Equities

The S&P 500 Was Up 0.8% This Week, Led By Healthcare, Utilities, Real Estate Sectors

Volatility shot up mid-week but dropped back into the weekend, as S&P 500 growth stocks rose 4.8% and value stocks 2.8% over the last couple of days

Rates

Rates Sold At The Front End On Friday, With A Slightly Flatter Curve And Lower Breakevens

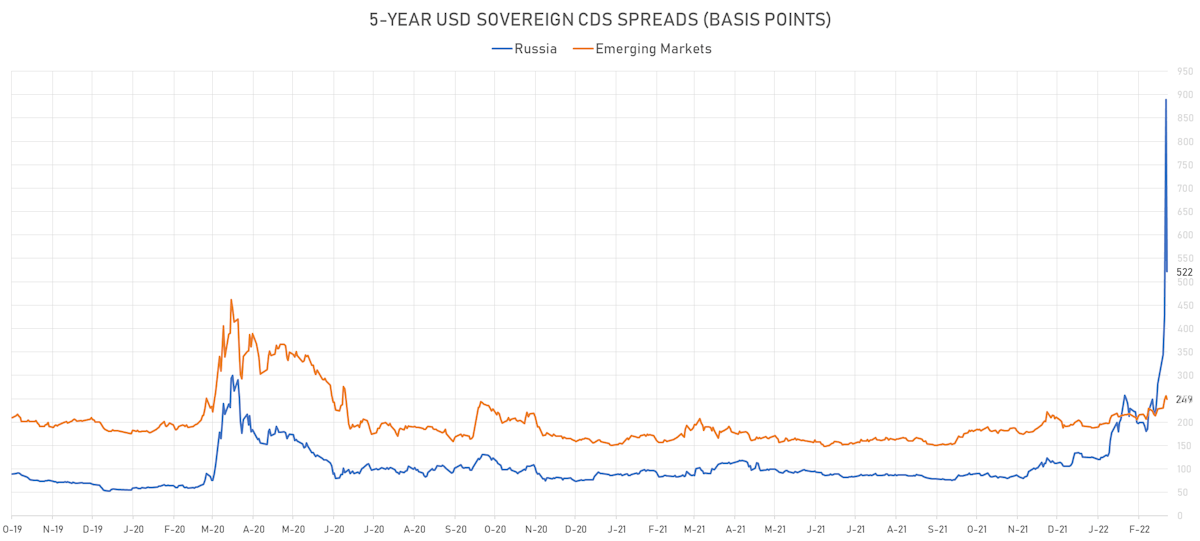

The risk sentiment shifted today as Putin seemed willing to negotiate with Ukrainians about their future leadership: Russia's 5Y US$ CDS spread was down 355 basis points to a still whopping 497 bp, and the Rouble was up 7.7% from Thursday's lows

Credit

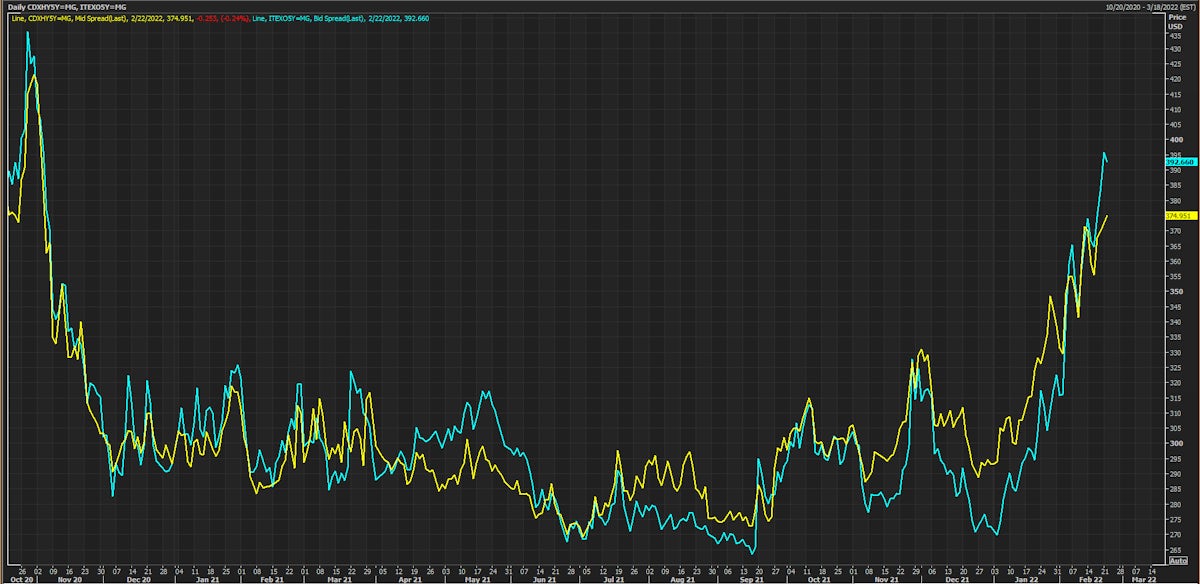

Spreads Widen Across The Credit Complex As Macro Risks Dominate All Asset Classes

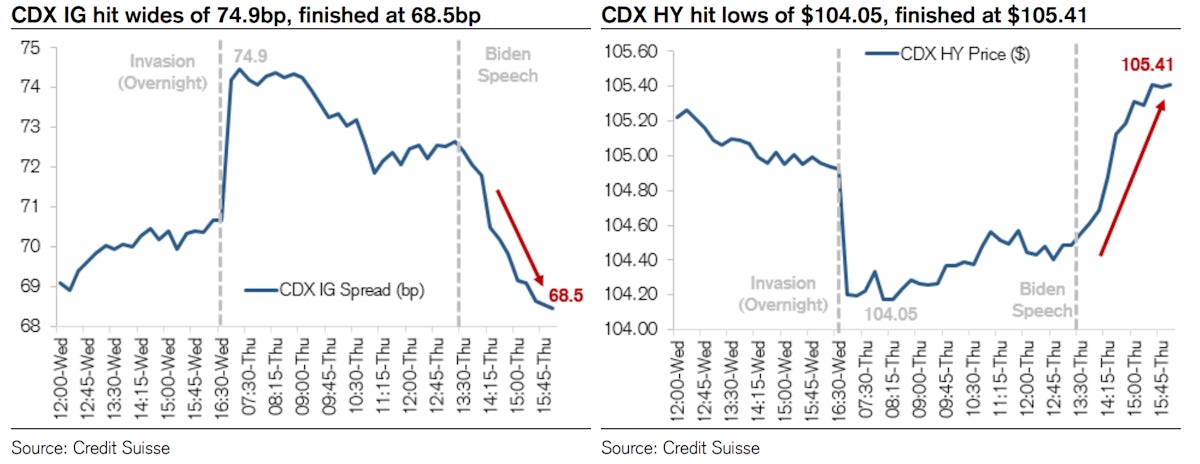

It was a roller coaster in the market today, with overnight and morning action bringing in a ton of protection buyers, followed by a reversal after Biden's speech and into the close

Rates

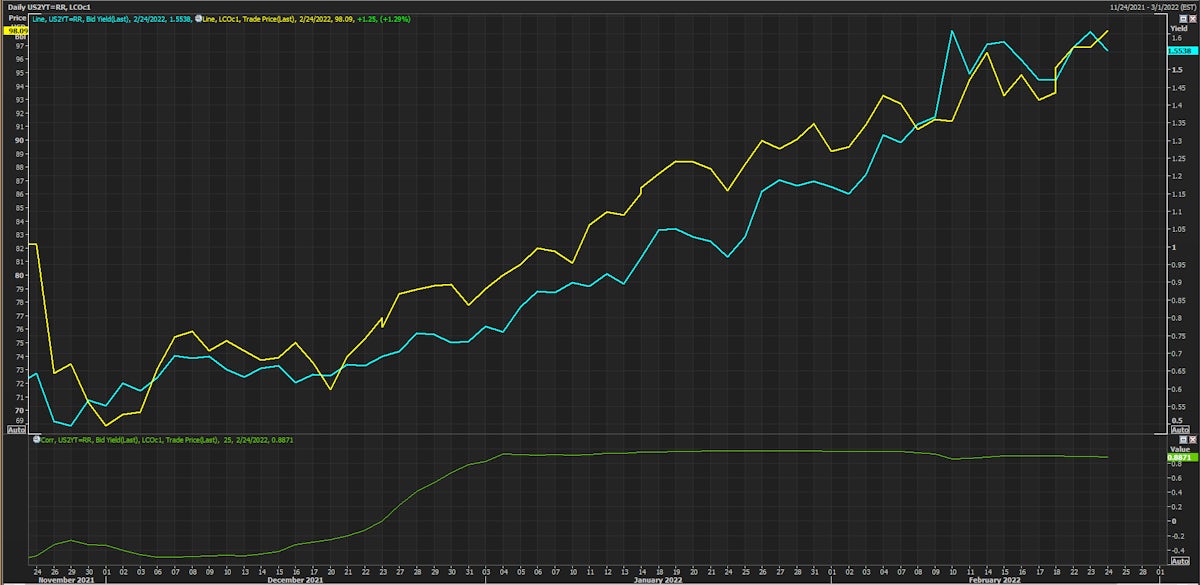

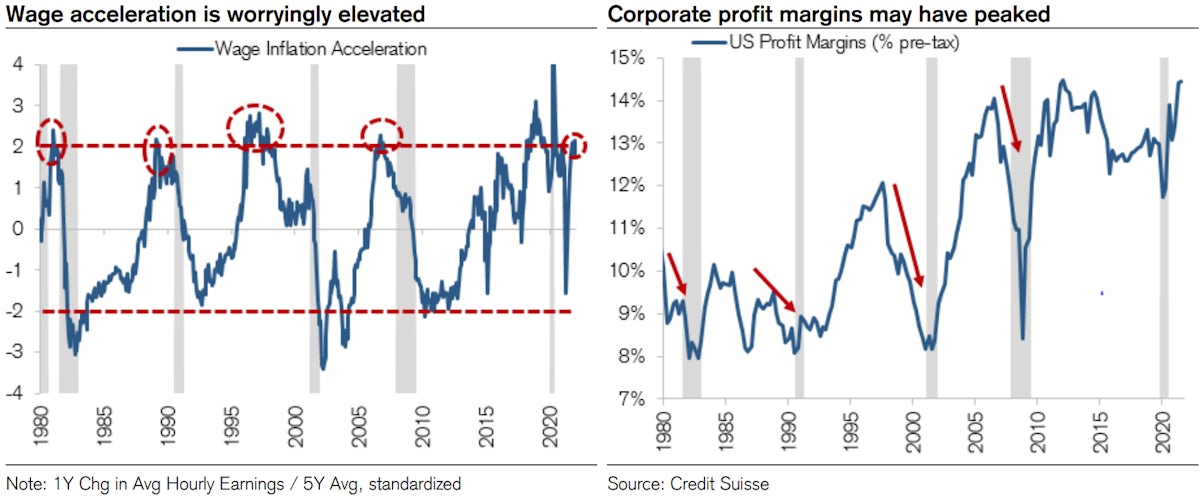

US GDP Data Showed Upward Revision To Price Deflator (+7.1% vs 6.9% est.), Leading To Further Rise In Inflation Breakevens

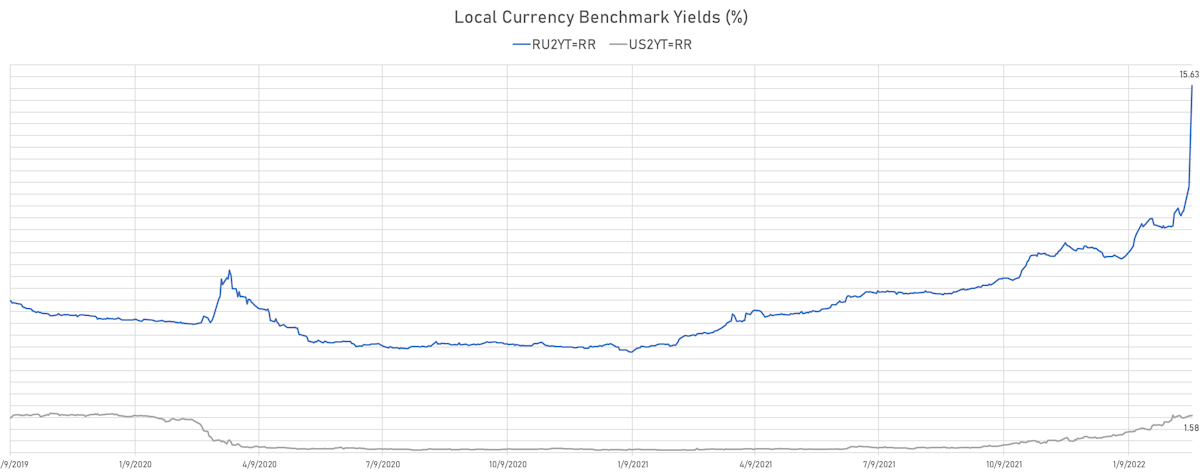

All eyes were obviously on Ukraine today and the monstrous volatility in Russian-related assets, with the 2-year Rouble benchmark yield jumping to nearly 16% and the Russian government's 5-year US$ CDS bid spread doubling to a new wide of 852 bp

Credit

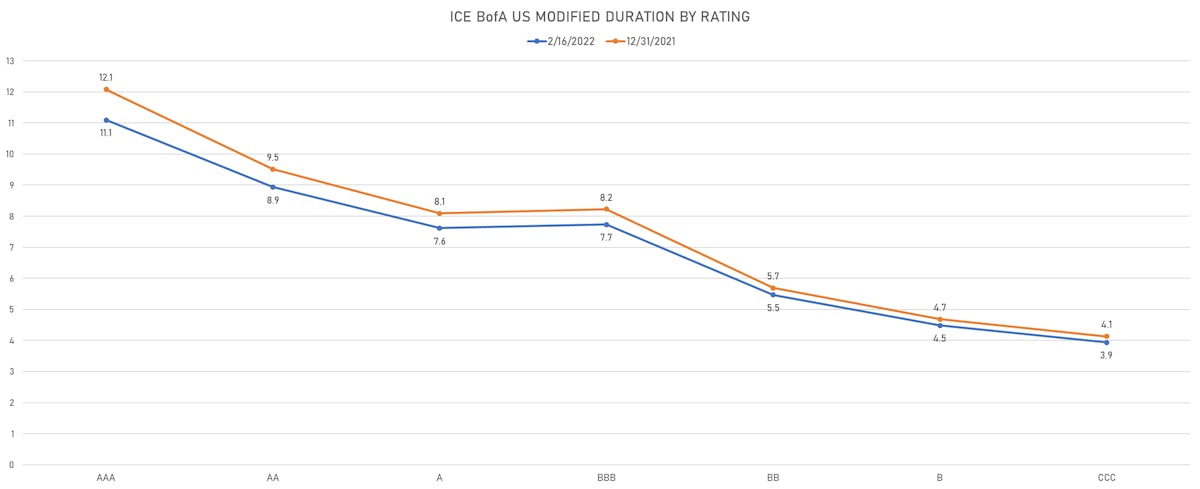

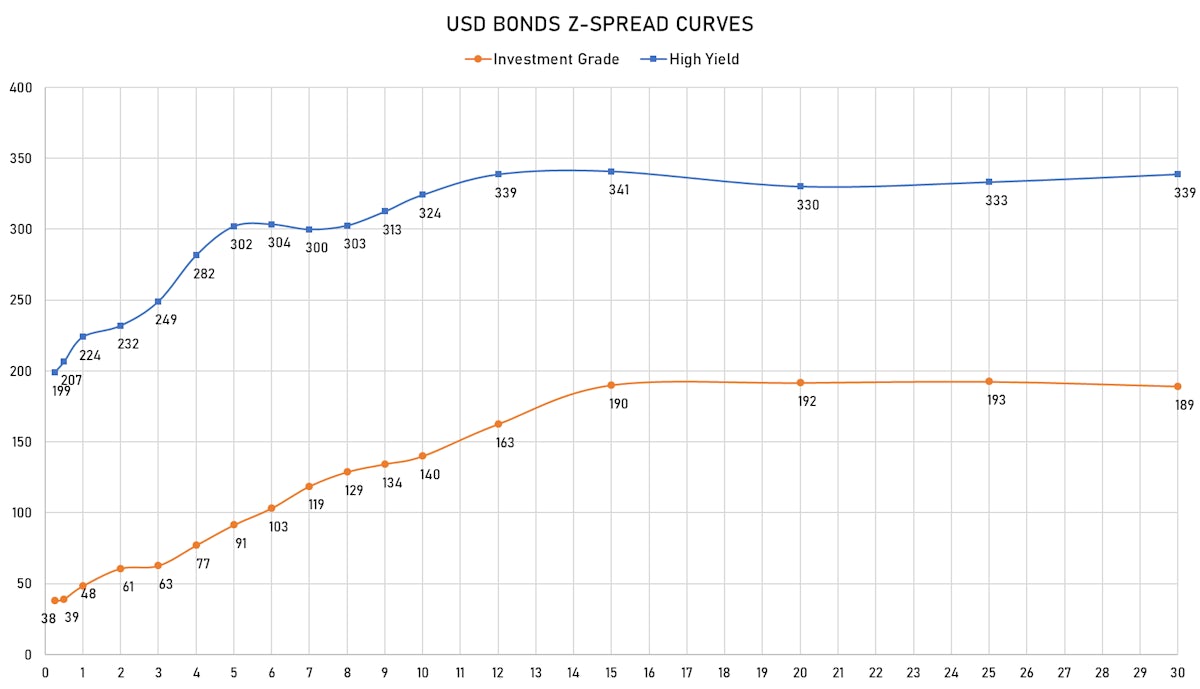

Duration Remains The Main Driver Of Price Action, As IG Spreads Were Close To Unchanged Today

After a hiatus of a couple of weeks, the high yield primary market saw a new offering priced today, with Twitter raising $1bn in a single tranche (8-year non-callable yielding 5%)

Rates

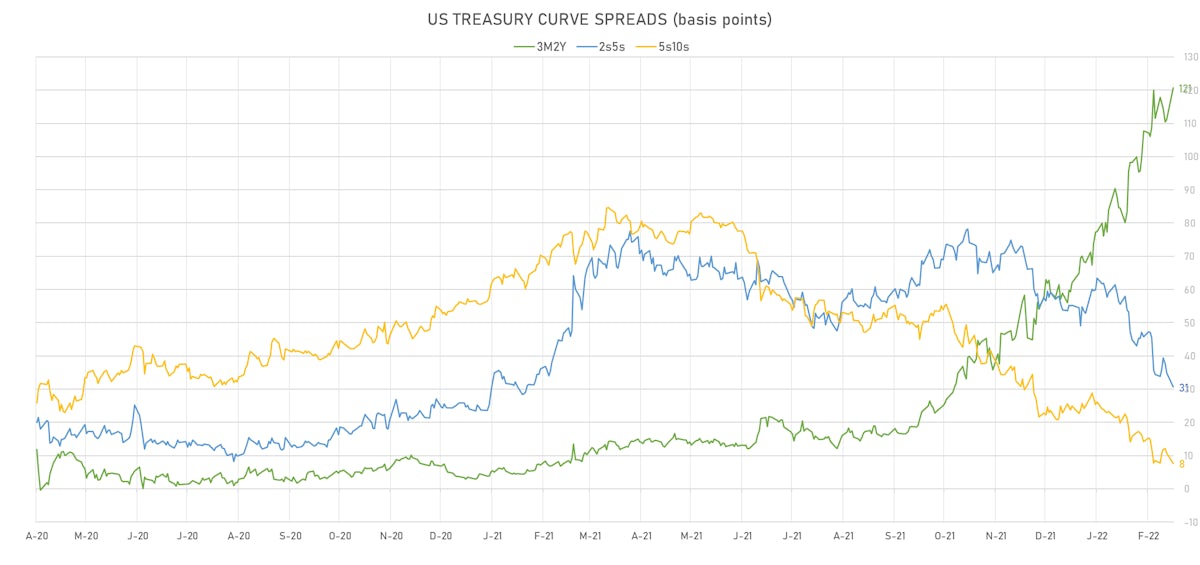

US Treasury Curve Continues To Bear Flatten, Driven By Higher Inflation Breakevens, As Oil Prices Near $100/BBL

Macro markets have increased the Ukrainian war risk premia over the past 24 hours: the Rouble is down close to 5% as we write, Russia's 5Y US$ CDS spread is up 80.1 basis points to 420 bp (1Y range: 75-420bp), nearly double where it was last week (215bp on 16 Feb.) and yields on local benchmarks are up 120bp across the curve (2Y now at 11.3%vs 10.1% last week)

Credit

Spreads On High Yield CDS Indices At Widest Since 2020, CDX.NA.HY 5Y Now At 375bp

Despite the still considerable level of rates volatility, a handful of US$ IG deals priced today, led by ConocoPhillips' $2.9bn 3-tranche offering

Rates

US Rates Sell Off At The Front End, Yield Curve Flattens As Inflation Breakevens Rise

Macro headlines were dominated by the situation in Ukraine, although weak sanctions from the US and Europe indicate that peak fear may be behind us; market impact was mixed with a positive tilt: Russia's sovereign US$ CDS spreads were significantly wider (at 6-year high), but the Rouble was up 1.8%, while commodities like platinum and palladium were down

Credit

Same Story Into The Weekend: Wider Spreads Across The Credit Complex, CDX IG Indices At New Highs For The Year

Primary market issuance volumes for the week (IFR data): $31.6bn in 37 tranches for IG (2022 YTD volume $216.0bn vs 2021 YTD $220.8bn) and $0 for HY this week (2022 YTD volume US$30.7bn vs 2021 YTD $77.4bn)

Equities

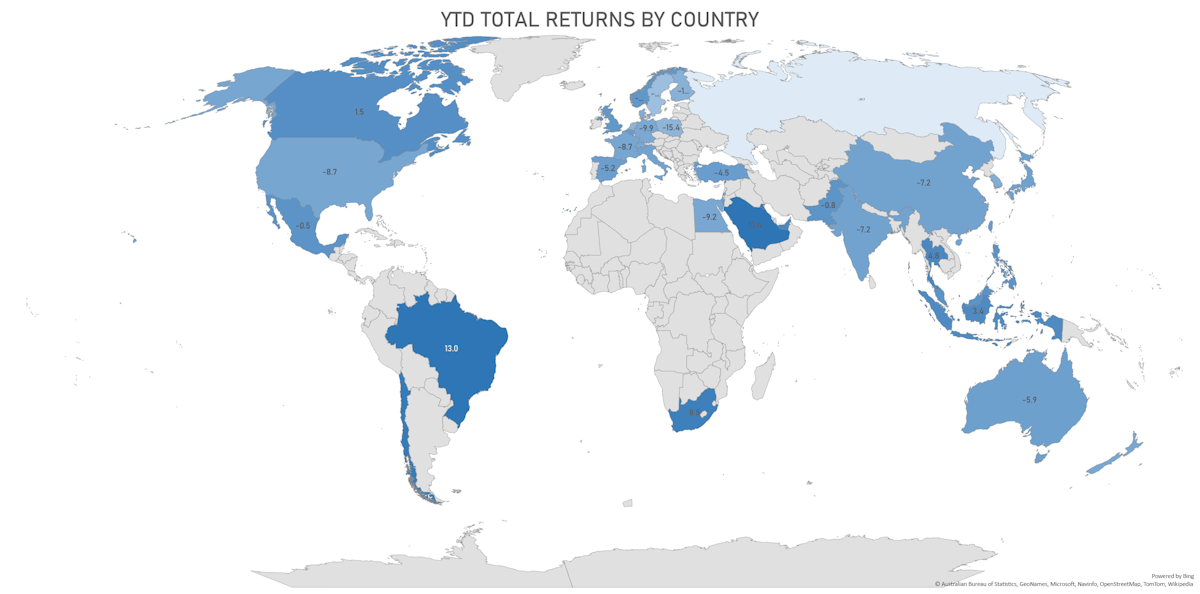

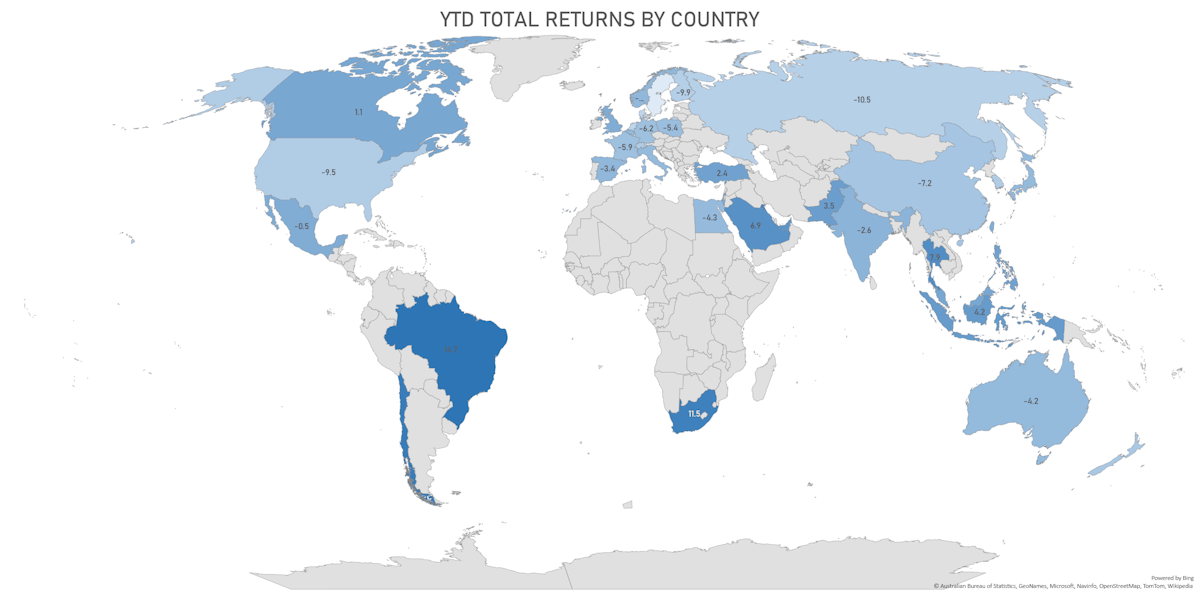

Another Week Of Losses Across Most Equity Markets, With The US Down 1.7%, While Mainland China Rebounded 2.5%

David Kostin, US equity strategist at Goldman Sachs, recently downgraded his forecast for the S&P 500 at the end of the year to 4,900 (from 5,100), a potential upside of about 13% from where we stand today; he views returns this year as solely driven by earnings growth, with multiples coming down

Macro

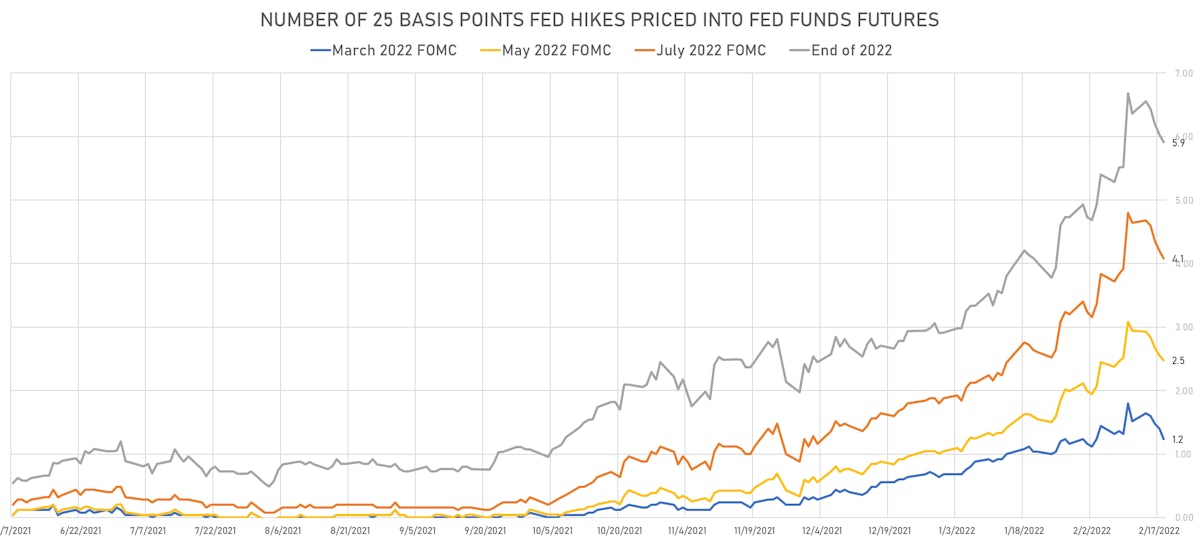

US Rates End The Week Higher, With A Flatter Curve; Market Still Prices In About 6 Hikes This Year

We're still 4 weeks away from the March FOMC, with ample time for Fed speakers to adjust current sentiment, but it looks increasingly unlikely that the Fed will kick off the tightening cycle with a 50bp hike

Credit

IG Cash Prices Rise Despite Wider Spreads, Helped By Longer Duration And Lower Yields

Not a ton of US corporate issuance today, but Amgen managed to raise $4bn in 4 tranches, while in SSA the Dominican Republic raised $3.6bn in 2 tranches