Macro

Risk Premia Drop Across Asset Classes: Treasuries, The US Dollar And Commodities Sell Off, While Equities Rise

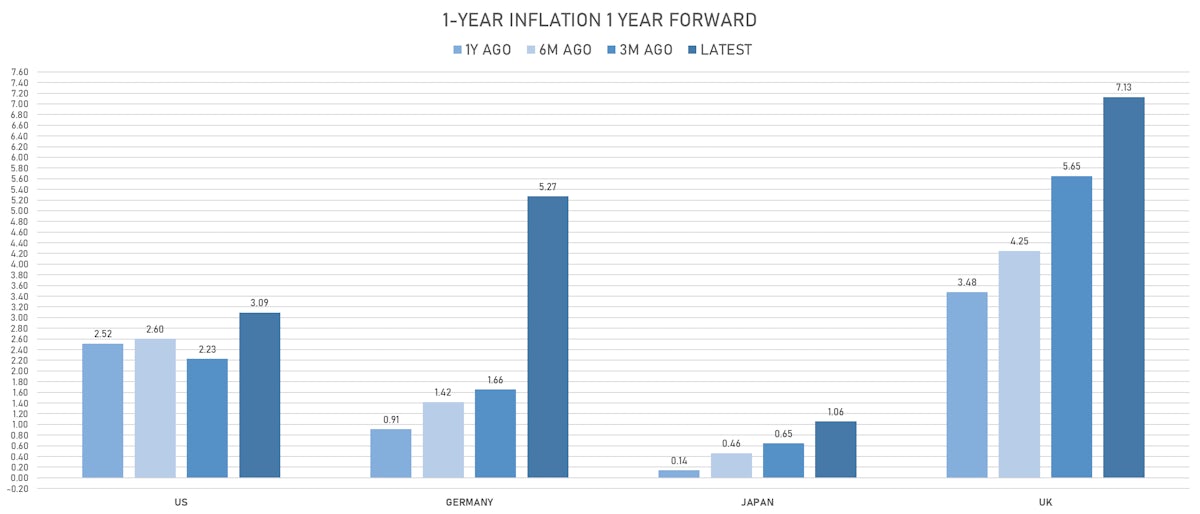

Important to watch the ECB decision on Thursday, as they're not expected to do anything, but the current inflation expectations (and the unlikelihood of them reversing anytime soon) would definitely justify a hike and could trigger a big move in the Euro after its recent weakness

Macro

A Worsening War Scenario Is Playing Out Across Markets: Higher Commodities, Higher Breakevens, Flatter Yield Curve, Stronger Dollar, Lower Equities

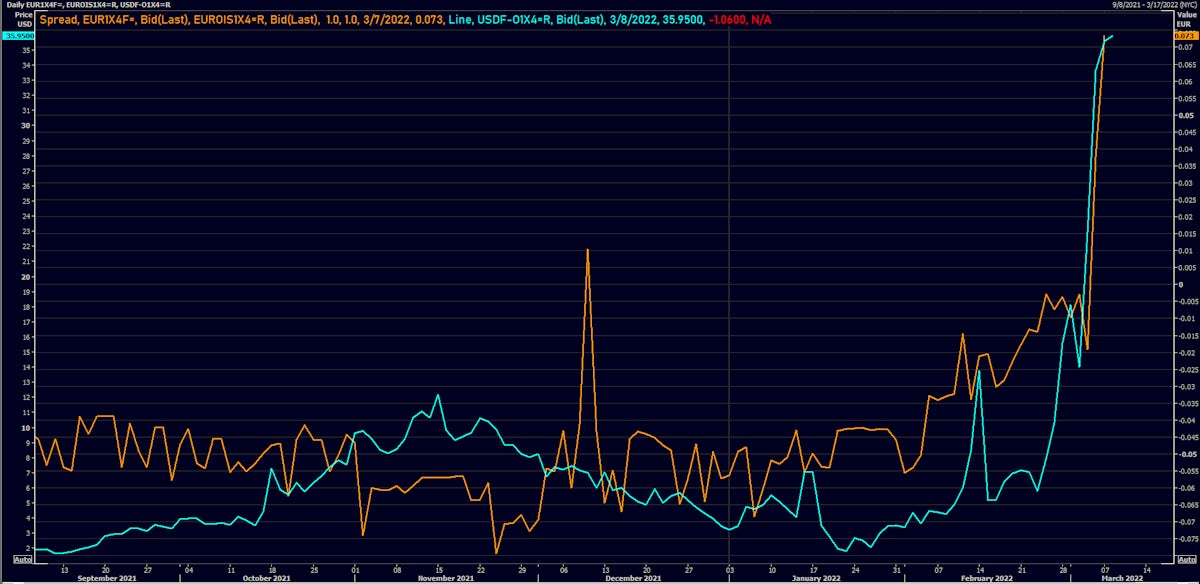

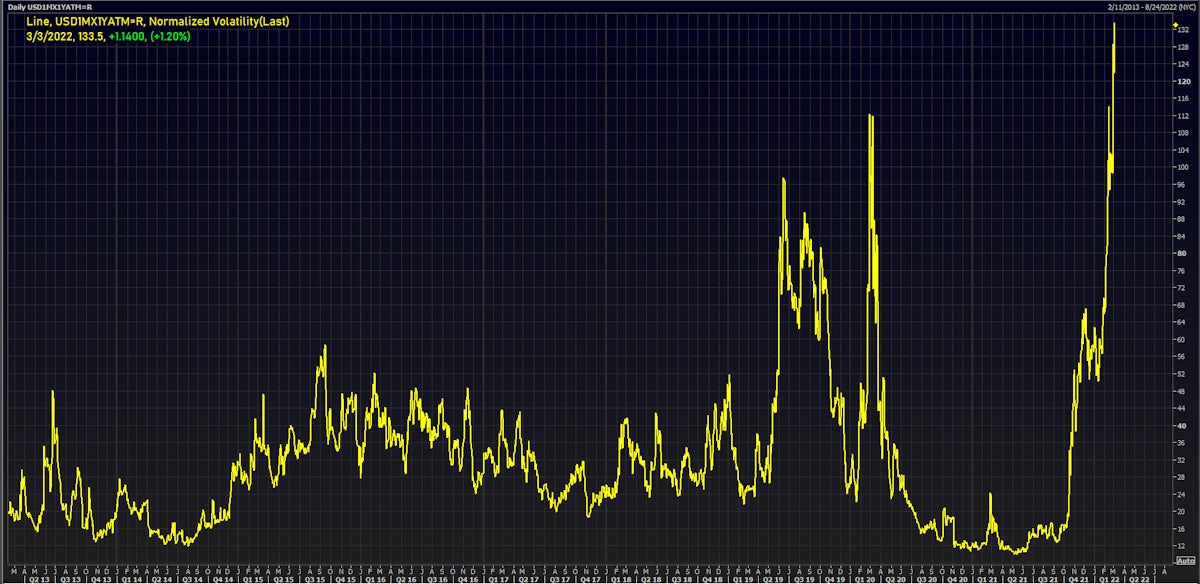

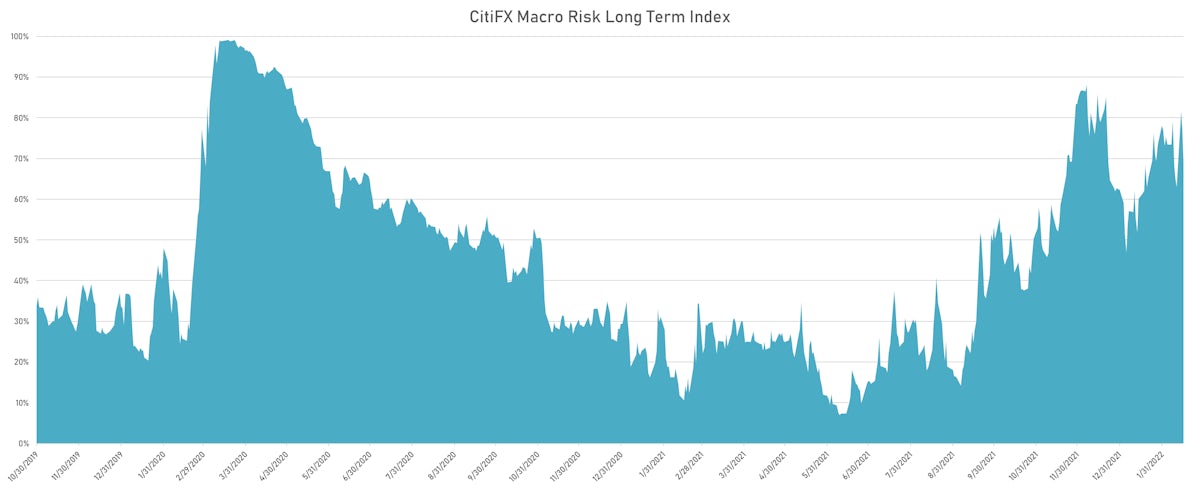

As the US administration continues to escalate the situation in Ukraine, markets are caught in a perfect storm, having to manage enormous volatility and deteriorating liquidity, while inflation concerns and slower growth point more and more towards stagflation

Macro

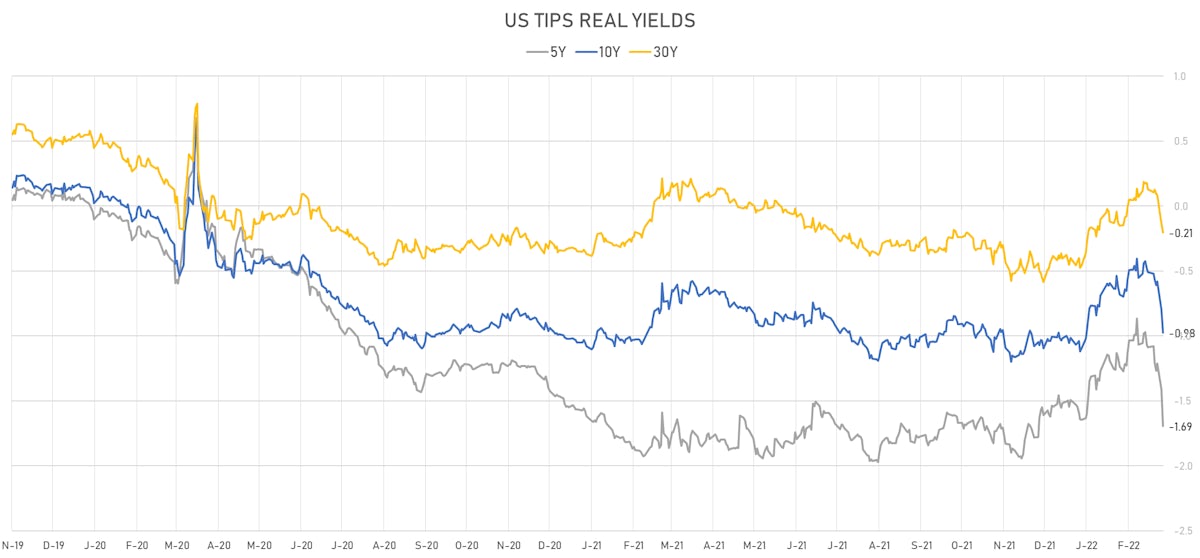

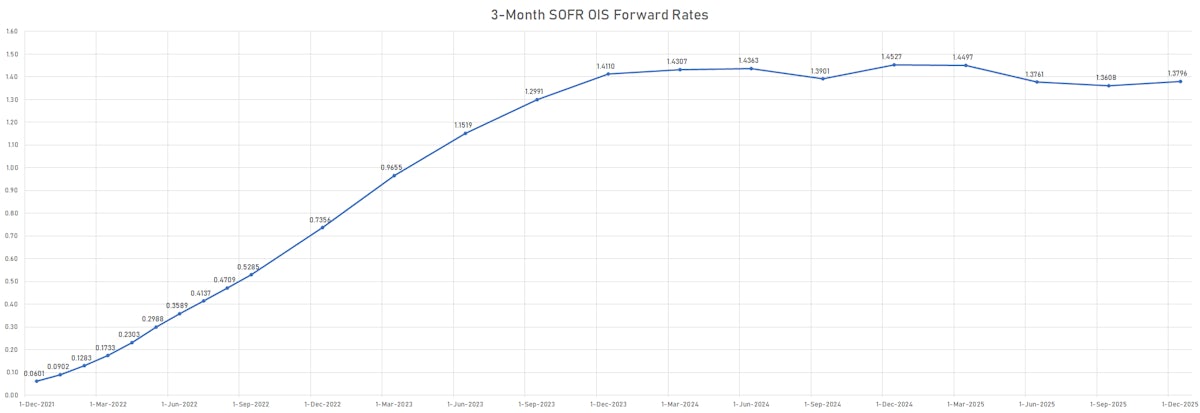

US Curve Flattens Further, 10Y Yield Down 4bp; Market Implied Hikes Down To 5 By The End Of The Year, With Just 1 Hike Priced For 2023

Fed policy uncertainty is driving short-term rates volatility to extreme levels, with many questions up in the air: how front-loaded can rate hikes be? will QT be used to steepen the curve? is inflation stabilizing or still getting worse? how will Ukraine, Iran and the prices of commodities impact inflation?

Macro

Yields Rise As Powell Confirms Liftoff Is Now A Couple Weeks Away, More Worried About Inflation Than Economic Growth Impact Of Ukraine-Russia War

Energy commodities keep rising at a frightening pace, with European TTF natural gas up over 40% and Brent Forties up 6% today, with the historic gap with Urals crude now at around $19

Macro

Inflation Breakevens And Rates Volatility Higher, But Risk Aversion Keeps Treasuries Well Bid; 5-Year TIPS Real Yield Now Down Over 60bp In The Past Week

Uncertainty around how Russian sanctions will be applied, and even possibly widened, is driving commodities higher, with Brent crude front month at $110/bbl to and European TTF natural gas up double digits to €114

Macro

Strong Bid For US Rates Despite Higher Breakevens, With a Bull Flattening Curve, And One Full Hike Has Been Priced Out Over Past Week (5.4 Implied By End 2022)

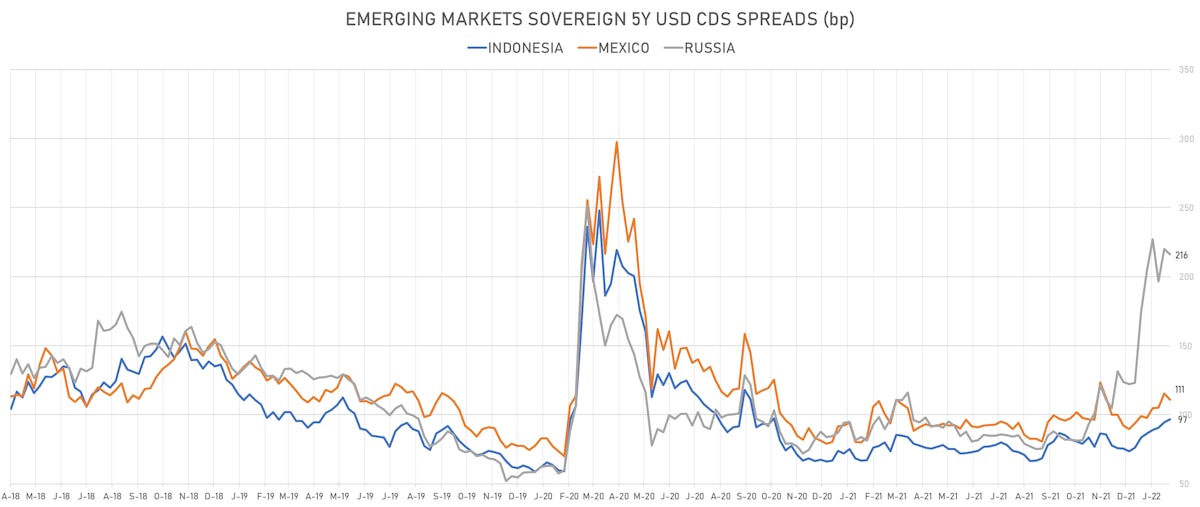

On the Russian front, the Rouble has had the largest percentage drop since the 1998 financial crisis, the government's CDS implied 5Y US$ default probability has surged to 60%, but commodities are doing well (if they can be paid): palladium prices up 5%, European TTF natural gas up 12%, wheat up 10%

Macro

US Rates End The Week Higher, With A Flatter Curve; Market Still Prices In About 6 Hikes This Year

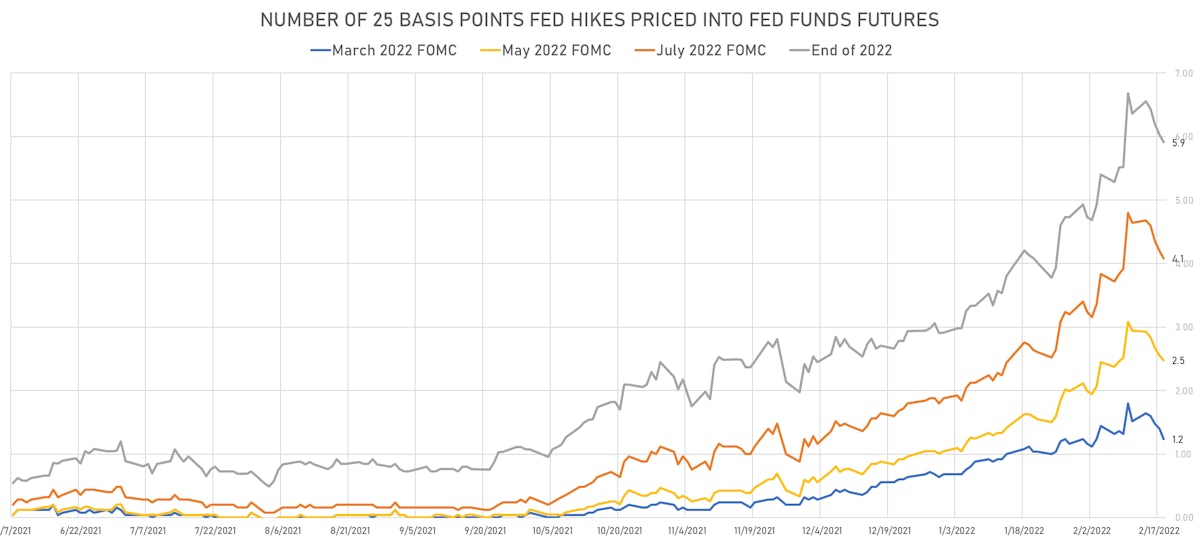

We're still 4 weeks away from the March FOMC, with ample time for Fed speakers to adjust current sentiment, but it looks increasingly unlikely that the Fed will kick off the tightening cycle with a 50bp hike

Macro

Front-End Yields Dip As Fed Minutes Dovish Compared To Expectations, No Discussion Of 50bp Hike in March

The US dollar was broadly lower today against all major currencies, with volatility falling and high-beta risk-on currencies up significantly (Aussie Dollar up 0.74% and Kiwi Dollar up 0.83%)

Macro

US Front-End Yields Drop, Curve Steepens On Positive Risk Sentiment, Despite Hotter Than Expected PPI Data

Russia's sovereign CDS spread narrowed by 29 basis points and the Rouble was up 1.6% today, as tension in Ukraine seemed to ease with the end of war games in Belarus and pullback of some troops

Macro

US CPI: Preview Of The Most Important Macro Release This Week

With most of the market now more focused on upside inflation risk, we could see a rally in risk assets and a steepening in the yield curve if elevated expectations are disappointed

Macro

FOMC Preview: Fed Will Publish More Front-Loaded Dot Plot Than In September

When the Fed releases its updated economic projections and dot plot on 15 December '21, we expect it to show 2 hikes in 2022, which is lower than current market expectations of 2.7 hikes

Macro

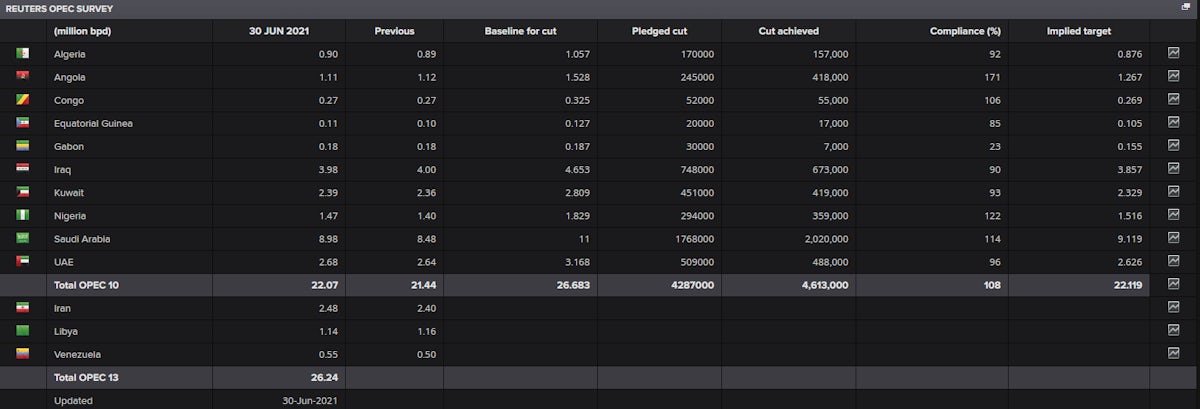

Likely OPEC+ Scenario Remains Increased Output To Balance The Market

Note that there is no tightness in the market (as some observers have claimed), with OPEC+ currently sitting on about 6m bpd of extra supply

Macro

Is This Peak Inflation ?

The insistent chatter about rising prices and rising commodities makes us think we might be close to a top

Macro

A Venezuelan Scenario For Ecuador Seems Averted For Now

The election of center-right Guillermo Lasso as president of Ecuador was well received by the bond market

Macro

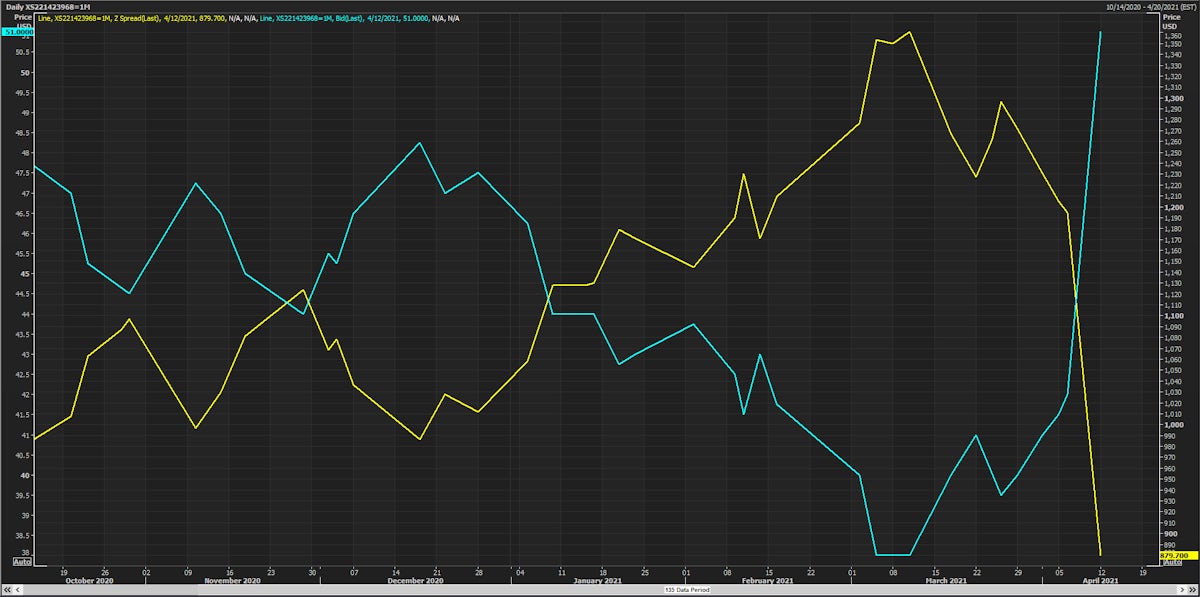

Reality Check: Recent Rates Volatility Is Not A "Reflation Trade"

Inflation expectations have not changed much since the beginning of the year, unlike last year when they were all over the place

Macro

The US Trying to Shake Up Saudi Leadership With The Release Of Intelligence Report

Antony Blinken using the euphemism of a "recalibration" for what seems like a more important policy shift