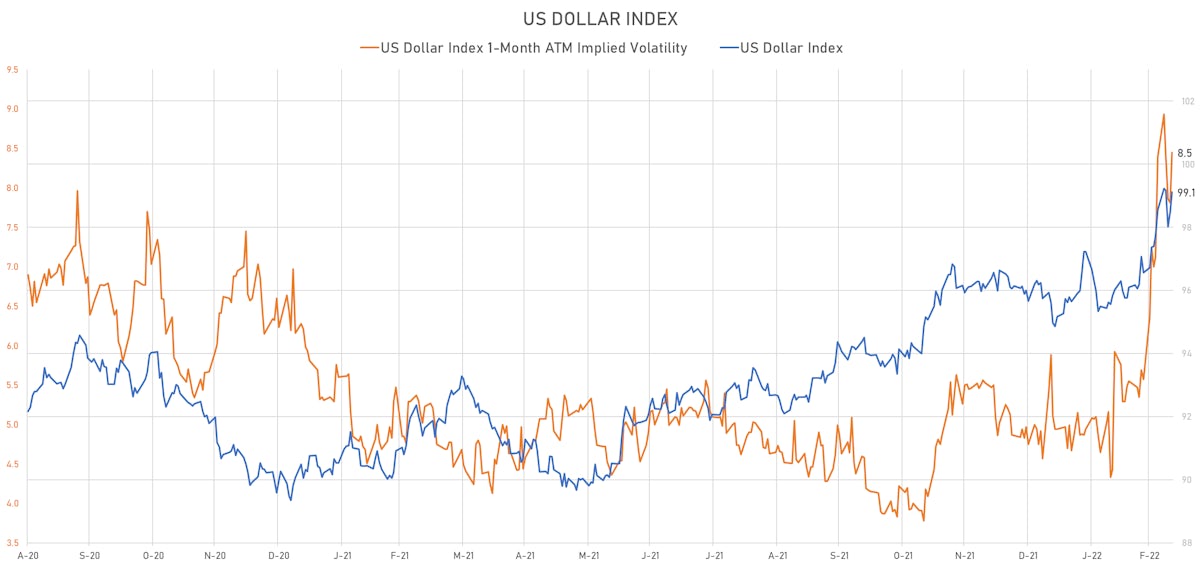

FX

US Dollar Index Ends Volatile Week Modestly Higher, With Both JPY And CHF Falling Close To 2%

The euro area is obviously more directly affected to the Ukrainian invasion than the US, and the volatility of the single currency has jumped in the past couple of weeks, although the brutal hedging moves into low-delta / high-gamma puts have started to recede

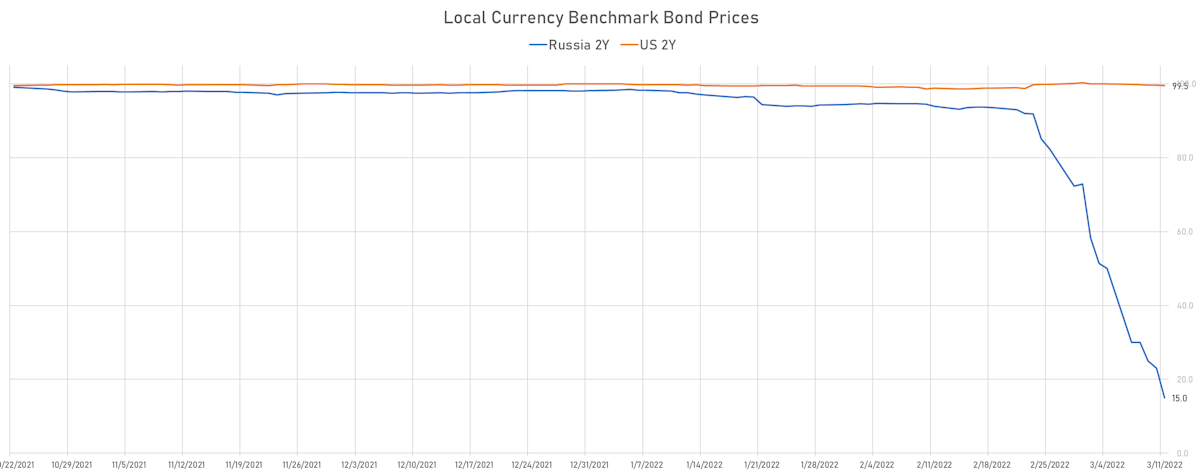

Rates

Front End Sells Off Into The Weekend, With Higher Breakevens And Lower Real Yields, As Market Now Prices In 6.5 Hikes By End Of '22

Although US rates volatility has been extraordinarily high this year, it doesn't register when prices of US Treasuries are mapped on the same chart as Russian debt, with 2-year local-currency paper now trading at 15 kopeks on the rouble

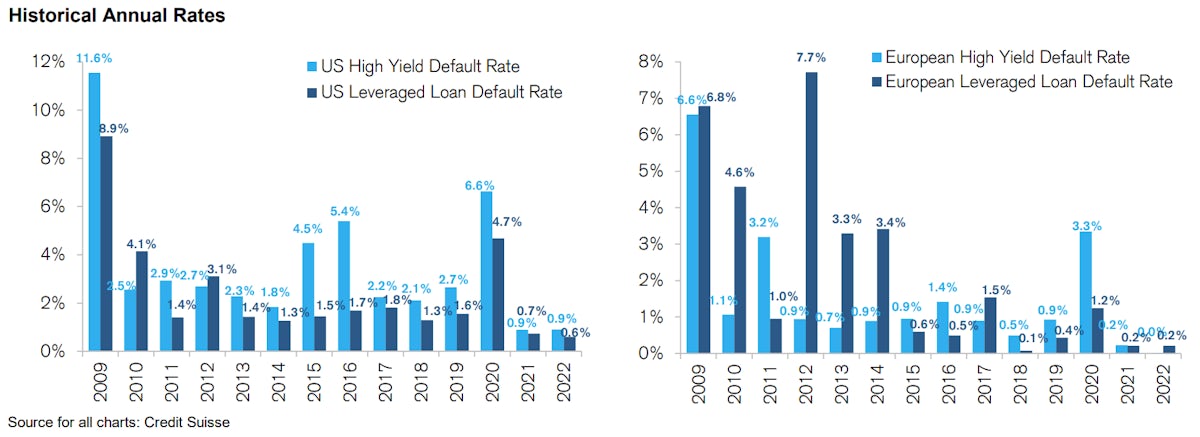

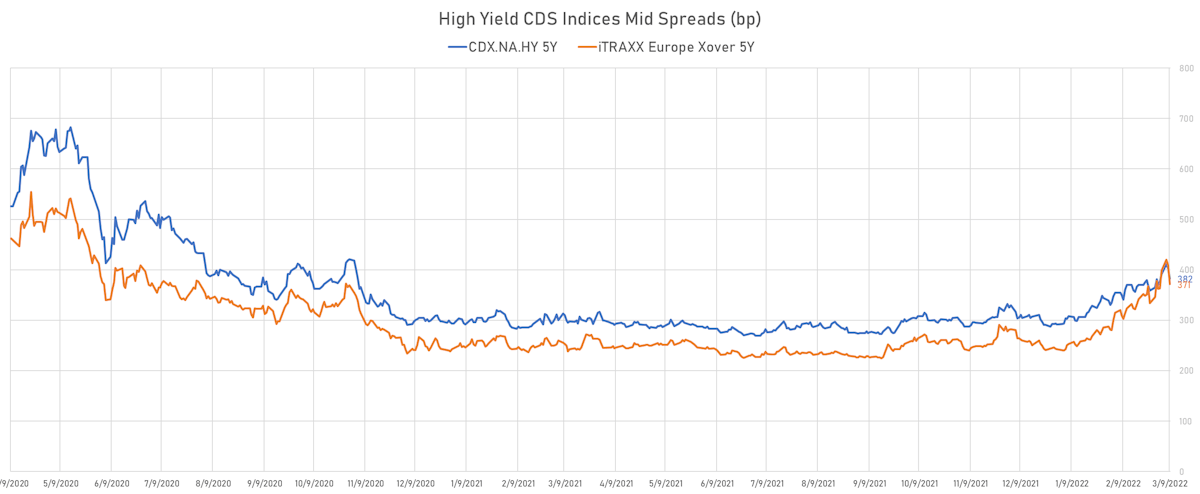

Credit

Weak Credit Performance In Line With Equities: IG Cash Spreads 1bp Wider, HY 5bp Wider

Another pretty good day for investment grade corporate bond issuance, with the largest prints coming from Goldman Sachs ($6bn in 4 tranches), Citigroup ($5.25bn in 3 tranches), and Charter Comms ($3.5bn in 3 tranches)

Rates

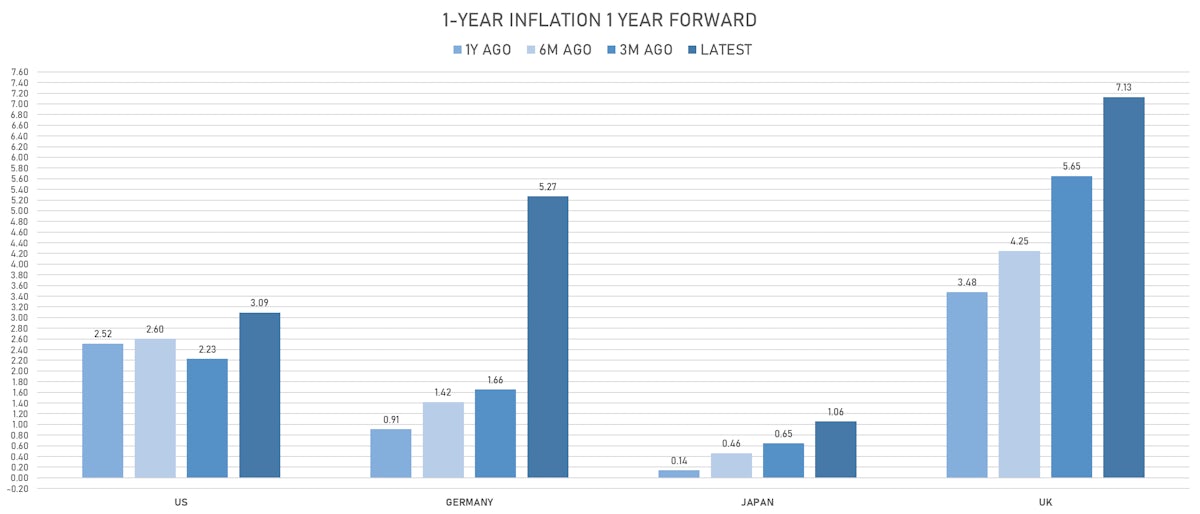

Hot CPI Data, Broadening Inflation Pressures Keep The Fed On Course For 25bp Liftoff Next Week, With 6.5 Hikes Priced In This Year

Despite growing inflationary pressures in Europe, the ECB chose not to raise rates today, in line with market consensus, but said they would accelerate the taper of their quantitative easing operations

Credit

Positive Mood Today Narrowed HY Spreads Considerably, With CDX HY 20bp Tighter, Cash Single-Bs 11 bp Tighter

Not many issuers printed new corporate bonds today, but what a print we got: Magallanes issued the 5th largest investment-grade deal ever, with an 11-tranche $30bn spin-off offering

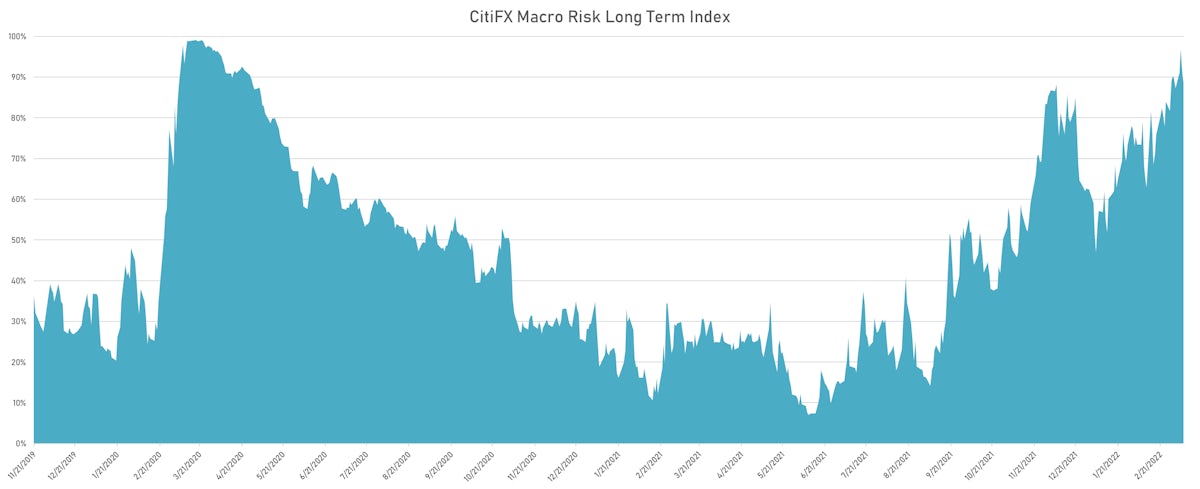

Macro

Risk Premia Drop Across Asset Classes: Treasuries, The US Dollar And Commodities Sell Off, While Equities Rise

Important to watch the ECB decision on Thursday, as they're not expected to do anything, but the current inflation expectations (and the unlikelihood of them reversing anytime soon) would definitely justify a hike and could trigger a big move in the Euro after its recent weakness

Credit

Cash Prices Fell In US Credit Today, With Moves In Rates Dominating The Action; In CDS Indices, Growth Concerns Continue To Weight On The Term Structure

Very little activity in the primary USD Corporate bond market, no new issue in HY so far this week and just a few new IG issues today, including Nomura ($3.25bn in 2 tranches) and Commonwealth Edison ($750m in 2 tranches)

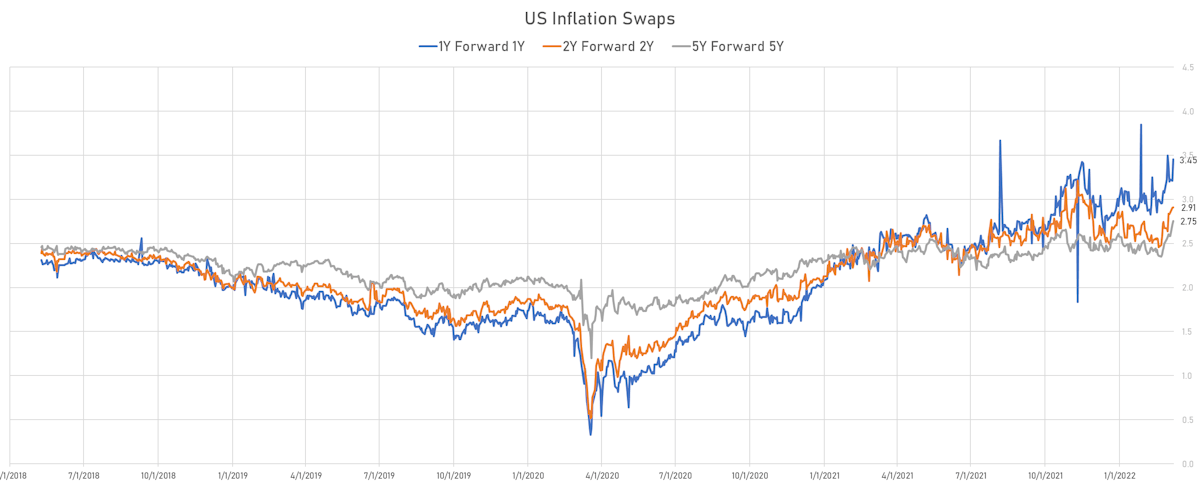

Rates

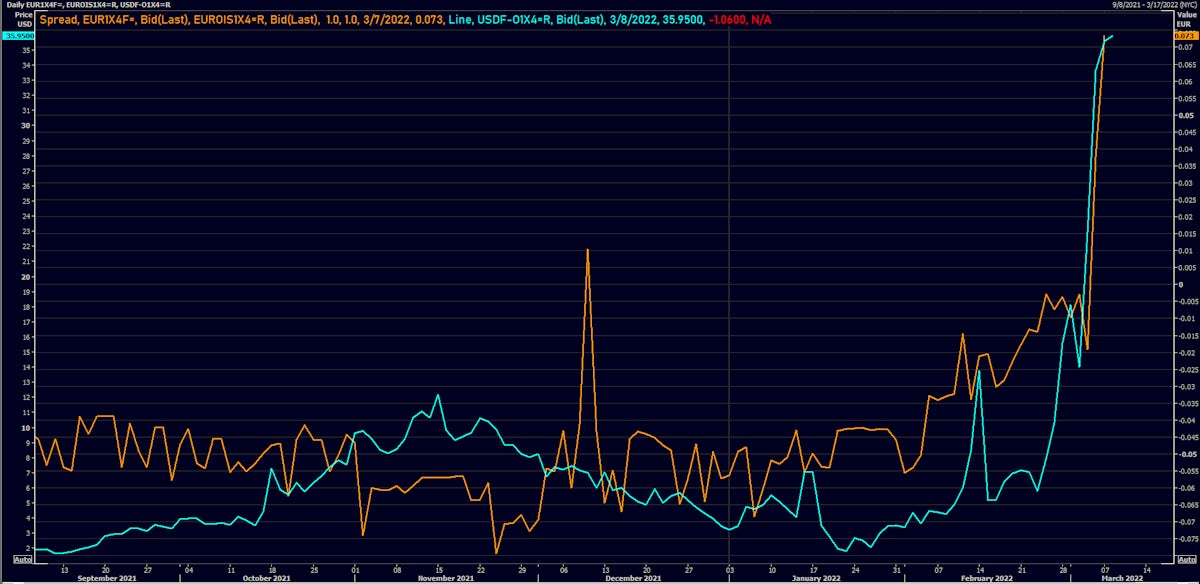

US TIPS Breakevens Keep Rising Rapidly In Line With Commodities, While Money Market Stress Worsened In FRA-OIS And FRA-EONIA

Looking at forward inflation swaps, it's clear that the market doesn't anticipate a quick reversal of inflationary pressures, meaning that if the Fed wants to reach a neutral rate (real rate at zero), it will have to hike a lot more and faster than what is currently priced into the term structure

Credit

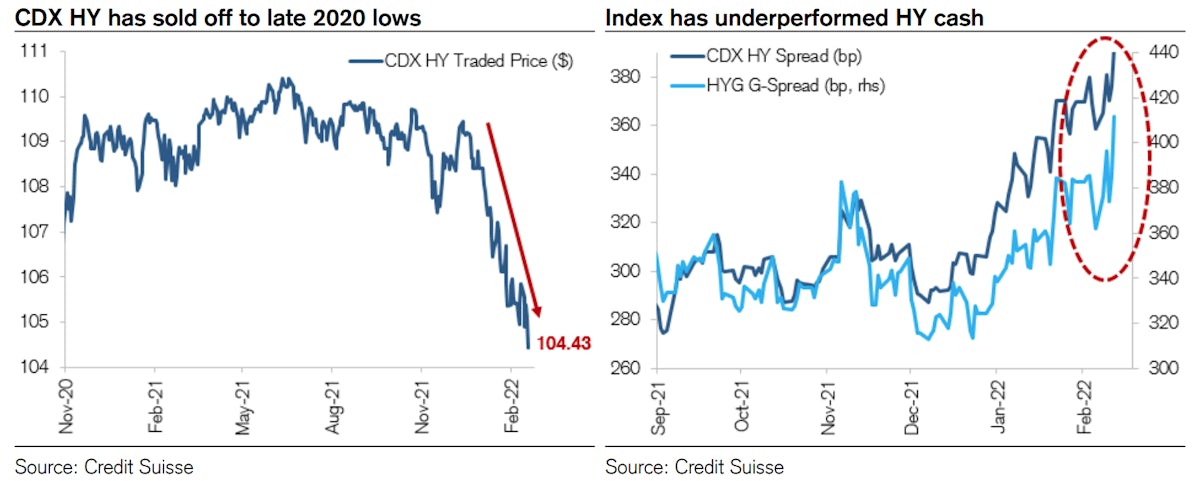

Further Widening Of Credit Spreads Across The Complex, With HY Derivatives Still Performing Worse Than Cash

It was a decent day for US$ IG bonds issuance, especially considering the current levels of volatility, with sizable offerings from Berkshire Hathaway ($4.5bn in 3 tranches), Rogers Communications ($7bn in 5 tranches) and Toronto Dominion ($4.5bn in 4 tranches)

Macro

A Worsening War Scenario Is Playing Out Across Markets: Higher Commodities, Higher Breakevens, Flatter Yield Curve, Stronger Dollar, Lower Equities

As the US administration continues to escalate the situation in Ukraine, markets are caught in a perfect storm, having to manage enormous volatility and deteriorating liquidity, while inflation concerns and slower growth point more and more towards stagflation

Credit

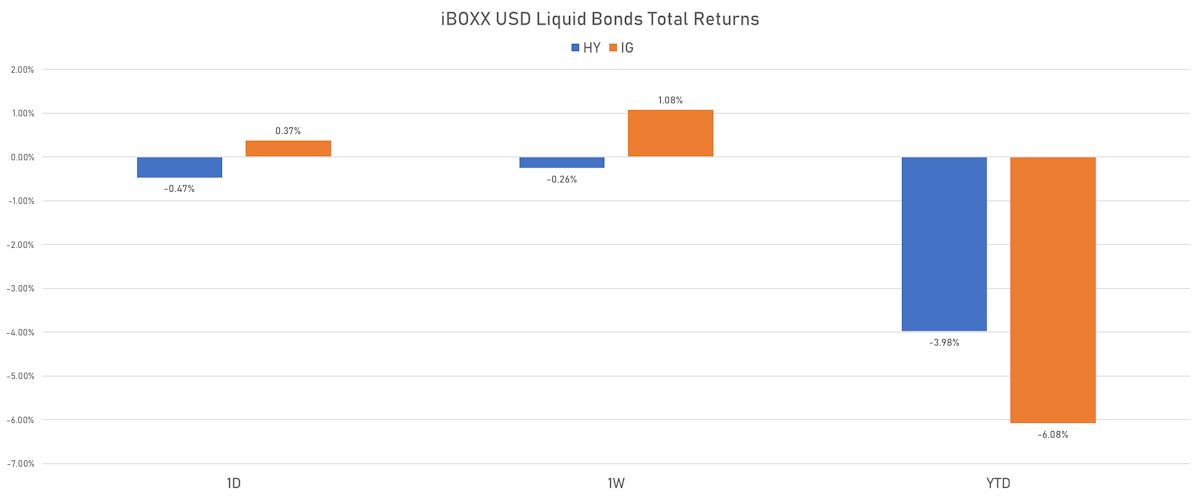

Mixed Performance For US Credit, With IG Cash Helped By Lower Yields, HY Cash Hampered By Wider Spreads

Weekly total issuance of USD corporate bonds (IFR Markets data): $59.2bn in 32 tranches for IG (2022 YTD volume $293.3bn vs 2021 YTD $324.1bn), $2.2bn in 5 tranches for HY (2022 YTD volume $33.9bn vs 2021 YTD $93.8bn)

Equities

Broad Fall For US Equities This Week, Led Down By Financials, As The Yield Curve Flattening Accelerated

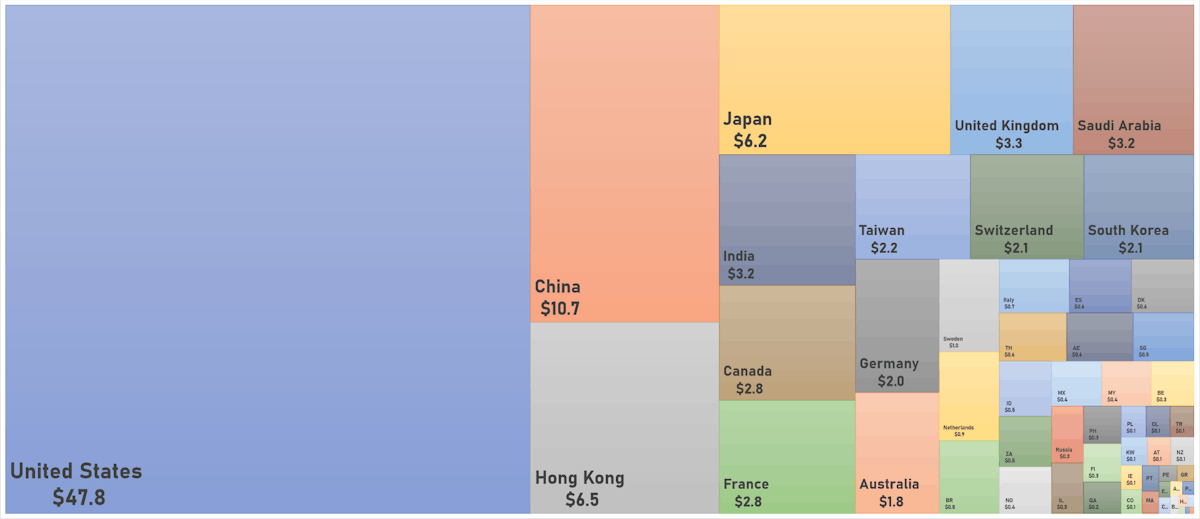

The world market capitalization has fallen by about $12 trillion since reaching $121 trillion in November 2021, with the US down 10% and China down 8% this year