Rates

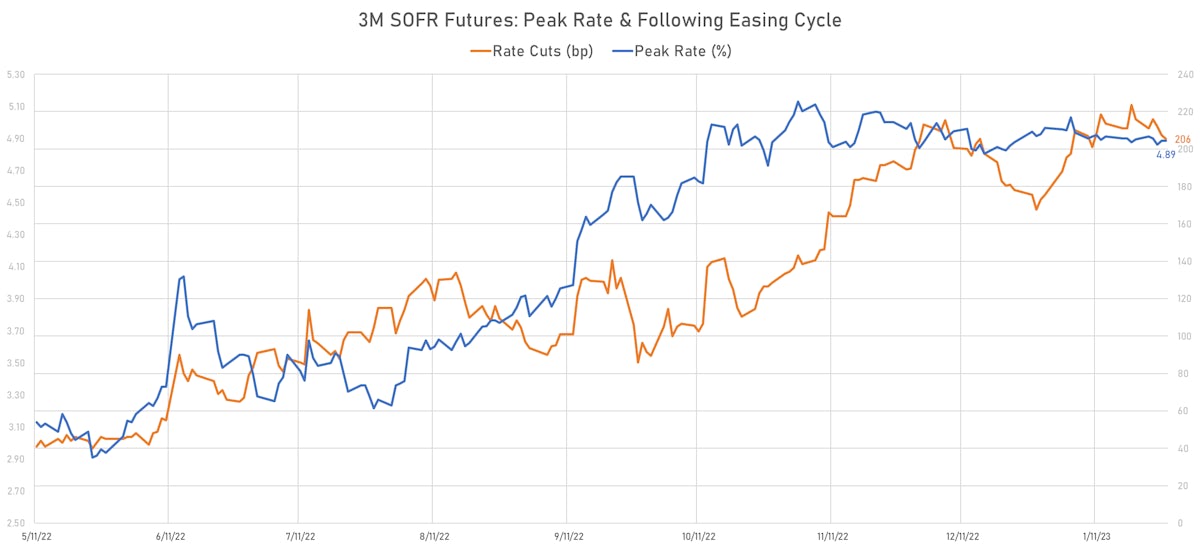

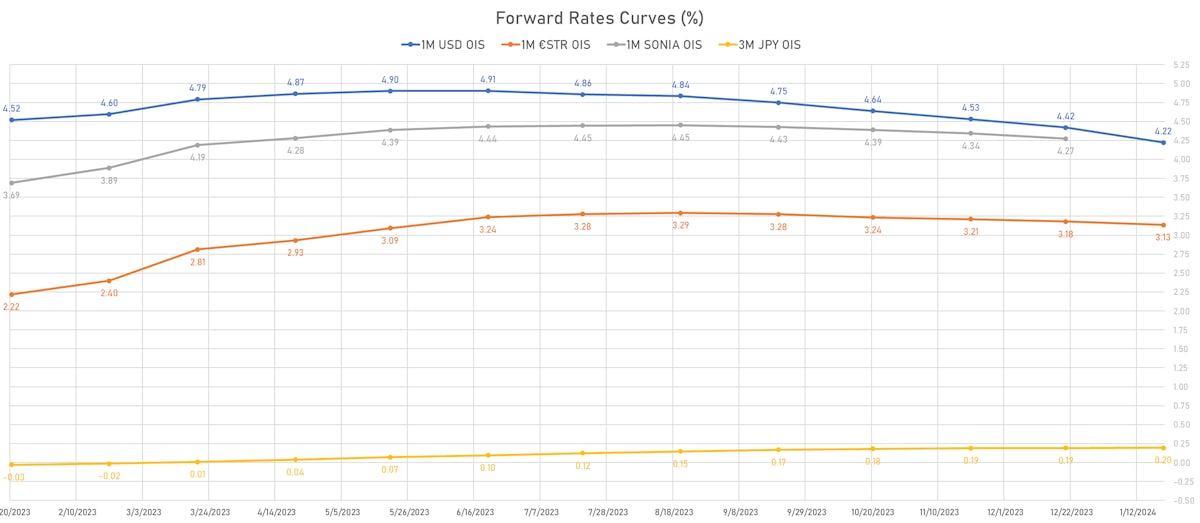

Very Little Change In US Fed Funds Forward Rates This Week, With No Surprise Expected From The FOMC

Having said that, the event risk is tilted towards a more hawkish Fed, as disinflationary data over the last 3 months has led to a dovish repricing of the forward curve, which Powell has a good opportunity to lean against

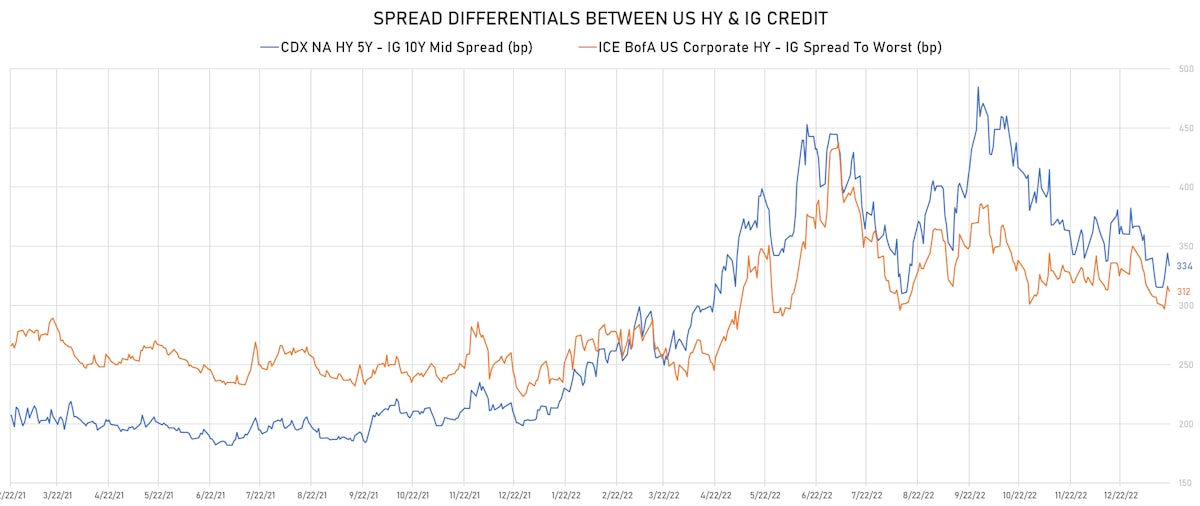

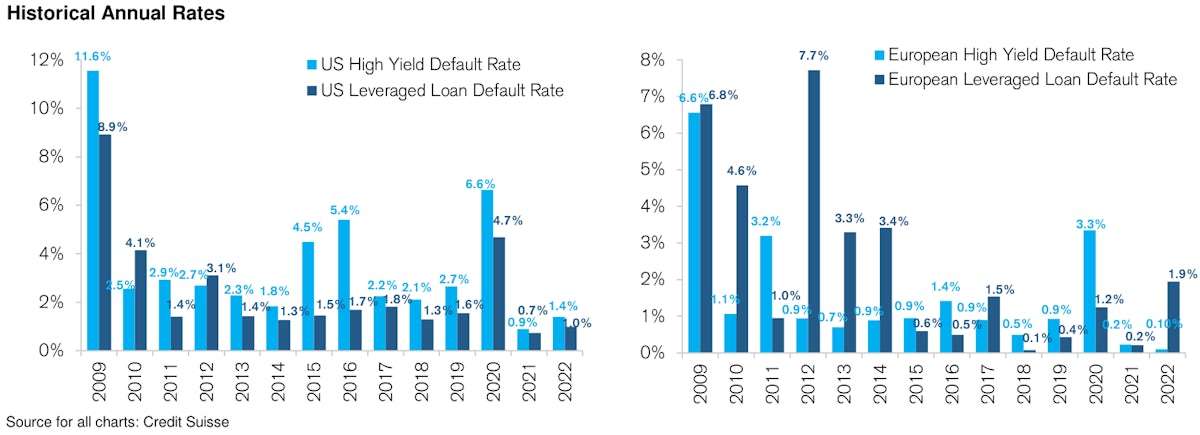

Credit

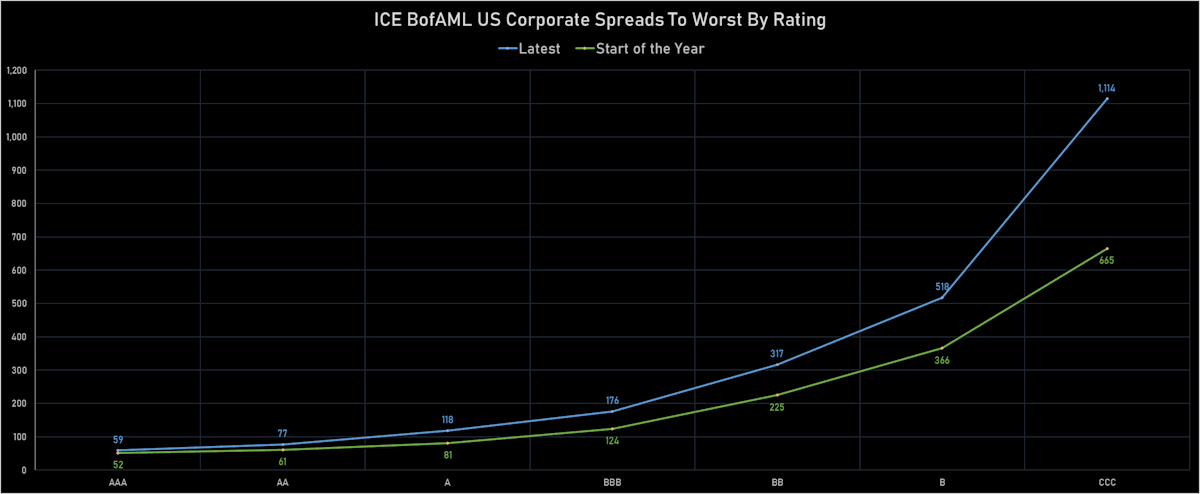

US High Grade Credit Overperformed Last Week, With BBBs Spreads Tighter And BBs Wider

Decent volumes of USD HY corporate bond issuance this week after a slow start to the year: 11 tranches for $16.05bn in IG (2023 YTD volume $110.15bn vs 2022 YTD $145.24bn), 9 Tranches for $6.7bn in HY (2023 YTD volume $11.7bn vs 2022 YTD $16.085bn)

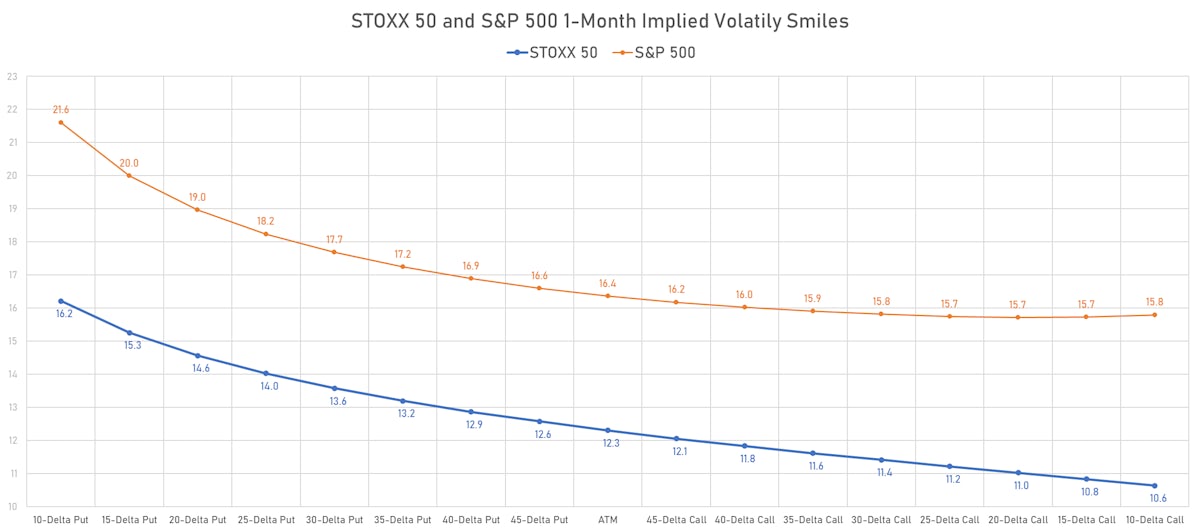

Equities

Equities Weaken As 4Q22 Earnings Start Rolling In, With 17% Of The S&P 500 Reporting In The Week Ahead

It's hard to see much upside from here for US stocks over the next 12 months, with the S&P 500 forward P/E around the 80th historical percentile and downward earnings revisions just beginning in earnest

Rates

Weak US Economic Data, Fear Of Recession Mean Fewer Rate Hikes Priced Into US Short-Term Rates

Despite the negative recent incoming data, US consumers should see a rise in real income of about 3.5% this year, helped by substantial wage growth, which will push the "stronger for longer" economic theme for a good part of the year

Credit

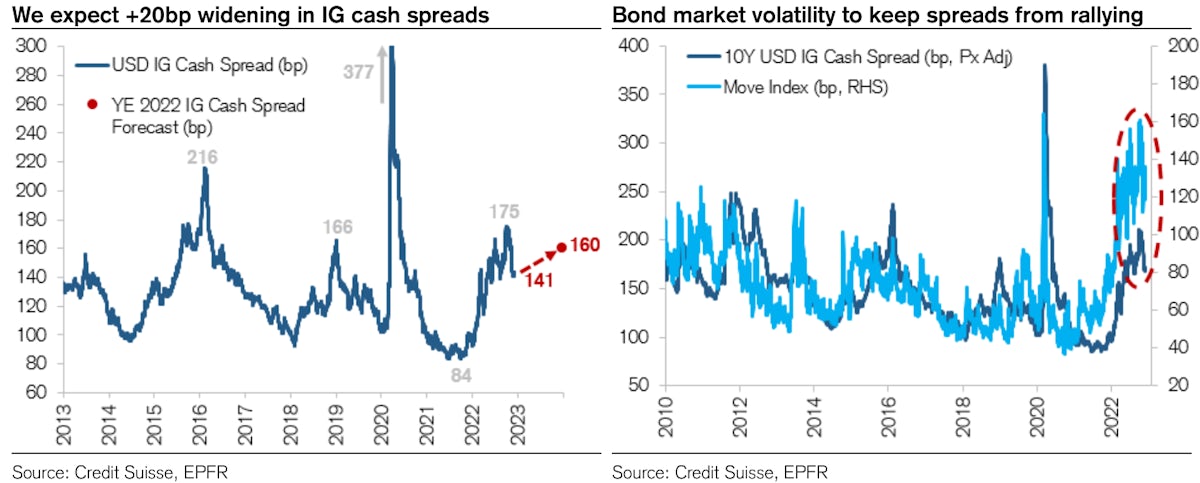

Limited Upside In Rates And Attractive Carry Have Pushed Flows Into USD Credit, Though Spreads Are Likely To Widen This Year

Solid start for investment grade issuance: 106 tranches for $94.1bn in IG in the first couple of weeks of 2023 (vs 2022 YTD $107.1bn), 7 tranches for $5bn in HY (vs 2022 YTD $11.815bn)

Equities

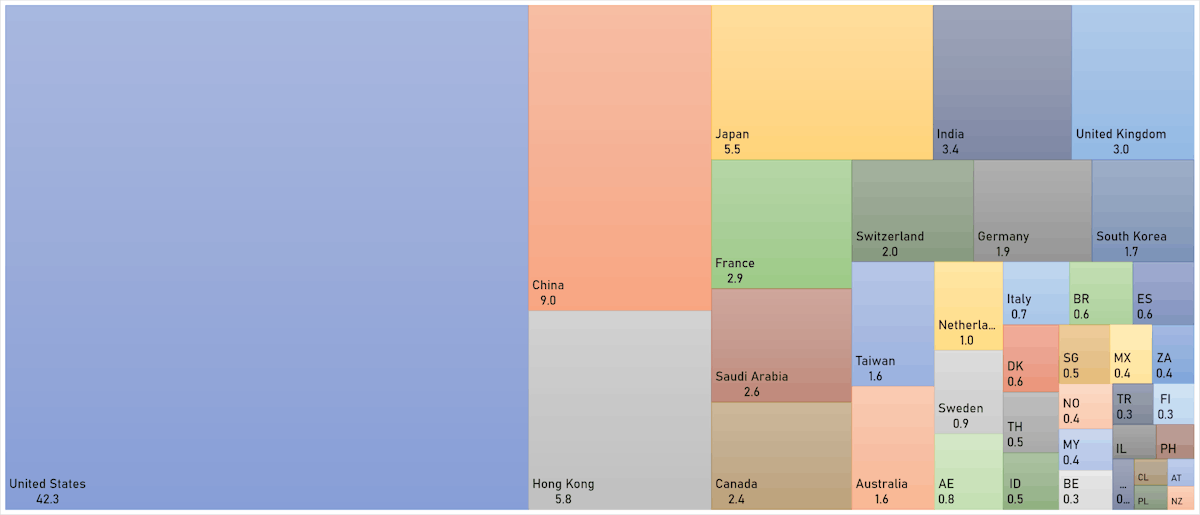

Global Equities Surf On The Current Goldilocks Vibe And Kick Off 2023 With Solid Gains

Although S&P 500 EPS estimates for CY2023 have fallen almost 5% over the past 3 months, they still project an EPS growth of nearly 5% vs CY2022; Goldman sees EPS growth of 0% this year and Jefferies expects -6.5%

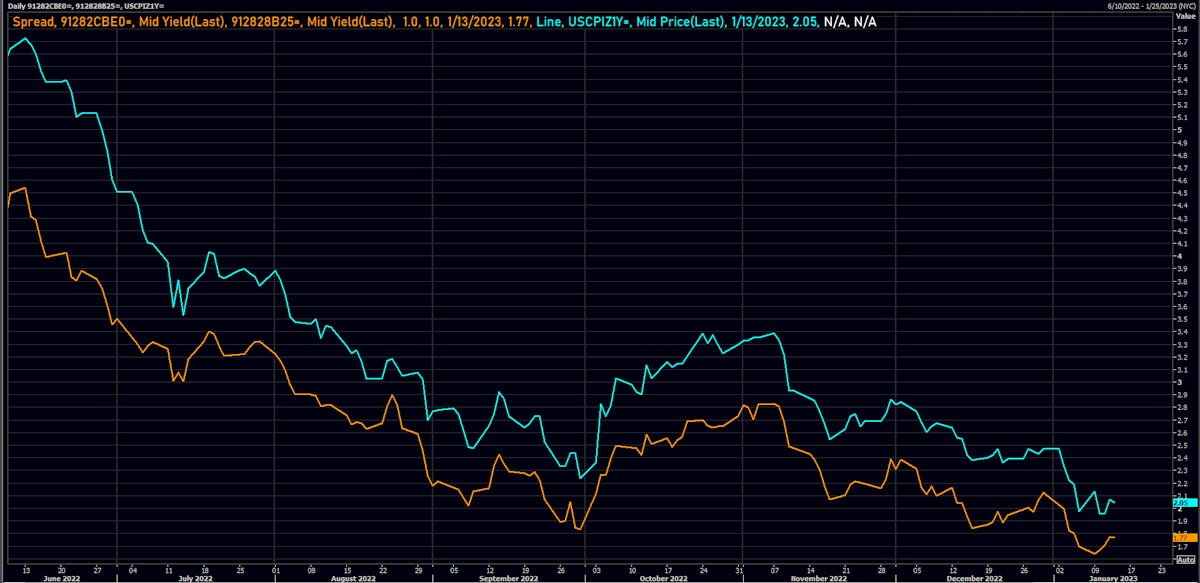

Rates

US Rates Complex Feeling Hopeful That Inflation Is Normalizing, With A Soft Landing As The New Base Case

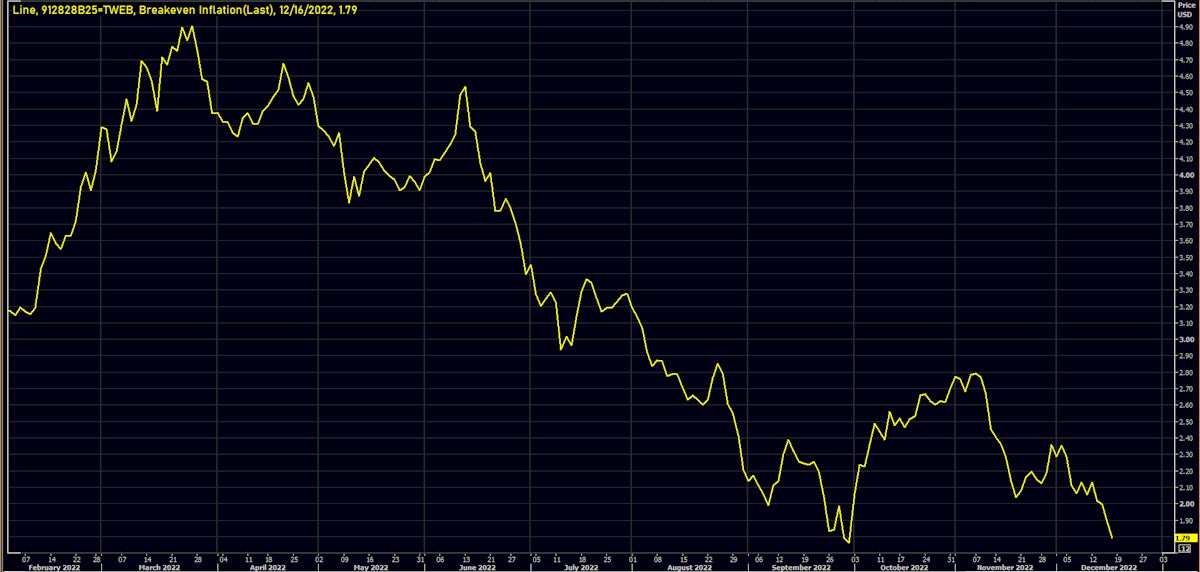

Even if headline inflation seems to be coming down rapidly markets are too sanguine about inflation pricing : 1Y TIPS breakeven around 1.80% and 1Y CPI swap at 2% look too low

Credit

2022 Was A Pretty Grim Year Across The Credit Complex, With Most Of The Damage Coming From Rates

Corporate bond issuance is pretty much done for the year: just 1 tranche for $3bn in IG this week (2022 YTD volume $1.211tn vs 2021 YTD $1.487tn, down 18.6% YoY) and no new pricing in HY (2022 YTD volume $101.971bn vs 2021 YTD $461.811bn, down -77.9% YoY)

Equities

Weakness Across Global Equities, As Hawkish Central Banks And Soft Data Add Up To A Challenging Environment

The year 2023 is setting up as a tale of two halves in the US: the first one should be dominated by earnings revisions and bring in a possible new bottom for the cycle, while the second half should be a positive recovery trade

Rates

Fed Chooses To Ignore FCI Loosening, While The ECB Points To Unexpectedly Hawkish Path In 2023

The most surprising thing to us at this point is how low the market is pricing inflation 1Y forward, with the 1Y US TIPS breakeven now around 1.80%, while the Fed's own forecast for the end of 2023 is above 3%

Credit

US CDS Indices See Spreads Widen Ahead Of FOMC, While Cash Held Up Better With Low Supply Helping

Very little issuance of new corporate bonds this week: 6 tranches for $4.25bn in IG (2022 YTD volume $1.208tn vs 2021 YTD $1.487tn, down 18.8% YoY), 3 tranches for $2.26bn in HY (2022 YTD volume $101.971bn vs 2021 YTD $459.461bn, down 77.8% YoY)

Equities

As Expected, US Equities Down 3.6% For The Week Ahead Of Critical Macro Events Next Week

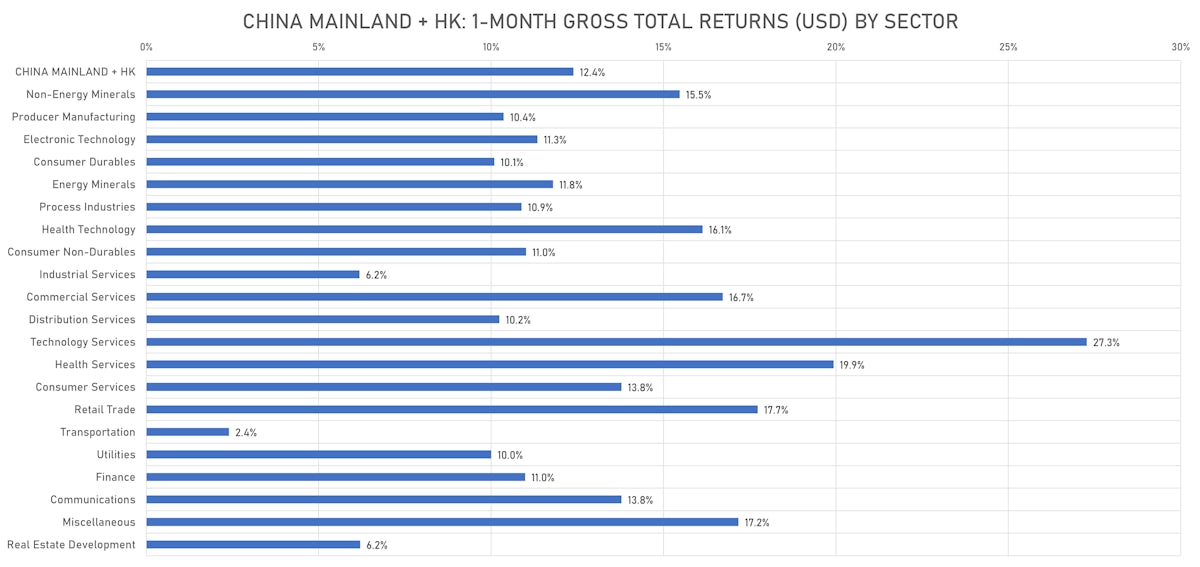

China's mainland and Hong Kong equity markets continued to rebound on the back of looser local COVID restrictions, with a full national reopening expected around April next year