Rates

Modest Sell-Off At The Long End, With The US Curve Steepening, Driven By Real Rates

The September FOMC decision not to hike is well-telegraphed, but it will be interesting to see what the Fed's latest economic projections and dot plot show, as the strength of the recent data continues to justify one more hike

Published ET

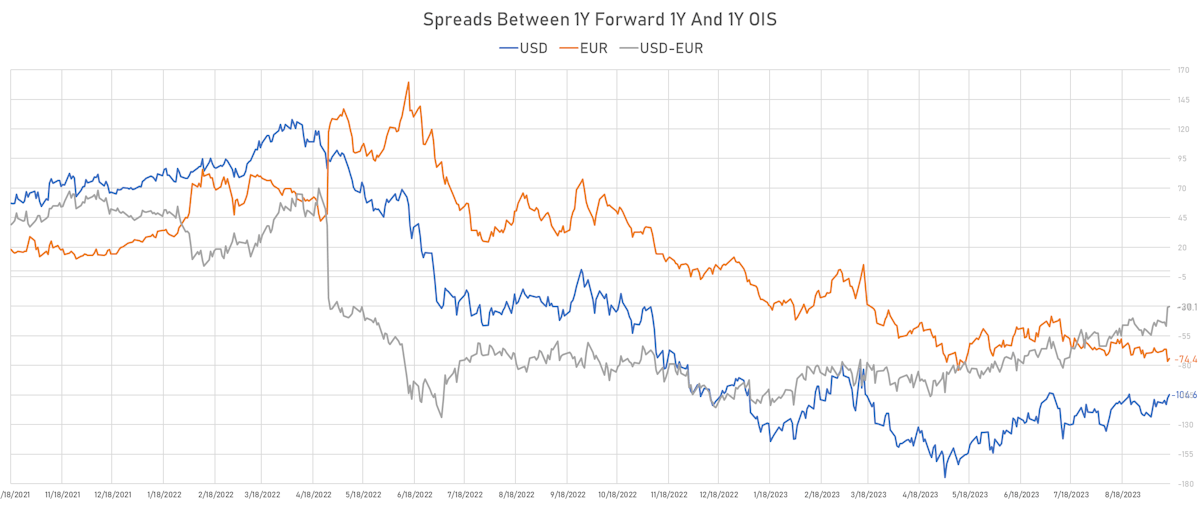

Convergence of USD vs EUR 1Y Forward inversion In 1Y Swap Rates | Sources: phipost.com, Refintiv data

US RATES OUTLOOK: FOMC PREVIEW

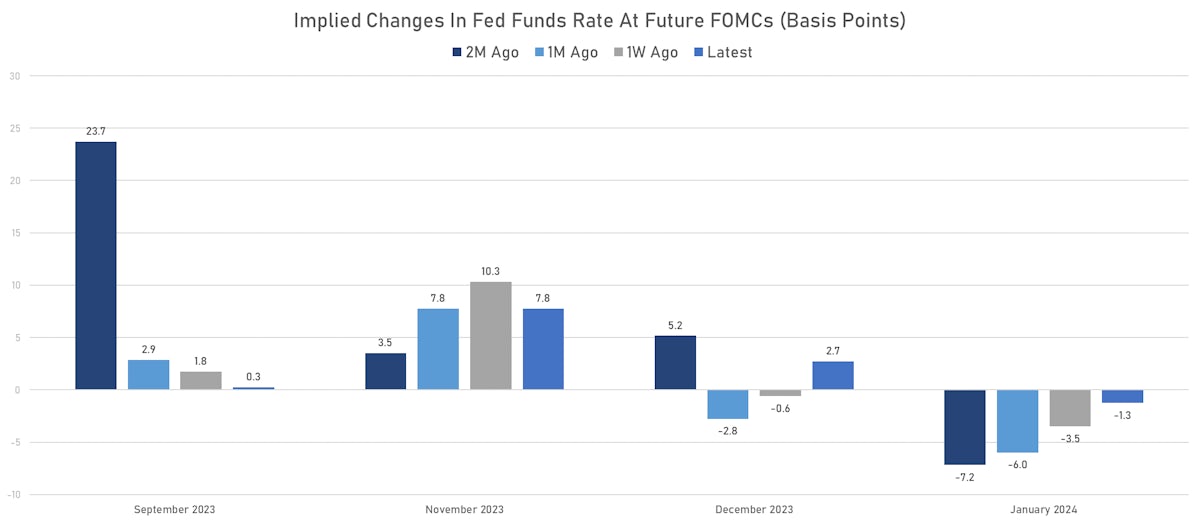

- What's priced in: almost nothing priced for the September meeting (0.25bp), and 10.75bp of additional hike this year (43% probability of another 25bp hike)

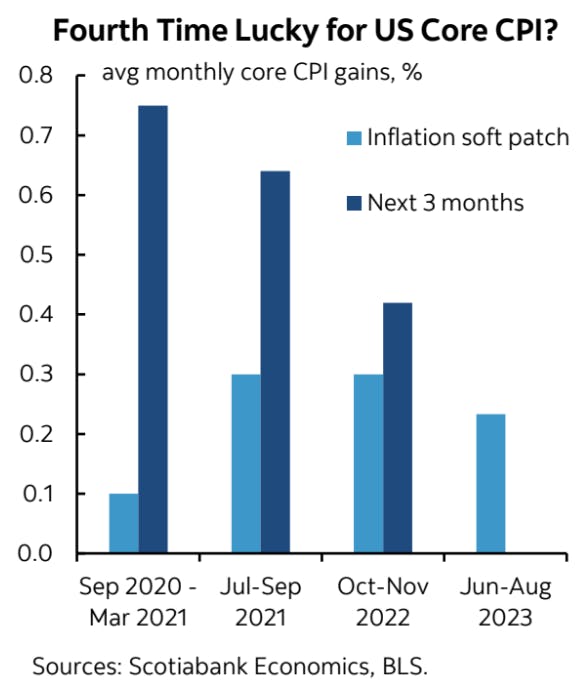

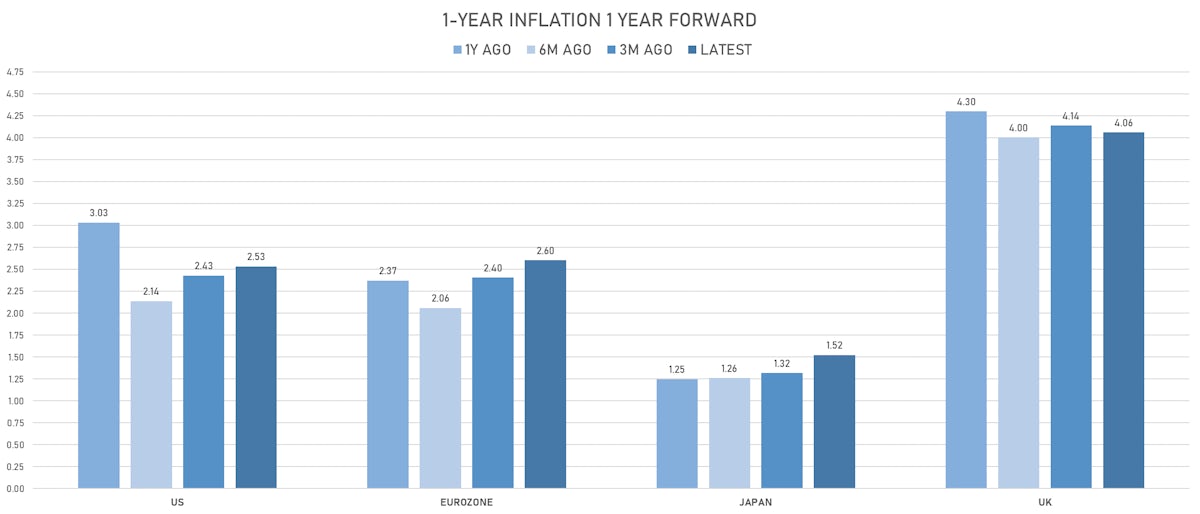

- Worry about a new resurgence of inflation should keep the Fed careful in their updated forecasts and statement

- Considering the current strength of the US economy, the updated dot plot is likely to keep showing an additional hike (although most market observers see the Fed as done), with the end of 2023 dot still at 5+5/8 (unchanged from June)

- Expected changes in the Fed's economic forecasts to the end of 2023: a substantial upward revision to GDP growth and slight downward revisions to the unemployment rate and core inflation

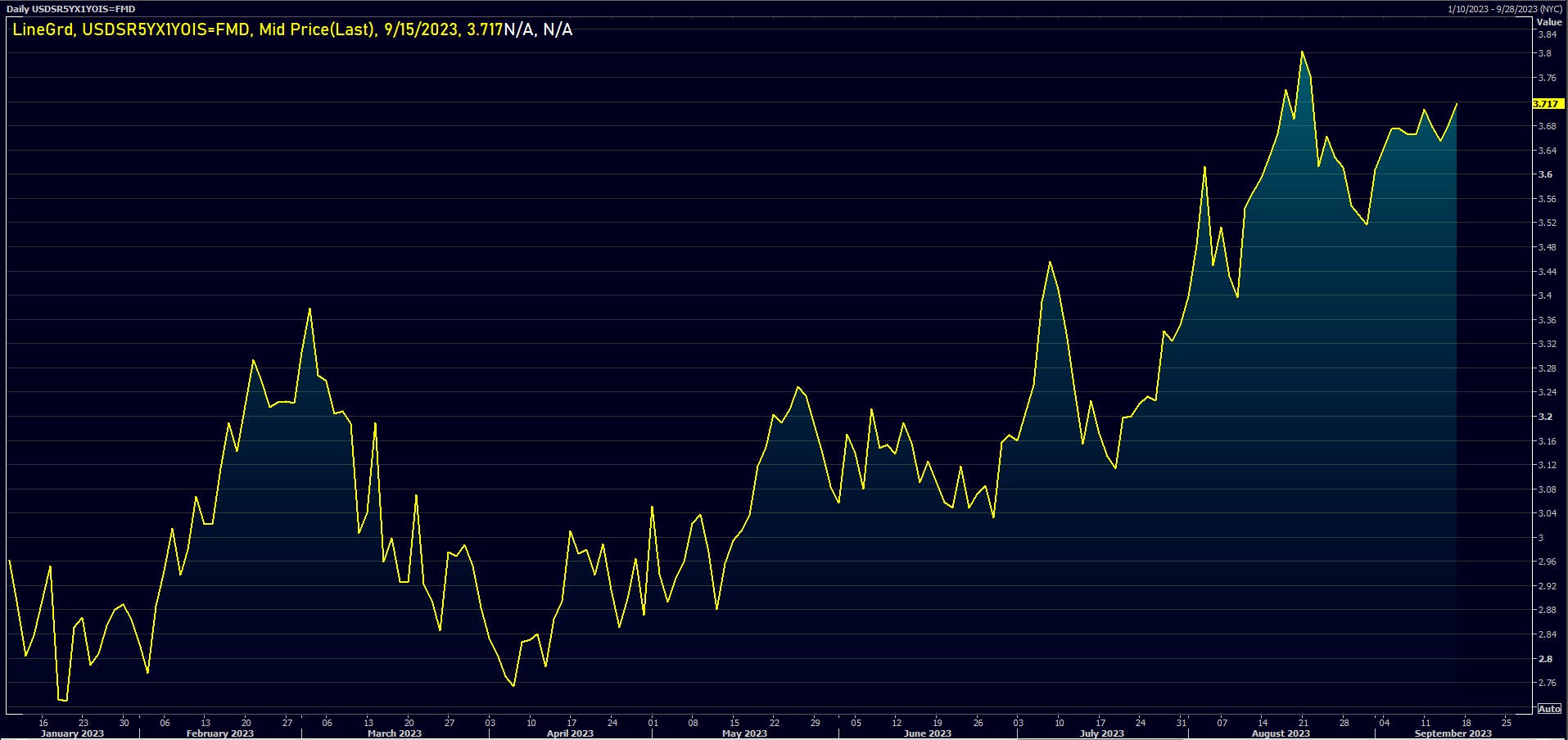

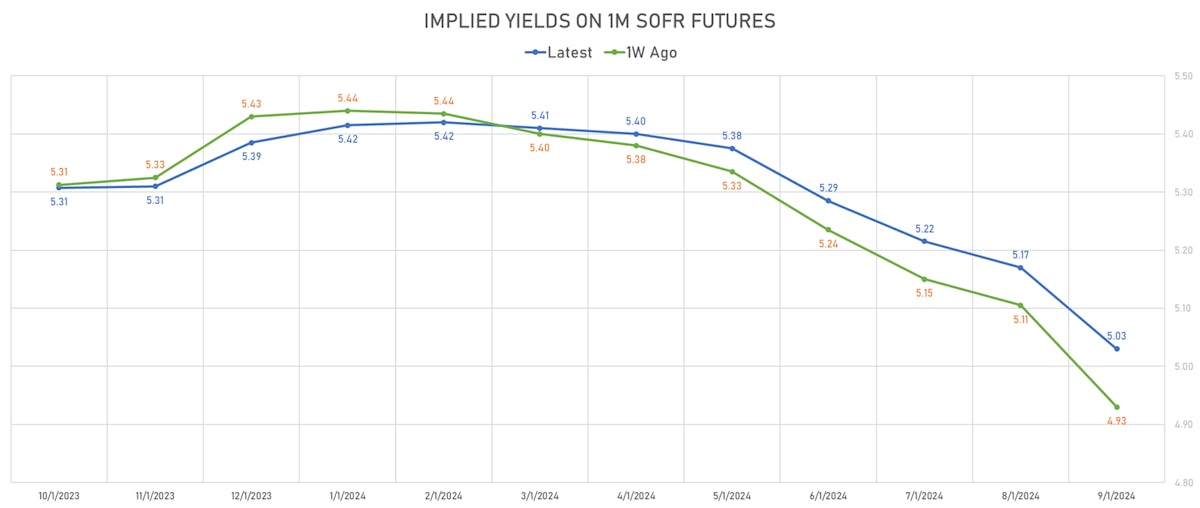

- The Fed is unlikely to change its take on the long-term neutral rate, although market pricing has been much higher for a while (5-year forward 1Y SOFR OIS below):

QUICK WEEKLY US SUMMARY

- 3-Month USD OIS -0.5bp at 5.4095%

- The treasury yield curve is slightly steeper, with the 1s10s spread up 4.4 bp, now at -109.1 bp (YTD change: -25.8bp)

- 1Y: 5.4265% (up 0.6 bp)

- 2Y: 5.0358% (up 2.3 bp)

- 5Y: 4.4633% (up 4.5 bp)

- 7Y: 4.4192% (up 4.8 bp)

- 10Y: 4.3354% (up 5.0 bp)

- 30Y: 4.4207% (up 4.2 bp)

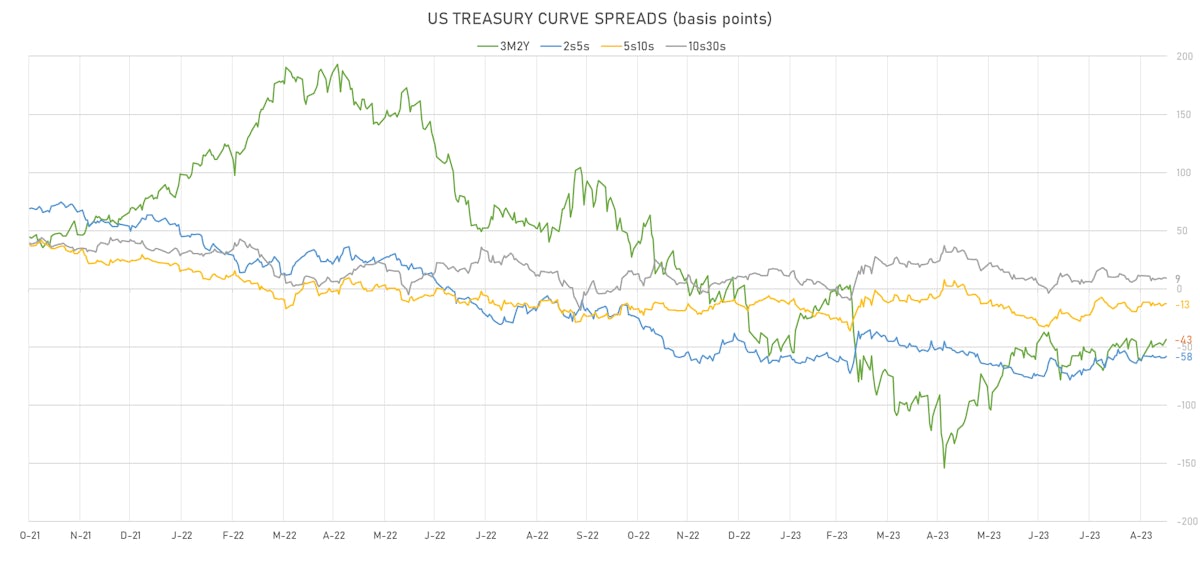

- US treasury curve spreads: 3m2Y at -43.1bp (up 2.9bp this week), 2s5s at -57.2bp (up 2.5bp), 5s10s at -12.8bp (down -0.2bp), 10s30s at 8.5bp (down -1.0bp)

- Treasuries butterfly spreads: 1s5s10s at 84.7bp (down -1.2bp), 5s10s30s at 20.9bp (down -1.4bp)

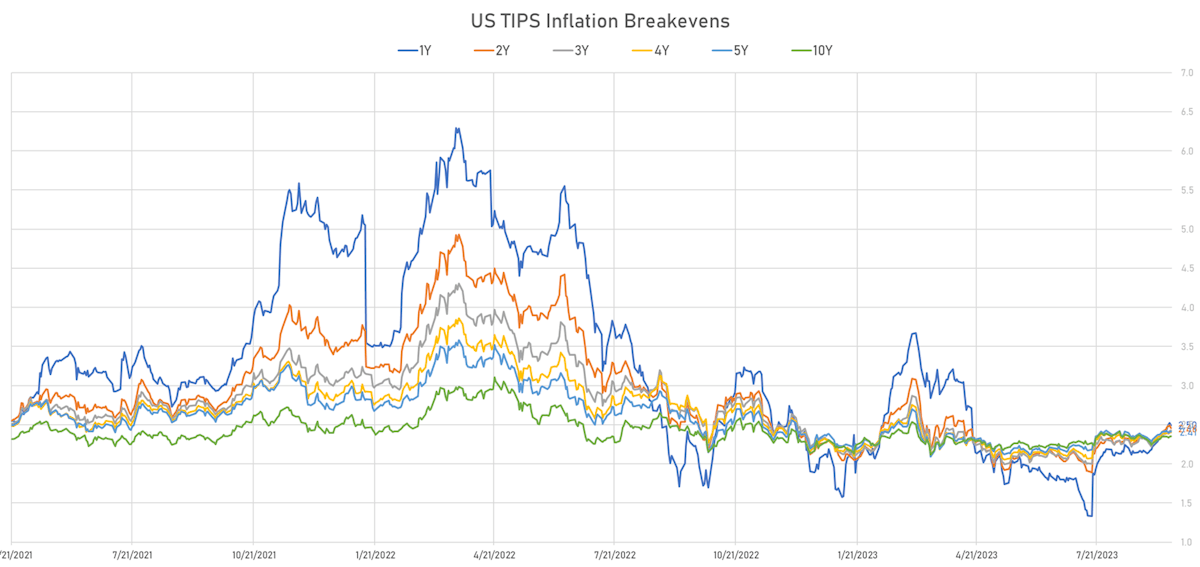

- TIPS 1Y breakeven inflation at 2.50% (down -3.0bp); 2Y at 2.46% (down -3.5bp); 5Y at 2.41% (up 0.6bp); 10Y at 2.35% (up 0.7bp); 30Y at 2.35% (up 0.4bp)

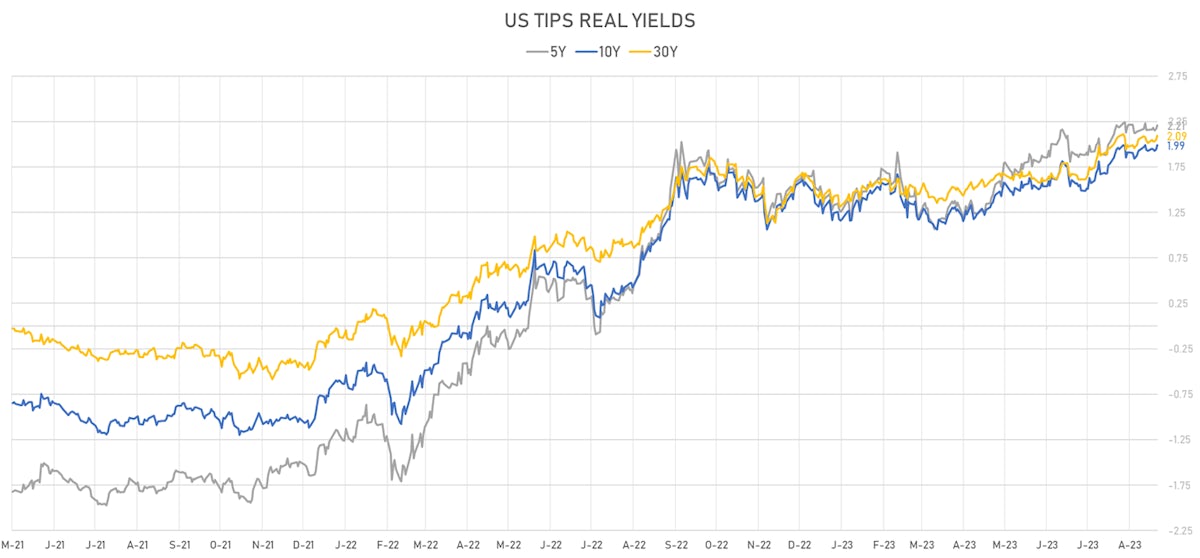

- US 5-Year TIPS Real Yield: +4.0 bp at 2.2080%; 10-Year TIPS Real Yield: +4.4 bp at 1.9910%; 30-Year TIPS Real Yield: +4.0 bp at 2.0940%

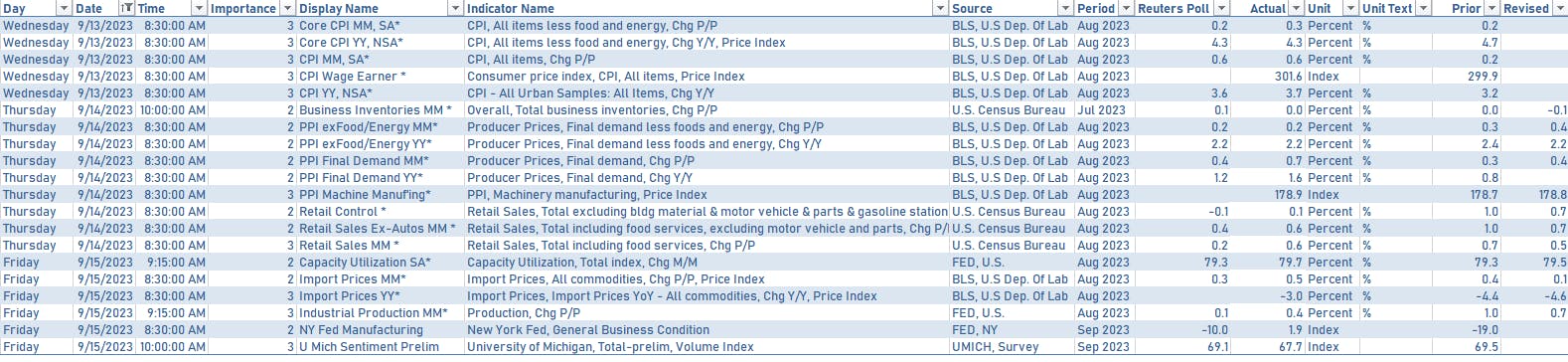

US ECONOMIC DATA OVER THE PAST WEEK

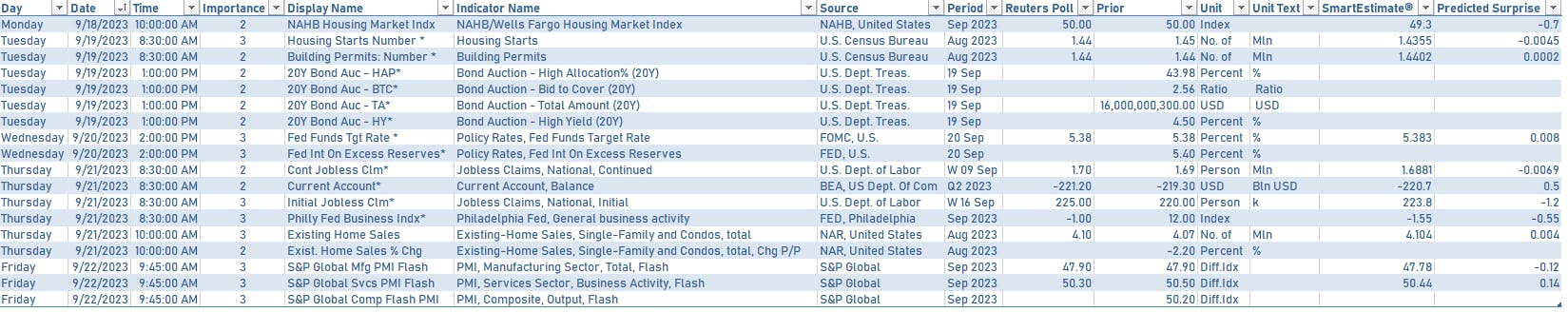

US MACRO RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Tuesday 1PM: $13bn in 20-year bond

- Thursday 1PM: $15bn in 10-year TIPS

FED SPEAKERS IN THE WEEK AHEAD

- Fed speak will resume on Friday with San Francisco Fed President Daly

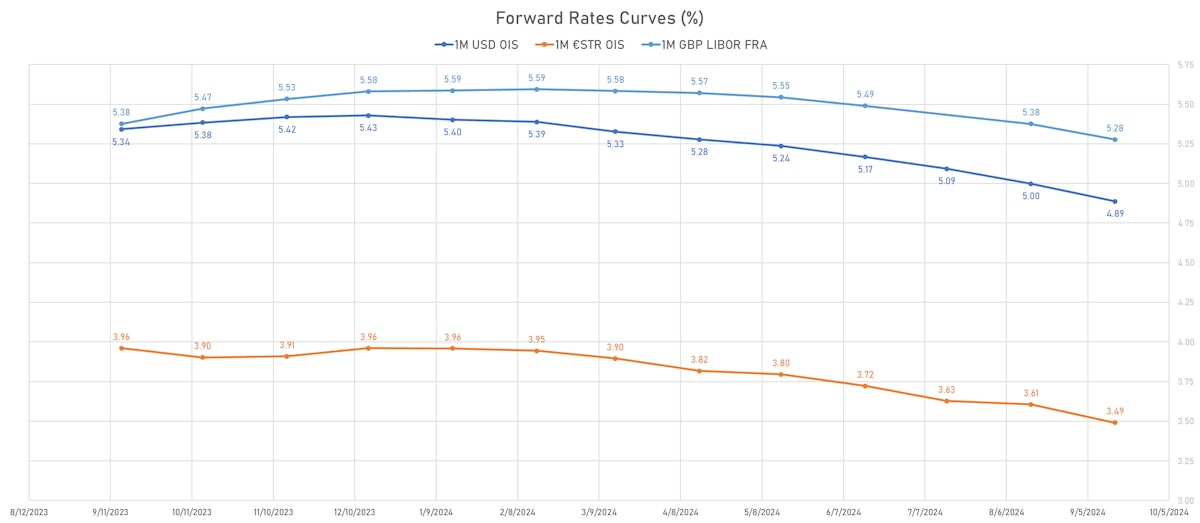

US FORWARD RATES

- Fed Funds futures now price in 0.3bp of Fed hikes by the end of September 2023, 8.0bp (0.3 x 25bp hikes) by the end of November 2023, and 0.4 hikes by the end of December 2023

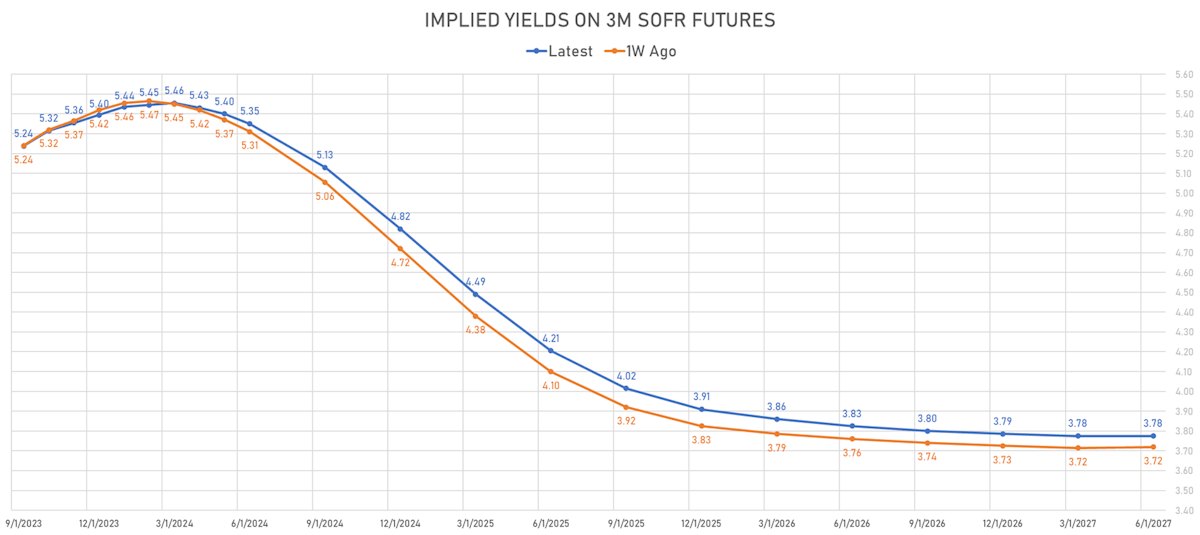

- Implied yields on 3-month SOFR futures top out at 5.45% for the March 2024 expiry and price in 168bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.50% (down -3.0bp); 2Y at 2.46% (down -3.5bp); 5Y at 2.41% (up 0.6bp); 10Y at 2.35% (up 0.7bp); 30Y at 2.35% (up 0.4bp)

- 6-month spot US CPI swap down -0.5 bp to 2.769%, with a steepening of the forward curve

- US Real Rates: 5Y at 2.2080%, +4.0 bp today; 10Y at 1.9910%, +4.4 bp today; 30Y at 2.0940%, +4.0 bp today

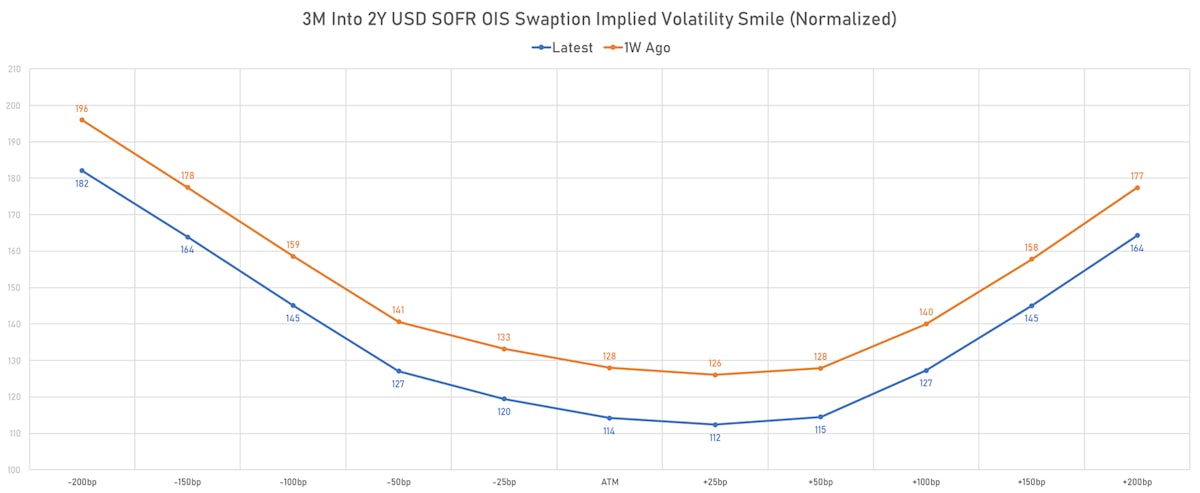

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.2 vols at 69.1 normals (down 6.2 normals from a week ago)

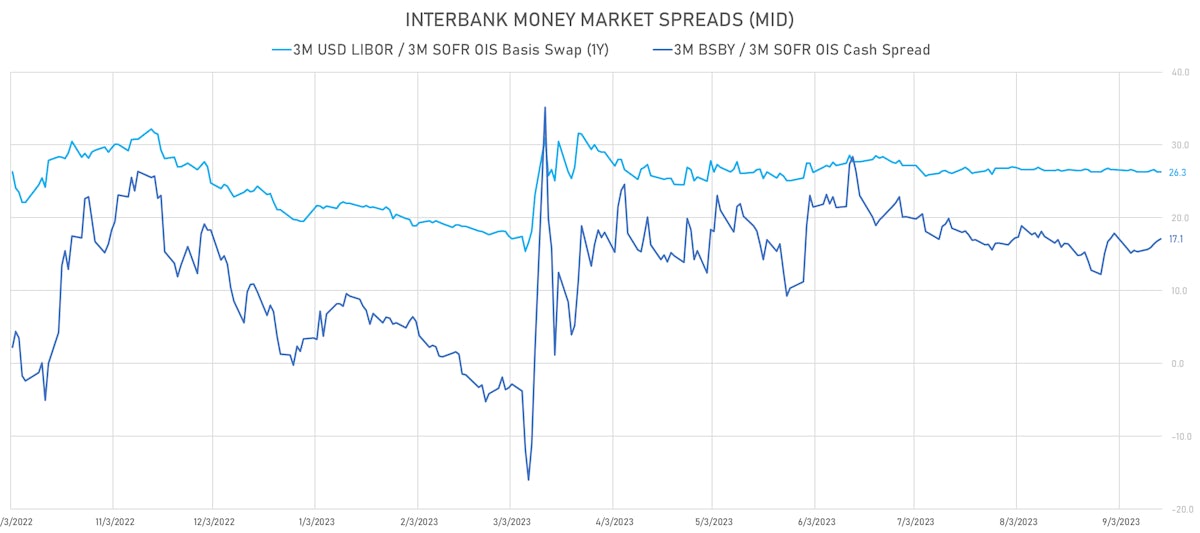

- No real change in money markets liquidity, although trading volume in Treasury futures was lighter last week

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.691% (up 6.5 bp); the German 1Y-10Y curve is 3.7 bp steeper at -104.0bp (YTD change: -102.7 bp)

- Japan 5Y: 0.282% (down -0.2 bp); the Japanese 1Y-10Y curve is 0.7 bp flatter at 77.8bp (YTD change: +35.6 bp)

- China 5Y: 2.490% (up 3.8 bp); the Chinese 1Y-10Y curve is 3.0 bp steeper at 54.8bp (YTD change: -18.8 bp)

- Switzerland 5Y: 1.099% (up 4.3 bp); the Swiss 1Y-10Y curve is 4.2 bp steeper at -82.8bp (YTD change: -89.1 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -1.7 bp at 183.7 bp (Weekly change: -6.5 bp; YTD change: +10.1 bp)

- US-JAPAN: +3.3 bp at 501.6 bp (Weekly change: +3.5 bp; YTD change: +62.3 bp)

- US-CHINA: +1.6 bp at 285.7 bp (Weekly change: +8.1 bp; YTD change: +67.4 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -1.5 bp at 179.6 bp (Weekly change: +2.9bp; YTD change: +50.8bp)

- US-JAPAN: +4.5 bp at 246.0 bp (Weekly change: +2.9bp; YTD change: +42.1bp)

- GERMANY-JAPAN: +6.0 bp at 66.4 bp (Weekly change: unchanged; YTD change: -8.7bp)