Rates

Modest Rise In Yields At The Front End Of The US Treasury Curve, With Flattening Further Down; 5s10s Spread Closed The Week At Just 0.6bp

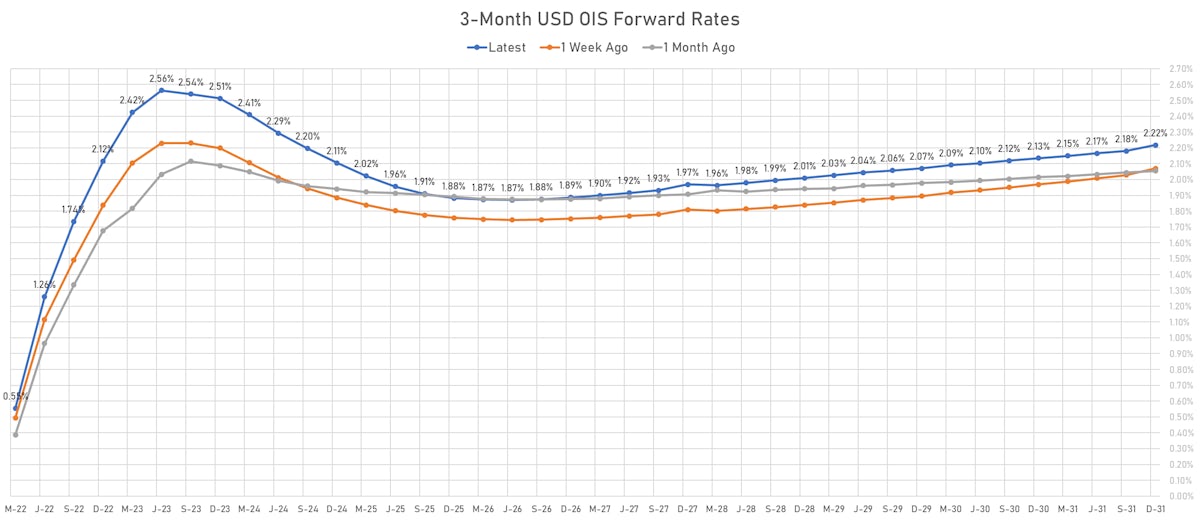

Minneapolis Fed President Kashkari thinks the neutral Fed Funds rate is likely 2% (below the Fed's published number), which matches the estimates of sell-siders like Morgan Stanley's Ellen Zentner; if that is correct, forward markets now expect neutral to be reached by the end of the year

Credit

Another Good Day For US Credit, With Lower Yields, Tighter Spreads Across The Board

A decent amount of issuance in USD corporate bonds, led by FIG deals from Wells Fargo ($4bn in one tranche) and Bank Of America ($3.5bn in 2 tranches)

Rates

Double-Digit Rises In Gasoil, Brent Crude Prices Take US TIPS Breakevens Much Higher, While The Treasury Curve Bull Steepens

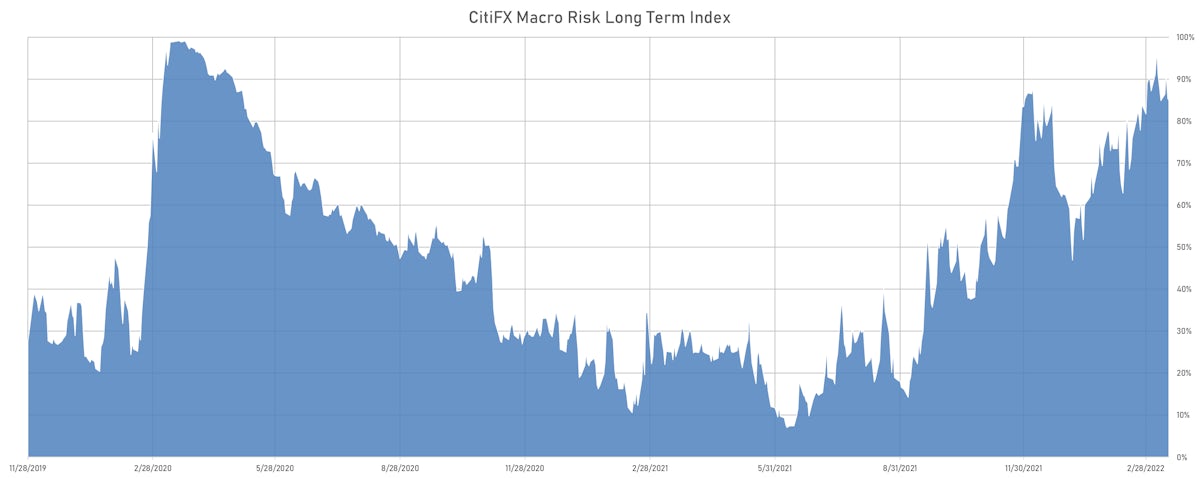

Rates volatility and macro risk indicators have started to recede, although they are still at extraordinary levels compared to a year ago, with 1-month into 1-year USD swaptions still trading at 104 normals

Credit

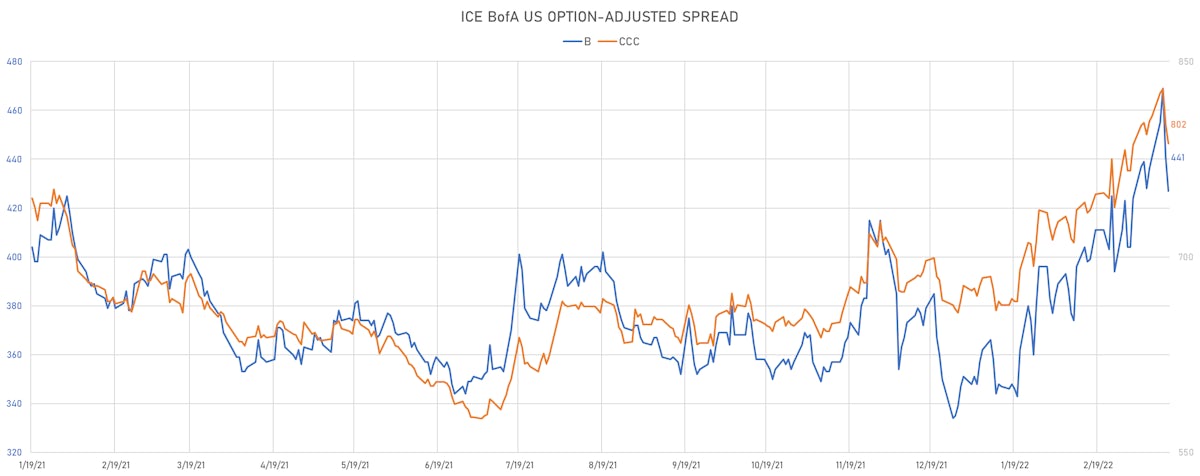

Huge Spread Compression Across The US Credit Complex: HY Cash Spread To Worst 23bp Tighter, CDX HY 5Y 26bp Tighter

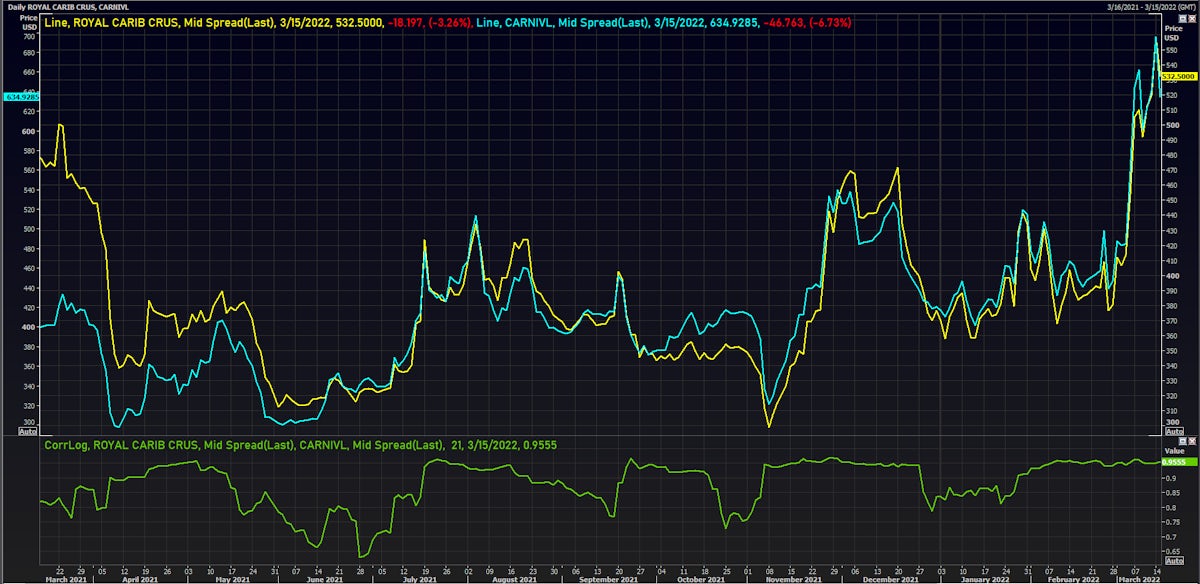

The move in credit had more to do with the relief seen in other stressed asset classes than the Fed hike, with Chinese equities up 12.8% in the last couple of days and the Russian Rouble mid spread now at 96.5 (vs a high of 150 earlier this month)

Rates

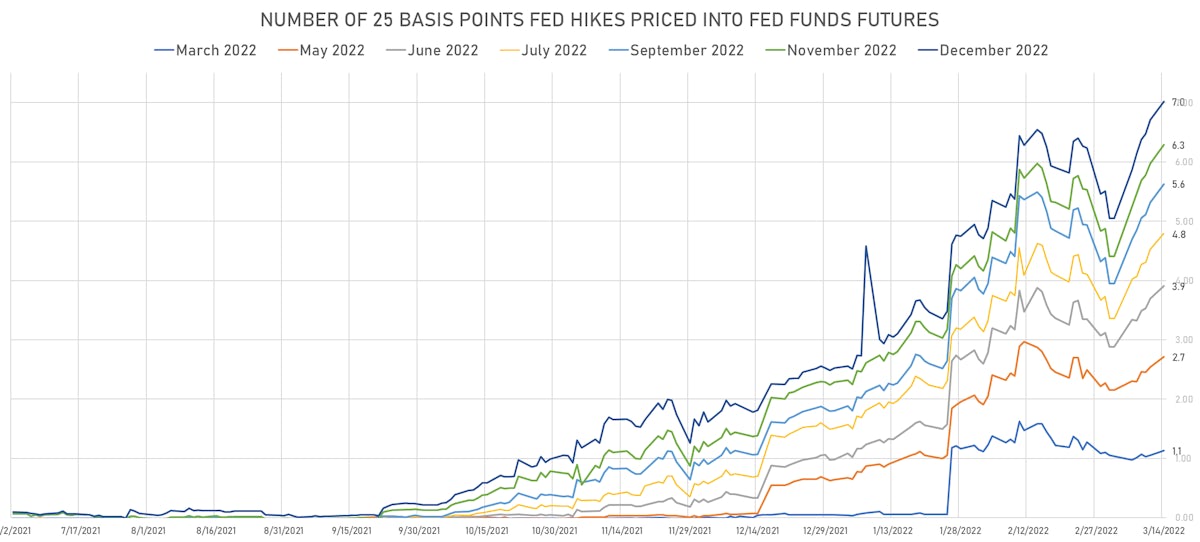

FOMC Wrap-Up: The Fed Mark Their Views To Market, With A Revised Dot Plot Showing A Median Of 7 Hikes This Year

The US Treasury curve continued to bear flatten, with higher real yields and lower breakevens, and the inversion in forward rates got wider: the market now expects 2 rate cuts between September 2023 and December 2025

Credit

Modest Moves In HY Cash Today, With Lower Yields Countering Wider Spreads For The Worst Credits

Very little issuance ahead of the FOMC decision tomorrow, with just a couple of notable foreign deals: $2.75bn in 4 tranches for Macquarie, and $2bn in a single tranche for the Bank of England

Rates

Slight Drop In Front-End Yields After Weaker Than Expected PPI, NY Fed Business Conditions Index

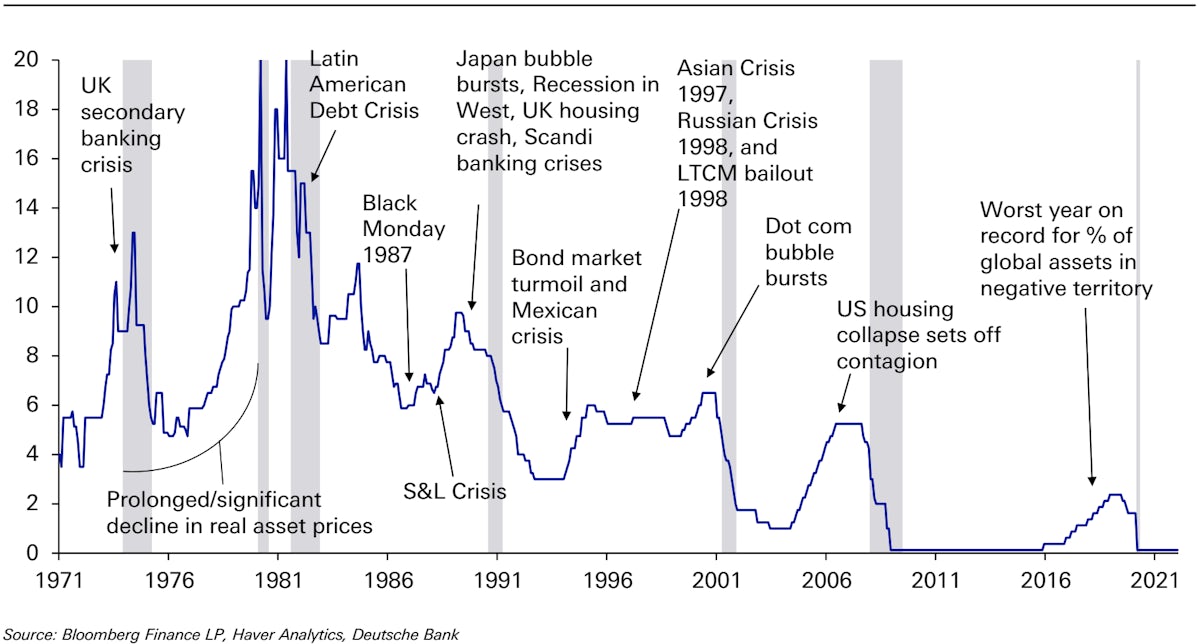

As the Fed finally gets to raising rates, Jim Reid (Deutsche Bank) points out that since the end of Bretton Woods every single hiking cycle came with a financial crisis somewhere in the world (vague but worth keeping an eye on, especially with the current tension in LIBOR-OIS)

Credit

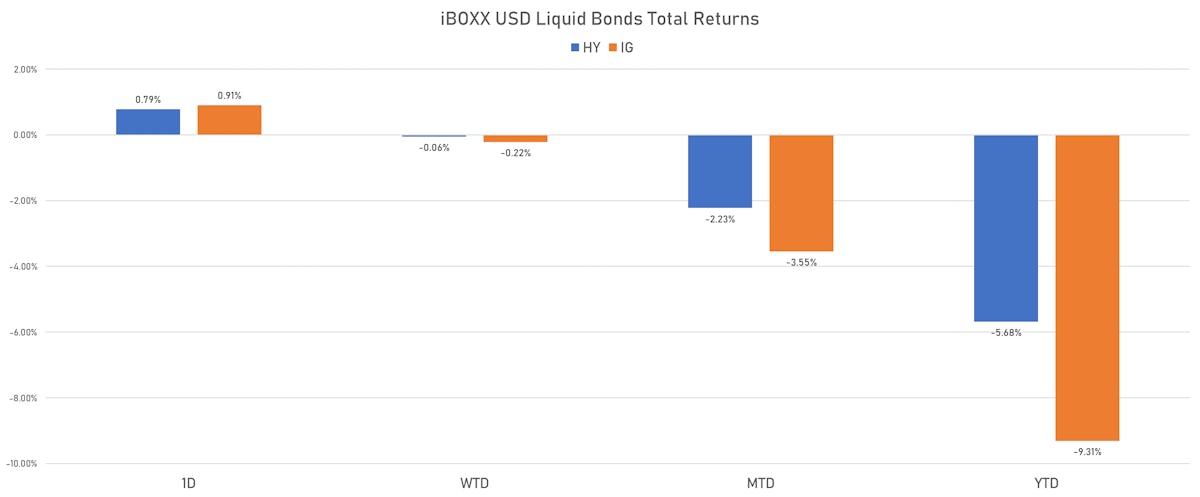

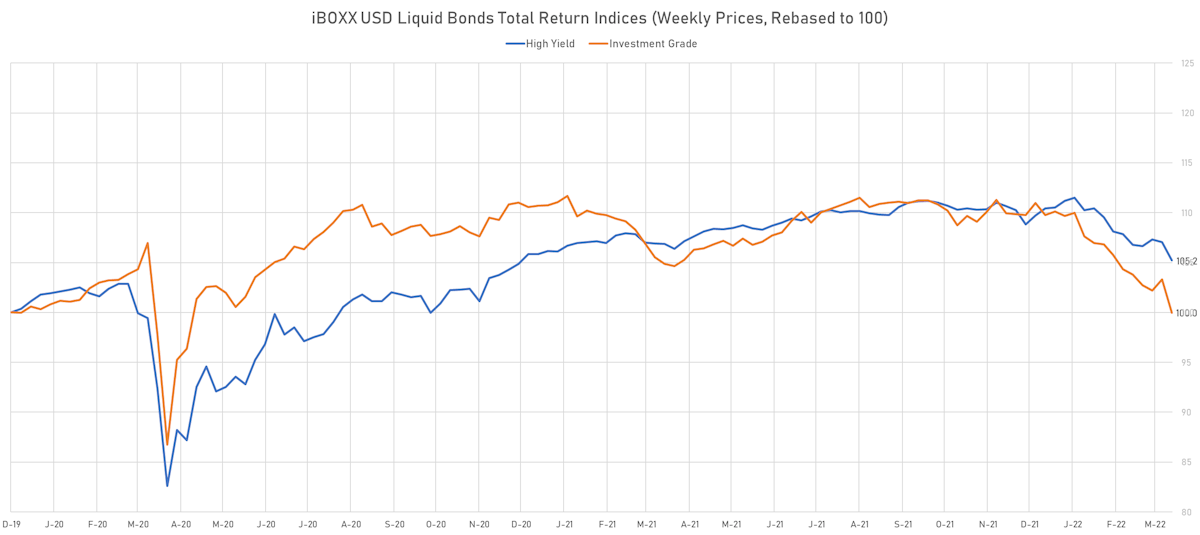

Higher Yields, Wider Spreads Take US$ Liquid Bonds Down 1.3% For IG, 1.0% For HY

Some US dollar bond issuance on both sides of the Atlantic to kick off the week, with the largest offering coming from BAT International Finance PLC ($2.3bn in 3 tranches)

Rates

Significant Rise In Front-End Yields, With Fed Funds Futures Now Pricing In Over Seven 25bp Hikes This Year

Breakevens have been coming down over the last couple of sessions, in line with the drop in the prices of commodities most impacted by the war (TTF natural gas, palladium, crude oil, etc.)

Credit

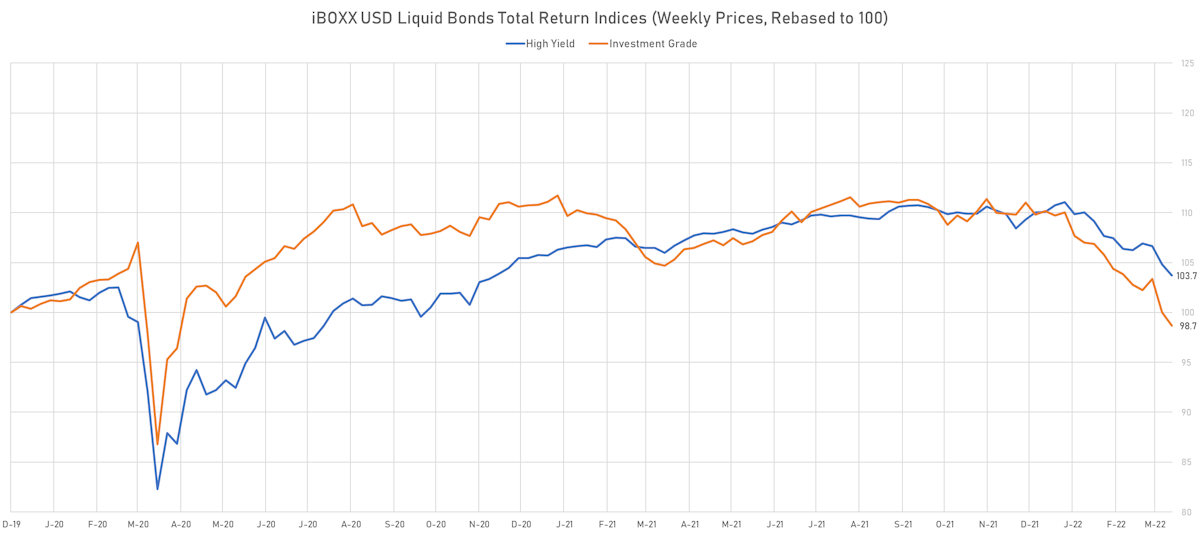

Credit Spreads Continued To Widen On Friday, With CDX HY 5Y 10bp Wider And ICE BofAML HY Cash 5bp Wider

Investment grade US$ corporate bond issuance had its best week of the year (7th best of all time according to IFR Markets), with a total volume of $70.2bn in 48 tranches (2022 YTD volume $363.5bn vs 2021 YTD $378.3bn)

Equities

The S&P 500 Ends The Week Down Nearly 3%, With Consumer Staples Falling 5.8% And Technology 3.8%

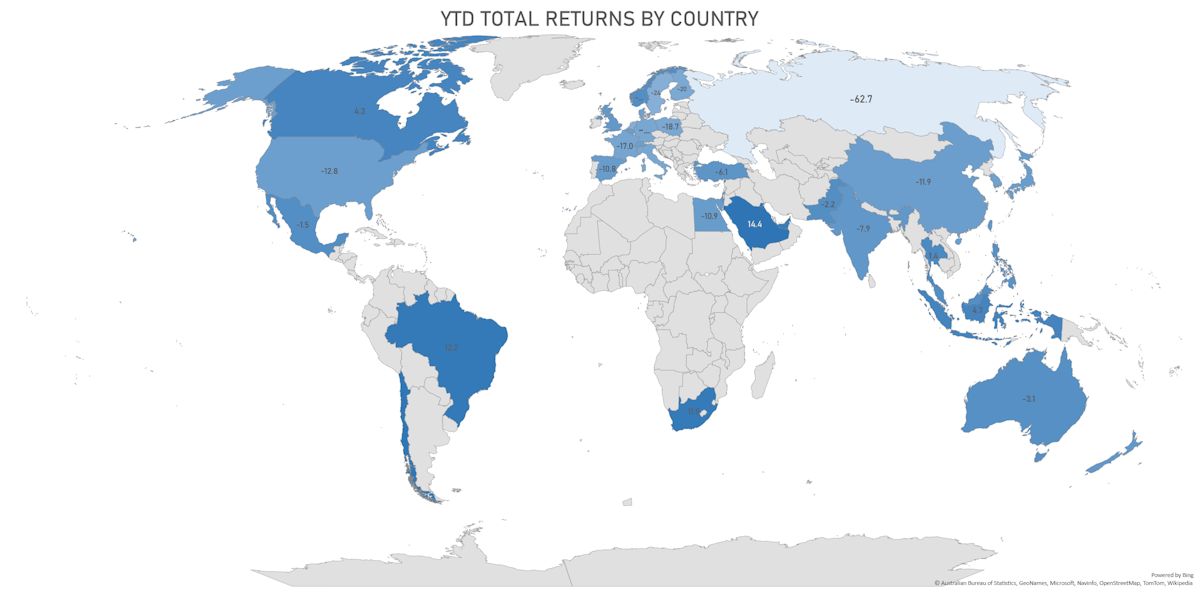

The worst-performing country this year (US$ total returns) is obviously Russia, now down more than 62%, followed by Sweden and the Netherlands, both down close to 24% year-to-date after a good rebound this week

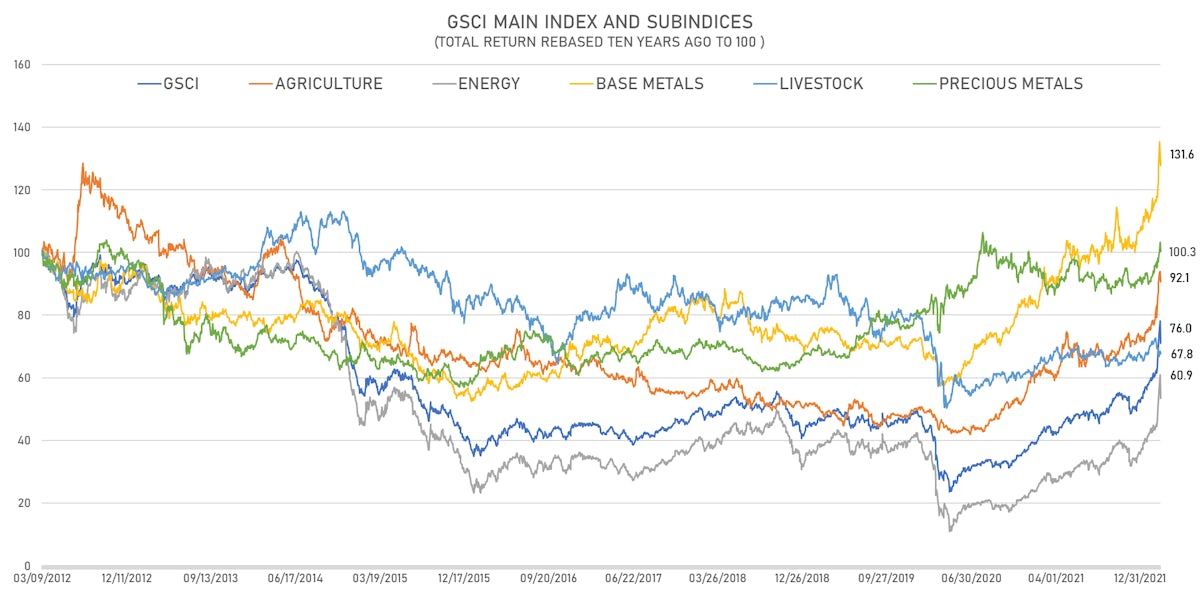

Commodities

Commodities That Gained The Most In The Early Days Of The Ukrainian Invasion Saw A Reversal This Week, With TTF Nat Gas Down 35% And Wheat Down 19%

Despite an amazing run over the past year, commodities still terrible longer-term performance, with base metals and precious metals the only groups having had positive total returns over the last 10 years