Rates

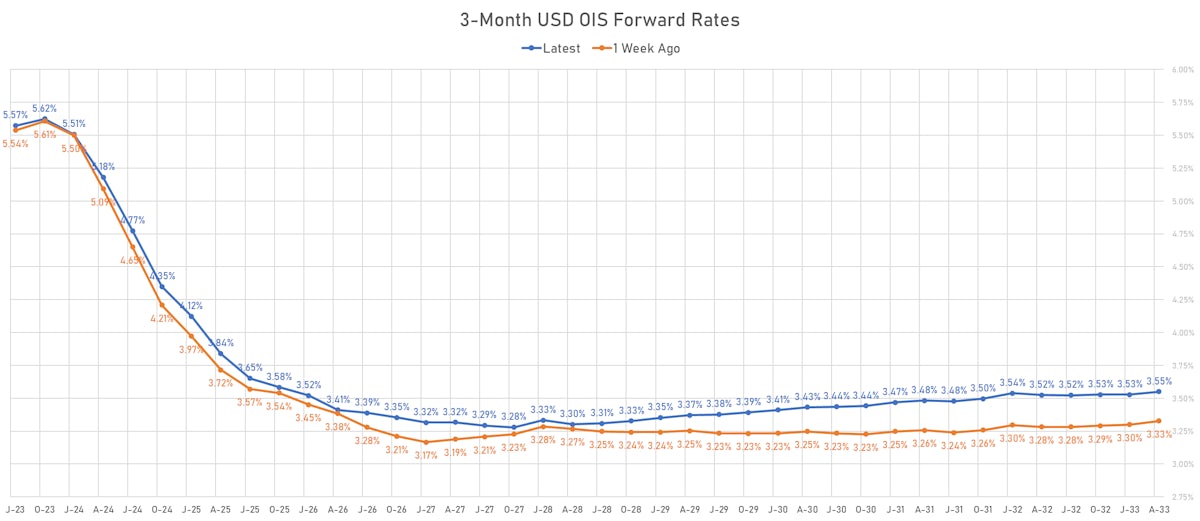

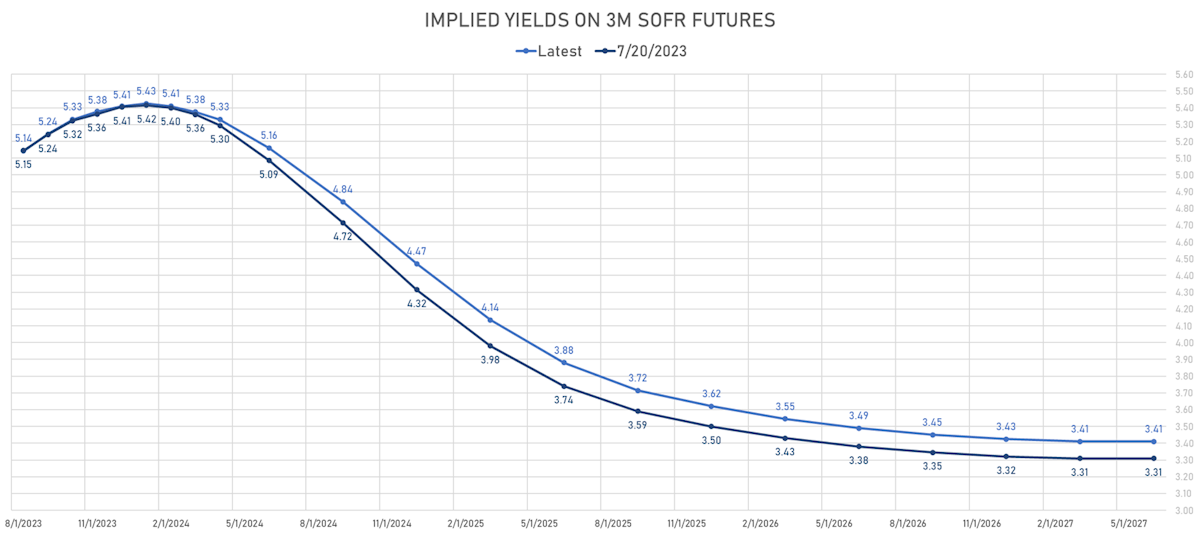

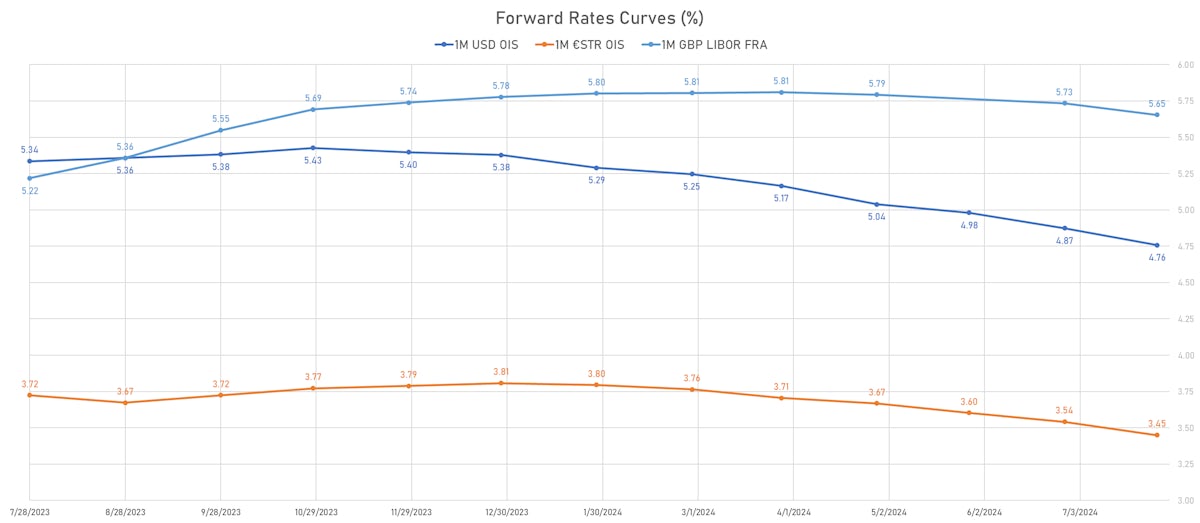

Strong US Macro Data Leads To Higher-For-Longer Shift In Forward Curve, With Fewer Cuts Priced In 2024

The low implied rates for the September and November FOMCs make sense (no clear asymmetry), as the inflation path is likely to stay favorable for the remainder of the year, putting little pressure on the Fed to tighten further

Published ET

US rates vs equities implied volatility | Source: Refinitiv

RATES OUTLOOK

- Just 9bp of hikes priced for the next 2 FOMCs, meaning that the market really expects the Fed to be done for the year

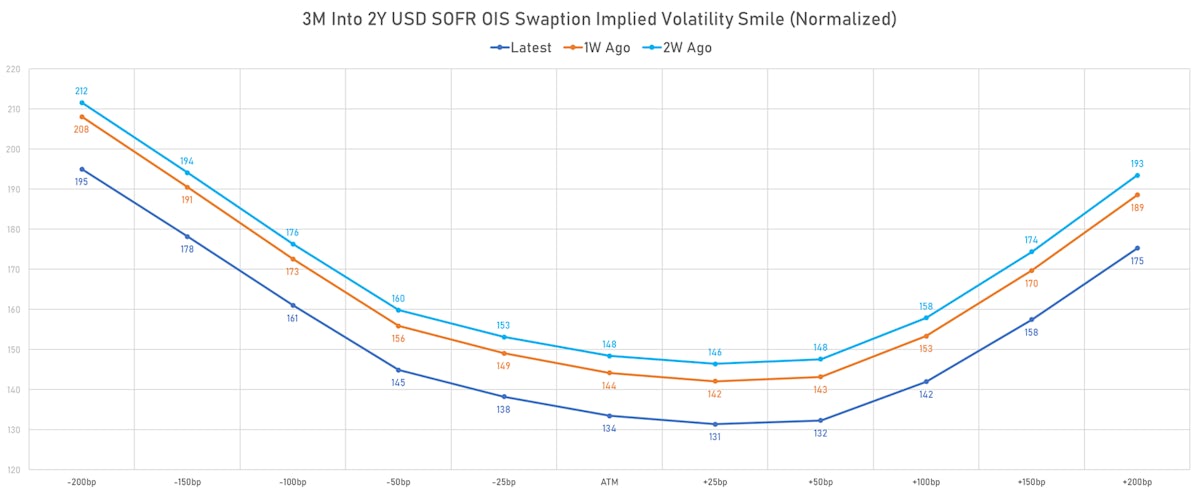

- The rather dovish picture painted by Powell helped the selloff in short-term rates volatility, with 3m into 2y atm swaptions down by about 10 normals this week

- It's hard to tell whether the Fed is really done hiking for good: economic indicators remain strong, and there is no real sense of an imminent landing (except for the fact that inflation is coming back down to more normal levels). Looking in particular at at the labor market and fiscal spending, it's hard to rule out a need for more hikes down the road.

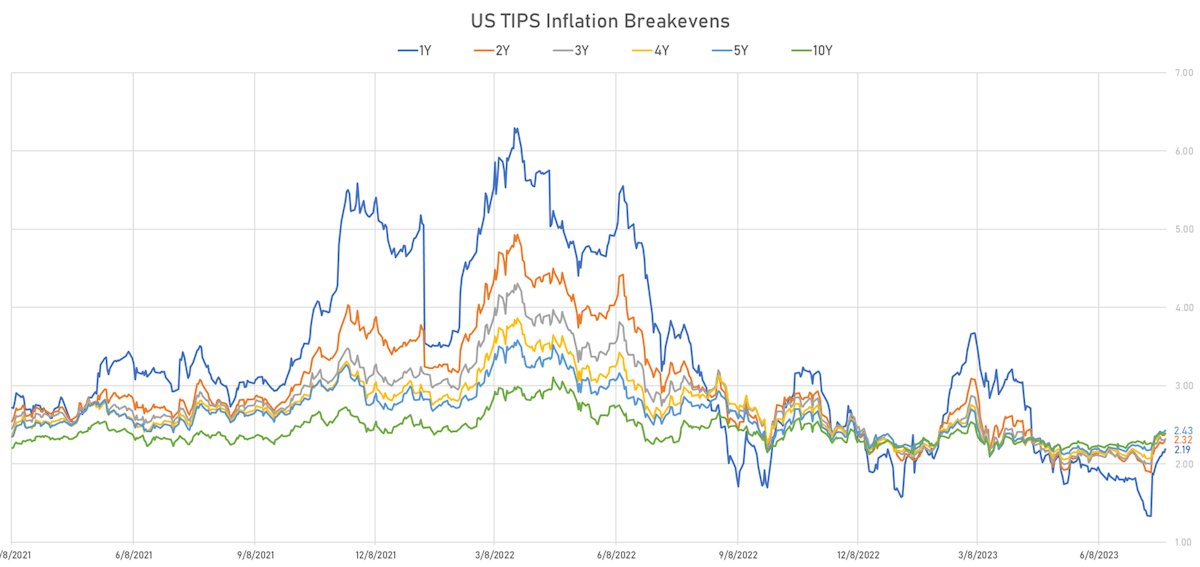

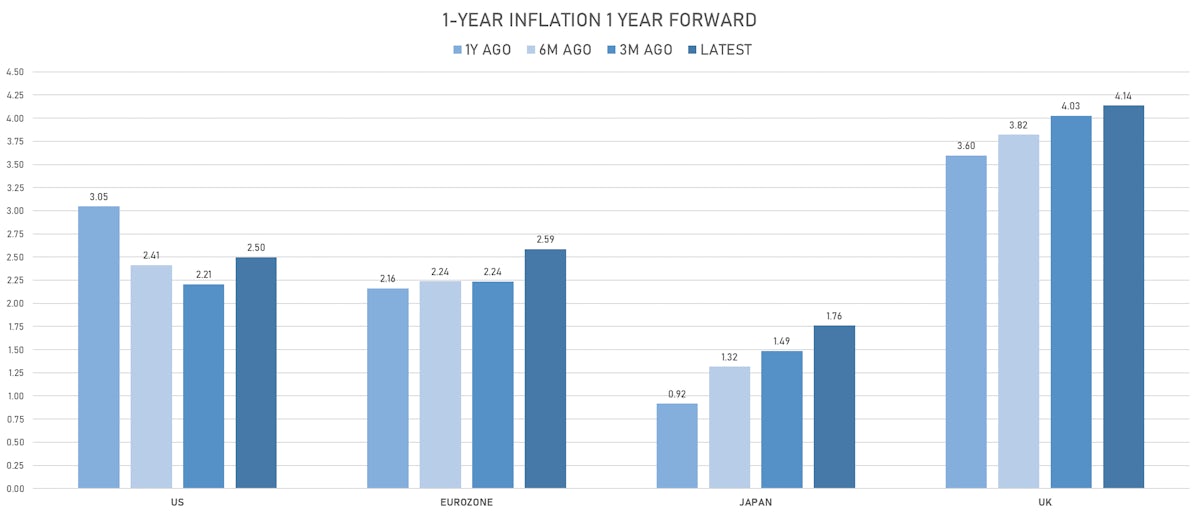

- Looking at TIPS, inflation pricing still looks too low at the front end of the breakeven curve, as it's very hard to see the CPI below 2.20% over the next 12 months

WEEKLY US RATES SUMMARY

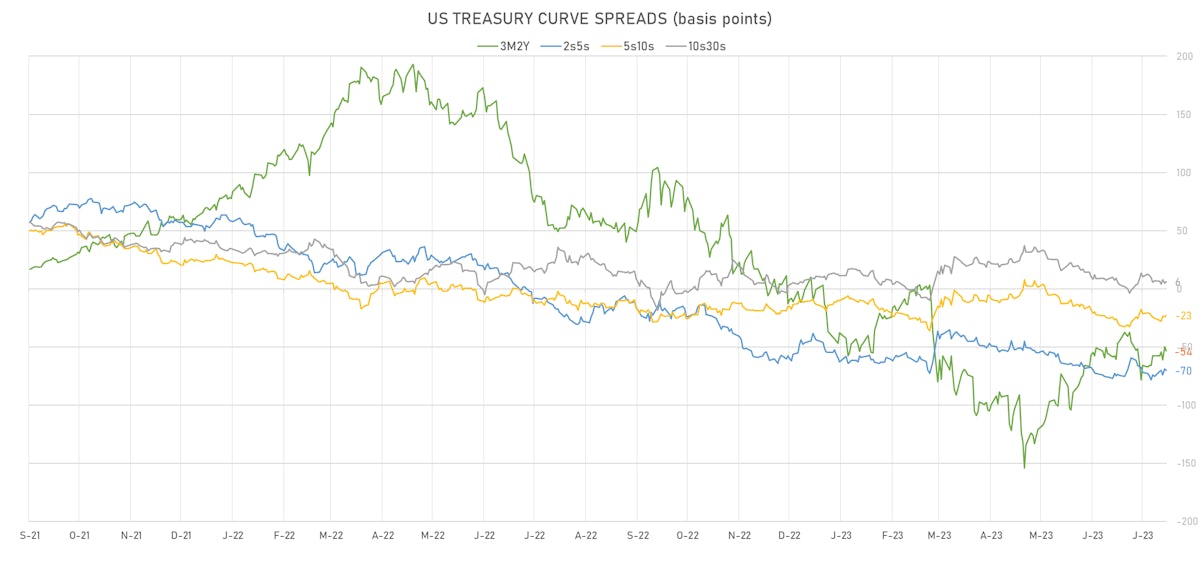

- The treasury yield curve bear steepened, with the 1s10s spread widening 8.8 bp, now at -141.5 bp (YTD change: -58.1bp)

- 1Y: 5.3703% (up 3.2 bp)

- 2Y: 4.8838% (up 3.9 bp)

- 5Y: 4.1818% (up 8.9 bp)

- 7Y: 4.0790% (up 11.0 bp)

- 10Y: 3.9556% (up 12.0 bp)

- 30Y: 4.0129% (up 11.4 bp)

- US treasury curve spreads: 3m2Y at -55.9bp (up 2.1bp this week), 2s5s at -70.2bp (up 5.3bp), 5s10s at -22.6bp (up 3.2bp), 10s30s at 5.7bp (down -0.3bp)

- US 5Y TIPS inflation breakeven at 2.32% up 6.9bp; 10Y breakeven at 2.38% up 4.0bp; 30Y breakeven at 2.31% up 1.2bp

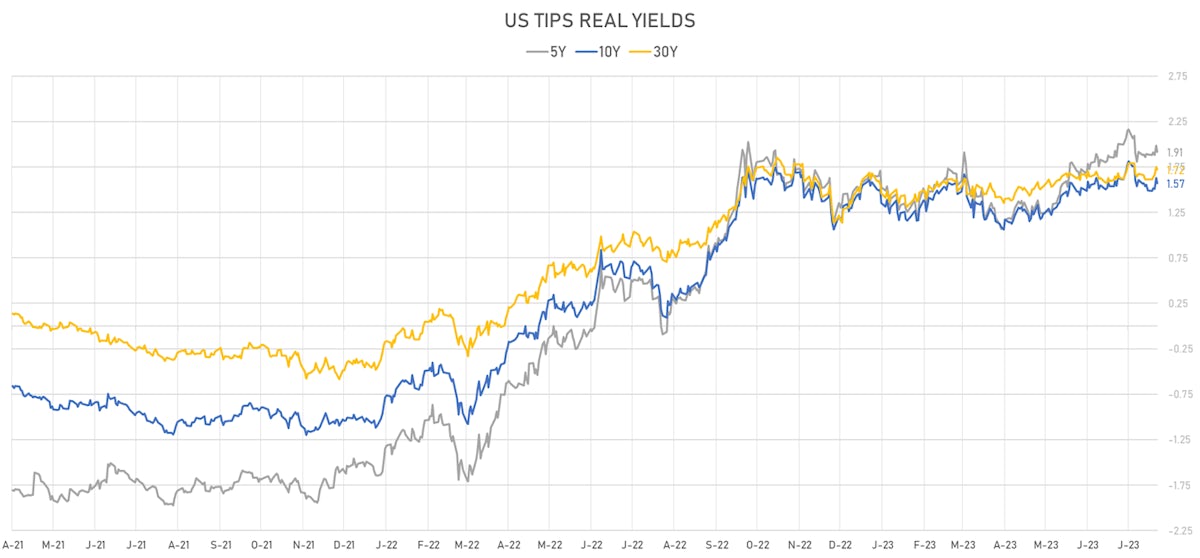

- US 5-Year TIPS Real Yield: +2.7 bp at 1.9140%; 10-Year TIPS Real Yield: +7.8 bp at 1.5710%; 30-Year TIPS Real Yield: +10.9 bp at 1.7200%

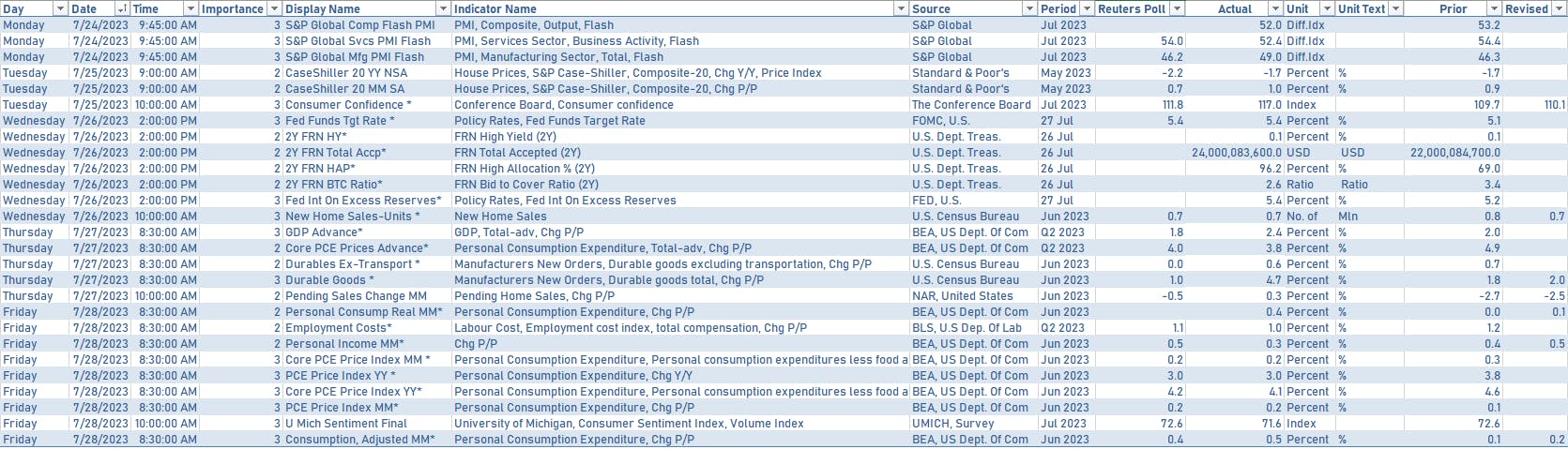

US ECONOMIC DATA OVER THE PAST WEEK

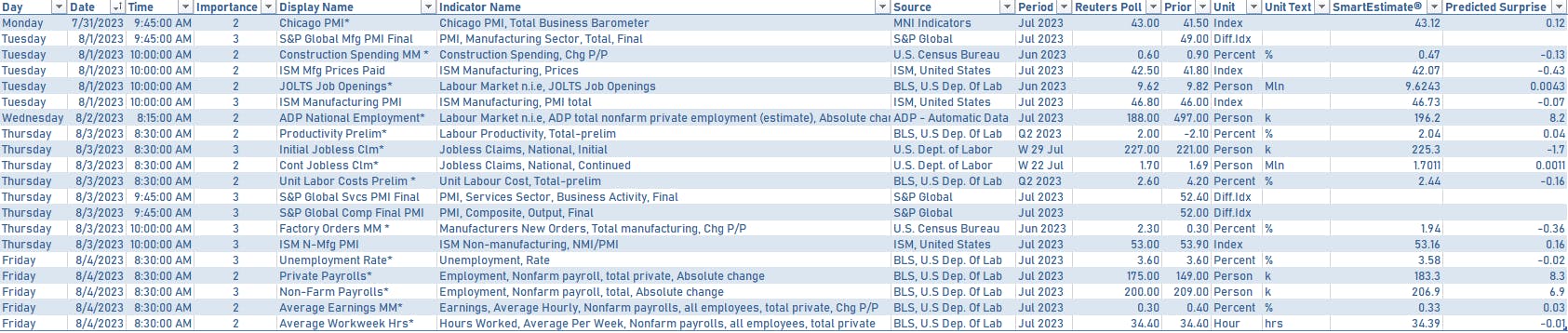

US MACRO RELEASES IN THE WEEK AHEAD

- The main event this week will be the July Employment report on Friday, with the ISMs, JOLTS, ADP, and Q2 Productivity also to be released

FED SPEAKERS IN THE WEEK AHEAD

- Monday 9:20AM: Chicago Fed President Goolsbee

- Tuesday 10:00AM: Chicago Fed President Goolsbee

- Thursday 8:30AM: Richmond Fed President Barkin

US FORWARD RATES

- Fed Funds futures now price in 5.0bp of Fed hikes by the end of September 2023, 9.1bp (0.4 x 25bp hikes) by the end of November 2023, and 0.2 hikes by the end of December 2023

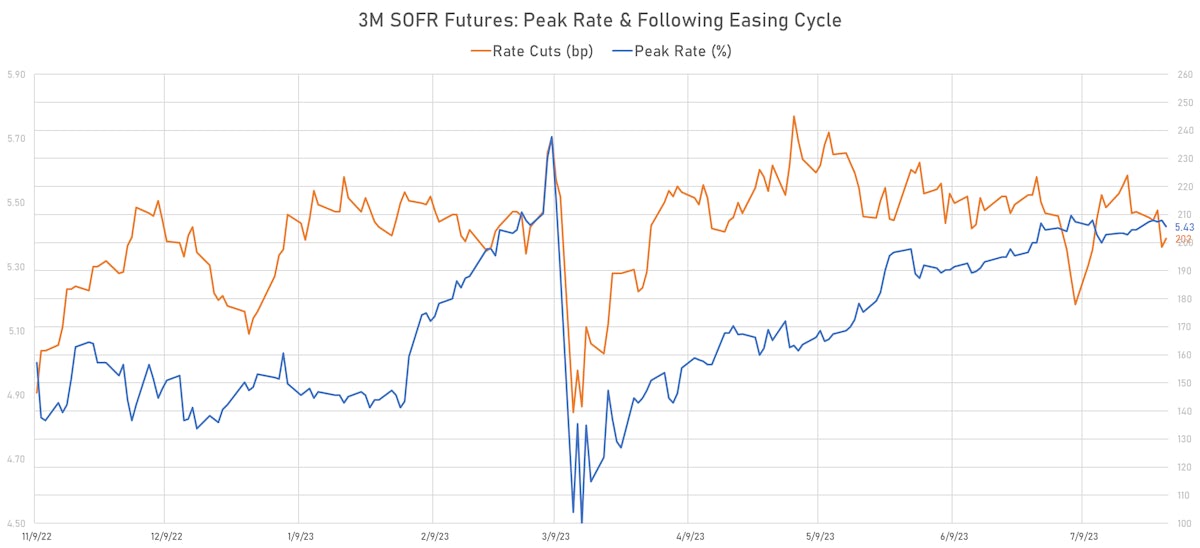

- Implied yields on 3-month SOFR futures top out at 5.43% for the January 2024 expiry and price in 202bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.19% (up 3.8bp); 2Y at 2.32% (up 3.7bp); 5Y at 2.43% (up 1.7bp); 10Y at 2.39% (up 1.0bp); 30Y at 2.31% (up 0.2bp)

- 6-month spot US CPI swap up 32.9 bp to 2.811%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.9140%, -7.0 bp today; 10Y at 1.5710%, -5.6 bp today; 30Y at 1.7200%, -2.8 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.1 vols at 92.2 normals (down 12.8 normals from a week ago)

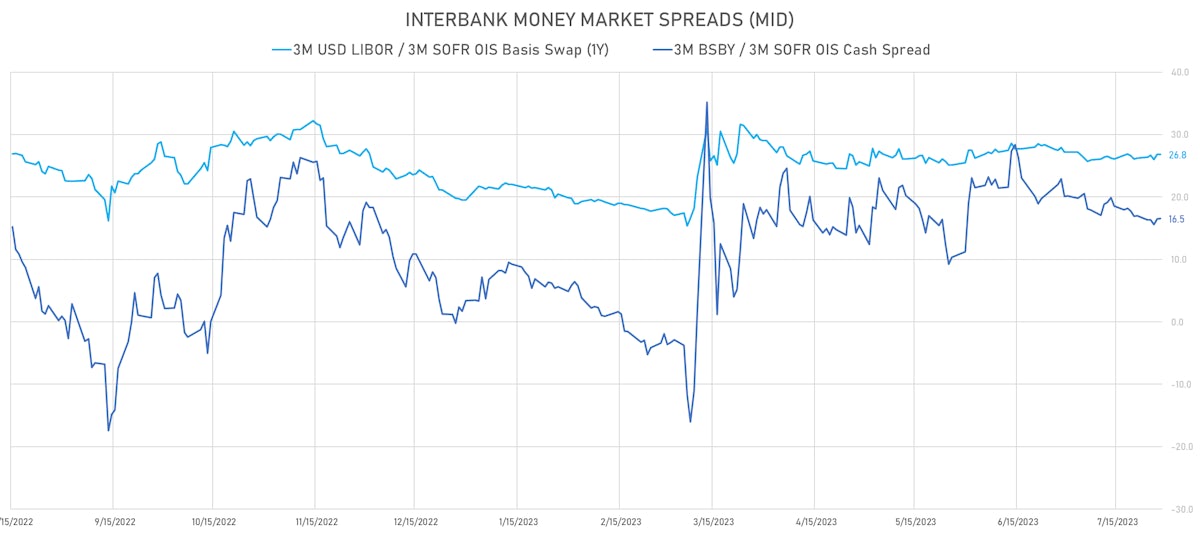

- USD money market spreads are very stable, no longer indicating any sign of stress in short-term liquidity

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.571% (unchanged 0.0 bp); the German 1Y-10Y curve is 4.5 bp steeper at -116.2bp (YTD change: -112.9 bp)

- Japan 5Y: 0.166% (up 6.1 bp); the Japanese 1Y-10Y curve is 9.4 bp steeper at 66.8bp (YTD change: +24.7 bp)

- China 5Y: 2.444% (up 1.9 bp); the Chinese 1Y-10Y curve is 8.8 bp steeper at 102.3bp (YTD change: +28.7 bp)

- Switzerland 5Y: 1.046% (up 2.0 bp); the Swiss 1Y-10Y curve is 10.3 bp steeper at -99.4bp (YTD change: -95.7 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -2.0 bp at 178.6 bp (Weekly change: +5.1 bp; YTD change: +5.0 bp)

- US-JAPAN: -7.0 bp at 492.1 bp (Weekly change: +1.6 bp; YTD change: +52.8 bp)

- US-CHINA: -5.8 bp at 281.5 bp (Weekly change: +0.2 bp; YTD change: +63.2 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -4.0 bp at 148.7 bp (Weekly change: +12.7bp; YTD change: +19.9bp)

- US-JAPAN: -13.2 bp at 224.7 bp (Weekly change: +5.7bp; YTD change: +20.8bp)

- GERMANY-JAPAN: -9.2 bp at 76.0 bp (Weekly change: -7.0bp; YTD change: +0.9bp)