Rates

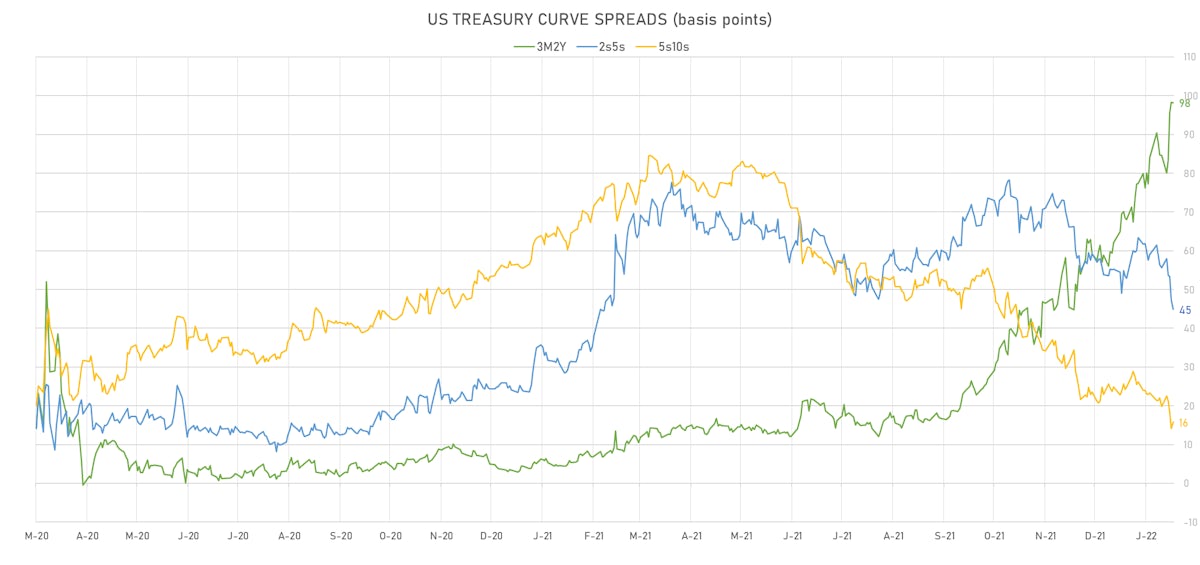

US Rates Curve Steepens At The Front End And Flattens From The Belly Out, With Market Implied Fed Hikes Up To 4.9 By End 2022

In Europe, the BoE raised rates by 25bp and the ECB didn't (both as expected), but the tone of their communication tilted hawkish, driving 1-year forward 3-month rates up 17bp in the UK, 20bp in the EZ, with market pricing now implying 4.2 hikes and 2.7 hikes over the next year respectively

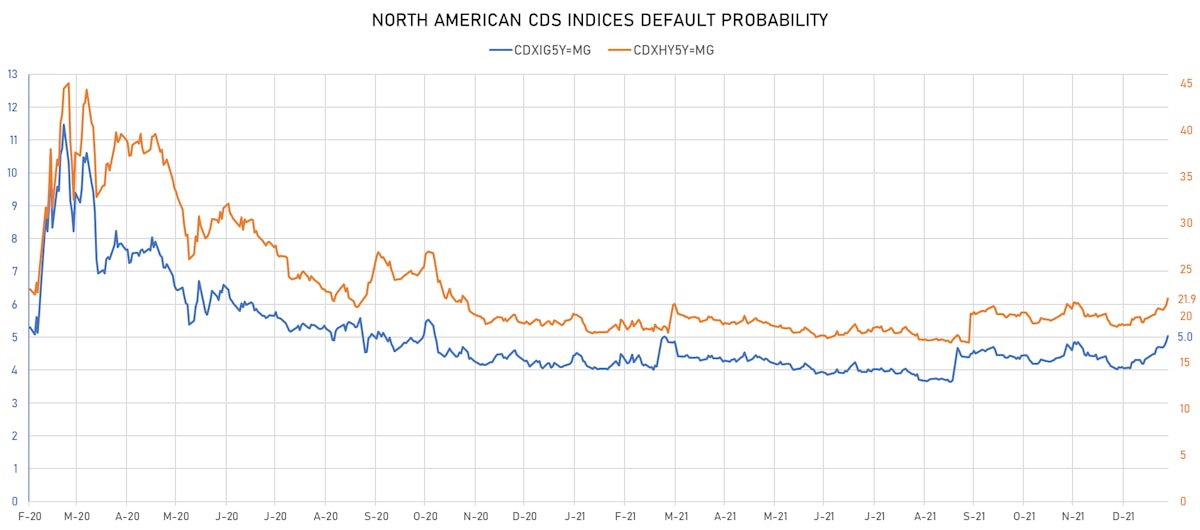

Credit

Credit Spreads Tighten Further: HY Cash And CDS Indices Now Both About 15bp Tighter Since Turn In Sentiment Last Week

Investment grade issuers are slowly coming back to market with new billion-dollar offerings priced today from IBM, State Street, Alexandria Real Estate

Credit

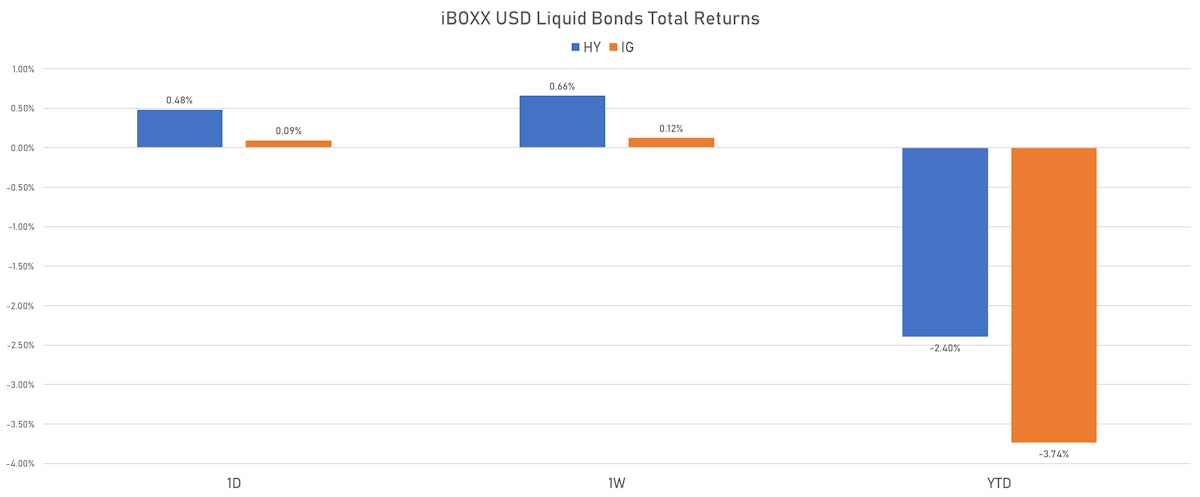

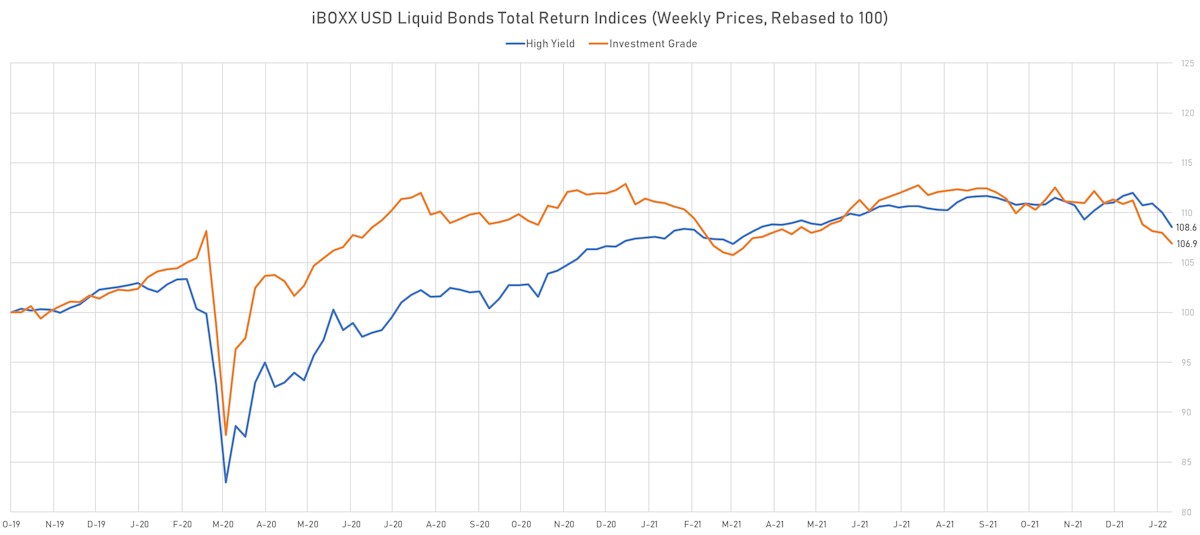

Solid Bounce Across USD HY As Equity Drawdown Turns And Risk-On Sentiment Returns

Still another quiet week in terms of corporate bond issuance, but a couple of sizeable FIG deals were priced today with Bank of America raising US$9bn in 5 tranches and Goldman Sachs €2.25 bn in 2 tranches

Credit

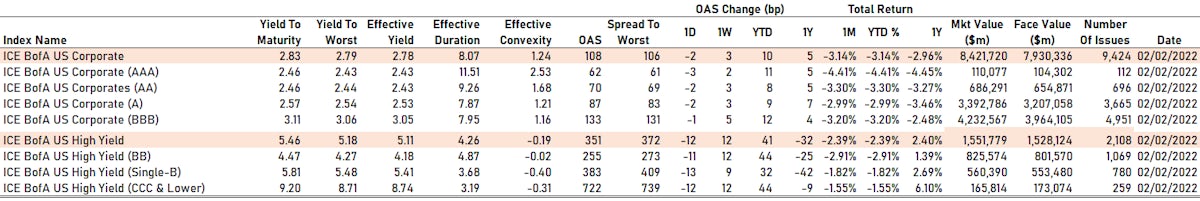

Rising Yields And Widening Spreads Continue To Weigh On US$ Credit, With Liquid Indices Down 3.9% For IG And 3.0% For HY YTD

Rates volatility brought measly volumes of issuance for the week (IFR data): US$ 6.275 bn in 8 tranches for HY (HY 2022 YTD: $22.36bn vs 2021 YTD $49.605 bn) and US$2.6bn in 3 tranches for IG (IG 2022 YTD: $148.39 bn vs 2021 YTD $135.97 bn)

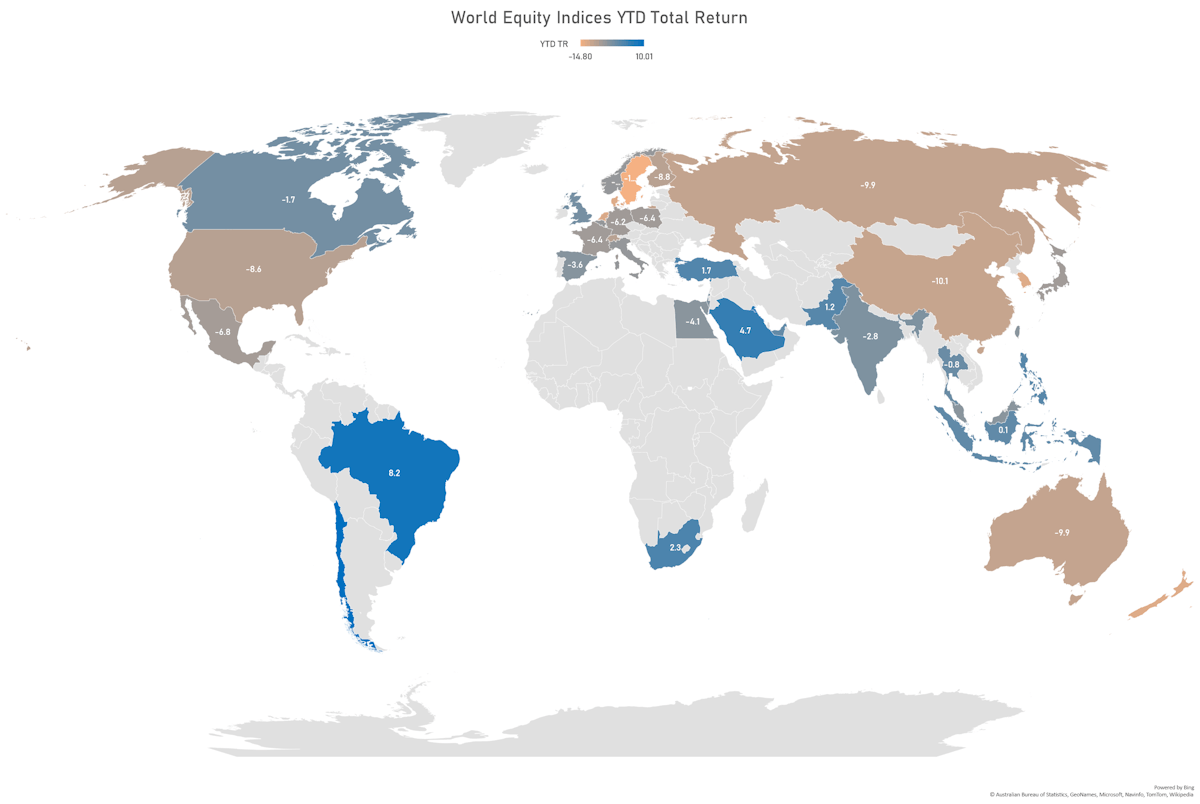

Equities

Sharp Rebound For US Equities On Friday Takes The S&P 500 Up 0.8% For The Week, Brings Nasdaq Comp Back To Unchanged

The rise today was broad, with almost 90% of S&P 500 stocks closing up, and was led by Technology (up 4.3%), Real Estate (up 3.4%), and Telecoms (up 2.9%)

Commodities

Energy Was The Big Story Again This Week In Commodities, With Brent Spot Above $90 And Nat Gas Up 16%

The failure of many countries OPEC+ to meet their quotas, combined with the slow / patient approach of shale producers is driving backwardation to levels where the back end of the curve will have to start catching up ($25/bbl spread between spot Brent Sullom Voe and December 2025 future)

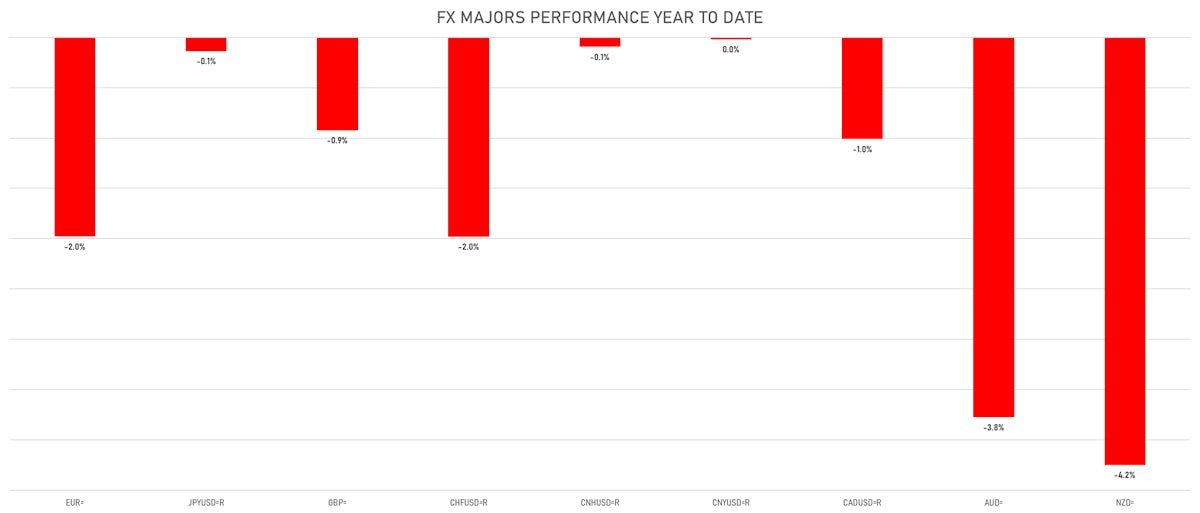

FX

Risk Aversion, Rates Differentials Push The US Dollar Up Against Most Currencies This Week

Antipodean currencies are faring the worst among majors, as they're the most sensitive to global risk sentiment, with the Kiwi dollar now down over 4% year-to-date, and the Aussie pretty close to that as well

Rates

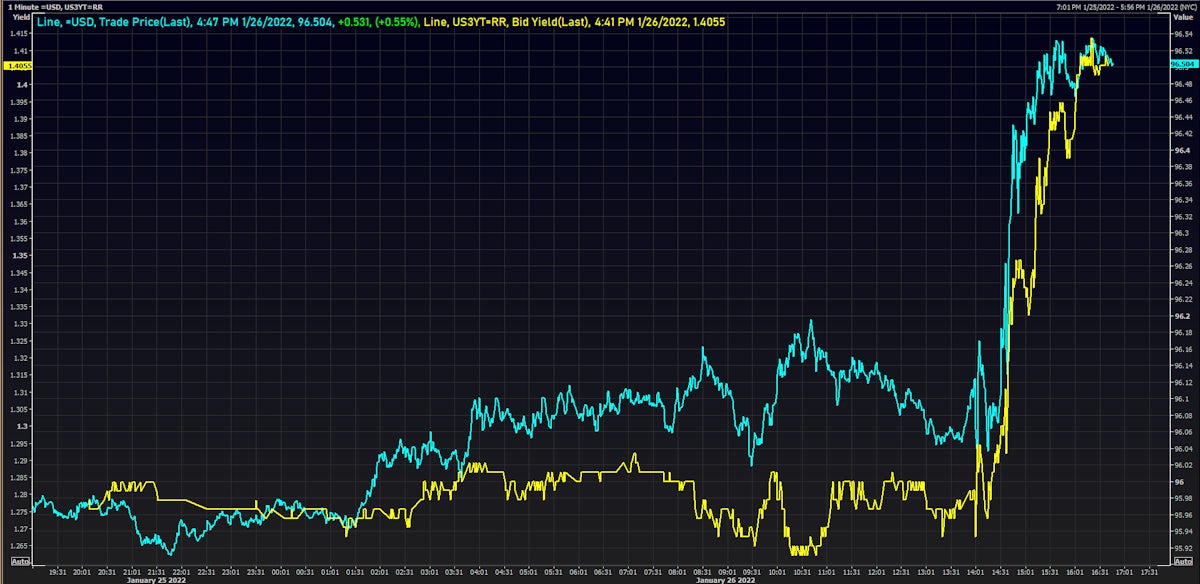

US Rates Move Towards Flatter Curve And Higher Volatility, As Expected After The FOMC

The front end of the curve rose about 20bp this week (almost a full additional hike priced into Fed Funds futures for this year), but the curve flattened by the same amount, with inflation breakevens higher and real yields lower (probably not what the Fed had in mind)

Credit

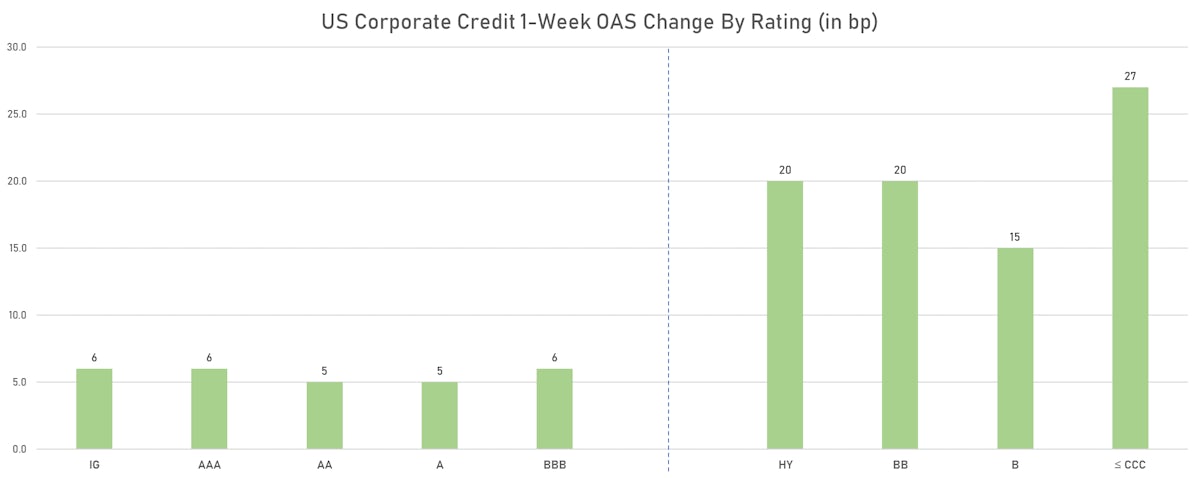

US$ Credit Performing Very Poorly, Along With Equities, As Spreads Widen Across The Complex

Implied default probabilities are rising in credit derivatives, with a flattening of the term structure (yields are up the most at the front end of the rates curves)

Rates

Opinion: The Fed's Hawkish Tone At The FOMC Is Amplifying Volatility, Without A Clear Sense That It's Part Of A Credible Plan

Since Wednesday afternoon, front-end yields have risen further and the curve has flattened as a consequence of the Fed's new positioning, but we wonder whether that is a feature or a bug in their new strategy

Cross Asset

FOMC Wrap-Up: Hawkish Fed Focused On Inflation, Spooks Market Into Pricing In More Than 4 Hikes This Year

The major risk outlined by Powell in his Q&A was that inflationary pressures might prove more long-lasting than the FOMC previously expected, notably wage growth in a very tight labor market

Credit

Spreads Wider Across The Credit Complex, With The OAS On ICE BofA US Corporate CCCs Up A Whopping 24bp Today

Weekly volumes of US$ bond issuance (IFR data): 29 Tranches for US$38.79bn in IG (2022 YTD volume US$145.79bn vs 2021 YTD US$108.795bn) and 8 Tranches for US$4.27bn in HY (2022 YTD volume US$16.085bn vs 2021 YTD US$35.545bn)