Rates

The Fed Delivered What The Market Expected With A Slightly Dovish Tilt, As Powell Took 75bp Off The Table

That was followed by curve steepening and tightening of financial conditions over the next sessions, as the market now expects a higher terminal rate; with the Fed's firm tone around inflation, we should see 3 more 50bp hikes until September, followed by 25 bp hikes into year end

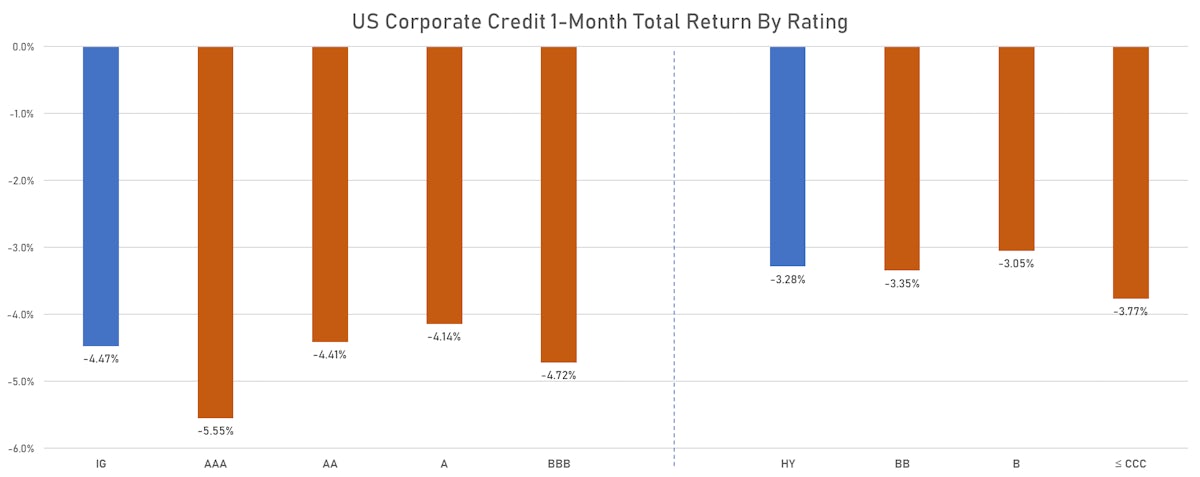

Credit

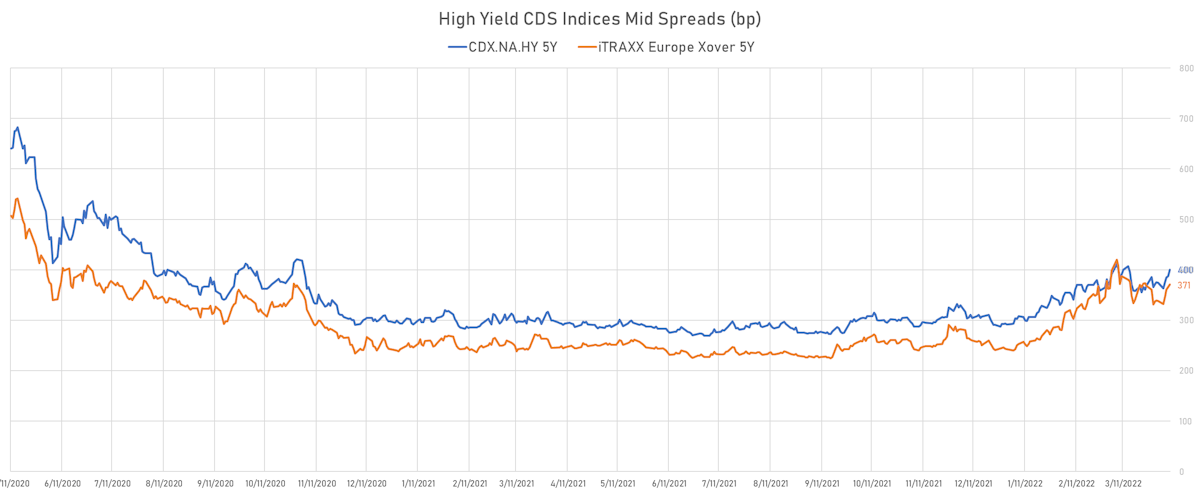

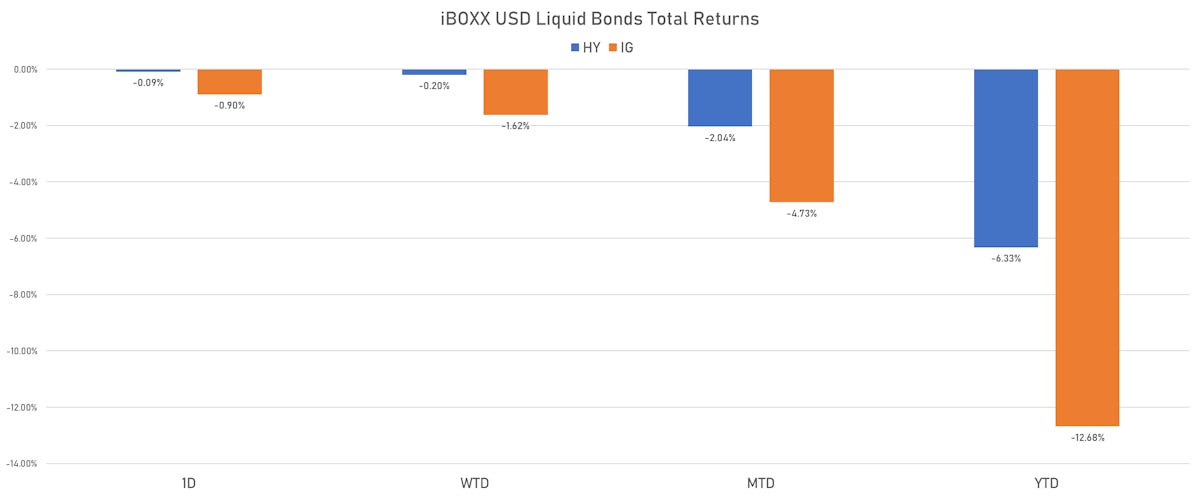

Wider Spreads Across The US Credit Complex This Week, With HY Cash +28bp And IG Cash +6bp

Pretty quiet week in terms of new USD bond issuance, as many of the large corporates are still in their quiet earnings period: 15 tranches for $10.1bn in IG (2022 YTD volume $577.6bn vs 2021 YTD $583.4bn) and 3 tranches for $4.52bn in HY (2022 YTD volume $54.2bn vs 2021 YTD $197.4bn)

Rates

Another Volatile Week For Rates, With The Belly Of The Curve Up 11 bp Into The Weekend

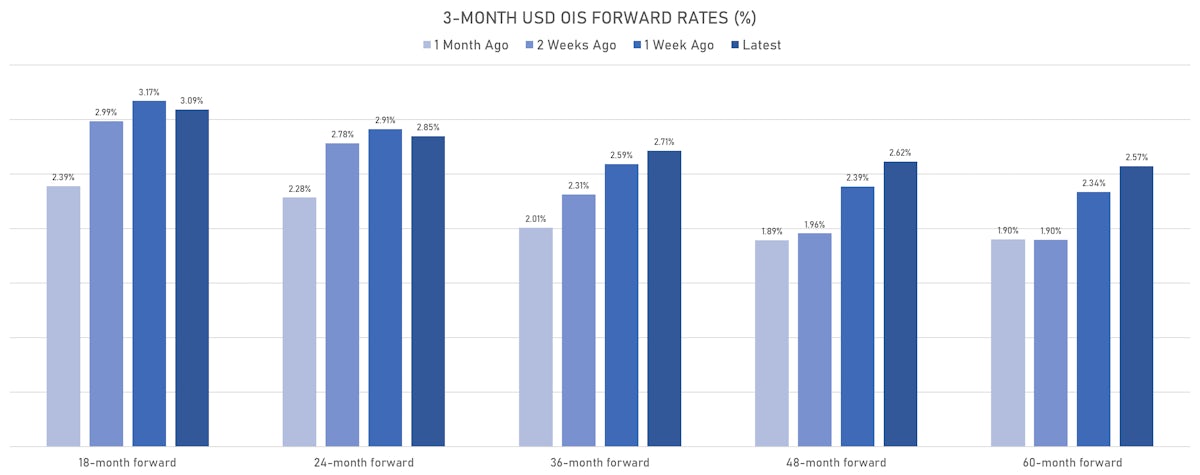

With the May FOMC just around the corner, we preview the outcome and set out why we think forward rates should continue to adjust higher, as elevated inflation could be more durable than currently expected

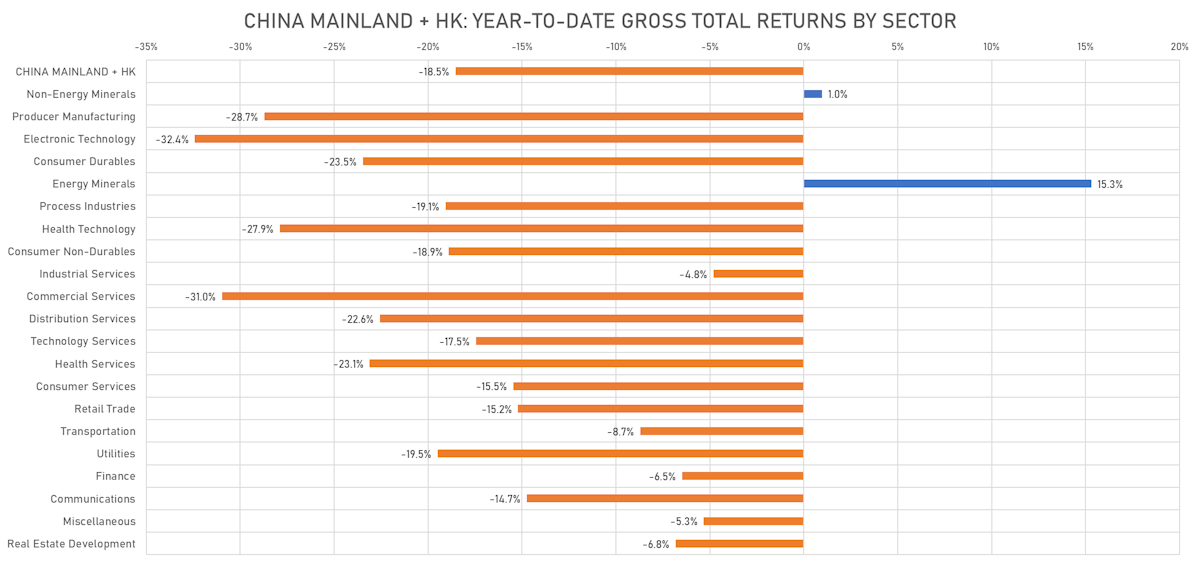

Equities

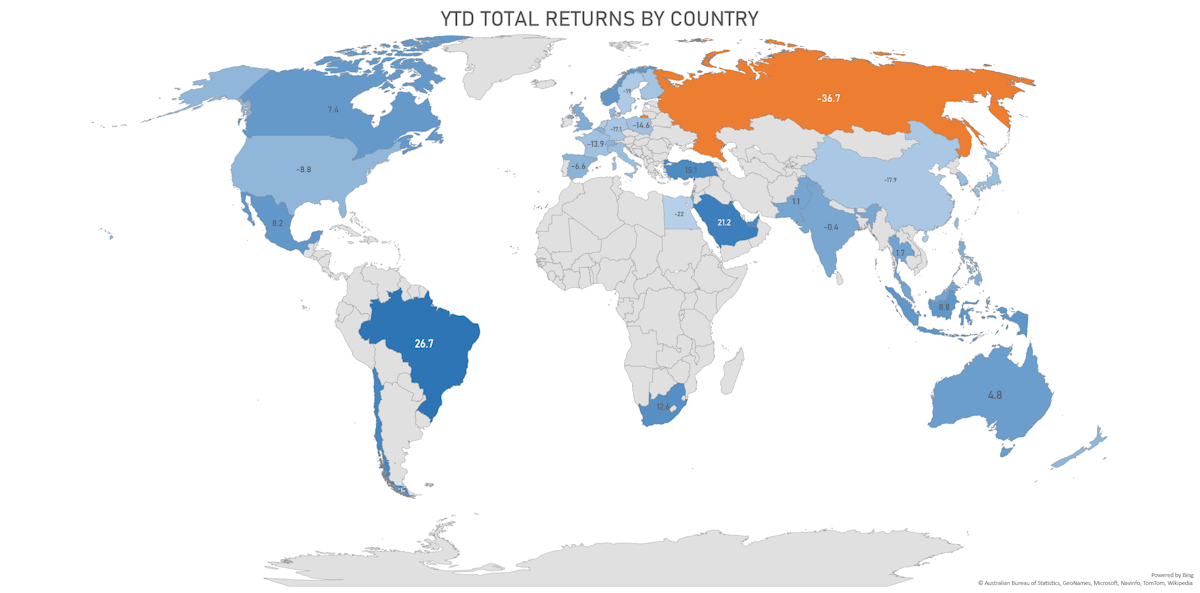

Sharp Drops Across US Markets On Friday, As Nasdaq Composite Ends Rough Month Down 14.6%, S&P 500 Down 10.2%

Technology stocks in Honk Kong bounced nearly 12% this week, but HK and Mainland markets remain deeply in the red year to date, down 10.4% and 26.0% respectively (gross total returns)

Equities

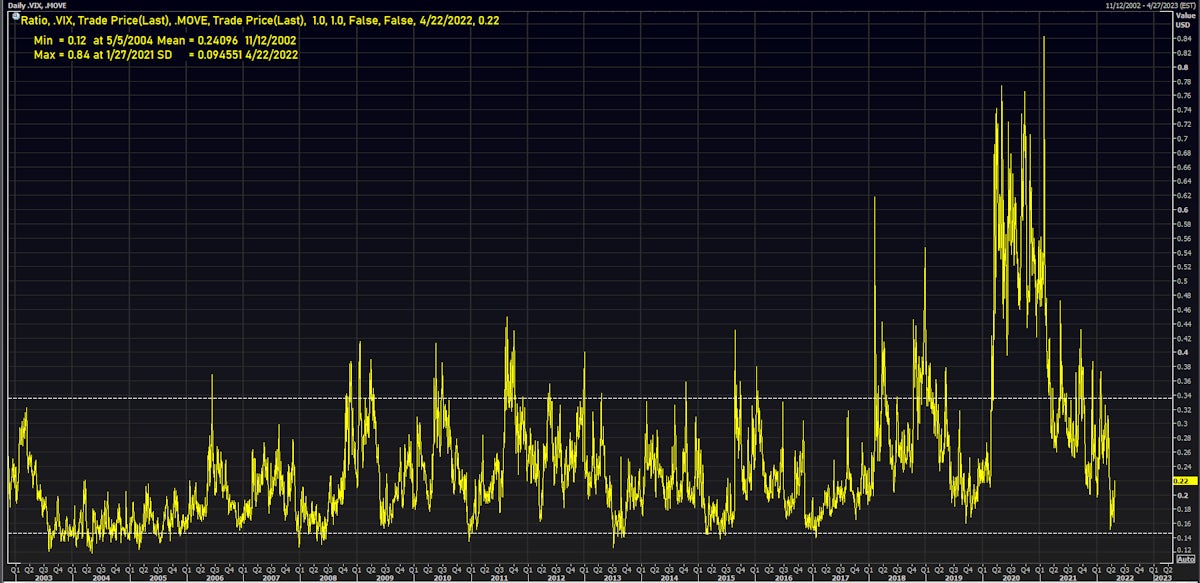

Ugly Session Across The Board For US Equities On Friday, With Just 3% Of S&P 500 Stocks Closing Higher Into The Weekend

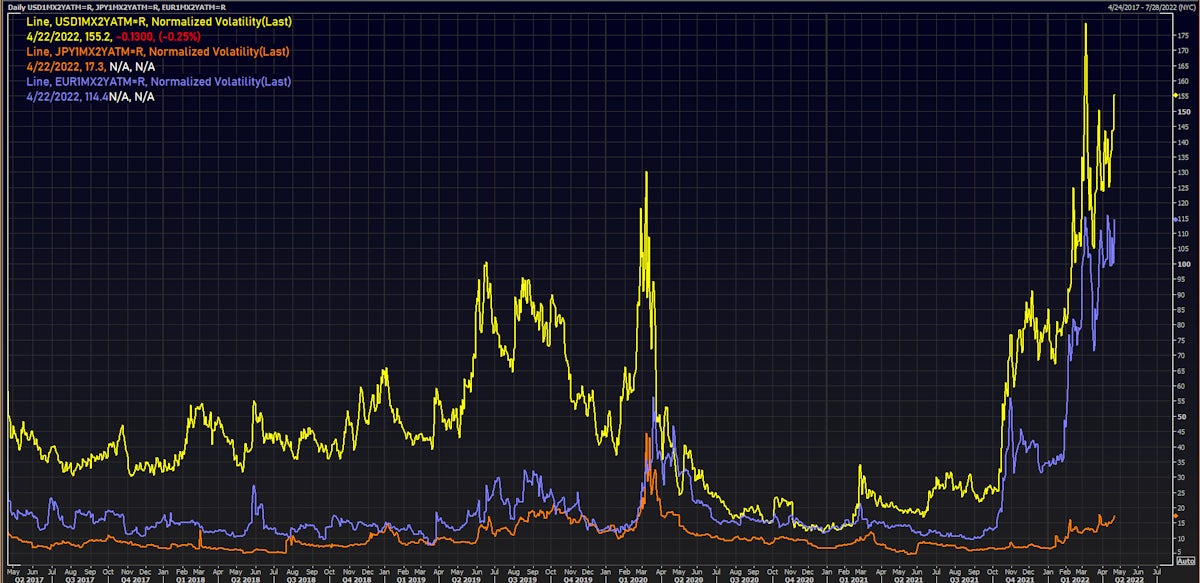

Looking at volatility across asset classes, it feels like equity implied vols are a little light on a relative basis: with 3m into 2Y USD swaptions trading above 150 normals, the VIX is still in the 20s

FX

The Japanese Yen Kept Falling Against The US Dollar Closing The Week Above 128, By Far The Worst Performing Major Currency YTD

With Euro area PMIs and growth data surprising positively, the possibility of an early liftoff by the ECB is becoming likelier: the front end of the curve looks like the weak point if the ECB hikes 3 times this year (July, September, December)

Credit

With The Exception Of Single-Bs, US Corporate Cash Spreads Were Modestly Wider This Week

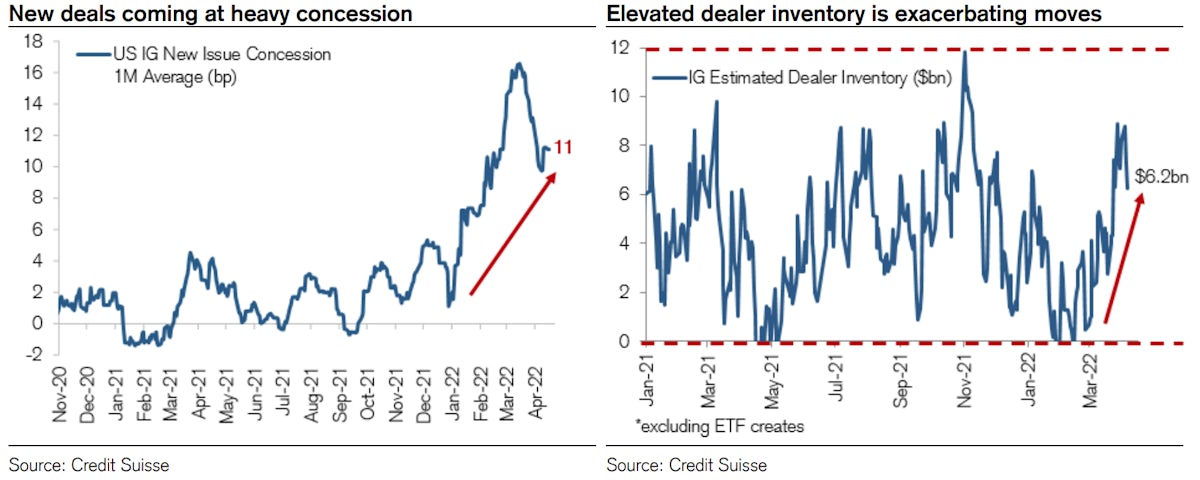

IG corporate bonds issuance remains heavy YTD, as companies look to frontload funding ahead of further monetary policy normalization; this week saw 46 tranches for $55.1bn in IG (2022 YTD volume $567.5bn vs 2021 YTD $568.6bn), 2 tranches for $900m in HY (2022 YTD volume $49.6bn vs 2021 YTD $190.2bn)

Rates

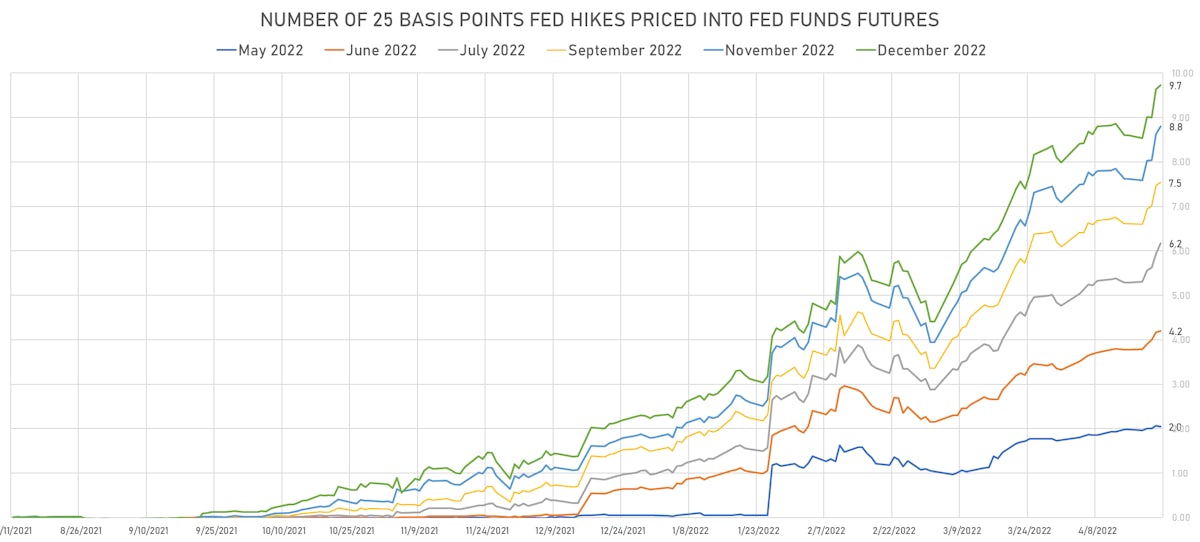

US Yield Curve Flattened This Week, With The Front End Pricing In More Aggressive Fed Tightening This Year

Money markets now expect to see close to 250 basis points in additional hikes this year: 4 consecutive 50bp hikes in May, June, July and September, followed by 25 bp hikes in November and December, thus bringing the overnight rate up to nearly 2.80% by year end

Equities

Another Week Of Losses For The Largest Global Equity Markets, With The US Down 2.0% And China+HK Down 1.2%

With higher energy and input costs, we're seeing an unusual divergence so far this quarter in US earnings: EPS are up 5%, with revenue growth of 14% and declining profit margins (which generally doesn't happen with rapidly expanding sales)

Credit

Pretty Quiet Week In The Primary Market, With Amazon's $12.7bn Jumbo Offering Accounting For 70% Of The Weekly IG Volume

With profit margins and profits as a share of GDP at all-time highs, earnings revisions turning negative, there's a significant chance we'll see further widening of spreads, driven by energy prices, credit deterioration and funding stress for HY issuers rather than the current duration-induced drawdown

Rates

Fed Credibility Increases: Rates Markets Price In Higher Likelihood For Narrow Path To Controlling Inflation Without Creating A Recession

The inversion of the US forward OIS curve has faded to a substantial extent, led by a sharp increase in 5Y-forward 3M rates, with the front end of the curve pretty stable and more fully priced

Credit

Significant Widening In US High Yield Spreads This Week, In Line With Weak Equities Performance, As US Economy Clearly Slowing Down

Reasonable volumes of new USD corporate bonds this week (IFR Markets data): US$27.7bn in 35 tranches for IG (2022 YTD volume $494.6bn vs 2021 YTD $480.4bn), US$6.5bn in 11 tranches for HY (2022 YTD volume $48.2bn vs 2021 YTD $164.9bn)