Rates

Macro Risk Aversion Leads To Modest Rebound Across The Rates Complex: Yields Down, Steeper Curve

Although the forward curve inversion is not a great development, the market seems to have some confidence that short-term rate hikes will allow inflation to drop back, with a high level of (negative) correlation between 5Y Treasury yields and 2Y forward 2Y inflation swaps

Credit

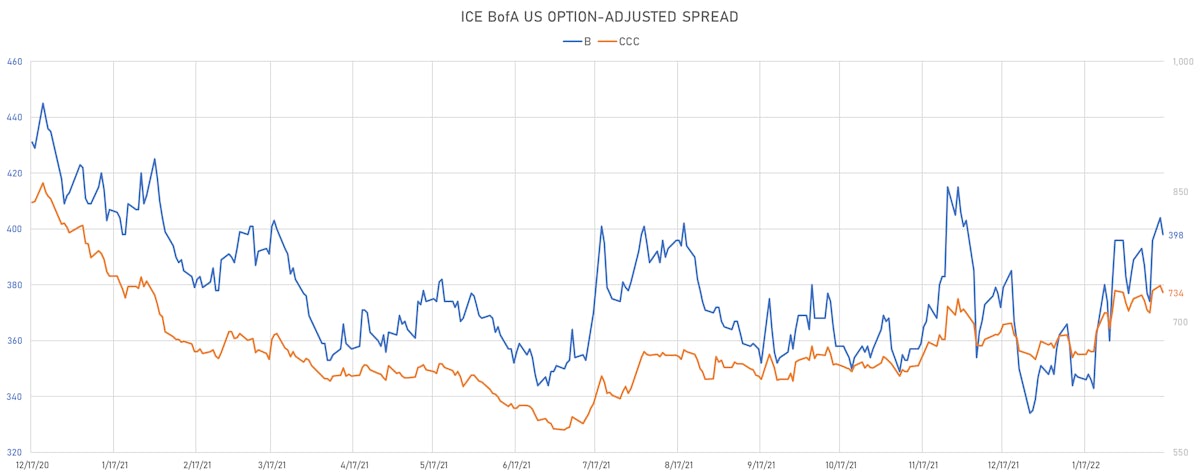

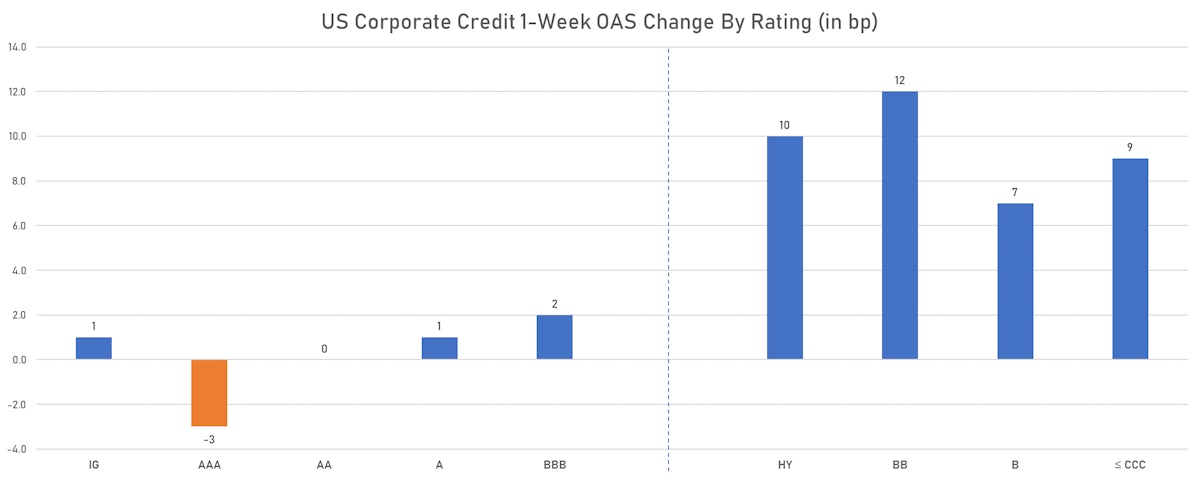

US IG Cash Spreads Widen Slightly Despite Rebound In Rates, As Risk Sentiment Around Credit Remains Very Prudent

With the recent rates volatility, high yield issuance has slowed to a crawl, but we are seeing a resurgence of IG deals this week, with JP Morgan, Citi, Morgan Stanley, PG&E among the largest issuers today

Macro

Front-End Yields Dip As Fed Minutes Dovish Compared To Expectations, No Discussion Of 50bp Hike in March

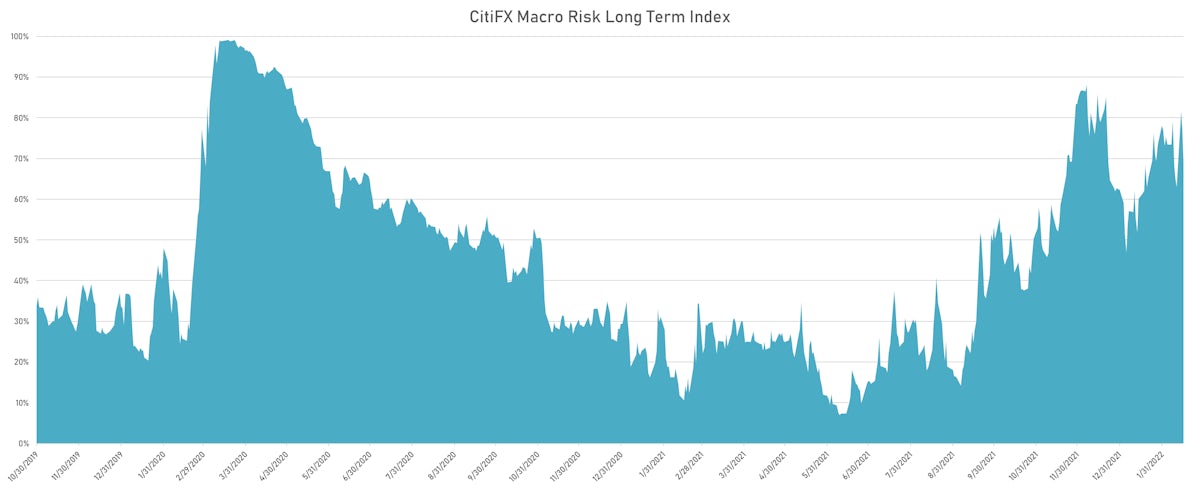

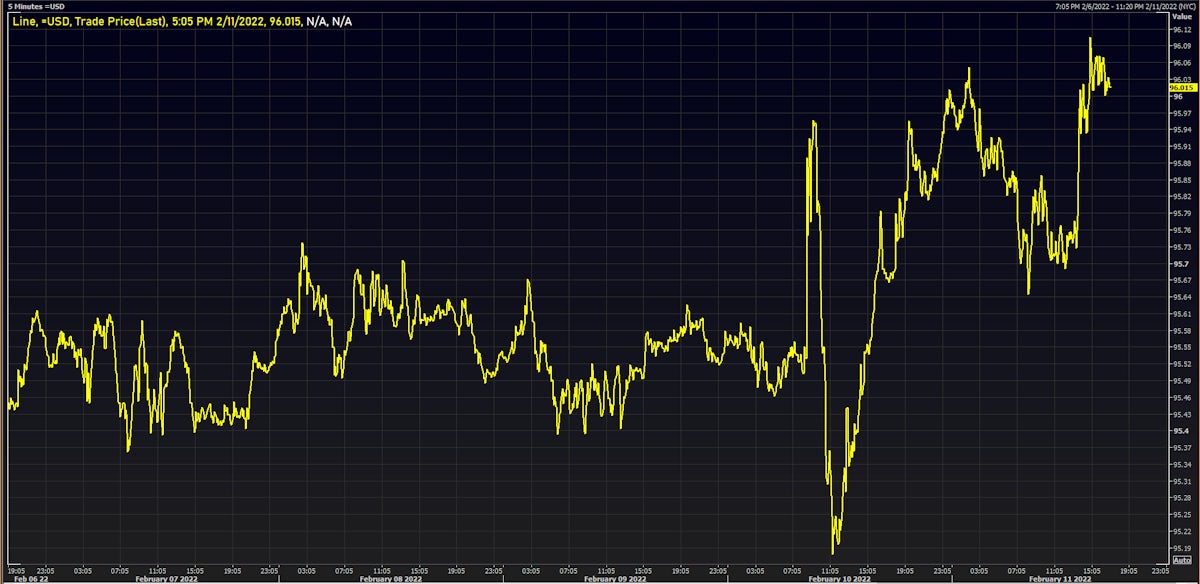

The US dollar was broadly lower today against all major currencies, with volatility falling and high-beta risk-on currencies up significantly (Aussie Dollar up 0.74% and Kiwi Dollar up 0.83%)

Credit

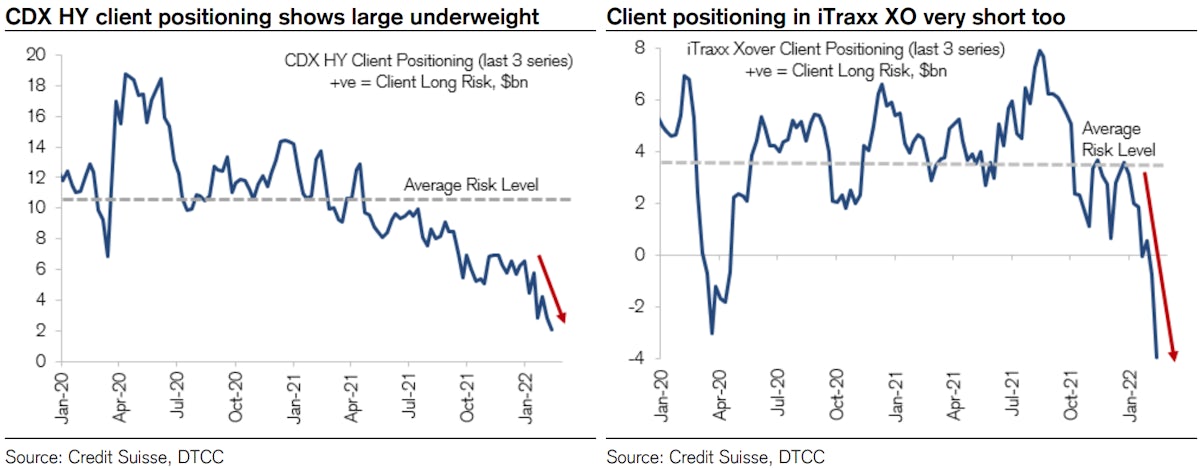

Risk-Off Mood Brings On Sizeable Compression In HY Credit Spreads, With OAS On Cash BBs Down 7bp

US$ IG issuance was back today, with a few large deals coming to market including Bristol-Myers Squibb ($6bn in 4 tranches) and Canadian energy company Enbridge ($1.5bn in 3 tranches)

Macro

US Front-End Yields Drop, Curve Steepens On Positive Risk Sentiment, Despite Hotter Than Expected PPI Data

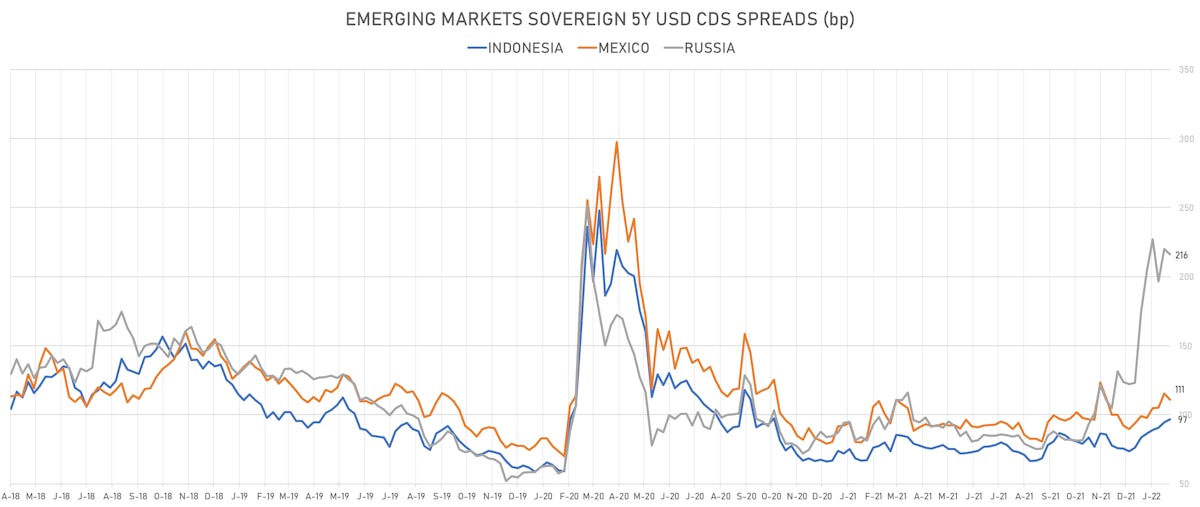

Russia's sovereign CDS spread narrowed by 29 basis points and the Rouble was up 1.6% today, as tension in Ukraine seemed to ease with the end of war games in Belarus and pullback of some troops

Credit

US Corporate Cash Spreads Widen, Yields Rise; Rates Volatility Keeps Issuance At Minimal Levels

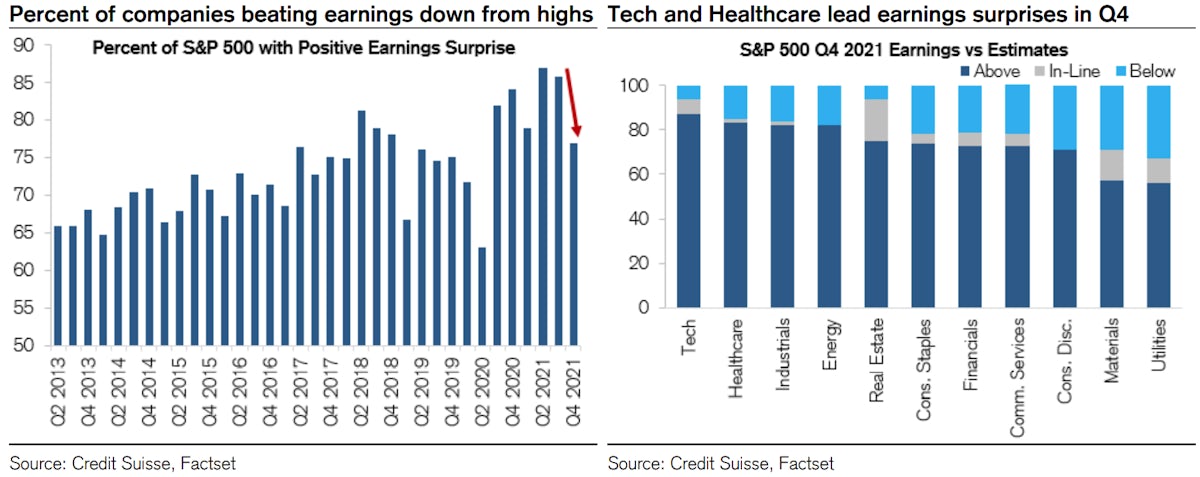

With earnings season winding down, companies are reporting strong results, but less so than in Q2/Q3 2021, with the tech and healthcare sectors having the largest numbers of positive surprises

Rates

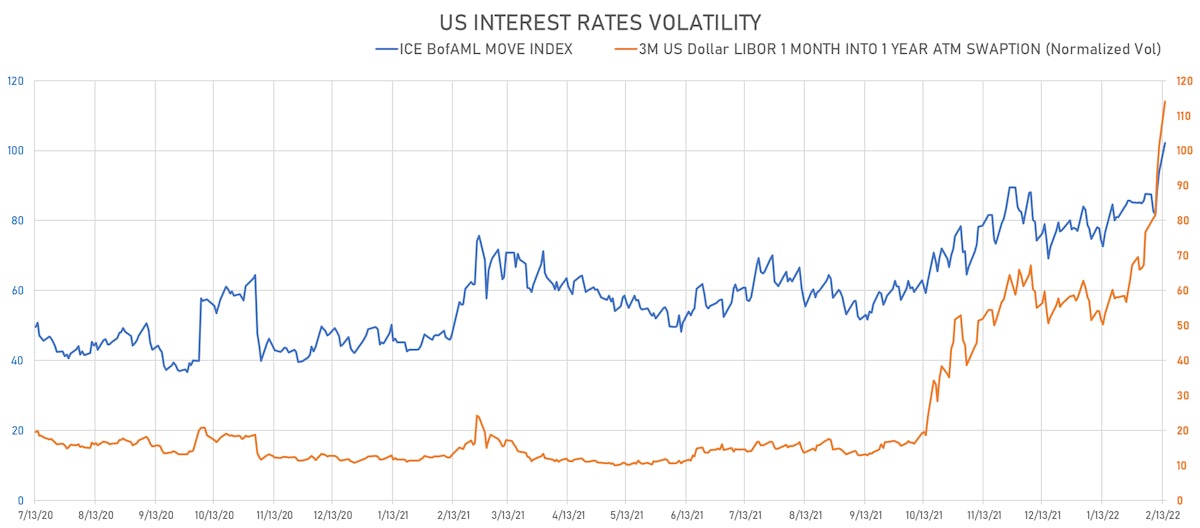

St. Louis Fed Bullard Spooks Markets Again, Brings Rates Volatility To Levels Not Seen Since March 2020

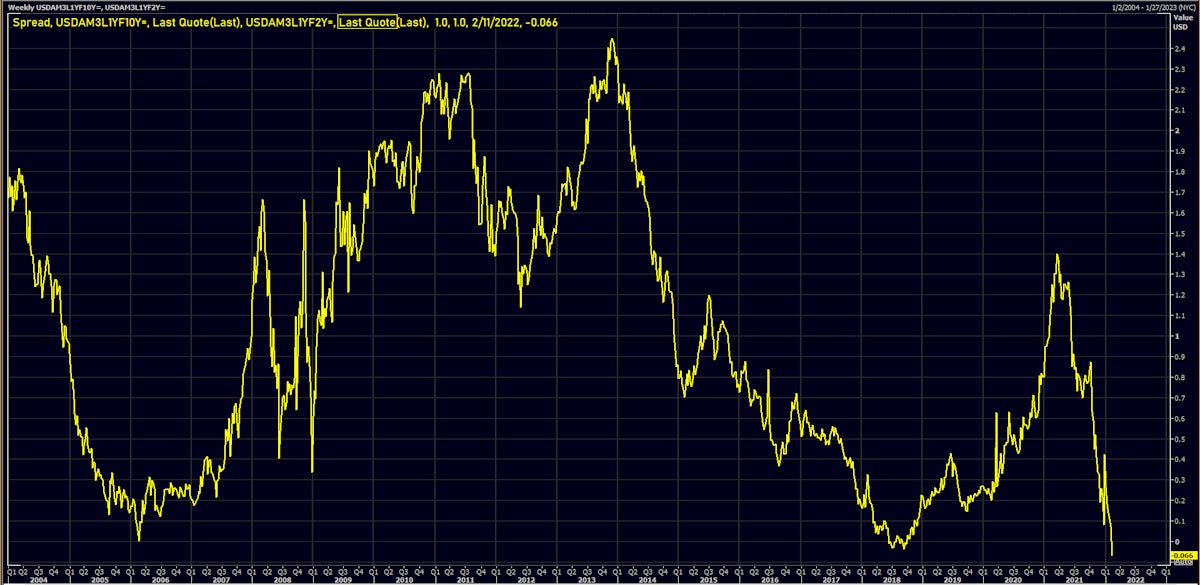

Over the past month, the market has come to expect 3 more hikes by the end of 2023, while the terminal rate in 5 years rose by less than one hike, with rates now pricing in almost 2/3 chance of a Fed cut in 2024 (reversal of policy mistake)

Credit

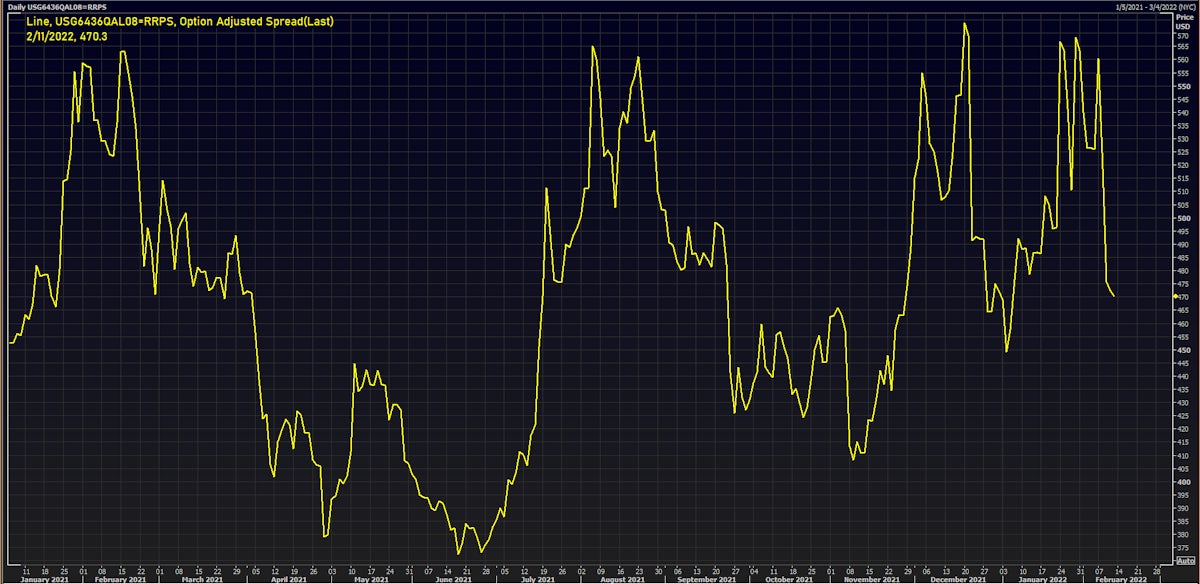

USD BBs Keep Underperforming High Yield Universe, As Spreads Widen Significantly To End Week

Tremendous rates volatility brought low volumes of bond issuance this week (IFR Markets data): $15.6bn in 25 Tranches for IG (2022 YTD volume $184.5bn vs 2021 YTD $206.8bn) and $2.75bn in 6 Tranches for HY (2022 YTD volume $30.7bn vs 2021 YTD US$73.7bn)

Equities

Tough Week For US Equities Ends In Red, Led Down By Technology And Communication Services

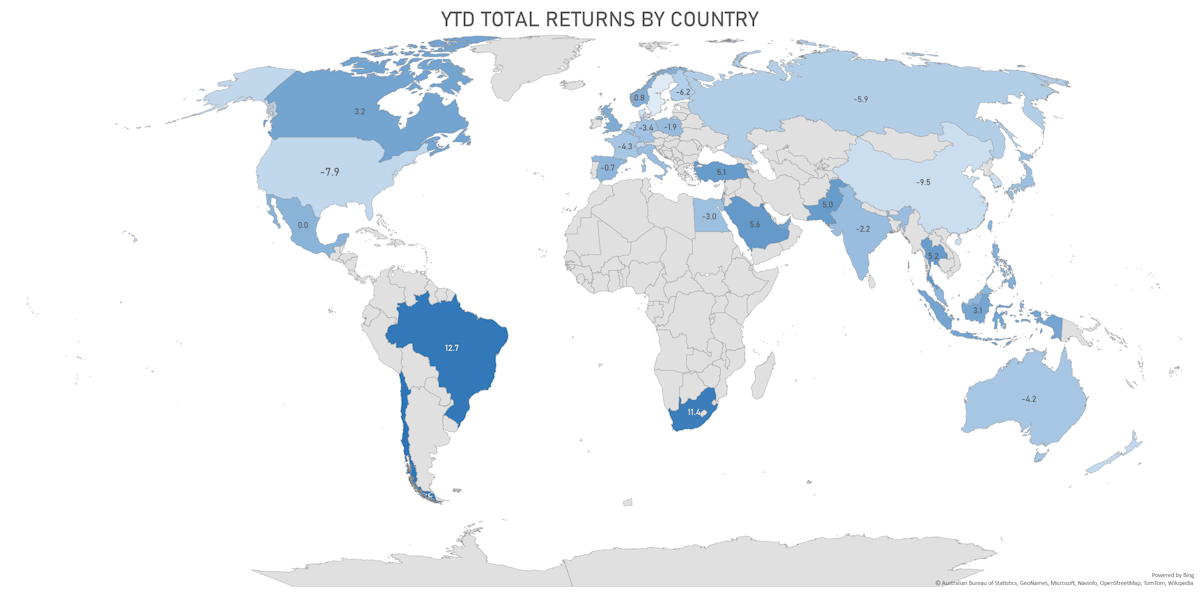

The US was an outlier, as most major markets saw positive performance this week, with Australia up 3%, the UK, Canada, and Hong Kong all up over 2%

Cross Asset

Macro Markets Saw Heightened Volatility, With Both The US Dollar And Commodities Rising This Week

All GSCI sub-indices rose this week, led by agriculture and precious metals; Chinese markets were open again and saw big gains after the new year holiday, most notably iron ore, thermal coal, and copper

Rates

Wild Week In US Rates, With The Market Now Firmly Pricing In A Fed Policy Error

The moves in rates were led by breakevens, with inflation expectations revised markedly upward throughout the curve, while real yields were down modestly for the week except at the very long end

Credit

Rough Day For US$ Credit, With Much Higher Yields And Wider Synthetic Spreads

With rates volatility through the roof after hot CPI print, bond issuers mostly sat on the sidelines today, with the only sizeable deal courtesy of Norwegian Cruise Line ($2bn in 3 tranches, including a $435m convertible)