Markets Currently Pricing In Significant Probability Of Fed Policy Error

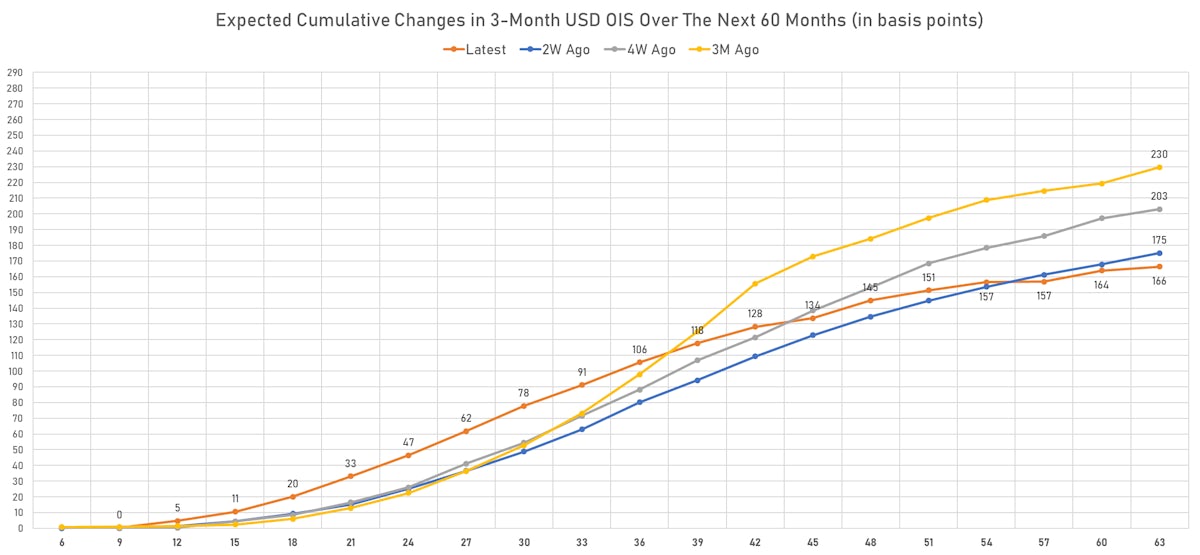

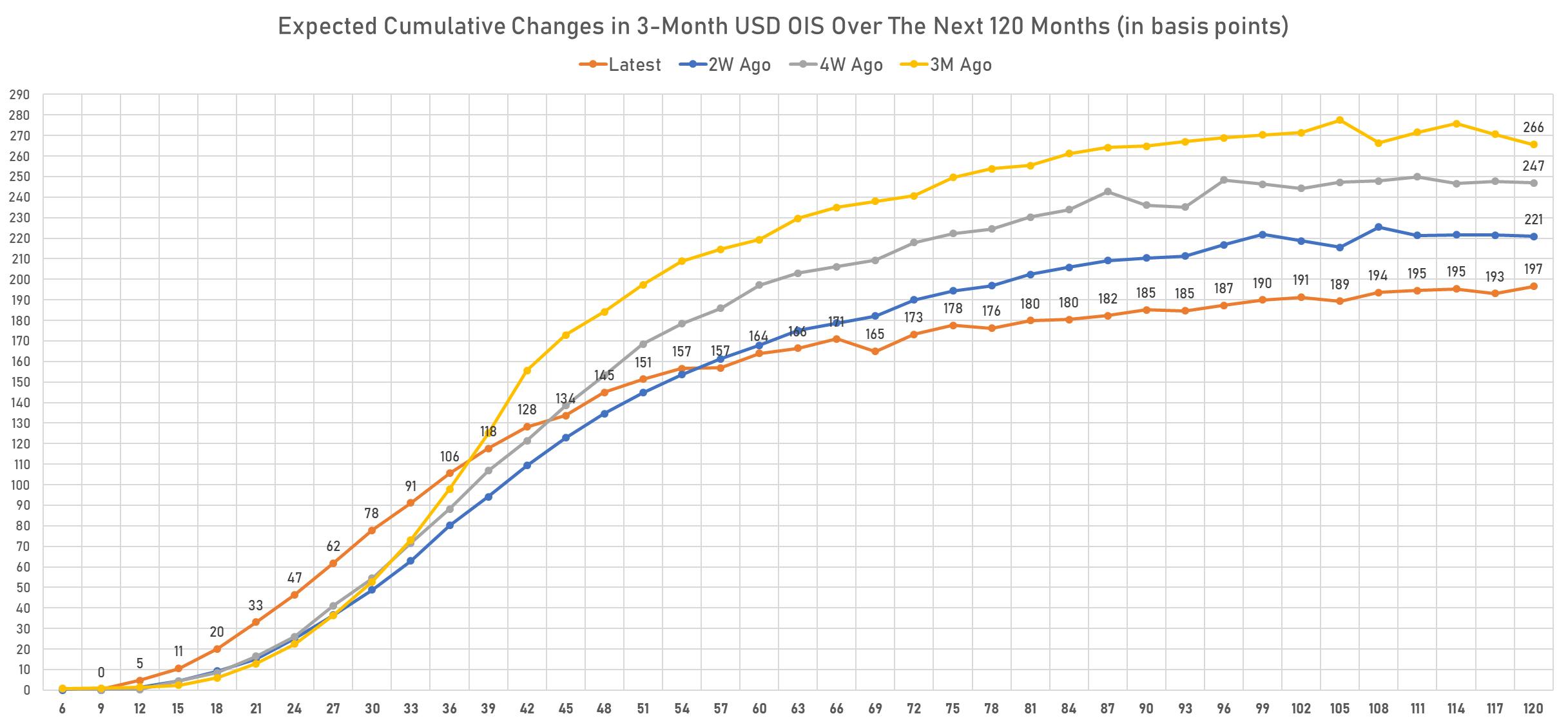

The forward curve of US short-term interest rates shows hikes over the next 4 years followed by years of stagnation, a sign that future economic weakening is a likely consequence of a rapid initial rise in rates

Published ET

Short-term USD rates Over the next 5 years | Sources: ϕpost, Refinitiv data

This is something we have mentioned in passing last week, but thought we should expand on a little bit: the 3-month USD OIS forward curve has changed drastically in the past week, and it is starting to look like the market is pricing in a monetary policy error.

WHAT'S CHANGED?

- The Fed indicated a willingness last week to see rates normalize faster than was previously anticipated

- The forward curve of short-term rates out to 4 years jumped far above the previous forward rates curve (see the chart below)

- Now something that has been less talked about: the forward rates now hit a plateau after 4 years, with a terminal rate that is lower than before

- In short, it means that rates are now seen to rise sooner and faster, and then pretty much stop after 4 years, which begs the question: why ?

POSSIBLE SCENARIOS

- Reflation: if markets expected a big reflationary environment, we would see it both in the forward inflation curve and in the forward rates, but we actually see the opposite: long-term inflation is well-anchored and the terminal interest rate is lower

- Back to normal: if markets expected a long period of continuous medium to high growth with no inflation, we would see rates continue to rise and hit a terminal rate that is markedly higher (the opposite of what we see for rates)

- Policy error: if instead markets expected that a sharp increase in short-term rates would create an economic growth slowdown after a few years, you would see something like what is currently happening: a short-term rate that is no longer moving up after the initial rise

- Fallback into recession (something we don't see right now): short term rates going into reverse after a few years as the economy rolls over

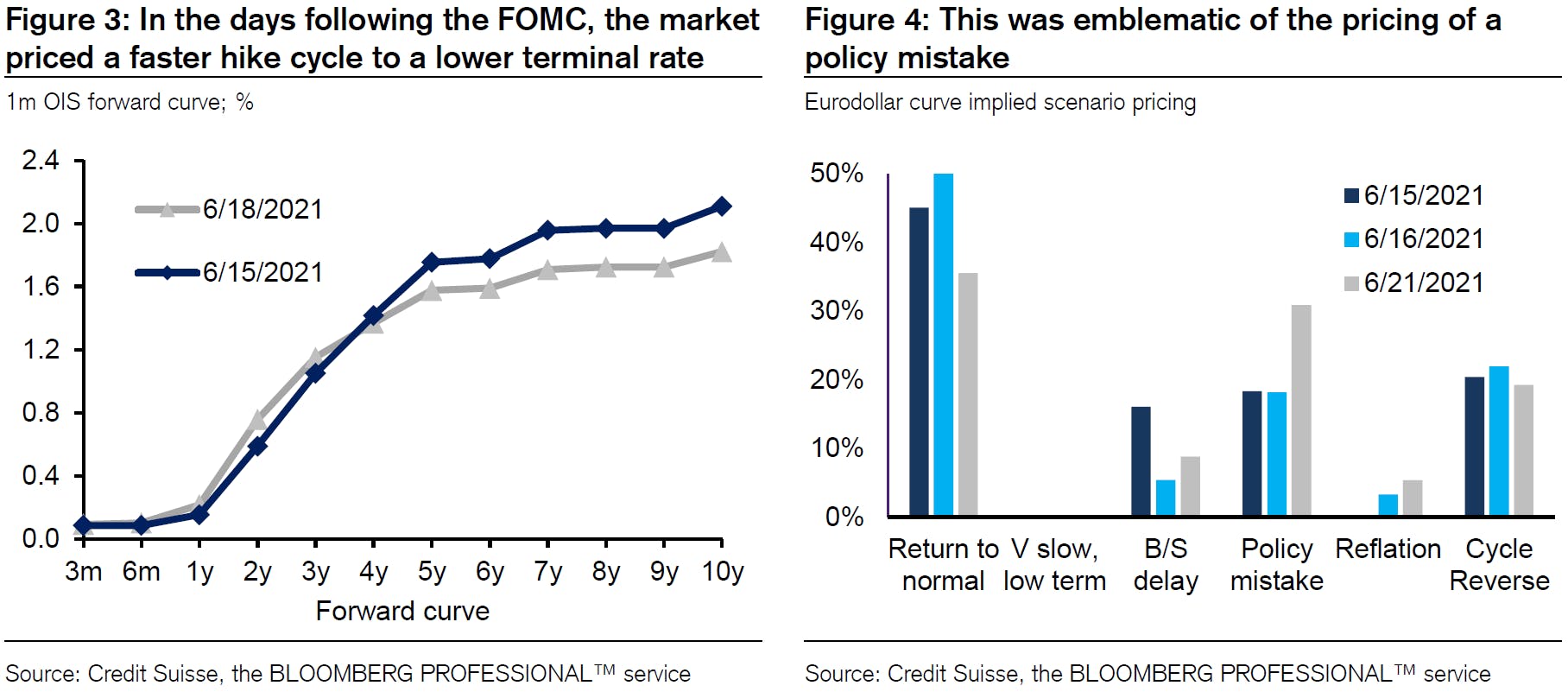

Here is how analysts at Credit Suisse quantified the likelihood of such scenarios using the 1-month USD OIS forward curve (they have a couple more scenarios than we do but it's essentially the same story):

In other words, adding up "cycle reverse" and "policy mistake", the analysts reckon that the market is now pricing in a roughly 50% probability that future economic growth is going to be adversely impacted by rate hikes over the next four years.

Now, we're not there yet, as the Fed hasn't even started tightening or even announced precisely what they are going to do. But a 50% chance is definitely something worth keeping in mind as the new policy unfolds.