Rates

US Yield Curve Twist Flattens As The Fed Seems To Maintain A Hawkish Bias At Jackson Hole

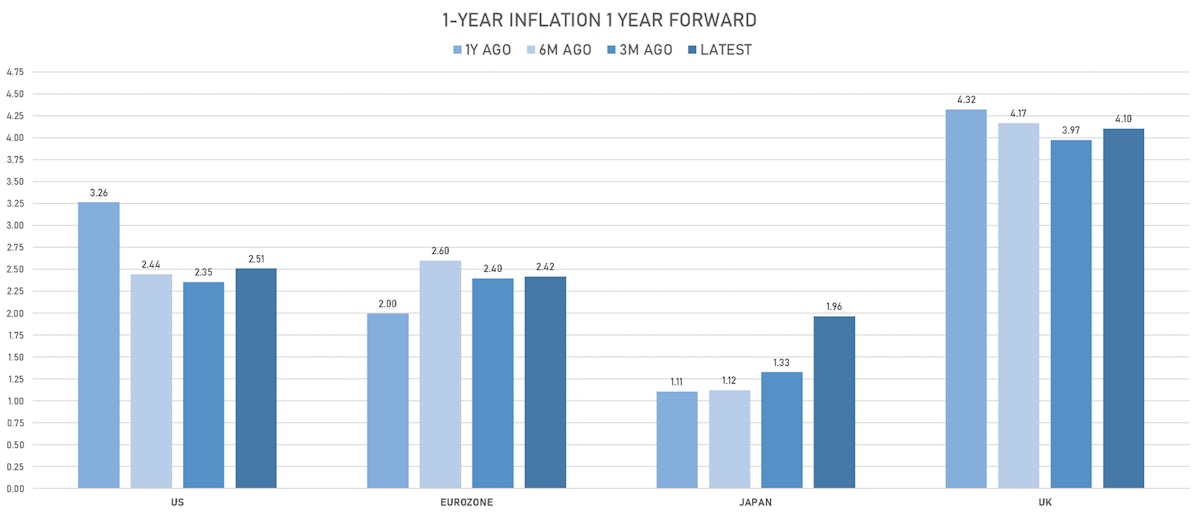

Although Powell strategically skirted around the neutral rate question, the policy focus in the US is to prevent the risk of a possible reacceleration of inflation, as the macro picture is still much healthier than in Europe or China

Published ET

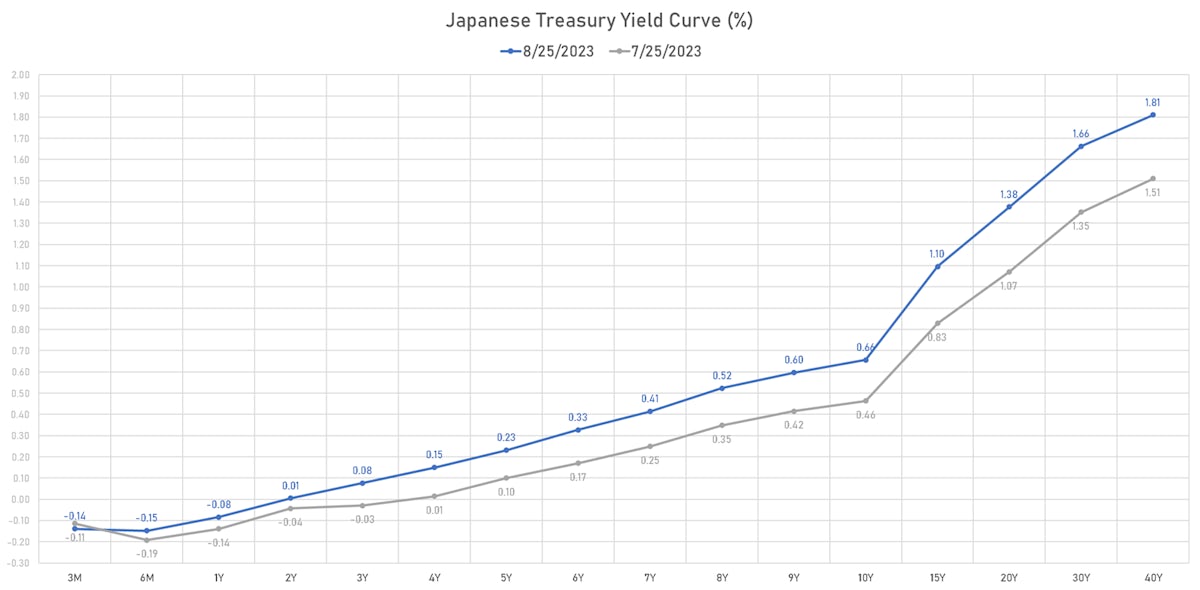

US 6-month CPI swap spot vs 5y forward | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK

- The US Treasury curve has shifted higher, as the market has come to realize that no recession is coming this year. Having said that , the curve has flattened this week with more rate cuts priced in the future easing cycle.

- Unless incoming data firms up unexpectedly quickly over the next weeks, effective Fed funds should stay around 5 and 3/8 for the next couple of months, as Powell seemed to confirm a skip at the September FOMC ("proceed carefully").

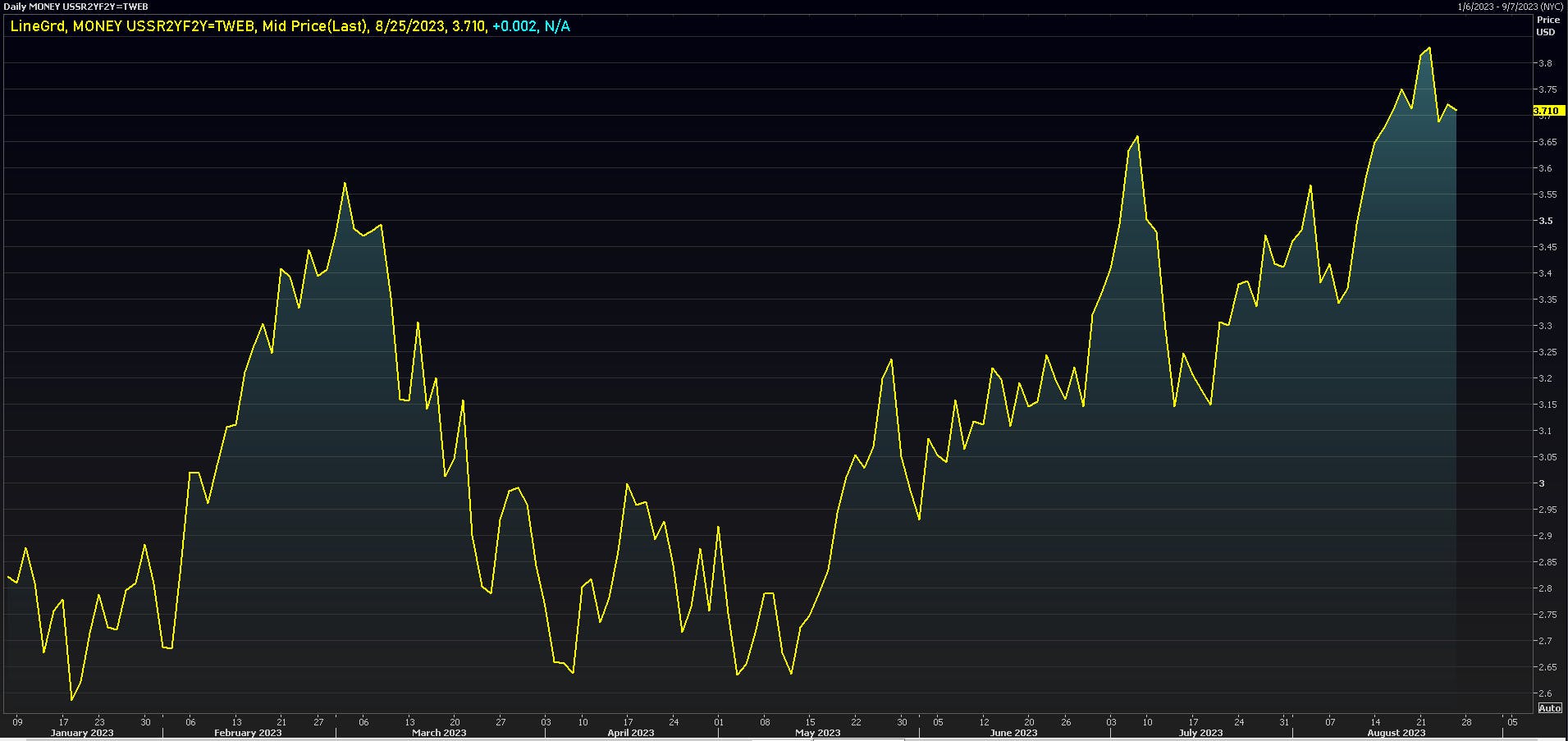

- If you think the real neutral rate r* is higher than the Fed's 0.5% estimate, say maybe 1.5%, adding 2.5% inflation gets you to a nominal neutral rate of 4.0%. The current 2Y forward 2Y SOFR OIS is around 3.70%, meaning that the market is much closer to that estimate than the Fed's position (2% inflation + 0.5% r* = 2.5%).

USD 2yf2y SOFR OIS | Source: Refinitiv

WEEKLY US RATES SUMMARY

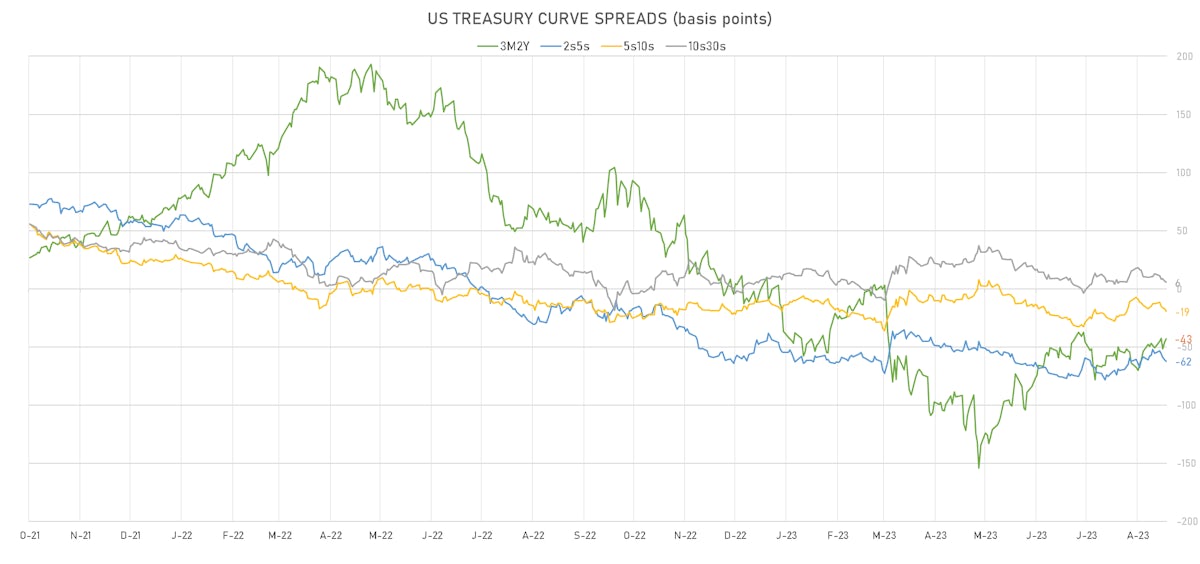

- The treasury yield curve flattened, with the 1s10s spread tightening -11.4 bp, now at -121.4 bp (YTD change: -38.0bp)

- 1Y: 5.4443% (up 9.5 bp)

- 2Y: 5.0768% (up 13.5 bp)

- 5Y: 4.4347% (up 5.2 bp)

- 7Y: 4.3571% (up 1.6 bp)

- 10Y: 4.2305% (down 1.9 bp)

- 30Y: 4.2789% (down 9.5 bp)

- US treasury curve spreads: 3m2Y at -41.0bp (up 9.0bp this week), 2s5s at -64.2bp (down -8.0bp), 5s10s at -20.4bp (down -7.3bp), 10s30s at 4.8bp (down -7.1bp)

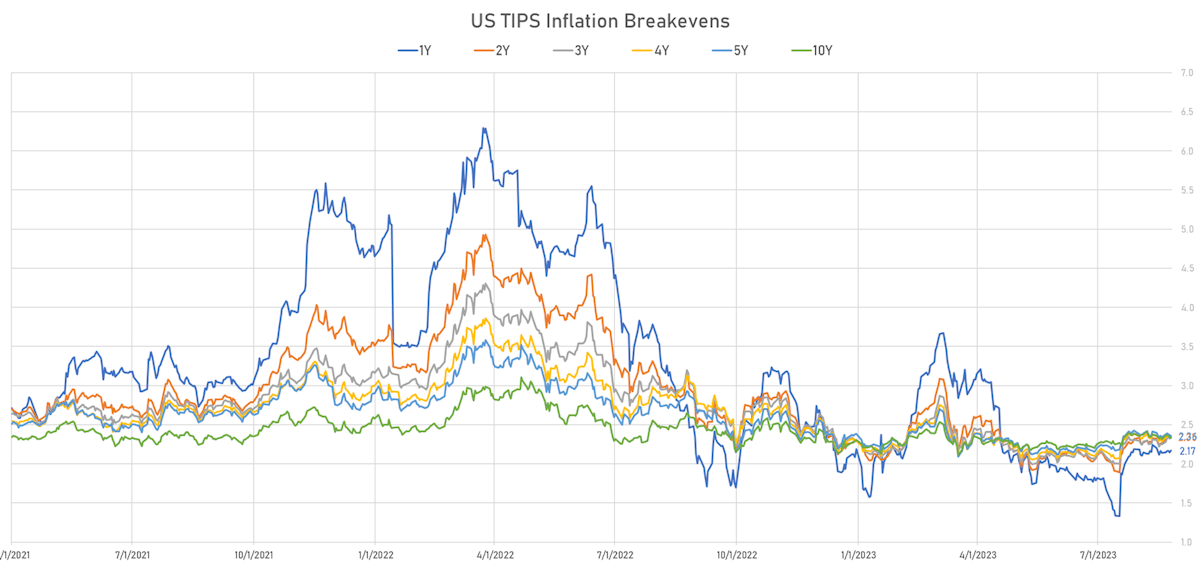

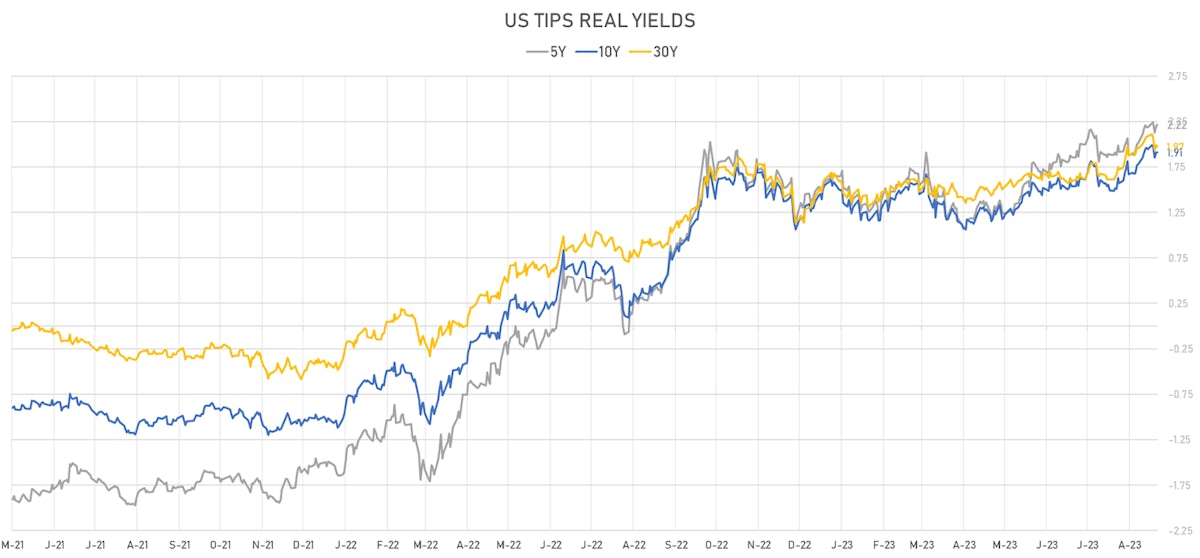

- US 5Y TIPS inflation breakeven at 2.27% up 2.6bp; 10Y breakeven at 2.33% up 1.7bp; 30Y breakeven at 2.32% up 1.9bp

- US 5-Year TIPS Real Yield: +2.9 bp at 2.2170%; 10-Year TIPS Real Yield: -3.2 bp at 1.9130%; 30-Year TIPS Real Yield: -11.2 bp at 1.9740%

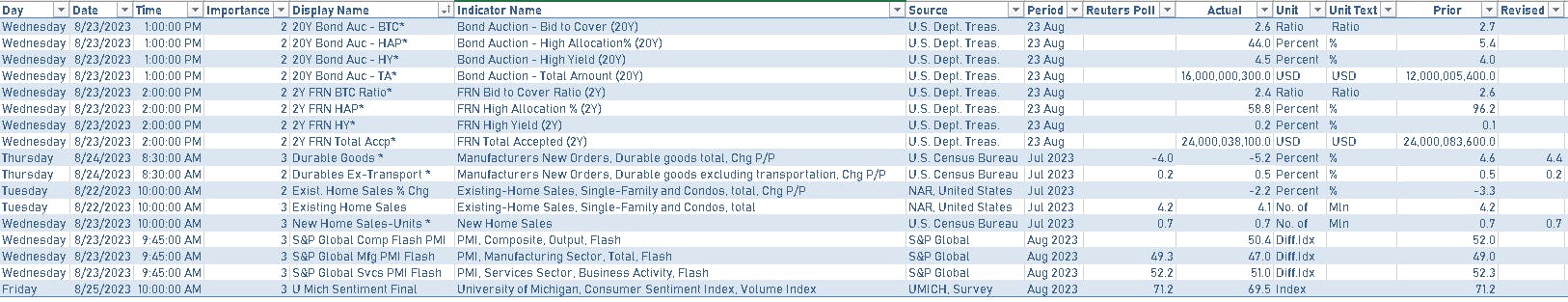

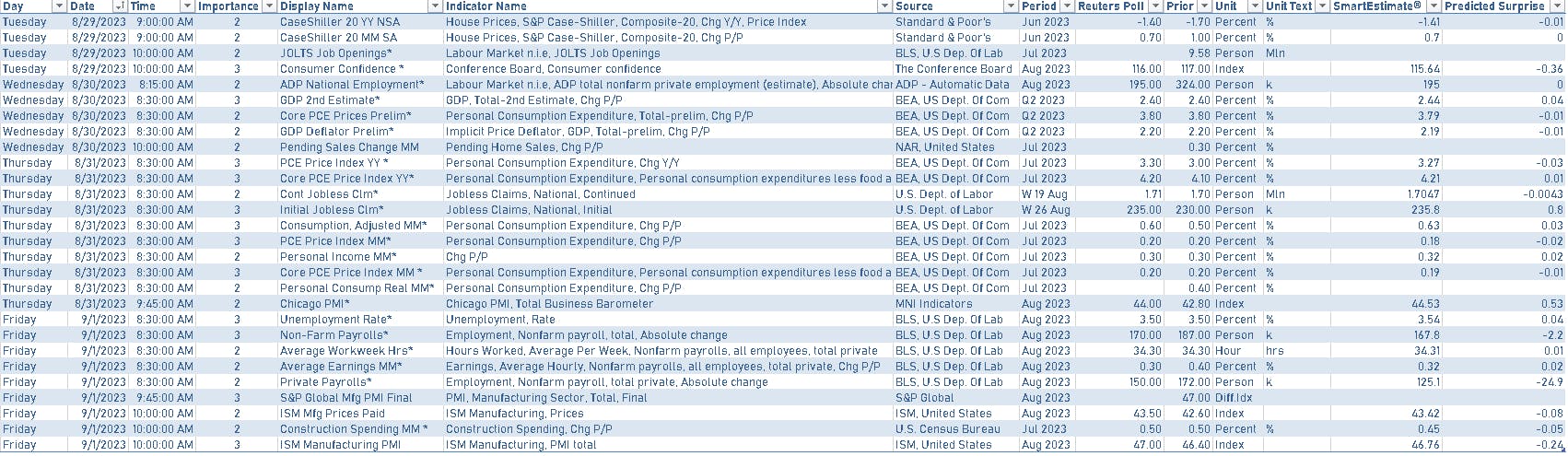

US ECONOMIC DATA OVER THE PAST WEEK

US MACRO RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Monday 8/28 @ 1PM: $45bn in 2Y notes

- Monday 8/28 @ 1PM: $46bn in 5Y notes

- Tuesday 8/29 @ 1PM: $36bn in 7Y Notes

FED SPEAKERS IN THE WEEK AHEAD

- Thursday 8/31: Federal Reserve Bank of Atlanta’s Raphael Bostic

- Thursday 8/31: Federal Reserve Bank of Boston’s Susan Collins

- Friday 9/1: Federal Reserve Bank of Atlanta’s Raphael Bostic

- Friday 9/1: Federal Reserve Bank of Cleveland’s Loretta Mester

US FORWARD RATES

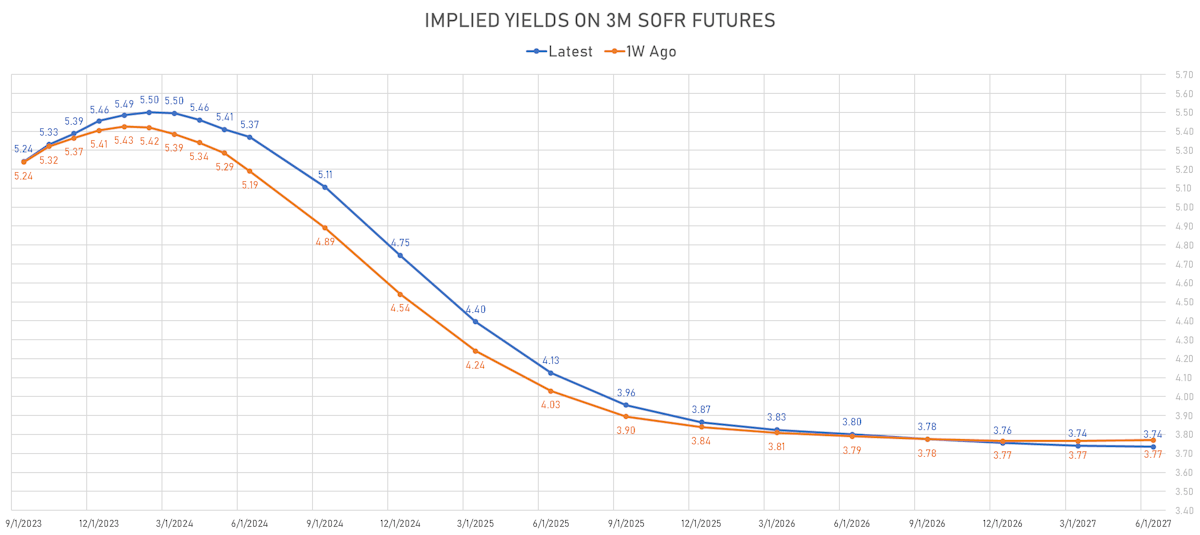

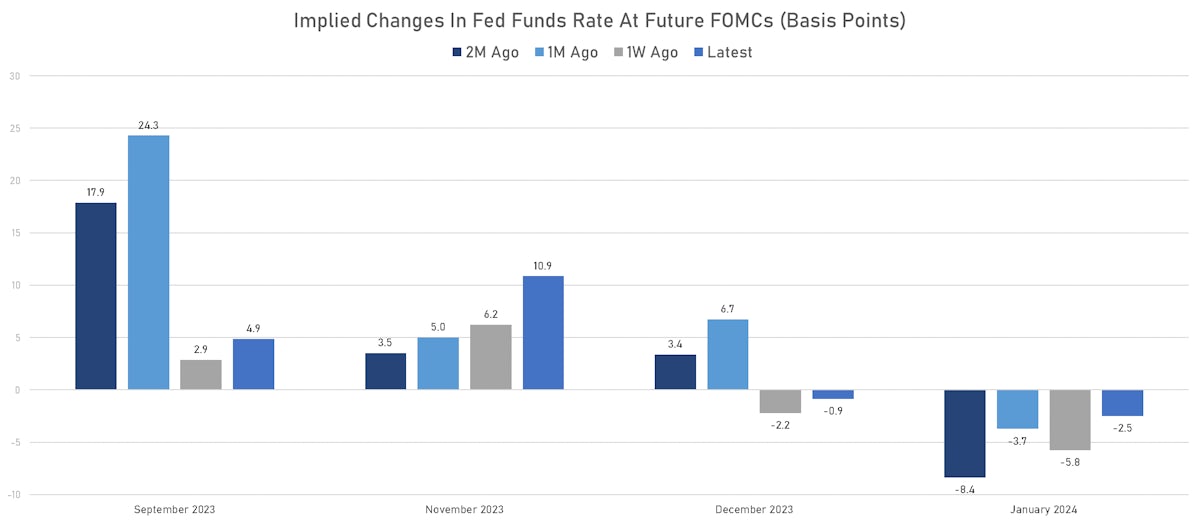

- Fed Funds futures now price in 4.9bp of Fed hikes by the end of September 2023, 15.7bp (63% chance of another 25bp hike) by the end of November 2023, and 0.6 hike by the end of December 2023

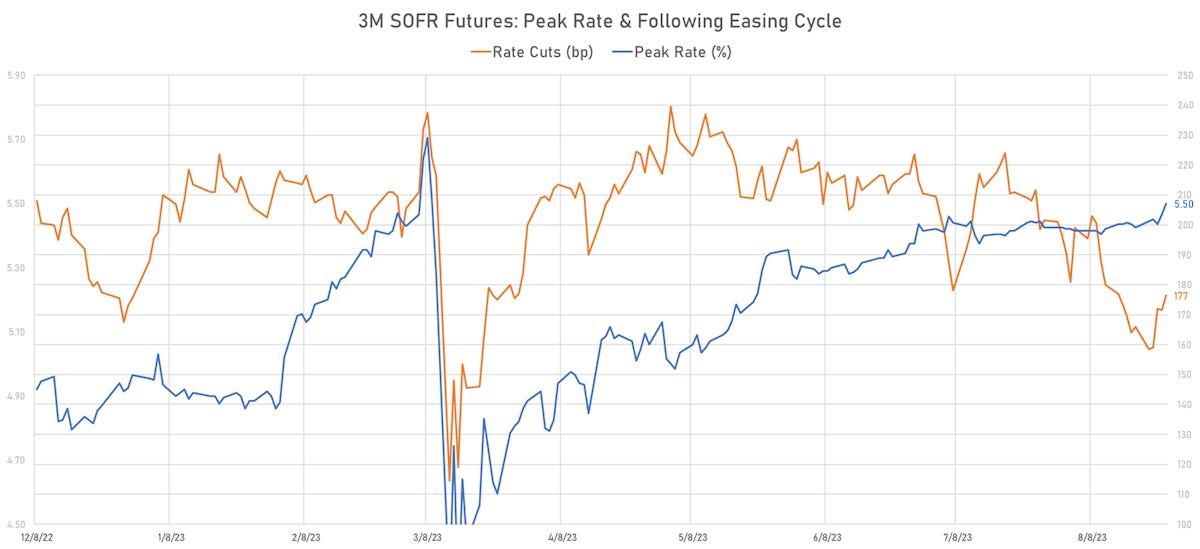

- Implied yields on 3-month SOFR futures top out at 5.49% for the February 2024 expiry and price in 177bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.17% (up 2.4bp); 2Y at 2.35% (up 2.8bp); 5Y at 2.36% (down -0.2bp); 10Y at 2.33% (down -1.1bp); 30Y at 2.32% (down -0.9bp)

- 6-month spot US CPI swap up 1.6 bp to 2.454%, with a flattening of the forward curve

- US Real Rates: 5Y at 2.2170%, +2.2 bp today; 10Y at 1.9130%, +0.1 bp today; 30Y at 1.9740%, -1.5 bp today

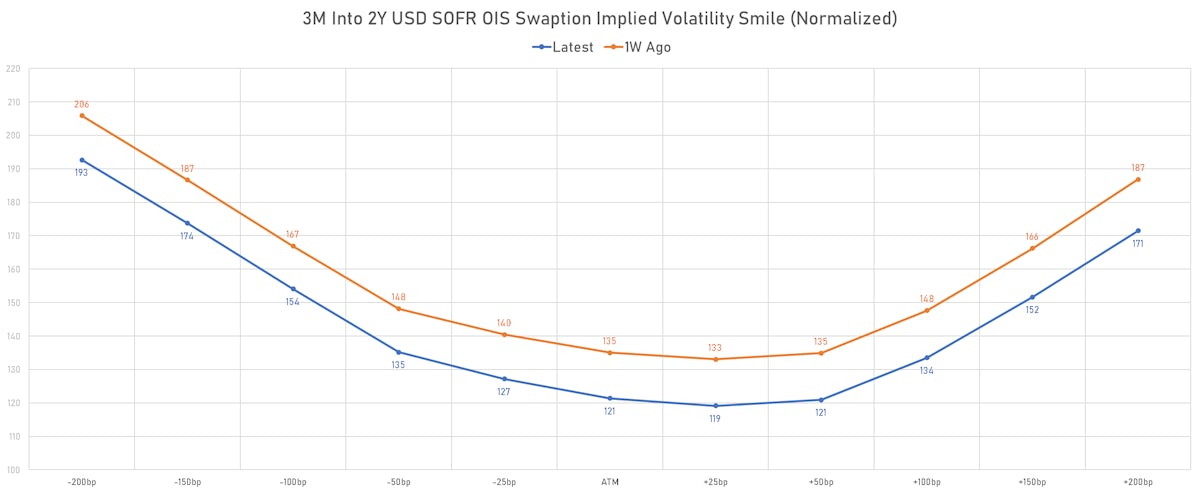

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -4.4 vols at 77.2 normals (down 9.3 normals from a week ago)

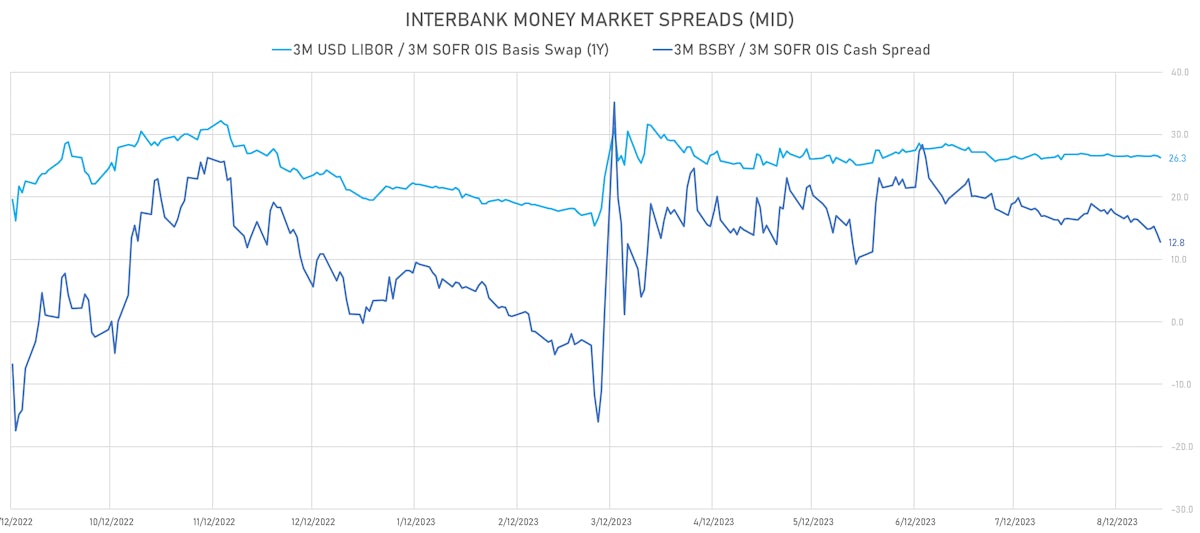

- Market liquidity is not great this time of year, but money markets are not showing signs of stress

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.584% (up 5.8 bp); the German 1Y-10Y curve is 1.4 bp steeper at -99.6bp (YTD change: -97.6 bp)

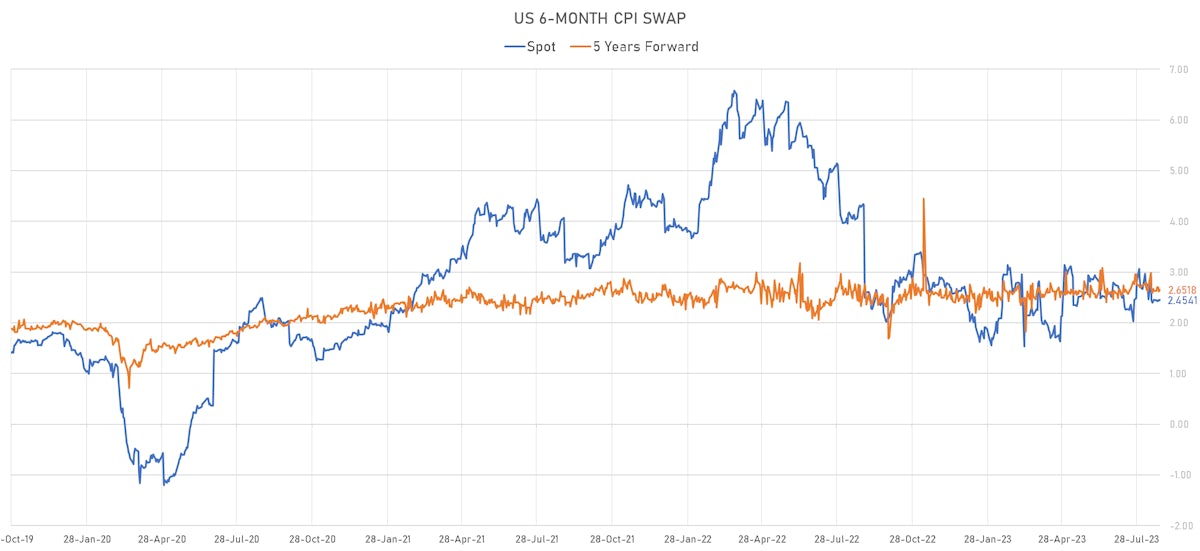

- Japan 5Y: 0.237% (up 0.9 bp); the Japanese 1Y-10Y curve is 0.7 bp steeper at 74.0bp (YTD change: +32.5 bp)

- China 5Y: 2.386% (up 2.4 bp); the Chinese 1Y-10Y curve is 0.5 bp steeper at 68.3bp (YTD change: -5.3 bp)

- Switzerland 5Y: 1.091% (up 3.8 bp); the Swiss 1Y-10Y curve is unchanged at -85.0bp (YTD change: -95.3 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +0.3 bp at 205.2 bp (Weekly change: +16.8 bp; YTD change: +31.6 bp)

- US-JAPAN: +4.2 bp at 505.3 bp (Weekly change: +14.8 bp; YTD change: +66.0 bp)

- US-CHINA: +3.6 bp at 298.9 bp (Weekly change: +11.4 bp; YTD change: +80.6 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -3.5 bp at 172.2 bp (Weekly change: -3.4bp; YTD change: +43.4bp)

- US-JAPAN: +1.6 bp at 244.1 bp (Weekly change: -0.7bp; YTD change: +40.2bp)

- GERMANY-JAPAN: +5.1 bp at 71.9 bp (Weekly change: +2.7bp; YTD change: -3.2bp)