Rates

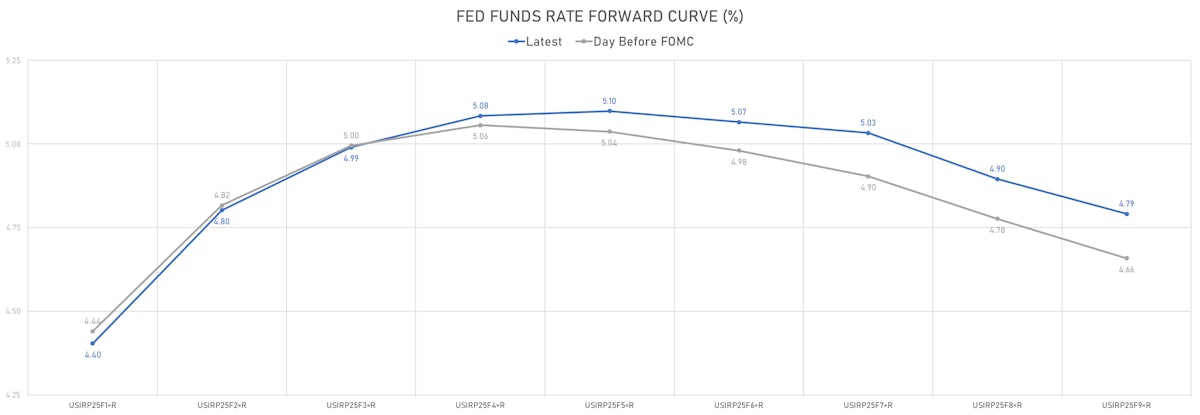

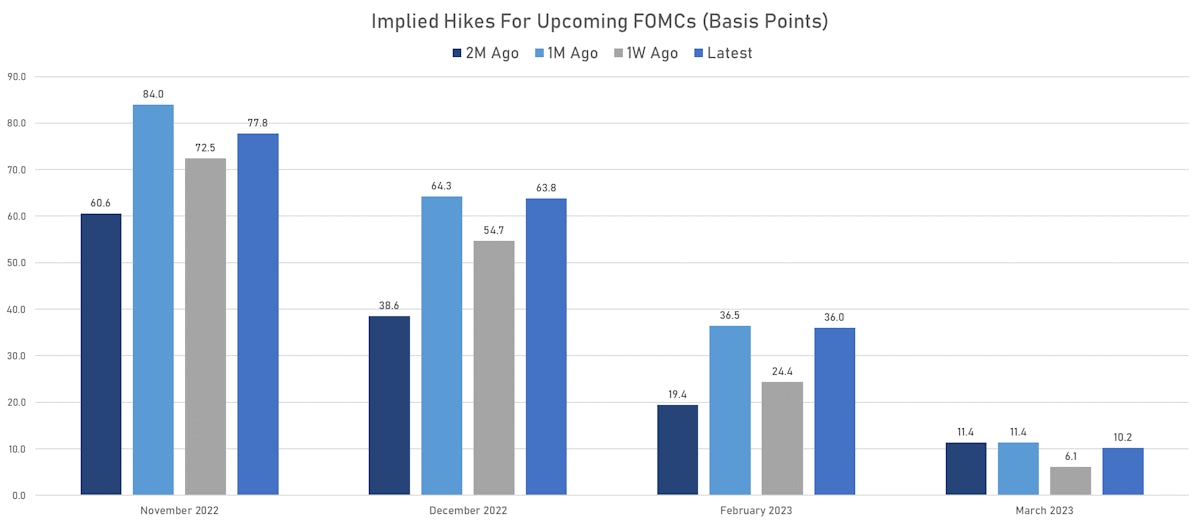

Fed Signals Pivot Towards Smaller Hiking Increments, Higher Terminal Rate

Perhaps the most important outcome is that the Fed no longer makes decisions based on the evolution of spot inflation data, but instead looks at the levels of rates (with uncertainty about the lagged impact of their actions), hoping to maximize the chances of a soft landing

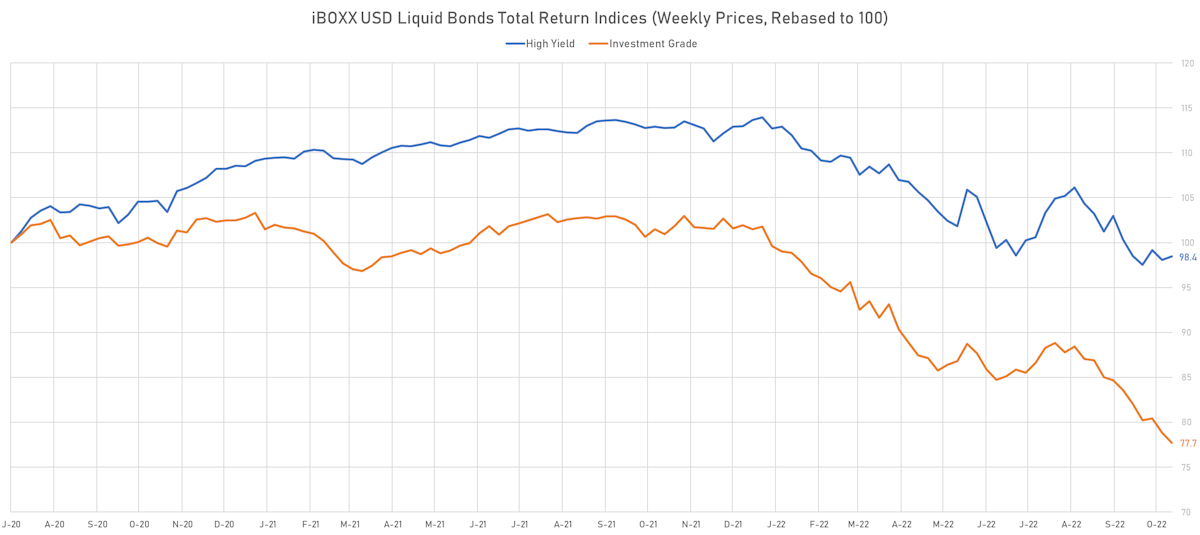

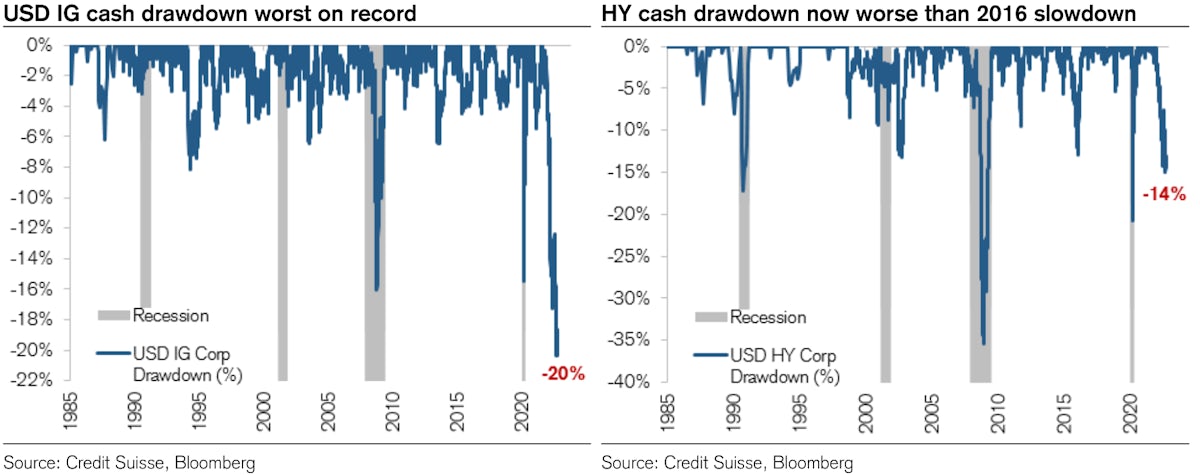

Credit

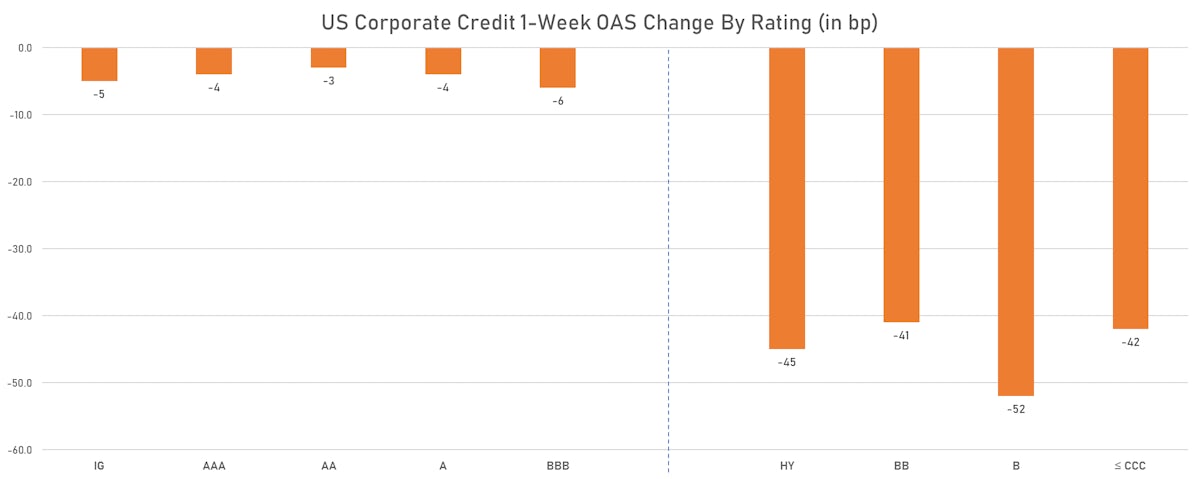

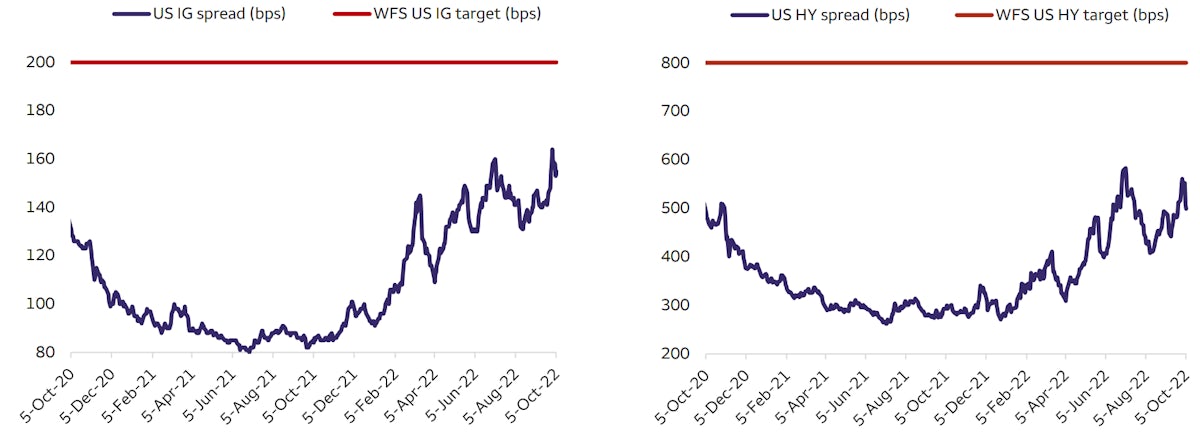

Risk-On Rebound Across The US Credit Complex, With A Significant Compression In Spreads

Solid week of issuance for USD IG corporate bonds, with $36.5bn raised in 33 tranches (2022 YTD volume $1.093tn vs 2021 YTD $1.311tn, down 16.6% YoY), while there was no new issuance in HY (2022 YTD volume $90.091bn vs 2021 YTD $420.331bn, down 78.6% YoY)

Equities

Solid Bounce In US Equities Despite Mediocre Earnings, As Fed Scores Own Goal Hinting At Policy Slowdown

With a little over half of S&P 500 companies having now reported their 3Q22 earnings, the results have been broadly disappointing, tracking well below weak expectations (2.2% EPS growth realized vs 3% expected)

Rates

US Yield Curve Flattens, Real Yields Fall Since Fed Hint At Policy Downshift From December

Though we understand the concerns caused by the UK LDI scare and the recent deterioration in bond market liquidity, slowing down the pace of hikes before inflation is firmly under control looks premature

Credit

Positive Week For US HY Credit, Though Cash Spreads Widened On Friday, Parting Ways With Equities Into The Weekend

US$ IG corporate issuance rebounded this week as 3Q earnings started to roll in: 24 tranches for $20.25bn in IG (2022 YTD volume $1.056tn, down 18% vs 2021 YTD), and 1 tranche for $2.03bn in HY (2022 YTD volume $90.091bn, down 78.3% vs 2021 YTD)

Equities

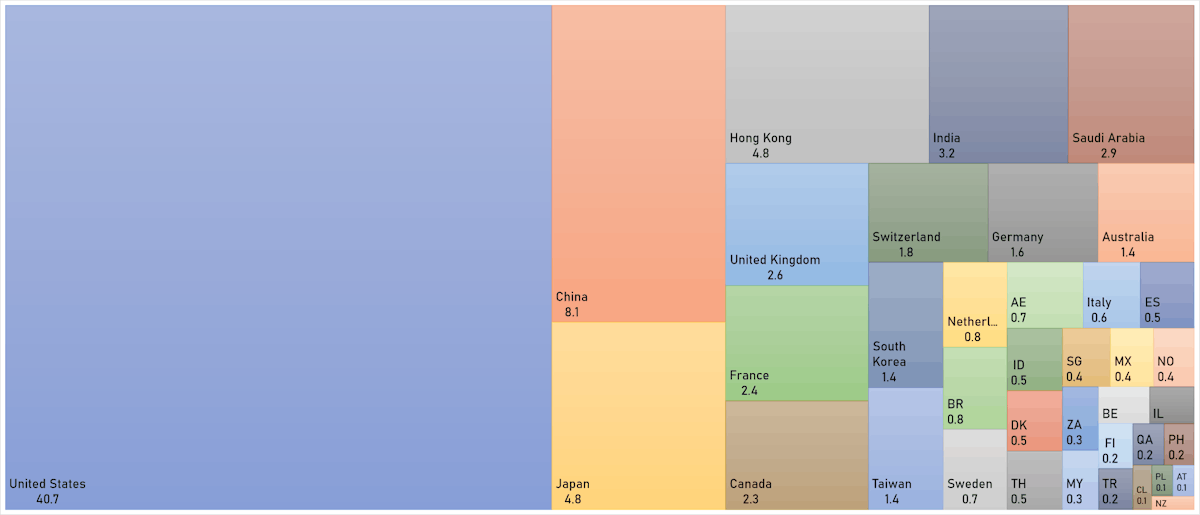

Broad Rise In Global Equities This Week, With China + HK Still The Most Visible Laggards

As the equity risk premium continues to look too skinny against the rise of real yields, Goldman strategists see the S&P 500 trough around 3,150 in a hard-landing scenario (down 16% from where we stand at pixel time)

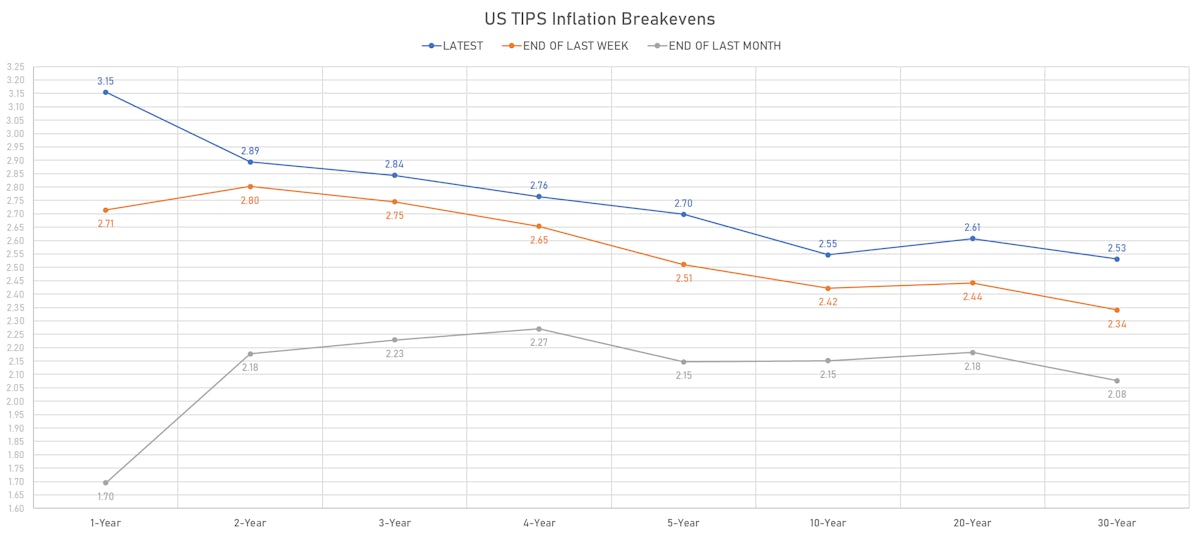

Rates

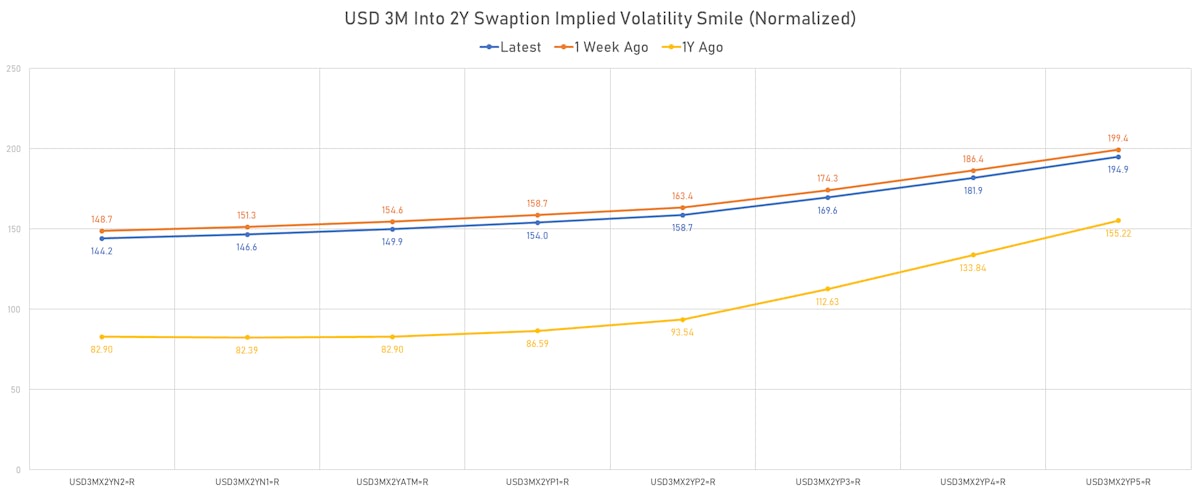

Front-End Rates Up Slightly, With Higher Inflation Breakevens, And A Steepening Of The Curve

Although two consecutive 75bp hikes are still our baseline for the next 2 FOMCs, we expect continued rates volatility and worsening market liquidity into year end

Credit

Poor Performance Across The US Credit Complex, With A Continued Rise In Rates And Wider Spreads

Very little activity in the USD primary corporate bond market this week: 3 tranches for $6.5bn in IG (2022 YTD volume $1.036trn vs 2021 YTD $1.232trn), 3 tranches for $1.06bn in HY (2022 YTD volume $88.061bn vs 2021 YTD $405.441bn)

Equities

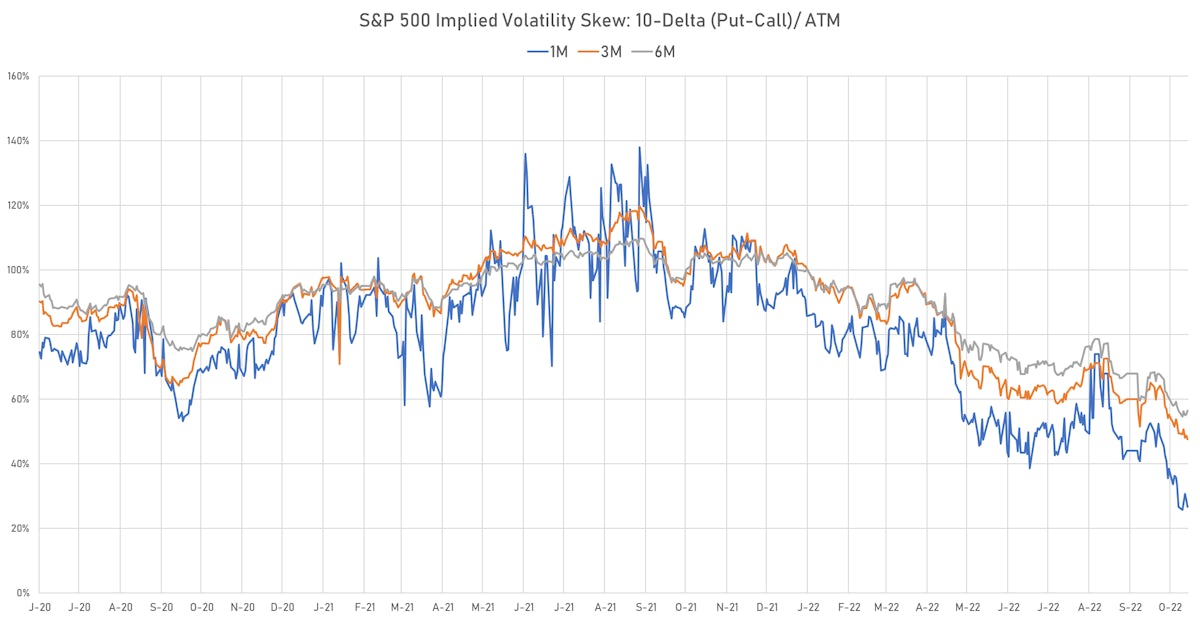

Light Directional Positioning, Combined With A Lot Of Hedging, Drive Unintuitive Moves In US Equities This Week

The broad selloff today came with a drop in implied volatility, indicating that portfolio managers took advantage of lower prices to cash in on their hedges

Rates

US CPI Brings The Fed's Terminal Rate To 5% In 1Q23, Money Markets Still Price In A Rate Cut In 4Q23

Compared to where the market currently sits, we see more upside risk to short rates over the next twelve months, and more downside risk from 2024 onward, with the likelihood of a recession not fully priced in

Credit

Decent Rebound For US Credit This Week, With High Yield Overperforming Equities On A Volatility-Adjusted Basis

Continued rates volatility kept volumes of corporate bond issuance low this week: 17 tranches for $13.55bn in IG (2022 YTD volume $1.030trn vs 2021 YTD $1.217trn), 1 tranche for $625m in HY (2022 YTD volume $87.001bn vs 2021 YTD $398.726bn)

Equities

Choppy Week For US Equities, Ending Modestly Up After Big Gapping Moves On Tuesday And Friday

3Q22 earnings season is upon us, with Pepsi kicking things off on Wednesday; estimates have come down over the past month, but probably not enough to reflect a US recession 1Y forward