Equities

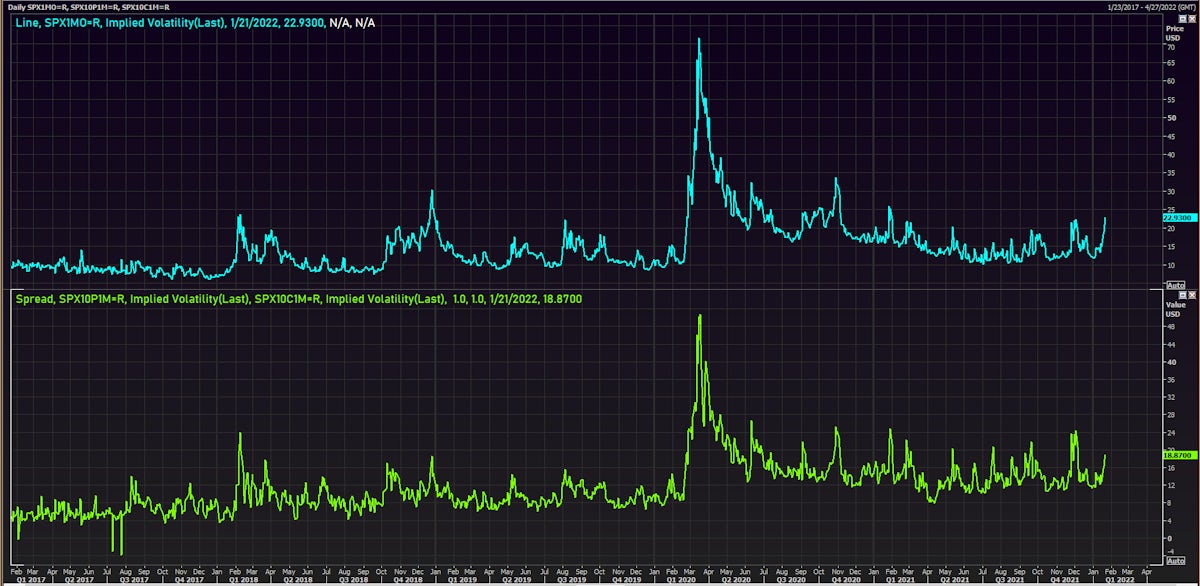

Sentiment In US Equities Very Depressed Although Implied Volatility, Skew Not At Extreme Levels

The tech meltdown and higher volatility has led to a more wholesale degrossing for long-short equity hedge funds, with net positioning and gross positioning now low according to some prime brokers

Commodities

Good Week Across The Commodities Complex, With All S&P GSCI Indices Moving Higher

Industrial metals are rising on the back of the loosening monetary policy in China, with nickel futures in Shanghai up nearly 9% this week and lithium up 16%

FX

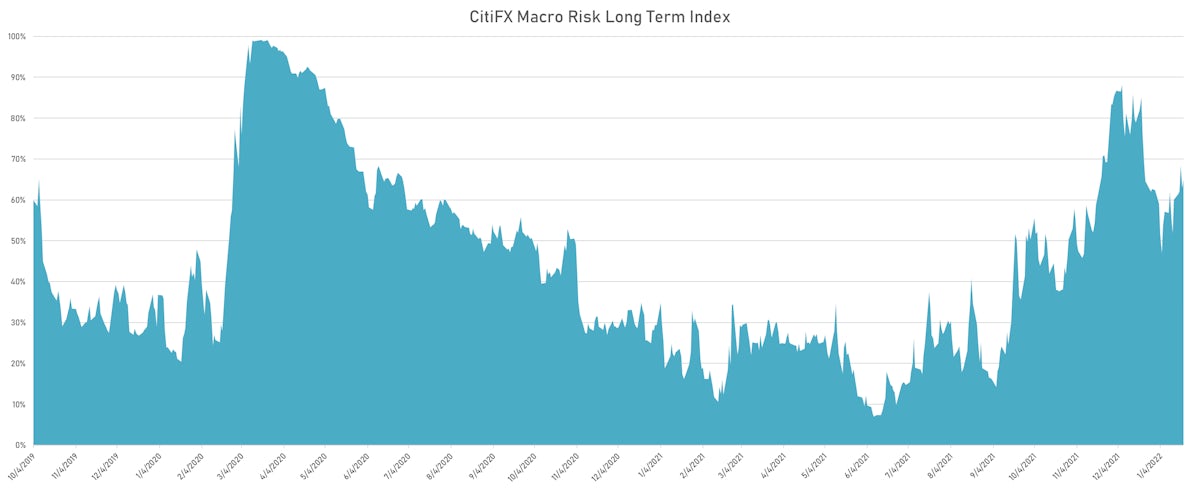

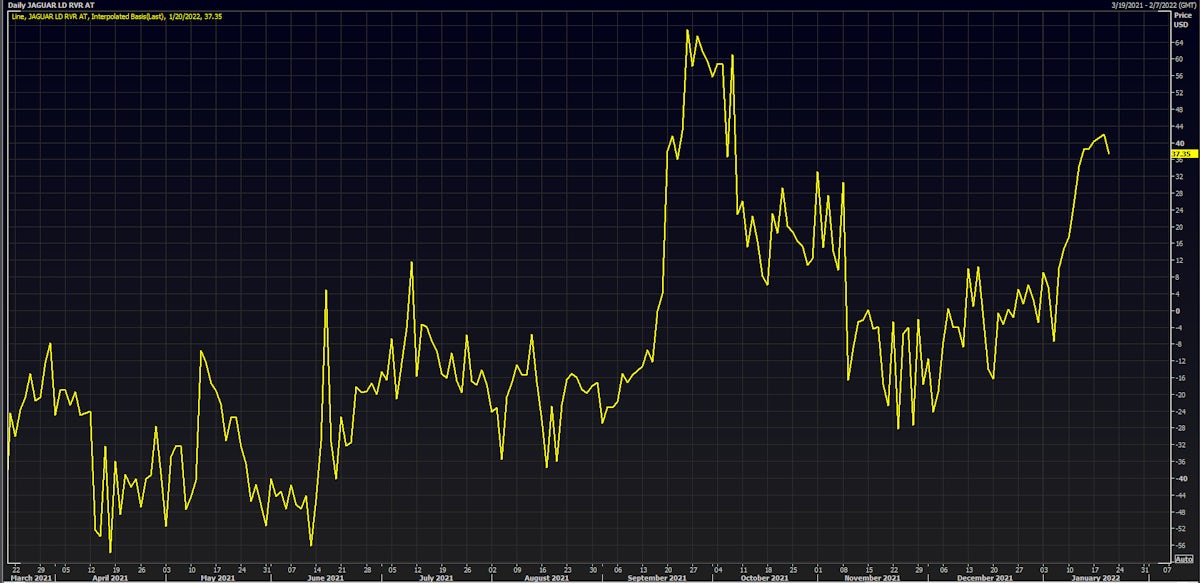

Risk-Off Trade Takes Down Australian And Canadian Dollar, While Funding Currencies Rise (JPY, EUR, CHF)

The (still modest) rise in volatility and risk aversion across asset classes we've seen this week, from US technology stocks to bitcoin and other cryptocurrencies, is causing some unwind of levered carry positions in FX

Rates

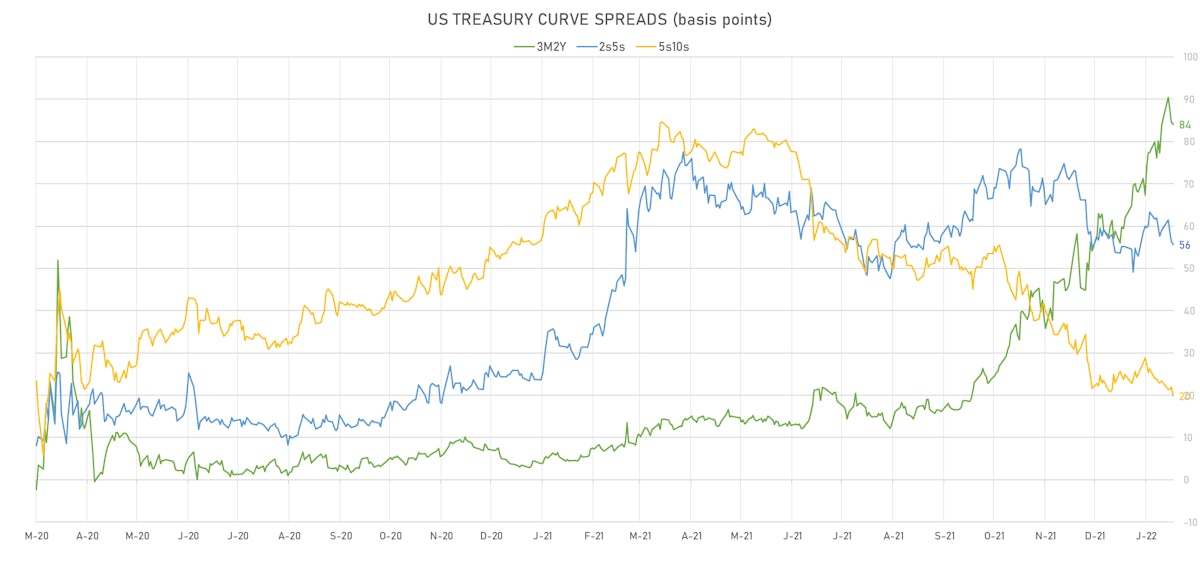

Flatter Curve Into The Weekend, Bringing The US Treasuries 1s10s Spread 8.4 bp Tighter For The Week

No rate hike expected at the FOMC next week, as the Fed is still actively buying securities (until the end of taper in March); but Powell will be cocking his gun, and the press conference should provide some detail about the Fed Funds rate liftoff, widely expected at the next meeting in March

Credit

Mixed Day For US$ Credit: Wider CDS Spreads, While Cash Spreads Were Mostly Unchanged

The CDS-bond basis on US$ cash keeps rising and is now at levels that have historically led to reversals: considering that liquidity is only going to get scarcer, credit derivatives look cheap relative to bonds

Equities

Tough Day For US Equities Brings S&P 500 Drawdown To 7%, With Consumer Discretionary Down Another 1.9%

Volume hasn't been terribly high and neither has volatility, though the skew in 1-month 10-delta SPX options has gone down sharply since the start of the year

Rates

Mixed US Data, With Positive Philly Fed Survey But Weaker Than Expected Jobless Claims

Not a ton of movement in rates today as the market now awaits the FOMC next week, with a limited number of new releases until then (most notably flash PMIs on Monday and consumer confidence on Tuesday)

Credit

Good Day For US$ Bond Issuance, Led By $12BN Offering From Goldman, $6BN From Morgan Stanley

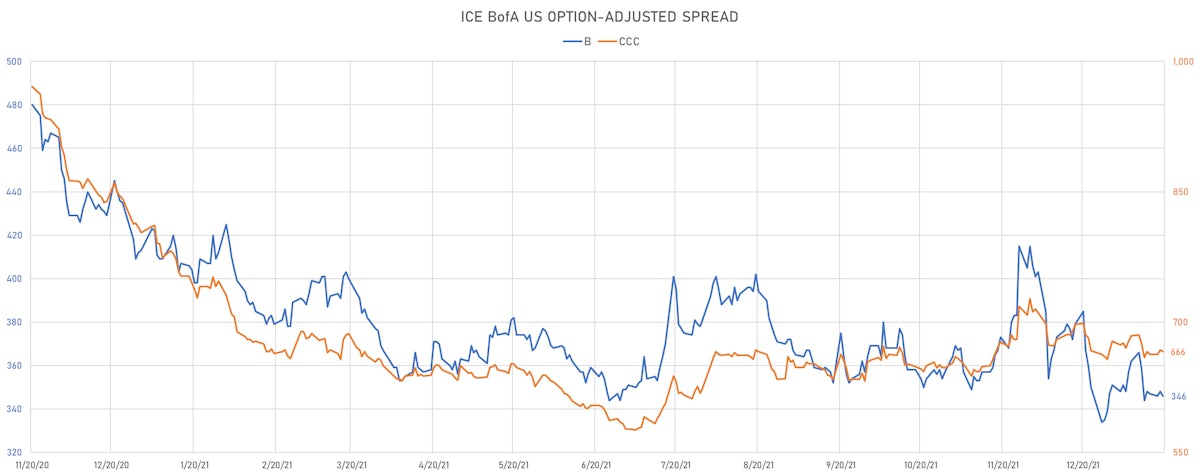

We could have expected the lowest-rated issuers to be hit the hardest by rising yields, but looking at USD cash indices, only single-Bs and CCCs have seen spread compression year-to-date (OAS down 5bp and 12bp respectively)

Equities

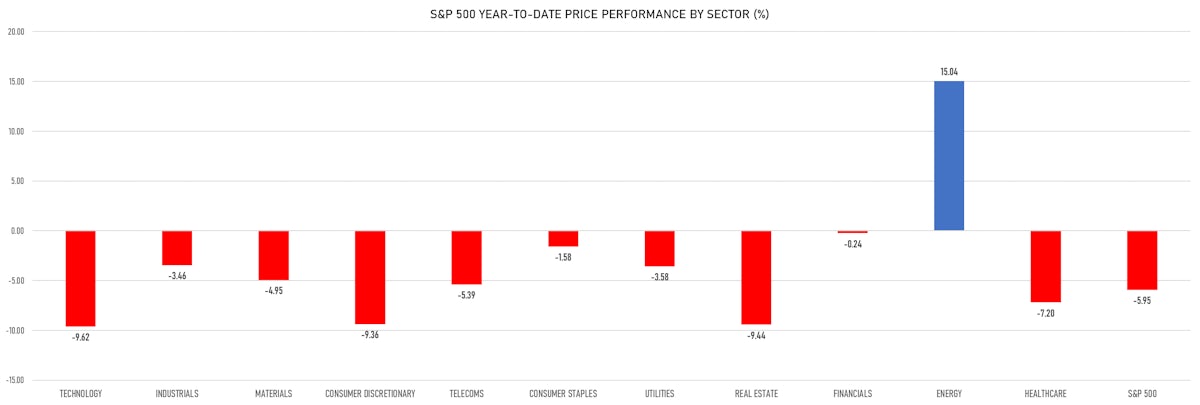

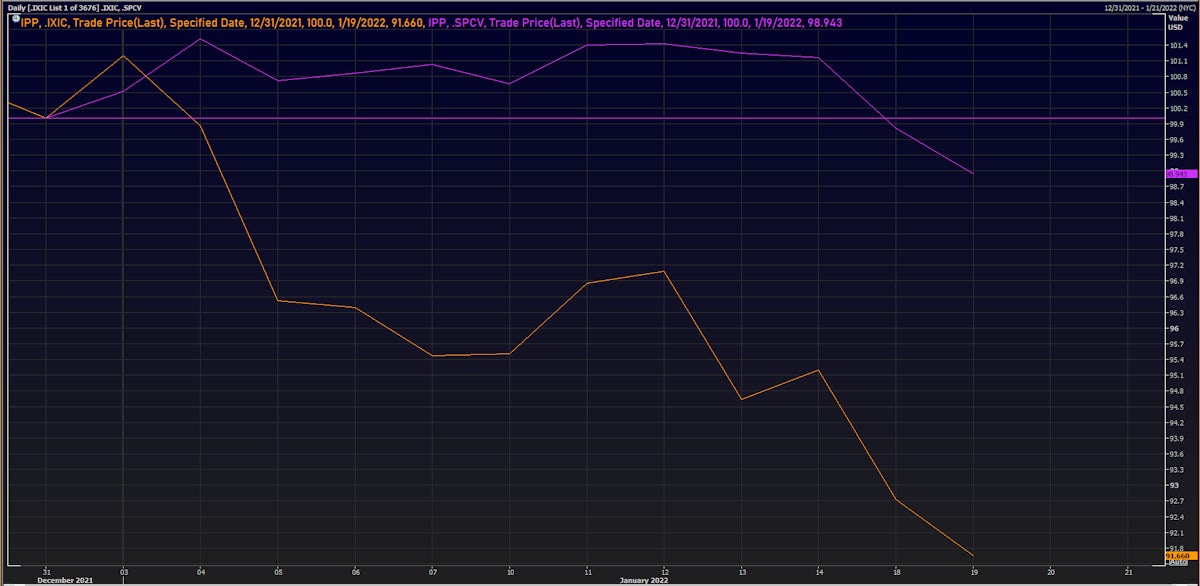

S&P 500 Drawdown Reaches 6%, With The Technology Sector Now Down 10% From Its Peak

Overall, that is not a large drawdown considering the volatility of tech stocks; value keeps overperforming growth, with the top performing sectors today being utilities and consumer staples

FX

Risk-On Moves In FX, With The Aussie Dollar Leading the Way Among Major Currencies

Sovereign credit spreads were down for Russia, Turkey, Brazil, South Africa, allowing EM currencies to make significant gains today: BRL up 2%, RUB up 1%, ZAR up 1%

Rates

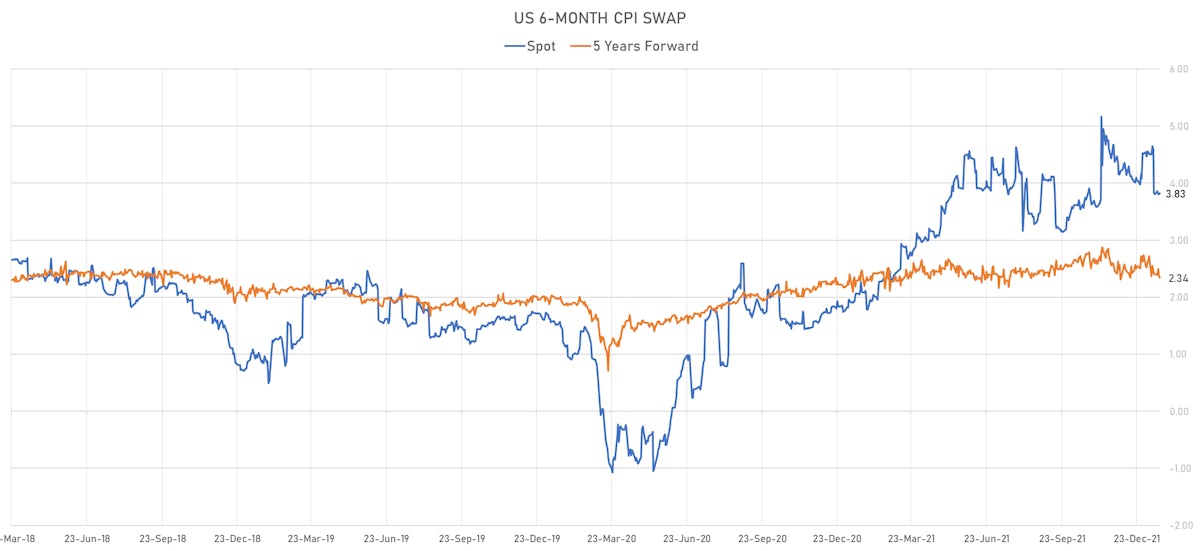

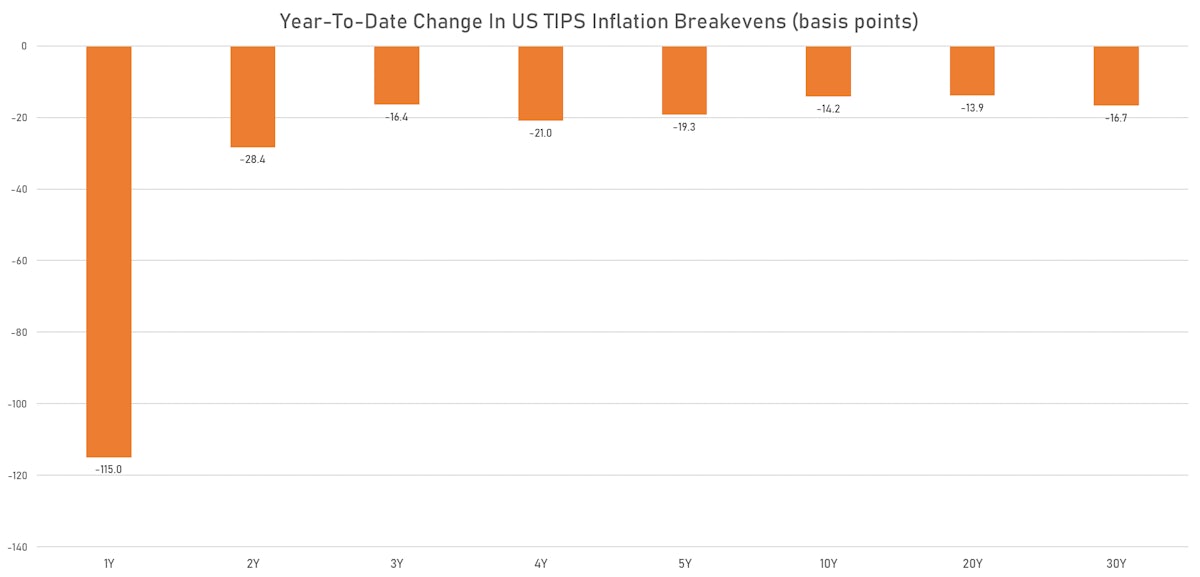

Yields Down Across The US Curve, With A Modest Flattening Out To The Belly

We've seen a dramatic repricing of front-end inflation expectations since the beginning of the year, though the curve is still well above where the Fed would want it to be

Credit

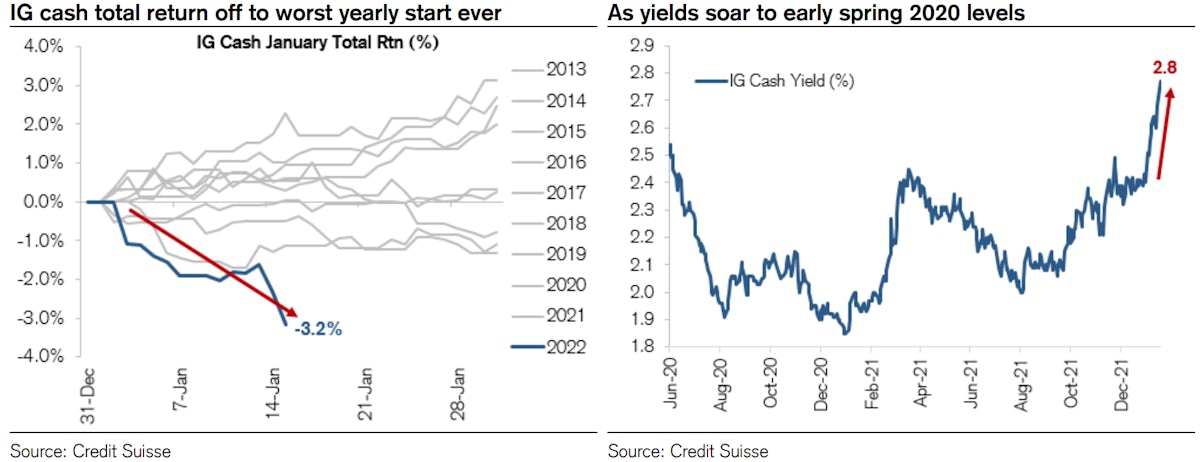

Wider Spreads Across The Credit Complex, Higher Yields Take US$ Liquid IG Down 3.58%, HY Down 1.41% YTD

In a note today, Credit Suisse points out that the recent weakness in US$ IG cash (worst yearly start ever) is likely to turn around after the March FOMC: with the first rate hike out of the way, rates volatility should start receding and demand for IG should come back, bringing spreads tighter