Credit

Risk Appetite Returns On Short-Term Volatility Fall: US HY Cash OAS 49bp Tighter This Week

Big week of US$ bond issuance for corporates, led by Walmart and Lowe's: 63 tranches for $53.1bn in IG (2022 YTD volume $989.2bn vs 2021 YTD $1.1tn), 4 tranches for $2.5bn in HY (2022 YTD volume $79.9bn vs 2021 YTD $350.0bn)

Published ET

S&P 500 and CDX HY 5Y Moving In Tandem | Source: Refinitiv

DAILY SUMMARY

- S&P 500 Bond Index was up 0.22% today, with investment grade up 0.18% and high yield up 0.70% (YTD total return: -13.86%)

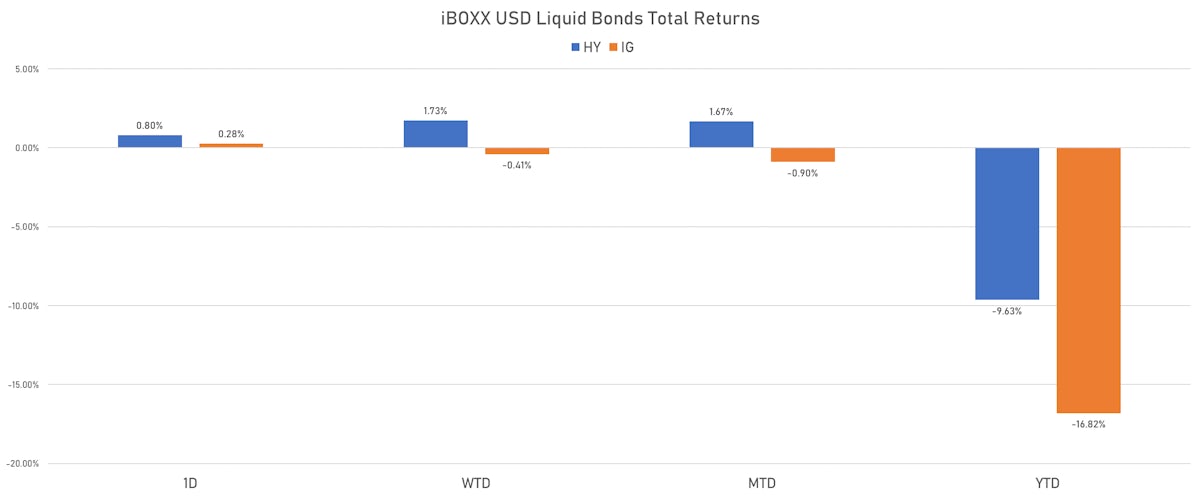

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.276% today (Month-to-date: -0.90%; Year-to-date: -16.82%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.801% today (Month-to-date: 1.67%; Year-to-date: -9.63%)

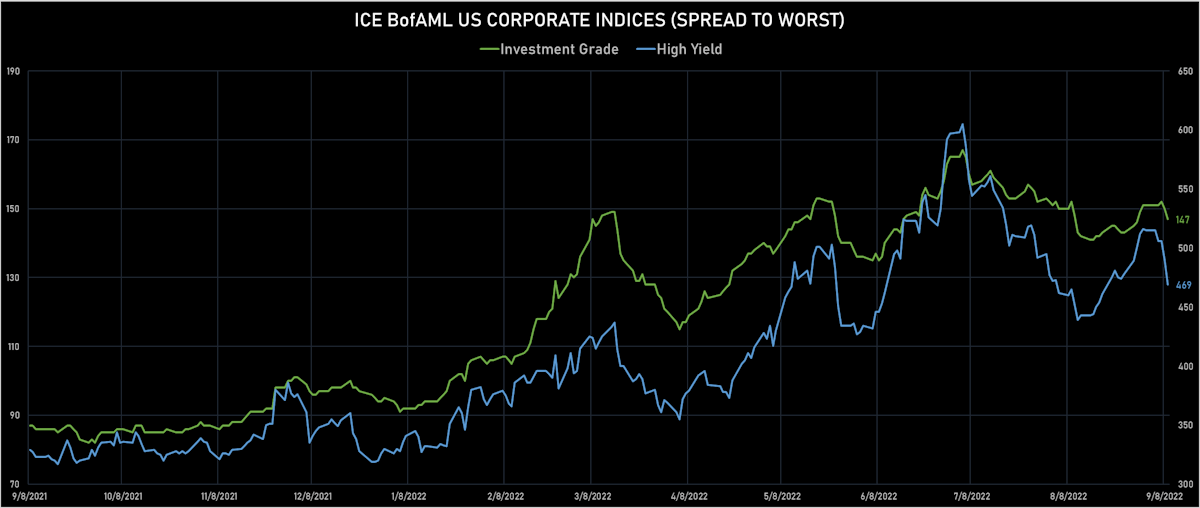

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -3.0 bp, now at 147.0 bp (YTD change: +52.0 bp)

- ICE BofA US High Yield Index spread to worst down -21.0 bp, now at 469.0 bp (YTD change: +139.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.16% today (YTD total return: -1.7%)

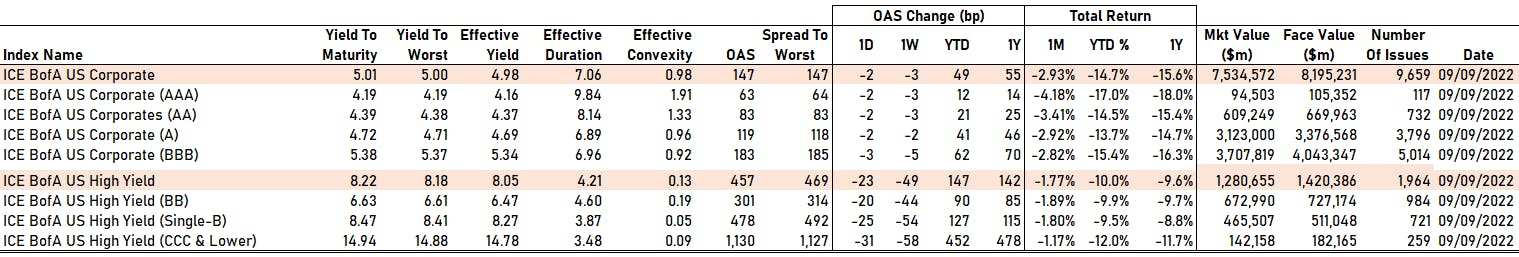

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING TODAY

- AAA down by -2 bp at 63 bp

- AA down by -2 bp at 83 bp

- A down by -2 bp at 119 bp

- BBB down by -3 bp at 183 bp

- BB down by -20 bp at 301 bp

- B down by -25 bp at 478 bp

- CCC down by -31 bp at 1,130 bp

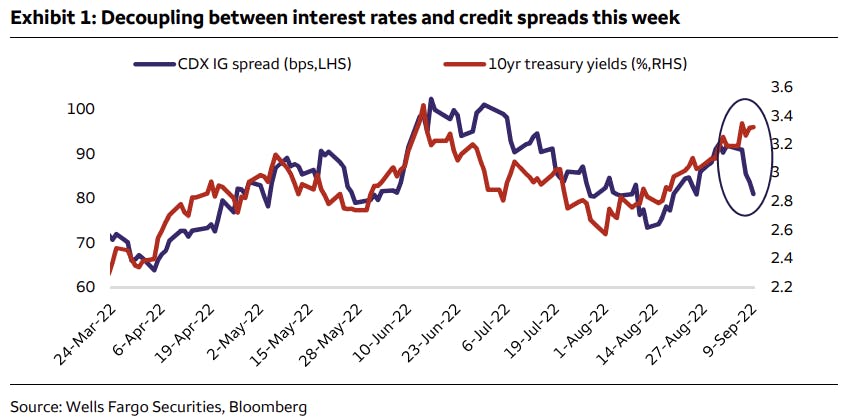

CREDIT SPREADS LIKELY TO RECOUPLE WITH RISE IN RATES

- Despite the technical rebound in credit this week, it's likely to be short-lived, as we pointed out for equities

- Wells Fargo strategists highlighted the decoupling between rates and credit spreads

CDS INDICES TODAY (mid-spreads)

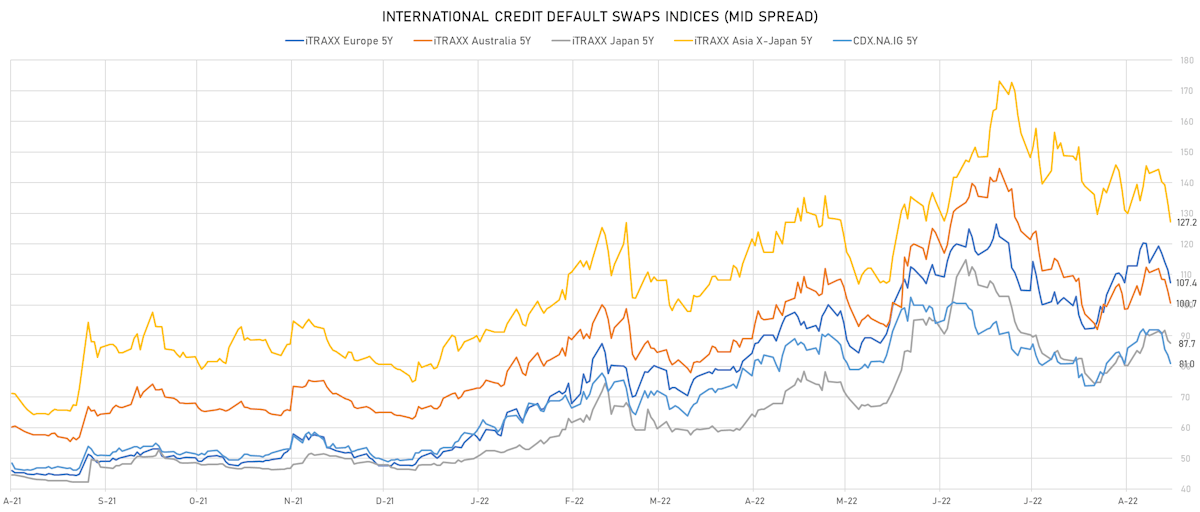

- Markit CDX.NA.IG 5Y down 2.7 bp, now at 81bp (1W change: -11.0bp; YTD change: +31.7bp)

- Markit CDX.NA.IG 10Y down 2.6 bp, now at 117bp (1W change: -10.3bp; YTD change: +28.2bp)

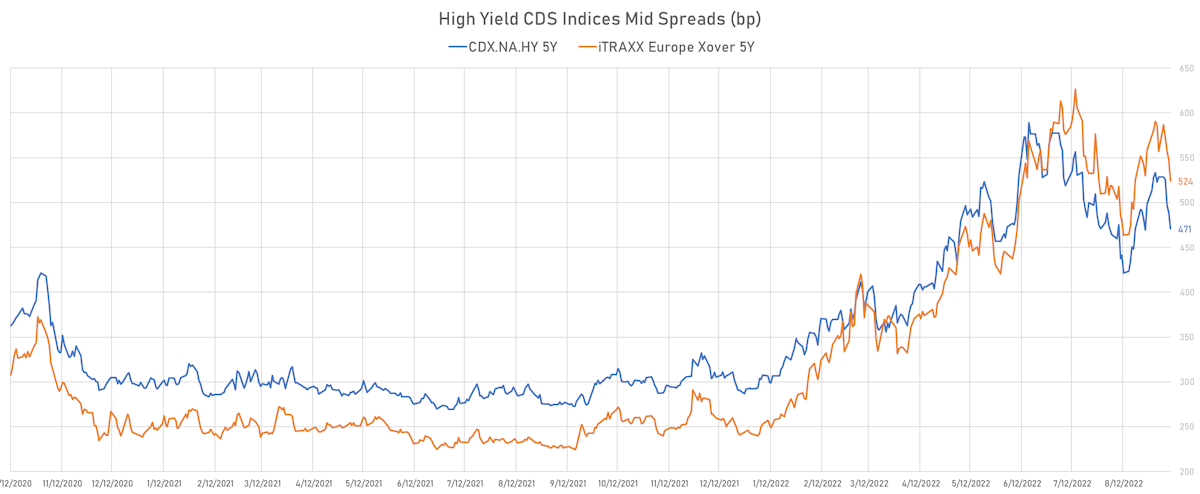

- Markit CDX.NA.HY 5Y down 17.8 bp, now at 471bp (1W change: -57.9bp; YTD change: +178.8bp)

- Markit iTRAXX Europe 5Y down 4.1 bp, now at 107bp (1W change: -6.5bp; YTD change: +59.7bp)

- Markit iTRAXX Europe Crossover 5Y down 23.7 bp, now at 524bp (1W change: -33.0bp; YTD change: +282.1bp)

- Markit iTRAXX Japan 5Y down 0.8 bp, now at 88bp (1W change: -2.5bp; YTD change: +41.2bp)

- Markit iTRAXX Asia Ex-Japan 5Y down 6.1 bp, now at 127bp (1W change: -15.9bp; YTD change: +48.1bp)

5Y USD CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- American Airlines Group Inc (Country: US; rated: B2): down 243.7 bp to 1,268.2bp (1Y range: 607-1,644bp)

- Carnival Corp (Country: US; rated: Ba3): down 210.7 bp to 894.7bp (1Y range: 316-1,583bp)

- United Airlines Holdings Inc (Country: US; rated: CCC+): down 183.4 bp to 740.0bp (1Y range: 104-740bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: B3): down 162.1 bp to 860.5bp (1Y range: 299-1,584bp)

- Rite Aid Corp (Country: US; rated: C): down 140.5 bp to 2,033.7bp (1Y range: 707-3,892bp)

- DISH DBS Corp (Country: US; rated: B2): down 108.6 bp to 1,350.7bp (1Y range: 317-1,506bp)

- Transocean Inc (Country: KY; rated: Caa3): down 106.5 bp to 1,989.8bp (1Y range: 1,019-2,858bp)

- Pactiv LLC (Country: US; rated: Caa1): down 78.7 bp to 616.0bp (1Y range: 363-1,041bp)

- Delta Air Lines Inc (Country: US; rated: A3): down 73.5 bp to 437.5bp (1Y range: 205-573bp)

- Gap Inc (Country: US; rated: Ba2): down 72.0 bp to 610.0bp (1Y range: 132-819bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): down 65.7 bp to 1,219.0bp (1Y range: 304-1,689bp)

- Staples Inc (Country: US; rated: B3): down 64.1 bp to 1,685.0bp (1Y range: 907-1,986bp)

- Beazer Homes USA Inc (Country: US; rated: A3): down 62.0 bp to 668.0bp (1Y range: 278-860bp)

- Nordstrom Inc (Country: US; rated: A3): down 60.3 bp to 573.1bp (1Y range: 212-627bp)

- Calpine Corp (Country: US; rated: LGD5 - 88%): down 59.3 bp to 454.4bp (1Y range: 285-608bp)

5Y EURO CDS SINGLE NAMES - LARGEST MOVES OVER THE PAST WEEK

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 94.1 bp to 1,109.6bp (1Y range: 213-1,197bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 87.4 bp to 970.6bp (1Y range: 359-1,296bp)

- ThyssenKrupp AG (Country: DE; rated: A2): down 56.6 bp to 575.5bp (1Y range: 205-652bp)

- Air France KLM SA (Country: FR; rated: C): down 51.7 bp to 765.1bp (1Y range: 386-990bp)

- Stena AB (Country: SE; rated: B2-PD): down 48.8 bp to 514.9bp (1Y range: 401-865bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 41.5 bp to 449.1bp (1Y range: 107-540bp)

- Premier Foods Finance PLC (Country: GB; rated: Ba3): down 39.6 bp to 363.3bp (1Y range: 154-463bp)

- Deutsche Lufthansa AG (Country: DE; rated: A3): down 39.1 bp to 467.2bp (1Y range: 209-606bp)

- CMA CGM SA (Country: FR; rated: Ba2): down 38.6 bp to 537.5bp (1Y range: 259-648bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 38.3 bp to 786.5bp (1Y range: 333-934bp)

- TUI AG (Country: DE; rated: B3-PD): down 33.3 bp to 1,335.8bp (1Y range: 607-1,641bp)

- Renault SA (Country: FR; rated: A3): down 32.5 bp to 358.6bp (1Y range: 171-476bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 28.4 bp to 366.8bp (1Y range: 164-486bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 28.2 bp to 476.9bp (1Y range: 222-585bp)

- Iceland Bondco PLC (Country: GB; rated: B3): up 59.6 bp to 1,324.0bp (1Y range: 471-1,326bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: WeWork Companies LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 10/7/2025 | Rating: CCC- | ISIN: USU9621PAA94 | Z-spread up by 73.0 bp to 2,026.9 bp, with the yield to worst at 23.4% and the bond now trading down to 62.5 cents on the dollar (1Y price range: 62.5-84.9).

- Issuer: CTR Partnership LP (San Clemente, California (US)) | Coupon: 3.88% | Maturity: 30/6/2028 | Rating: BB | ISIN: USU1268FAB41 | Z-spread down by 72.2 bp to 327.9 bp, with the yield to worst at 6.7% and the bond now trading up to 86.3 cents on the dollar (1Y price range: 83.3-102.9).

- Issuer: NCL Finance Ltd (United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread down by 73.0 bp to 784.0 bp, with the yield to worst at 11.1% and the bond now trading up to 79.0 cents on the dollar (1Y price range: 72.5-99.5).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 7.75% | Maturity: 15/2/2029 | Rating: CCC+ | ISIN: USG6436QAP12 | Z-spread down by 73.0 bp to 813.0 bp, with the yield to worst at 11.4% and the bond now trading up to 82.8 cents on the dollar (1Y price range: 74.5-103.0).

- Issuer: Brinker International Inc (Dallas, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU6223WAB01 | Z-spread down by 76.3 bp to 242.0 bp, with the yield to worst at 6.4% and the bond now trading up to 97.4 cents on the dollar (1Y price range: 91.1-106.8).

- Issuer: Fair Isaac Corp (Bozeman, Montana (US)) | Coupon: 5.25% | Maturity: 15/5/2026 | Rating: BB | ISIN: USU2947RAA78 | Z-spread down by 81.1 bp to 195.8 bp, with the yield to worst at 5.4% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 96.0-110.0).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Z-spread down by 84.4 bp to 264.9 bp, with the yield to worst at 6.0% and the bond now trading up to 94.5 cents on the dollar (1Y price range: 90.0-106.3).

- Issuer: Owens-Brockway Glass Container Inc (Perrysburg, Ohio (US)) | Coupon: 5.38% | Maturity: 15/1/2025 | Rating: B | ISIN: USU6S19GAC10 | Z-spread down by 90.4 bp to 429.1 bp (CDS basis: -95.1bp), with the yield to worst at 7.5% and the bond now trading up to 94.5 cents on the dollar (1Y price range: 92.4-104.1).

- Issuer: Nextera Energy Operating Partners LP (Juno Beach, Florida (US)) | Coupon: 4.25% | Maturity: 15/7/2024 | Rating: BB | ISIN: USU6500TAF22 | Z-spread down by 97.6 bp to 162.9 bp, with the yield to worst at 5.2% and the bond now trading up to 97.6 cents on the dollar (1Y price range: 95.0-103.9).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B | ISIN: USU98347AL87 | Z-spread down by 99.6 bp to 334.8 bp, with the yield to worst at 6.7% and the bond now trading up to 93.4 cents on the dollar (1Y price range: 84.1-102.8).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB+ | ISIN: USU3230LAA45 | Z-spread down by 111.5 bp to 366.0 bp (CDS basis: -160.2bp), with the yield to worst at 7.4% and the bond now trading up to 97.4 cents on the dollar (1Y price range: 93.0-109.5).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread down by 126.3 bp to 294.8 bp, with the yield to worst at 6.2% and the bond now trading up to 95.5 cents on the dollar (1Y price range: 92.0-107.1).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 133.0 bp to 661.3 bp (CDS basis: 635.3bp), with the yield to worst at 10.0% and the bond now trading up to 86.3 cents on the dollar (1Y price range: 83.5-95.6).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 139.7 bp to 807.5 bp, with the yield to worst at 11.4% and the bond now trading up to 83.5 cents on the dollar (1Y price range: 76.5-100.0).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: B | ISIN: USU83854AB29 | Z-spread down by 199.1 bp to 836.9 bp, with the yield to worst at 11.7% and the bond now trading up to 87.5 cents on the dollar (1Y price range: 83.8-102.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.38% | Maturity: 9/5/2030 | Rating: BB- | ISIN: XS2406607171 | Z-spread down by 65.4 bp to 487.8 bp, with the yield to worst at 7.1% and the bond now trading up to 83.7 cents on the dollar (1Y price range: 78.9-98.9).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B+ | ISIN: XS2010037682 | Z-spread down by 68.0 bp to 874.2 bp (CDS basis: 149.1bp), with the yield to worst at 10.7% and the bond now trading up to 87.2 cents on the dollar (1Y price range: 84.6-113.4).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | Z-spread down by 71.6 bp to 452.9 bp, with the yield to worst at 6.7% and the bond now trading up to 83.9 cents on the dollar (1Y price range: 78.6-103.0).

- Issuer: Adler Real Estate AG (Berlin, Germany) | Coupon: 3.00% | Maturity: 27/4/2026 | Rating: CCC | ISIN: XS1713464524 | Z-spread down by 71.9 bp to 1,028.9 bp, with the yield to worst at 10.5% and the bond now trading up to 73.4 cents on the dollar (1Y price range: 60.9-94.5).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | Z-spread down by 75.4 bp to 430.0 bp, with the yield to worst at 6.5% and the bond now trading up to 82.0 cents on the dollar (1Y price range: 76.7-100.4).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread down by 76.6 bp to 433.7 bp, with the yield to worst at 6.6% and the bond now trading up to 75.2 cents on the dollar (1Y price range: 69.8-87.3).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.25% | Maturity: 3/5/2028 | Rating: BB+ | ISIN: XS2399851901 | Z-spread down by 81.9 bp to 469.5 bp, with the yield to worst at 6.9% and the bond now trading up to 78.2 cents on the dollar (1Y price range: 73.0-100.0).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.88% | Maturity: 11/2/2025 | Rating: BB- | ISIN: XS2296201424 | Z-spread down by 82.8 bp to 422.8 bp (CDS basis: -41.0bp), with the yield to worst at 6.1% and the bond now trading up to 92.1 cents on the dollar (1Y price range: 88.2-102.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 3.75% | Maturity: 9/5/2027 | Rating: BB- | ISIN: XS2406607098 | Z-spread down by 91.3 bp to 409.4 bp, with the yield to worst at 6.2% and the bond now trading up to 89.7 cents on the dollar (1Y price range: 82.4-99.6).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.00% | Maturity: 21/9/2025 | Rating: BB+ | ISIN: XS2231715322 | Z-spread down by 93.5 bp to 354.3 bp, with the yield to worst at 5.7% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 87.4-105.2).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread down by 94.1 bp to 455.1 bp, with the yield to worst at 6.7% and the bond now trading up to 81.5 cents on the dollar (1Y price range: 76.3-101.8).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: CCC | ISIN: XS2283225477 | Z-spread down by 95.9 bp to 1,096.8 bp, with the yield to worst at 12.5% and the bond now trading up to 54.3 cents on the dollar (1Y price range: 41.1-84.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread down by 103.8 bp to 390.6 bp, with the yield to worst at 6.1% and the bond now trading up to 83.2 cents on the dollar (1Y price range: 77.1-92.0).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread down by 136.0 bp to 385.4 bp, with the yield to worst at 5.9% and the bond now trading up to 87.5 cents on the dollar (1Y price range: 82.4-100.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 4.50% | Maturity: 1/3/2025 | Rating: BB- | ISIN: XS1813724603 | Z-spread down by 141.9 bp to 320.2 bp, with the yield to worst at 5.3% and the bond now trading up to 97.9 cents on the dollar (1Y price range: 91.6-103.6).

RECENT DOMESTIC USD BOND ISSUES

- Analog Devices Inc (Electronics | Wilmington, Massachusetts, United States | Rating: A-): US$300m Senior Note (US032654AY10), fixed rate (4.25% coupon) maturing on 1 October 2032, priced at 99.36 (original spread of 106 bp), callable (10nc10)

- Citigroup Inc (Banking | New York City, New York, United States | Rating: BBB+): US$150m Senior Note (XS2110100455), fixed rate (4.05% coupon) maturing on 30 September 2027, priced at 100.00, non callable

- Dollar General Corp (Retail Stores - Other | Goodlettsville, Tennessee, United States | Rating: BBB): US$300m Senior Note (US256677AM79), fixed rate (5.50% coupon) maturing on 1 November 2052, priced at 99.90 (original spread of 215 bp), callable (30nc30)

- Dollar General Corp (Retail Stores - Other | Goodlettsville, Tennessee, United States | Rating: BBB): US$700m Senior Note (US256677AL96), fixed rate (5.00% coupon) maturing on 1 November 2032, priced at 99.65 (original spread of 170 bp), callable (10nc10)

- Dollar General Corp (Retail Stores - Other | Goodlettsville, Tennessee, United States | Rating: BBB): US$750m Senior Note (US256677AJ41), fixed rate (4.25% coupon) maturing on 20 September 2024, priced at 99.91 (original spread of 80 bp), with a make whole call

- Dollar General Corp (Retail Stores - Other | Goodlettsville, Tennessee, United States | Rating: BBB): US$550m Senior Note (US256677AK14), fixed rate (4.63% coupon) maturing on 1 November 2027, priced at 99.90 (original spread of 120 bp), callable (5nc5)

- Equifax Inc (Service - Other | Atlanta, Georgia, United States | Rating: BBB): US$750m Senior Note (US294429AV70), fixed rate (5.10% coupon) maturing on 15 December 2027, priced at 99.91 (original spread of 175 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$300m Bond (US3133ENK823), fixed rate (4.13% coupon) maturing on 12 December 2025, priced at 100.00 (original spread of 71 bp), callable (3nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133ENL995), fixed rate (3.38% coupon) maturing on 15 September 2027, priced at 99.52, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$525m Bond (US3133ENL409), fixed rate (3.50% coupon) maturing on 13 September 2024, priced at 99.80 (original spread of 16 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$725m Bond (US3133ENL813), floating rate (SOFR + 9.0 bp) maturing on 16 September 2024, priced at 100.00, non callable

- Federal Home Loan Mortgage Corp (Agency | Mclean, Virginia, United States | Rating: AA+): US$300m Unsecured Note (US3134GXZ641), fixed rate (4.32% coupon) maturing on 21 March 2025, priced at 100.00 (original spread of 87 bp), callable (2nc3m)

- Hudson Pacific Properties LP (Service - Other | Los Angeles, California, United States | Rating: BBB): US$350m Senior Note (US44409MAD83), fixed rate (5.95% coupon) maturing on 15 February 2028, priced at 99.61 (original spread of 265 bp), callable (5nc5)

- Inter-American Development Bank (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$3,000m Senior Note (US4581X0EF19), fixed rate (3.50% coupon) maturing on 14 September 2029, priced at 99.42 (original spread of 22 bp), non callable

- International Finance Corp (Supranational | Washington, Washington Dc, United States | Rating: AAA): US$2,000m Senior Note (US45950KDA51), fixed rate (3.63% coupon) maturing on 15 September 2025, priced at 99.96 (original spread of 13 bp), non callable

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: BBB+): US$3,500m Junior Subordinated Note (US46647PDK93), floating rate maturing on 14 September 2033, priced at 100.00 (original spread of 233 bp), callable (11nc10)

- John Deere Capital Corp (Financial - Other | Reno, Nevada, United States | Rating: A): US$900m Senior Note (US24422EWK18), fixed rate (4.15% coupon) maturing on 15 September 2027, priced at 99.83 (original spread of 75 bp), non callable

- John Deere Capital Corp (Financial - Other | Reno, Nevada, United States | Rating: A): US$600m Senior Note (US24422EWL90), fixed rate (4.35% coupon) maturing on 15 September 2032, priced at 99.73 (original spread of 105 bp), non callable

- John Deere Capital Corp (Financial - Other | Reno, Nevada, United States | Rating: A): US$750m Senior Note (US24422EWJ45), fixed rate (4.05% coupon) maturing on 8 September 2025, priced at 99.95 (original spread of 50 bp), non callable

- Lowe's Companies Inc (Retail Stores - Other | Mooresville, North Carolina, United States | Rating: BBB+): US$1,500m Senior Note (US548661EM57), fixed rate (5.63% coupon) maturing on 15 April 2053, priced at 99.64 (original spread of 242 bp), callable (31nc30)

- Lowe's Companies Inc (Retail Stores - Other | Mooresville, North Carolina, United States | Rating: BBB+): US$1,250m Senior Note (US548661EL74), fixed rate (5.00% coupon) maturing on 15 April 2033, priced at 99.75 (original spread of 171 bp), callable (11nc10)

- Lowe's Companies Inc (Retail Stores - Other | Mooresville, North Carolina, United States | Rating: BBB+): US$1,000m Senior Note (US548661EK91), fixed rate (4.40% coupon) maturing on 8 September 2025, priced at 99.98 (original spread of 85 bp), with a make whole call

- Lowe's Companies Inc (Retail Stores - Other | Mooresville, North Carolina, United States | Rating: BBB+): US$1,000m Senior Note (US548661EN31), fixed rate (5.80% coupon) maturing on 15 September 2062, priced at 99.24 (original spread of 278 bp), callable (40nc40)

- Marriott International Inc (Lodging | Bethesda, United States | Rating: BBB-): US$1,000m Senior Note (US571903BJ14), fixed rate (5.00% coupon) maturing on 15 October 2027, priced at 99.13 (original spread of 175 bp), callable (5nc5)

- McDonald's Corp (Restaurants | Chicago, United States | Rating: BBB+): US$750m Senior Note (US58013MFS89), fixed rate (4.60% coupon) maturing on 9 September 2032, priced at 99.56 (original spread of 133 bp), callable (10nc10)

- McDonald's Corp (Restaurants | Chicago, Illinois, United States | Rating: BBB+): US$750m Senior Note (US58013MFT62), fixed rate (5.15% coupon) maturing on 9 September 2052, priced at 99.61 (original spread of 198 bp), callable (30nc30)

- Mondelez International Holdings Netherlands BV (Food Processors | Oosterhout, United States | Rating: BBB): US$500m Senior Note (US60920LAS34), fixed rate (4.25% coupon) maturing on 15 September 2025, priced at 99.68 (original spread of 80 bp), with a make whole call

- Newell Brands Inc (Consumer Products | Atlanta, Georgia, United States | Rating: BBB-): US$500m Senior Note (US651229BD74), fixed rate (6.63% coupon) maturing on 15 September 2029, priced at 100.00 (original spread of 323 bp), callable (7nc7)

- Northwestern Mutual Global Funding (Financial - Other | New Castle, United States | Rating: AA+): US$700m Note (US66815M2K28), fixed rate (4.35% coupon) maturing on 15 September 2027, priced at 99.96 (original spread of 98 bp), non callable

- NortonLifeLock Inc (Information/Data Technology | Tempe, Arizona, United States | Rating: BB-): US$900m Senior Note (US668771AK49), fixed rate (6.75% coupon) maturing on 30 September 2027, priced at 100.00 (original spread of 334 bp), callable (5nc2)

- NortonLifeLock Inc (Information/Data Technology | Tempe, United States | Rating: BB-): US$600m Senior Note (US668771AL22), fixed rate (7.13% coupon) maturing on 30 September 2030, priced at 100.00 (original spread of 386 bp), callable (8nc3)

- Oncor Electric Delivery Company LLC (Utility - Other | Dallas, Texas, United States | Rating: A): US$500m Senior Note (US68233JCL61), fixed rate (4.95% coupon) maturing on 15 September 2052, priced at 99.53 (original spread of 172 bp), callable (30nc30)

- Oncor Electric Delivery Company LLC (Utility - Other | Dallas, Texas, United States | Rating: A): US$700m Note (US68233JCJ16), fixed rate (4.55% coupon) maturing on 15 September 2032, priced at 99.90 (original spread of 123 bp), callable (10nc10)

- Owl Rock Core Income Corp (Financial - Other | New York City, New York, United States | Rating: BBB-): US$600m Senior Note (US69120VAN10), fixed rate (7.75% coupon) maturing on 16 September 2027, priced at 99.74 (original spread of 438 bp), callable (5nc5)

- Pacific Lifecorp (Life Insurance | Newport Beach, United States | Rating: A-): US$750m Senior Note (US694476AF99), fixed rate (5.40% coupon) maturing on 15 September 2052, priced at 99.85 (original spread of 195 bp), callable (30nc30)

- Southern Company Gas Capital Corp (Financial - Other | Atlanta, Georgia, United States | Rating: BBB+): US$500m Senior Note (US8426EPAF56), fixed rate (5.15% coupon) maturing on 15 September 2032, priced at 99.72 (original spread of 185 bp), callable (10nc10)

- Stellantis Finance US Inc (Financial - Other | Auburn Hills, Michigan, United States | Rating: BBB): US$550m Senior Note (US85855CAD20), fixed rate (5.63% coupon) maturing on 12 January 2028, priced at 99.50 (original spread of 238 bp), callable (5nc5)

- Stellantis Finance US Inc (Financial - Other | Auburn Hills, Michigan, United States | Rating: BBB): US$700m Senior Note (USU85861AE97), fixed rate (6.38% coupon) maturing on 12 September 2032, priced at 99.91 (original spread of 313 bp), callable (10nc10)

- Target Corp (Retail Stores - Other | Minneapolis, Minnesota, United States | Rating: A): US$1,000m Senior Note (US87612EBP07), fixed rate (4.50% coupon) maturing on 15 September 2032, priced at 99.82 (original spread of 120 bp), callable (10nc10)

- Tennessee Valley Authority (Agency | Knoxville, Tennessee, United States | Rating: AAA): US$500m Senior Note (US880591EY48), fixed rate (4.25% coupon) maturing on 15 September 2052, priced at 96.79 (original spread of 100 bp), non callable

- Union Pacific Corp (Railroads | Omaha, Nebraska, United States | Rating: A-): US$600m Senior Note (US907818GC65), fixed rate (4.95% coupon) maturing on 9 September 2052, priced at 99.34 (original spread of 176 bp), callable (30nc30)

- Union Pacific Corp (Railroads | Omaha, Nebraska, United States | Rating: A-): US$400m Senior Note (US907818GD49), fixed rate (5.15% coupon) maturing on 20 January 2063, priced at 99.28 (original spread of 207 bp), callable (40nc40)

- Union Pacific Corp (Railroads | Omaha, Nebraska, United States | Rating: A-): US$900m Senior Note (US907818GB82), fixed rate (4.50% coupon) maturing on 20 January 2033, priced at 99.66 (original spread of 120 bp), callable (10nc10)

- Walmart Inc (Retail Stores - Other | Bentonville, Arkansas, United States | Rating: AA): US$1,000m Senior Note (US931142EX77), fixed rate (3.95% coupon) maturing on 9 September 2027, priced at 99.78 (original spread of 55 bp), callable (5nc5)

- Walmart Inc (Retail Stores - Other | Bentonville, Arkansas, United States | Rating: AA): US$1,750m Senior Note (US931142EW94), fixed rate (3.90% coupon) maturing on 9 September 2025, priced at 99.93 (original spread of 35 bp), with a make whole call

- Walmart Inc (Retail Stores - Other | Bentonville, Arkansas, United States | Rating: AA): US$1,250m Senior Note (US931142EY50), fixed rate (4.15% coupon) maturing on 9 September 2032, priced at 99.69 (original spread of 85 bp), callable (10nc10)

- Walmart Inc (Retail Stores - Other | Bentonville, Arkansas, United States | Rating: AA): US$1,000m Senior Note (US931142EZ26), fixed rate (4.50% coupon) maturing on 9 September 2052, priced at 99.95 (original spread of 129 bp), callable (30nc30)

- Wayfair Inc (Retail Stores - Other | Boston, Massachusetts, United States | Rating: NR): US$600m Bond (US94419LAN10), fixed rate (3.25% coupon) maturing on 15 September 2027, priced at 100.00, non callable, convertible

RECENT INTERNATIONAL USD BOND ISSUES

- Abu Dhabi Commercial Bank PJSC (Banking | Abu Dhabi, United Arab Emirates | Rating: A+): US$500m Senior Note (XS2530757082), fixed rate (4.50% coupon) maturing on 14 September 2027, priced at 99.80 (original spread of 115 bp), non callable

- Aon Corp (Financial - Other | Chicago, Illinois, Ireland | Rating: BBB): US$500m Senior Note (US03740LAF94), fixed rate (5.00% coupon) maturing on 12 September 2032, priced at 99.92 (original spread of 175 bp), callable (10nc10)

- Asian Infrastructure Investment Bank (Supranational | Beijing, Beijing, China (Mainland) | Rating: AAA): US$2,000m Senior Note (US04522KAH95), fixed rate (3.75% coupon) maturing on 14 September 2027, priced at 99.72 (original spread of 44 bp), non callable

- Banco Bilbao Vizcaya Argentaria SA (Banking | Madrid, Madrid, Spain | Rating: BBB+): US$1,000m Note (US05946KAK79), fixed rate (5.86% coupon) maturing on 14 September 2026, priced at 100.00 (original spread of 233 bp), callable (4nc3)

- Banco Bilbao Vizcaya Argentaria SA (Banking | Madrid, Madrid, Spain | Rating: BBB+): US$750m Note (US05946KAL52), fixed rate (6.14% coupon) maturing on 14 September 2028, priced at 100.00 (original spread of 280 bp), callable (6nc5)

- Bank of Montreal (Banking | Toronto, Canada | Rating: A-): US$1,000m Senior Note (US06368LAQ95), fixed rate (4.70% coupon) maturing on 14 September 2027, priced at 99.96 (original spread of 135 bp), callable (5nc5)

- Bank of Montreal (Banking | Toronto, Canada | Rating: A-): US$1,500m Senior Note (US06368LAP13), fixed rate (4.25% coupon) maturing on 14 September 2024, priced at 99.94 (original spread of 85 bp), with a make whole call

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: A-): US$150m Hypothekenpfandbrief (Covered Bond) (XS2533544701), fixed rate (4.20% coupon) maturing on 16 September 2024, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0459906649), fixed rate (3.60% coupon) maturing on 3 October 2024, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): US$500m Note (XS0459908264), floating rate maturing on 29 September 2026, priced at 100.00, non callable

- Deutsche Bank AG (New York Branch) (Banking | New York City, New York, Germany | Rating: A-): US$400m Note (US25160PAM95), fixed rate (5.37% coupon) maturing on 9 September 2027, priced at 100.00 (original spread of 203 bp), non callable

- Export Finance and Insurance Corp (Agency | Sydney, New South Wales, Australia | Rating: AAA): US$500m Unsecured Note (XS2532604597), fixed rate (1.00% coupon) maturing on 5 October 2032, priced at 100.00, non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$500m Senior Note (US302154DS58), fixed rate (4.50% coupon) maturing on 15 September 2032, priced at 99.67 (original spread of 120 bp), non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$1,000m Senior Note (US302154DR75), fixed rate (4.25% coupon) maturing on 15 September 2027, priced at 99.56 (original spread of 90 bp), non callable

- Export-Import Bank of Korea (Agency | Seoul, Seoul, South Korea | Rating: AA-): US$1,000m Senior Note (US302154DP10), fixed rate (4.00% coupon) maturing on 15 September 2024, priced at 99.89 (original spread of 55 bp), non callable

- Ganzhou Urban Investment Holdings Group Co Ltd (Service - Other | Ganzhou, China (Mainland) | Rating: BBB-): US$250m Senior Note (XS2499580269), fixed rate (6.00% coupon) maturing on 14 September 2025, priced at 100.00, non callable

- ITC Holdings Corp (Utility - Other | Novi, Michigan, Canada | Rating: BBB+): US$600m Senior Note (US465685AR63), fixed rate (4.95% coupon) maturing on 22 September 2027, priced at 99.90 (original spread of 158 bp), callable (5nc5)

- Indonesia, Republic of (Government) (Sovereign | Jakarta Pusat, Dki Jakarta, Indonesia | Rating: BBB): US$500m Senior Note (US455780DP83), fixed rate (5.45% coupon) maturing on 20 September 2052, priced at 98.55 (original spread of 203 bp), callable (30nc30)

- Indonesia, Republic of (Government) (Sovereign | Jakarta Pusat, Dki Jakarta, Indonesia | Rating: BBB): US$750m Bond (US455780DM52), fixed rate (4.15% coupon) maturing on 20 September 2027, priced at 98.89 (original spread of 95 bp), callable (5nc5)

- Indonesia, Republic of (Government) (Sovereign | Jakarta Pusat, Dki Jakarta, Indonesia | Rating: BBB): US$1,400m Bond (US455780DN36), fixed rate (4.65% coupon) maturing on 20 September 2032, priced at 98.82 (original spread of 145 bp), callable (10nc10)

- Japan Bank for International Cooperation (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): US$1,500m Bond (US471048CT36), fixed rate (3.88% coupon) maturing on 16 September 2025, priced at 99.73 (original spread of 59 bp), non callable

- Johnson Controls International PLC (Service - Other | Cork, Ireland | Rating: BBB): US$400m Senior Note (US47837RAE09), fixed rate (4.90% coupon) maturing on 1 December 2032, priced at 98.51 (original spread of 175 bp), callable (10nc10)

- Mitsubishi HC Capital Inc (Leasing | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$500m Senior Note (USJ4395BBC30), fixed rate (5.08% coupon) maturing on 15 September 2027, priced at 100.00 (original spread of 168 bp), with a make whole call

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$400m Senior Note (US606822CP74), floating rate (SOFR + 138.5 bp) maturing on 12 September 2025, priced at 100.00, callable (3nc2)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$2,000m Senior Note (US606822CQ57), fixed rate (5.06% coupon) maturing on 12 September 2025, priced at 100.00 (original spread of 155 bp), callable (3nc2)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$1,250m Senior Note (US606822CN27), fixed rate (5.35% coupon) maturing on 13 September 2028, priced at 100.00 (original spread of 199 bp), callable (6nc5)

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$750m Senior Note (US606822CR31), fixed rate (5.47% coupon) maturing on 13 September 2033, priced at 100.00 (original spread of 213 bp), callable (11nc10)

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): US$1,000m Senior Note (US60687YCL11), fixed rate (5.41% coupon) maturing on 13 September 2028, priced at 100.00 (original spread of 205 bp), callable (6nc5)

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$750m Senior Note (US60687YCM93), fixed rate (5.67% coupon) maturing on 13 September 2033, priced at 100.00 (original spread of 240 bp), callable (11nc10)

- Nestle Holdings Inc (Consumer Products | Arlington, Switzerland | Rating: AA-): US$500m Senior Note (US641062BC76), fixed rate (4.25% coupon) maturing on 1 October 2029, priced at 99.91 (original spread of 85 bp), callable (7nc7)

- Nestle Holdings Inc (Consumer Products | Arlington, Switzerland | Rating: AA-): US$1,250m Senior Note (US641062BD59), fixed rate (4.30% coupon) maturing on 1 October 2032, priced at 99.67 (original spread of 100 bp), callable (10nc10)

- Nestle Holdings Inc (Consumer Products | Arlington, Switzerland | Rating: AA-): US$750m Senior Note (US641062BA11), fixed rate (4.00% coupon) maturing on 12 September 2025, priced at 99.97 (original spread of 45 bp), with a make whole call

- Nestle Holdings Inc (Consumer Products | Arlington, Virginia, Switzerland | Rating: AA-): US$1,000m Senior Note (USU74078CV30), fixed rate (4.70% coupon) maturing on 15 January 2053, priced at 99.61 (original spread of 153 bp), callable (30nc30)

- Nestle Holdings Inc (Consumer Products | Arlington, Virginia, Switzerland | Rating: AA-): US$500m Senior Note (US641062BB93), fixed rate (4.13% coupon) maturing on 1 October 2027, priced at 99.93 (original spread of 70 bp), callable (5nc5)

- Norinchukin Bank (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): US$500m Senior Note (US656029AK10), fixed rate (5.07% coupon) maturing on 14 September 2032, priced at 100.00 (original spread of 180 bp), non callable

- Norinchukin Bank (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): US$500m Senior Note (US656029AJ47), fixed rate (4.87% coupon) maturing on 14 September 2027, priced at 100.00 (original spread of 150 bp), non callable

- ORIX Corp (Leasing | Minato-Ku, Tokyo-To, Japan | Rating: A-): US$500m Senior Note (US686330AQ49), fixed rate (5.00% coupon) maturing on 13 September 2027, priced at 99.82 (original spread of 160 bp), non callable

- ORIX Corp (Leasing | Minato-Ku, Tokyo-To, Japan | Rating: A-): US$500m Senior Note (US686330AR22), fixed rate (5.20% coupon) maturing on 13 September 2032, priced at 99.71 (original spread of 190 bp), non callable

- Qinglun International (BVI) Co Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): US$400m Bond (XS2480855258), fixed rate (5.45% coupon) maturing on 16 September 2025, priced at 100.00, non callable

- SNB Funding Ltd (Financial - Other | George Town, Saudi Arabia | Rating: NR): US$325m Senior Note (XS2529291002), floating rate (SOFR + 120.0 bp) maturing on 7 September 2027, priced at 100.00, non callable

- Santander Holdings USA Inc (Banking | Boston, Spain | Rating: BBB-): US$500m Senior Note (US80282KBE55), floating rate maturing on 9 September 2026, priced at 100.00 (original spread of 219 bp), callable (4nc3)

- Single Platform Investment Repackaging Entity SA (Financial - Other | Senningerberg, Netherlands | Rating: NR): US$289m Unsecured Note (XS2533114877) zero coupon maturing on 20 June 2052, priced at 34.62, non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): US$500m Senior Note (USJ7771YNJ21), fixed rate (4.80% coupon) maturing on 15 September 2025, priced at 99.97 (original spread of 125 bp), non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): US$500m Senior Note (USJ7771YNL76), fixed rate (4.95% coupon) maturing on 15 September 2027, priced at 99.79 (original spread of 155 bp), non callable

- Suqian Economic Development Group Co Ltd (Financial - Other | Suqian, Jiangsu, China (Mainland) | Rating: NR): US$145m Senior Note (XS2508584773), fixed rate (6.50% coupon) maturing on 14 September 2025, priced at 100.00, non callable

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): US$1,500m Senior Note (US89115A2J08), fixed rate (4.29% coupon) maturing on 13 September 2024, priced at 100.00 (original spread of 80 bp), with a make whole call

- Toronto-Dominion Bank (Banking | Toronto, Ontario, Canada | Rating: A): US$1,500m Senior Note (US89115A2H42), fixed rate (4.69% coupon) maturing on 15 September 2027, priced at 100.00 (original spread of 130 bp), with a make whole call

- Xcent Trade and Investment Ltd (Financial - Other | Mauritius | Rating: NR): US$535m Bond (XS2502364255), fixed rate (12.07% coupon) maturing on 9 September 2024, priced at 100.00, non callable

- Zhaohai Investment BVI Ltd (Financial - Other | China (Mainland) | Rating: NR): US$144m Bond (XS2530767123), fixed rate (5.60% coupon) maturing on 14 September 2025, priced at 100.00, non callable

- Zhengzhou Real Estate Group Co Ltd (Home Builders | Zhengzhou, Henan, China (Mainland) | Rating: BBB+): US$350m Senior Note (XS2502717601), fixed rate (5.10% coupon) maturing on 13 September 2025, priced at 100.00 (original spread of 168 bp), non callable

SELECTED RECENT EUR BOND ISSUES

- ABANCA Corporacion Bancaria SA (Banking | Betanzos, La Coruna, Spain | Rating: BBB-): €500m Bond (ES0265936031), floating rate maturing on 14 September 2028, priced at 99.72 (original spread of 361 bp), callable (6nc5)

- Aareal Bank AG (Banking | Wiesbaden, Hessen, Germany | Rating: A-): €625m Hypothekenpfandbrief (Covered Bond) (DE000AAR0363), fixed rate (2.38% coupon) maturing on 14 September 2029, priced at 99.40 (original spread of 111 bp), non callable

- African Development Bank (Supranational | Abidjan, Ivory Coast | Rating: AAA): €1,250m Senior Note (XS2532472235), fixed rate (2.25% coupon) maturing on 14 September 2029, priced at 99.62 (original spread of 102 bp), non callable

- Air Liquide Finance SA (Financial - Other | Paris, France | Rating: AAA): €600m Senior Note (FR001400CND2), fixed rate (2.88% coupon) maturing on 16 September 2032, priced at 99.09 (original spread of 130 bp), callable (10nc10)

- Autobahnen Und Schnellstrassen finanzierungs AG (Agency | Wien, Wien, Austria | Rating: AA+): €600m Senior Note (XS2532310682), fixed rate (2.13% coupon) maturing on 13 September 2028, priced at 99.41 (original spread of 89 bp), non callable

- Banco BPM SpA (Banking | Verona, Verona, Italy | Rating: BB): €500m Senior Note (XS2530053789), fixed rate (6.00% coupon) maturing on 13 September 2026, priced at 99.65 (original spread of 493 bp), non callable

- Bank Gospodarstwa Krajowego (Agency | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): €600m Senior Note (XS2530208490), fixed rate (4.00% coupon) maturing on 8 September 2027, priced at 99.75 (original spread of 275 bp), non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €750m Bond (FR001400CMZ7), fixed rate (3.63% coupon) maturing on 14 September 2032, priced at 99.38 (original spread of 211 bp), non callable

- Banque Federative du Credit Mutuel SA (Banking | Strasbourg, Grand Est, France | Rating: A+): €1,500m Bond (FR001400CMY0), fixed rate (3.13% coupon) maturing on 14 September 2027, priced at 99.70 (original spread of 190 bp), non callable

- Barclays Bank Ireland PLC (Banking | Dublin, United Kingdom | Rating: A): €350m Unsecured Note (XS2171218683), floating rate maturing on 23 September 2024, priced at 100.00, non callable

- Bausparkasse Schwaebisch Hall AG (Luxembourg Branch) (Banking | Strassen, Luxembourg | Rating: AAA): €500m Hypothekenpfandbrief (Covered Bond) (DE000A30VN02), fixed rate (2.38% coupon) maturing on 13 September 2029, priced at 99.85 (original spread of 105 bp), non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000BLB9SC0), fixed rate (3.05% coupon) maturing on 13 September 2027, priced at 99.82, non callable

- Bayerische Landesbank (Banking | Muenchen, Bayern, Germany | Rating: A-): €200m Inhaberschuldverschreibung (DE000BLB9SD8), floating rate (EU06MLIB + 83.0 bp) maturing on 13 September 2029, priced at 100.00, non callable

- Compagnie de Financement Foncier SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,250m Obligation de Financement de l'Habitat (Covered Bond) (FR001400CM22), fixed rate (2.38% coupon) maturing on 15 March 2030, priced at 99.18 (original spread of 111 bp), non callable

- Credit Mutuel Arkea SA (Banking | Le Relecq-Kerhuon, Bretagne, France | Rating: AA-): €1,000m Note (FR001400CQ85), fixed rate (3.38% coupon) maturing on 19 September 2027, priced at 99.91 (original spread of 197 bp), non callable

- Danske Kiinnitysluottopankki Oyj (Mortgage Banking | Helsinki, Etela-Suomen, Denmark | Rating: AAA): €1,250m Covered Bond (Other) (XS2531929094), fixed rate (2.13% coupon) maturing on 16 September 2025, priced at 99.78 (original spread of 120 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U8B4), fixed rate (1.80% coupon) maturing on 29 September 2025, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000DB9U8C2), floating rate maturing on 29 September 2027, priced at 100.00, non callable

- ENEL Finance International NV (Financial - Other | Amsterdam, Noord-Holland, Italy | Rating: BBB+): €1,000m Senior Note (XS2531420656), fixed rate (3.88% coupon) maturing on 9 March 2029, priced at 99.63 (original spread of 255 bp), callable (7nc6)

- Ferrovie dello Stato Italiane SpA (Agency | Rome, Roma, Italy | Rating: BBB): €1,100m Senior Note (XS2532681074), fixed rate (3.75% coupon) maturing on 14 April 2027, priced at 99.62 (original spread of 246 bp), non callable

- Finsbury Castle DAC (Financial - Other | Dublin, Ireland | Rating: NR): €200m Unsecured Note (XS2533211483) zero coupon maturing on 9 September 2024, non callable

- France, Republic of (Government) (Sovereign | Paris, Ile-De-France, France | Rating: AA): €5,000m Obligation Assimilable du Tresor (FR001400CMX2), fixed rate (2.50% coupon) maturing on 25 May 2043, priced at 98.47 (original spread of 87 bp), non callable

- Henkel AG & Co KGaA (Conglomerate/Diversified Mfg | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: A): €650m Senior Note (XS2530219349), fixed rate (2.63% coupon) maturing on 13 September 2027, priced at 99.65 (original spread of 140 bp), callable (5nc5)

- ING Diba AG (Banking | Frankfurt, Hessen, Netherlands | Rating: A): €1,000m Hypothekenpfandbrief Jumbo (Covered Bond) (DE000A2YNWB9), fixed rate (2.38% coupon) maturing on 13 September 2030, priced at 99.60 (original spread of 103 bp), non callable

- Islandsbanki hf (Banking | Kopavogur, Iceland | Rating: BBB): €300m Unsecured Note (XS2530443659), fixed rate (1.00% coupon) maturing on 13 September 2027, priced at 100.00, non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €6,000m Buono del Tesoro Poliennali (IT0005508590), fixed rate (4.00% coupon) maturing on 30 April 2035, priced at 99.73 (original spread of 247 bp), non callable

- John Deere Bank SA (Banking | Luxembourg, United States | Rating: A): €600m Senior Note (XS2531438351), fixed rate (2.50% coupon) maturing on 14 September 2026, priced at 99.90 (original spread of 135 bp), non callable

- La Poste SA (Agency | Paris, Ile-De-France, France | Rating: A+): €600m Bond (FR001400CN54), fixed rate (2.63% coupon) maturing on 14 September 2028, priced at 99.32 (original spread of 141 bp), non callable

- La Poste SA (Agency | Paris, Ile-De-France, France | Rating: A+): €600m Bond (FR001400CN47), fixed rate (3.13% coupon) maturing on 14 March 2033, priced at 99.07 (original spread of 157 bp), non callable

- Macquarie Bank Ltd (Banking | Sydney, New South Wales, Australia | Rating: A): €600m Covered Bond (Other) (XS2531803828), fixed rate (2.57% coupon) maturing on 15 September 2027, priced at 100.00 (original spread of 133 bp), non callable

- Neoen SA (Utility - Other | Paris, Ile-De-France, France | Rating: NR): €300m Bond (FR001400CMS2), fixed rate (2.88% coupon) maturing on 14 September 2027, priced at 100.00, non callable, convertible

- Nordea Kiinnitysluottopankki Oyj (Banking | Helsinki, Etela-Suomen, Finland | Rating: NR): €1,000m Covered Bond (Other) (XS2532376949), fixed rate (2.50% coupon) maturing on 14 September 2032, priced at 99.35 (original spread of 92 bp), non callable

- OP Yrityspankki Oyj (Banking | Helsinki, Etela-Suomen, Finland | Rating: AA-): €1,250m Note (XS2530506752), fixed rate (2.88% coupon) maturing on 15 December 2025, priced at 99.96 (original spread of 180 bp), non callable

- Orsted A/S (Service - Other | Fredericia, Denmark | Rating: BBB+): €900m Senior Note (XS2531569965), fixed rate (3.25% coupon) maturing on 13 September 2031, priced at 99.98 (original spread of 171 bp), callable (9nc9)

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A+): €1,500m Covered Bond (Other) (XS2531567753), fixed rate (2.38% coupon) maturing on 13 September 2027, priced at 99.85 (original spread of 120 bp), non callable

- SKF AB (Machinery | Goeteborg, Vastra Gotalands, Sweden | Rating: BBB+): €400m Senior Note (XS2532247892), fixed rate (3.13% coupon) maturing on 14 September 2028, priced at 99.29 (original spread of 192 bp), callable (6nc6)

- Siemens Energy Finance BV (Financial - Other | Zoeterwoude, Netherlands | Rating: NR): €960m Bond (DE000A3K81W7), fixed rate (5.63% coupon) maturing on 14 September 2025, priced at 100.00, with a make whole call, convertible

- Statkraft AS (Utility - Other | Oslo, Oslo, Norway | Rating: BBB+): €500m Senior Note (XS2532312548), fixed rate (2.88% coupon) maturing on 13 September 2029, priced at 99.04 (original spread of 160 bp), callable (7nc7)

- UBS Group AG (Banking | Zurich, Zuerich, Switzerland | Rating: A-): €150m Bond (CH1212189141), fixed rate (4.10% coupon) maturing on 15 September 2037, priced at 100.00, callable (15nc12)

- Wallonie, State of (Official and Muni | Namur, Namur, Belgium | Rating: A-): €1,000m Bond (BE0002877588), fixed rate (2.88% coupon) maturing on 14 January 2038, priced at 99.45 (original spread of 119 bp), non callable