Scotland Is Voting next Thursday; What That Means For Investors

With COVID protocols, the official results of the vote probably won't be known for a few days, which should make the GBP temporarily more volatile

Published ET

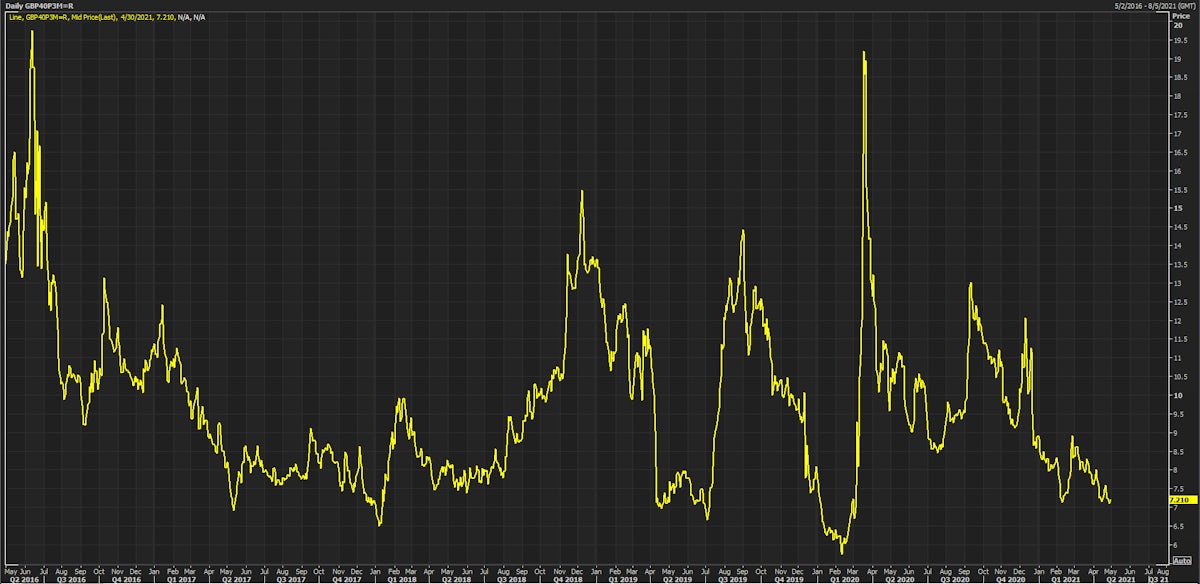

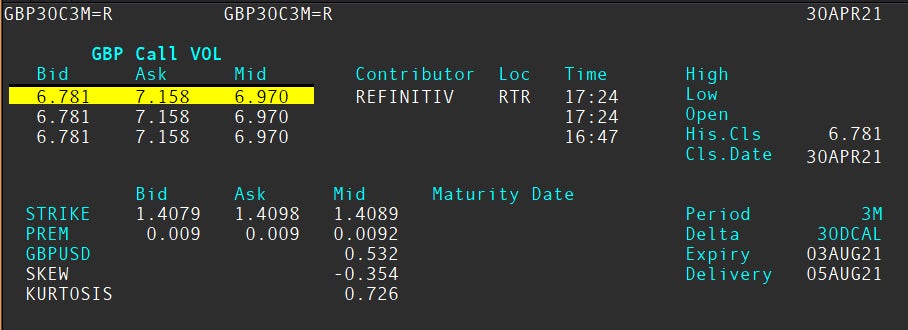

Implied volatility of a 3-month 30-delta call on the British Pound | Source: Refinitiv

Scotland is holding parliamentary elections on Thursday, and British bookmakers see a good chance of a majority for the Scottish National Party, who are pushing for a new referendum to break up with England (something that is unlikely to be granted by the British PM from what we understand).

Note that we are not in any way political analysts and have no idea what the real odds or practical implications of the vote are.

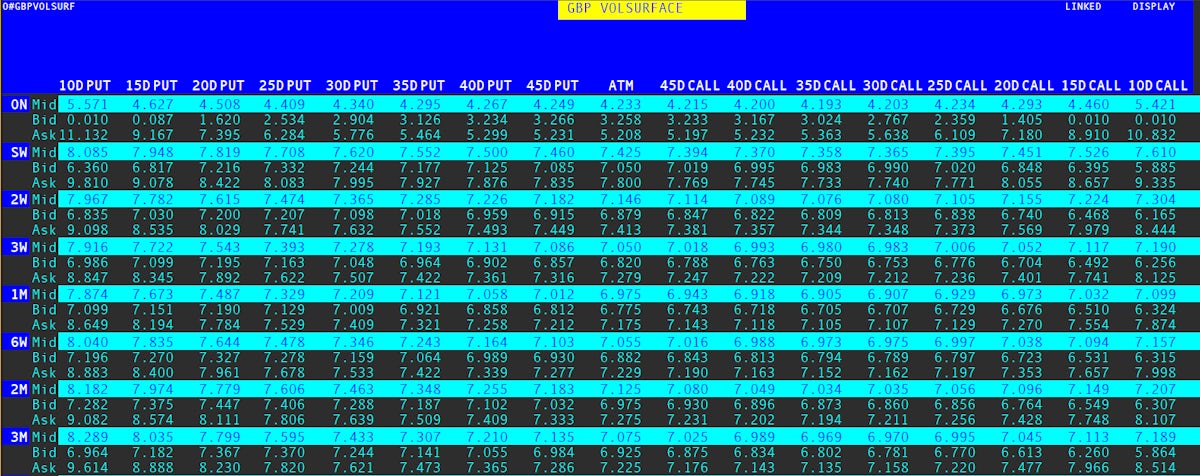

But considering the Sterling's current low level of volatility (and thereby the cheapness of options), a bet on more short-term uncertainty / volatility doesn't sound completely stupid.

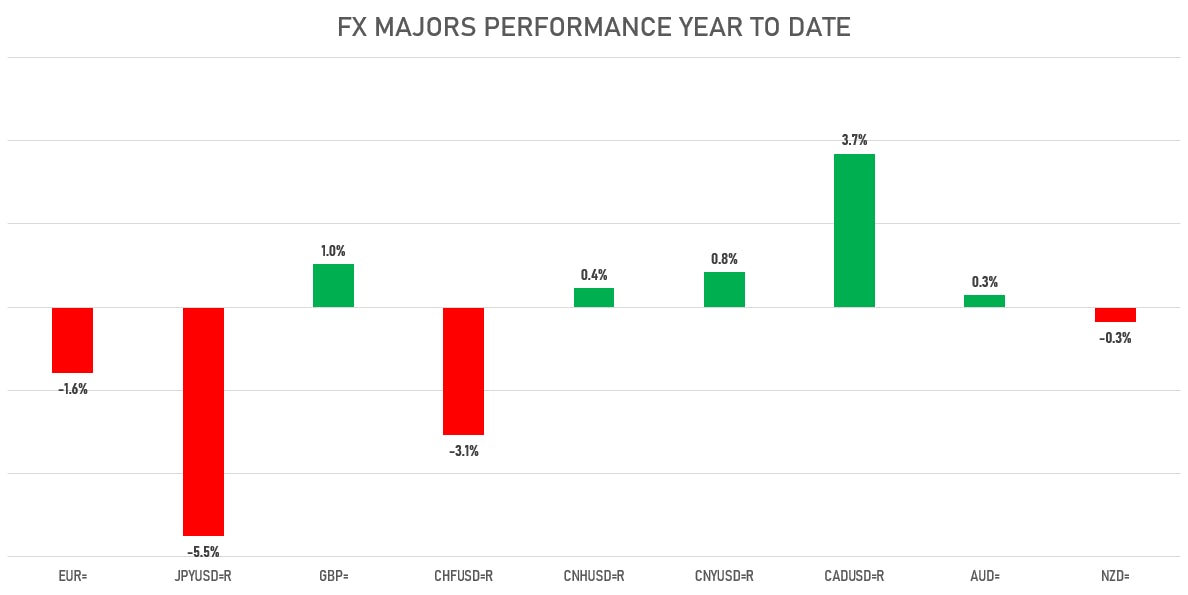

The British pound has had a decent performance this year, currently up 1% against the US dollar, which has been matched by a downward trend in the implied volatility of options.

Surprisingly (to us at least), there has been absolutely no recent uptick in the price of downside protection: implied volatility on GBP puts not far off the lowest levels in the past 5 years.

In other words, FX markets seem to have placed zero risk premium on the Scottish vote. To be sure, this event may prove to be completely inconsequential for the United Kingdom of Great Britain. But zero risk premium sounds very cheap indeed.

With this in mind, Goldman FX strategists had a good idea this week, by offering a down-and-in 3-month 1.4100 call on the Sterling (with a 1-month window for the 1.3675 knock-in).

The logic is simple: the SNP wins, insults fly, uncertainty ensues, Cable falls temporarily, then bounces back above the current level.

It's not a forecast, but that scenario doesn't sound so far-fetched not to warrant some consideration. Time will tell.