Rates

Higher Yields, Flatter Curve Across Rates This Week, As US Economy Continues To Show Strength

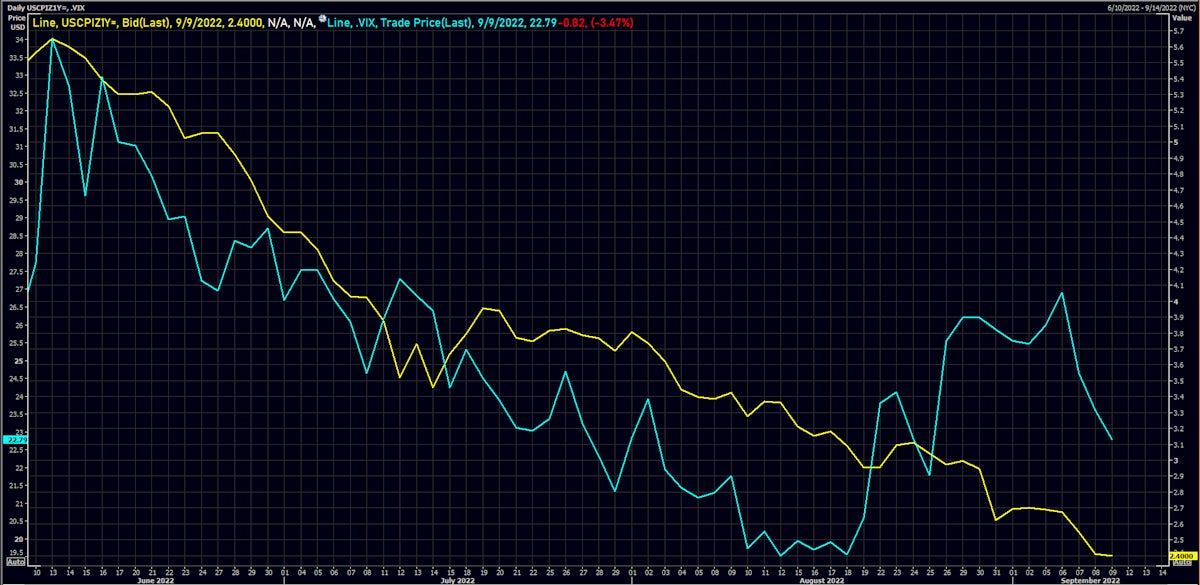

Although the US CPI data next week is likely to show a sharp deceleration, the Fed indicated this week its preference for a 75bp hike at the next FOMC, which drove volatility lower and asset prices higher

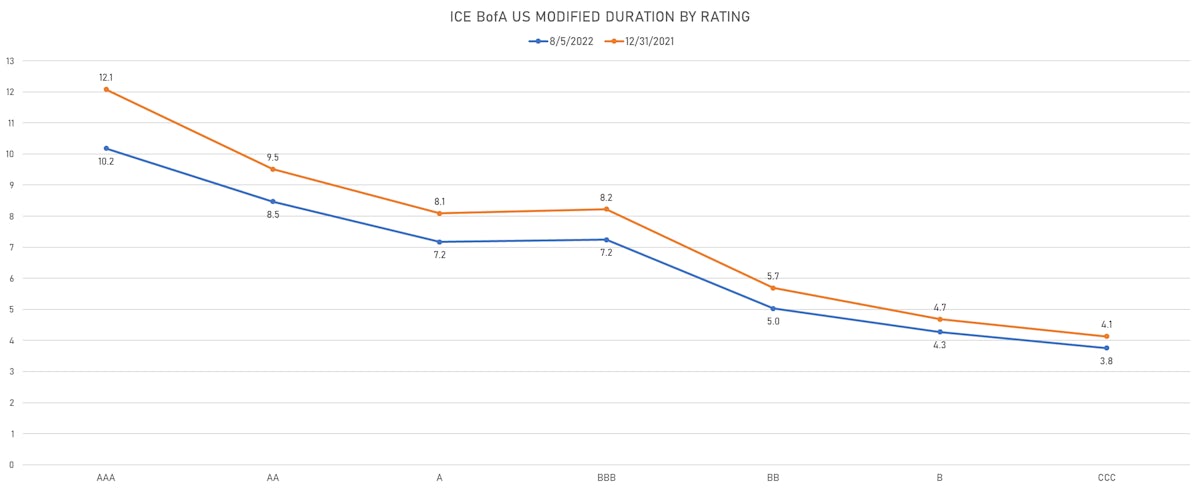

Credit

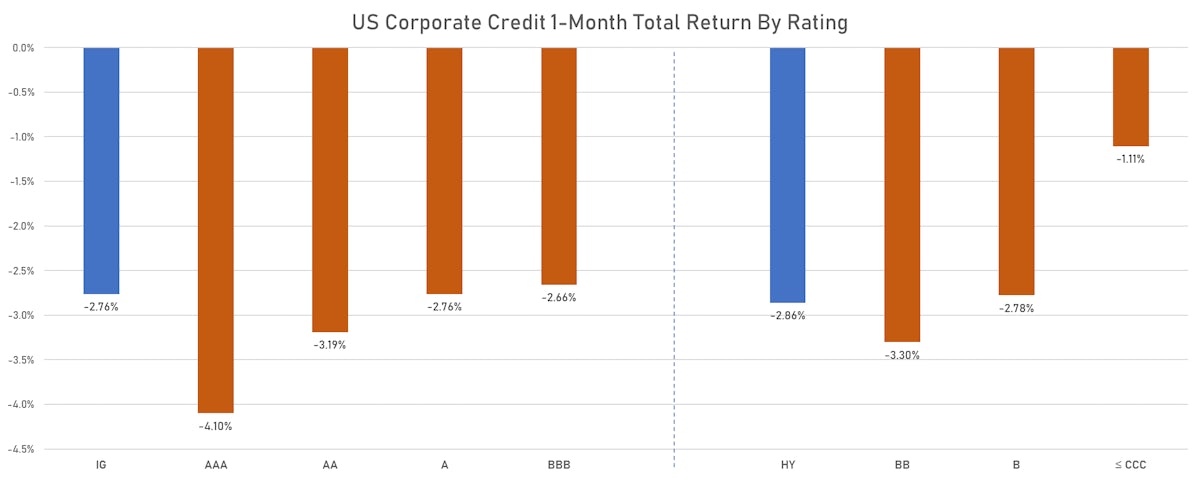

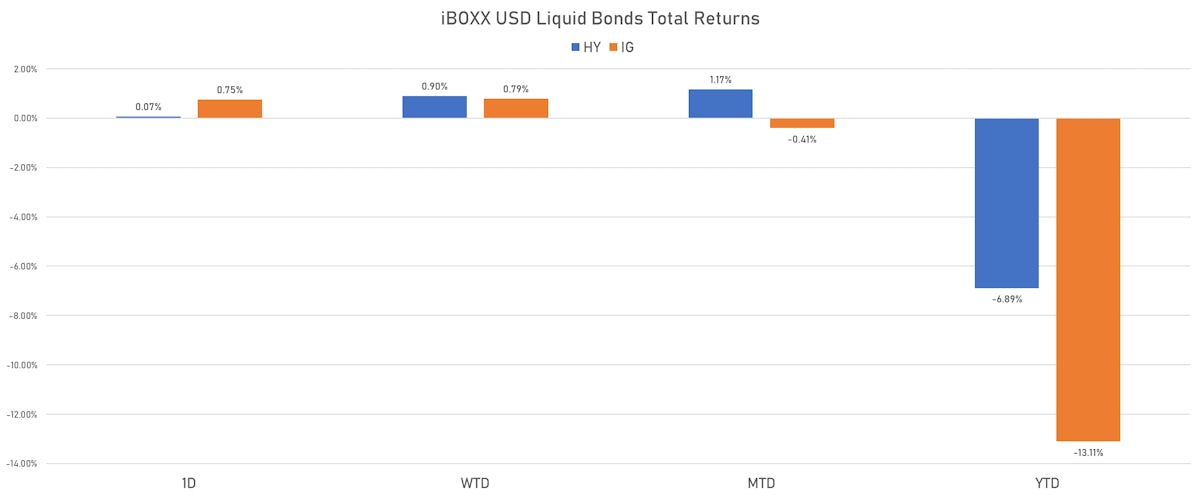

September Starts Much Like August Ended Across The US Credit Complex: Duration Selloff, Coupled With Wider Spreads

Very little US$ corporate issuance in the first days of September, but next week should see a flurry of deals, with around $50bn expected to price in IG alone

Equities

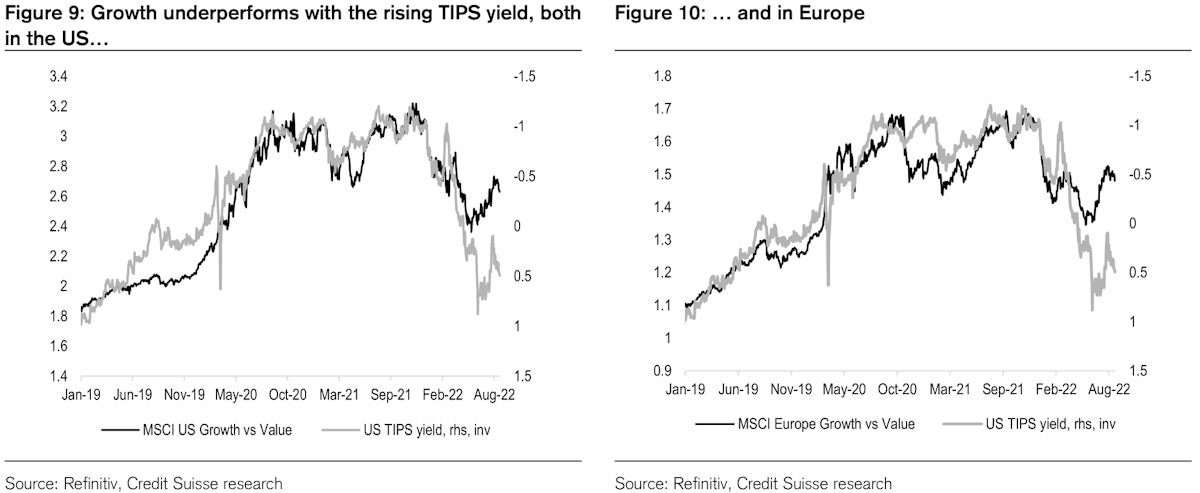

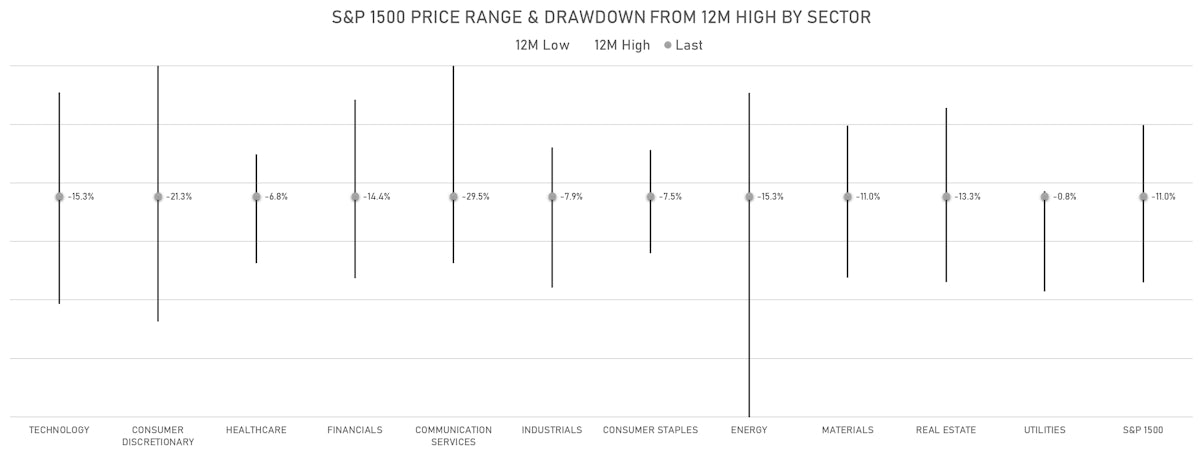

Tough Weak For Global Equities, As The Perspective Of Higher Rates And Weaker Growth Starts Getting Repriced

As Peter Oppenheimer (Goldman Sachs) has pointed out recently, the split between growth and value stocks is no longer important: what matters more in the current context is identifying reasonably priced defensive positions (as opposed to cyclicals or long-duration unprofitable growth)

Rates

US Treasury Curve Bear Steepened This Week On The Back Of Lower Breakevens And Higher Real Yields

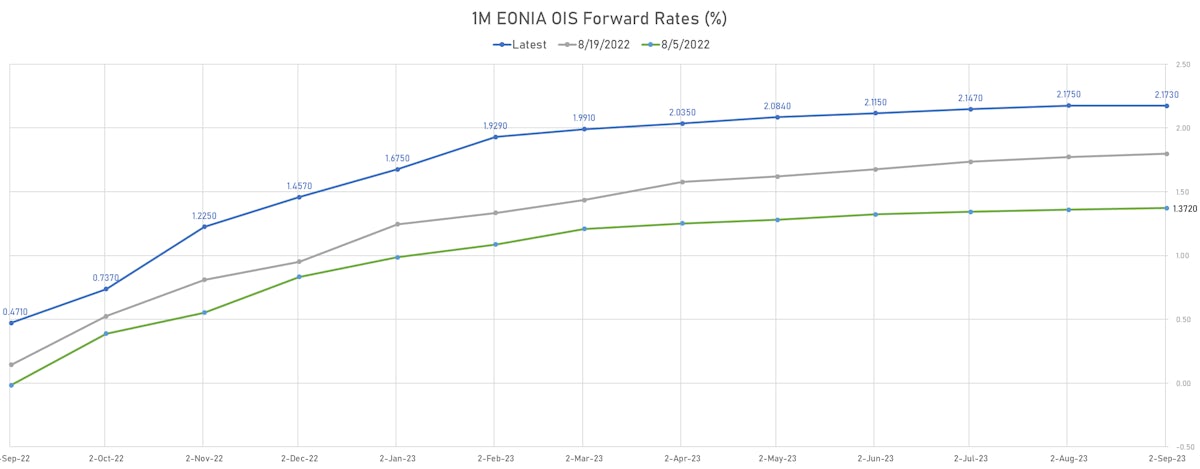

Having been outhiked by the Fed, foreign central banks are under pressure to act and FX markets are forcing their hands to be more hawkish: the ECB will likely go for 75bp at their next meeting and the BoE might opt for 100bp to restore its credibility

Credit

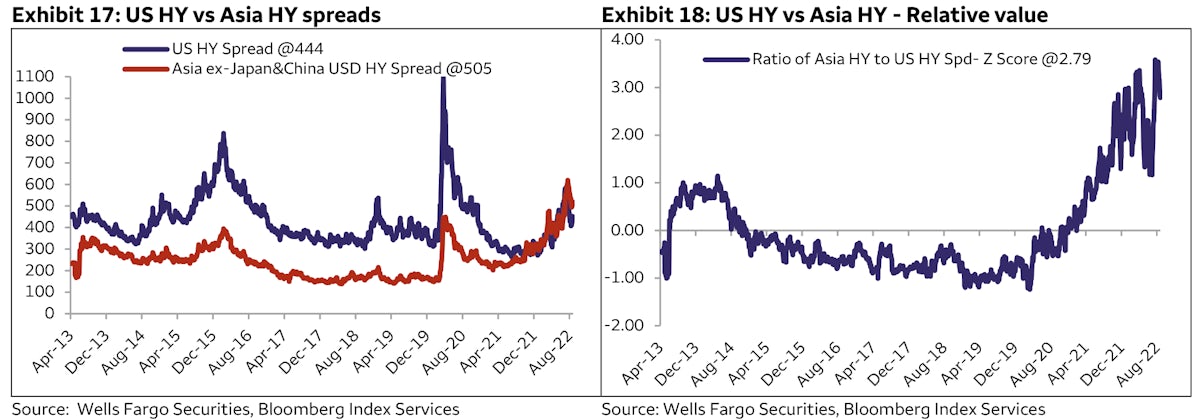

Wider Spreads Across US High Yield After Nice Summer Bounce; Single Bs OAS Up 23bp Over The Past Week

Very limited volume of issuance in US$ corporate bonds this week (IFR Markets data): 3 tranches for $1.3bn in IG (2022 YTD volume $936.1bn vs 2021 YTD $1.02trn) and no new pricing in HY

Equities

Friday Meltdown For US Equities As Fed Not Amused By Recent Loosening In Financial Conditions

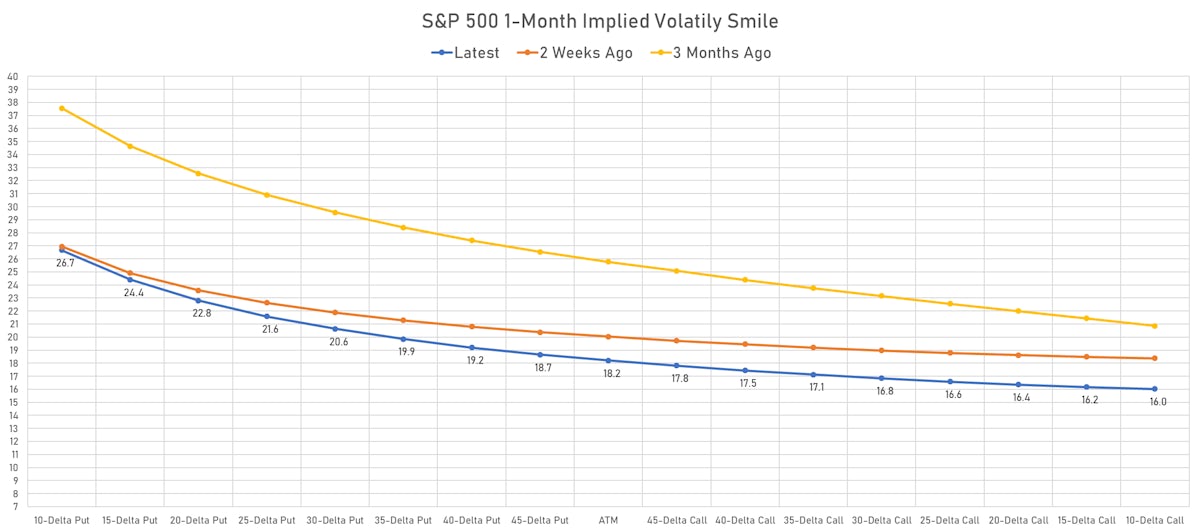

Despite a little jolt today, volatility remains low considering the difficult background for the remainder of the year: if the labor market and the economy stay strong, the flight path will need to be higher rates, wider credit spreads, lower equity valuations

Rates

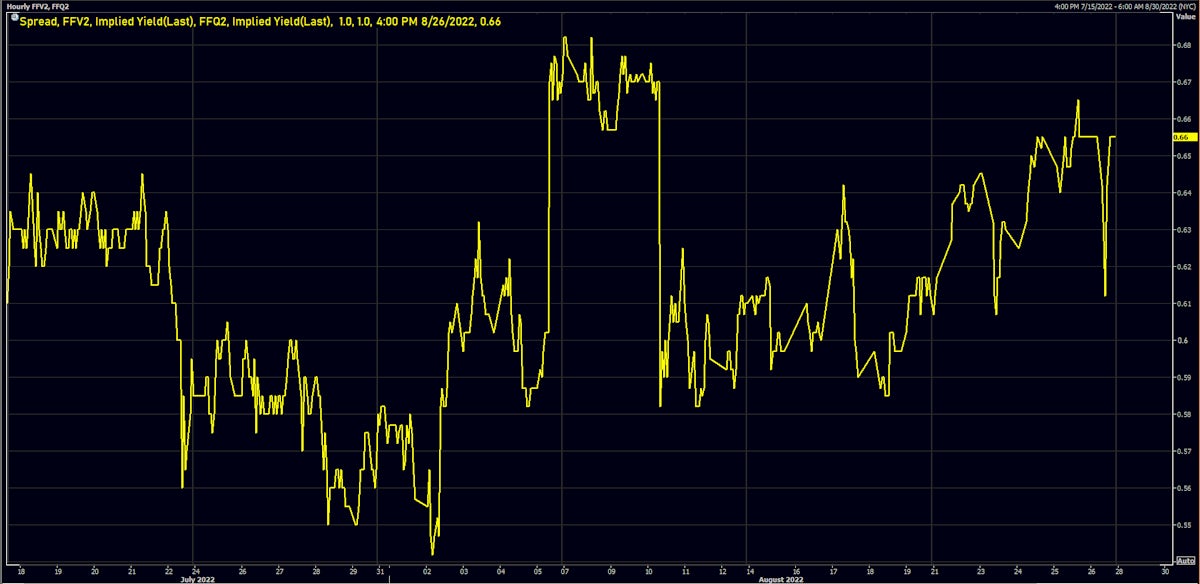

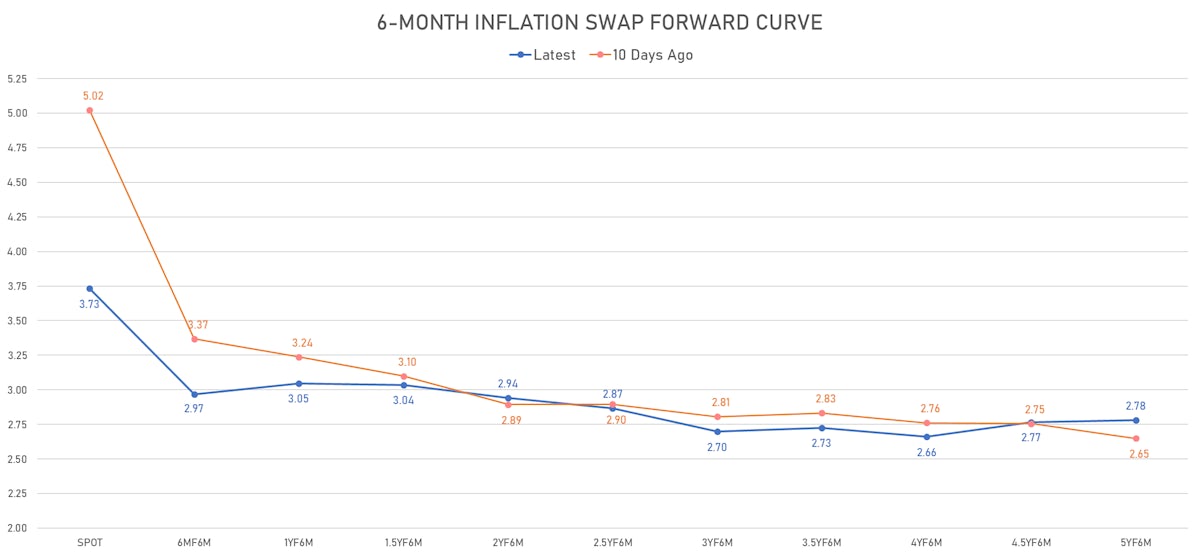

Jackson Hole Leads To Hawkish Repricing At The Front End, But Market Still Expects Rate Cuts Next Year

The clarity and brevity of Powell's speech were definite positives, but the Fed continues to place perhaps undue importance on monthly volatile data points to chart its course, when short-term real rates remain far from restrictive

Credit

High Yield Spread Compression Continued This Week Across The Credit Complex, Helped By Very Low YTD Issuance

Reasonable volume of US$ investment grade bonds this week: 33 tranches for $30.6bn in IG (2022 YTD volume $912.6bn vs 2021 YTD $1,011bn, down 9.8%) and 2 tranches for $900m in HY (2022 YTD volume $72.2bn vs 2021 YTD $341.3bn, down 78.8%)

Equities

US Equities Fly Higher As 2Q22 Earnings Showed Surprisingly Robust Margins, Corporates Mostly Able To Pass On Higher Costs

The path of least resistance is up for now, with strong technicals and low summer liquidity; but at some point, perhaps after Jackson Hole, the Fed will have to ensure that financial conditions aren't getting too loose to bring down inflation

Rates

Breakevens Keep Falling At The Front End Of The Curve, But UMich Long-Run Inflation Expectations Tick Higher

The much-improved market sentiment and rallies in risky assets are unwinding some of the tightening in financial conditions, an unwelcome development if the Fed wants to win the fight against inflation

Credit

A Bifurcated Week For US Corporate Credit, As IG Suffers From Duration Selloff While HY Does Better On Spreads Compression

Good week for US$ IG bond issuance, led by Facebook's first offering: 53 tranches for $57.85bn in IG (2022 YTD volume $881.9bn vs 2021 YTD $969.8bn), 2 tranches for $2bn in HY (2022 YTD volume $71.3bn vs 2021 YTD $325.8bn)

Equities

Mixed Day For Equities On Friday, A Fairly Positive Development Considering The Rates Backdrop

The second quarter earnings season is coming to an end, with 86% of S&P 500 companies having already reported, and the numbers are better than expected (though not spectacular from a historical perspective): about 60% of S&P 500 stocks beat on both revenue and earnings