Rates

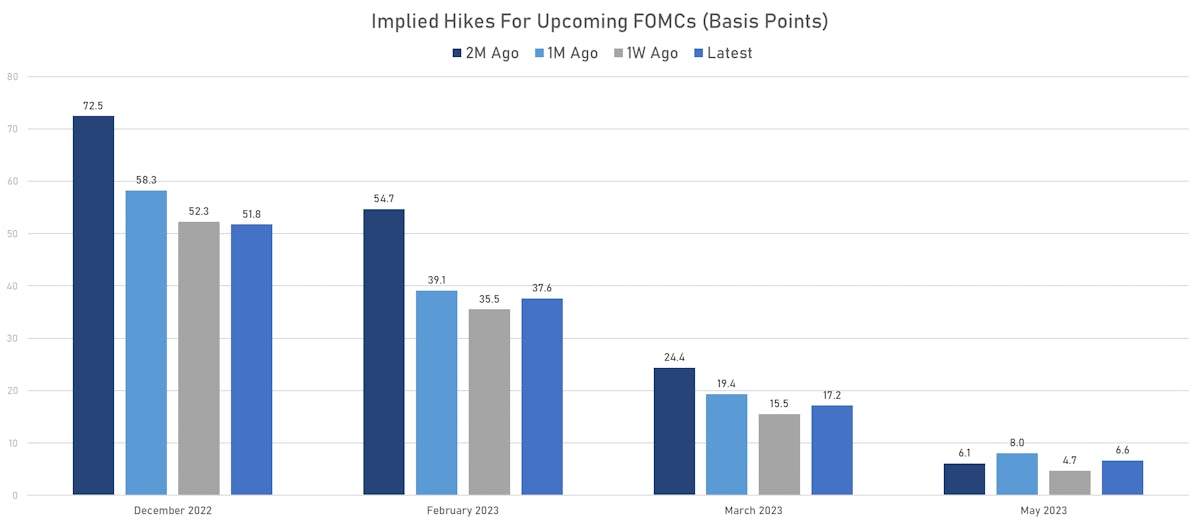

Big Macro Week Ahead Gives The Fed An Opportunity To Reset Recent Dovish Leanings

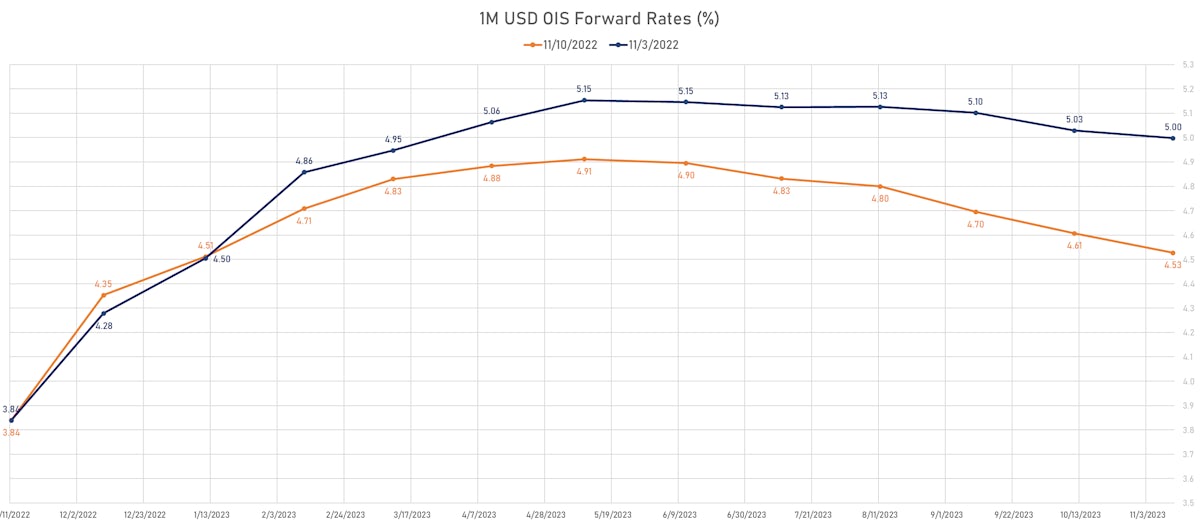

The easing in financial conditions over the past month has not been met by any pushback from the Fed, but the December FOMC is as good a time as any to change expectations and market pricing

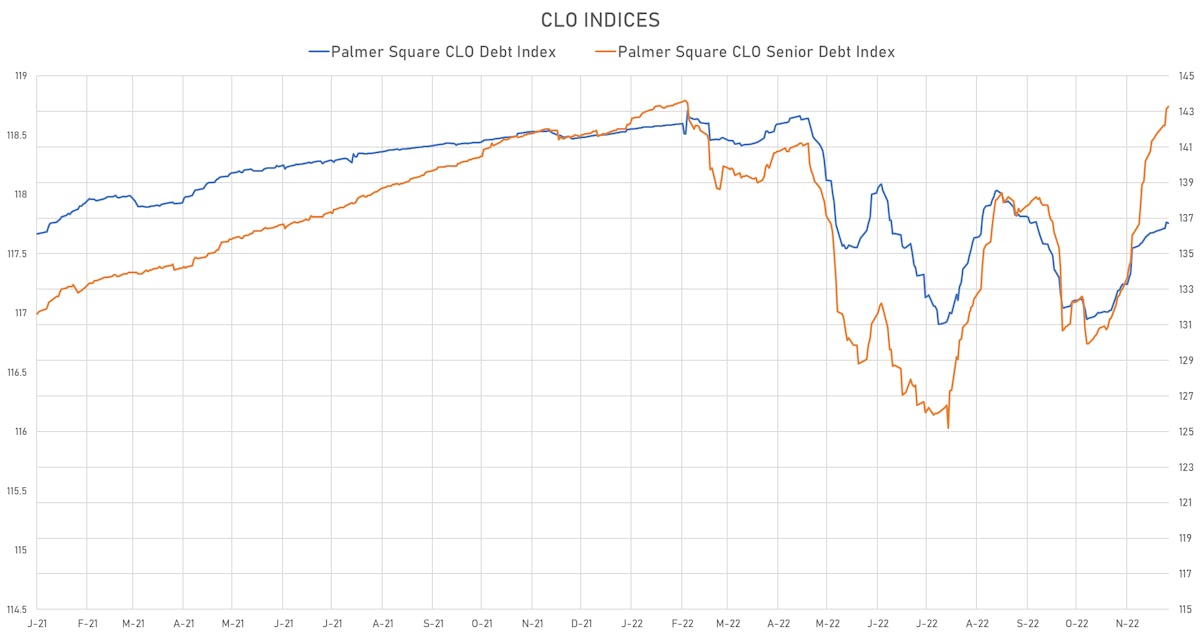

Credit

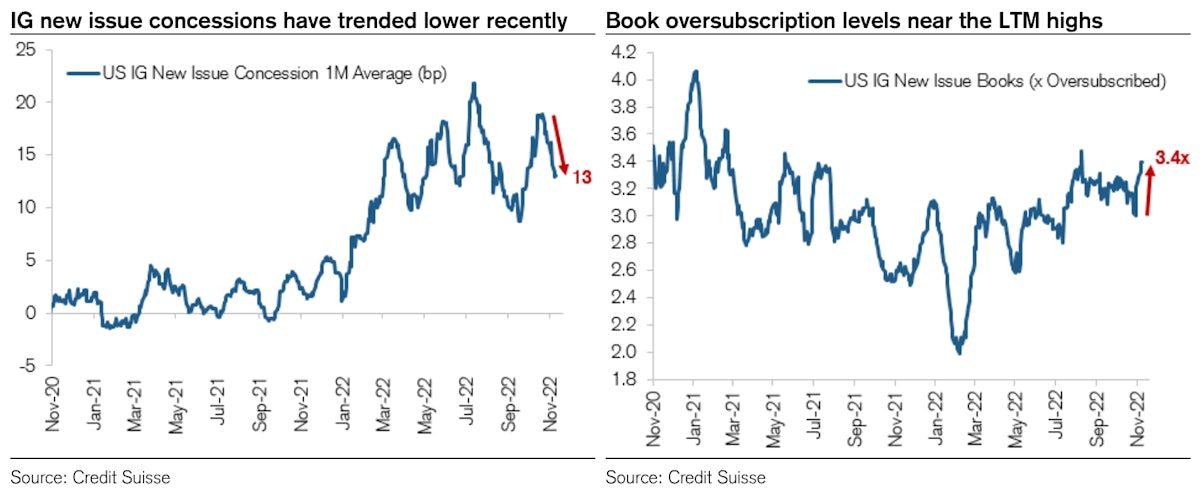

After November's Huge Rebound, US Credit Is Looking Much Less Attractive Into The December FOMC

US corporate bond issuance is slowing but still decent in IG (IFR Markets data): 27 tranches for $22.15bn in IG (2022 YTD volume $1.204tn vs 2021 YTD $1.447tn, down 16.8% YoY) and no new print in HY (2022 YTD volume $97.701bn vs 2021 YTD $452.631bn, down 78.4% YoY)

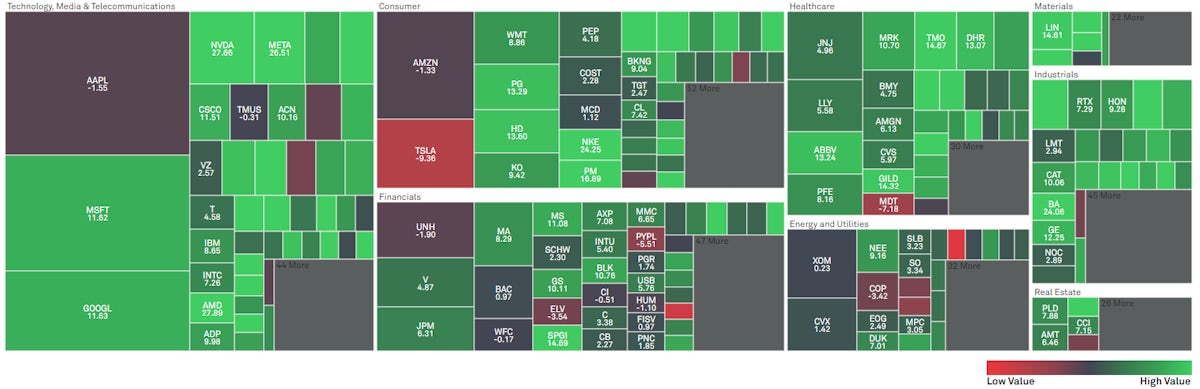

Equities

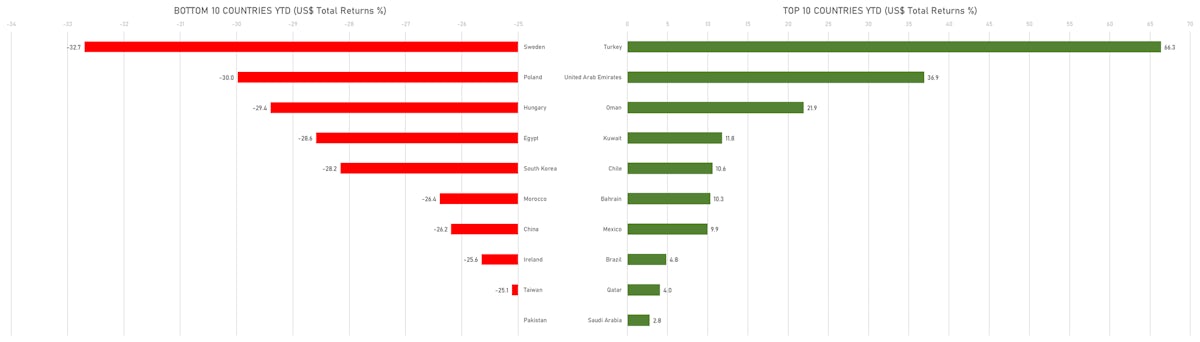

Nice Further Gains For Global Equities This Week, Driven By Hopes Of Looser Fed Policy And Chinese Reopening

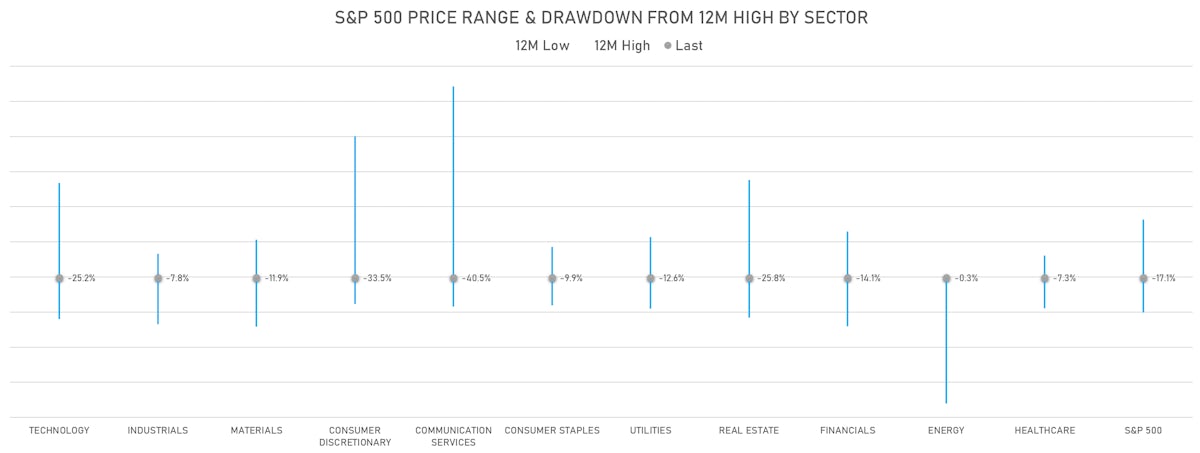

At current levels US equities are pricing in a soft landing, and with the VIX sub 20 and US CTAs now 80% net long (from net short a month ago), it's hard not to be cautious into year end

Rates

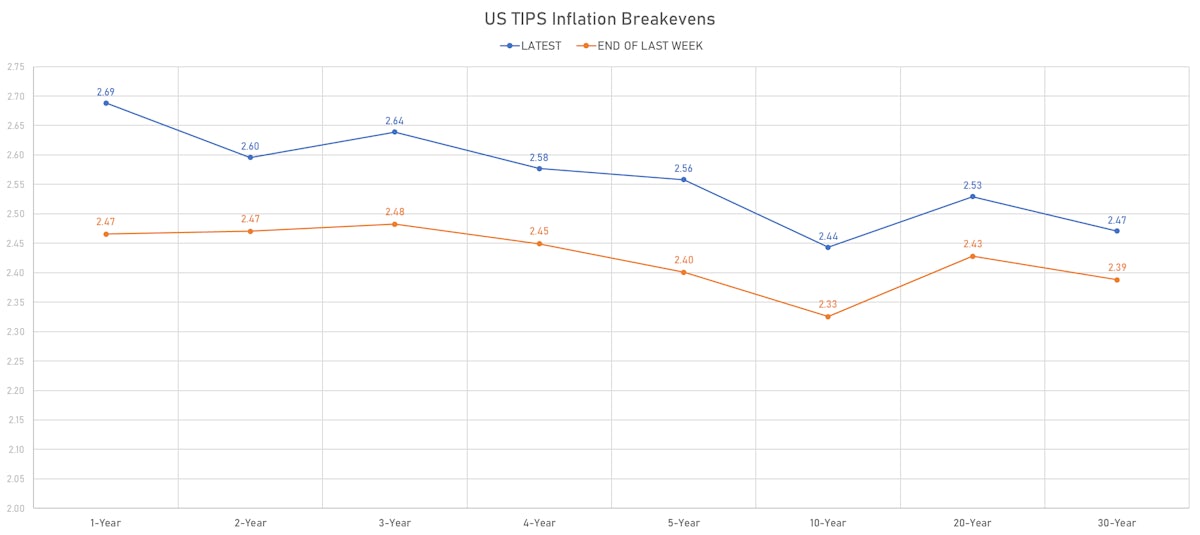

Mixed US Data And Powell's Speech Brought Lower Real Yields, Higher Inflation Breakevens This Week

The Fed Chair's speech was widely interpreted as dovish, and money markets hurried to price in a lower peak rate as well as two full rate cuts in 2023, both of which seem contrary to the stated Fed policy of reaching a higher terminal rate and holding there for a while

Credit

Significant Tightening In Spreads Brought Positive Performance Across US$ Credit This Week Despite Higher Rates

Good volume of corporate issuance at the tail end of 3Q22 earnings season: 31 tranches for $24.78bn in IG (2022 YTD volume $1.176tn vs 2021 YTD $1.414tn), 2 tranches for $1.9bn in HY (2022 YTD volume $99.701bn vs 2021 YTD $451.381bn)

Equities

Mostly Poor Performance Across US Equities This Week, With Higher Rates And Falling 2023 EPS Forecasts Weighing

Looking at 2023 sell-side outlooks, it's worth noting that most firms don't see much upside for US equities from here: Credit Suisse's end of 2023 S&P 500 index forecast is at 4,050, Goldman Sachs at 4,000 and Jefferies at 4,200

Rates

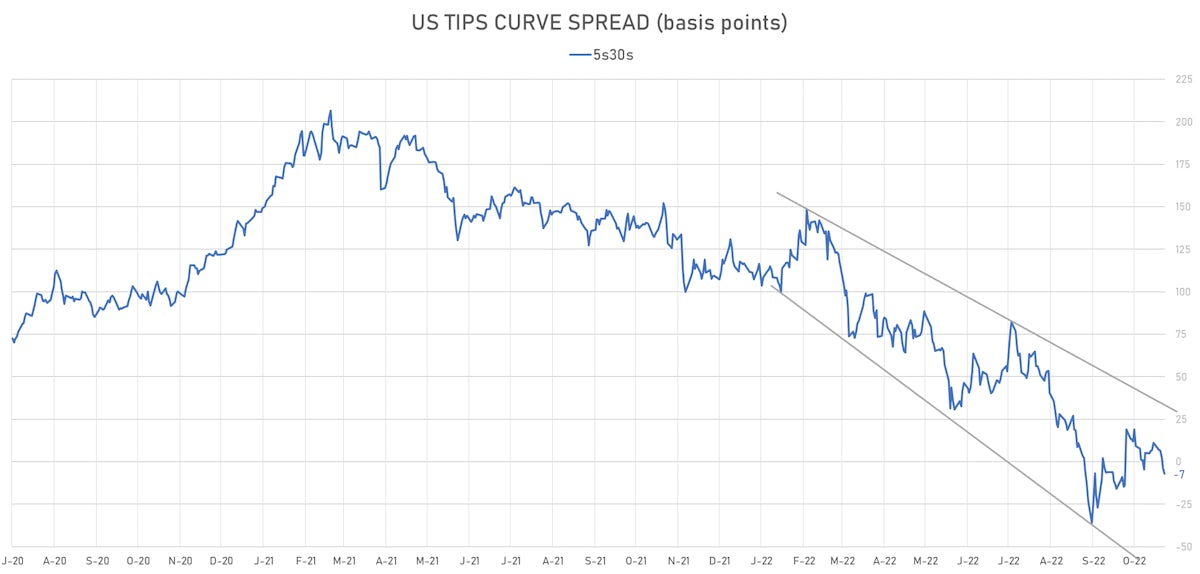

US Yield Curve Bear Flattens, As Hawkish Bullard Speech Puts Terminal Rate Range At 5% To 7%

The sharp drop in breakevens and the flattening of the real yields curve reflect the credibility of the recent Fed shift to a "higher for longer" rates environment (with sub-par GDP growth and lower inflation expectations)

Credit

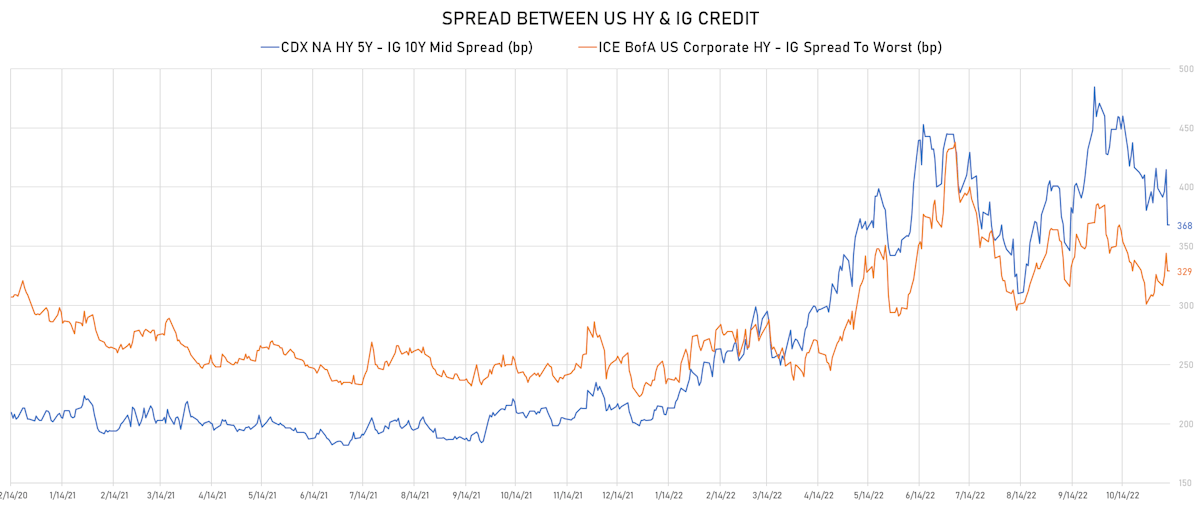

Mixed Picture In US Credit, With HY-IG CDS Spreads Differentials Compressing Markedly Post CPI, While HY Cash Performance Lagged

Solid week of bond issuance for US corporates (IFR Markets data): 46 tranches for $45.45bn in IG (2022 YTD volume $1.151tn vs 2021 YTD $1.357tn, down 15.2% YoY), 5 tranches for $6.2bn in HY (2022 YTD volume $97.801bn vs 2021 YTD $442.541bn, down 77.9% YoY)

Equities

Tremendous Rise In US Equities As CPI Print Brings Hopes Of A Soft Landing, Shorter Hiking Cycle

Chinese equities continued their rebound this week, largely driven by a fear of missing out, as most observers point out that the most likely time for a change of covid policies will be after the two sessions in March 2023

Rates

Fed Likely To Push Back Against Overreaction To Positive CPI Print, As Inflation Still Very Elevated

The CPI surprise brought huge moves across asset classes, with rates differentials pushing the dollar lower and driving one of the largest one-day loosening in the GS financial conditions index

Credit

Mixed Spreads Across The US Credit Complex This Week, But HY Synthetics Overperformed Equities

Light volume of issuance for US corporate bonds this week: 17 tranches for $12.45bn in IG (2022 YTD volume $1.105tn vs 2021 YTD $1.332tn, down 17% YoY), and a $1.5bn tranche (from Ford Motors) was the lone issue in HY (2022 YTD volume $91.591bn vs 2021 YTD $428.656bn, down 78.6% YoY)

Equities

US Equities Dropped This Week Along With Implied Volatility, An Illustration Of A Nervous Market With Low Convictions, Light Positioning

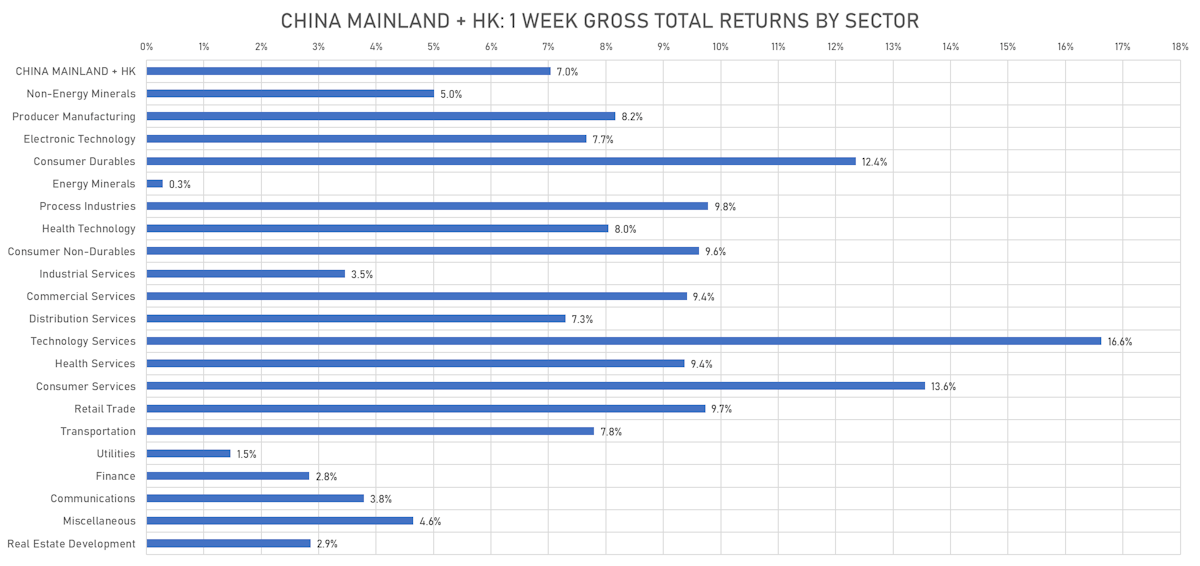

Optimism about China's reopening drove speculative enthusiasm through the Mainland and HK markets this week, with the most depressed sectors (internet stocks) leading the way