Rates

Hot CPI Data Pushes US Rates Volatility Ever Higher, With 2s10s Inversion Now Expected Over Next 12 Months

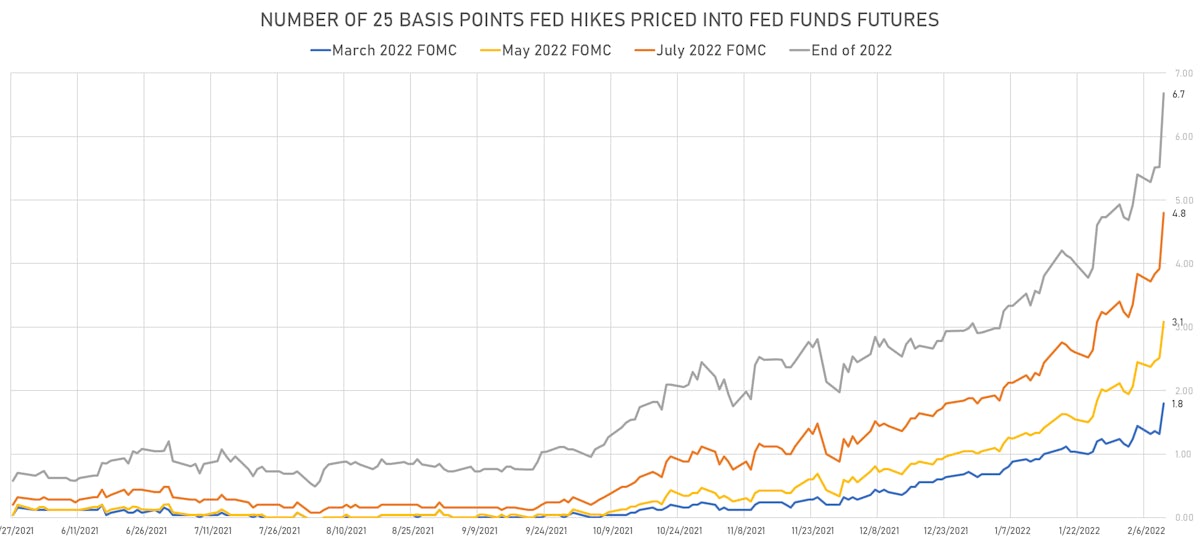

It's hard to overstate the jump in front-end yields today, with a 50bp hike in March now turning into the baseline scenario, and Fed Funds futures getting closer to pricing in 7 hikes for the year

Credit

US Credit Up With Risk-On Rebound Across Asset Classes; CDX.NA.HY 5Y Mid Spread Down 13bp Since The Beginning Of The Week

Tighter cash spreads also brought on a good deal of issuance today, with the largest offerings coming from Union Pacific ($3.5bn in 4 tranches) and Aptiv Plc ($2.5bn in 3 tranches)

Macro

US CPI: Preview Of The Most Important Macro Release This Week

With most of the market now more focused on upside inflation risk, we could see a rally in risk assets and a steepening in the yield curve if elevated expectations are disappointed

Credit

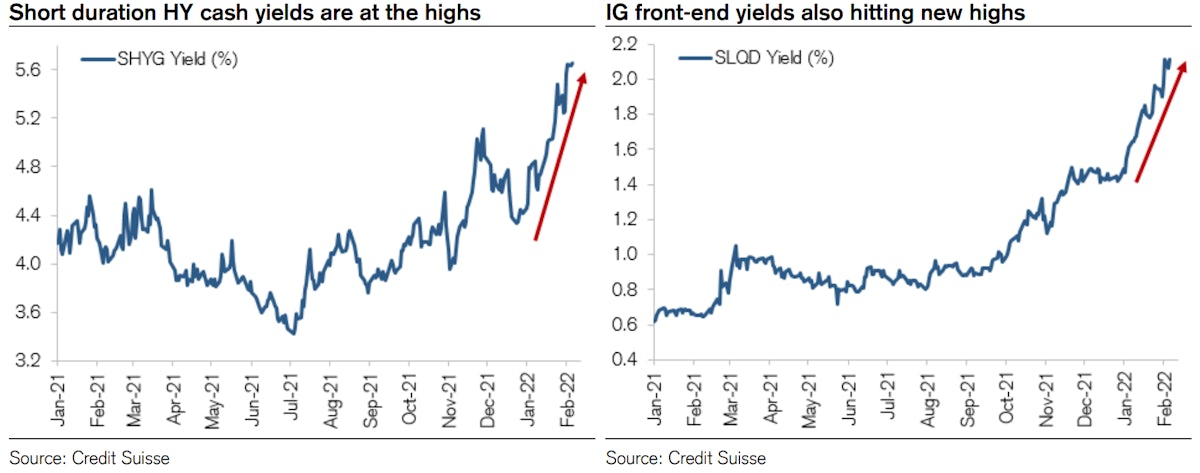

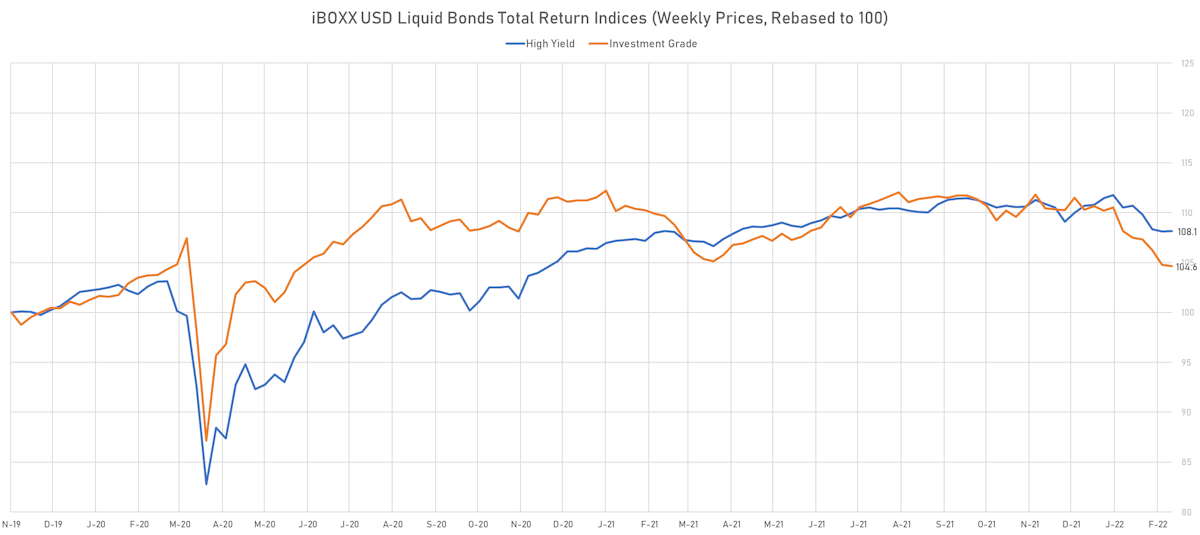

Tighter Spreads Across The Credit Complex As Risk Appetite Returned Today, Though IG Bonds Fall On Higher Yields

A few supranational bond deals priced today, led by the European Union (€2.2bn in a single tranche) and the Development Bank of Japan (US$1.4bn in two tranches)

Equities

Broad Rally For US Stocks, Led By Small Caps; S&P 500 Up 0.84%, Russell 2000 Up 1.63%, NASDAQ Comp Up 1.28%

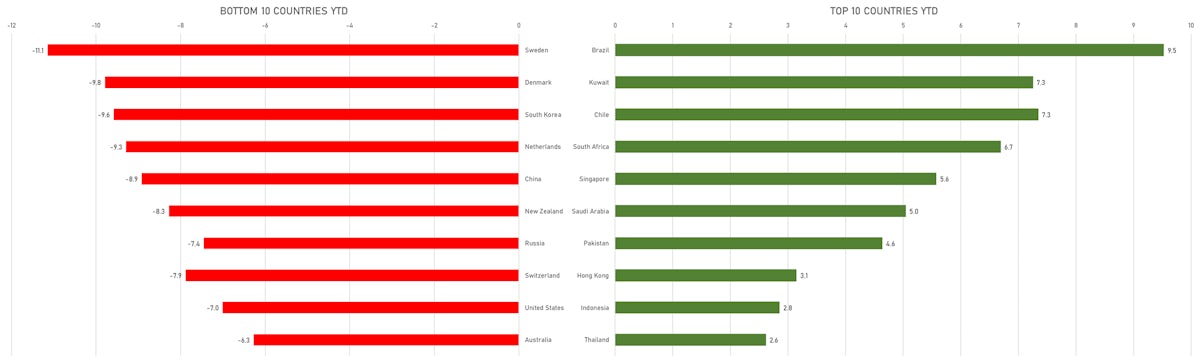

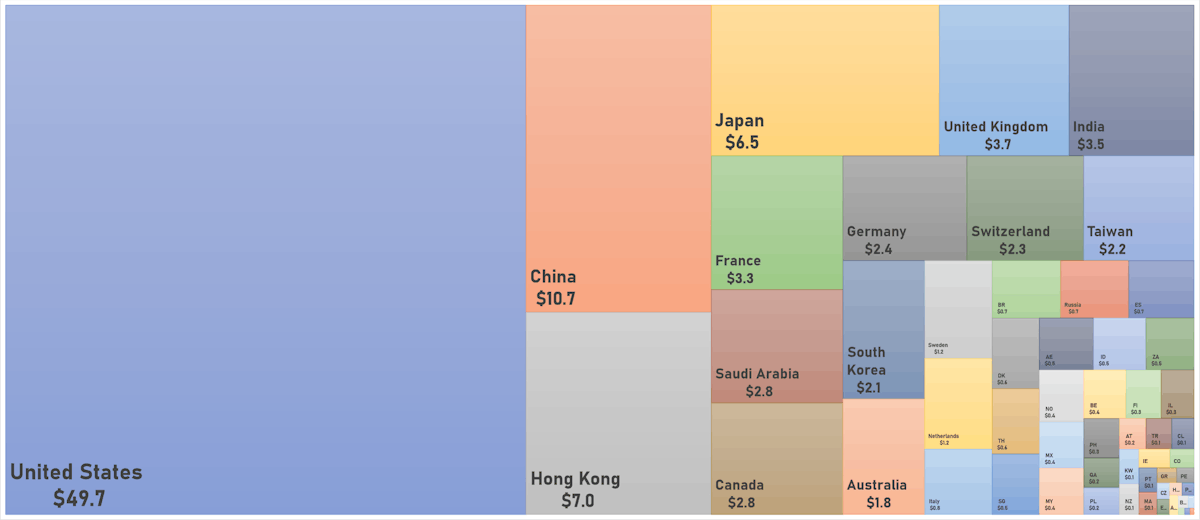

Looking at the performance of global equities year-to-date, the top countries are Brazil, Kuwait and Chile, the worst are Sweden, Denmark and South Korea

FX

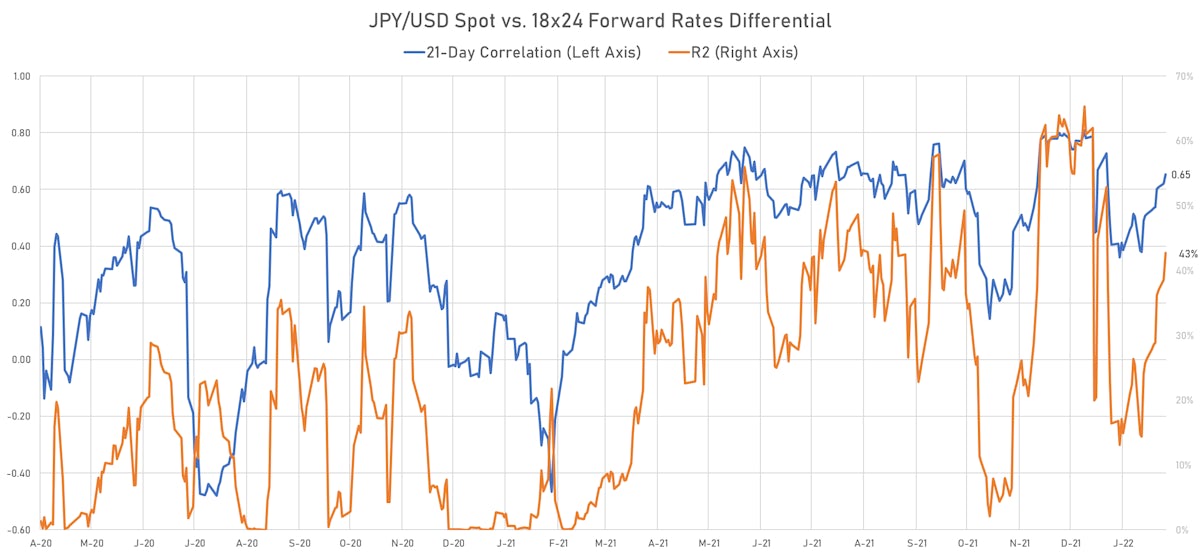

US Dollar Rises Against The Euro And Yen, In Line With Short Rates Differentials

In EM currencies, the shekel weakened 1% today as the bank of Israel sold the currency in the open market, and the Polish zloty was essentially unchanged after a 50bp rate hike widely anticipated by the market

Rates

US Treasury Yields Rise Out To The Belly, Flatten Further Down The Curve As Macro Uncertainty Keeps Volatility High

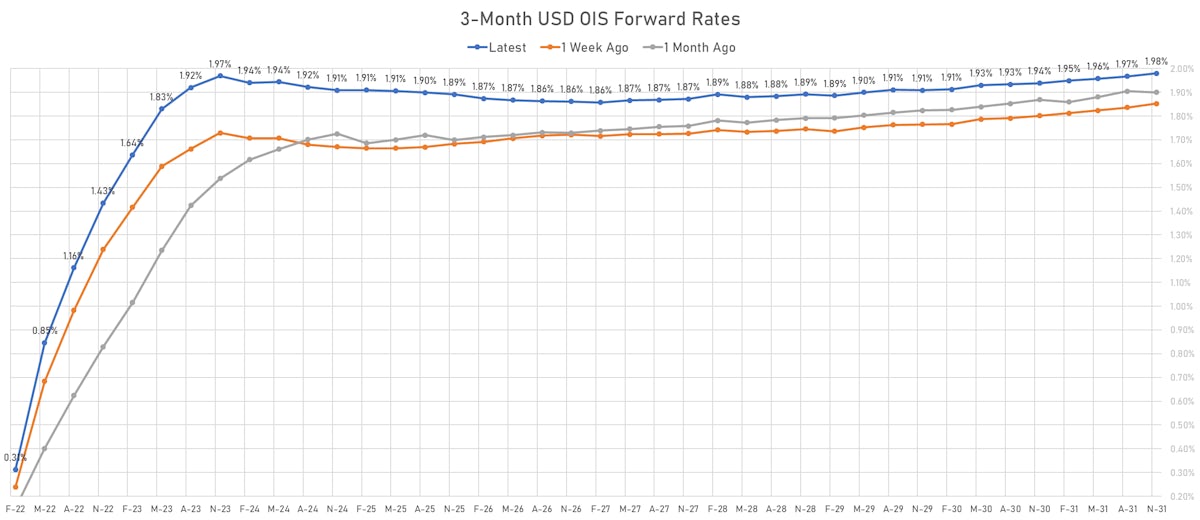

Eurodollar futures continue to see a very short rate normalization cycle, with almost no hike expected after 2023, while the 3M USD OIS forward curve is getting more deeply inverted (-11bp 2023 / 2026 spread)

Credit

Not A Ton Of Movement In US Credit, With Cash Spreads Slightly Wider, Rates Broadly Unchanged

No investment grade bond deal priced today in the US, and February should see limited supply, with about $100bn in the US$ IG pipeline for the full month

Credit

US Credit Performance Still Mostly Driven By Rates: IG Cash Spreads Unchanged Today But The Sharp Rise In Yields Took Down Bond Prices

Weekly total issuance of US$ corporate bonds (IFR Markets data): $20.5bn in 25 tranches for IG (2022 YTD volume $168.9 bn vs 2021 YTD $188.4 bn) and $5.6 bn in 8 tranches for HY (2022 YTD volume $27.9 bn vs 2021 YTD $59.9 bn)

Equities

Mixed Performance In US Equities Today, With Less Than Half Of S&P 500 Stocks Ending Up

Technology stocks rebounded, led by Amazon's blowout earnings, with the market now favoring highly profitable, long visibility stocks (like Apple, Microsoft, Google) rather than expensive and unprofitable growth companies

Cross Asset

Weekly Macro Summary: Seismic Shift In ECB Policy, Market Repricing Brought Considerable Realized Volatility In Euros Over The Past Days

Very strong US employment report today raised the likelihood of a 50bp Fed hike in March (now 35 bp priced into Fed Funds futures), showed the Fed is likely well behind the curve

Credit

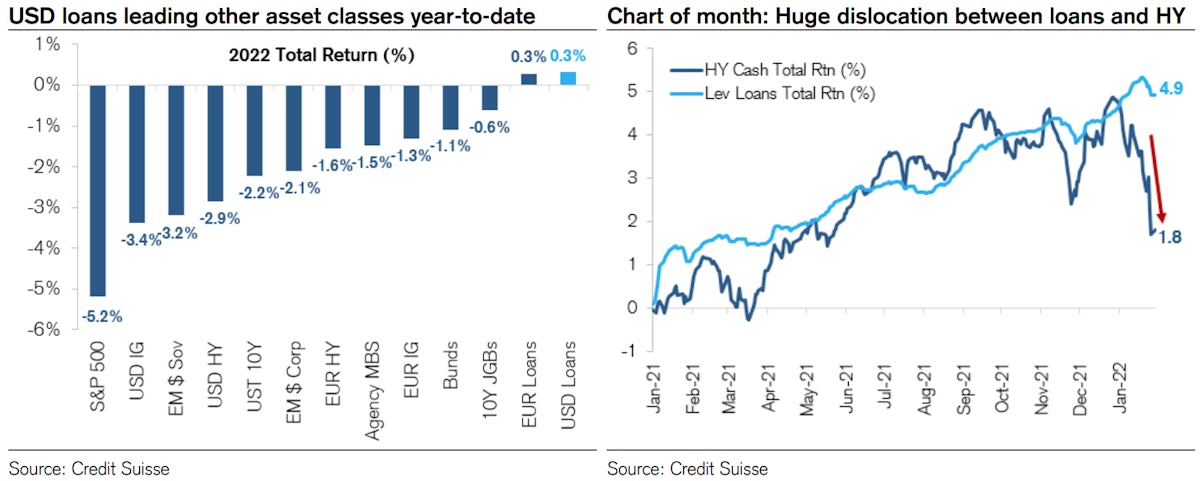

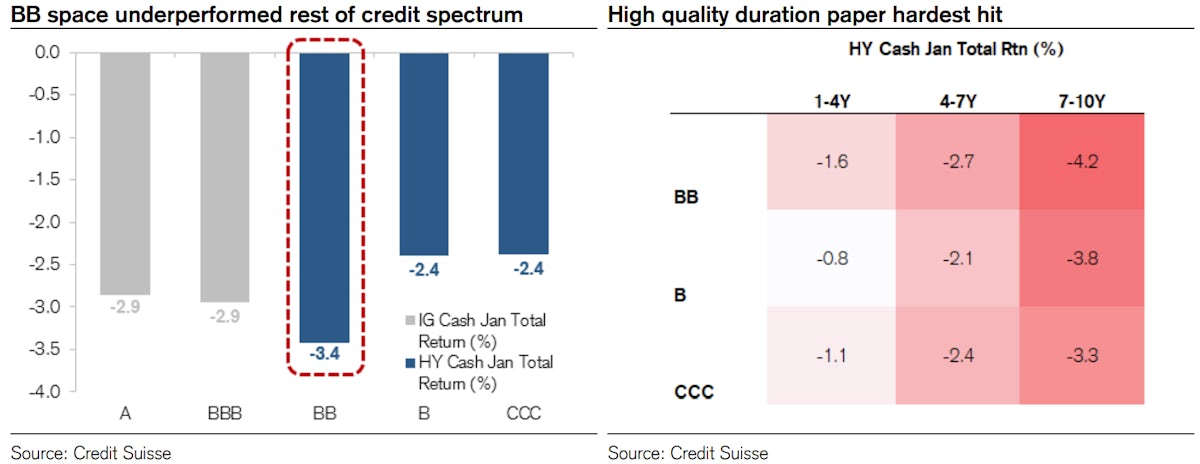

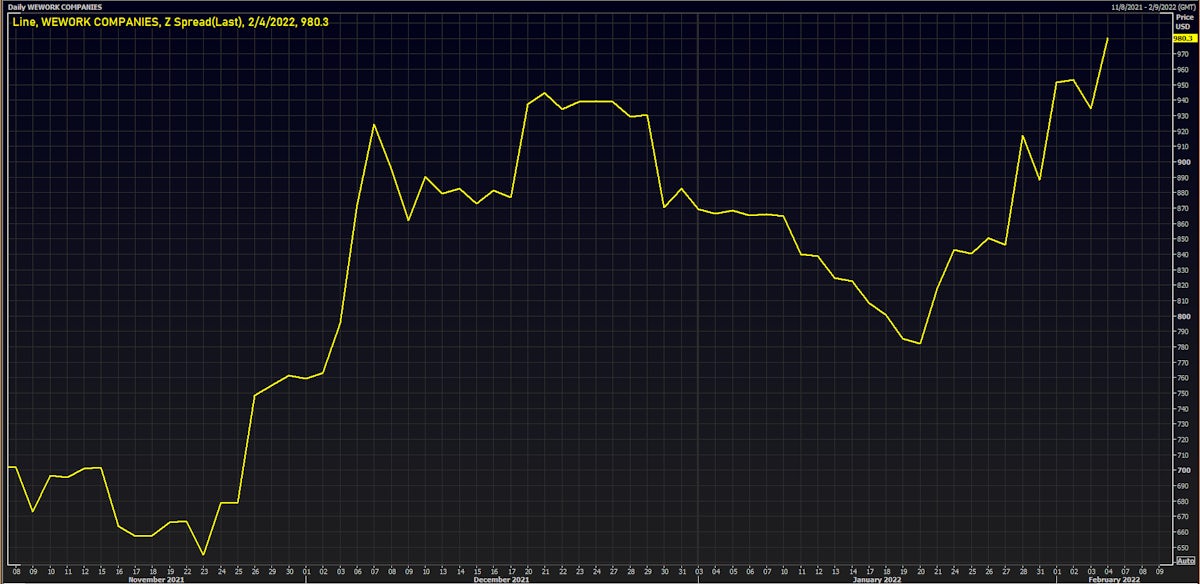

Tough Day For US$ Corporate Bonds, With Higher Yields And Wider Cash Spreads Taking IG & HY Down In Almost Equal Measure

The Meta meltdown (FB down 26% in one day), which is taking broad stock indices along for the ride, had less of an impact on credit, as media and technology companies have much lower weights in bond indices (less leverage than many other sectors)