Rates

US Rates Rise And Treasury Curve Steepens Further After Bounce Yesterday

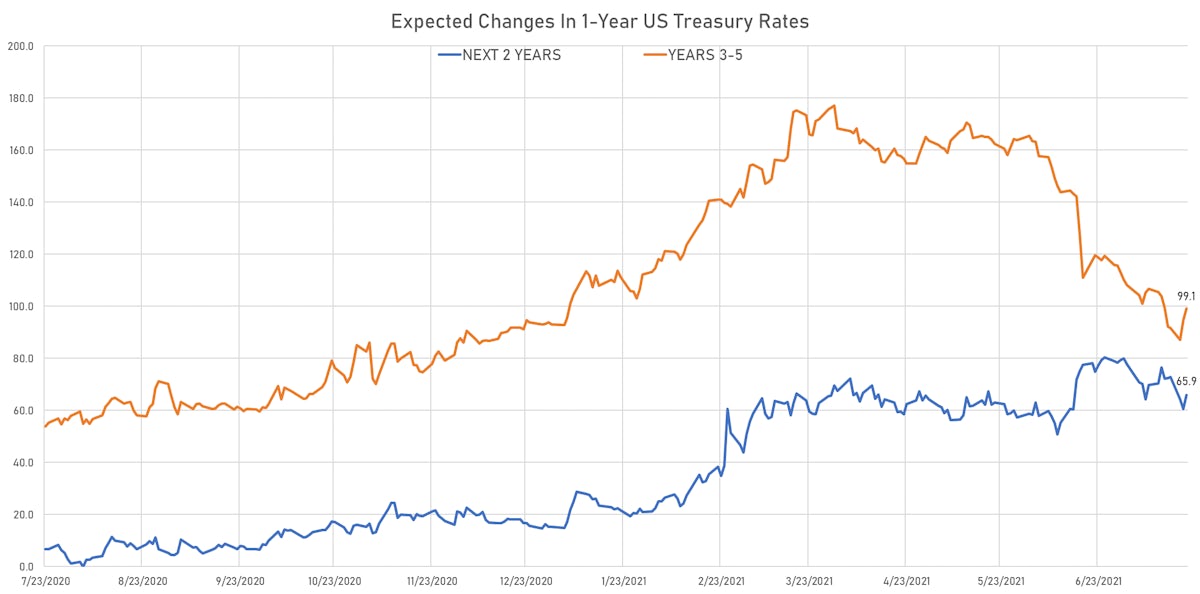

Short rates remain higher and long rates much lower than they were at the height of the "reflation theme" 4 months ago, as Fed tapering is now very much on the table, a prospect that markets consider harmful to growth

Published ET

Implied Hikes From the 3-month USD OIS forward curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

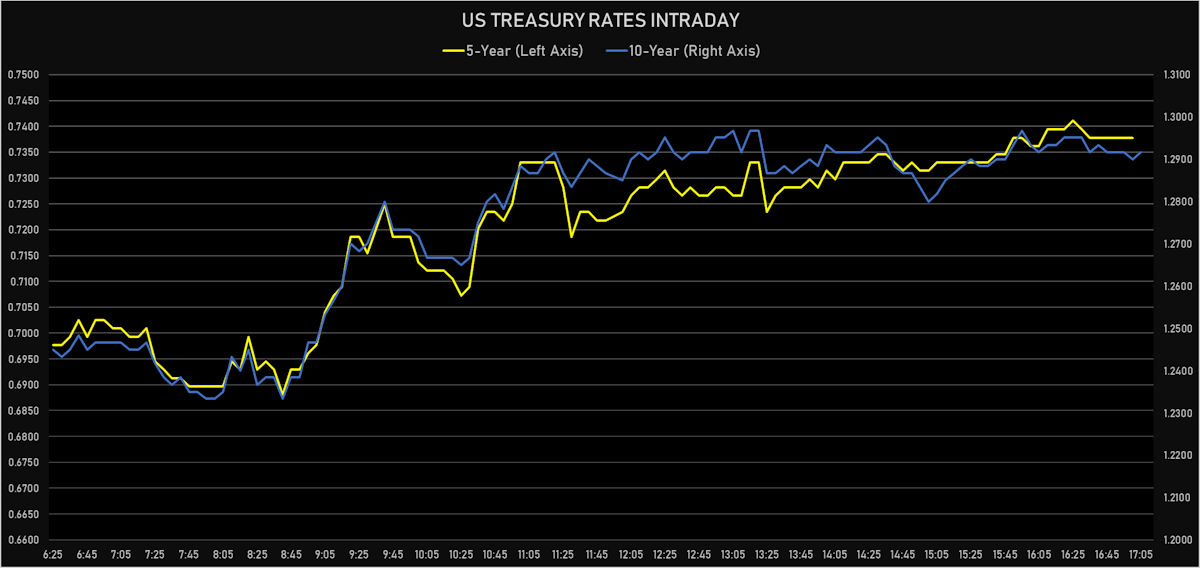

- Yield curve steepening, with the 1s10s Treasury spread widening 7.0 bp on the day, now at 121.8 bp (YTD change: +41.3)

- 1Y: 0.0740% (unchanged)

- 2Y: 0.2098% (up 0.8 bp)

- 5Y: 0.7378% (up 5.3 bp)

- 7Y: 1.0464% (up 6.7 bp)

- 10Y: 1.2917% (up 7.0 bp)

- 30Y: 1.9400% (up 6.3 bp)

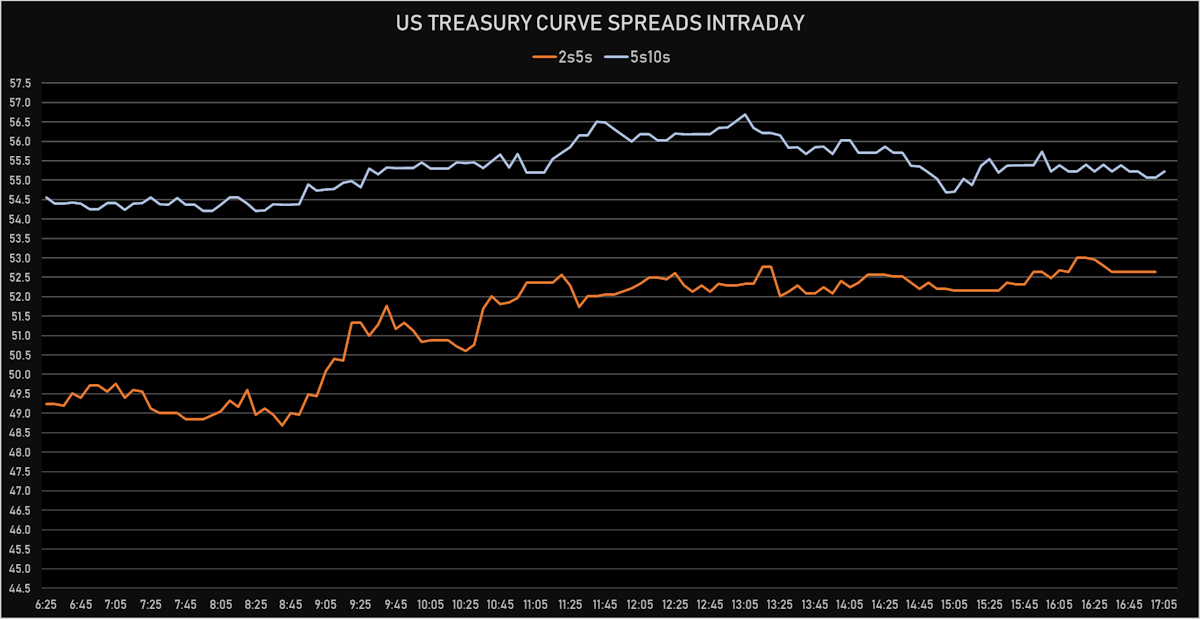

- US treasury curve spreads: 2s5s at 52.8bp (up 4.5bp today), 5s10s at 55.4bp (up 1.7bp today), 10s30s at 64.9bp (down -0.7bp)

- Treasuries butterfly spreads: 2s5s10s at 2.2bp (down -2.8bp), 5s10s30s at 9.6bp (down -1.7bp)

- US 5-Year TIPS Real Yield: +0.1 bp at -1.7730%; 10-Year TIPS Real Yield: +3.9 bp at -1.0110%; 30-Year TIPS Real Yield: +3.6 bp at -0.2530%

COMMENTARY

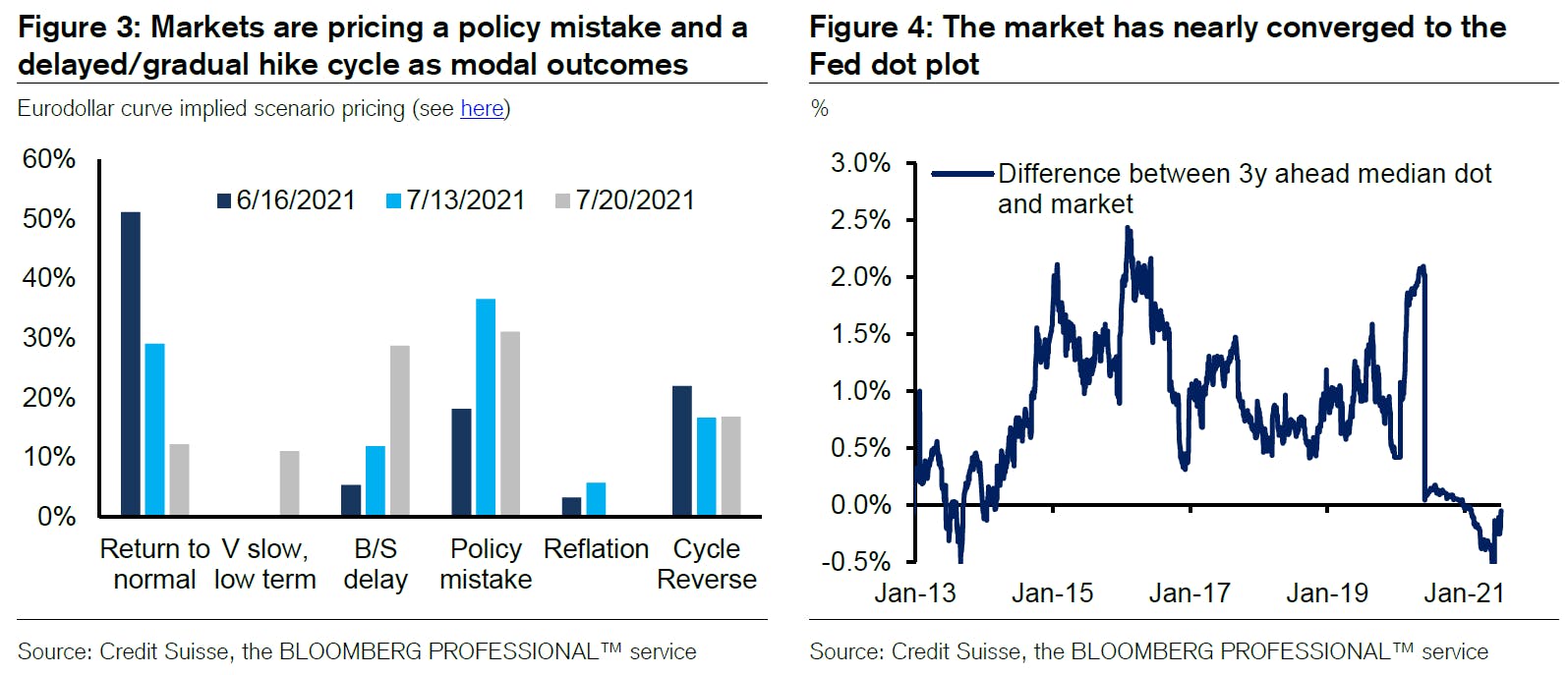

- As mentioned last month, we still believe markets are pricing in a policy error from the Fed: a premature rate hike leading to a growth slowdown, followed by a reversal of policy and a much lower terminal rate

- Credit Suisse analysts also consider the "policy mistake" as the central economic scenario for fixed income markets:

US MACRO RELEASES

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 16 Jul (MBA, USA) at -4.00 %

- Mortgage applications, market composite index for W 16 Jul (MBA, USA) at 698.30

- Mortgage applications, market composite index, purchase for W 16 Jul (MBA, USA) at 255.80

- Mortgage applications, market composite index, refinancing for W 16 Jul (MBA, USA) at 3267.60

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 16 Jul (MBA, USA) at 3.11 %

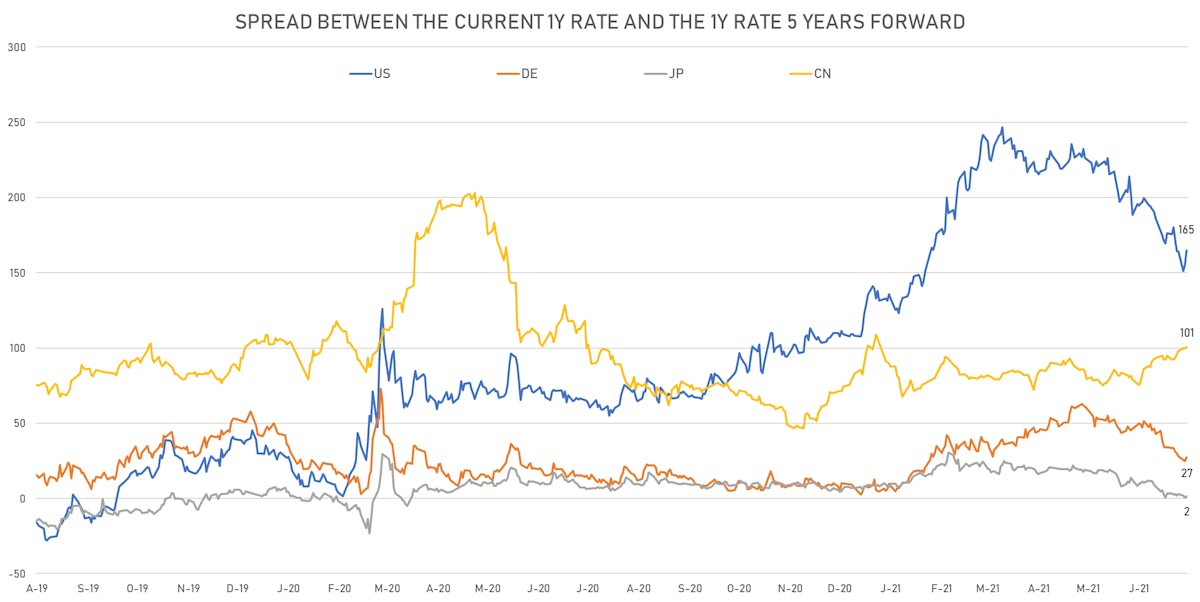

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward up 9.9 bp, now at 1.7309%

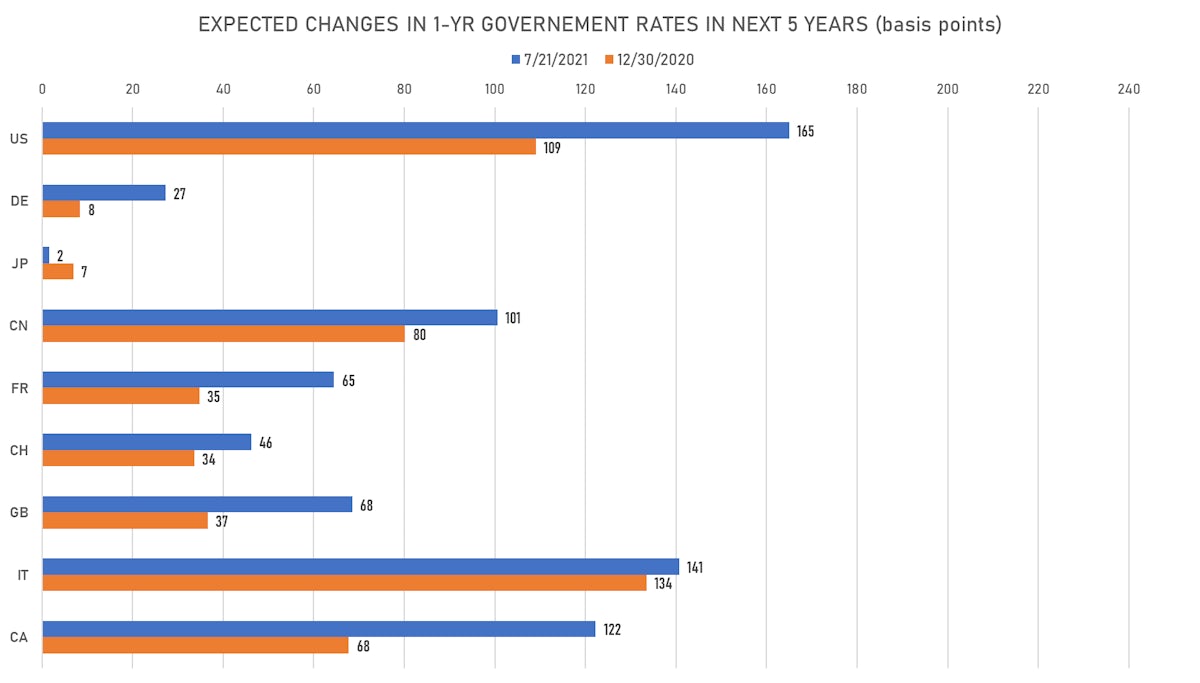

- 1-Year Treasury rates are now expected to increase by 165.0 bp over the next 5 years

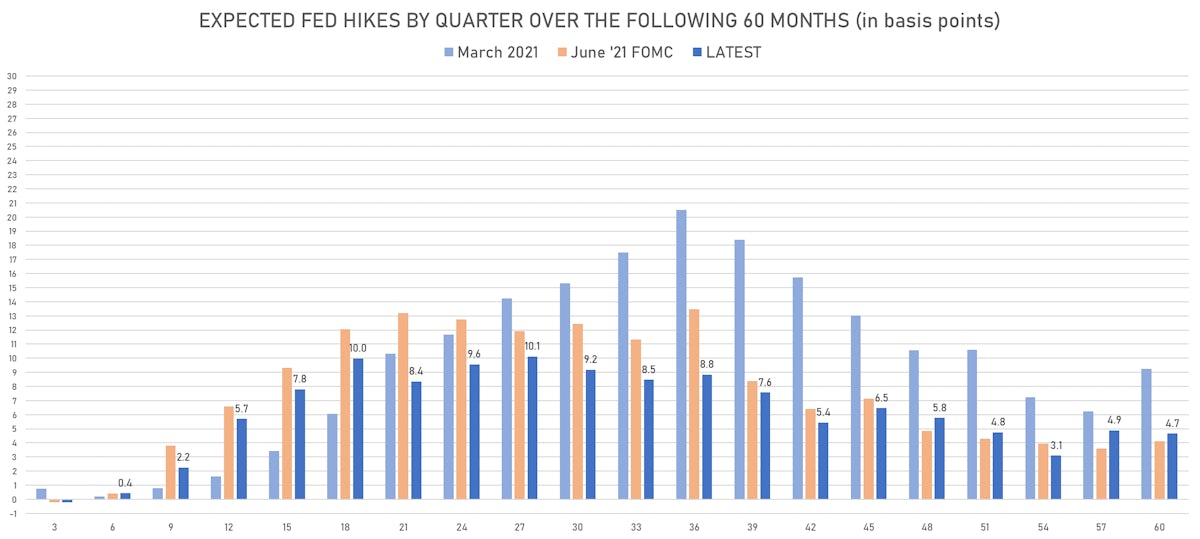

- 3-month Eurodollar futures expected hike of 17.2 bp by the end of 2022 (meaning the market prices 68.7% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 71.7 bp over the next 3 years (equivalent to 2.87 rate hikes), down sharply from 105bp last month

US INFLATION & REAL RATES

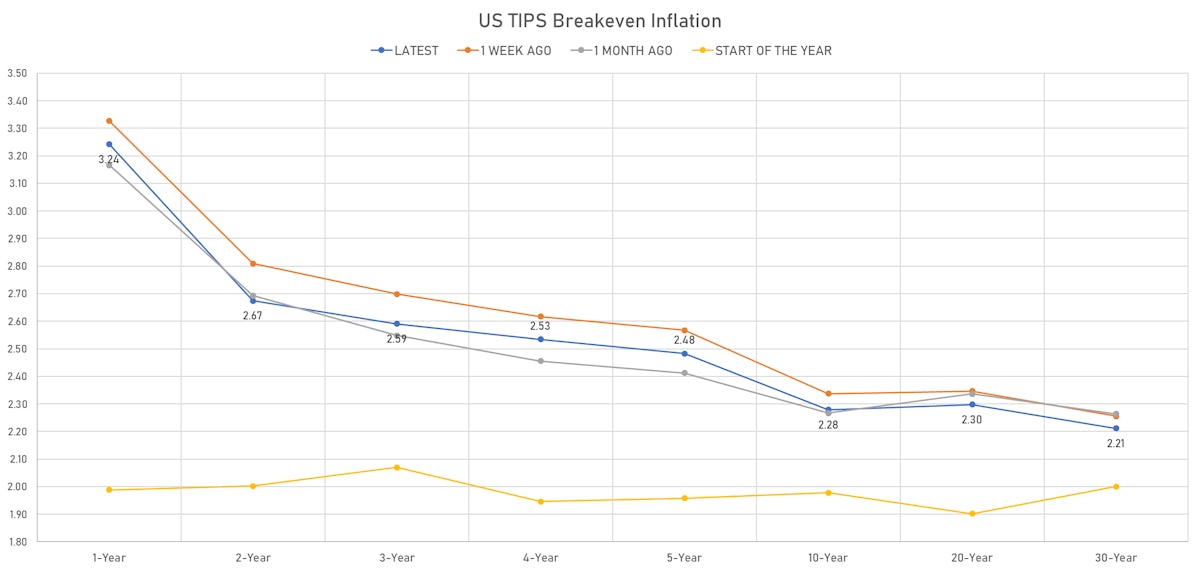

- TIPS 1Y breakeven inflation at 3.24% (up 10.4bp); 2Y at 2.67% (up 4.8bp); 5Y at 2.48% (up 4.8bp); 10Y at 2.28% (up 2.8bp); 30Y at 2.21% (up 2.6bp)

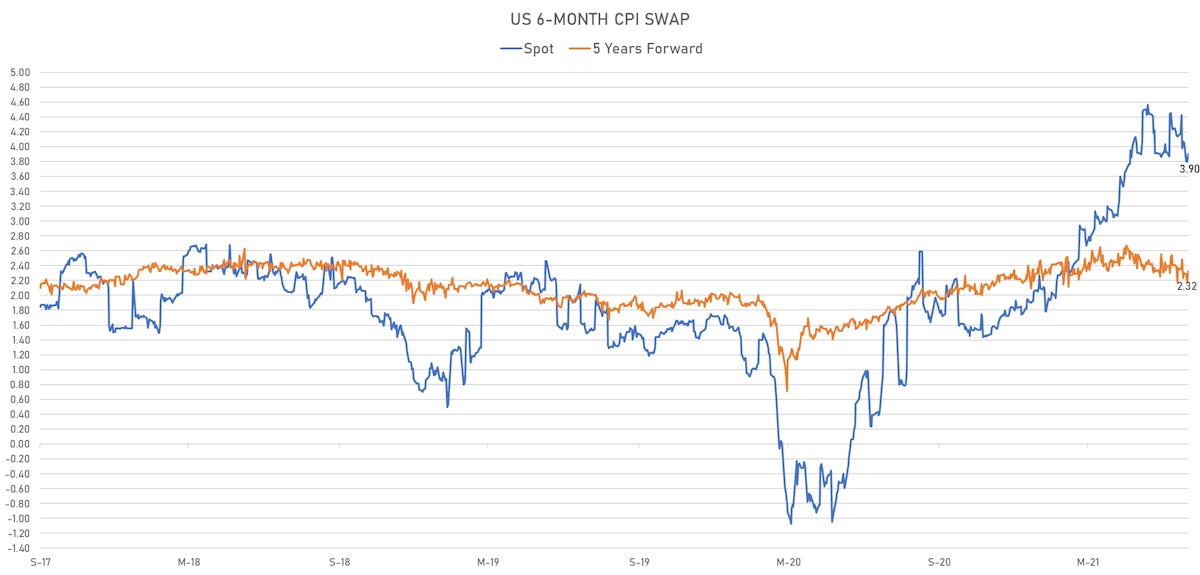

- 6-month spot US CPI swap up 10.3 bp to 3.904%, with a flattening of the forward curve

RATES VOLATILITY & LIQUIDITY

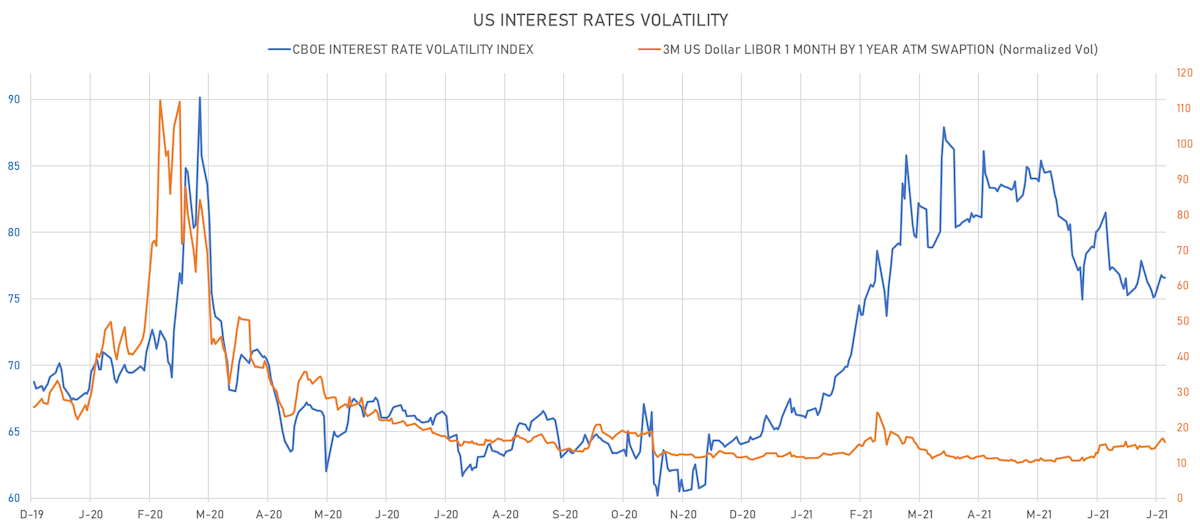

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.0% at 15.8%

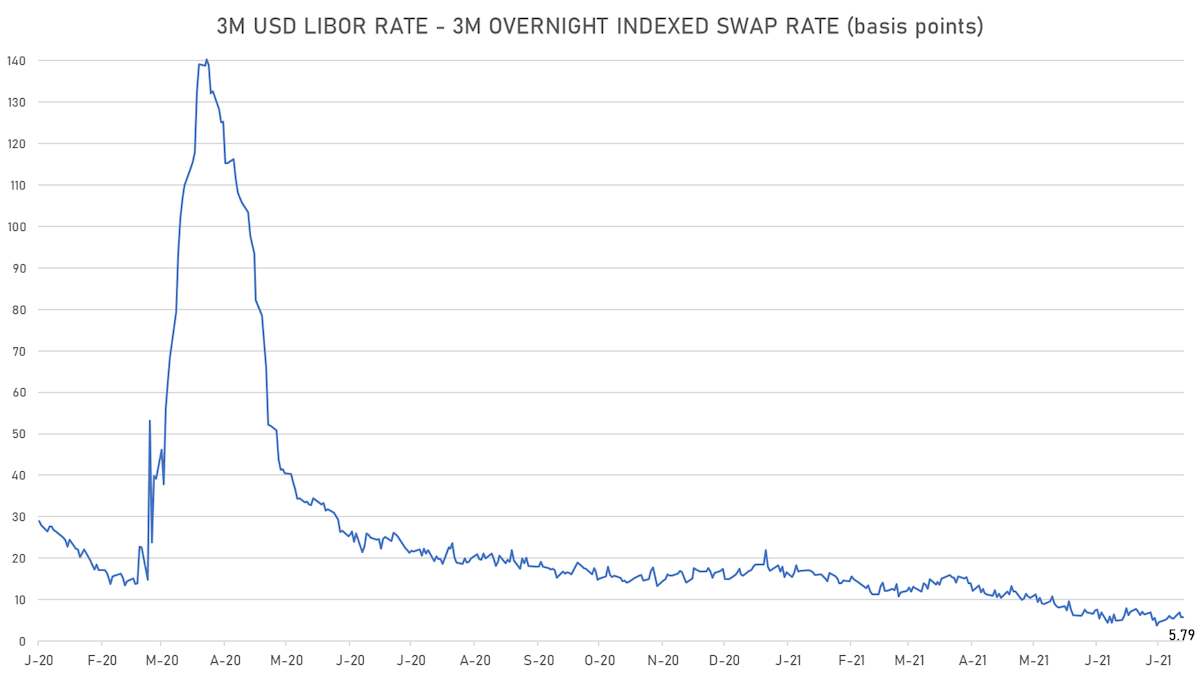

- 3-Month LIBOR-OIS spread unchanged at 5.8 bp (12-months range: 3.7-23.6 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.678% (up 0.8 bp); the German 1Y-10Y curve is 1.4 bp steeper at 24.5bp (YTD change: +8.6 bp)

- Japan 5Y: -0.122% (unchanged); the Japanese 1Y-10Y curve is 0.3 bp flatter at 14.4bp (YTD change: -0.1 bp)

- China 5Y: 2.740% (down -2.1 bp); the Chinese 1Y-10Y curve is 1.5 bp flatter at 96.9bp (YTD change: +50.5 bp)

- Switzerland 5Y: -0.666% (up 1.6 bp); the Swiss 1Y-10Y curve is 2.4 bp steeper at 45.7bp (YTD change: +15.3 bp)