Rates

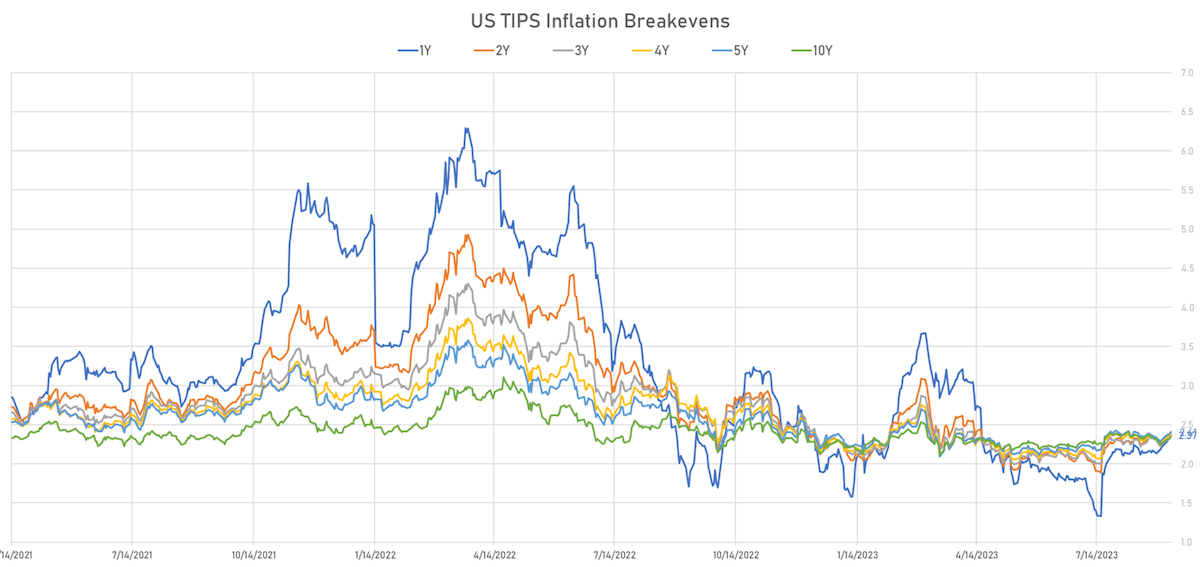

Rates Sold Off This Week, With The OPEC Decision Adding Some Pressure To The Front-End Of The Inflation Curve

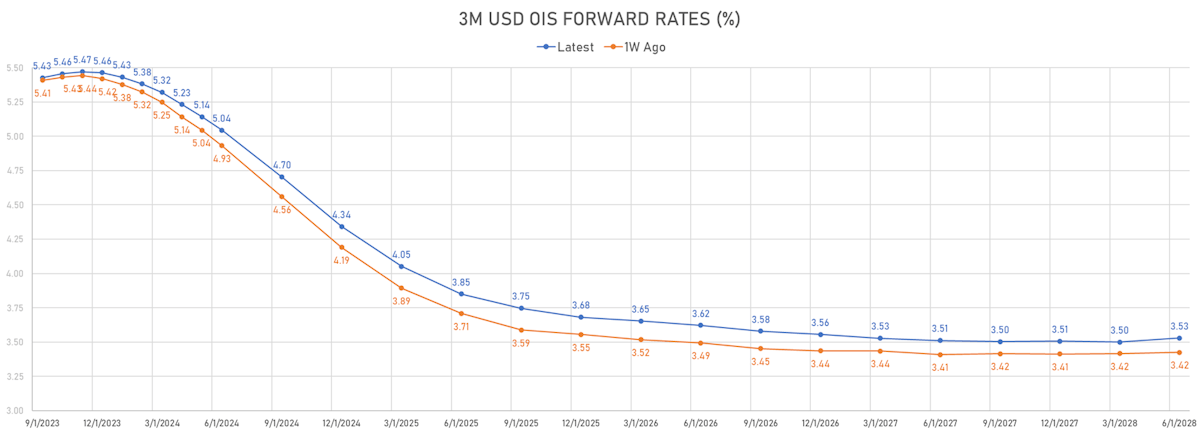

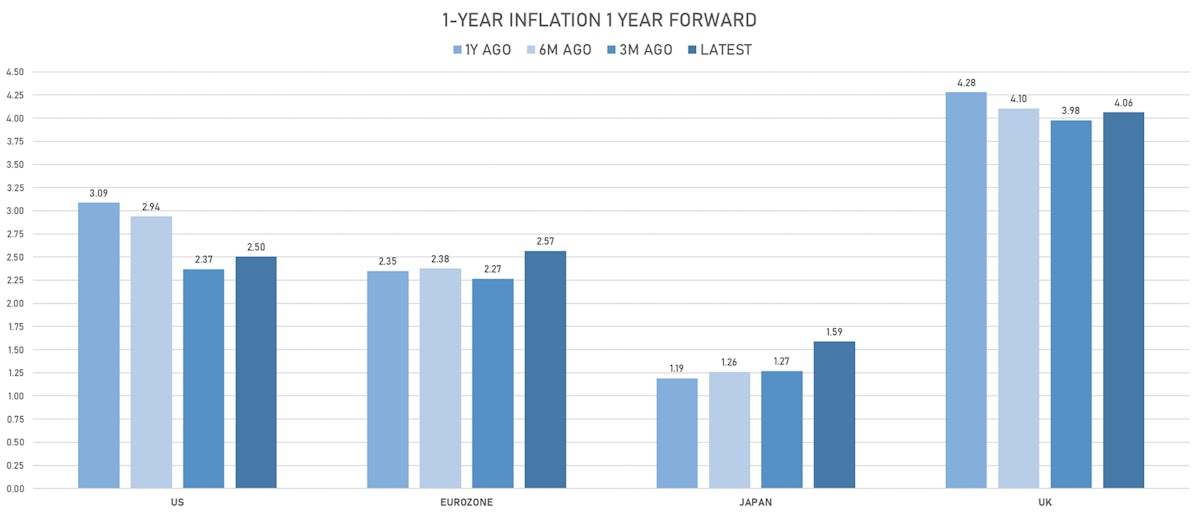

The main driver of the recent moves in US rates has been the robustness of US economic growth, pushing up 1y forward 1y and repricing the belly of the curve towards a higher neutral rate

Published ET

1y forward 1y USD OIS | Source: Refinitiv

US RATES OUTLOOK

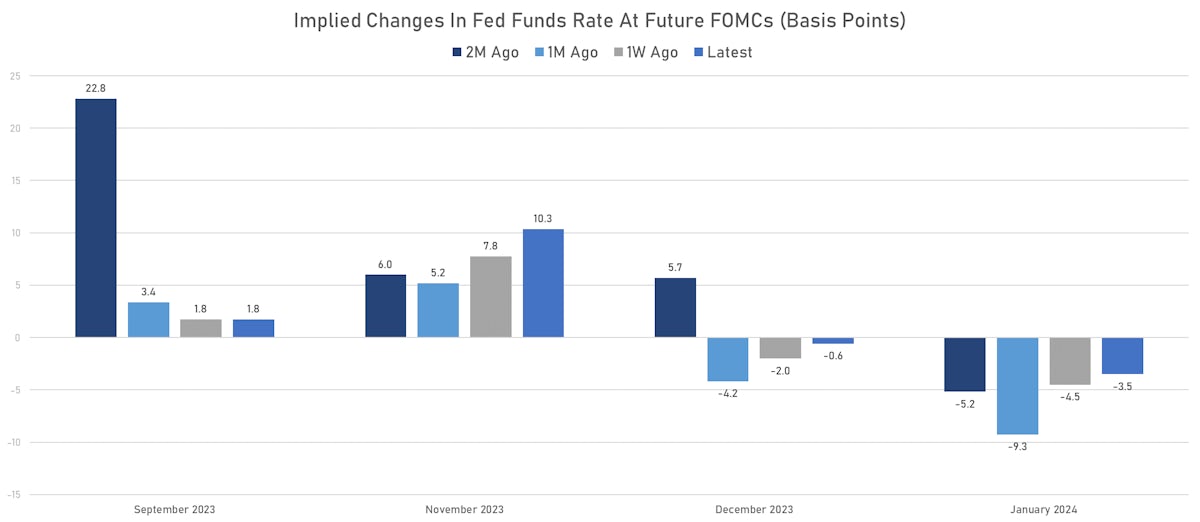

- Fed Funds forward rates price in 2bp of hike at the September FOMC and 10bp at the November FOMC, which looks fair considering the dovish signals sent by voting members lately

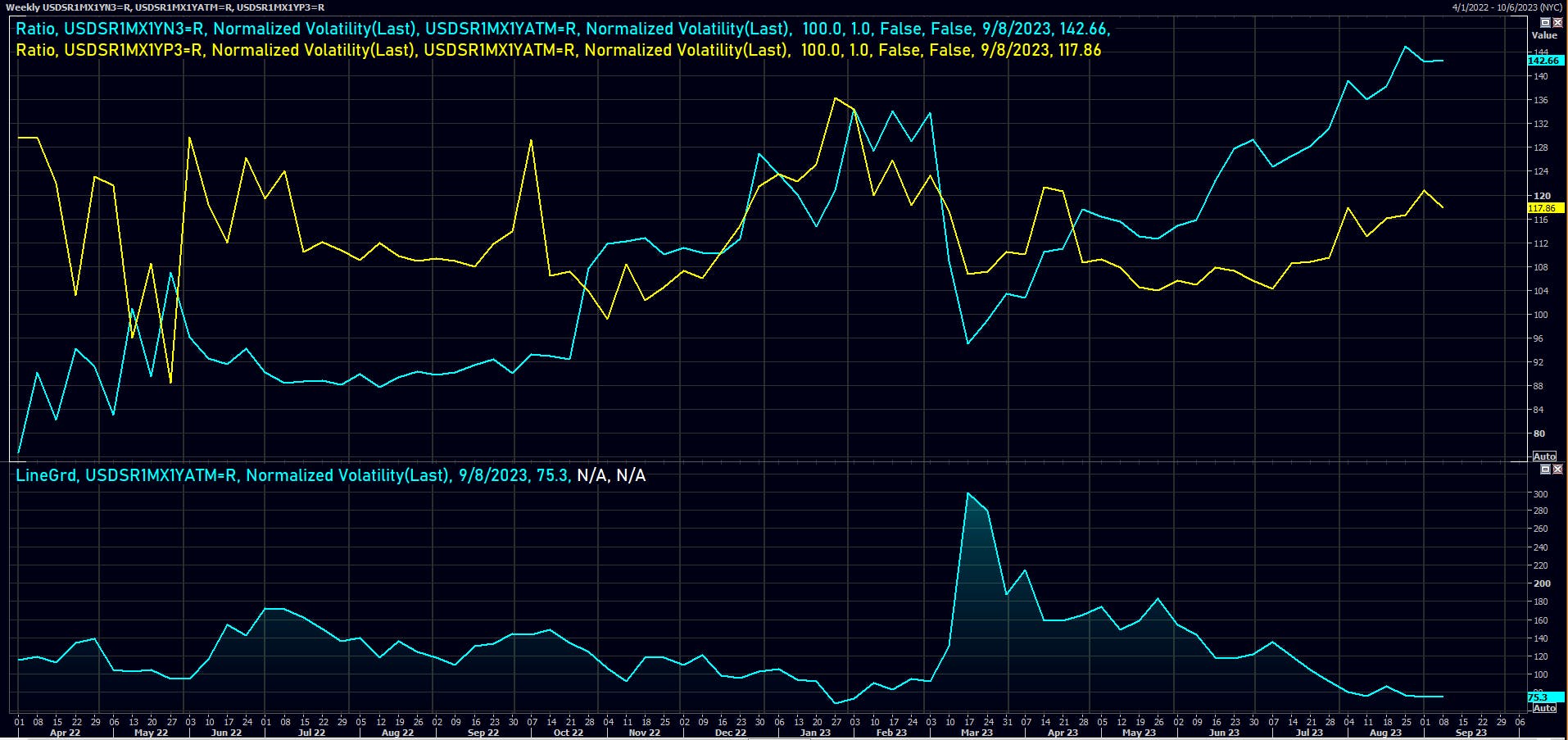

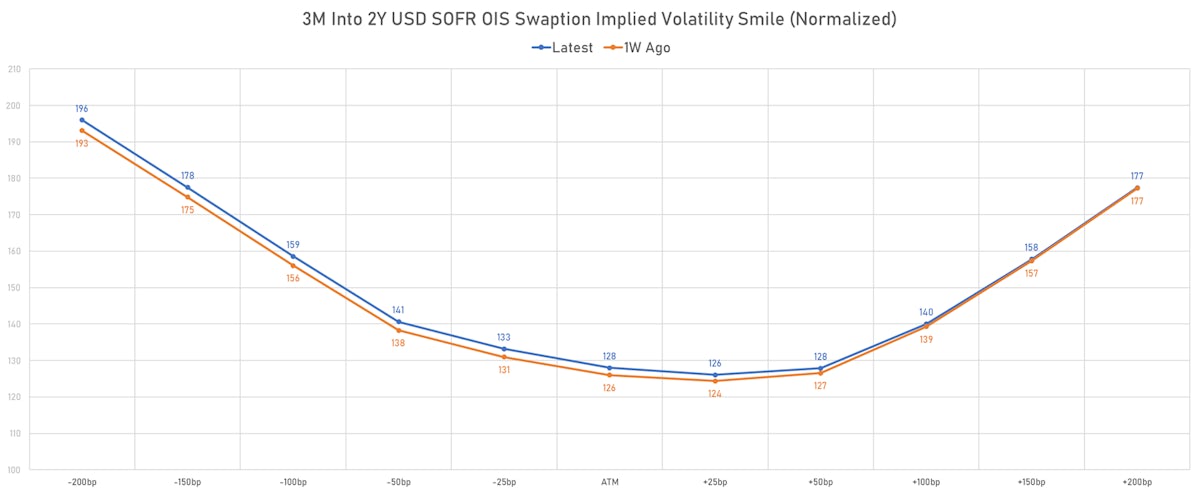

- There is little incentive for speculators to step in and pay the November meeting, with front-end implied vols still trading at high levels despite the established “Fed on hold” narrative

1-Month Into 1Y USD SOFR swaption implied volatility skew (+- 100bp) | Source: Refinitiv

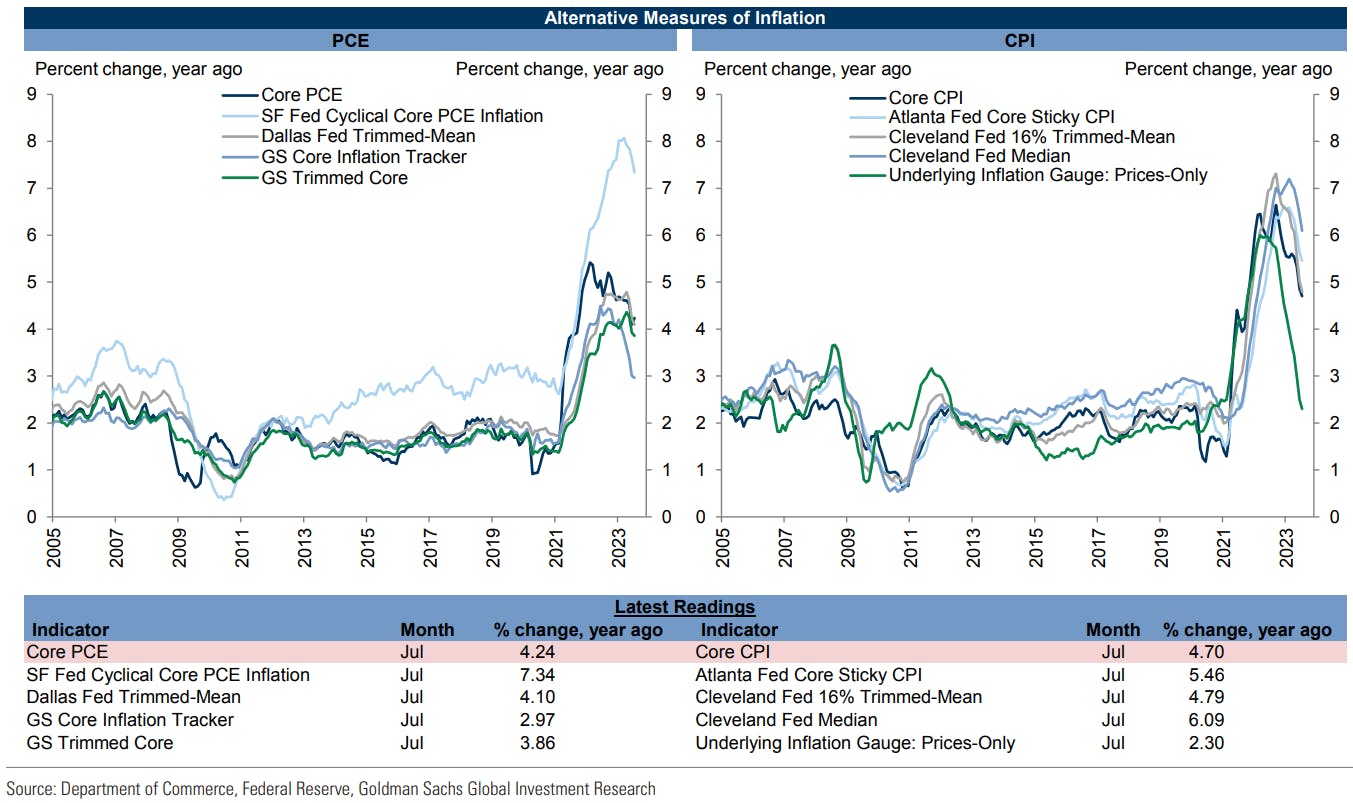

- CPI coming up this week should show continued disinflation, but is likely to be the last positive report this year, as economists expect a slight reacceleration of inflation through December: GS forecasts core PCE at 3.4% YoY in December 2023 and 2.4% YoY in December 2024, with core CPI staying above 3% YoY through 2024

- Looking towards the longer end of the curve, pricing looks reasonable but holding duration is still unattractive (very inverted curve = negative carry), unless you're betting on a risk-off sudden Fed cuts scenario

WEEKLY US RATES SUMMARY

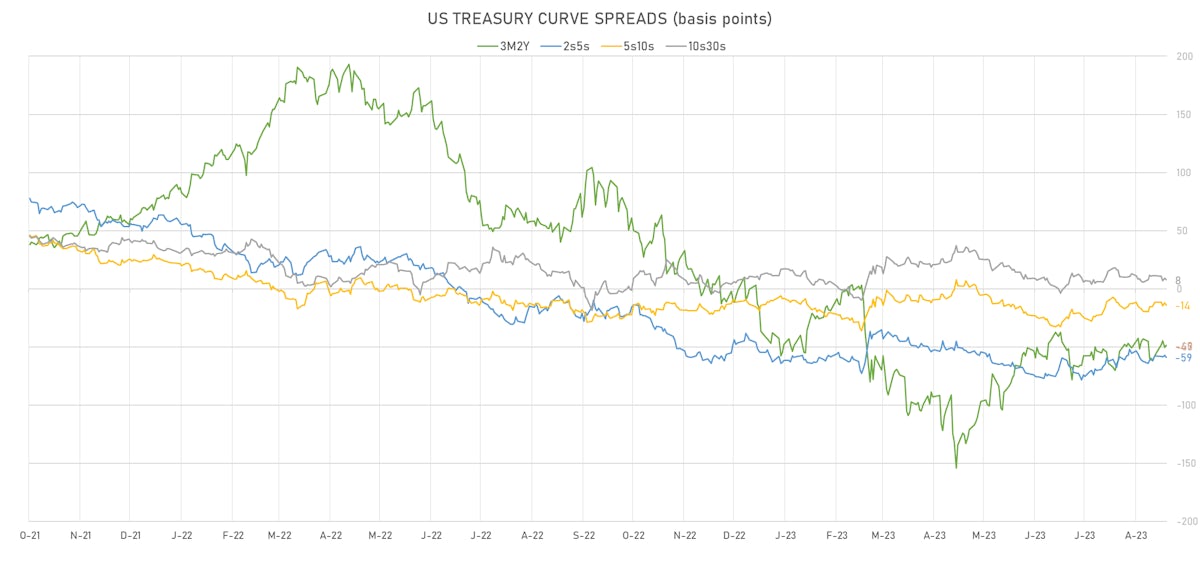

- The treasury yield curve steepened, with the 1s10s spread widening 14.2 bp, now at -114.3 bp (YTD change: -30.9bp)

- 1Y: 5.4018% (up 1.2 bp)

- 2Y: 4.9875% (up 12.6 bp)

- 5Y: 4.3986% (up 15.1 bp)

- 7Y: 4.3524% (up 15.0 bp)

- 10Y: 4.2591% (up 15.4 bp)

- 30Y: 4.3333% (up 12.5 bp)

- US treasury curve spreads: 3m2Y at -47.8bp (up 12.8bp this week), 2s5s at -58.9bp (up 1.9bp), 5s10s at -13.9bp (up 0.9bp), 10s30s at 7.4bp (down -3.3bp)

- US 5Y TIPS inflation breakeven at 2.31% up 9.6bp; 10Y breakeven at 2.34% up 8.5bp; 30Y breakeven at 2.34% up 8.4bp

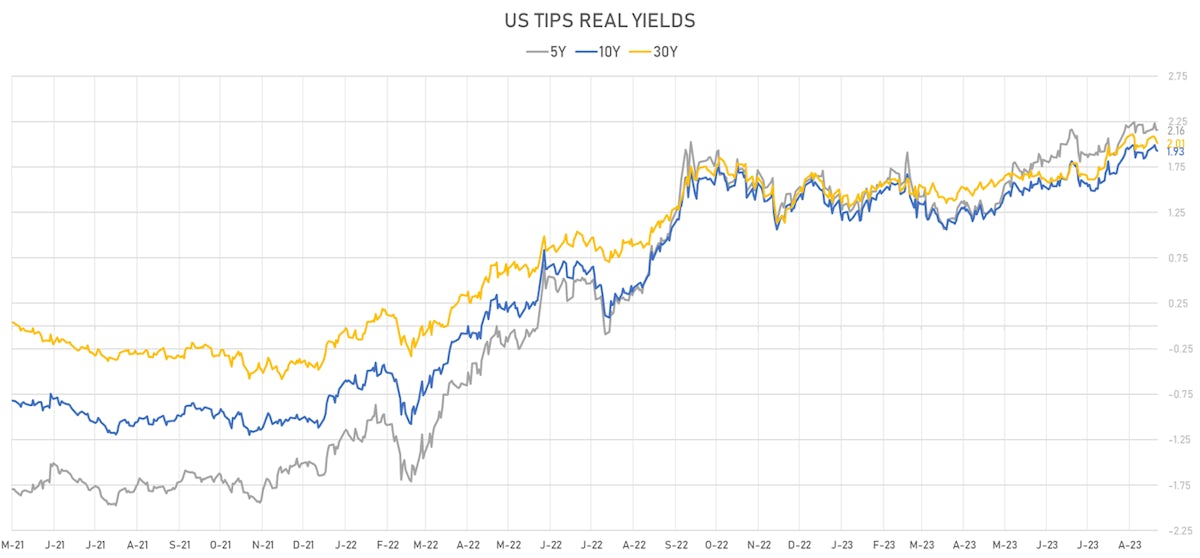

- US 5-Year TIPS Real Yield: +2.0 bp at 2.1590%; 10-Year TIPS Real Yield: +5.1 bp at 1.9250%; 30-Year TIPS Real Yield: +2.4 bp at 2.0130%

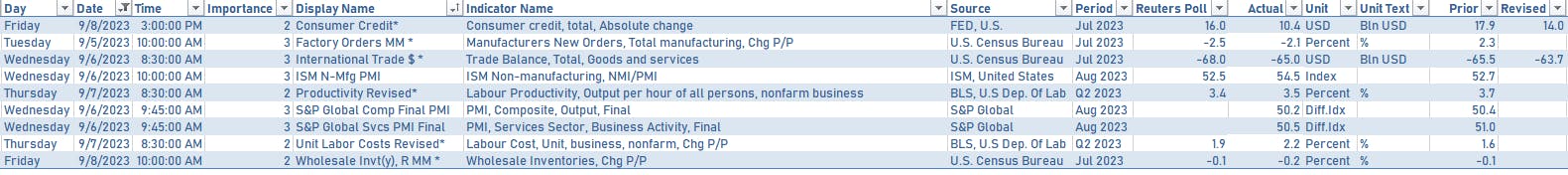

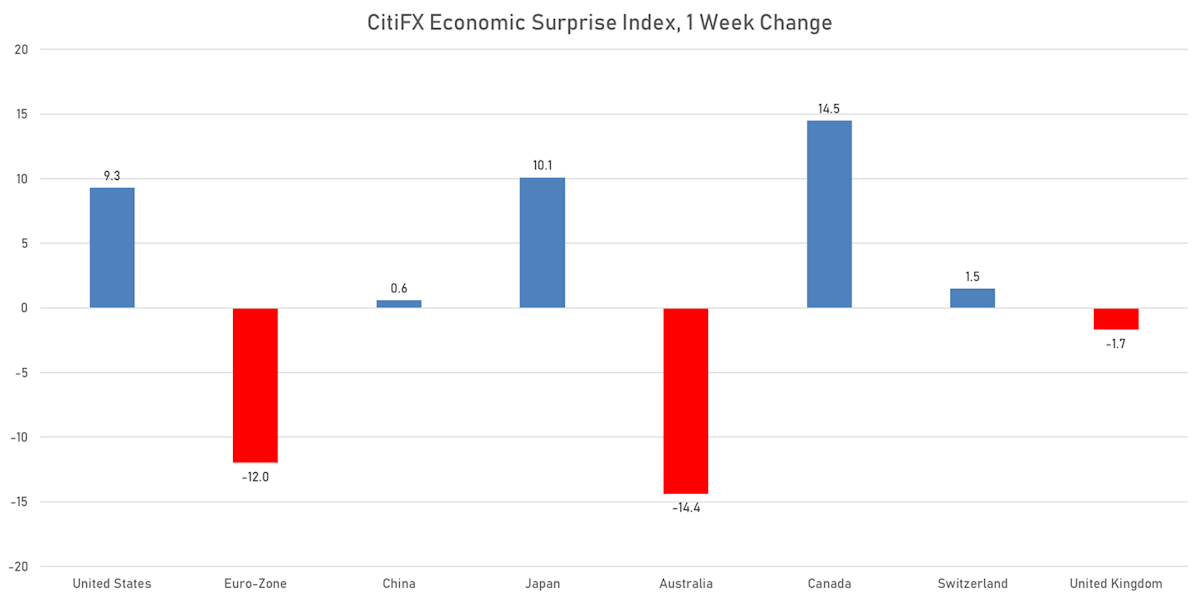

US ECONOMIC DATA OVER THE PAST WEEK

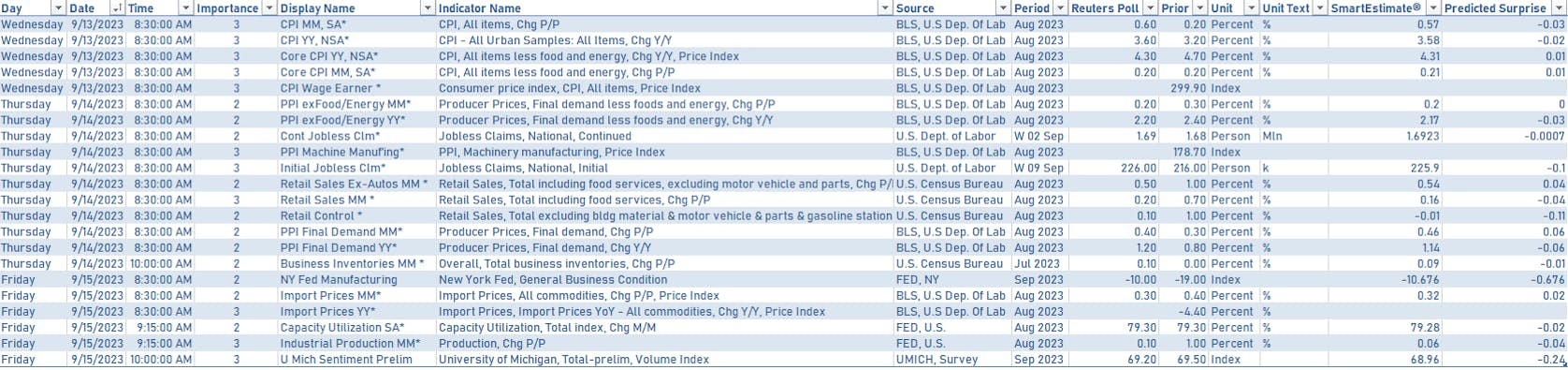

US MACRO RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Monday $44bn in 3Y notes

- Tuesday $35bn in 10Y notes

- Wednesday $20bn in 30Y bonds

FED SPEAKERS IN THE WEEK AHEAD

- None as we are now in the blackout period ahead of the September FOMC

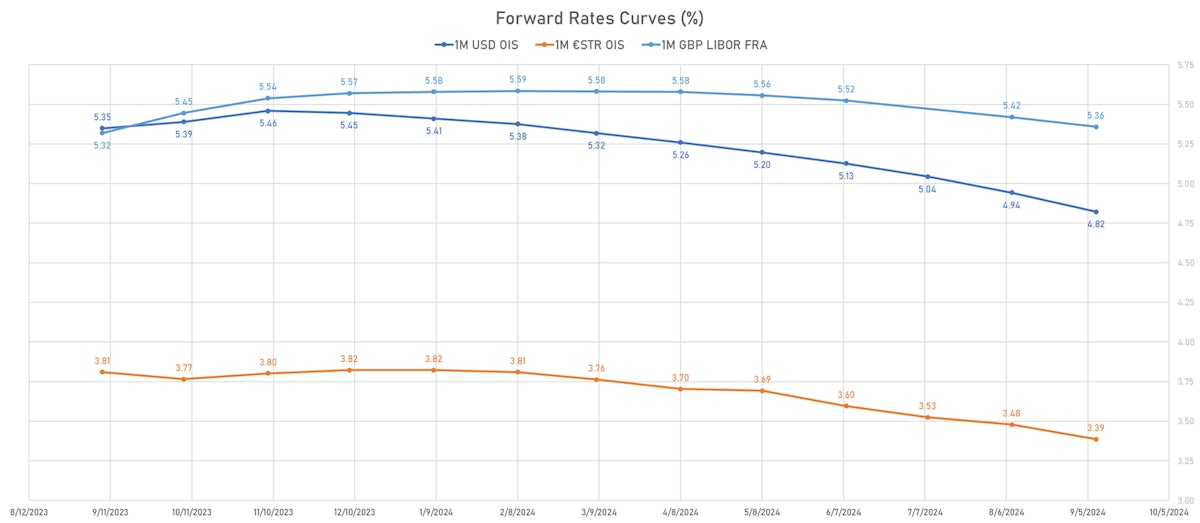

US FORWARD RATES

- Fed Funds futures now price in 1.8bp of Fed hikes by the end of September 2023, 12.1bp (0.5 x 25bp hikes) by the end of November 2023, and 0.5 hikes by the end of December 2023

- Implied yields on 3-month SOFR futures top out at 5.47% for the February 2024 expiry and price in 175bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.37% (up 3.1bp); 2Y at 2.41% (up 3.8bp); 5Y at 2.41% (up 2.4bp); 10Y at 2.34% (up 2.4bp); 30Y at 2.34% (up 2.5bp)

- 6-month spot US CPI swap up 5.0 bp to 2.647%, with a steepening of the forward curve

- US Real Rates: 5Y at 2.1590%, +0.2 bp today; 10Y at 1.9250%, -1.4 bp today; 30Y at 2.0130%, -3.2 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.5 vols at 75.3 normals (up 0.4 vol from a week ago)

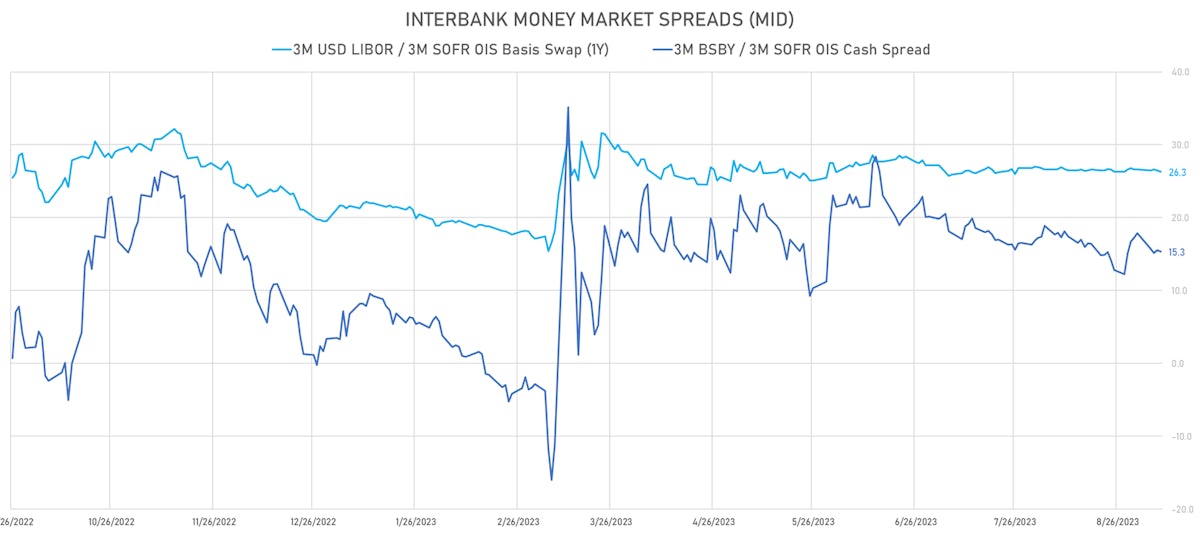

- Trading volumes in the treasury complex were pretty muted this week, but top of book spreads and basis swaps show ample liquidity

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.616% (down -1.6 bp); the German 1Y-10Y curve is 2.4 bp flatter at -98.0bp (YTD change: -96.7 bp)

- Japan 5Y: 0.219% (down -0.8 bp); the Japanese 1Y-10Y curve is 0.6 bp flatter at 74.0bp (YTD change: +32.1 bp)

- China 5Y: 2.503% (down -0.7 bp); the Chinese 1Y-10Y curve is 0.9 bp flatter at 56.8bp (YTD change: -16.8 bp)

- Switzerland 5Y: 1.070% (down -3.5 bp); the Swiss 1Y-10Y curve is 2.3 bp flatter at -82.4bp (YTD change: -88.7 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +0.3 bp at 190.2 bp (Weekly change: -3.6 bp; YTD change: +16.6 bp)

- US-JAPAN: +1.2 bp at 498.1 bp (Weekly change: +13.7 bp; YTD change: +58.8 bp)

- US-CHINA: +3.7 bp at 277.6 bp (Weekly change: +3.0 bp; YTD change: +59.3 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +0.3 bp at 176.7 bp (Weekly change: +1.2bp; YTD change: +47.9bp)

- US-JAPAN: +2.0 bp at 243.1 bp (Weekly change: +2.9bp; YTD change: +39.2bp)

- GERMANY-JAPAN: +1.7 bp at 66.4 bp (Weekly change: -3.1bp; YTD change: -8.7bp)