Rates

US Interest Rates Fall At The Front End Of The Curve After Latest FOMC As Hiking Cycle Close To The End

During his FOMC Q&A session Powell expressed how difficult it is to quantify the impact of the recent regional banking crisis, which has led to widely different market interpretations: some traders think the Fed is done, while others see two more hikes

Credit

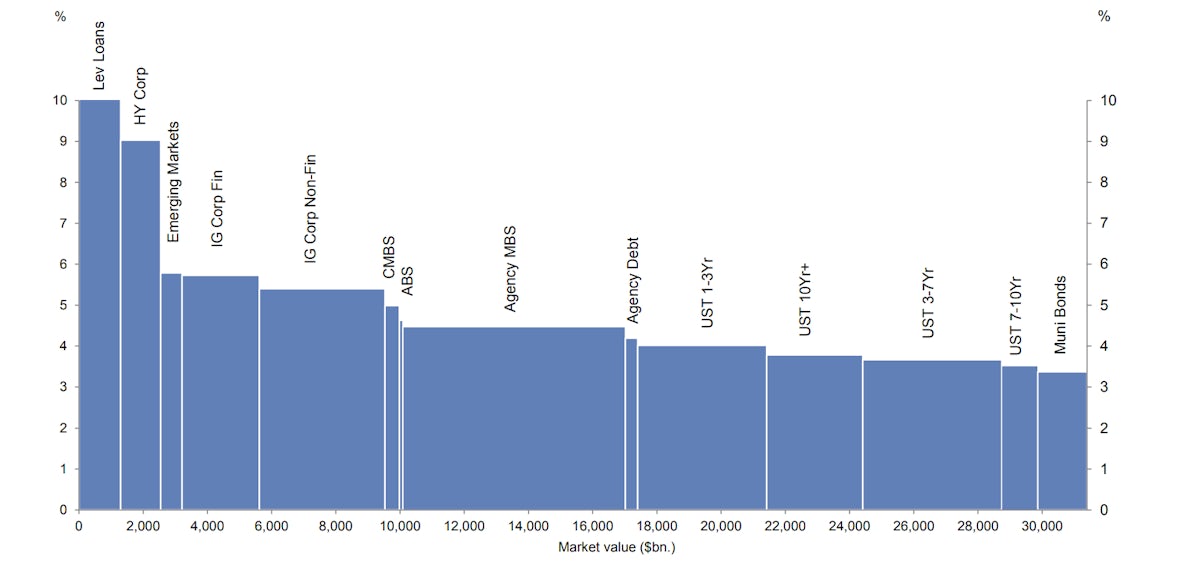

Wider Spreads Across The Credit Complex Driven By The Higher Likelihood Of A Credit Crunch

A quiet week for USD DCM syndicates: zero issuance in IG (2023 YTD volume $354.665bn vs 2022 YTD $392.19bn), and zero issuance in HY for the second straight week (2023 YTD volume $39.575bn vs 2022 YTD $34.876bn)

Equities

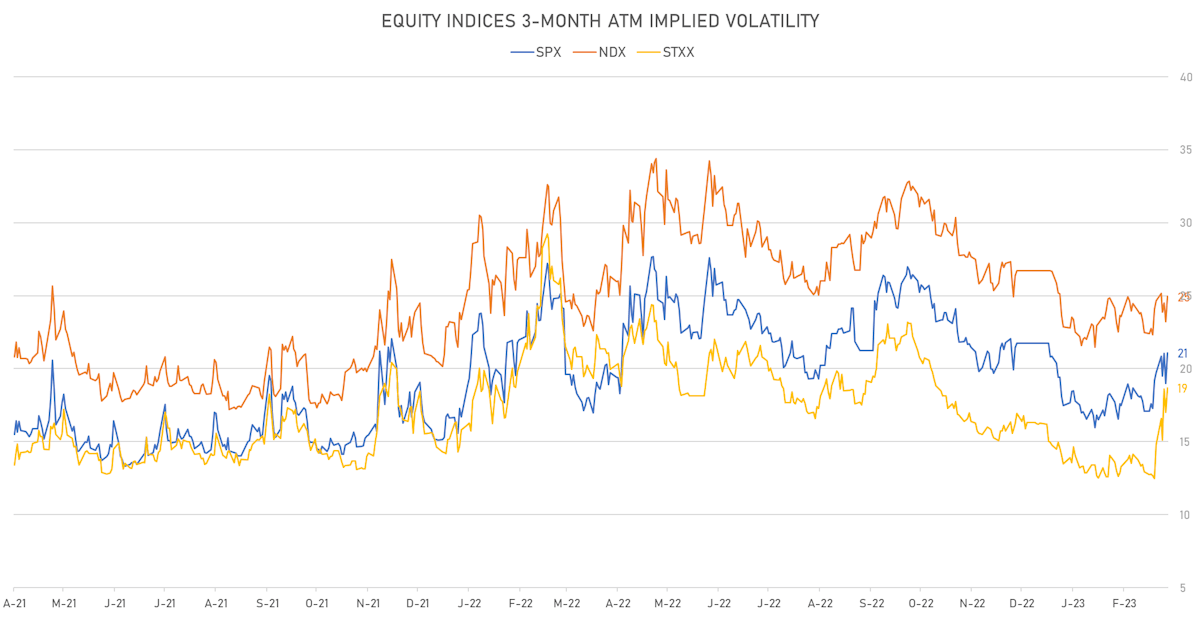

US Equities Did Relatively Well This Week, Despite A Selloff Ahead Of Potential Weekend Surprises

Defensives and highly liquid stocks outperformed this week, as the downside focus was obviously on weak balance sheets and rates sensitive sectors like regional financials

Rates

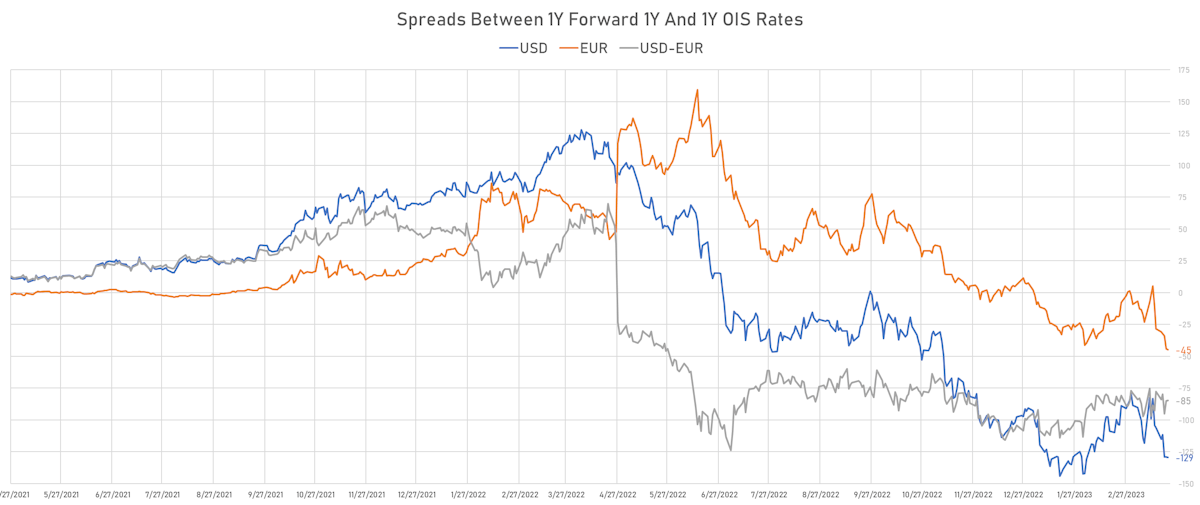

Crazily Volatile Week For Rates, US Money Markets Now Price In More Than 3 Rate Cuts Through Year End

Regardless of whether the FOMC results in a 25bp hike or no hike, clarity of purpose will be critical as the Fed fights to restore confidence in the regional banking sector

Credit

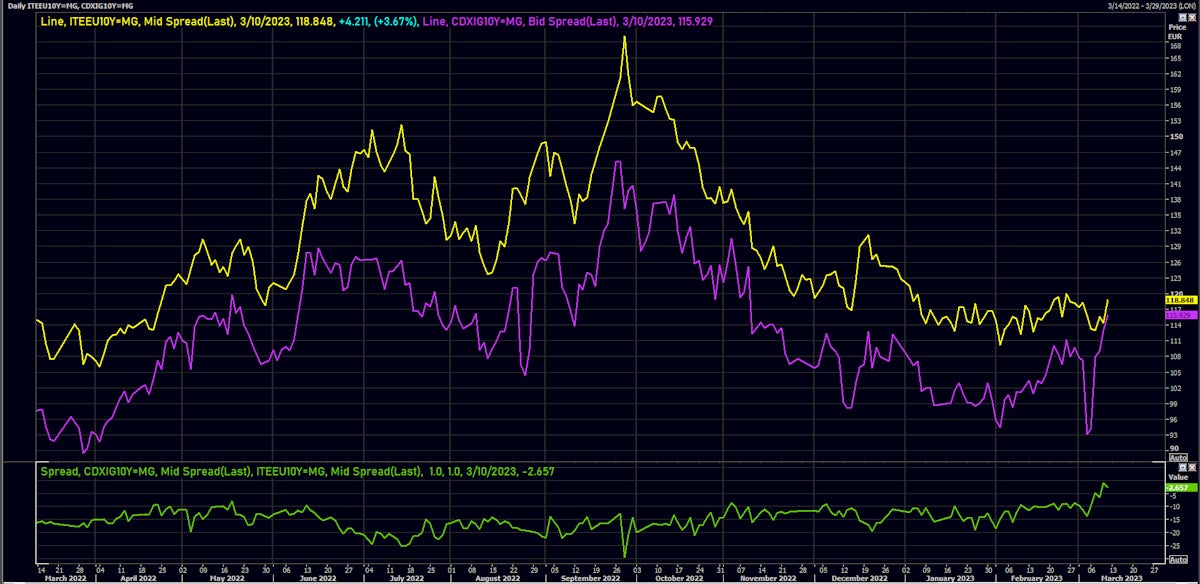

Broad Widening In Spreads Across The US Credit Complex, With IG Overperforming On Duration Bid

USD IG bond issuance continued at a fast clip this week: 53 tranches for $39.275bn in IG (2023 YTD volume $354.665bn vs 2022 YTD $361.14bn), no new issuance in HY (2023 YTD volume $39.575bn vs 2022 YTD $34.076bn)

Equities

US Equities Had A Difficult Week As Powell And Regional Financials Provide One-Two Punch

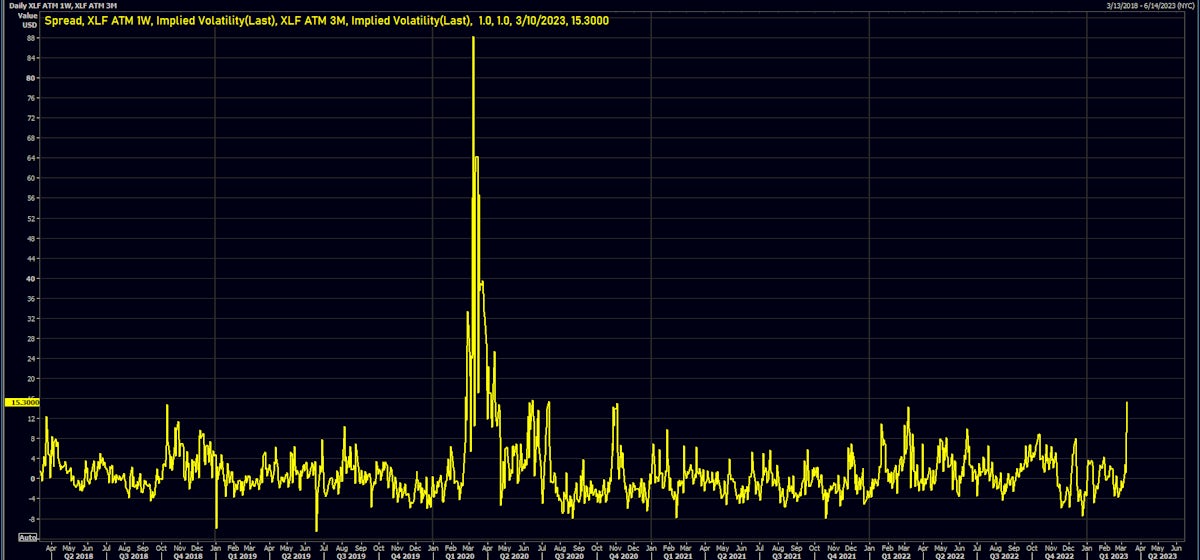

The speed at which things got out of hand with SVB is the worry for US regional banks, with short-term implied volatility on financials getting a little panicky while the broader market stays relatively calm

Rates

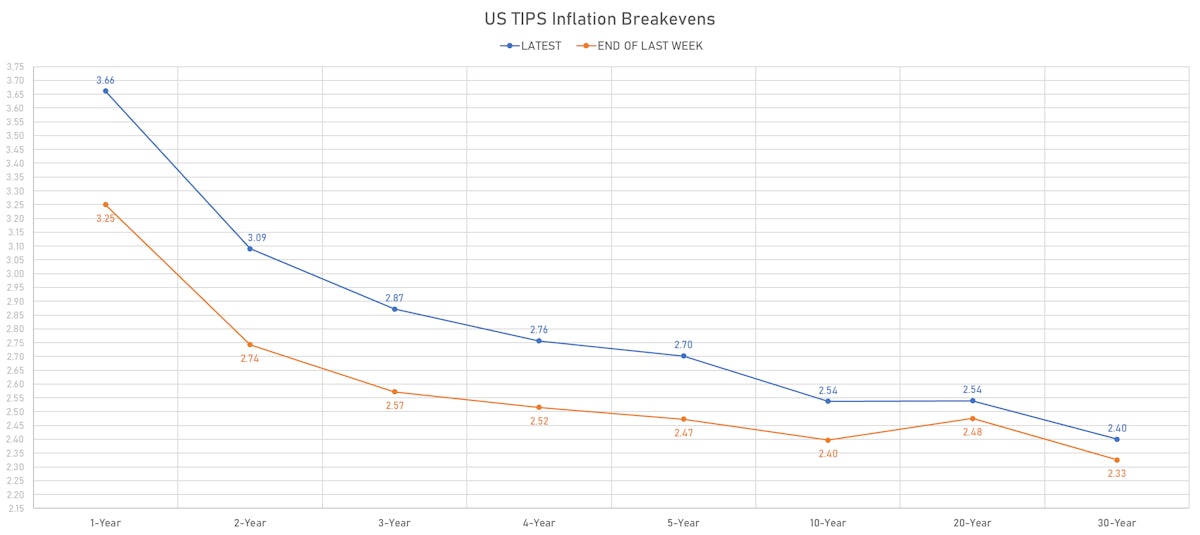

The US Yield Curve Bull Flattened For The Week, Driven By Much Lower Inflation Breakevens

The market fright around Western regional banks impacted mostly equities, but did cause a jolt to money markets: basis swaps were extremely tight on Tuesday and got wider into the weekend, though nothing to worry about for the moment

Credit

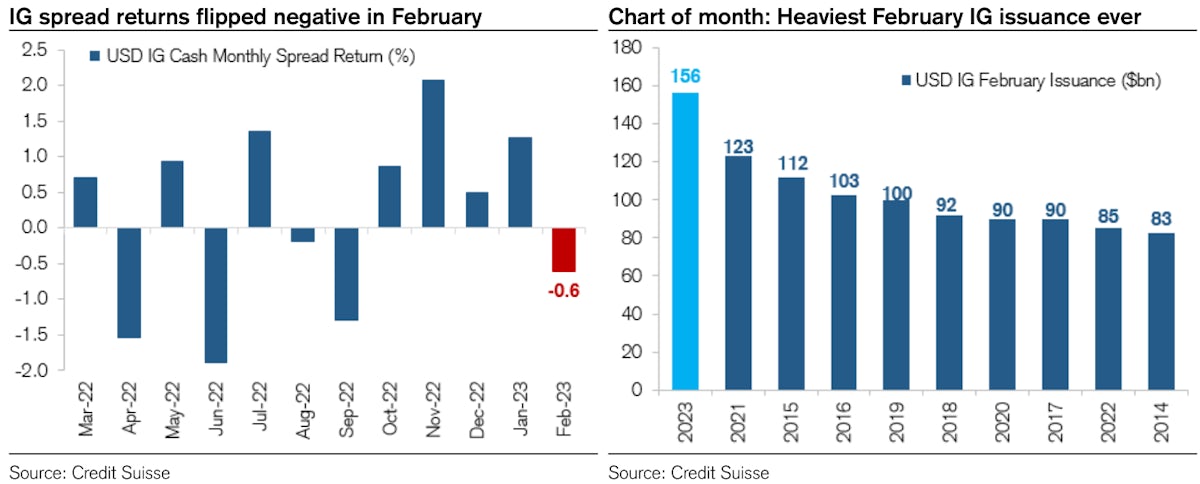

Tighter Spreads Across The USD Credit Complex, Led By Single Bs, As BBs Continued To Underperform

Strong volumes of issuance this week (IFR Markets data): 66 tranches for $48.09bn in IG (2023 YTD volume $315.69bn vs 2022 YTD $287.841bn), 11 tranches for $7bn in HY (2023 YTD volume $39.575bn vs 2022 YTD $33.875bn)

Equities

Broad Rebound For US Equities This Week, Though S&P 500 Ends February Down 2.6%

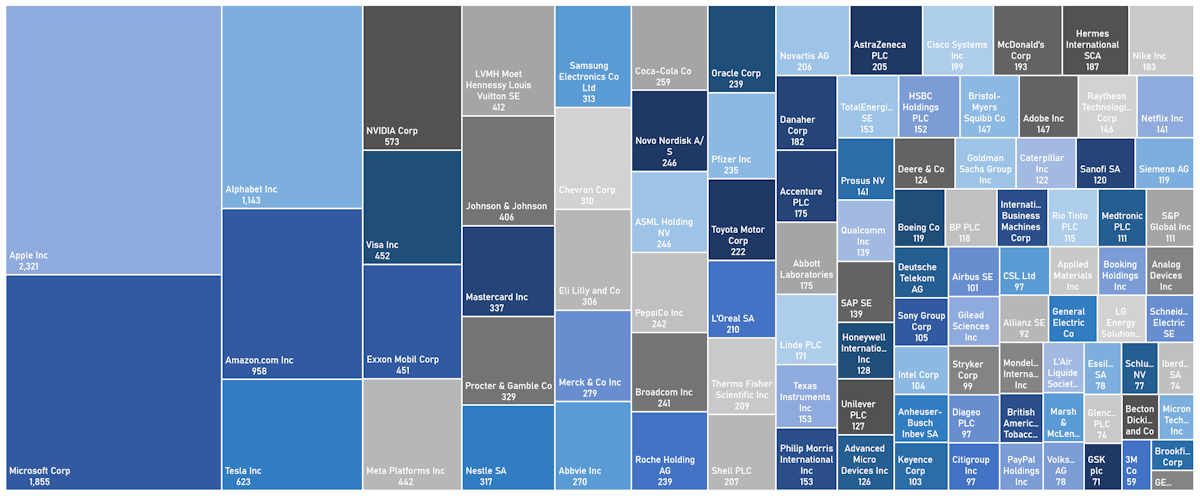

The story of equities so far this year has been one of resilient revenue, declining margins and expanding valuations on the back of more positive than expected growth; as such, the greatest risk to the market remains that of recession and growth downgrades

Rates

US Inflation Expectations Rose Further This Week, With 1Y TIPS Breakeven Now Up 200bp Since Early January

The front end of the curve continues to lead the action, as the market stays focused on very short-term event risk: Powell's appearance before the Senate this week and the latest employment report coming on Friday

Credit

Dealer Inventory For USD HY Bonds Estimated To Be At 12-Month High, While The CDS-Cash Basis Widened This Week

Investors' appetite for high grade USD corporate bonds remains undiminished for now: 29 tranches for US$22.525bn in IG this week (2023 YTD volume US$267.3bn vs 2022 YTD US$234.091bn), 1 tranche for US$1.1bn in HY (2023 YTD volume US$32.757bn vs 2022 YTD US$31.686bn)

Equities

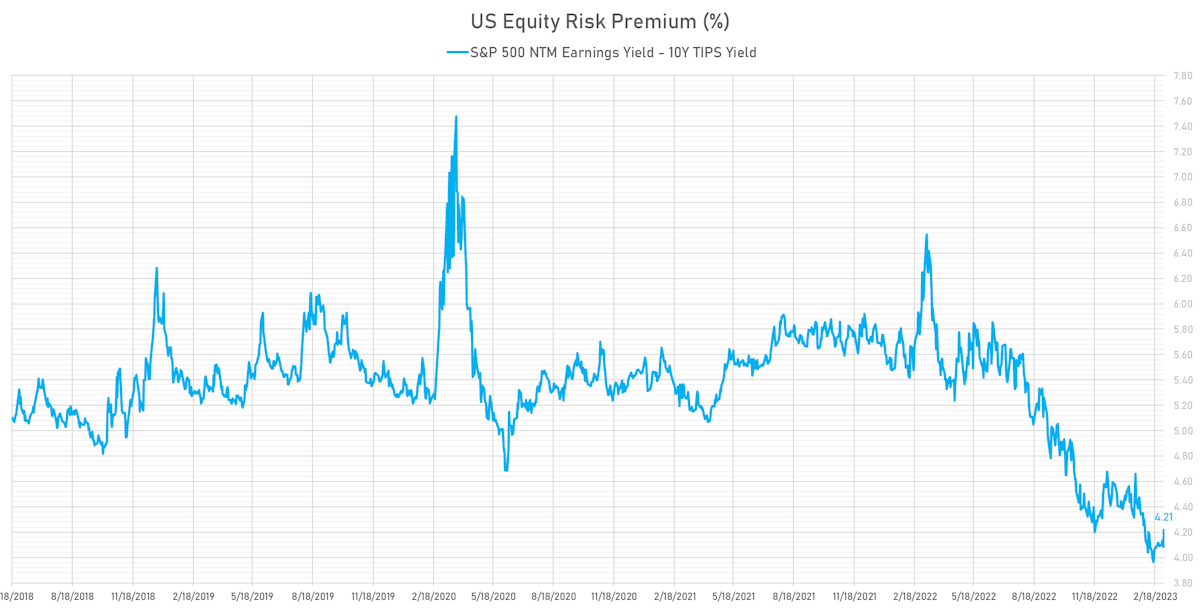

US Valuations Have Come Down Somewhat With Higher Rates, But The Equity Risk Premium Remains Low

In the absence of pressure on risk premia, the story of equities this month has been entirely driven by a shift in the economic narrative, with investors wondering how high rates will need to go for the Fed to achieve a landing