Rates

Duration Sold Off This Week, With 30Y Bond Yields Touching 4.3% For The First Time In 2023

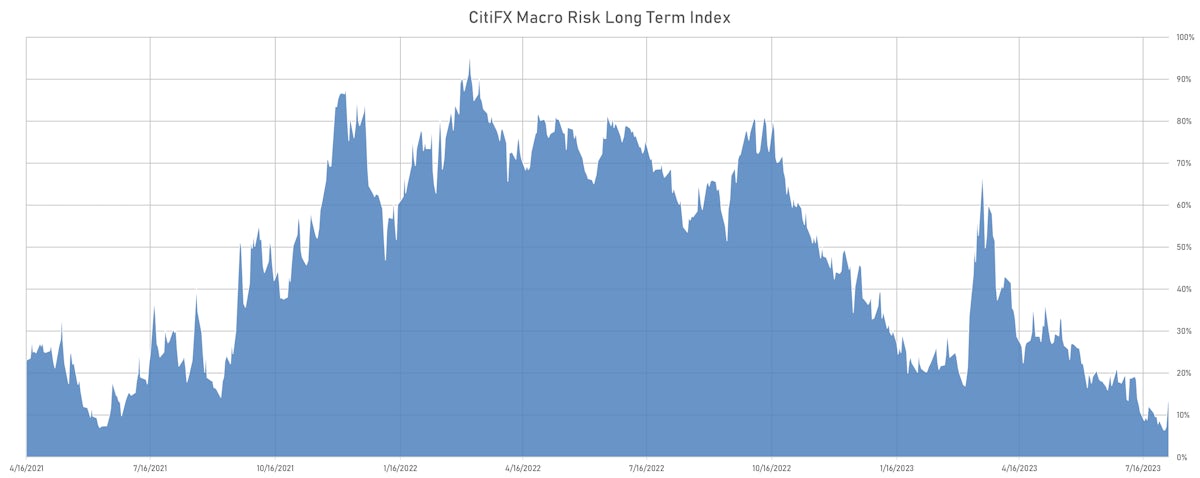

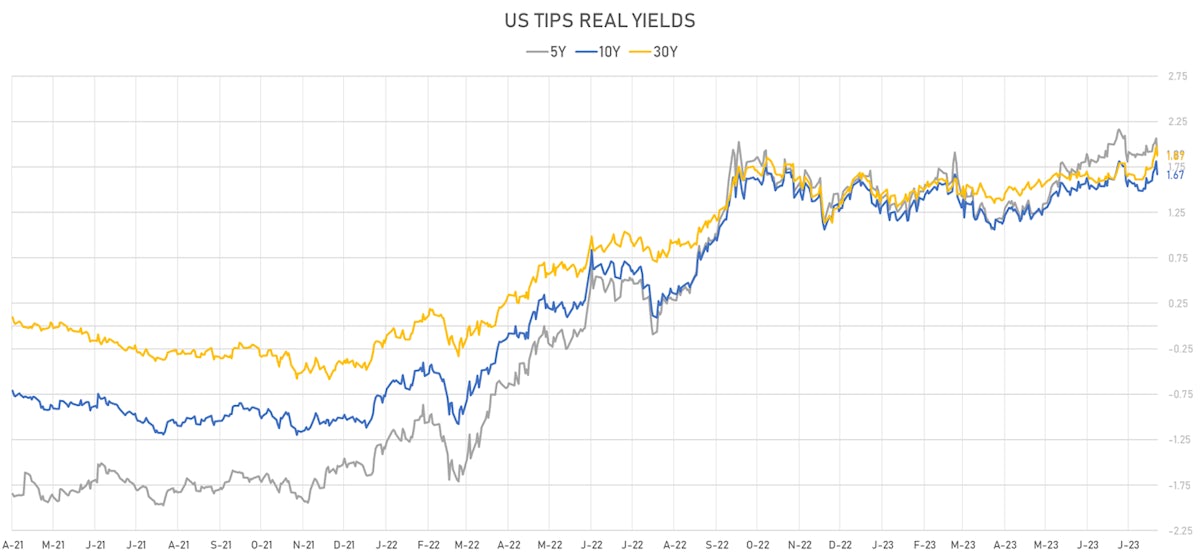

The US economy has been able to withstand Fed hikes much better than anticipated, causing multiple investment banks to abandon their calls for a recession this year, and putting pressure on the level of the real neutral rate

Published ET

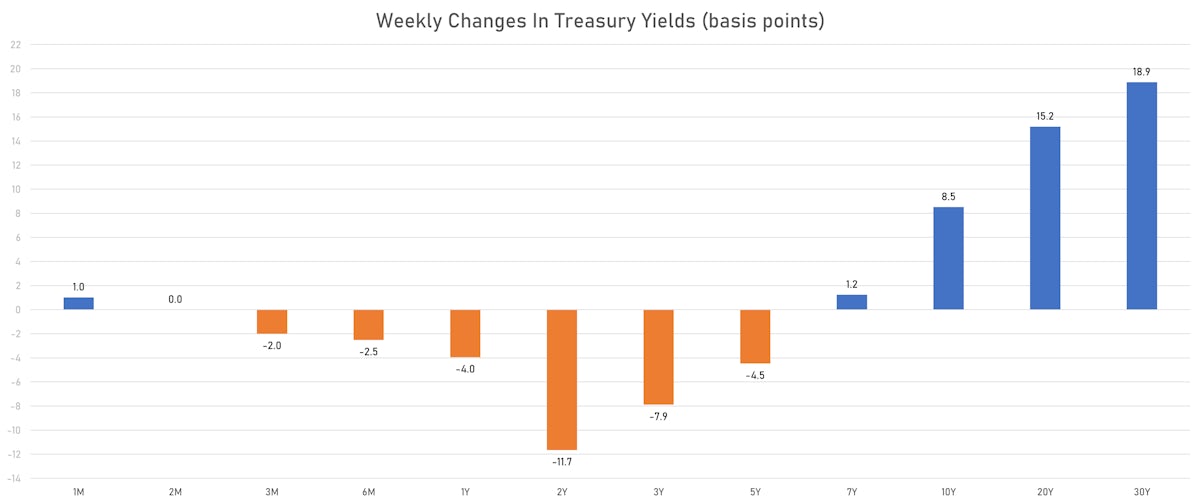

Weekly Change In the US Treasury Yield Curve (bp) | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK

- The US yield curve bear steepened over the past week, with various narratives coming up: a consequence of Japanese YCC adjustments, the US Treasury's quarterly refunding statement showing increased supply, the Fitch downgrade, etc.

- None of those provide a satisfactory explanation for the magnitude of the moves though

- After expecting a recession all year, the market has realized that the "no landing" scenario should now be the base case

- The fact that the US economy has withstood higher rates much better than initially thought means that the neutral real rate is likely significantly higher than the previous 0.5% estimate

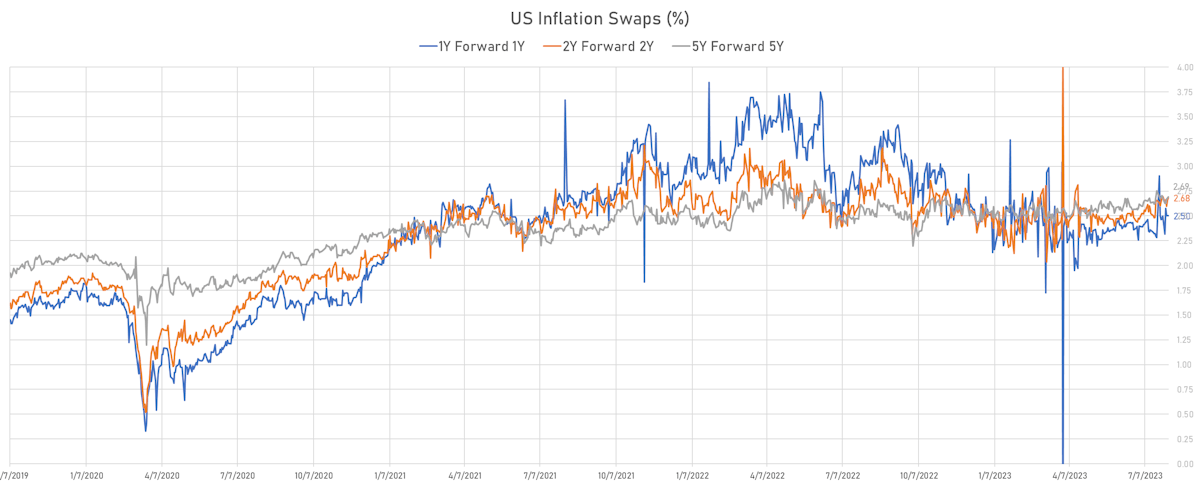

- That explains the move in long-term nominal and real yields, with relatively minor moves in breakevens

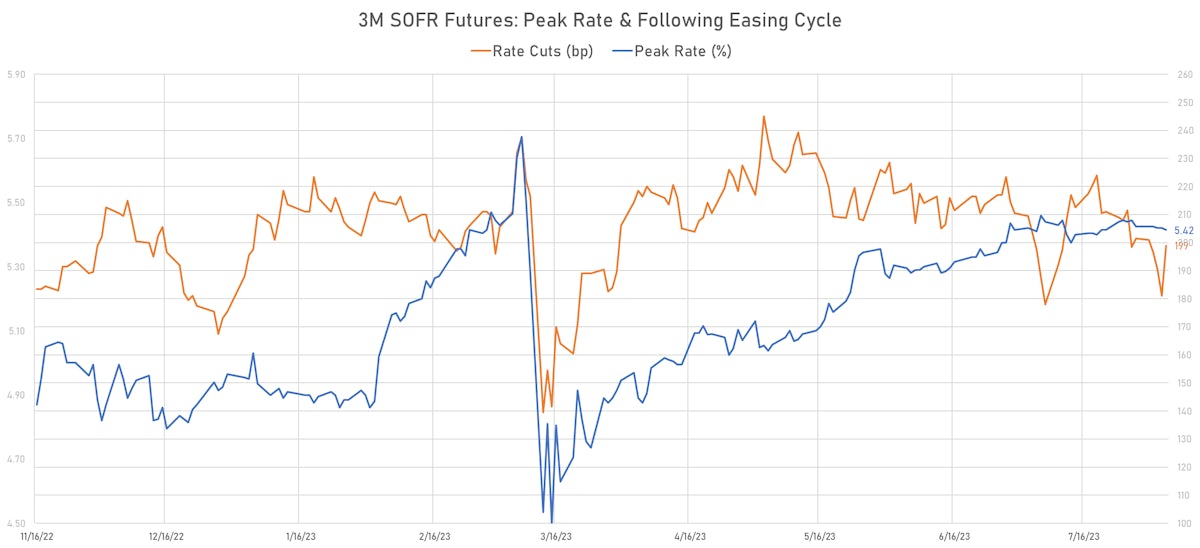

- The increased number of rate cuts priced over the next 2 years is harder to explain in this context, but makes sense if disinflation continues amidst moderate growth

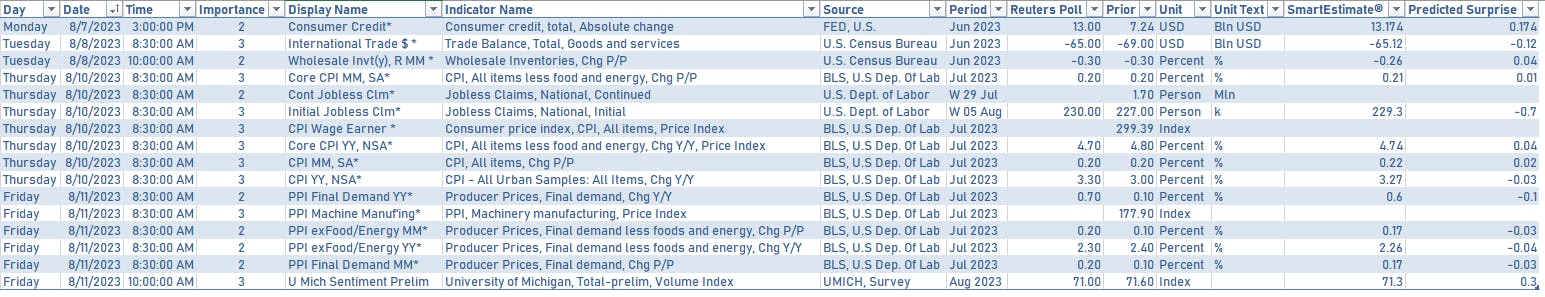

- The CPI data this week will probably not cause large moves in FOMC pricing: there's only about 8bp priced for the next two meetings, which looks about right unless we see a huge beat

WEEKLY US RATES SUMMARY

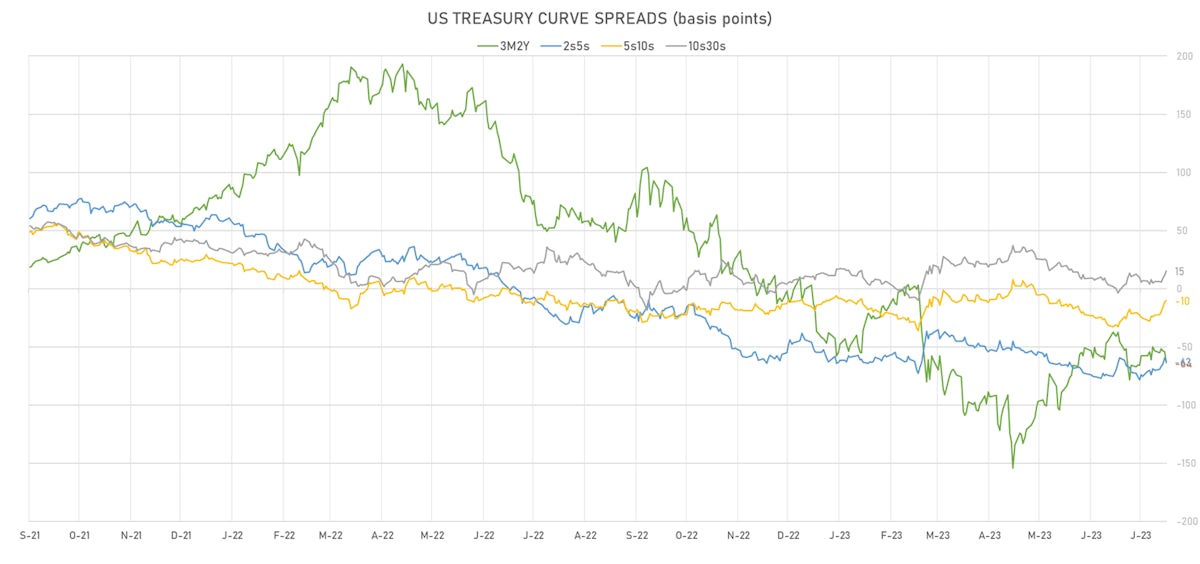

- The treasury yield curve steepened, with the 1s10s spread widening 12.5 bp, now at -129.0 bp (YTD change: -45.6bp)

- 1Y: 5.3308% (down 4.0 bp)

- 2Y: 4.7672% (down 11.7 bp)

- 5Y: 4.1371% (down 4.5 bp)

- 7Y: 4.0914% (up 1.2 bp)

- 10Y: 4.0408% (up 8.5 bp)

- 30Y: 4.2017% (up 18.9 bp)

- US treasury curve spreads: 3m2Y at -66.0bp (down -10.1bp this week), 2s5s at -63.0bp (up 6.8bp), 5s10s at -9.6bp (up 12.7bp), 10s30s at 16.1bp (up 10.5bp)

- US 5Y TIPS inflation breakeven at 2.29% down 2.7bp; 10Y breakeven at 2.37% down 1.5bp; 30Y breakeven at 2.35% up 4.1bp

- US 5-Year TIPS Real Yield: -2.4 bp at 1.8900%; 10-Year TIPS Real Yield: +9.9 bp at 1.6700%; 30-Year TIPS Real Yield: +15.4 bp at 1.8740%

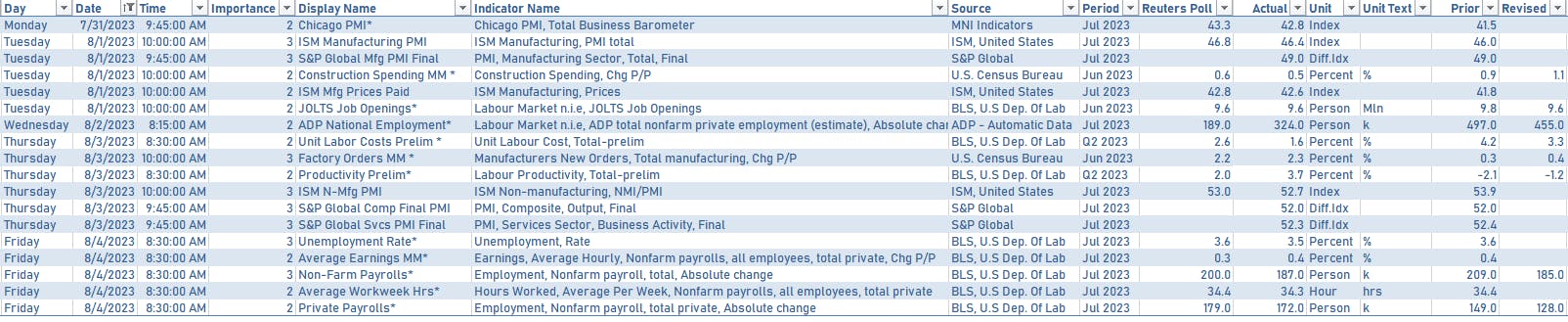

US ECONOMIC DATA OVER THE PAST WEEK

US MACRO RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Tuesday 1.00PM (EST): $42bn in 3Y notes

- Wednesday 1.00PM: $38bn in 10Y notes

- Thursday 1.00PM: $23bn in 30Y bonds

FED SPEAKERS IN THE WEEK AHEAD

- Monday 8:30AM: Atlanta Fed President Bostic

- Monday 8:30AM: Fed Governor Bowman

- Tuesday 8:15AM: Philadelphia Fed President Harker

- Thursday 3:00PM: Atlanta Fed President Bostic

- Thursday 4:15PM: Philadelphia Fed President Harker

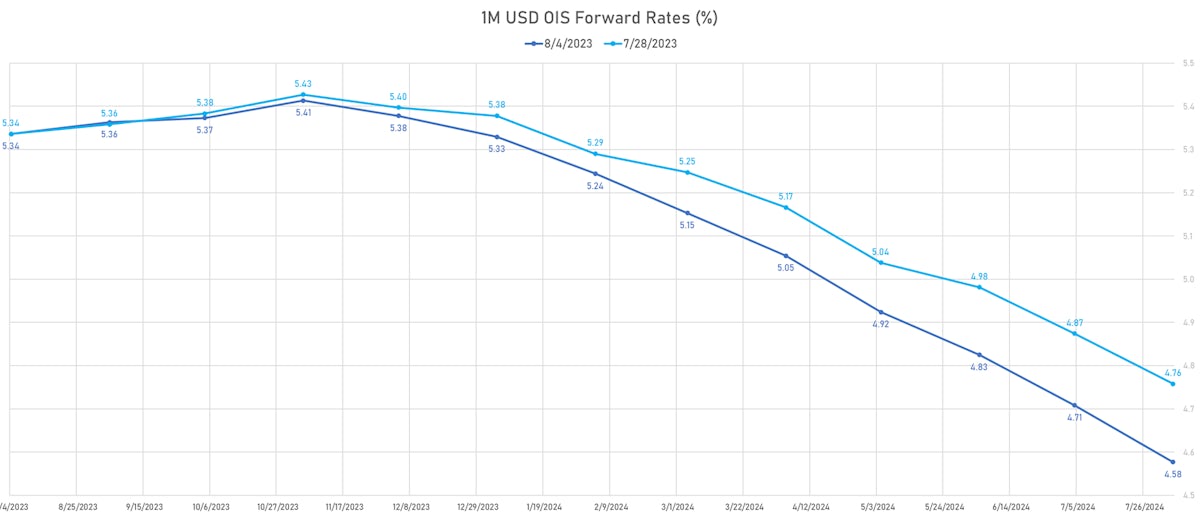

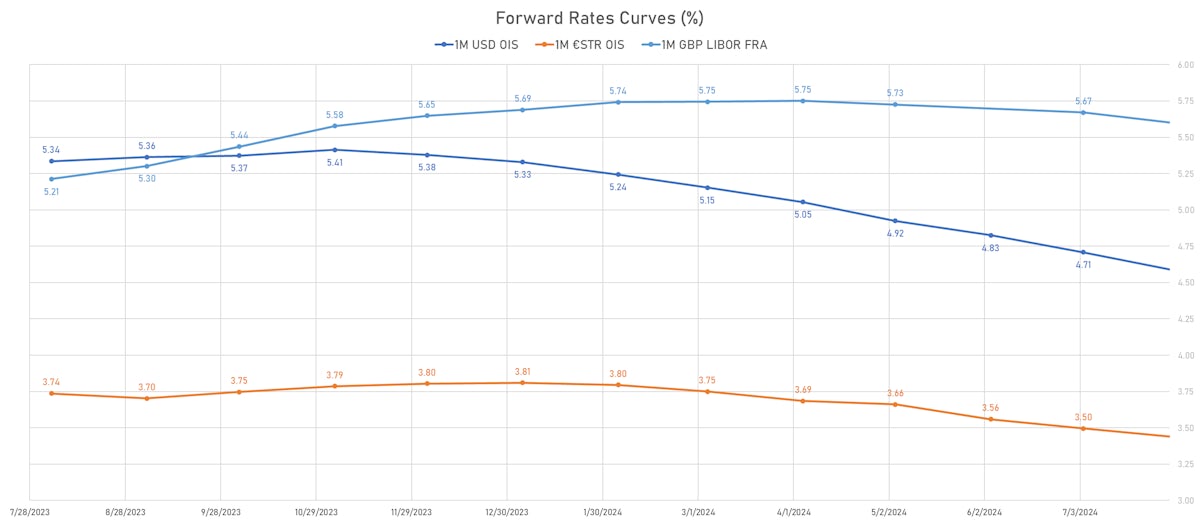

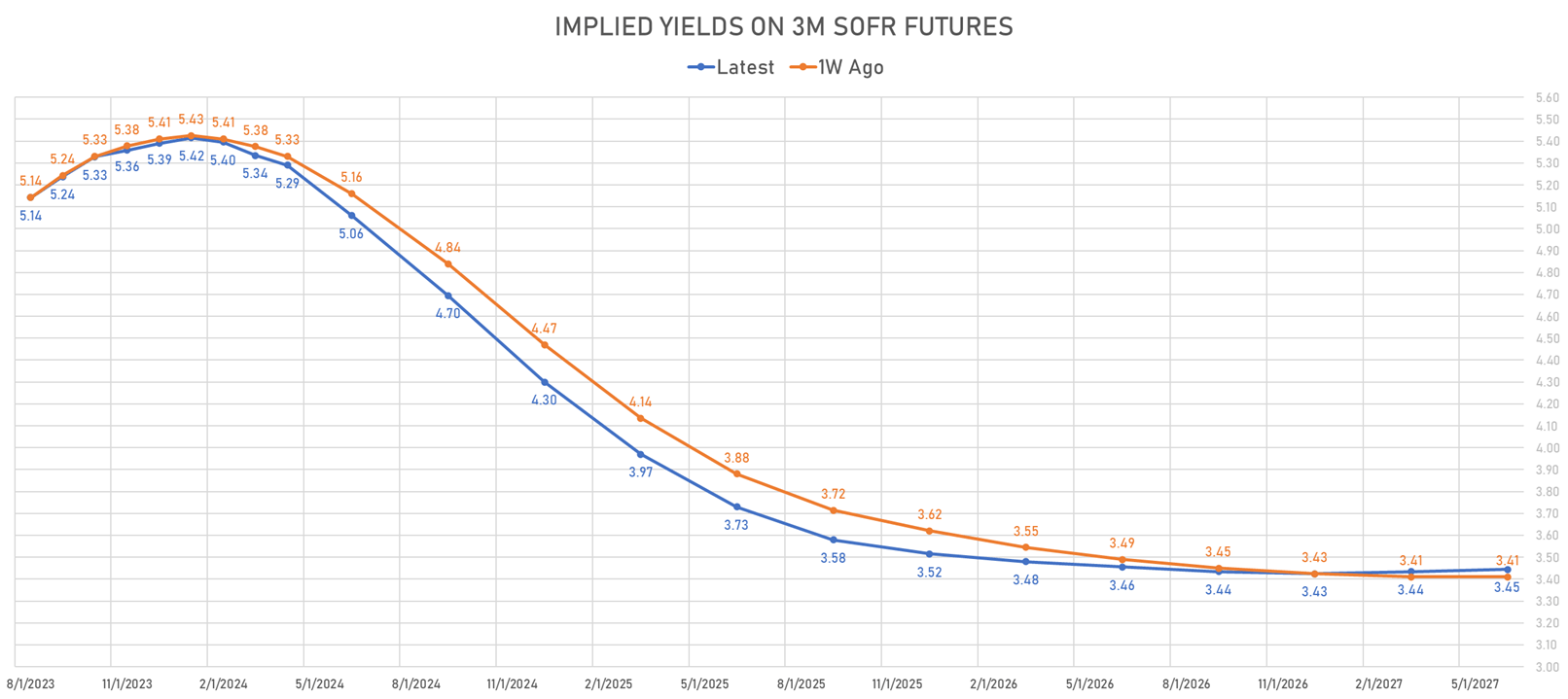

US FORWARD RATES

- Fed Funds futures now price in 3.1bp of Fed hikes by the end of September 2023, 7.8bp (0.3 x 25bp hikes) by the end of November 2023, and 0.2 hikes by the end of December 2023

- Implied yields on 3-month SOFR futures top out at 5.42% for the January 2024 expiry and price in 199bp of rate cuts over the following easing cycle

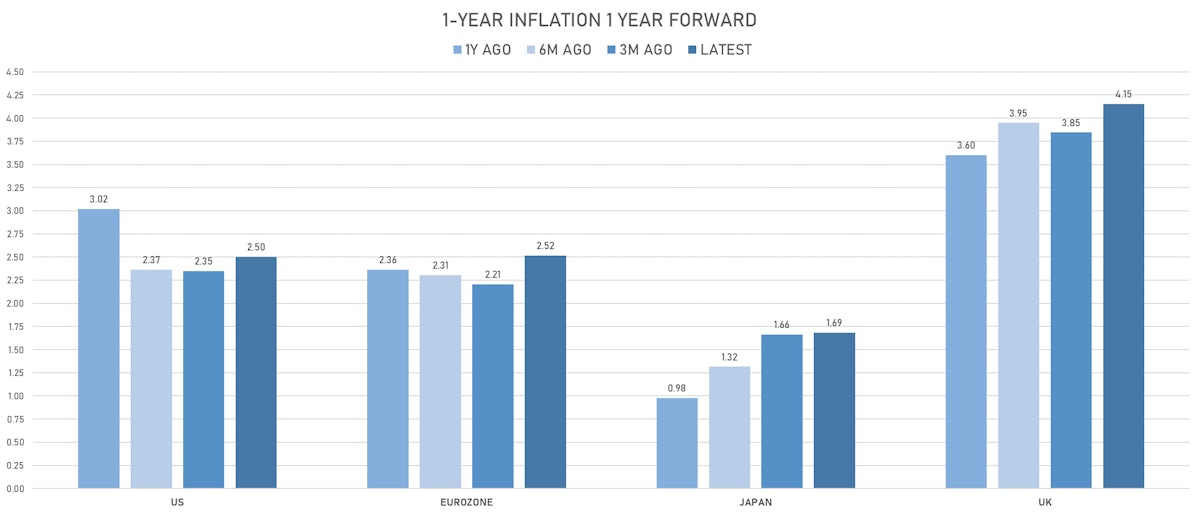

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.14% (up 3.8bp); 2Y at 2.28% (up 2.7bp); 5Y at 2.39% (up 2.1bp); 10Y at 2.38% (up 0.5bp); 30Y at 2.34% (up 1.0bp)

- 6-month spot US CPI swap down -0.6 bp to 2.670%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.8900%, -17.4 bp today; 10Y at 1.6700%, -14.2 bp today; 30Y at 1.8740%, -10.4 bp today

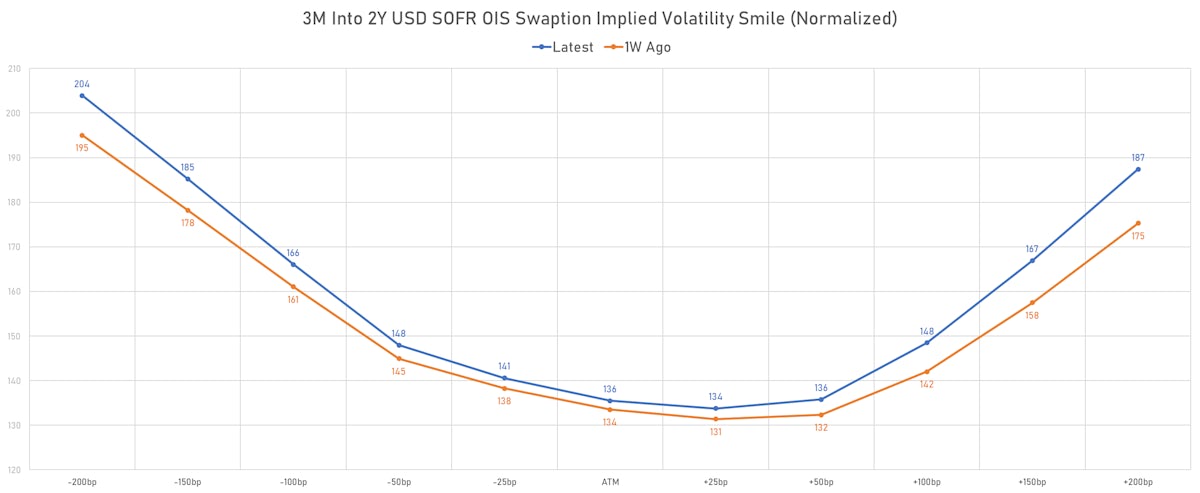

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -4.5 vols at 80.8 normals (down 11.4 normals from a week ago)

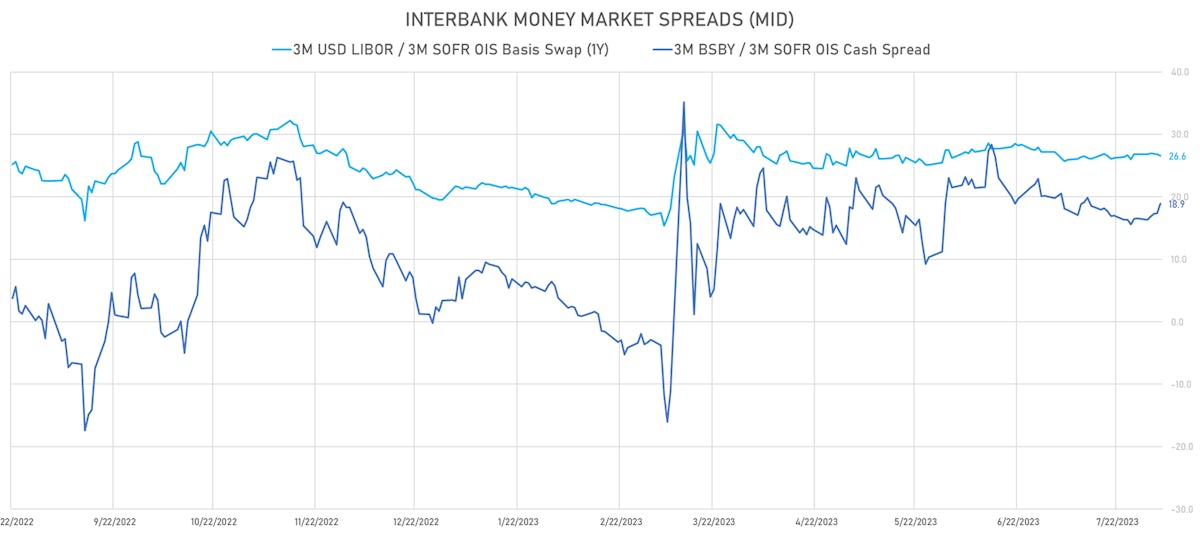

- Liquidity in interbank market is normal, though still more elevated than before the SVB event

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.575% (up 0.4 bp); the German 1Y-10Y curve is 4.0 bp flatter at -114.3bp (YTD change: -108.1 bp)

- Japan 5Y: 0.218% (unchanged); the Japanese 1Y-10Y curve is 1.1 bp flatter at 72.3bp (YTD change: +31.1 bp)

- China 5Y: 2.428% (down -0.2 bp); the Chinese 1Y-10Y curve is 4.9 bp steeper at 101.4bp (YTD change: +27.8 bp)

- Switzerland 5Y: 1.014% (down -0.1 bp); the Swiss 1Y-10Y curve is 1.0 bp flatter at -90.2bp (YTD change: -96.7 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -8.7 bp at 175.0 bp (Weekly change: -3.6 bp; YTD change: +1.4 bp)

- US-JAPAN: -6.6 bp at 479.7 bp (Weekly change: -12.4 bp; YTD change: +40.4 bp)

- US-CHINA: -12.5 bp at 274.3 bp (Weekly change: -7.2 bp; YTD change: +56.0 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -5.6 bp at 159.8 bp (Weekly change: +11.1bp; YTD change: +31.0bp)

- US-JAPAN: -17.3 bp at 221.9 bp (Weekly change: -2.8bp; YTD change: +18.0bp)

- GERMANY-JAPAN: -11.7 bp at 62.1 bp (Weekly change: -13.9bp; YTD change: -13.0bp)