Rates

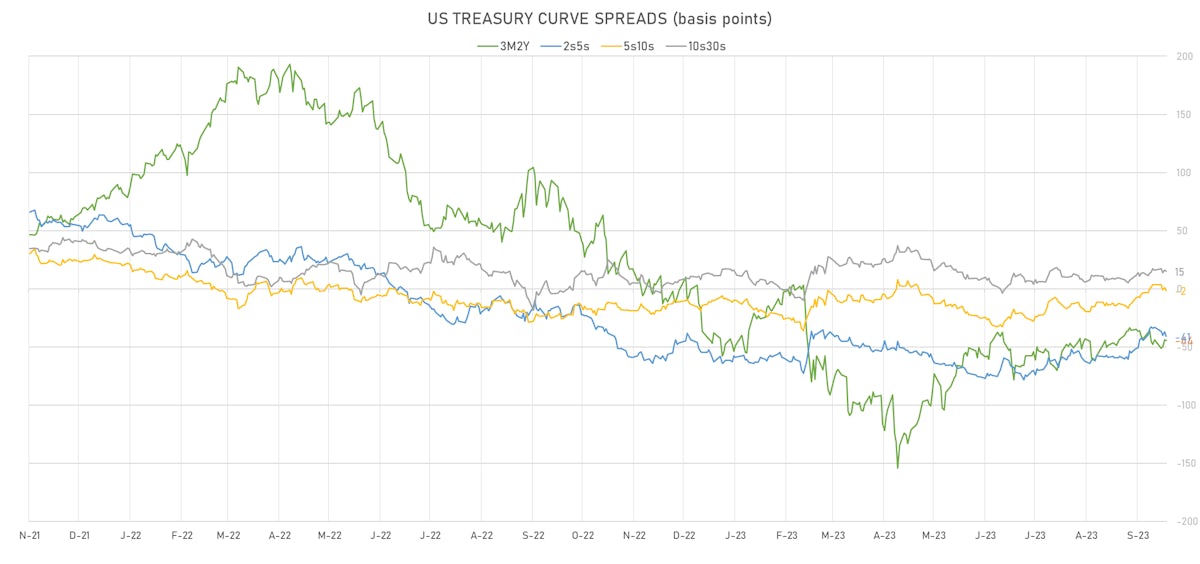

US Duration Rebounded This Week, Curve Inversion Deepened As 2s10s Spread Fell 16bp

Fed officials seemed to indicate last week that a decision has been made to keep rates unchanged at the next FOMC, pointing to the tightening in US financial conditions to justify their position

Published ET

Spread between US Treasury 10-year notes and 3-month T-Bills | Source: Refinitiv

US RATES OUTLOOK

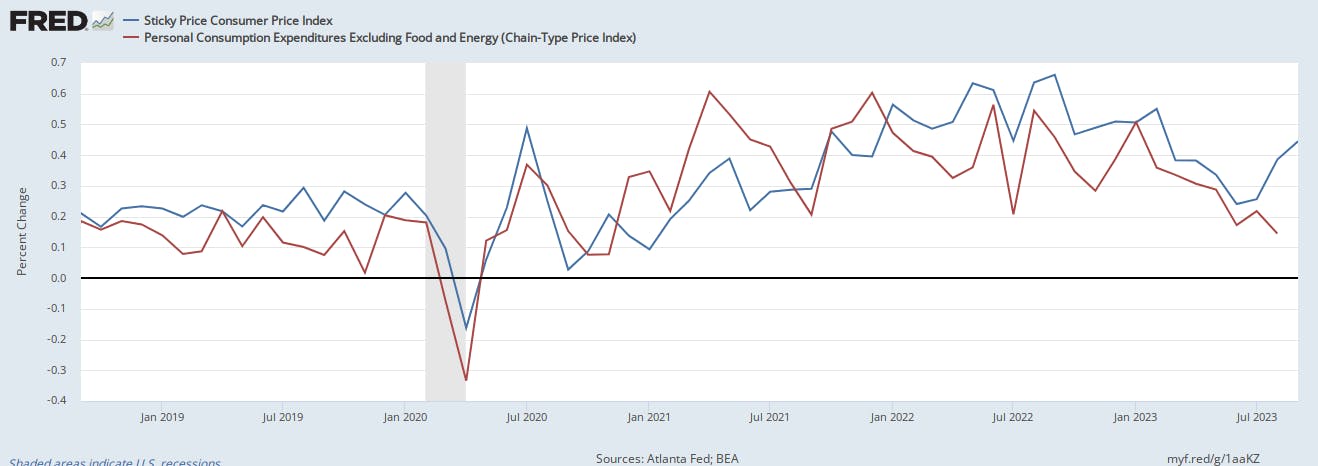

- It’s interesting that the Fed has maintained they are completely data dependent, and yet when NFP prints over 330k MoM and sticky elements of the CPI are back to running over 0.4% MoM, they just take cover and say that financial conditions have been tightened sufficiently by the market selloff in duration and equities.

- In other words, listening to FOMC voters over the past week and reading Timiraos in the WSJ, it sounds like the decision has been made to keep rates unchanged at the next FOMC despite the strong data.

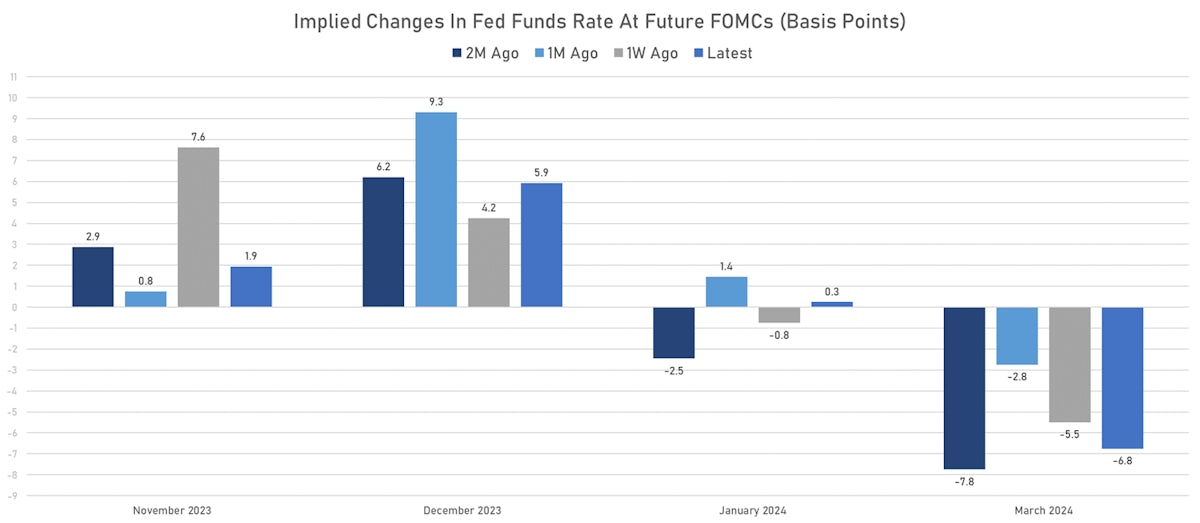

- That’s certainly how the market has been interpreting Fed communications, with forward Fed Funds rates now pricing in only 8bp to the peak (i.e. 1/3 chance of another hike).

- The focus over the next week will stay on the Fed, with a barrage of speeches scheduled ahead of the FOMC blackout period, most notably Powell on Thursday

- However, the bounce in equities and duration, coupled with a noticeable divergence between the core PCE and sticky CPI should make it uncomfortable for officials to express a definitive judgement until the latest PCE data is published during the blackout period (October 27th)

Core PCE vs sticky CPI (% change MoM) | Source: FRED

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread down 11.7 bp (deeper inversion), now at -77.8 bp (YTD change: +5.6bp)

- 1Y: 5.3935% (up 1.3 bp)

- 2Y: 5.0571% (up 3.4 bp)

- 5Y: 4.6424% (down 4.5 bp)

- 7Y: 4.6526% (down 7.6 bp)

- 10Y: 4.6155% (down 10.4 bp)

- 30Y: 4.7560% (down 13.5 bp)

- US treasury curve spreads: 3m2Y at -44.3bp (up 4.7bp this week), 2s5s at -41.5bp (down -8.1bp), 5s10s at -2.7bp (down -6.0bp), 10s30s at 14.1bp (down -2.9bp)

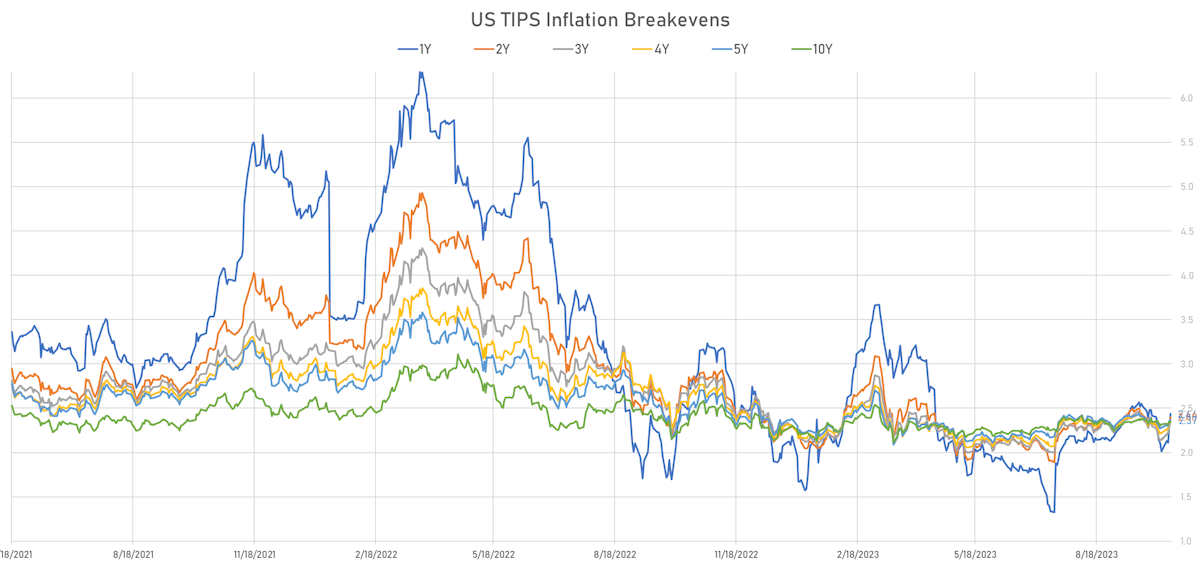

- US 5Y TIPS inflation breakeven at 2.28% up 10.0bp; 10Y breakeven at 2.34% up 2.2bp; 30Y breakeven at 2.40% down 1.6bp

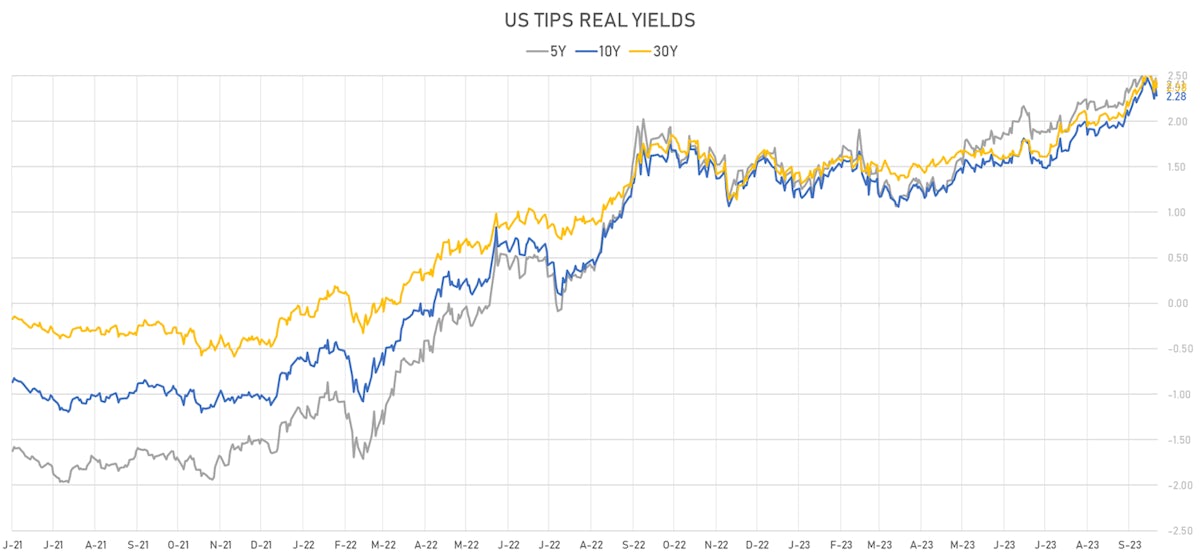

- US 5-Year TIPS Real Yield: -15.2 bp at 2.4060%; 10-Year TIPS Real Yield: -13.8 bp at 2.2810%; 30-Year TIPS Real Yield: -12.6 bp at 2.3760%

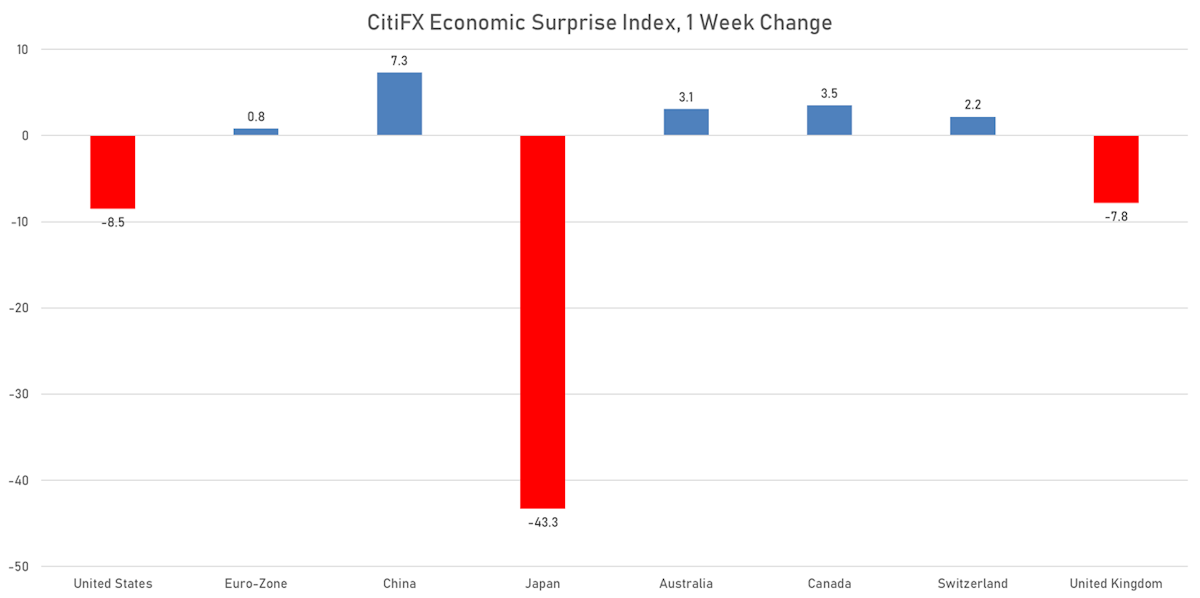

US ECONOMIC DATA OVER THE PAST WEEK

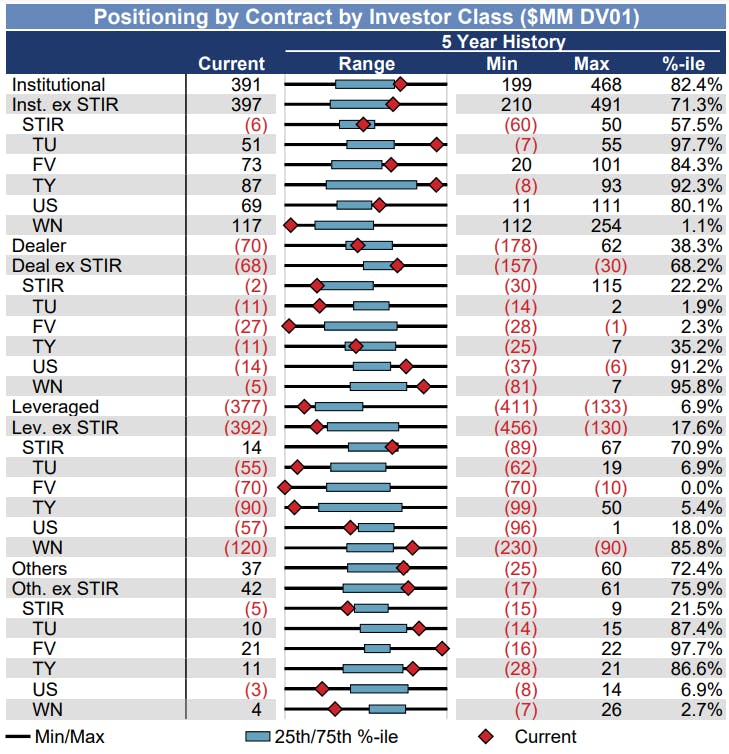

US RATES WEEKLY CFTC POSITIONING UPDATE

Futures positioning | Source: Goldman Sachs

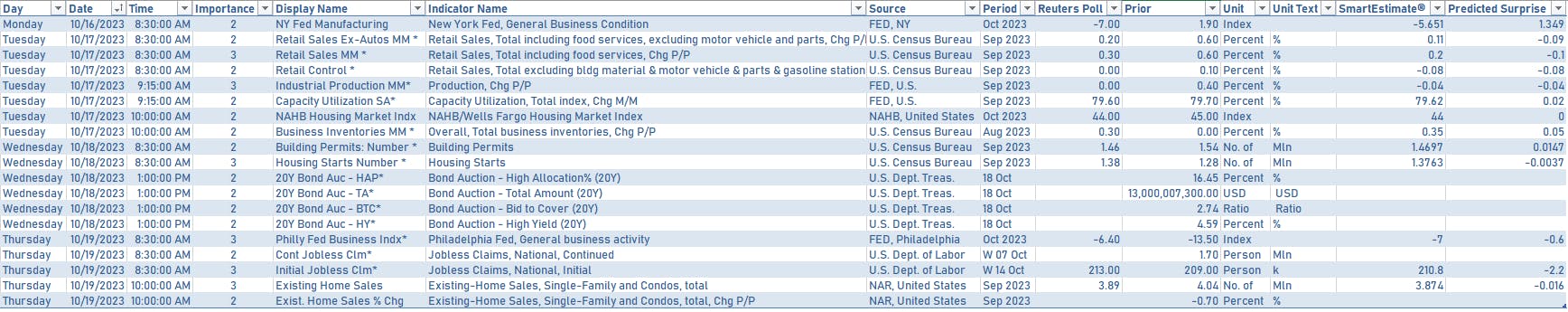

US MACRO RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Wednesday 18 October: $13bn in 20-year bond

- Thursday 19 October: $22bn in 5-year TIPS

FED SPEAKERS IN THE WEEK AHEAD

- Monday 10:30am: Phil Fed’s Harker

- Monday 4:30pm: Phil Fed’s Harker

- Tuesday 8:00am: NY Fed’s Williams

- Tuesday 9:20am: Fed Gov Bowman

- Tuesday 1:00pm: Rich Fed’s Barkin

- Wednesday 12:00pm: Fed Gov Waller

- Wednesday 12:30pm: NY Fed’s Williams

- Wednesday 1:00pm: Fed Gov Bowman

- Wednesday 3:15pm: Phil Fed’s Harker

- Thursday 9:00am: Fed Gov Jefferson

- Thursday 12:00pm: Fed Chair Powell

- Thursday 1:20pm: Chi Fed’s Goolsbee

- Thursday 1:30pm: Fed Gov Barr

- Thursday 5:30pm: Phil Fed’s Harker

- Thursday 7:00pm: Dal Fed’s Logan

- Friday 9:00am: Phil Fed’s Harker

- Friday 12:15pm: Cle Fed’s Mester

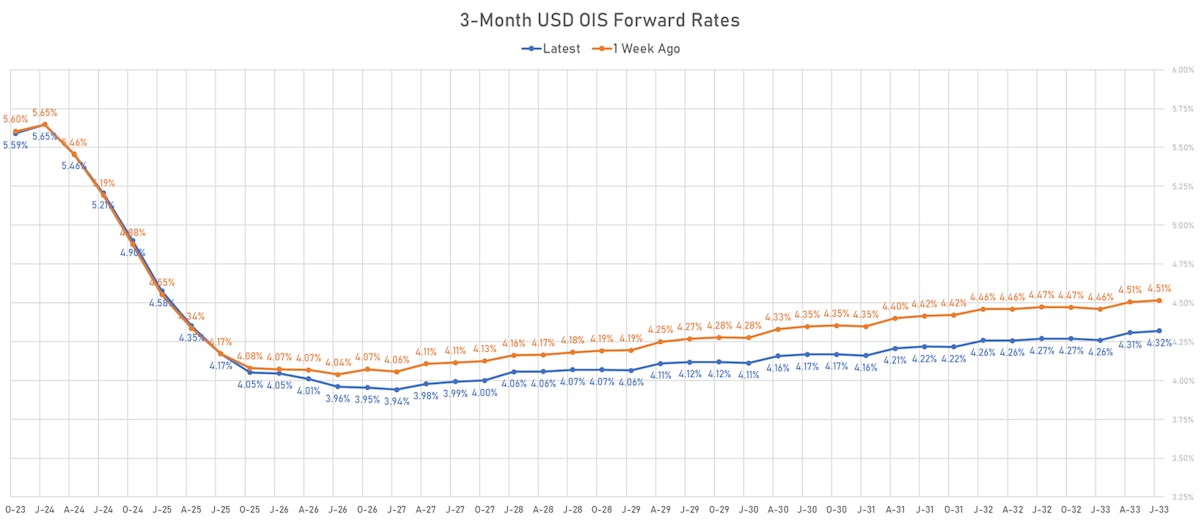

US FORWARD RATES

- Fed Funds futures now price in 1.9bp of Fed hikes by the end of November 2023, 7.9bp (0.3 x 25bp hike) by the end of December 2023, and 0.3 hike by the end of January 2024

- Implied yields on 3-month SOFR futures top out at 5.44% for the March 2024 expiry and price in 144bp of rate cuts over the following easing cycle

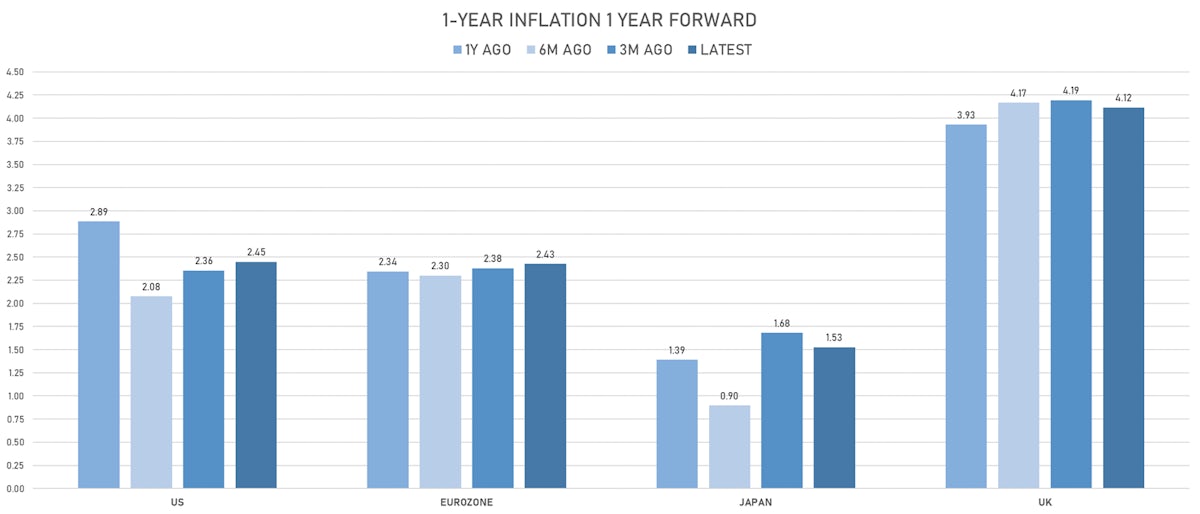

US INFLATION & REAL RATES TODAY

- TIPS: 1Y breakeven inflation at 2.44% (up 17.4bp); 2Y at 2.40% (up 9.4bp); 5Y at 2.37% (up 1.4bp); 10Y at 2.34% (down -0.6bp); 30Y at 2.40% (down -1.5bp)

- 6-month spot US CPI swap up 2.7 bp to 2.732%, with a steepening of the forward curve

- US Real Rates: 5Y at 2.4060%, -6.6 bp today; 10Y at 2.2810%, -7.4 bp today; 30Y at 2.3760%, -8.5 bp today

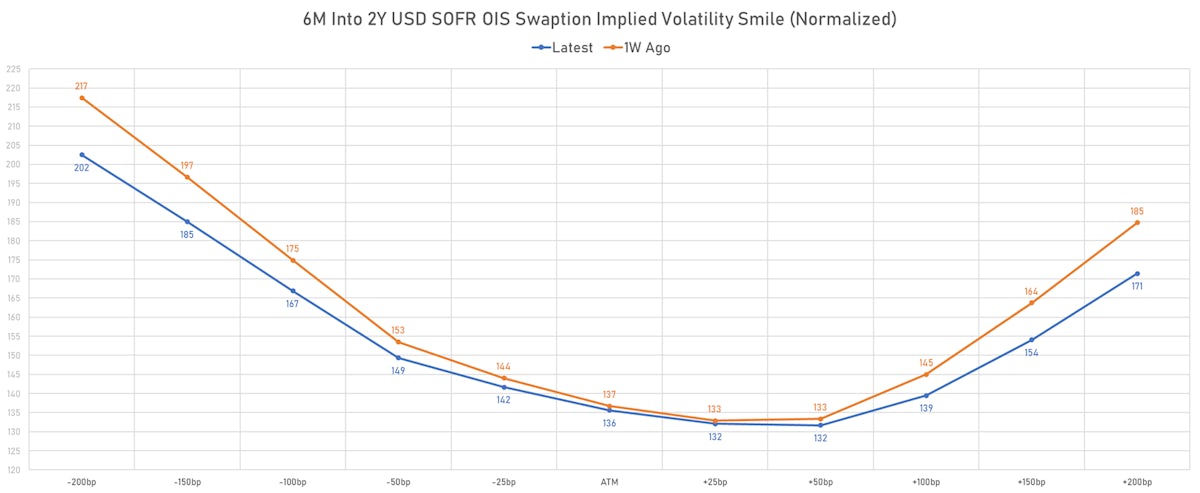

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) at 81.8 normals (down 3.4 normals from a week ago)

- Liquidity pretty much unchanged

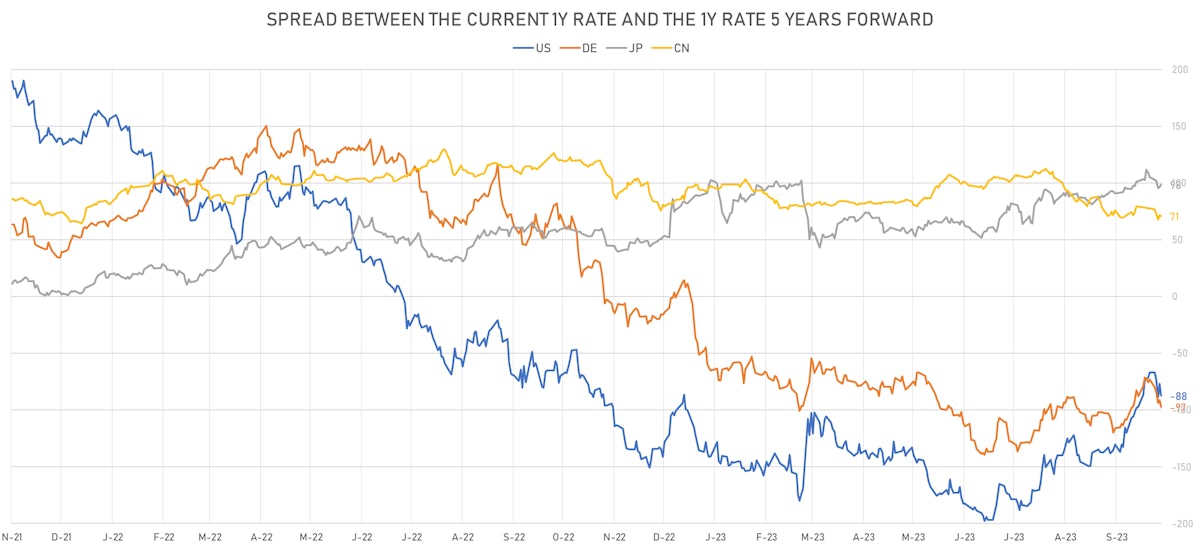

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.674% (down -4.1 bp); the German 1Y-10Y curve is 9.0 bp flatter at -103.1bp (YTD change: -99.6 bp)

- Japan 5Y: 0.320% (up 0.6 bp); the Japanese 1Y-10Y curve is 0.7 bp steeper at 81.5bp (YTD change: +40.5 bp)

- China 5Y: 2.560% (down -2.4 bp); the Chinese 1Y-10Y curve is 0.4 bp flatter at 53.6bp (YTD change: -20.0 bp)

- Switzerland 5Y: 1.087% (down -3.6 bp); the Swiss 1Y-10Y curve is 4.0 bp flatter at -67.9bp (YTD change: -74.2 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -1.1 bp at 192.1 bp (Weekly change: +1.8 bp; YTD change: +18.5 bp)

- US-JAPAN: -0.7 bp at 502.1 bp (Weekly change: +5.8 bp; YTD change: +62.8 bp)

- US-CHINA: -0.4 bp at 278.8 bp (Weekly change: -10.8 bp; YTD change: +60.5 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -0.1 bp at 184.6 bp (Weekly change: +1.6bp; YTD change: +55.8bp)

- US-JAPAN: -8.3 bp at 277.8 bp (Weekly change: -9.3bp; YTD change: +73.9bp)

- GERMANY-JAPAN: -8.2 bp at 93.2 bp (Weekly change: -10.9bp; YTD change: +18.1bp)