Cross Asset

A Note About Weekly Updates

Just a short message to let you know that time constraints make continued weekly updates unsustainable for the time being

Cross Asset

Spring Break: We're Taking A Little Time Off And Will Be Back Next Week

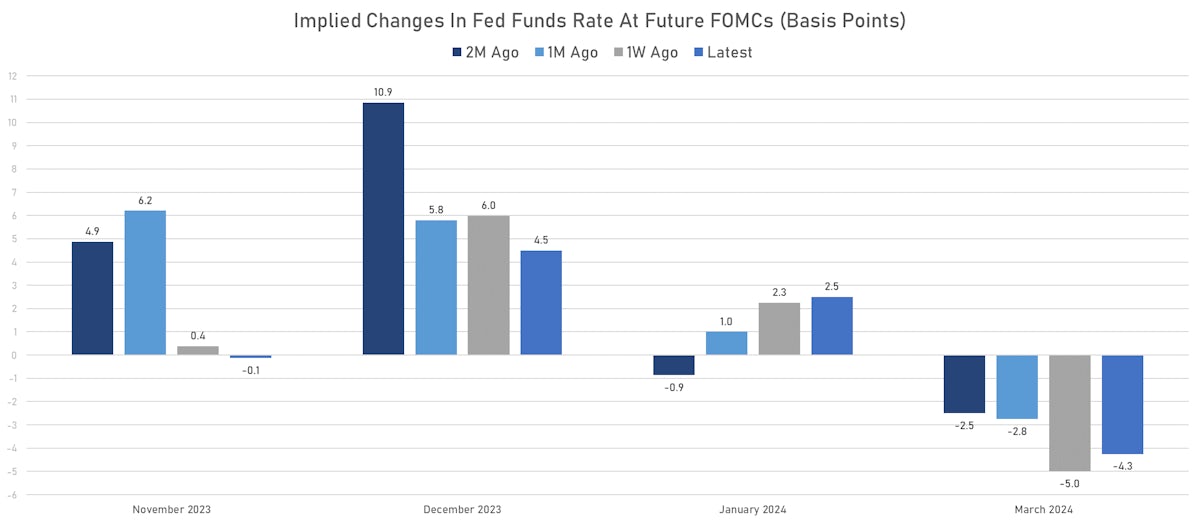

The market is now pricing in close to 9 hikes this year (2.25% by end of December), and with a slew of Fed speakers coming up later this week, it will be interesting to see how they position the May hike and the announcement of QT (which was initially supposed to count as one hike)

Cross Asset

Macro Markets Saw Heightened Volatility, With Both The US Dollar And Commodities Rising This Week

All GSCI sub-indices rose this week, led by agriculture and precious metals; Chinese markets were open again and saw big gains after the new year holiday, most notably iron ore, thermal coal, and copper

Cross Asset

Weekly Macro Summary: Seismic Shift In ECB Policy, Market Repricing Brought Considerable Realized Volatility In Euros Over The Past Days

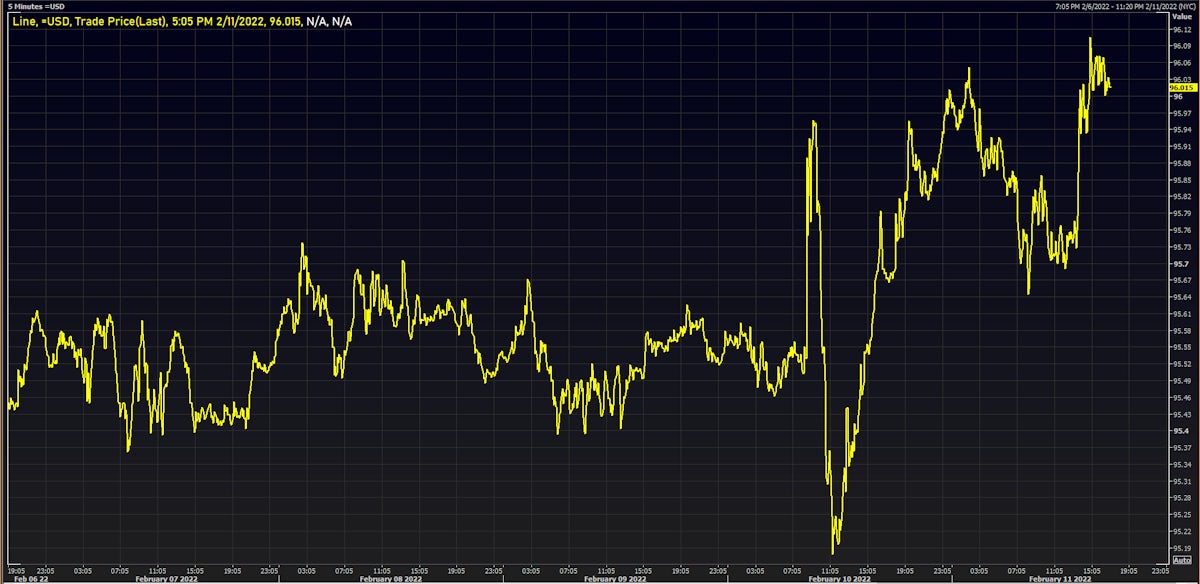

Very strong US employment report today raised the likelihood of a 50bp Fed hike in March (now 35 bp priced into Fed Funds futures), showed the Fed is likely well behind the curve

Cross Asset

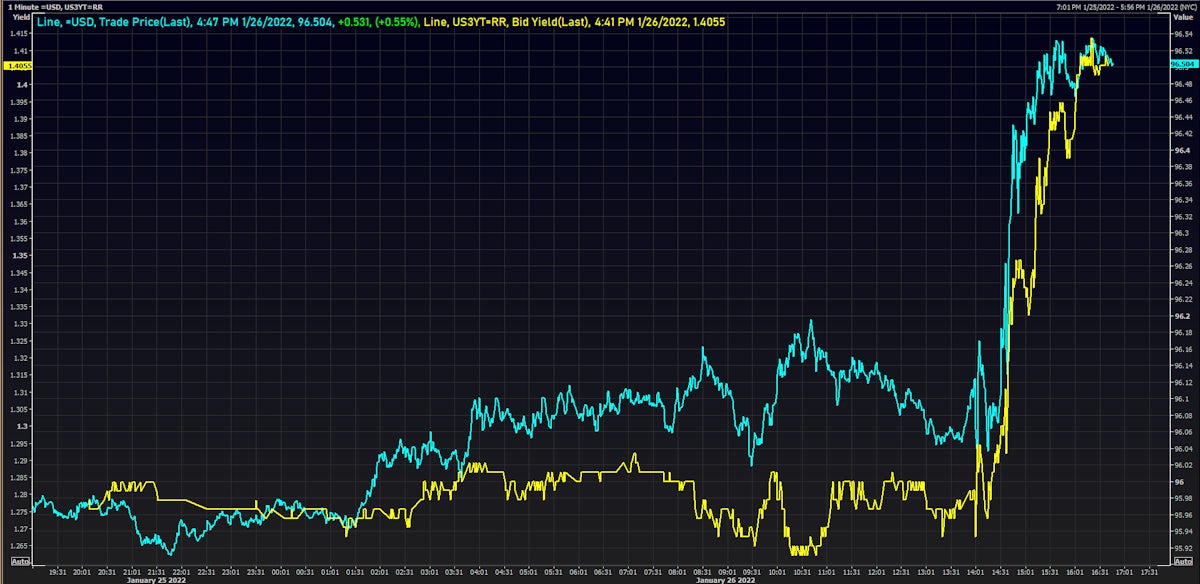

FOMC Wrap-Up: Hawkish Fed Focused On Inflation, Spooks Market Into Pricing In More Than 4 Hikes This Year

The major risk outlined by Powell in his Q&A was that inflationary pressures might prove more long-lasting than the FOMC previously expected, notably wage growth in a very tight labor market