Equities

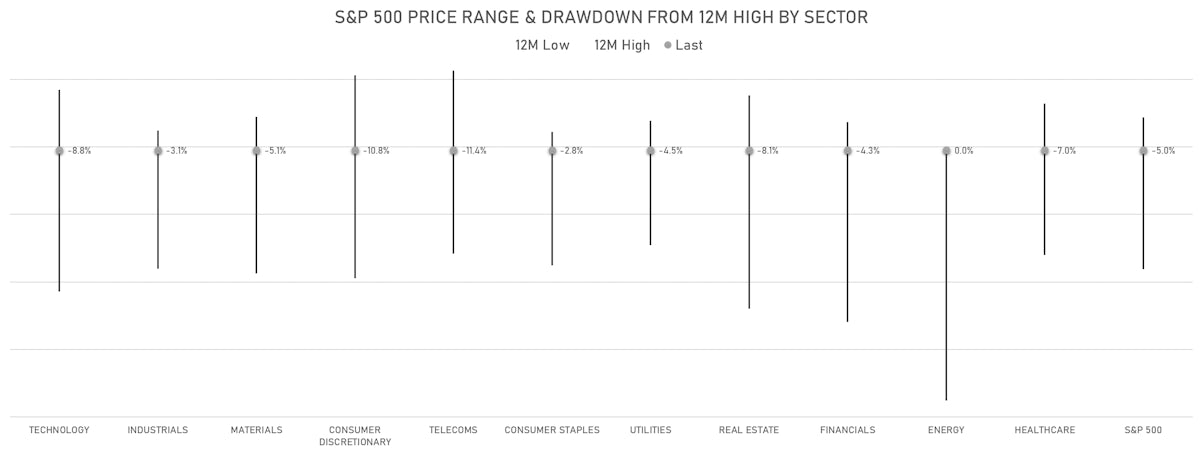

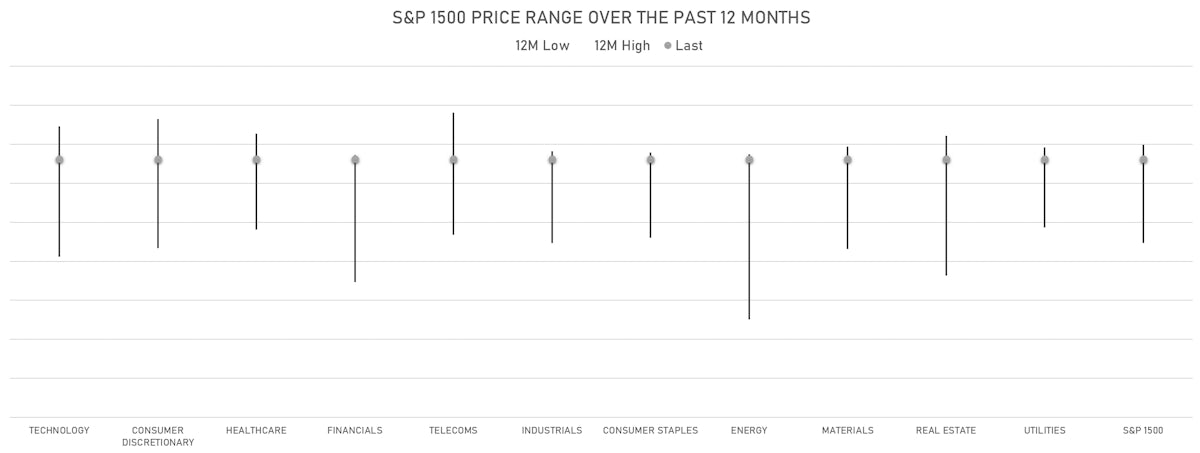

Broad Slide For US Equities Takes S&P 500 Drawdown To 5% Below All-Time Highs

The S&P 500 energy was the lone positive sub-index today, hitting its highest level since 2019, as Brent crude front-month futures reached prices not seen since 2014; real market tightness in the spot market is likely to materialize later this year, with some OPEC+ members unable to meet their current production quotas

FX

Rates Differentials Take US Dollar Higher Against Euro, Swissie, Sterling

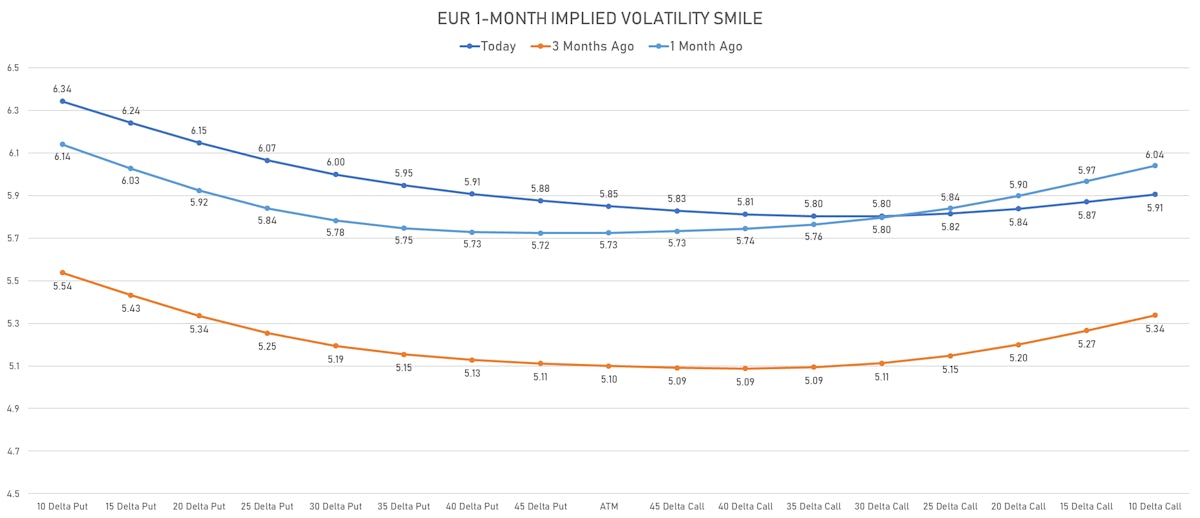

Euro implied volatilities have become more skewed to the downside over the past month, while risk reversals are showing less bias to a strengthening yen (lower risk aversion)

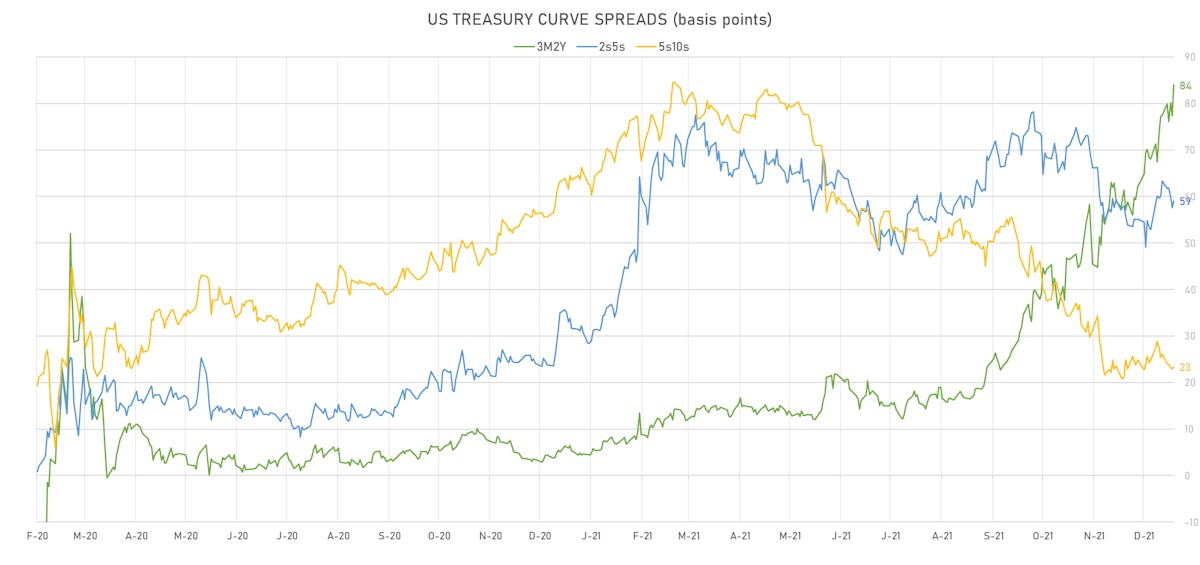

Rates

US Yields Rise Out To The Belly, With Further Flattening At The Long End Of The Curve

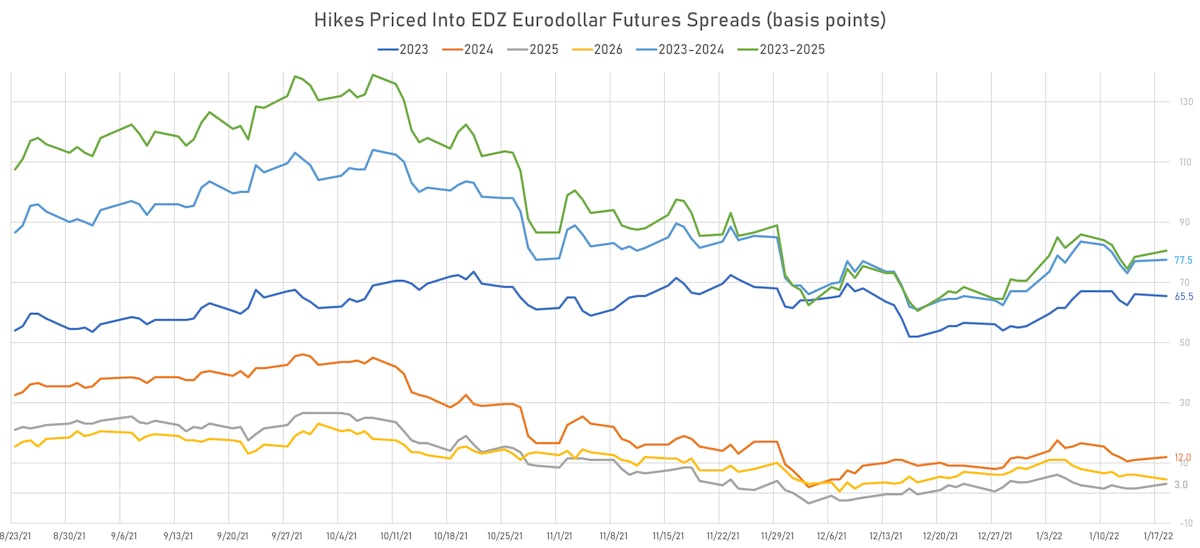

Forward rates continue to price in a very shallow hiking cycle, with only 3 hikes expected from 2023 to 25: this reflects both anemic forward growth expectations (flattening US TIPS 5s30s) and the Fed's possible use of more aggressive QT to accelerate its normalization efforts

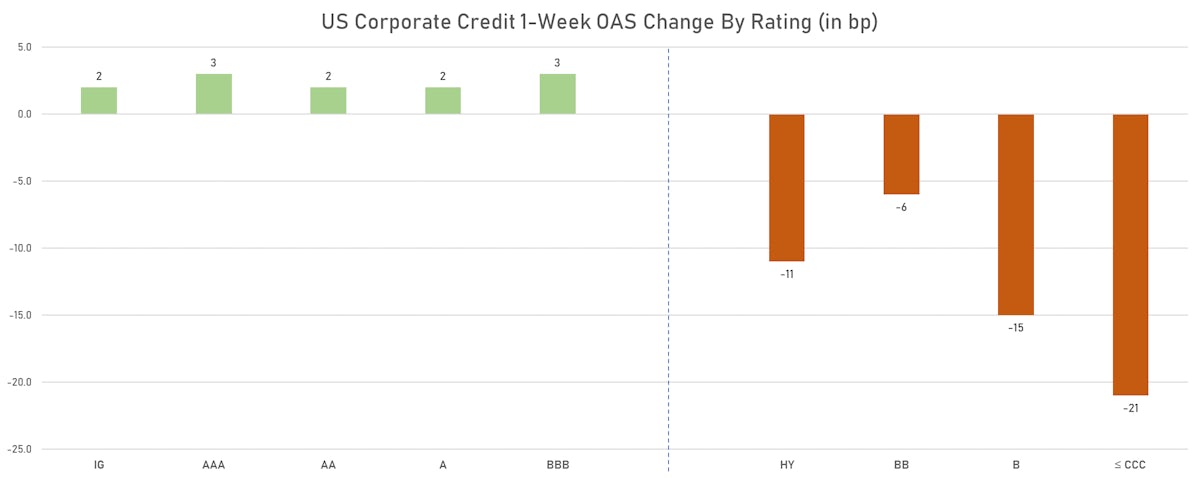

Credit

Mixed Total Returns For US$ Liquid Corporate Bonds This Week, With IG Down 0.62% and HY Up 0.17%

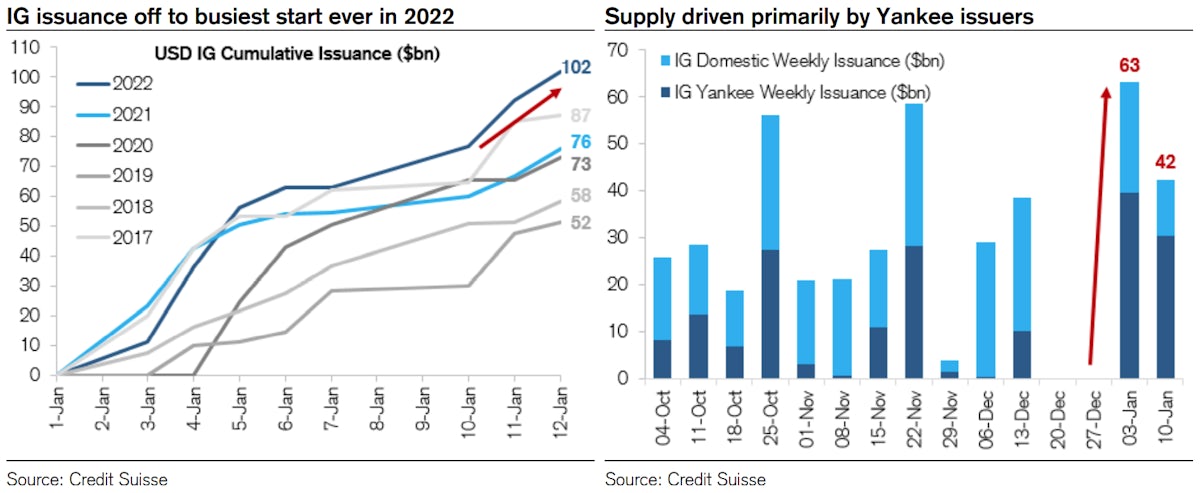

Summary of US$ corporate bond issuance this week (IFR data): 12 Tranches for US$6.8bn in HY (2022 YTD volume US$11.815bn vs 2021 YTD US$22.61bn), 61 Tranches for US$44.601bn in IG (2022 YTD volume US$107.001bn vs 2021 YTD US$79.585bn)

Equities

US Equities Fall For A Second Straight Week, With the S&P 500 Down 0.30% This Week, Nasdaq -0.28%, Russell 2000 -0.80%

Disappointing volumes for US ECMs, with less-than-ideal market conditions: this week saw just $1bn in IPOs, $2bn in SPAC IPOs, $1bn in Accelerated Book Builds / Blocks, and $425m in convertibles

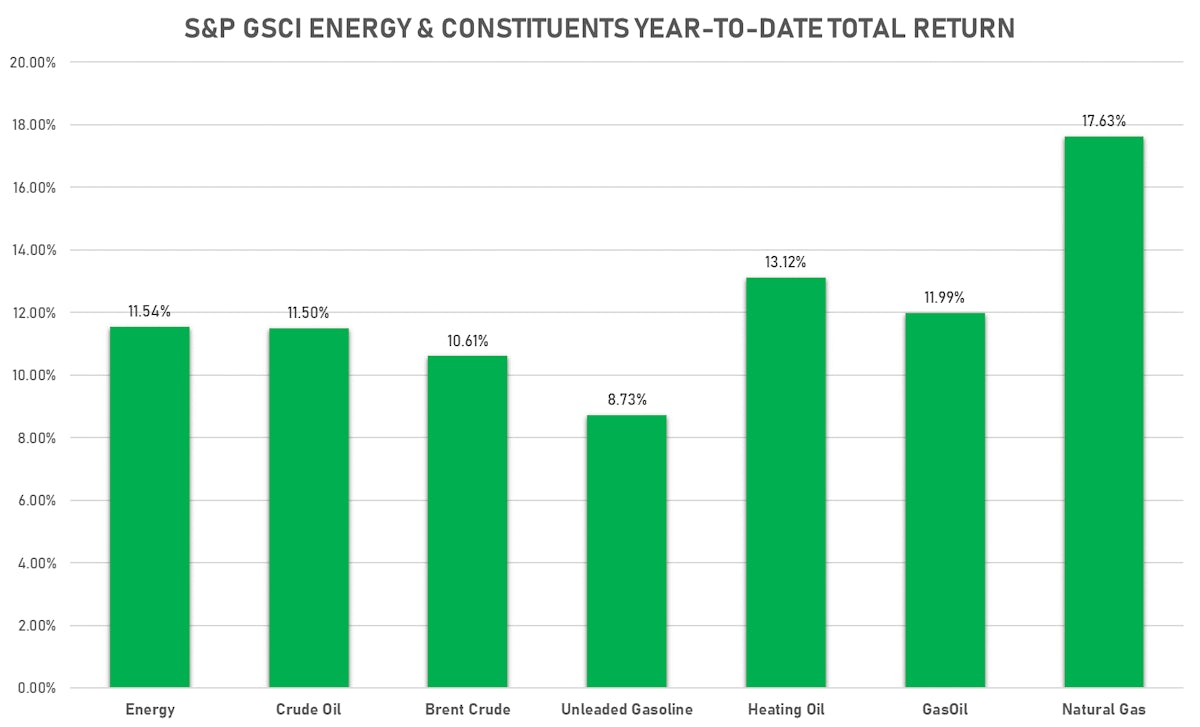

Commodities

Looking At GSCI Sub-Indices, Energy Is Off To A Great Start This Year, Led By Natural Gas And Heating Oil

Among macro trends, shipping has seen a continued slide since the beginning of the year (Baltic dry index down 20% YTD and down 69% since October), while EV-related base metals have done really well (Lithium up 20% and Nickel up 10% YTD)

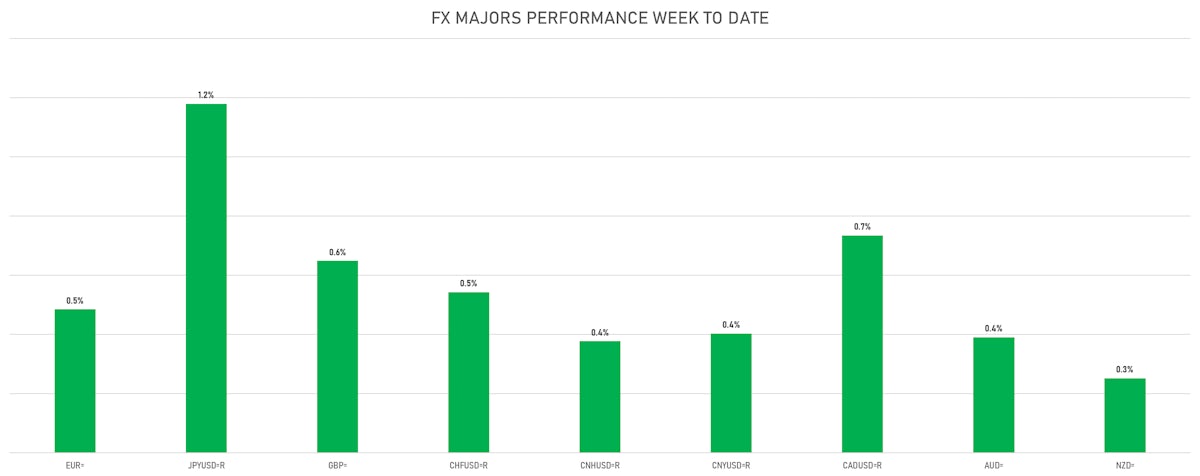

FX

Widening Rates Differentials With The US Curve Take Down Euro, Swissie To End Week

Good week for major currencies against the dollar, with gains across the board, led by the Japanese Yen, Canadian Dollar and Pound Sterling

Rates

Yields Rise As US Rates Markets Look Through Big Miss In Retail Sales, Weaker Industrial Production

The Fed is in a difficult situation as there is limited scope for more than 5 hikes in 2022 without inverting the spot curve (many forward curves are already inverted); so they will likely choose to use QT as a policy tool to steepen the forward curve, despite the reduced market appetite for duration

Credit

Spreads Widen Across The Credit Complex, Though IG Bonds Rose On Lower Yields

US$ Investment grade issuance is off to the fastest pace ever, with $102 bn already raised since the beginning of the year according to a Credit Suisse analysis

Equities

US Equities Slide On Profit Taking As 4Q 2021 Earnings Season Gets Under Way

The risk-off move has been fairly limited so far, with 44% of S&P 500 stocks rising today and over 60% still above their 50-day moving average

FX

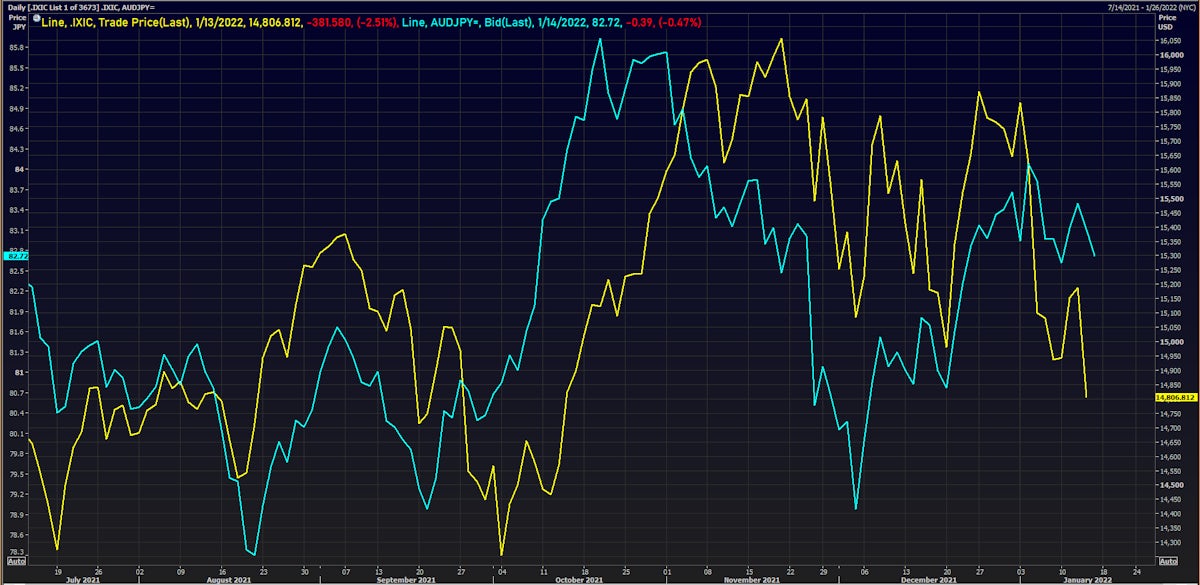

Risk-Off Move, Rates Differentials Combine To Push Yen, Swissie Higher Against The USD

One of the purest risk-off trades has been to go long Japanese Yen, short Aussie Dollar, and we expect to see this continue to play out over the course of the year

Rates

US Yield Curve Bull Flattens On Weaker Than Expected Jobless Claims, With Lower Inflation Breakevens, Lower Real Yields

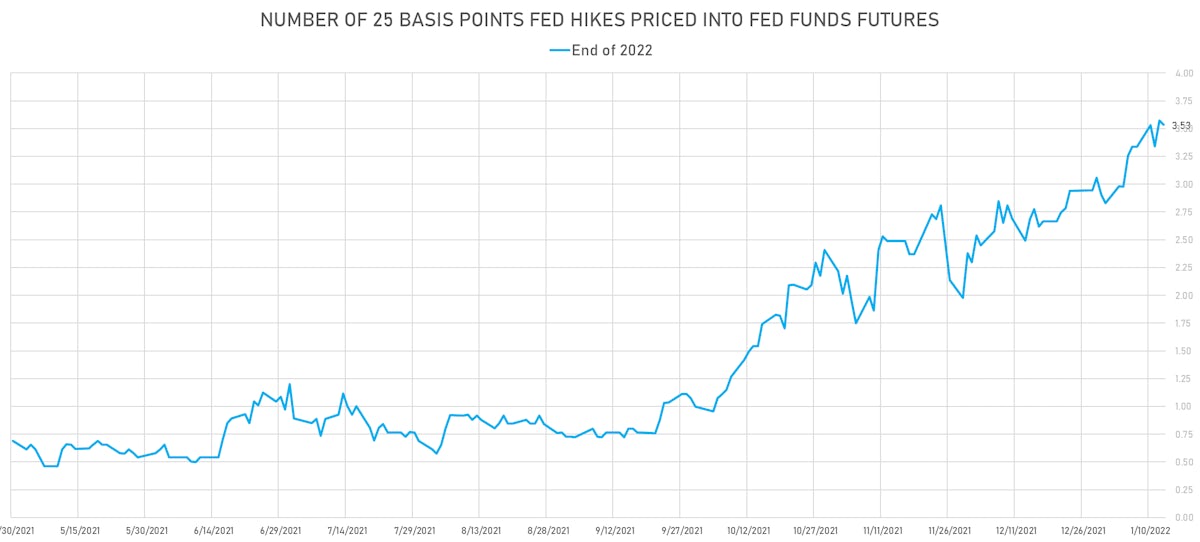

The front end could rise further still (towards 5 hikes if inflation doesn't peak soon) but with nearly 4 hikes priced in for 2022 it's not a great quality trade; slightly further down the curve, only 2.5 hikes are priced in for 2023 and just 0.4 hike for 2024 (fewer than 3 over 2 years), selling EDZ23 or EDZ24 looks like a more asymmetric / attractive opportunity