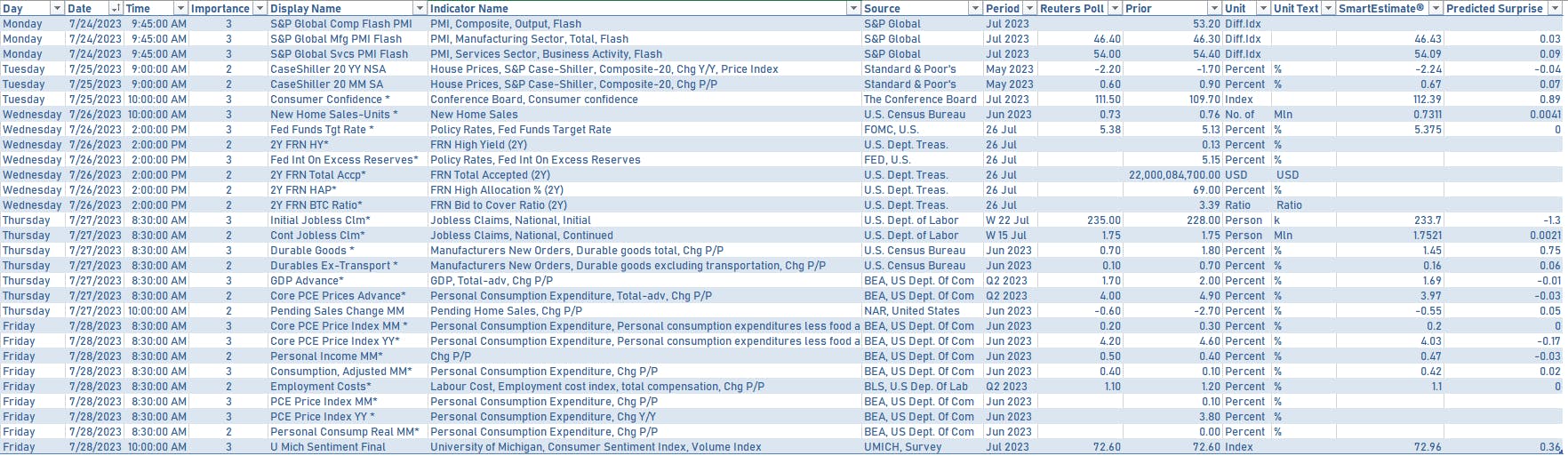

US MACRO RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Monday at 1:00PM: $40bn in 2-year notes

- Tuesday at 1:00PM: $43bn in 5-year notes

- Wednesday at 11:30AM: $24bn in 2-year FRNs

- Thursday at 1:00PM: $35bn in 7-year notes

US FORWARD RATES

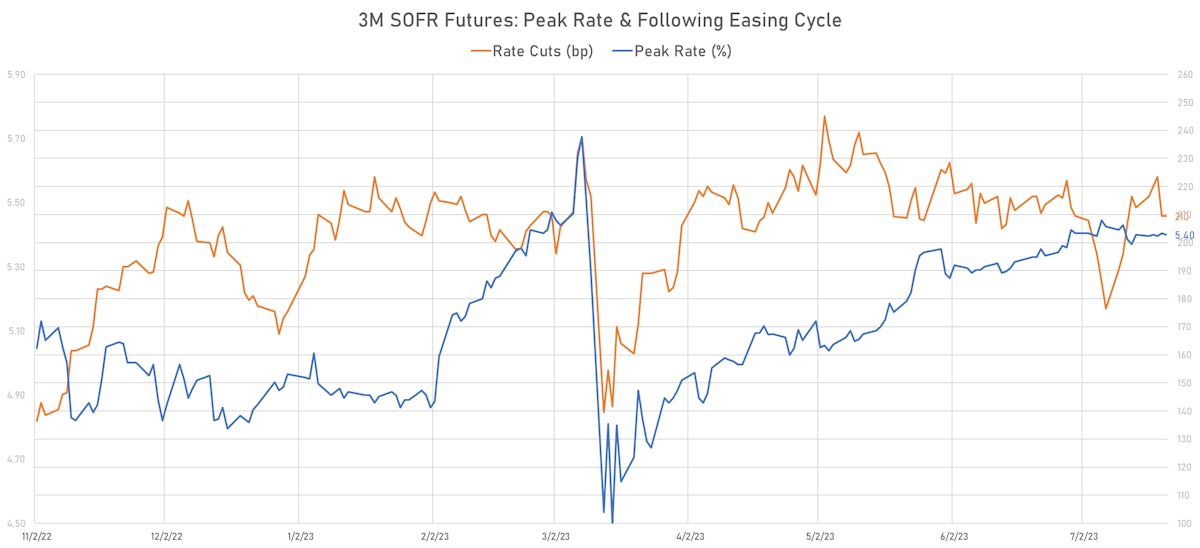

- Fed Funds futures now price in 24.0bp of Fed hikes by the end of July 2023, 27.7bp (1.1 x 25bp hikes) by the end of September 2023, and 1.3 hikes by the end of November 2023

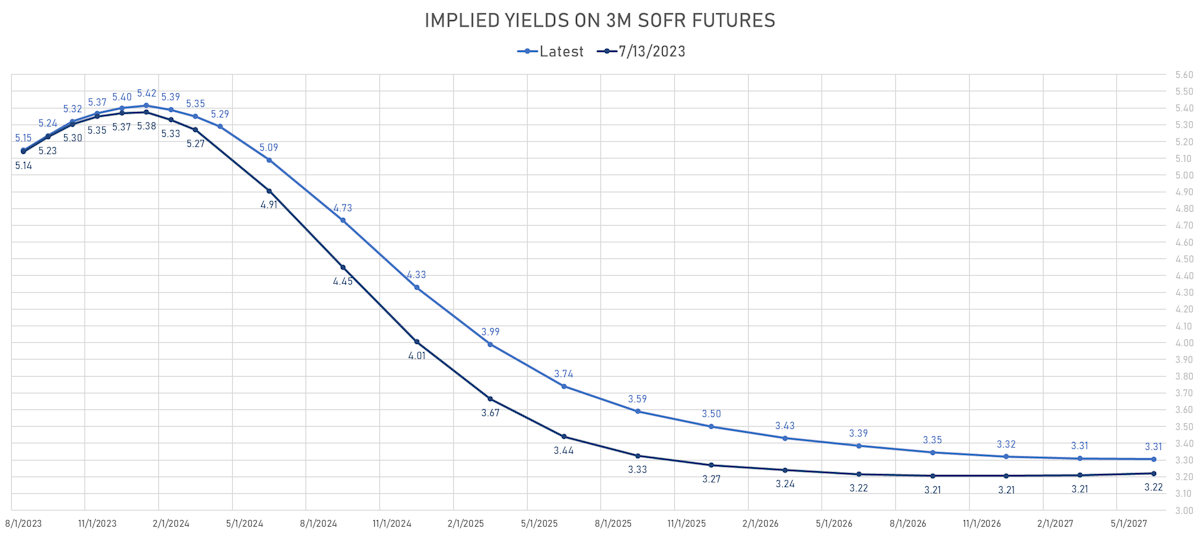

- Implied yields on 3-month SOFR futures top out at 5.42% for the January 2024 expiry and price in 211bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.00% (up 6.6bp); 2Y at 2.21% (up 1.0bp); 5Y at 2.35% (down -0.3bp); 10Y at 2.35% (up 1.8bp); 30Y at 2.30% (down -1.0bp)

- 6-month spot US CPI swap up 1.4 bp to 2.357%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.8870%, -0.6 bp today; 10Y at 1.4930%, -6.3 bp today; 30Y at 1.6110%, -0.3 bp today

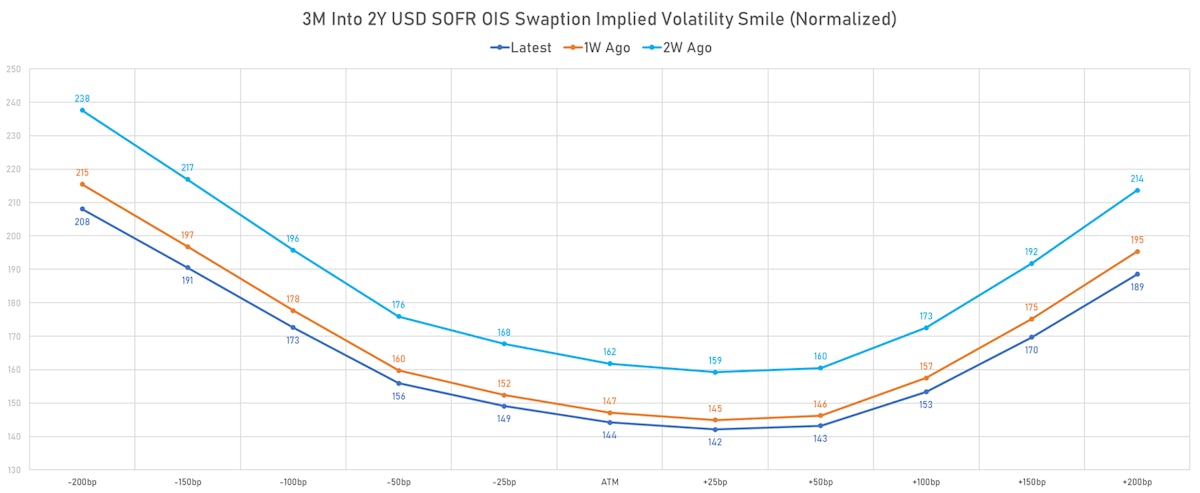

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -9.0 vols at 105.0 normals (down 14.7 normals from a week ago)

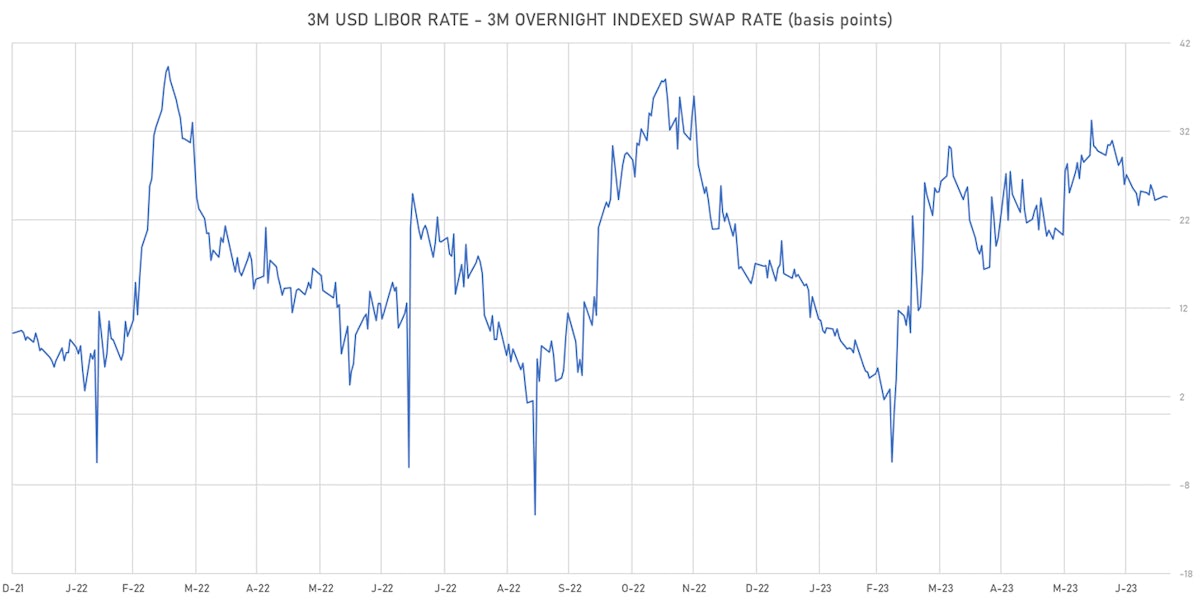

- Liquidity conditions in money markets remain stable, though term rates / OIS spreads still pretty close to YTD highs

KEY INTERNATIONAL RATES TODAY

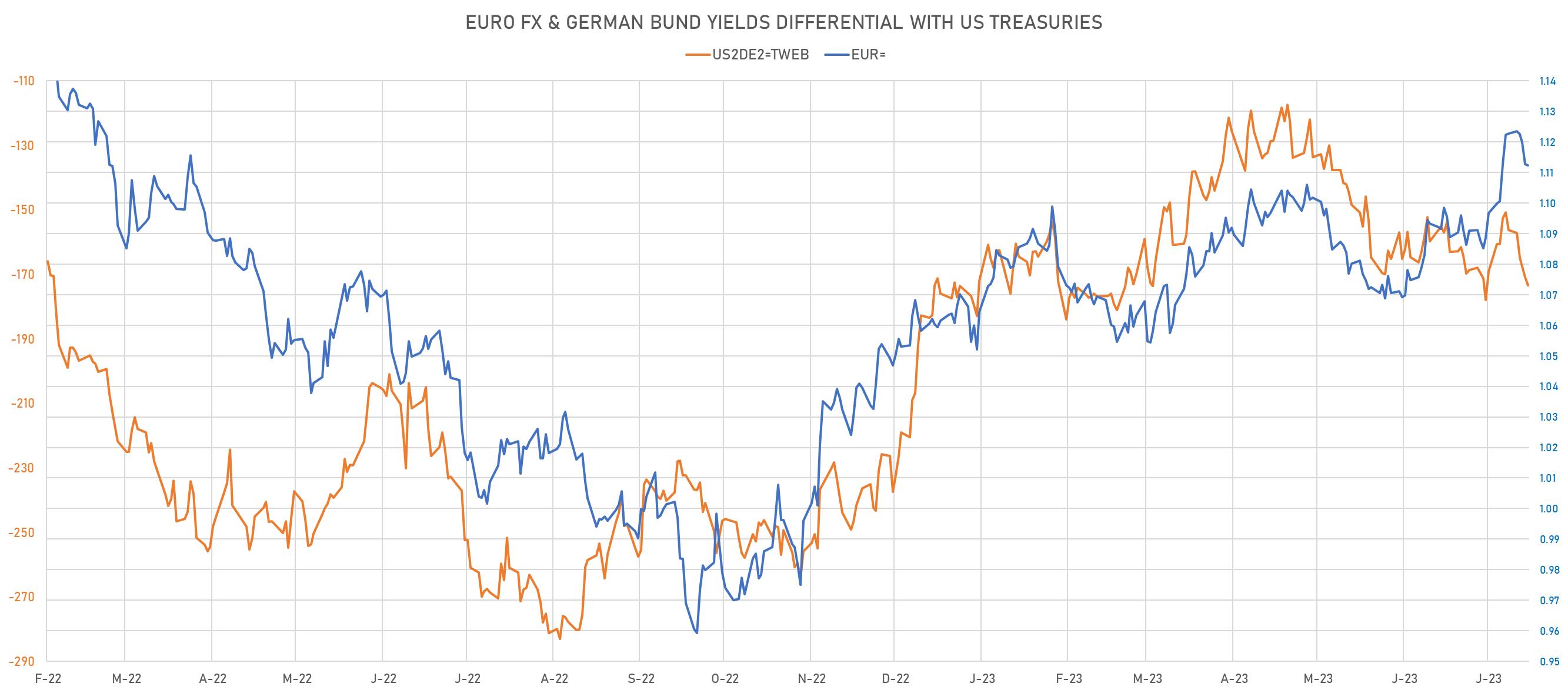

- Germany 5Y: 2.582% (down -2.3 bp); the German 1Y-10Y curve is 3.6 bp flatter at -121.0bp (YTD change: -122.6 bp)

- Japan 5Y: 0.087% (up 0.9 bp); the Japanese 1Y-10Y curve is 1.7 bp steeper at 53.9bp (YTD change: +19.2 bp)

- China 5Y: 2.395% (down -0.8 bp); the Chinese 1Y-10Y curve is 0.2 bp flatter at 91.8bp (YTD change: +18.2 bp)

- Switzerland 5Y: 1.014% (down -1.2 bp); the Swiss 1Y-10Y curve is 7.4 bp flatter at -97.8bp (YTD change: -107.7 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +2.7 bp at 173.5 bp (Weekly change: +17.2 bp; YTD change: -0.1 bp)

- US-JAPAN: -0.4 bp at 490.5 bp (Weekly change: +23.3 bp; YTD change: +51.2 bp)

- US-CHINA: +0.6 bp at 281.3 bp (Weekly change: +12.6 bp; YTD change: +63.0 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -0.6 bp at 136.0 bp (Weekly change: -4.2bp; YTD change: +7.2bp)

- US-JAPAN: -5.3 bp at 219.0 bp (Weekly change: -3.3bp; YTD change: +15.1bp)

- GERMANY-JAPAN: -4.7 bp at 83.0 bp (Weekly change: +0.1bp; YTD change: +7.9bp)