Reality Check: Recent Rates Volatility Is Not A "Reflation Trade"

Inflation expectations have not changed much since the beginning of the year, unlike last year when they were all over the place

Published ET

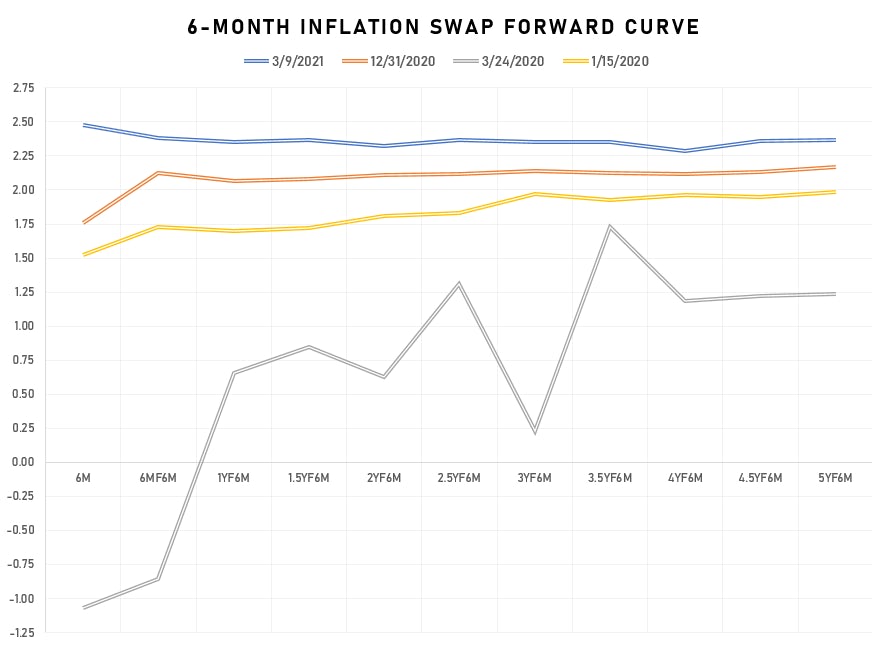

Source: Refinitiv Eikon

A lot of recent commentary has found a boogeyman for the recent increase in interest rates: THE INFLATION MONSTER IS BACK ! But, as we noted a few weeks ago, inflation expectations haven't materially changed since the beginning of the year. Unlike last year, when they briefly went negative amidst the chaos of economic shutdown (along with a crash in equities, commodities, etc.), forward inflation has been pretty stable in the midst of large interest rates moves.

WHAT THE DATA SAYS

- Inflation expectations went negative last year but rebounded strongly into the end of 2020. In other words, the big move already happened.

- With a rise in commodities, strong economic numbers and a new economic stimulus, the near end of the curve did rise significantly since the start of the year: 6-month inflation swaps are up by 75 basis points (from 1.75% to 2.50%).

- But the most notable move has been an inversion of the forward curve: despite a rise in near-term inflation expectations, the rest of the curve has stayed well anchored close to the same levels. What that means is that the markets expect inflationary pressures to be short lived.

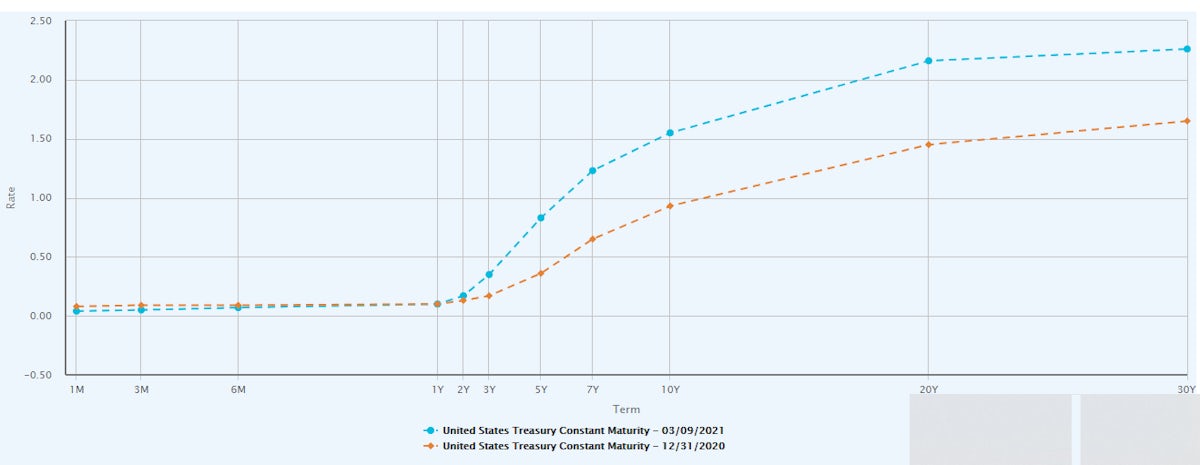

- By comparison, interest rates have moved most at the long end of the curve, expecting a strong economic rebound to lead to progressively higher rates (see our take on that).

In conclusion, the data is very clear that the recent volatility in rates cannot be explained by a change in long-term inflation expectations.

Rates markets expect a post-covid boom time, and a return of the wild "Roaring Twenties". Whether that is likely to happen is another story..