Rates

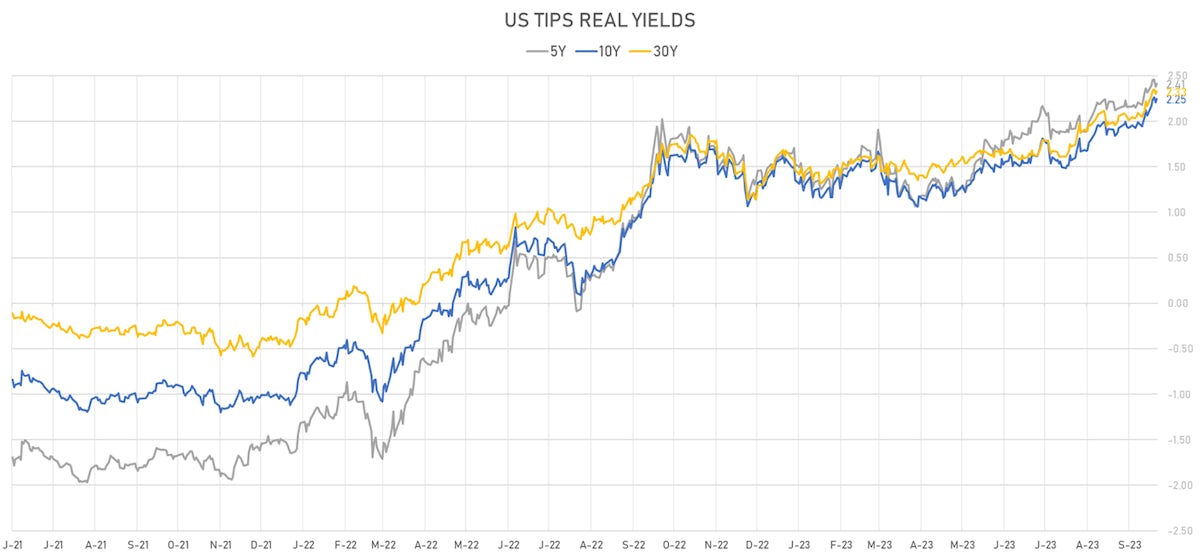

Continued Selloff At The Back End Of The US Curve, With 10Y Real Yields Up Another 18bp

The interesting thing about the move at the long end is that it's been more about risk management from the long side than speculative shorts, which have remained largely unchanged over the past weeks

Published ET

Net Managed Money Positioning in 10Y Notes | Source: CFTC Commitment of Traders

US RATES OUTLOOK

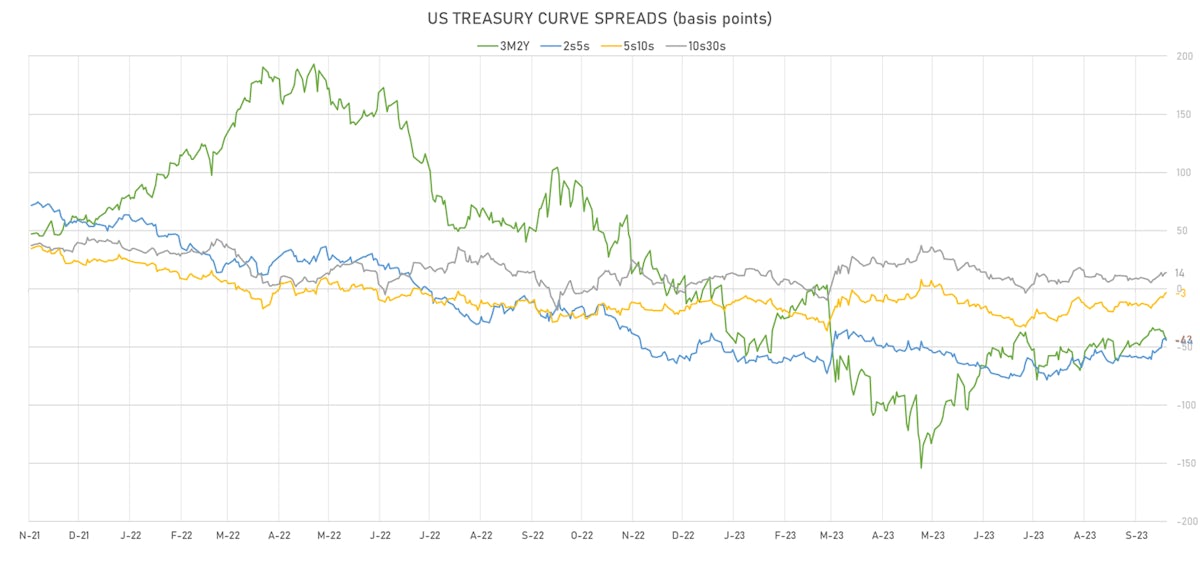

- The US curve has continued to bear steepen, with the front end well anchored (just 40% probability of another hike now priced in)

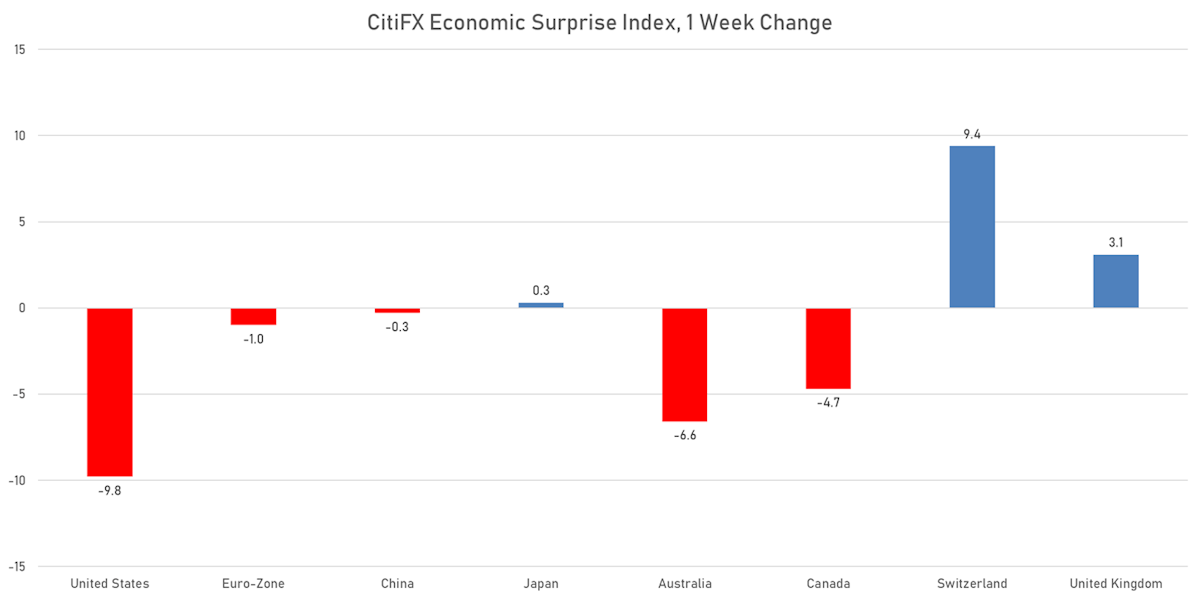

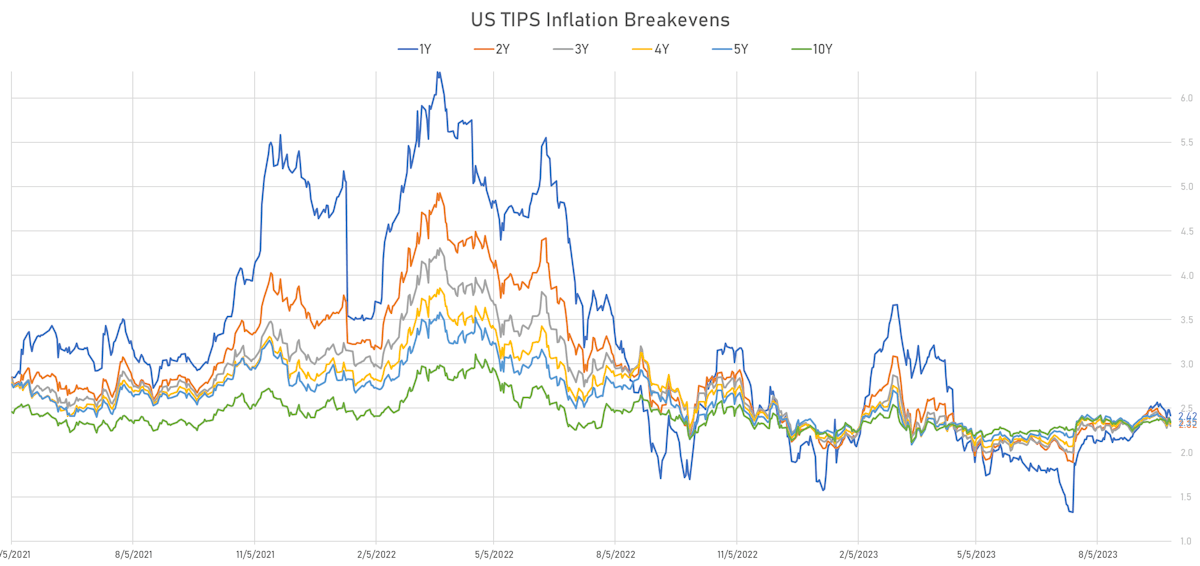

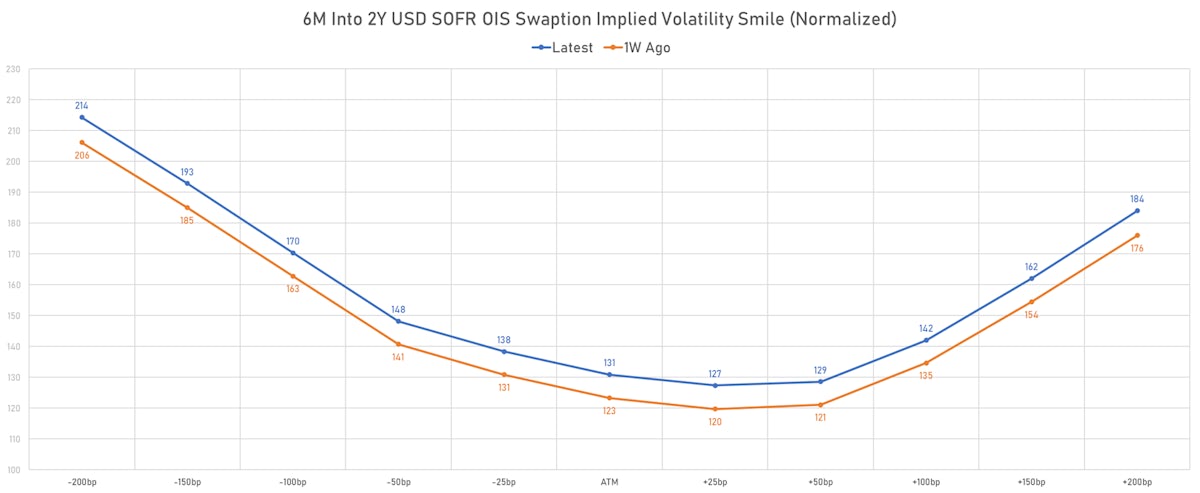

- But the price action in the rates complex has been puzzling to many, for several reasons: 1) US economic data has come in relatively soft and leading firms (including Goldman) have adjusted their forecasts down for 4Q23 and 1Q24; 2) all of the move has been in real yields, with breakevens staying put despite the rise in crude prices (Brent settling around $95/bbl) and fears of inflation reacceleration; 3) the COT report shows that speculative net positioning hasn't changed since August

- It's best to understand what's happened from a risk management perspective: large moves in a short time (i.e. an increase in volatility) creates a VAR shock for portfolio managers and dealers, who have to adjust their positioning, leading to second-order effects (more selling in this case)

- A positive development is that we're not seeing in an increase in upside implied volatility skew (ATM+100bp / ATM) at the long end, meaning that most of the gamma move might be done

6-Month Into 30Y USD swaption implied volatility skew (ATM+100bp/ATM) | Source: Refinitiv

- Considering solely the economic / macro picture, the rise in yields at the long end looks overdone, and we should see a reversal before year end. The timing is tricky because of the current volatility, but should happen when things start to calm down.

WEEKLY US RATES SUMMARY

- The treasury yield curve steepened, with the 1s10s spread widening 13.3 bp, now at -88.4 bp (YTD change: -5.0bp)

- 1Y: 5.4621% (up 1.0 bp)

- 2Y: 5.0509% (down 5.9 bp)

- 5Y: 4.6143% (up 5.0 bp)

- 7Y: 4.6204% (up 9.5 bp)

- 10Y: 4.5783% (up 14.3 bp)

- 30Y: 4.7076% (up 18.0 bp)

- US treasury curve spreads: 3m2Y at -43.0bp (down -5.5bp this week), 2s5s at -43.7bp (up 11.7bp), 5s10s at -3.6bp (up 8.4bp), 10s30s at 12.9bp (up 3.8bp)

- US 5Y TIPS inflation breakeven at 2.25% down 6.5bp; 10Y breakeven at 2.34% down 3.2bp; 30Y breakeven at 2.40% up 2.4bp

- US 5-Year TIPS Real Yield: +9.8 bp at 2.4110%; 10-Year TIPS Real Yield: +17.9 bp at 2.2450%; 30-Year TIPS Real Yield: +16.0 bp at 2.3290%

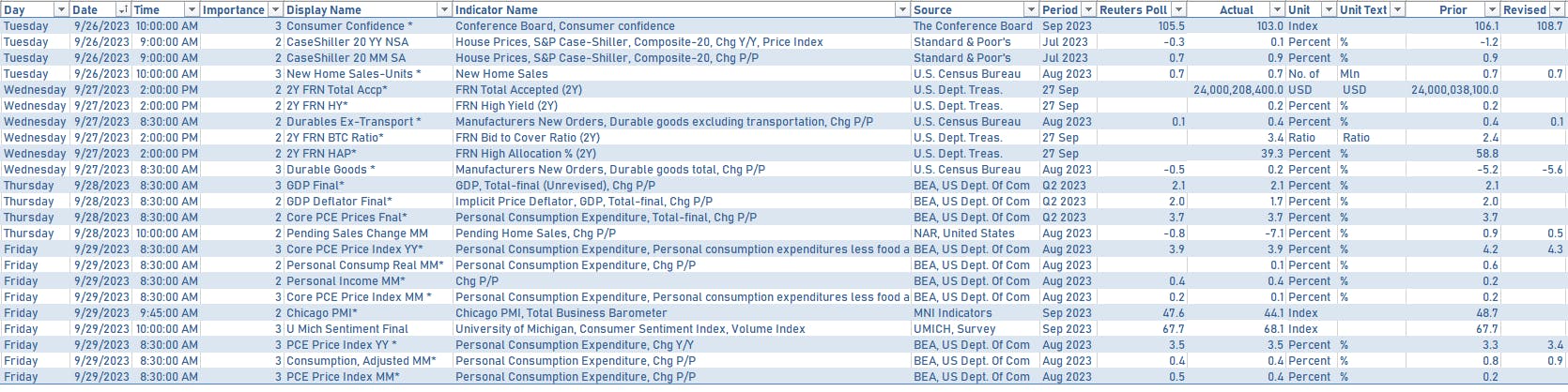

US ECONOMIC DATA OVER THE PAST WEEK

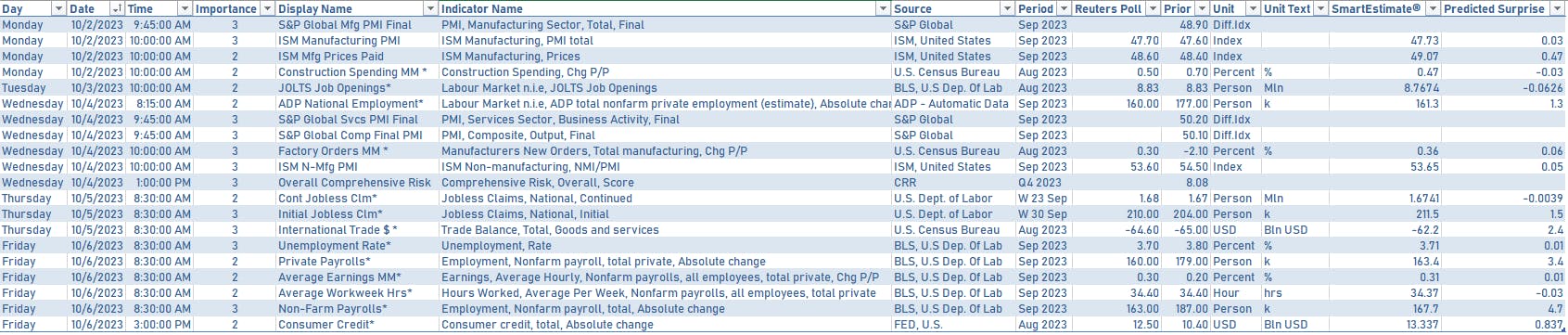

US MACRO RELEASES IN THE WEEK AHEAD

FED SPEAKERS IN THE WEEK AHEAD

- Monday 11:00 AM: Fed Chair Powell and Philadelphia Fed President Harker

- Monday 1:30 PM: New York Fed President

- Monday 7:30 PM: Cleveland Fed President Mester

- Tuesday 8:00 AM: Atlanta Fed President Bostic

- Wednesday 10:25 AM: Fed Governor Bowman

- Wednesday 10:30 PM: Chicago Fed President Goolsbee

- Thursday 9:00 AM: Cleveland Fed President Mester

- Friday 12:00 PM: San Francisco Fed President Daly

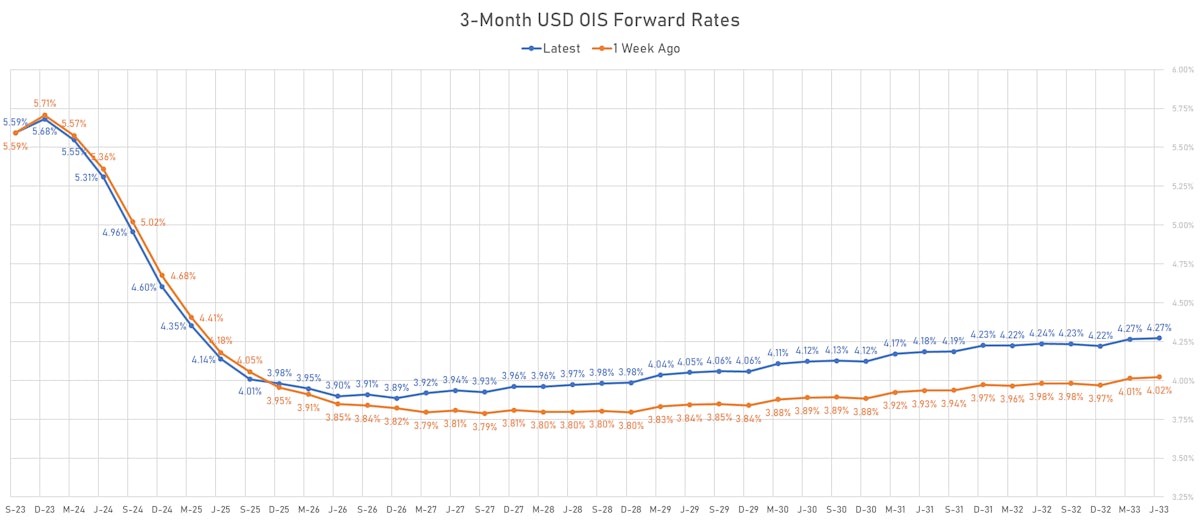

US FORWARD RATES

- Fed Funds futures now price in 4.7bp of Fed hikes by the end of November 2023, 10.0bp (40% chance of another 25bp hike) by the end of December 2023

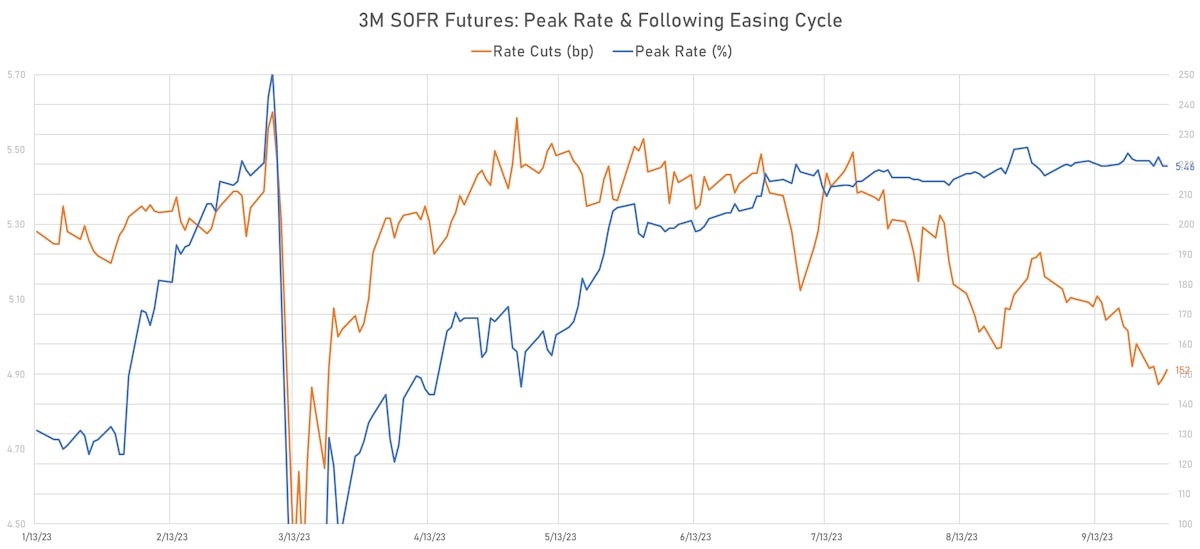

- Implied yields on 3-month SOFR futures top out at 5.45% for the March 2024 expiry and price in 152bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

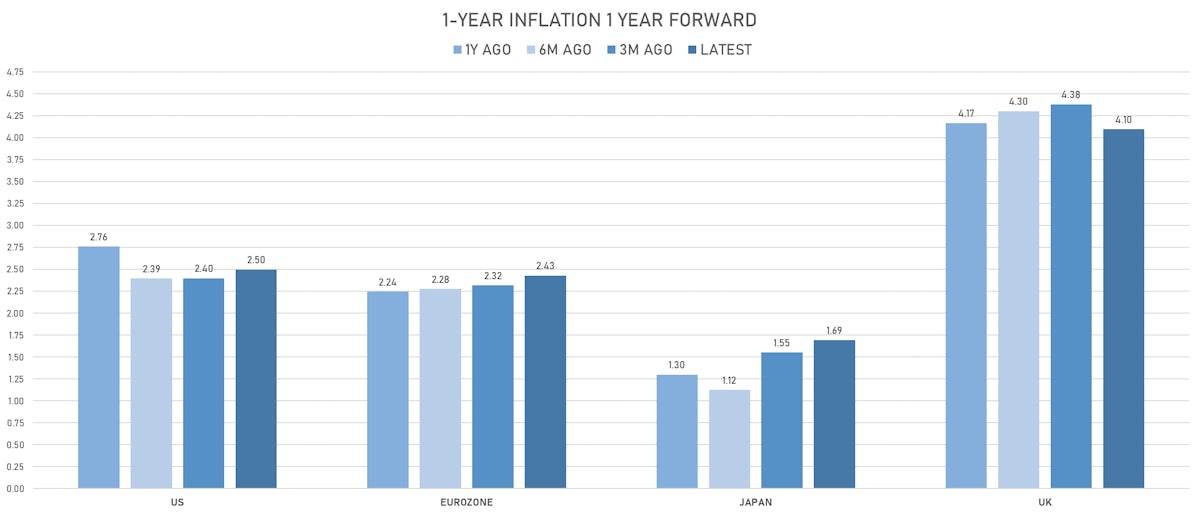

- TIPS 1Y breakeven inflation at 2.42% (down -6.6bp); 2Y at 2.32% (down -5.7bp); 5Y at 2.35% (down -4.5bp); 10Y at 2.34% (down -3.9bp); 30Y at 2.40% (down -2.9bp)

- 6-month spot US CPI swap down -1.3 bp to 2.768%, with a steepening of the forward curve

- US Real Rates: 5Y at 2.4110%, +3.0 bp today; 10Y at 2.2450%, +3.9 bp today; 30Y at 2.3290%, +2.9 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 2.2 vols at 74.8 normals (up 12.1 normals from a week ago)

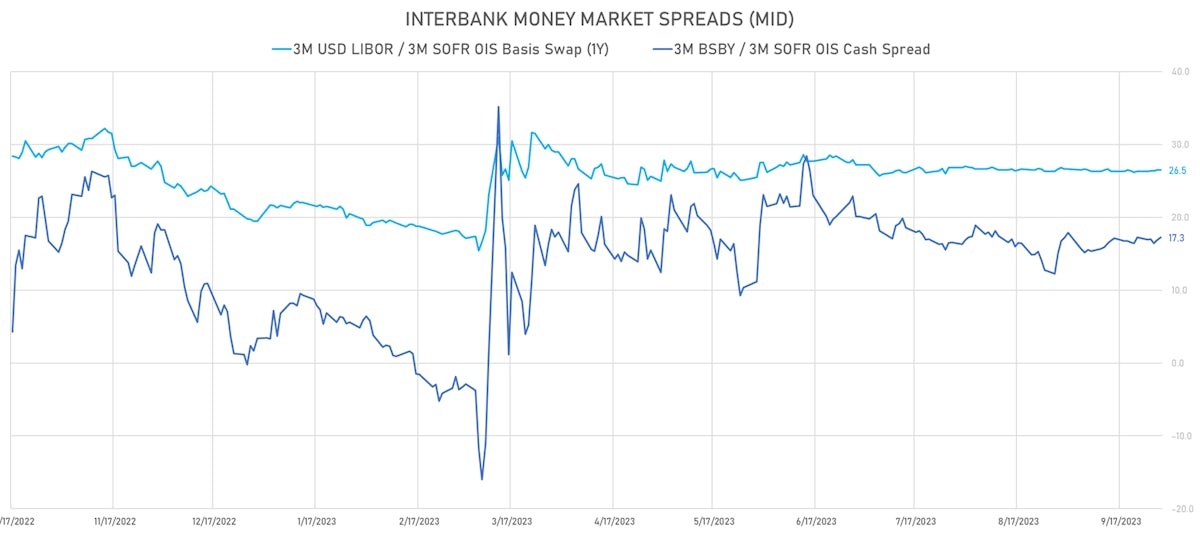

- Liquidity is not an issue, not seeing any widening in money market spreads

KEY INTERNATIONAL RATES TODAY

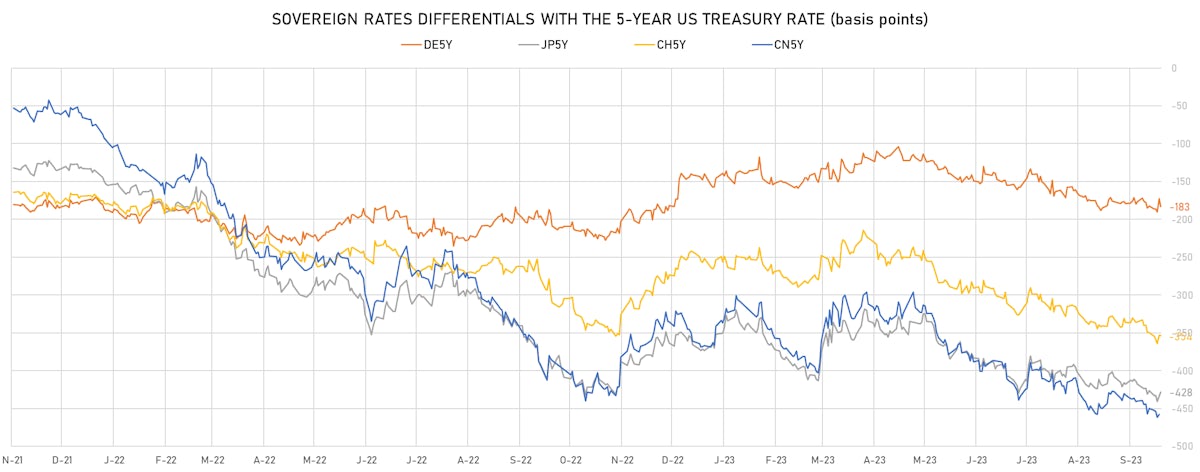

- Germany 5Y: 2.788% (down -14.2 bp); the German 1Y-10Y curve is 8.5 bp flatter at -84.8bp (YTD change: -82.2 bp)

- Japan 5Y: 0.317% (up 1.5 bp); the Japanese 1Y-10Y curve is 1.3 bp steeper at 80.4bp (YTD change: +39.7 bp)

- China 5Y: 2.523% (down -2.5 bp); the Chinese 1Y-10Y curve is 3.8 bp steeper at 55.1bp (YTD change: -18.5 bp)

- Switzerland 5Y: 1.064% (down -5.0 bp); the Swiss 1Y-10Y curve is 10.7 bp flatter at -72.7bp (YTD change: -79.0 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +3.5 bp at 185.1 bp (Weekly change: -2.1 bp; YTD change: +11.5 bp)

- US-JAPAN: -6.6 bp at 500.7 bp (Weekly change: -8.3 bp; YTD change: +61.4 bp)

- US-CHINA: -1.3 bp at 286.7 bp (Weekly change: -1.8 bp; YTD change: +68.4 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +9.8 bp at 177.9 bp (Weekly change: -2.1bp; YTD change: +49.1bp)

- US-JAPAN: +3.0 bp at 273.0 bp (Weekly change: +14.2bp; YTD change: +69.1bp)

- GERMANY-JAPAN: -6.8 bp at 95.1 bp (Weekly change: +16.3bp; YTD change: +20.0bp)