Rates

US Rates Up Slightly, Fed's Bostic In Favor Of Fast Start To Tapering

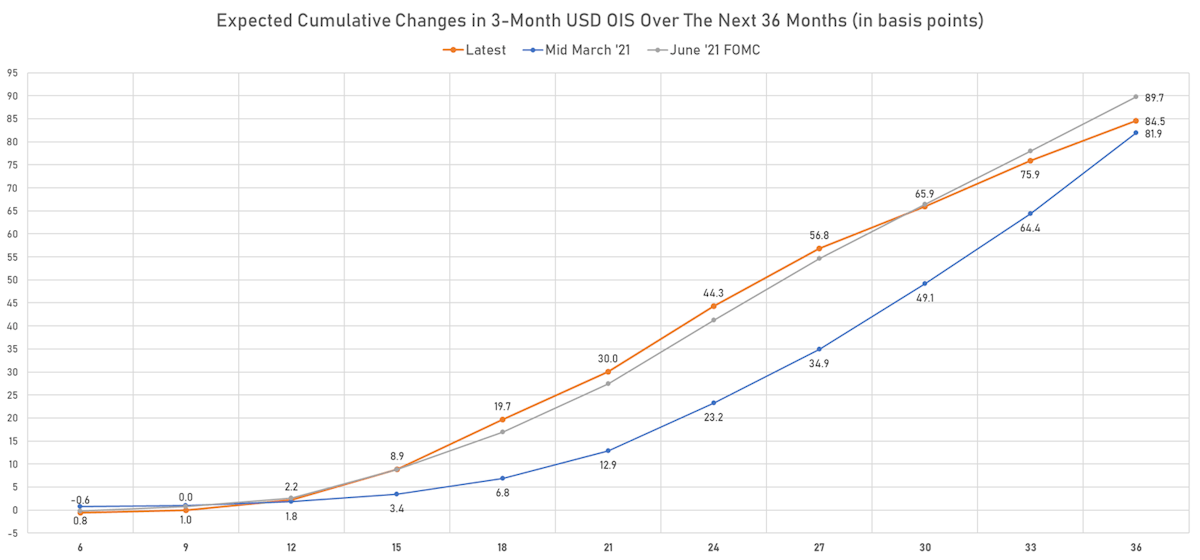

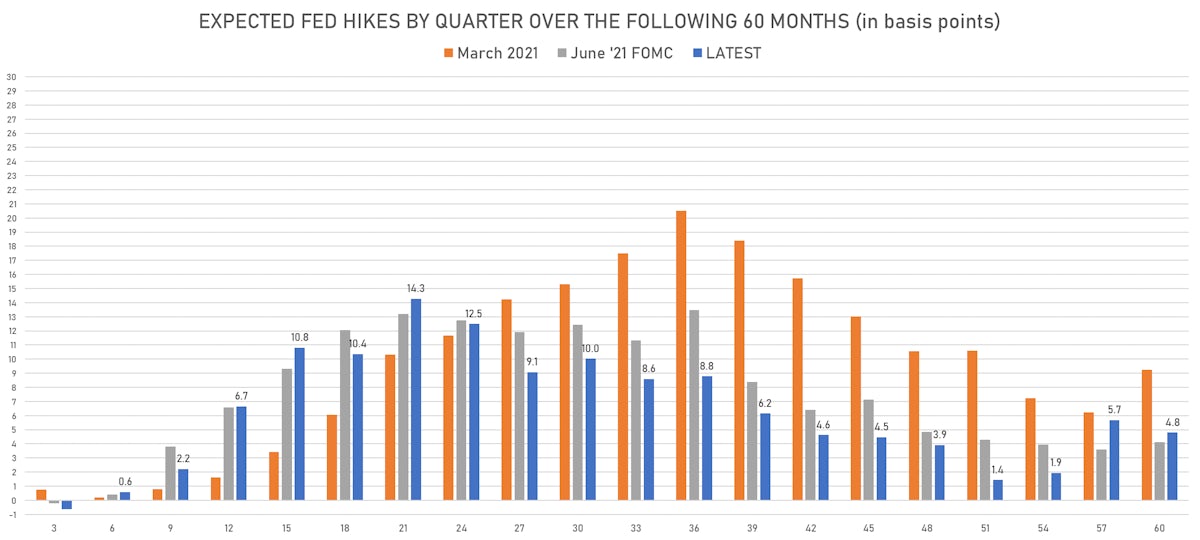

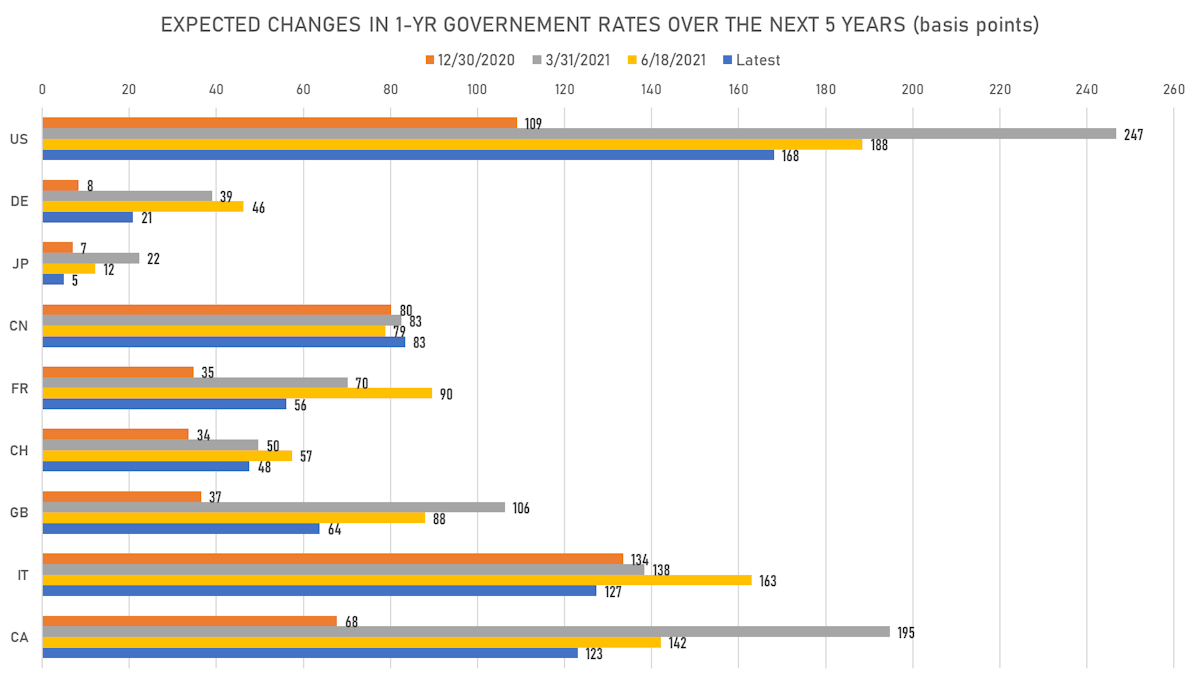

Rate hikes expectations over the next 3 years have bounced back, but markets still see a very shallow hiking cycle, with very modest terminal rates indicating growth is very sensitive to a rise in rates in a highly levered economy

Published ET

Expected Fed Hikes Over The Next 5 Years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- As we pointed out last week ahead of the Jobs report, markets have now priced in more Fed hikes over the 2 to 3 year horizon, with the view that: 1) growth and the return of economic activity seems robust despite ongoing reopening issues, 2) seeing the positive outcome in the UK the delta scare is probably not going to be that bad in the US, and 3) inflation is unlikely to normalize as quickly as originally expected.

- Biggest US macro events for rates this week are the CPI data on Wednesday and the 10-Year Treasury Auction on the same day

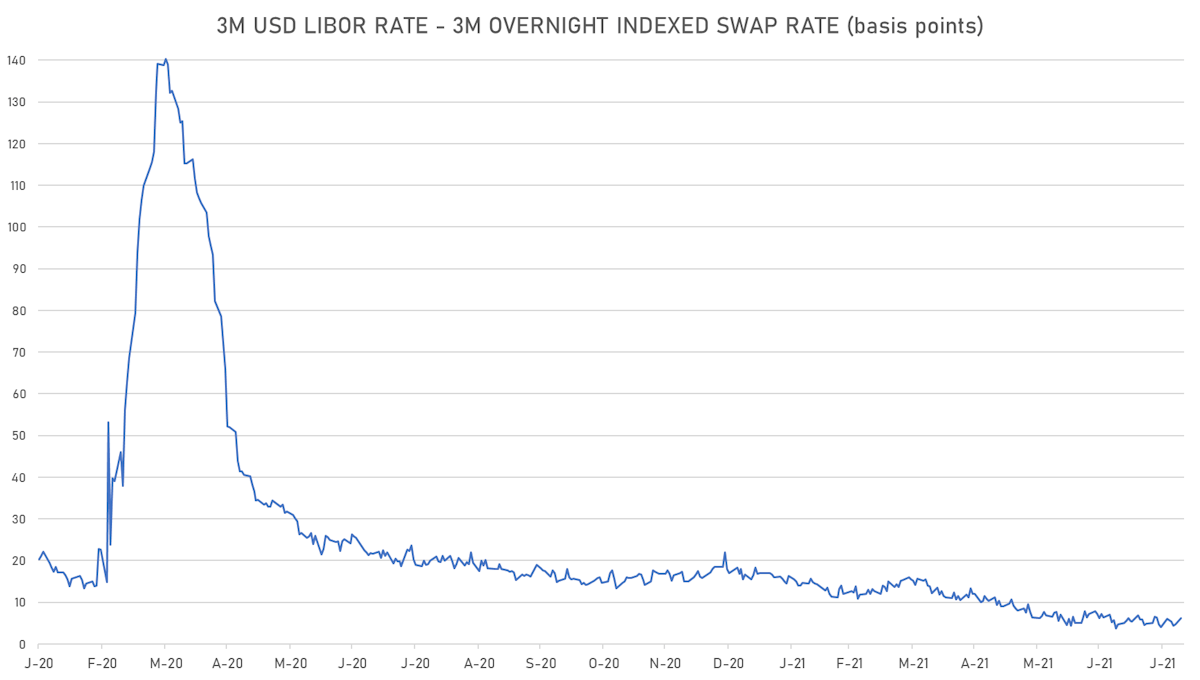

- 3-Month USD LIBOR -0.1bp today, now at 0.1273%

- The treasury yield curve steepened, with the 1s10s spread widening 1.8 bp, now at 125.1 bp (YTD change: +44.7bp)

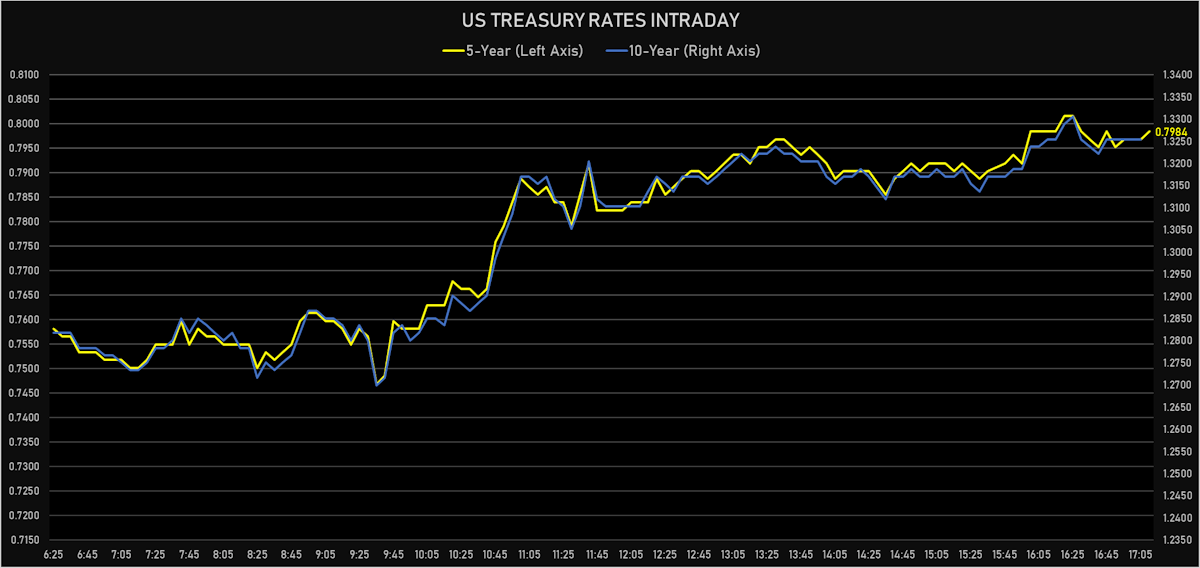

- 1Y: 0.0740% (up 0.3 bp)

- 2Y: 0.2223% (up 1.0 bp)

- 5Y: 0.7984% (up 2.4 bp)

- 7Y: 1.1027% (up 2.2 bp)

- 10Y: 1.3254% (up 2.0 bp)

- 30Y: 1.9703% (up 1.8 bp)

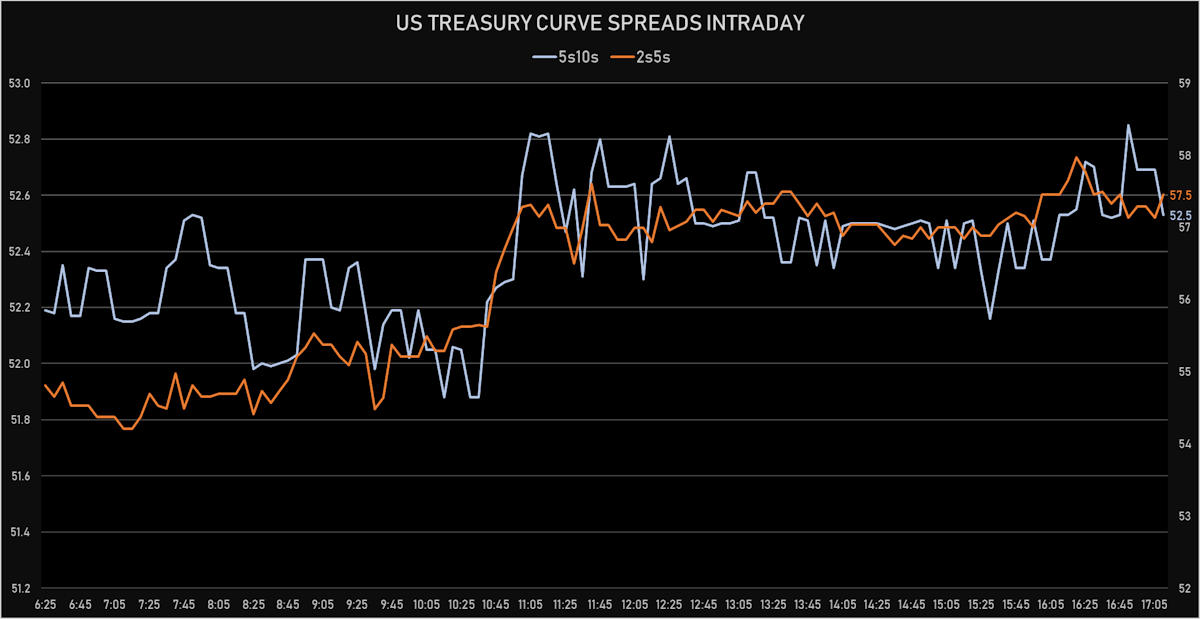

- US treasury curve spreads: 2s5s at 57.6bp (up 1.4bp today), 5s10s at 52.7bp (down -0.4bp), 10s30s at 64.5bp (down -0.4bp)

- Treasuries butterfly spreads: 2s5s10s at -5.3bp (down -1.9bp), 5s10s30s at 11.6bp (up 0.3bp)

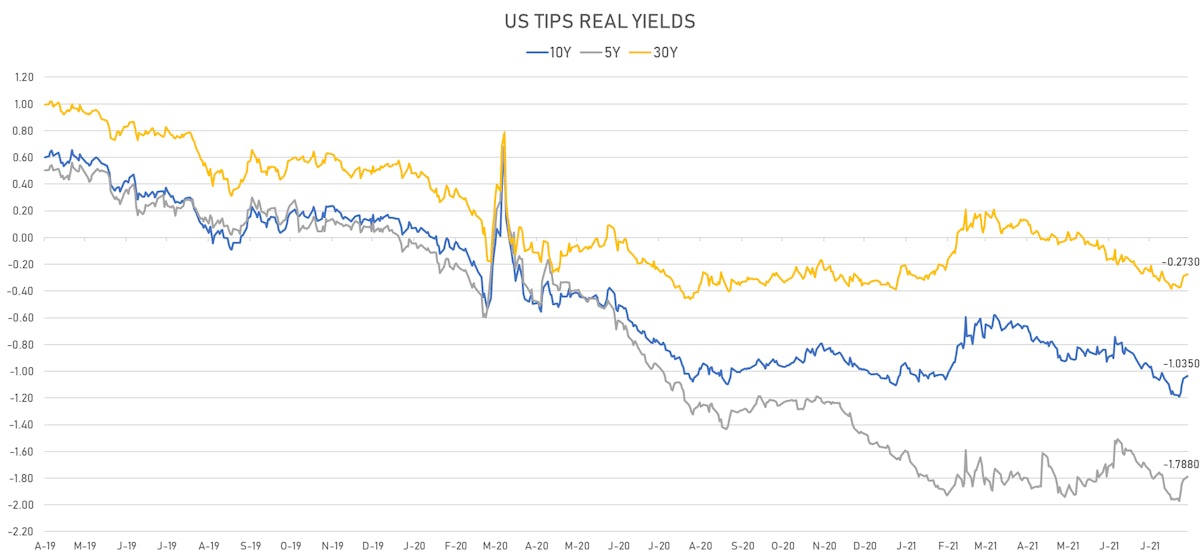

- US 5-Year TIPS Real Yield: +2.5 bp at -1.7880%; 10-Year TIPS Real Yield: +2.0 bp at -1.0350%; 30-Year TIPS Real Yield: +1.7 bp at -0.2730%

US MACRO RELEASES

- JOLTS Job Openings for Jun 2021 (BLS, U.S Dep. Of Lab) at 10.07 Mln, above consensus estimate of 9.28 Mln

- The Conference Board Employment Trends Index (ETI) for Jul 2021 (The Conference Board) at 109.80

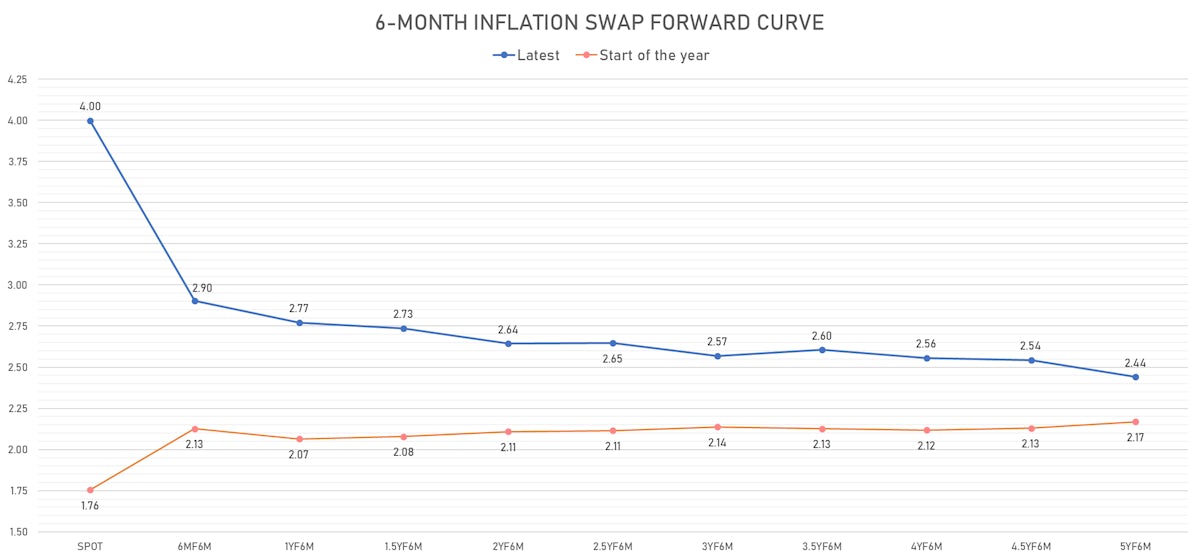

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward up 2.9 bp, now at 1.7633%, meaning that 1-Year Treasury rates are now expected to increase by 168.1 bp over the next 5 years

- 3-month Eurodollar futures prices imply Fed hike of 18.2 bp by the end of 2022 (meaning the market prices 72.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 19.7 bp of rate hikes over the next 18 months (equivalent to 0.79 rate hike) and 84.5 bp over the next 3 years (equivalent to 3.38 rate hikes)

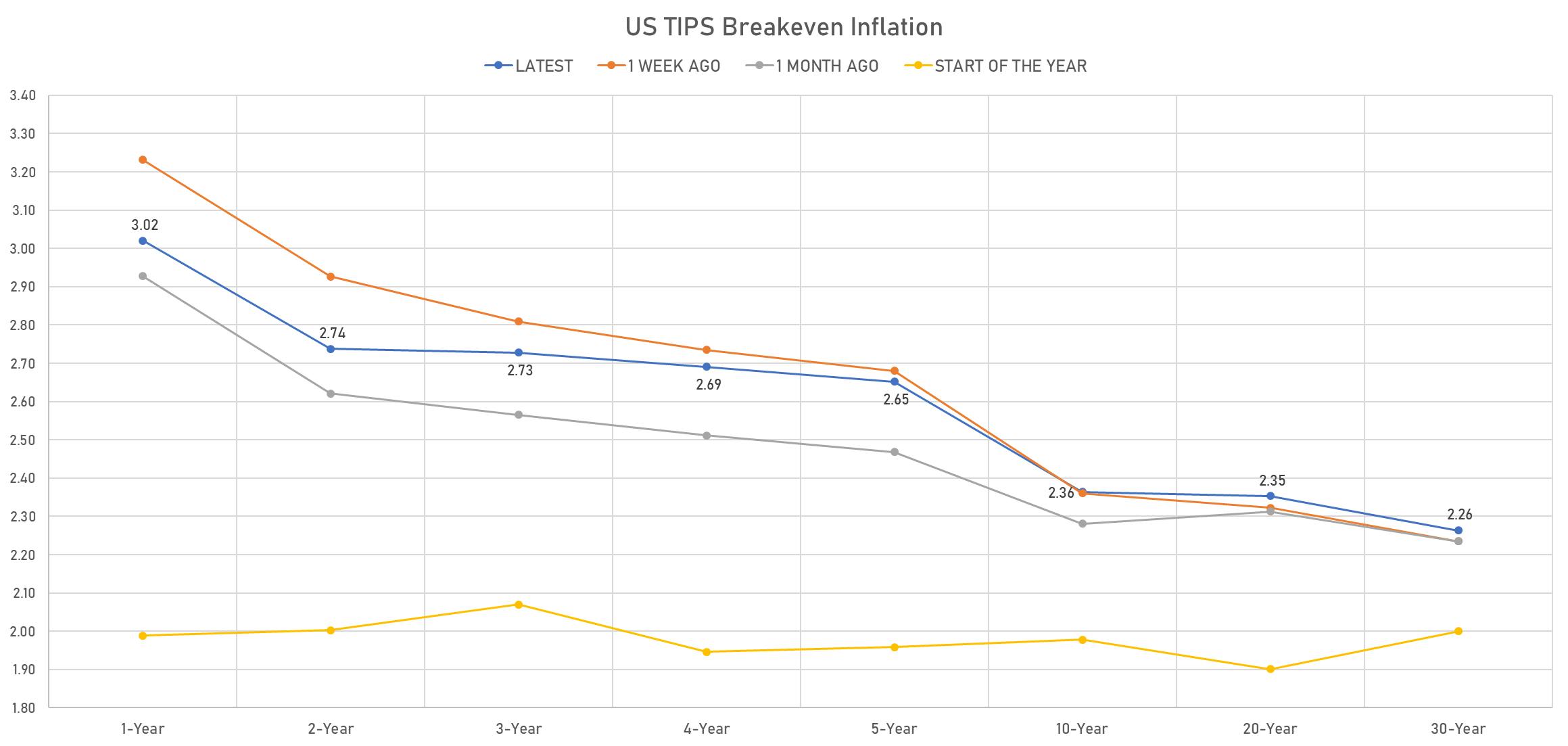

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.02% (down -6.4bp); 2Y at 2.74% (down -4.3bp); 5Y at 2.65% (down -0.3bp); 10Y at 2.36% (unchanged); 30Y at 2.26% (unchanged)

- US Real Rates: 5Y at -1.7880%, +2.5 bp today; 10Y at -1.0350%, +2.0 bp today; 30Y at -0.2730%, +1.7 bp today

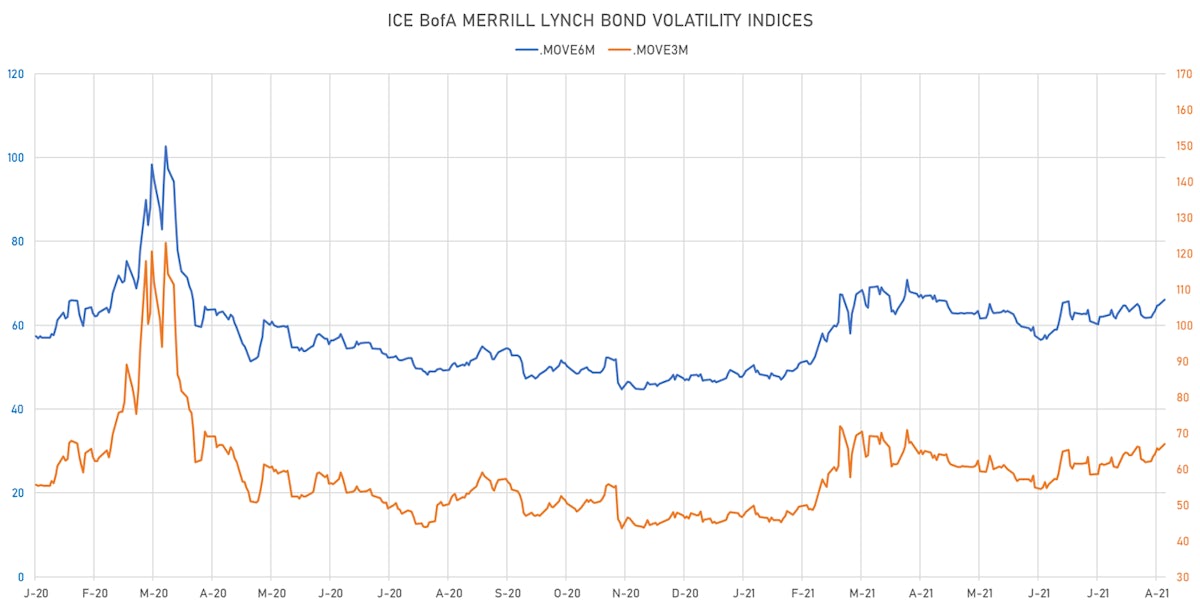

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.8% at 16.2%

- 3-Month LIBOR-OIS spread up 1.5 bp at 6.1 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.722% (up 0.4 bp); the German 1Y-10Y curve is 0.2 bp flatter at 19.5bp (YTD change: +4.0 bp)

- Japan 5Y: -0.121% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.9 bp steeper at 16.4bp (YTD change: +1.1 bp)

- China 5Y: 2.719% (up 6.6 bp); the Chinese 1Y-10Y curve is 2.3 bp steeper at 69.3bp (YTD change: +22.9 bp)

- Switzerland 5Y: -0.675% (up 1.8 bp); the Swiss 1Y-10Y curve is 4.2 bp steeper at 33.4bp (YTD change: +10.0 bp)