Rates

Solid US Economic Performance Lead Front-End Rates Higher This Week, Driven By Higher Breakevens

It was a good week for the Fed's soft-landing scenario, as labor demand is cooling without creating unemployment, and the recent UK situation might give the Fed a reason to slow down the pace of hikes, depending on how the CPI data looks next Thursday

Credit

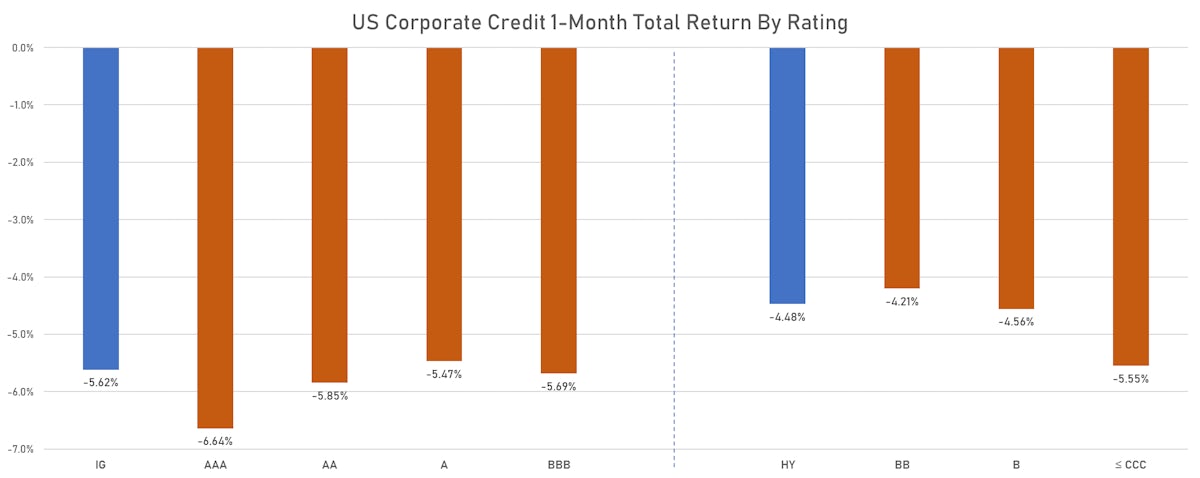

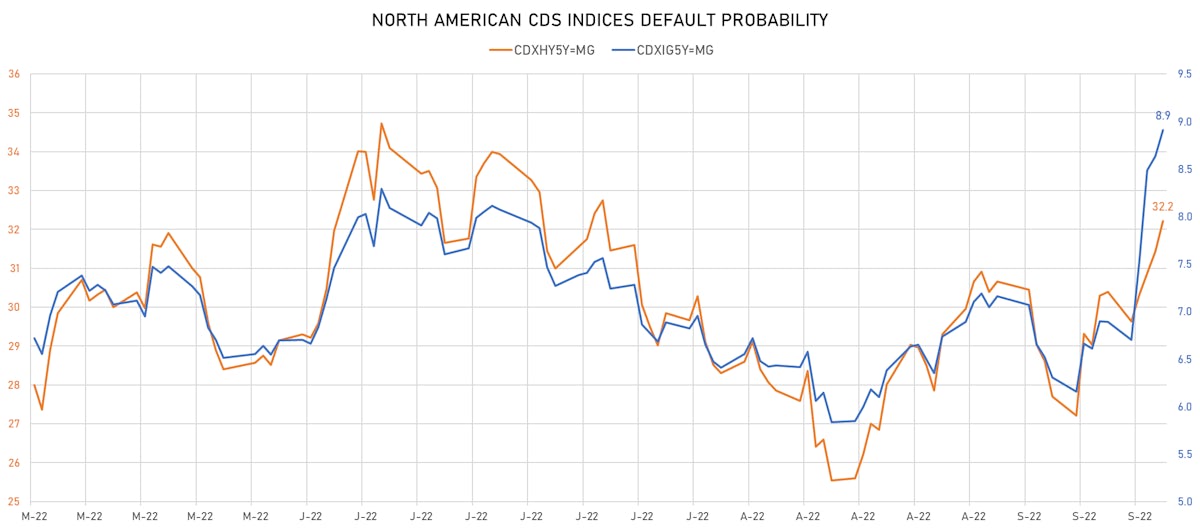

Tough Month Across The US$ Credit Complex, But HY Spreads Still Have A Lot Of Room To Widen Into A Recession

Rates volatility almost completely shut down the US corporate bond primary market this week: only 6 tranches for $2.5bn in IG (2022 YTD volume $1.016tn vs 2021 YTD $1.190tn) and no new issue in HY

Equities

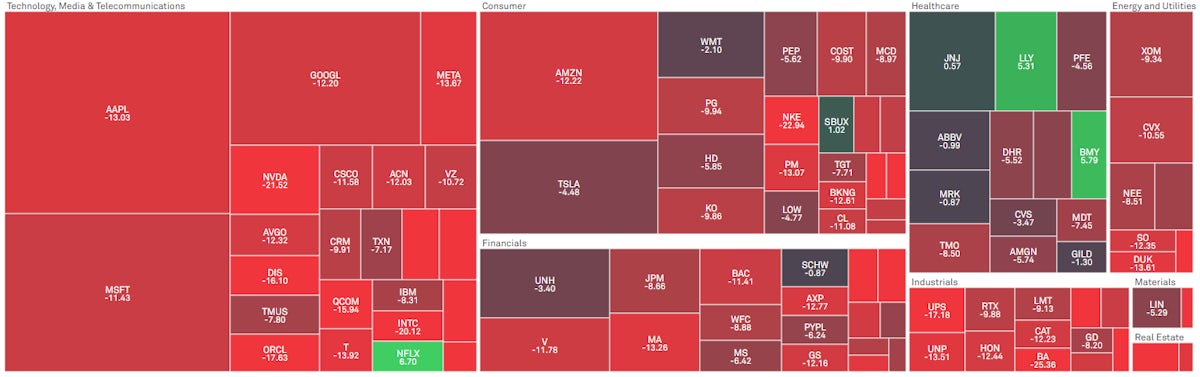

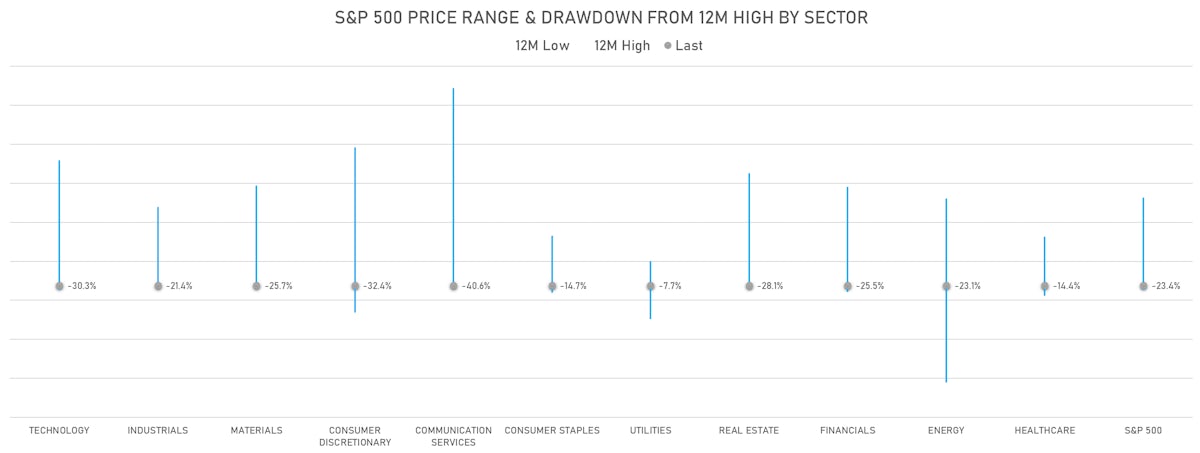

Choppy Trade For US Equities This Week; S&P 500 Price Index Ends September Down 9.4% For The Month, Down 5.3% For The Quarter

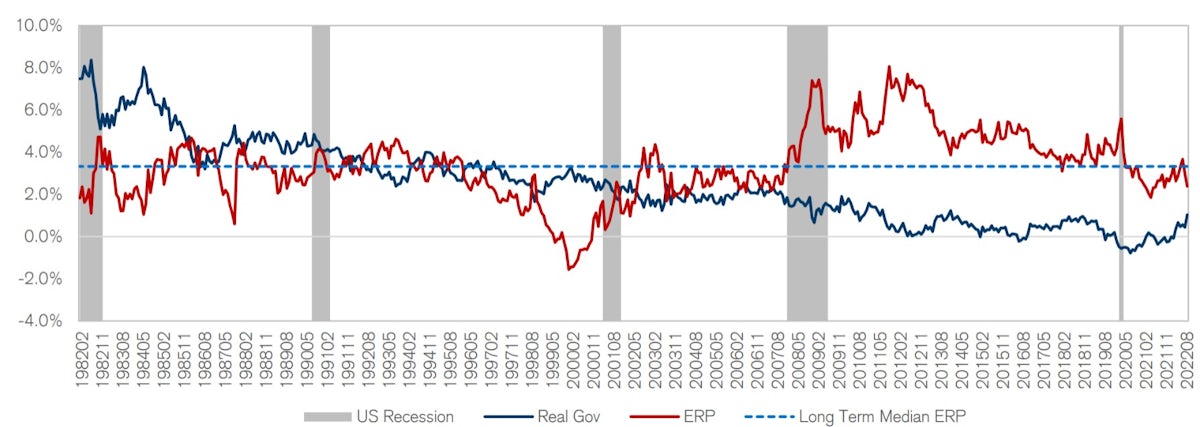

We still expect to see lower cycle lows: valuation multiples are too high relative to real yields and corporate margins expectations will need to compress further

Rates

Another Crazy Week Across The Rates Complex, With Volatility Reaching Worrying Levels In Sterling

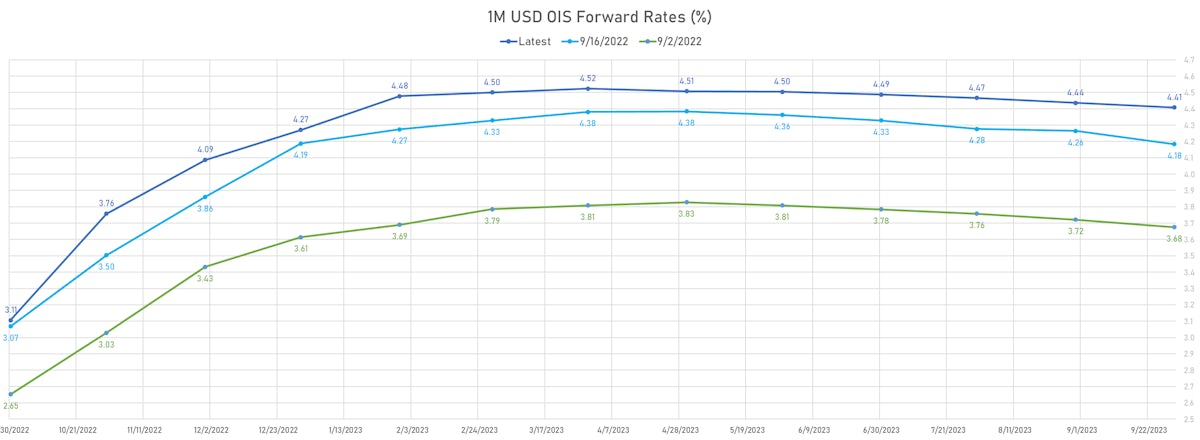

Although US rates have risen significantly over the past weeks, the positive economic momentum in services could drive the peak Fed Funds rate higher than current expectations

Credit

US IG Has Repriced More Violently Than HY And Currently Looks More Attractive On A Relative Basis

Very little volume of issuance for US$ corporate bonds this week (IFR Markets data): 8 tranches for $6.1bn in IG (2022 YTD volume $1.014tn vs 2021 YTD $1.163tn), 3 tranches for $6bn in HY (2022 YTD volume $86.376bn vs 2021 YTD $372.469bn)

Equities

No Surprises In The Extended US Equities Drawdown, With Rates Volatility Driving Further Losses

Although we still expect lower lows for this cycle, from a compression in multiples and corporate margins, we should see a bounce this week, as multiple technical indicators point to short-term capitulation

Rates

The Fed Did A Good Job Of Reanchoring The Front End Higher, With The 3m/2Y Treasury Spread Rising Nearly 40bp Since The FOMC

Crazy week in macro markets: the BOJ intervening to help the Yen for the first time since 1998, signaling that yield curve control is likely coming to an end soon, and Cable getting shattered by a weak BoE hike and Truss' inflationary new economic plan (with rumors now flying of a possible 100bp BoE hike before markets reopen on Sunday)

Credit

US High Yield Credit Performed Poorly This Week, With A Significant Decompression In HY-IG Spreads

Reasonable amount of USD corporate bond issuance over the past week (IFR Markets data): 25 tranches for $18.85bn in IG (2022 YTD volume $1.008tn vs 2021 YTD $1.147tn), 1 tranche for $500m in HY (2022 YTD volume $80.376bn vs 2021 YTD $360.239bn)

Equities

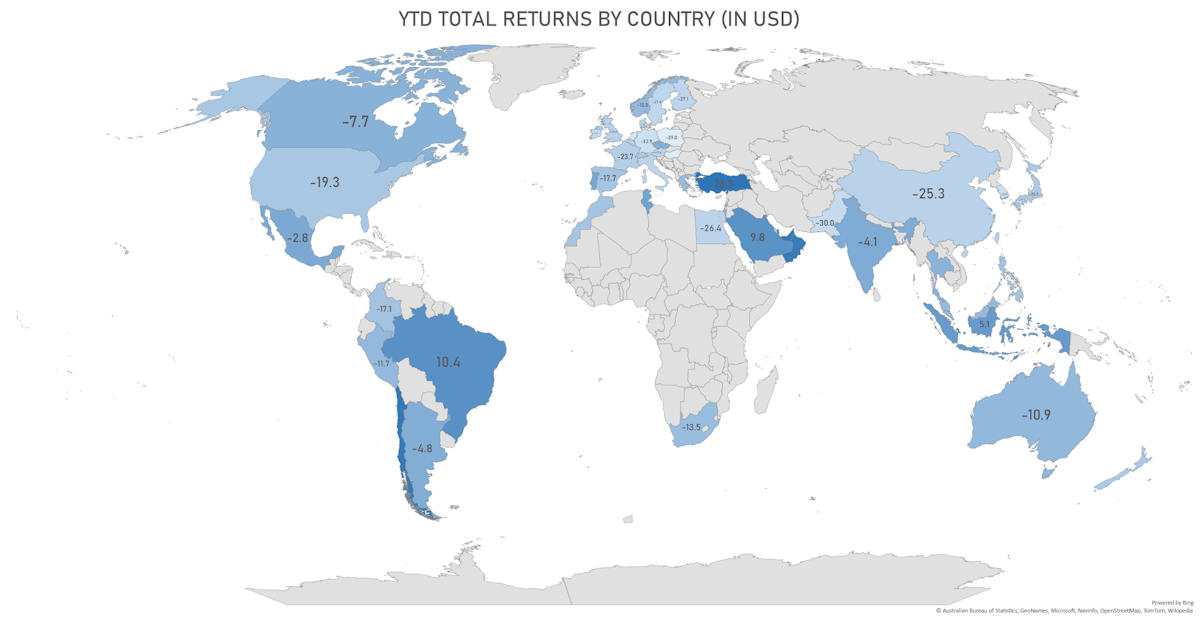

Ugly Week For Equities, With All Major Global Indices Falling: S&P 500 Down 4.8%, Nasdaq Composite Down 5.5%

As mentioned last week, we continue to expect equities to make new cycle lows: with US core inflation still rising, the rates complex is repricing the path of Fed Funds higher, which will inevitably lead valuation multiples lower

Rates

Front End Yields Rise, Driven By Breakevens, While The Curve Continues To Bear Flatten

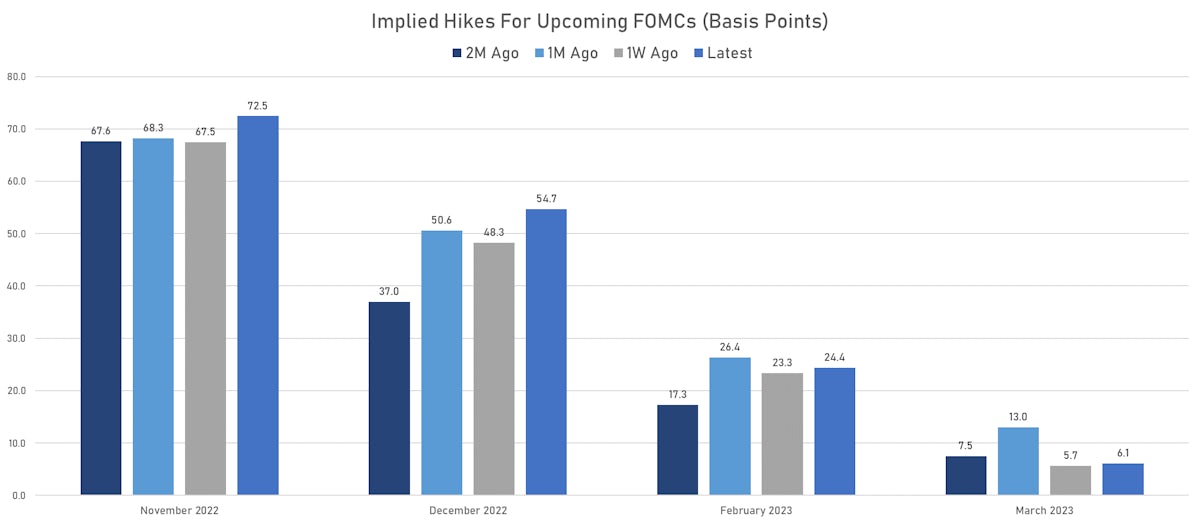

Despite the Fed's "higher for longer" messaging, money markets still price in rate cuts next year after peaking in March 2023 (EDZ23-EDH23 spread at -42bp), something Powell will no doubt have to address at his FOMC press conference

Credit

Risk Appetite Returns On Short-Term Volatility Fall: US HY Cash OAS 49bp Tighter This Week

Big week of US$ bond issuance for corporates, led by Walmart and Lowe's: 63 tranches for $53.1bn in IG (2022 YTD volume $989.2bn vs 2021 YTD $1.1tn), 4 tranches for $2.5bn in HY (2022 YTD volume $79.9bn vs 2021 YTD $350.0bn)

Equities

Broad Rebound In Global Equities From Oversold Levels, Helped By Lower Rates Volatility

Considering the current level of the US equity risk premium, and the stretched implied volatility skew on 1-month S&P 500 options, we doubt this technical move higher will prove durable