Rates

Very Strong Employment Data Lifts Yields And Flattens The Curve To End A Week Marked By Positive Economic Surprises

The narrative last week, driven by the Fed, of a possible recession and a pivot towards a more balanced policy fell on its face this week: economic data came in stronger than expected, which brought higher real yields on the realization that inflation is still very much the focal point

Credit

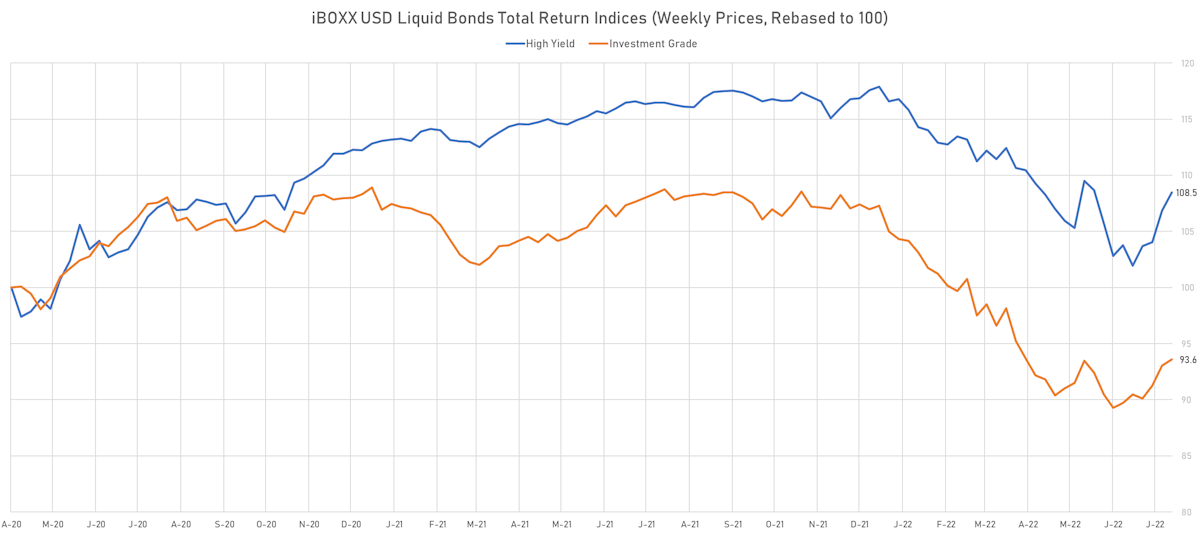

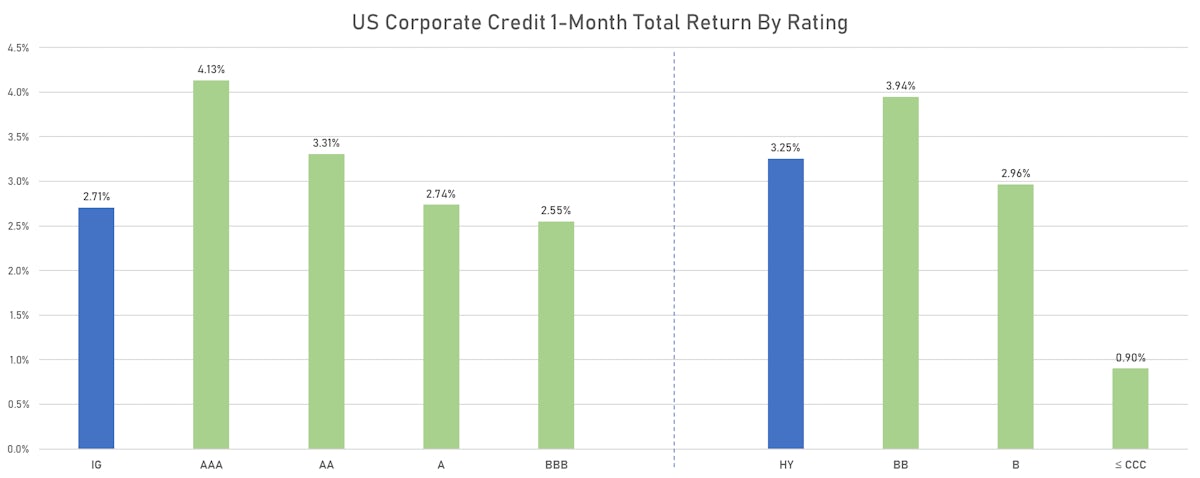

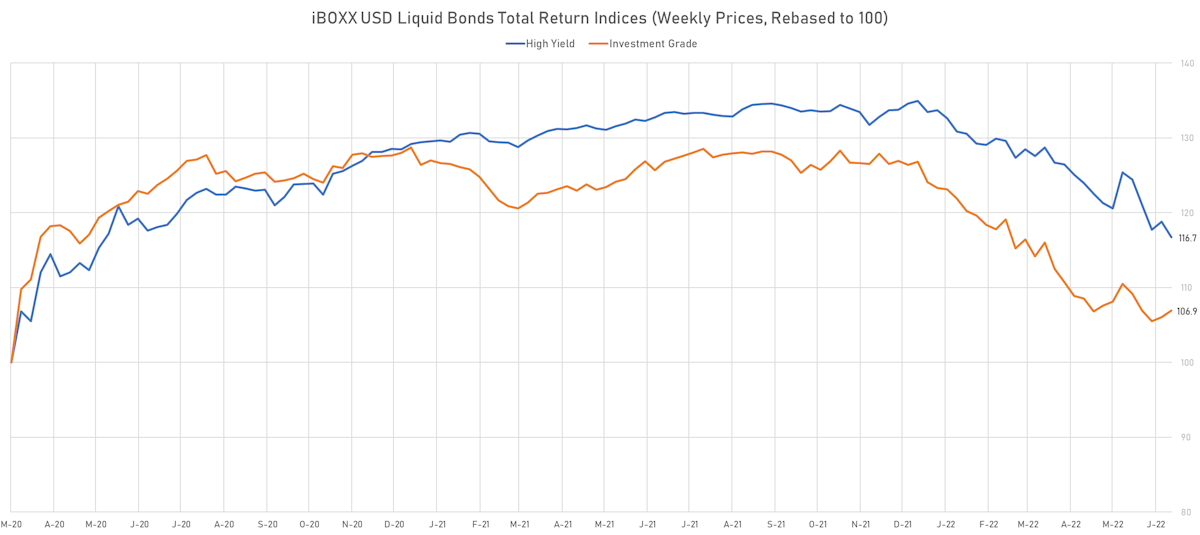

July Was A Good Month For US$ Credit: IG Liquid Bonds Up 4.2%, HY Up 6.8%

Weekly issuance of US$ corporate bonds (IFR Markets data): 17 tranches for $18.6bn in IG (2022 YTD volume $824.09bn vs 2021 YTD $933.973bn) and a single $725m tranche in HY (2022 YTD volume $68.576bn vs 2021 YTD $462.661bn)

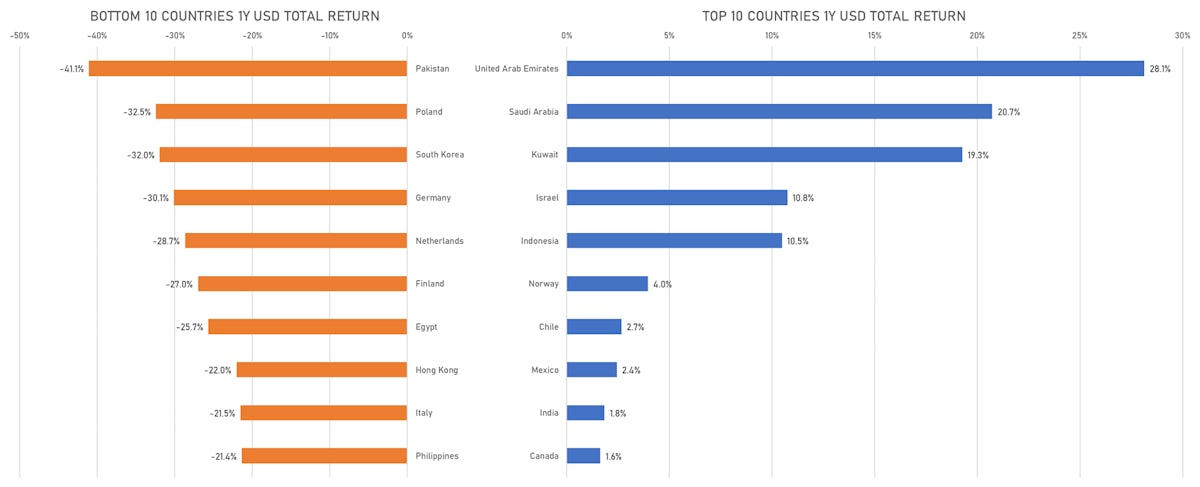

Equities

US Equities Up 4.2% This Week, Energy Stocks Up Another 10%, With The Brent Crude Spot Price Closing Around $110/bbl

The current bear market rally is likely one of the most unloved: beat-up stocks rising double digits with very low participation, as hedge funds and real money managers had to reduce gross exposures markedly to provide cash for client withdrawals that have yet to materialize

Rates

Forward Breakevens Move Higher, Real Yield Curve Steepens As Fed Pivots Towards Broader View Of The Economy

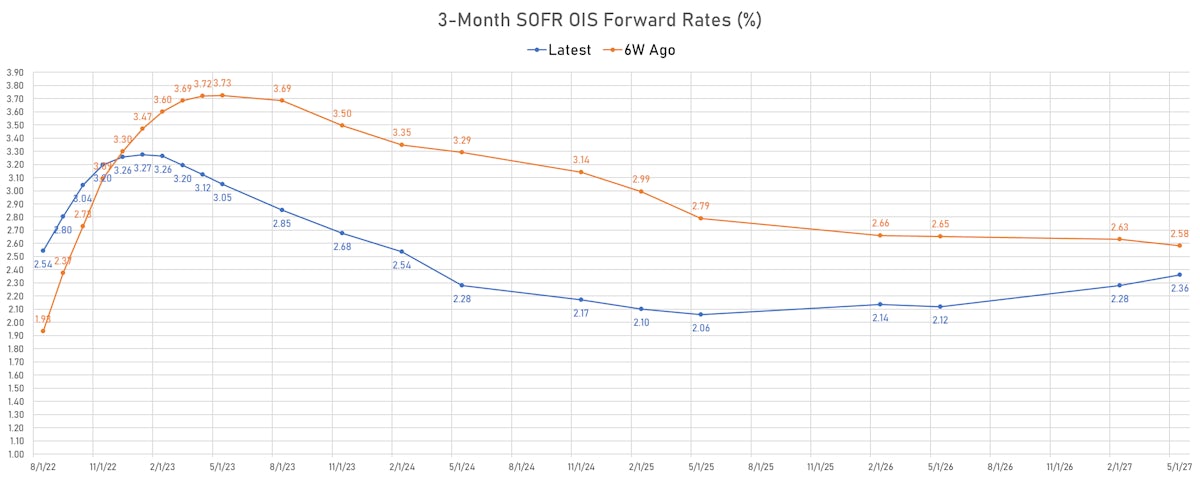

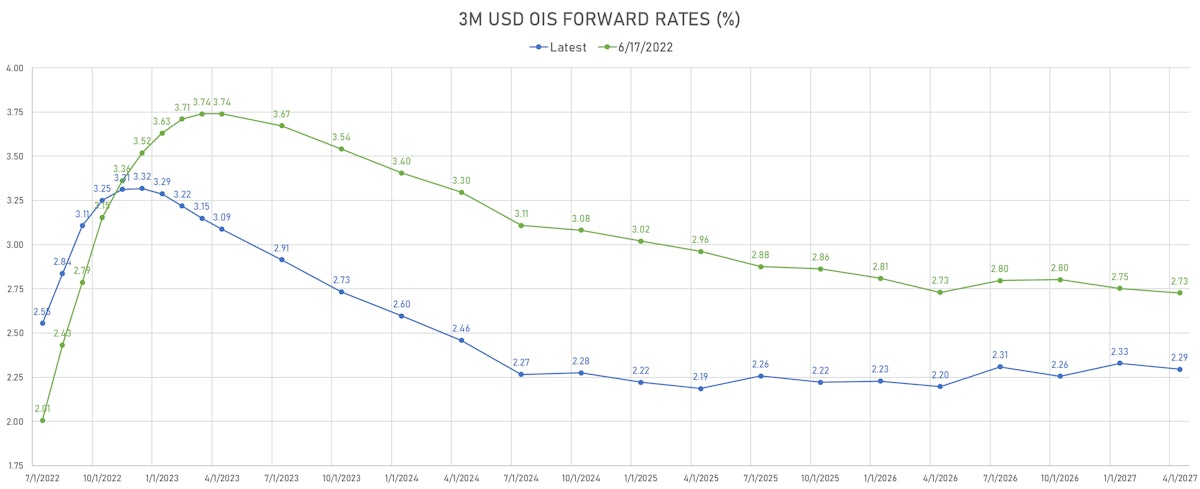

It's important to note that pivoting away from a sole focus on inflation is likely not as dovish as current market pricing: with sticky inflationary pressures still rising, most notably in the employment cost index, the Fed will have to keep rates higher for longer (i.e. forward rates look too low at this point)

Credit

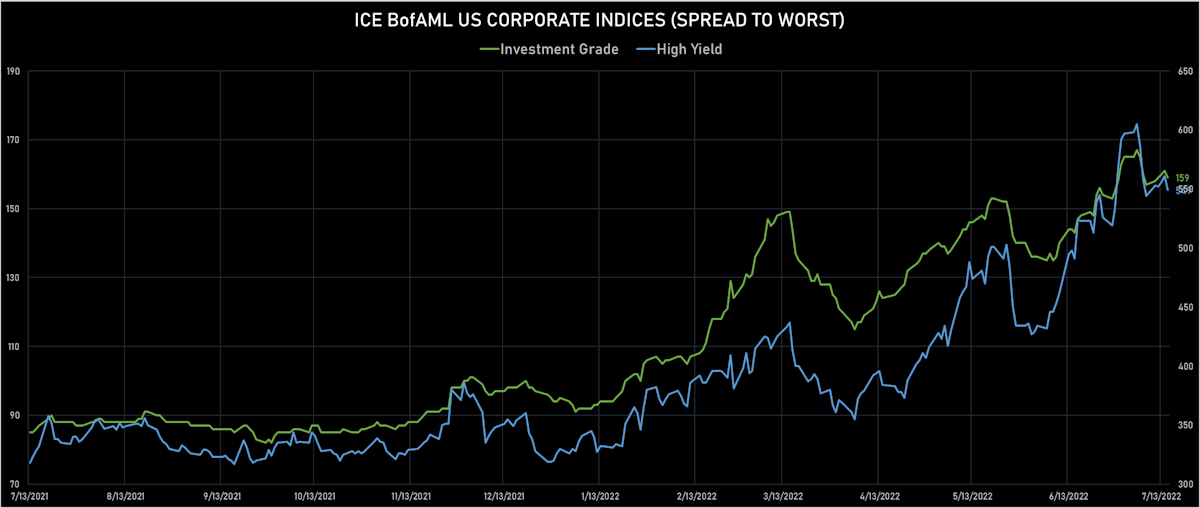

Meaningful Spread Compression Across The US Credit Complex This Week, Though Some Commentators Expect Widening Next Year Towards 200bp For IG, 800bp For HY

Weekly volumes of US$ corporate bond issuance (IFR Markets data): 31 tranches for US$45.8bn in IG (2022 YTD volume $805.5bn vs 2021 YTD $909.0bn) and 2 tranches for US$760m in HY (2022 YTD volume $68.6bn vs 2021 YTD $462.7bn)

Equities

Losses On Friday Ahead Of Big Earnings Week, Which Will See About A Third Of S&P 500 Companies Reporting

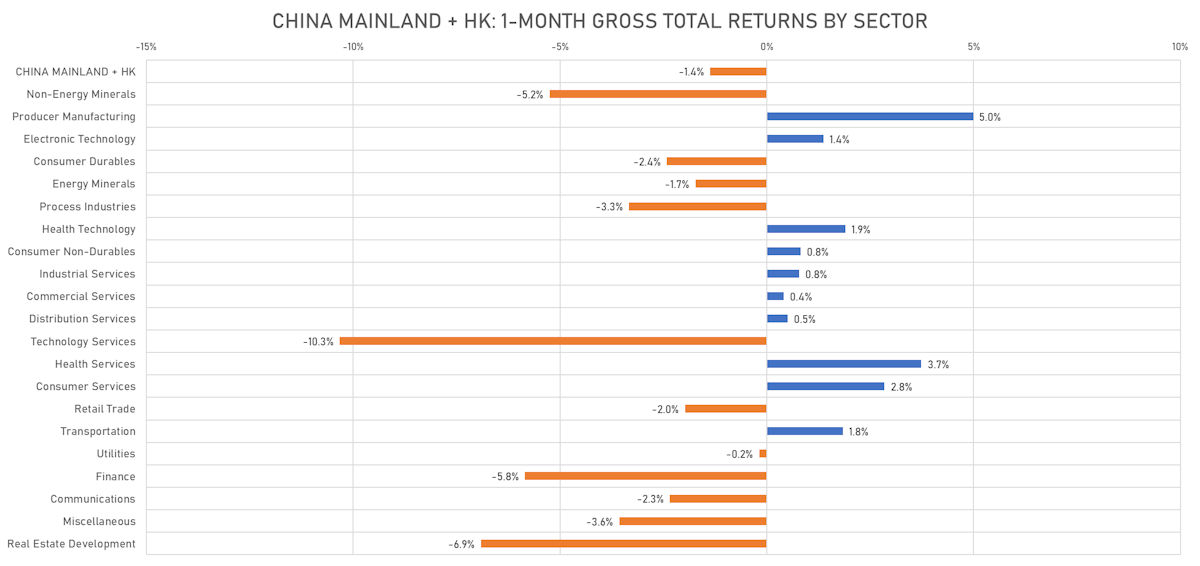

While US equities have performed well recently, Chinese stocks have seen a slight turn of fortune: main CN+HK indices showed strong performance after the reopening of major cities, but have been weaker again in the past weeks, down about 1.4% over the past month

Rates

Important FOMC Coming On Wednesday As Inflation Stays High While Growth Has Been Trending Weaker Lately

The Fed has been resolute in its commitment to tame inflation, while the market has recently been pricing in a possible change in the Fed's reaction function (towards more balance between inflation and growth)

Credit

Positive Seasonality For Credit With Limited Issuance, As Earnings Season Hits Full Stride Next Week (14% Of S&P 500 Reporting 2Q22 Results)

Weekly volume of US$ corporate issuance (IFR data): 10 tranches for $10.05bn in IG (2022 YTD volume S$759.6bn vs 2021 YTD US$894.6bn) and no new issue in HY for the second straight week (2022 YTD volume $67.8bn vs 2021 YTD $294.1bn)

Equities

Another Losing Week For Global Equity Indices, Though Friday Saw A Good Rebound, With 93% Of S&P 500 Stocks Up

The high level of uncertainty right now makes it hard for equities to have a sustainable rally, and despite recession fears over the past weeks the market still hasn't marked down earnings estimates: Goldman strategists think that a recession would cut earnings by 15% and bring the S&P 500 down to 3,150

Rates

Fed Speakers Bring July Hike Expectations Back Towards 75bp After CPI Scare Put 100bp Firmly In Play

The most worrying aspect of the inflation print was its breadth, and the reluctance of governors to accelerate the pace of hikes further (to 100bp increments) means that the Fed will likely have to hike for longer than the market currently expects (hard to see them being done by the end of the year)

Credit

More Dispersion Of Performance Across The Credit Complex Over The Past 2 Weeks, As The Recession Trade Helps IG Outperform HY (Duration Over Spreads)

Weekly US$ corporate bond issuance was pretty slim (IFR Markets data): $8.35bn in 14 tranches for IG (2022 YTD volume $735.49bn, down -13.0% vs YTD 2021), and a single $450m tranche for HY (2022 YTD volume $67.816bn, down 76.2% vs YTD 2021)

Equities

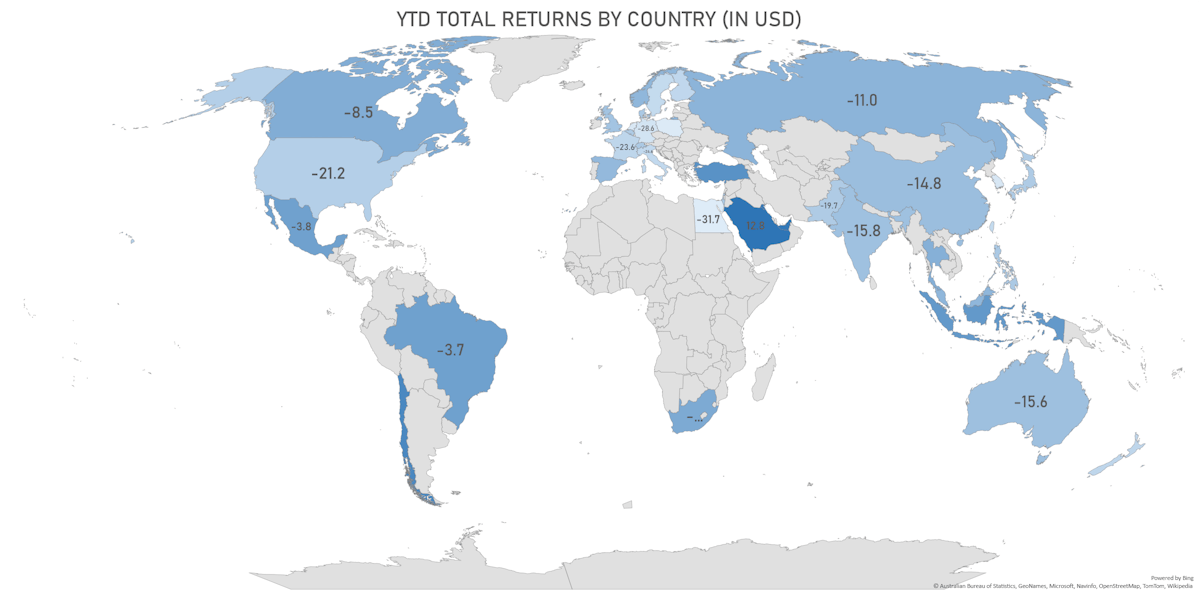

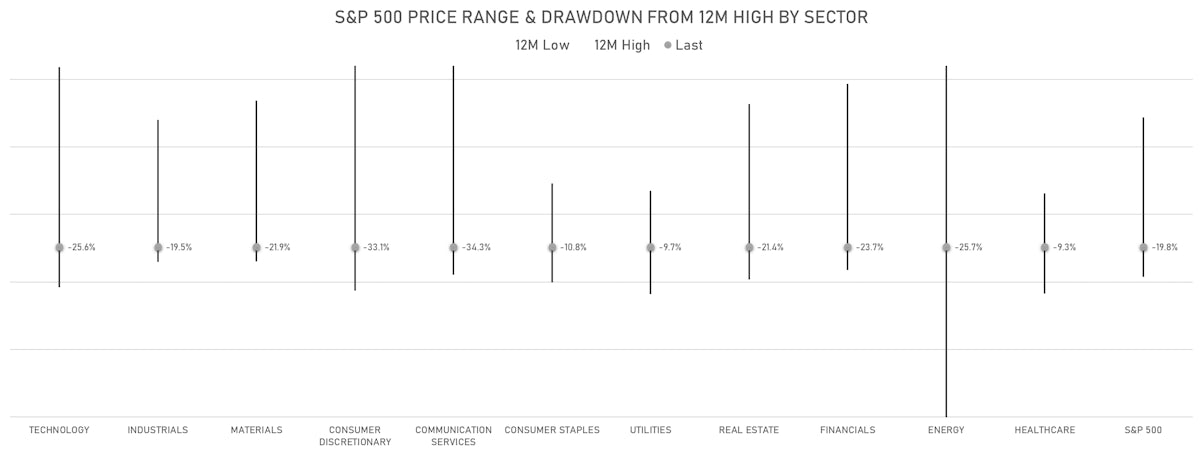

Global Equities Have Already Lost Over $24 Trillion In Market Capitalization Since A High Of $120 Trillion Late Last Year, But The Bottom Of The Current Cycle Is Likely Lower

Considering the potential for continued volatility in rates, with both economic and geopolitical risks, it doesn't seem unreasonable to expect a deeper drawdown for US equities before things stabilize