FX

The Euro Continued To Fall This Week, With The War In Ukraine And The Risk Of A Russian Nat Gas Ban Now Putting The EU On The Edge Of A Recession

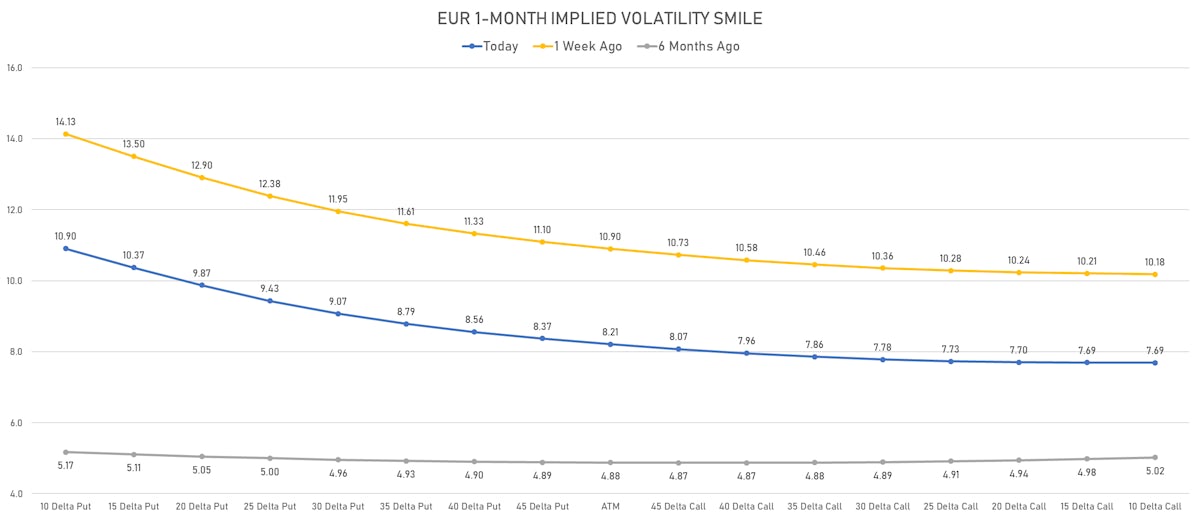

Euro options positioning is skewed to the downside with the first round of the French presidential elections now upon us; a win by Le Pen would push the spot further down towards 1.0500 with a widening of the OATs-Bunds spreads (and a likely spillover into BTPs)

Rates

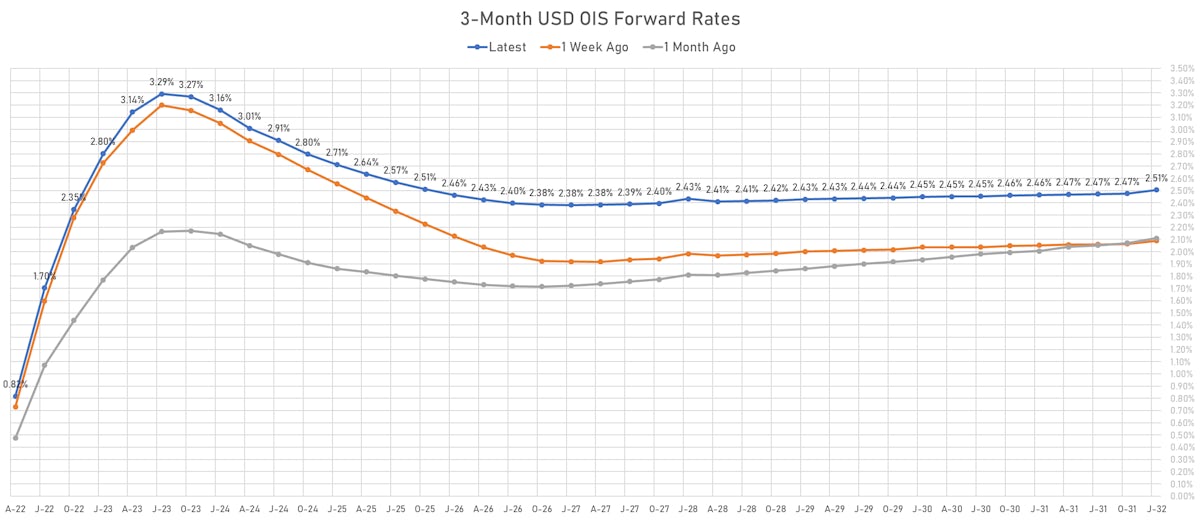

Repricing Of Forward Rates Higher Was The Main Development This Week, With 3M USD OIS 4 Years Forward Up Nearly 50bp, Leading To Curve Steepening

On the sell side, Goldman Sachs contends that "expeditiously" might mean 4 x 50bp hikes until the Fed reaches its neutral rate, although the GS base case is still for 2x50bp followed by 4x25bp this year, and 3x25bp next year

Credit

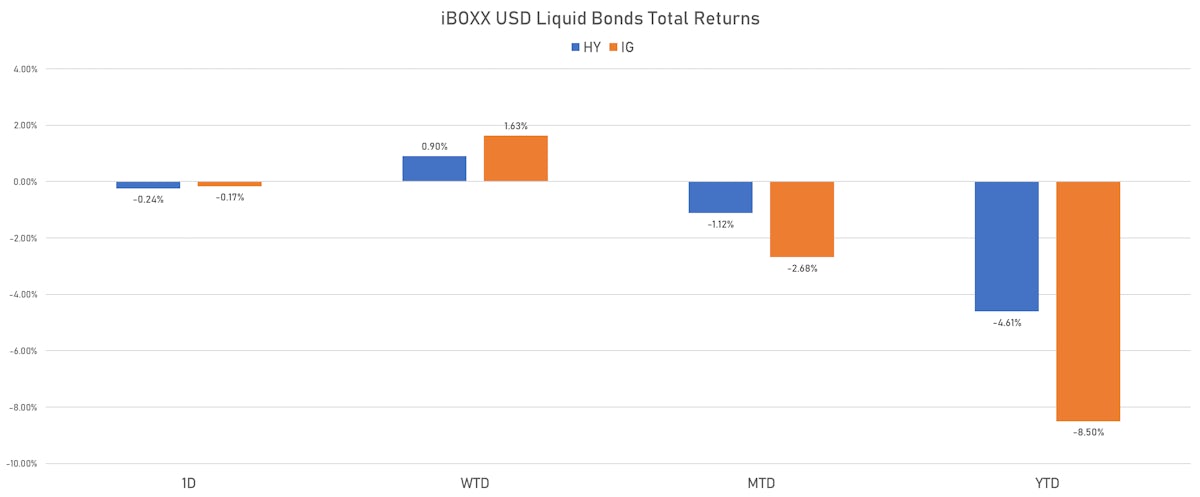

US$ Spreads Tighten Slightly On Friday, With A Decent OAS Compression For The Week Of 9bp In IG And 11bp In HY

Strong end to the quarter for investment grade corporate bond issuance, ahead of the earnings quiet period (IFR Markets data): 44 tranches for $35.8bn in IG (2022 1Q volume $466.9bn vs 2021 1Q US$459.6bn) and 5 tranches for $1.96bn in HY (2022 1Q volume $40.1bn vs 2021 1Q $152.4bn)

Equities

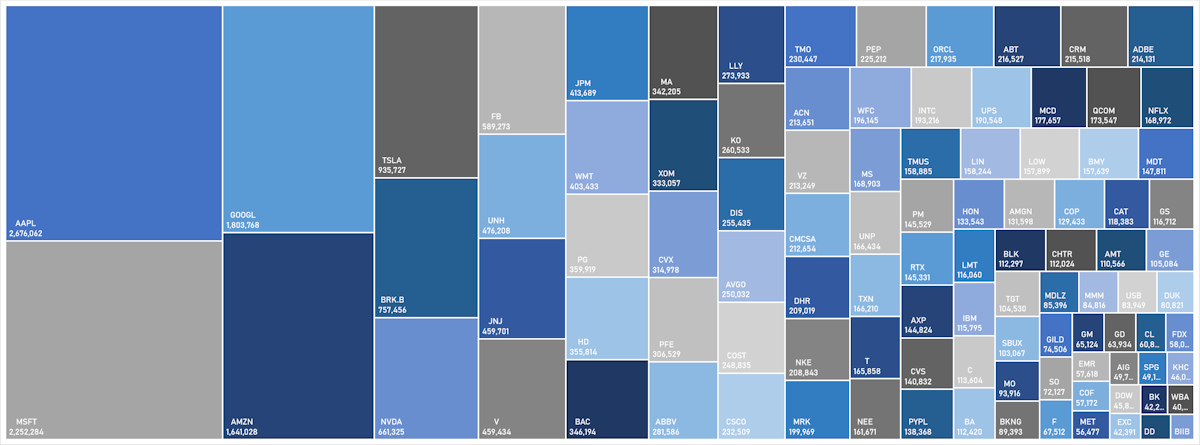

Equities Finished The Week On A Less Volatile Note, With Total US Market Capitalization Edging Back Above $50 Trillion

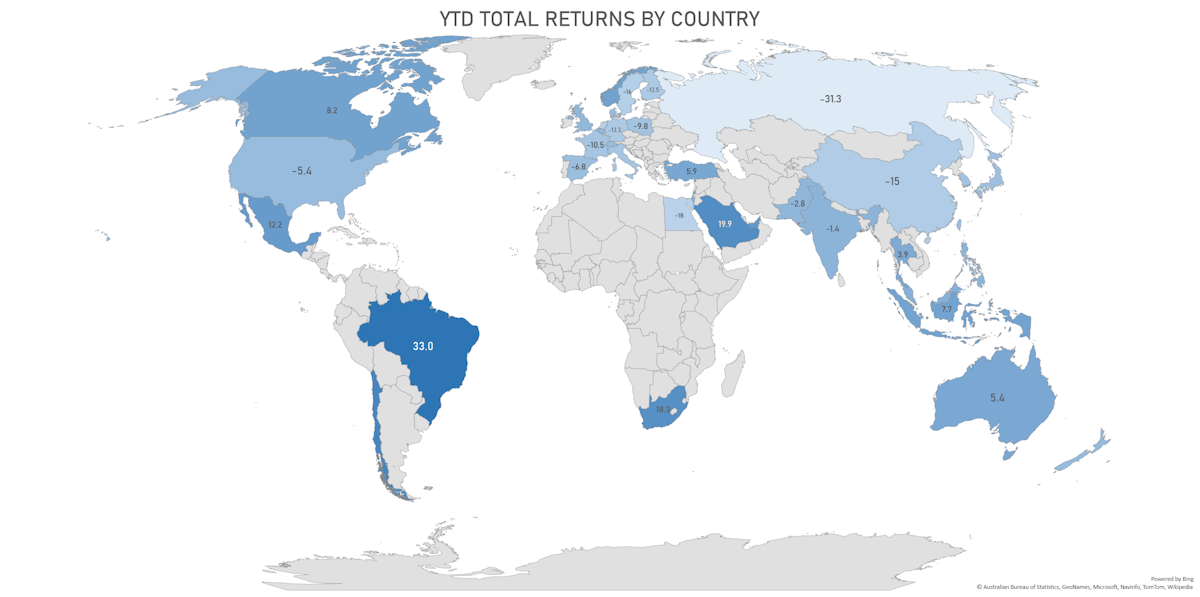

Looking at the top- and bottom-performing countries year-to-date, it's still very much about commodities and inflation, with exporters doing well (with the exception of Russia) and big importers doing badly

Commodities

Broad Fall Across The Commodities Complex, With All GSCI Sub-Indices Ending The Week In Red

Most of the big recent gainers (crude oil, nickel, wheat, etc.) had a decent selloff and the skew in their implied volatilities dropped back to less extreme levels

FX

Lack Of Additional Sanctions Against Russia Leads To A Return Of Risk Appetite, With EM Currencies The Main Beneficiaries

Rates differentials continue to push the yen lower, as the BoJ keeps buying JGBs to maintain control of the curve, with no sign yet that the central bank is worried about importing inflation with a weak currency

Rates

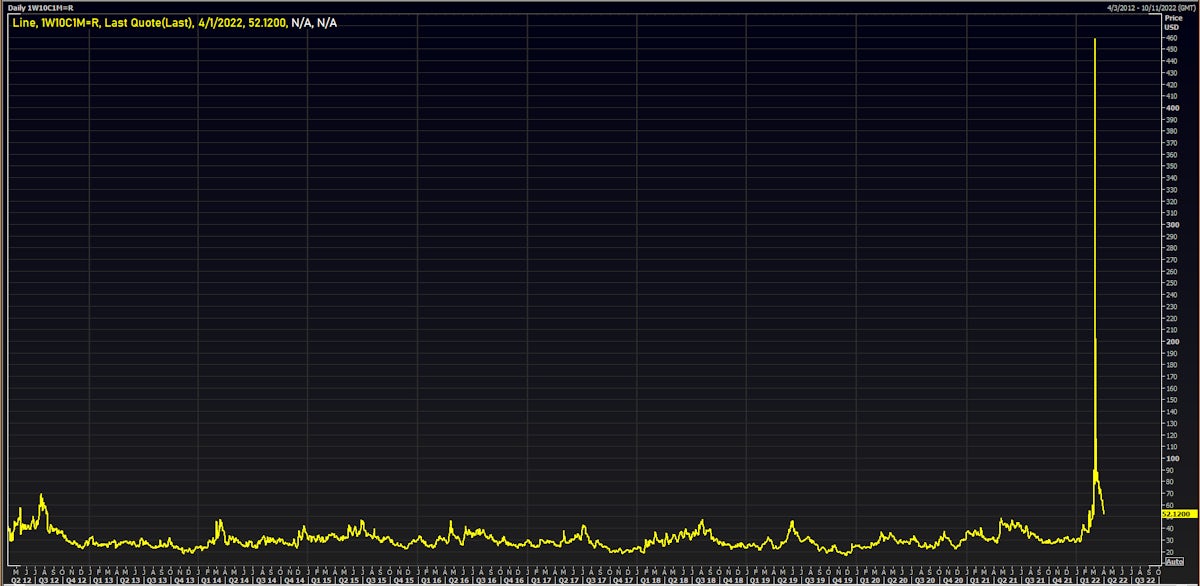

US Treasuries 2s10s Spread Inverted This Week, With The Rise In Front-End Cash Yields Met By Additional Rate Cuts Priced Into Forwards

USD LIBOR-OIS basis spreads tightened this week as tensions in funding markets calmed down significantly, but the USD OIS curve now prices in close to 4 rate cuts of 25bp between 2023 and 2025 (a growing forward reversal of the current hiking cycle)

Cross Asset

Spring Break: We're Taking A Little Time Off And Will Be Back Next Week

The market is now pricing in close to 9 hikes this year (2.25% by end of December), and with a slew of Fed speakers coming up later this week, it will be interesting to see how they position the May hike and the announcement of QT (which was initially supposed to count as one hike)

Equities

US Equities End The Week With A Strong Rebound, Led By Technology And Consumer Discretionary Stocks

Commodities-focused emerging markets are clocking the best performances (US$ total returns) year-to-date, with Chile up 18%, Brazil up 17%, and Saudi Arabia up nearly 16%

Credit

Not A Ton Of Movement On Friday, With US Credit Spreads Just Slightly Tighter Into The Weekend

Weekly total US$ corporate bond issuance (IFR Markets data): IG saw 32 tranches for a total of $28.6bn (2022 YTD volume $392.2bn vs 2021 YTD $404.8bn) and HY 2 tranches for $1bn (2022 YTD volume $35.4bn vs 2021 YTD $93.8bn)

Commodities

Most Commodity Groups Fell This Week, With The Exception Of Livestock; The GSCI Energy Was Down Over 7%

As the war in Ukraine continues, fertilizers spot prices keep rising: the Urea New Orleans FOB Index is now up nearly 70% since the middle of February

FX

The US Dollar Fell This Week, Along With FX Implied Volatilities; Ukrainian War Fading In The Background, As Monetary Policy Decisions Take The Limelight

Although ATM implied volatilities fell this week, the skew is still very much to the downside, with the Euro 3-Month 10-delta put / ATM ratio around 1.40, close to the highest levels in the past 5 years