Rates

Hawkish FOMC Leads To Repricing Higher In USD Curves, Forward Inversion Still High Compared To Fed Forecasts

The market is currently giving roughly equal probability to a Fed hike in November and in December, but the former sounds increasingly unlikely if the Federal government shuts down for weeks in October

Published ET

Implied Changes Priced In Fed Funds Futures | Sources: phipost.com, Refinitiv data

RATES OUTLOOK

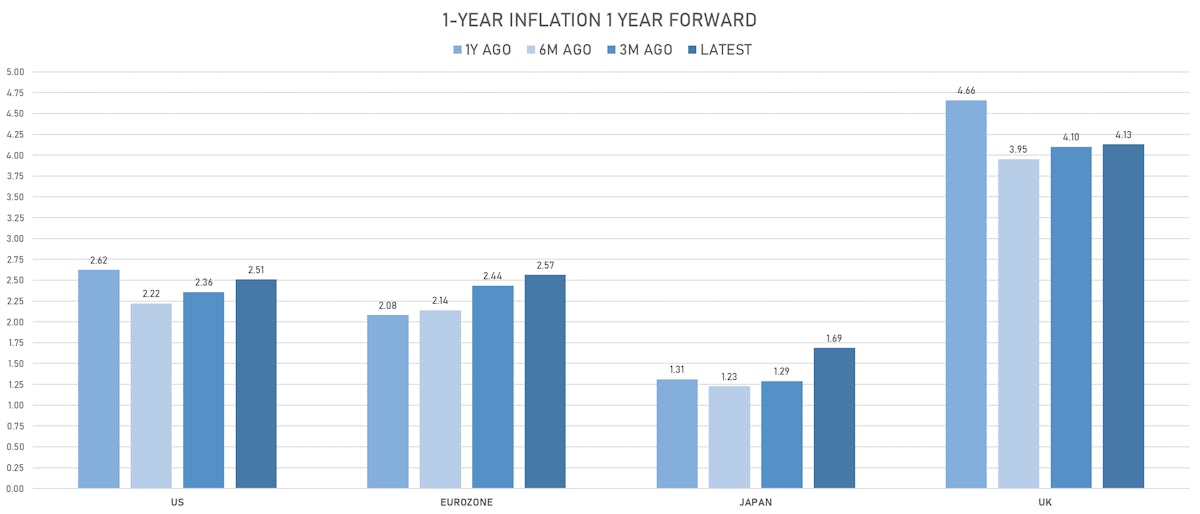

- The Fed was hawkish at the September FOMC, removing 50bps of 2024 cuts and keeping 2023 hike on table. Powell was more hawkish than usual, sees no recession, and healthy / soft landing. This contrasts with dovish pivots by ECB and BOE amid weakening European data.

- The market is now pricing in 12bp of additional Fed hike, and 85bp of cuts through 2024 from the peak

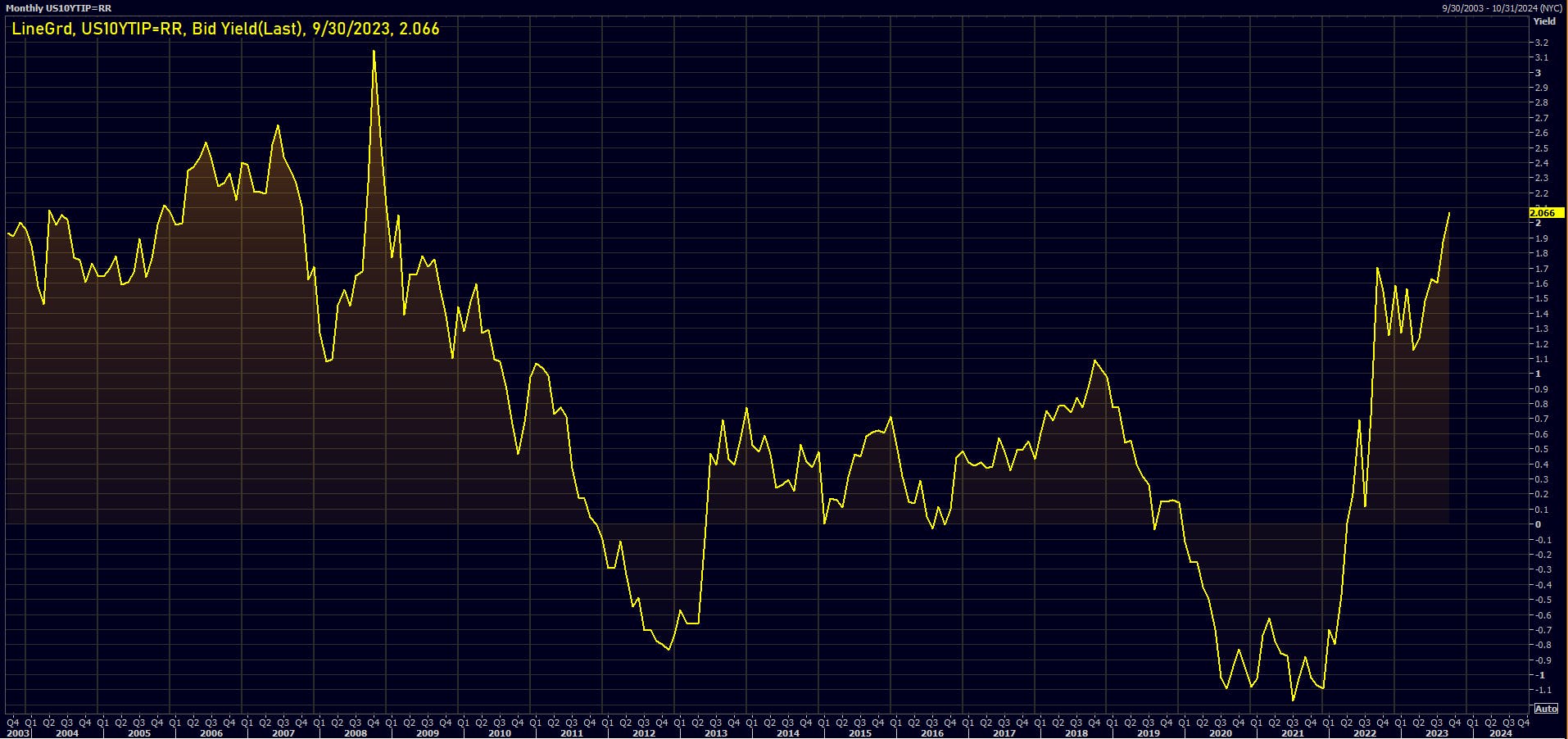

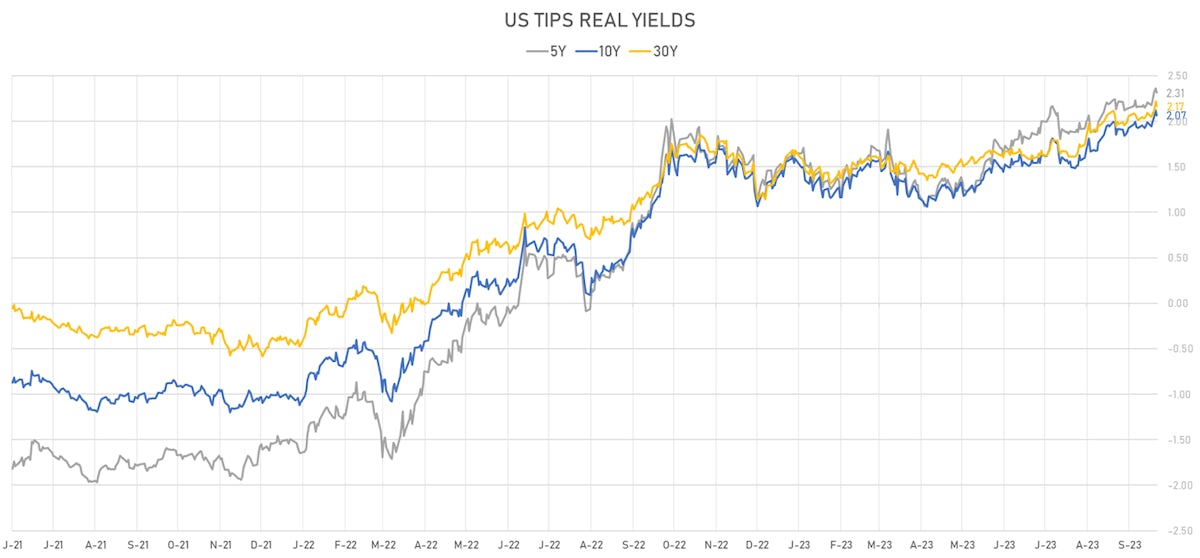

- It's no surprise to see long-end real yields continue to rise, as the economy is staying resilient and the Fed intends to stay "higher for longer". Having said that, with a temporary slowdown in US growth expected in 4Q23, and with the rise in oil prices bringing stagflation fears, I would not be an aggressive short at the longer end of the TIPS curve here: real yields are now at level that were historically attractive buy-and-holds

WEEKLY US RATES SUMMARY

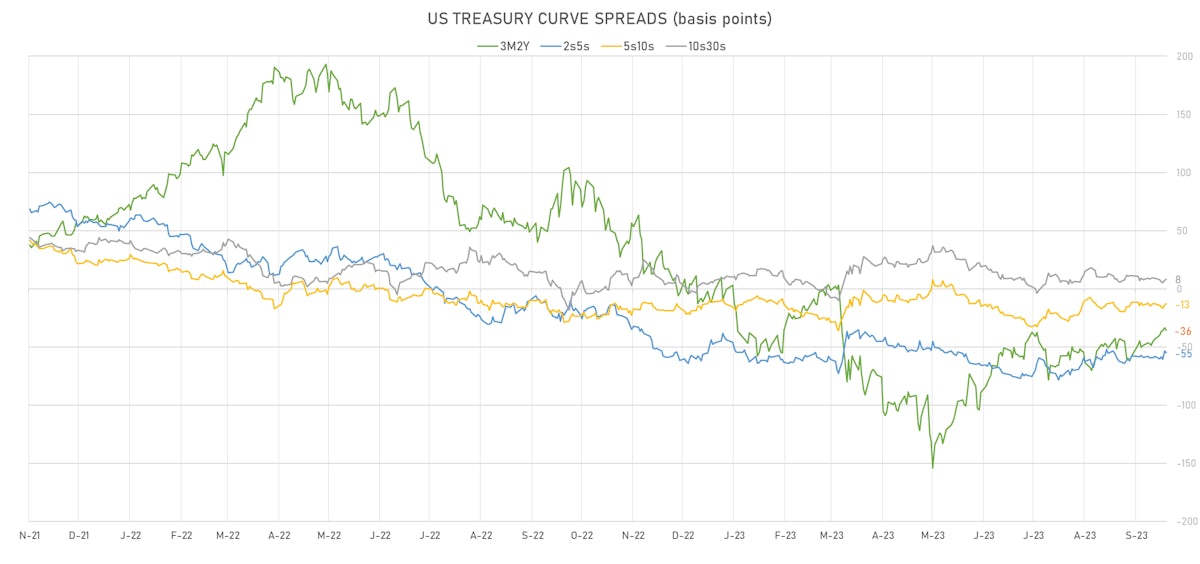

- The treasury yield curve steepened, with the 1s10s spread widening 7.4 bp, now at -101.7 bp (YTD change: -18.3bp)

- 1Y: 5.4526% (up 2.6 bp)

- 2Y: 5.1098% (up 7.4 bp)

- 5Y: 4.5647% (up 10.1 bp)

- 7Y: 4.5256% (up 10.6 bp)

- 10Y: 4.4357% (up 10.0 bp)

- 30Y: 4.5280% (up 10.7 bp)

- US treasury curve spreads: 3m2Y at -37.5bp (up 5.6bp this week), 2s5s at -54.5bp (up 1.8bp), 5s10s at -12.9bp (up 0.9bp), 10s30s at 9.2bp (up 0.8bp)

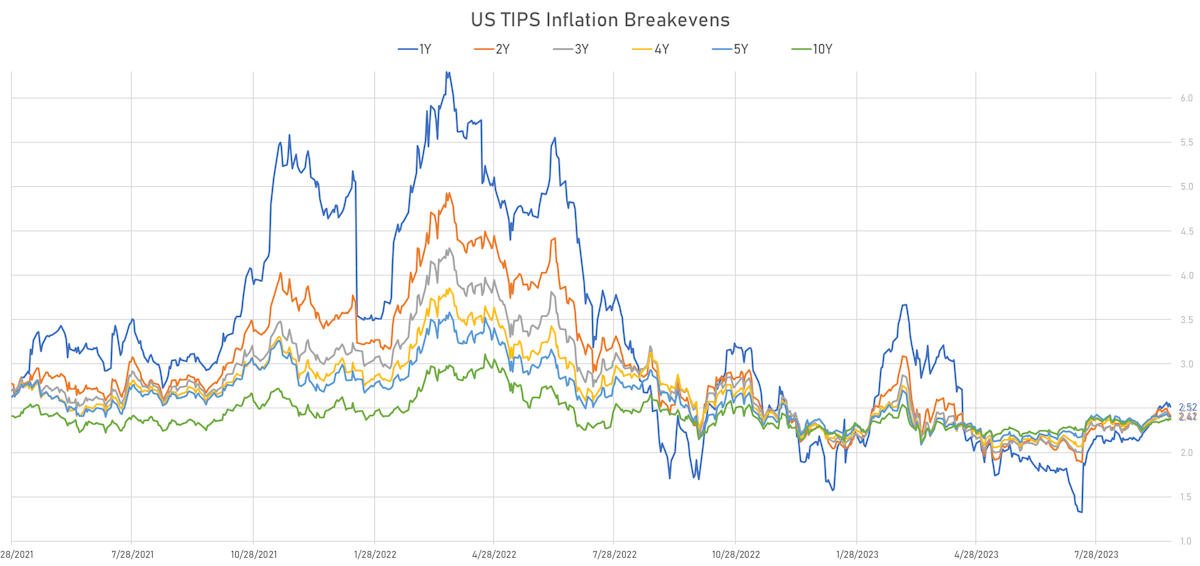

- US 5Y TIPS inflation breakeven at 2.31% down 0.6bp; 10Y breakeven at 2.37% up 2.9bp; 30Y breakeven at 2.38% up 3.9bp

- US 5-Year TIPS Real Yield: +10.5 bp at 2.3130%; 10-Year TIPS Real Yield: +7.5 bp at 2.0660%; 30-Year TIPS Real Yield: +7.5 bp at 2.1690%

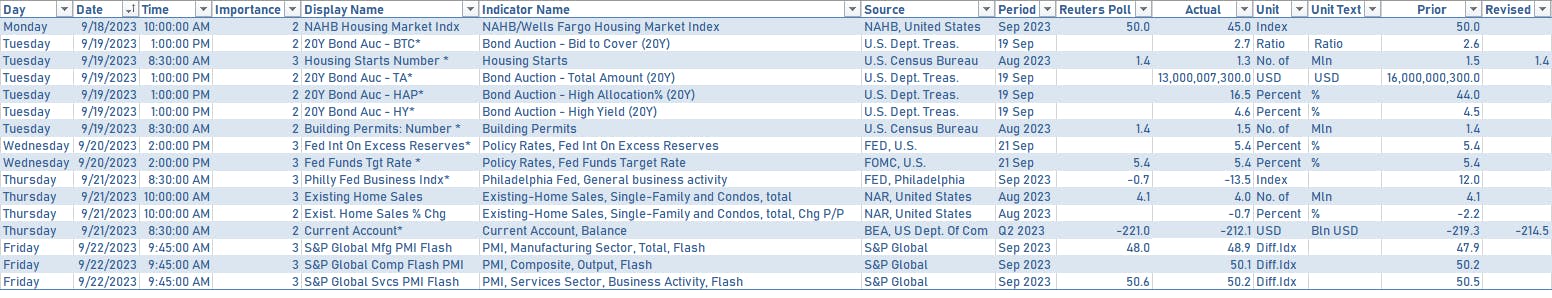

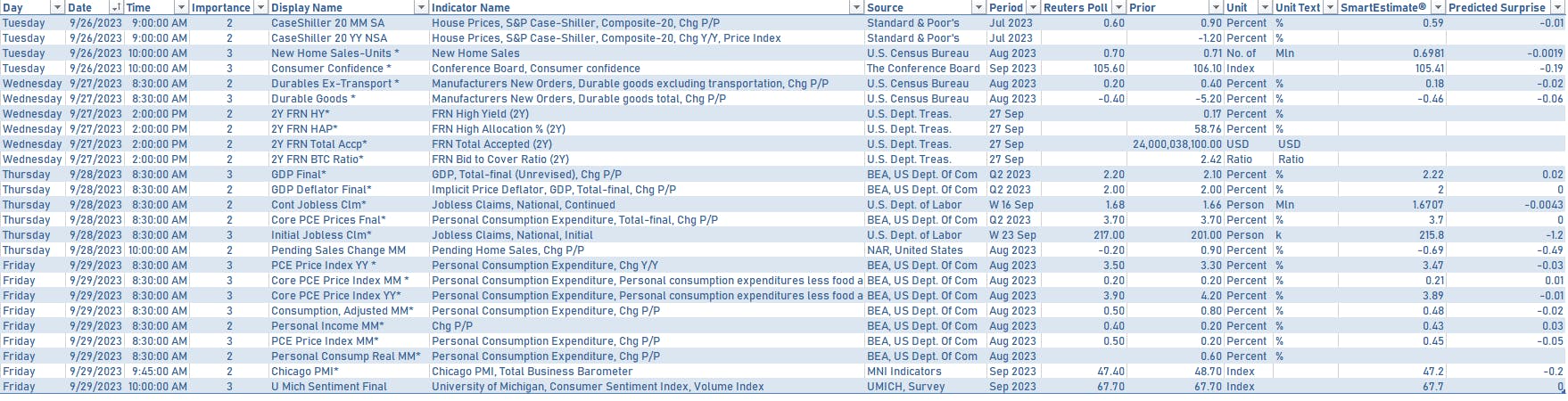

US ECONOMIC DATA OVER THE PAST WEEK

US MACRO RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Tuesday: $48bn in 2-year notes

- Wednesday: $49bn in 5-year notes

- Thursday: $37bn in 7-year notes

FED SPEAKERS IN THE WEEK AHEAD

- Monday 6:00 PM: Minneapolis Fed President Kashkari

- Tuesday 3:30 PM: Fed Governor Michelle Bowman

- Thursday 9:00 AM: Chicago Fed President Goolsbee

- Thursday 3:00 PM: Fed Governor Lisa Cook

- Thursday 4:00 PM: Fed Chair Powell

- Thursday 7:00 PM: Richmond Fed President Barkin

- Friday 12:45 PM: New York Fed President John Williams

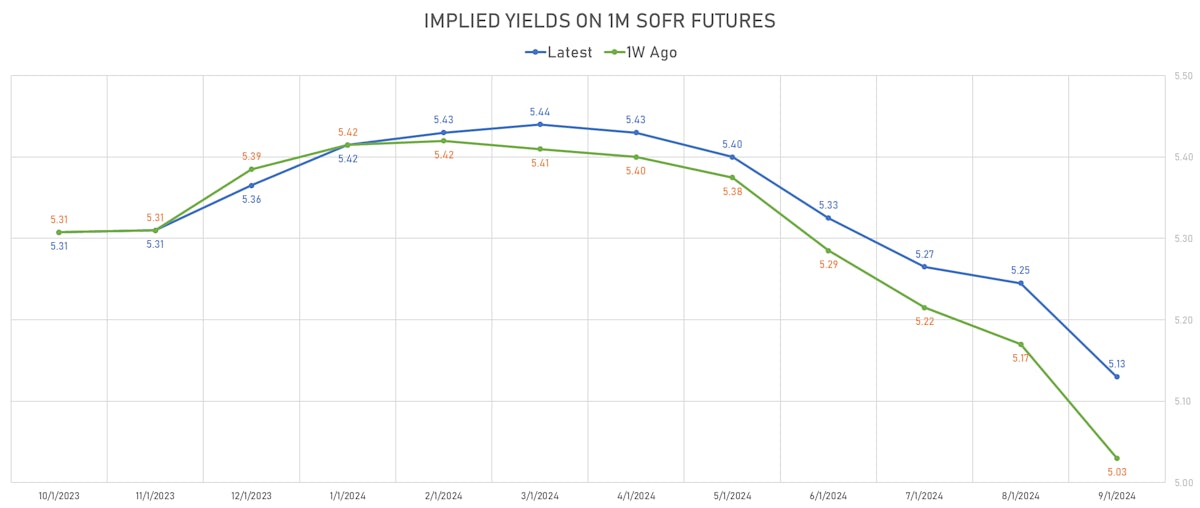

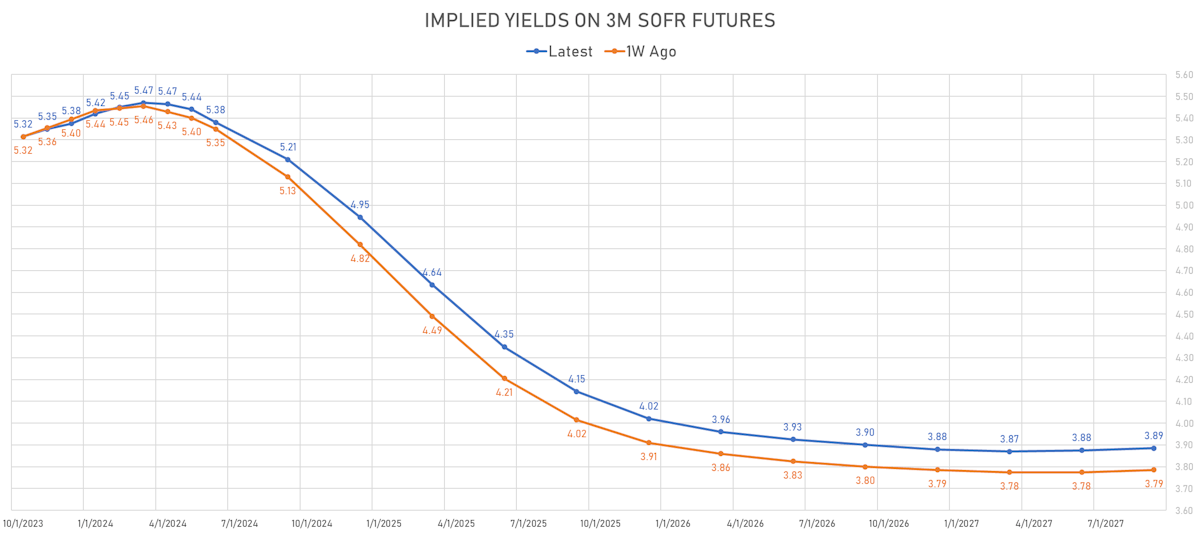

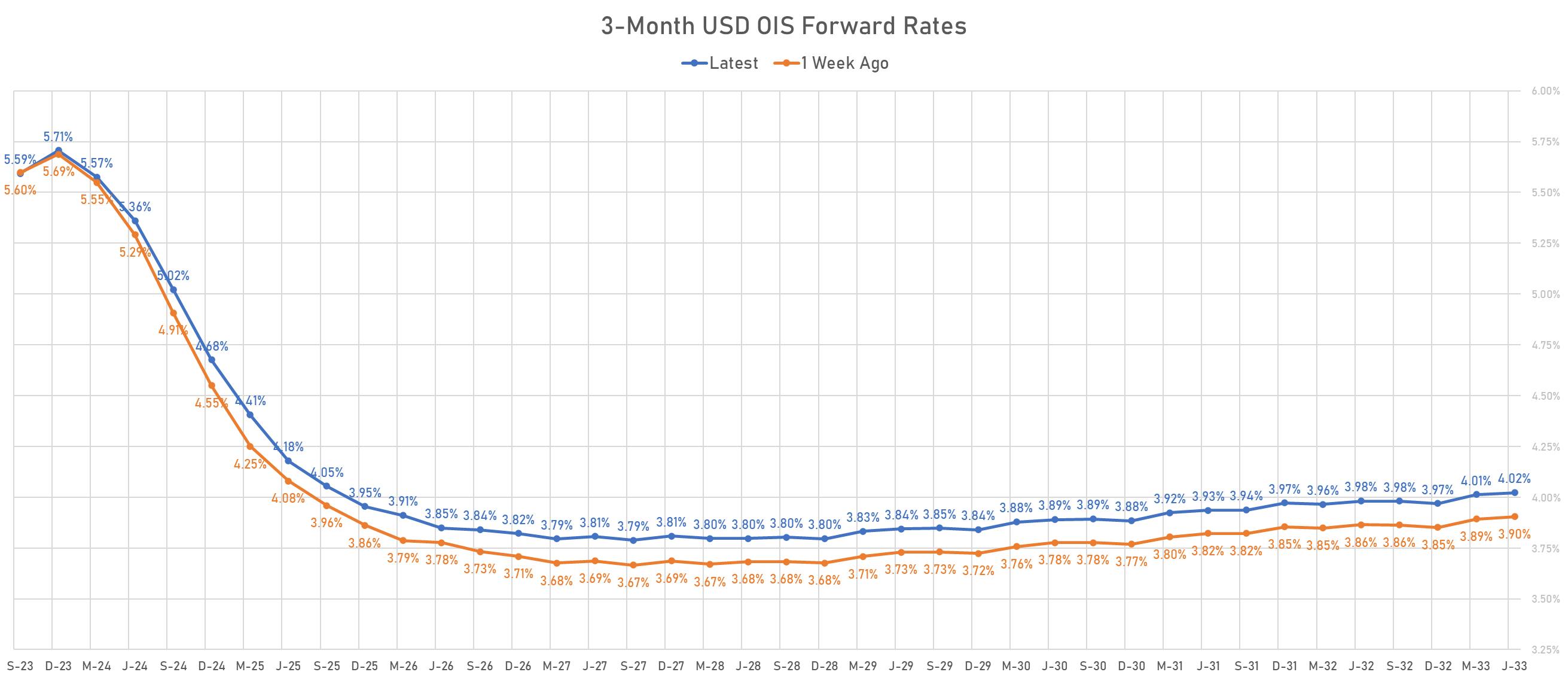

US FORWARD RATES

- Fed Funds futures now price in 5.2bp of Fed hikes by the end of November 2023, 11.5bp (0.5 x 25bp hike) by the end of December 2023, and 12.5bp by the end of January 2024

- Implied yields on 3-month SOFR futures top out at 5.47% for the March 2024 expiry and price in 160bp of rate cuts over the following easing cycle

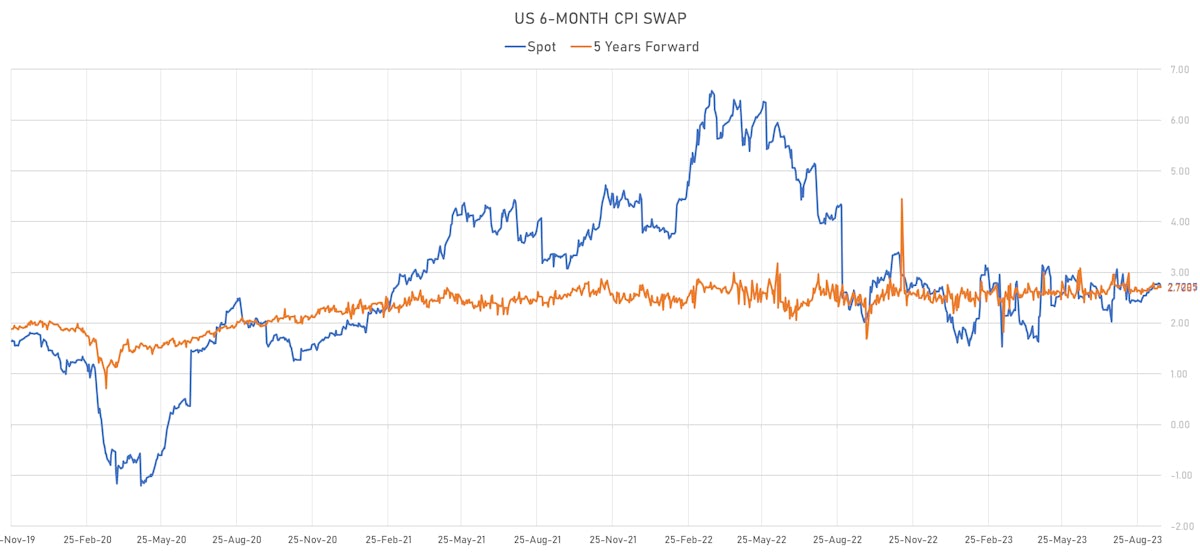

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.52% (down -3.6bp); 2Y at 2.42% (down -2.0bp); 5Y at 2.41% (down -0.6bp); 10Y at 2.38% (down -0.4bp); 30Y at 2.38% (up 0.1bp)

- 6-month spot US CPI swap down -5.4 bp to 2.721%, with a flattening of the forward curve

- US Real Rates: 5Y at 2.3130%, -4.8 bp today; 10Y at 2.0660%, -5.5 bp today; 30Y at 2.1690%, -5.0 bp today

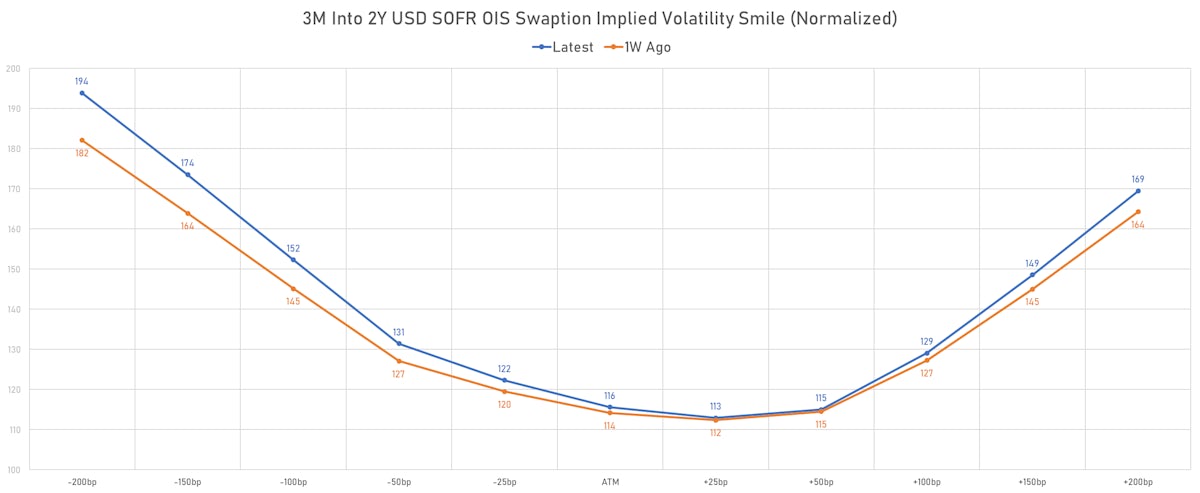

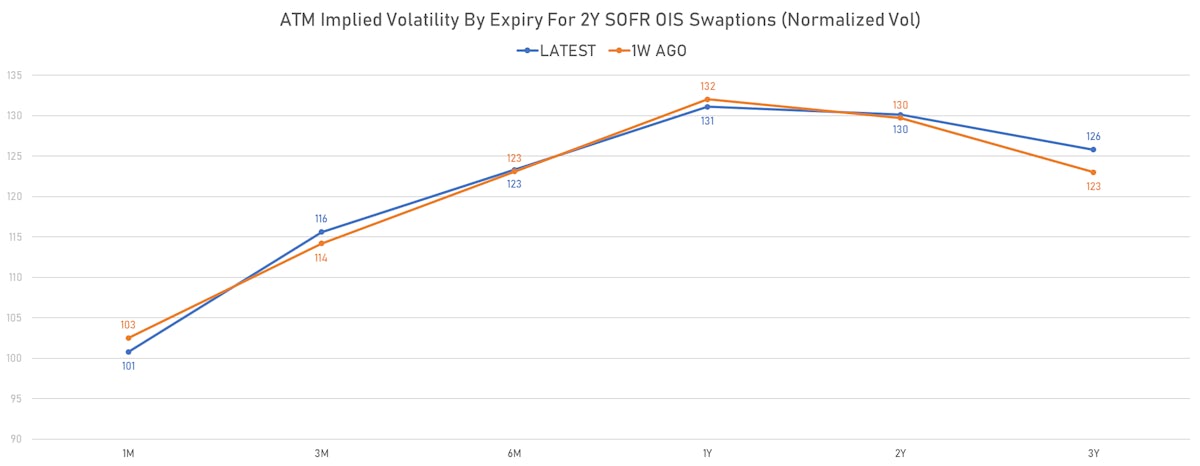

RATES VOLATILITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -3.4 vols at 62.7 normals (down 6.4 normals from a week ago)

KEY INTERNATIONAL RATES TODAY

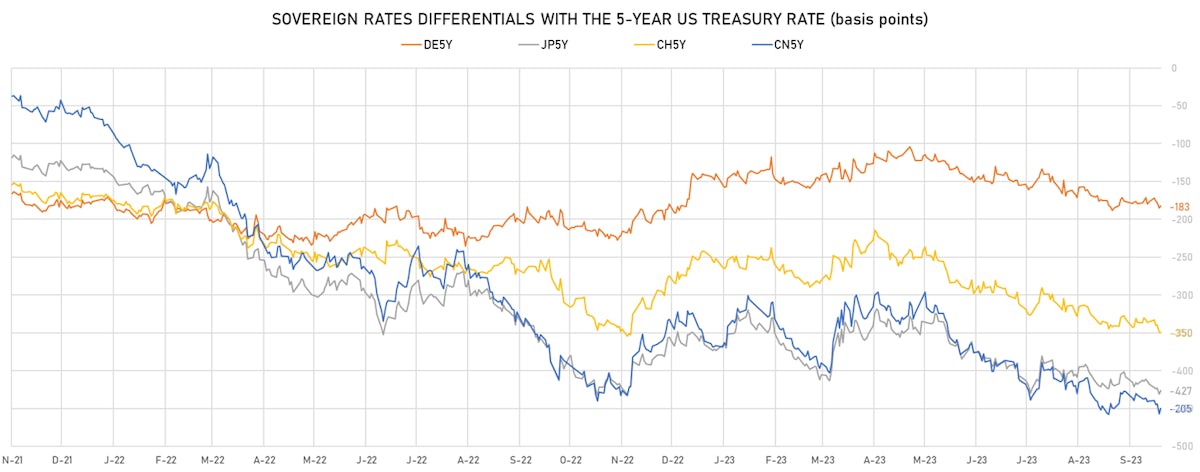

- Germany 5Y: 2.742% (down -1.9 bp); the German 1Y-10Y curve is 0.7 bp flatter at -101.2bp (YTD change: -98.2 bp)

- Japan 5Y: 0.304% (up 0.1 bp); the Japanese 1Y-10Y curve is 0.7 bp flatter at 77.8bp (YTD change: +37.1 bp)

- China 5Y: 2.521% (up 2.2 bp); the Chinese 1Y-10Y curve is 0.1 bp steeper at 49.7bp (YTD change: -23.9 bp)

- Switzerland 5Y: 1.079% (down -4.8 bp); the Swiss 1Y-10Y curve is 6.0 bp steeper at -75.8bp (YTD change: -83.3 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -2.2 bp at 187.2 bp (Weekly change: +3.5 bp; YTD change: +13.6 bp)

- US-JAPAN: -2.5 bp at 509.0 bp (Weekly change: +10.7 bp; YTD change: +69.7 bp)

- US-CHINA: unchanged at 288.5 bp (Weekly change: +5.3 bp; YTD change: +70.2 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -6.8 bp at 180.0 bp (Weekly change: +0.4bp; YTD change: +51.2bp)

- US-JAPAN: -2.1 bp at 258.8 bp (Weekly change: +17.3bp; YTD change: +54.9bp)

- GERMANY-JAPAN: +4.7 bp at 78.8 bp (Weekly change: +18.4bp; YTD change: +3.7bp)