Commodities

Crazy Week In Commodities, With The S&P GSCI Equal-Weighted Index Up 17%, Led By Energy And Agriculture

Uncertainty around Russian supplies saw the prices of European energy benchmarks jump this week: Newcastle Coal up 75%, TTF natural gas up 125%, Brent Forties up 25%

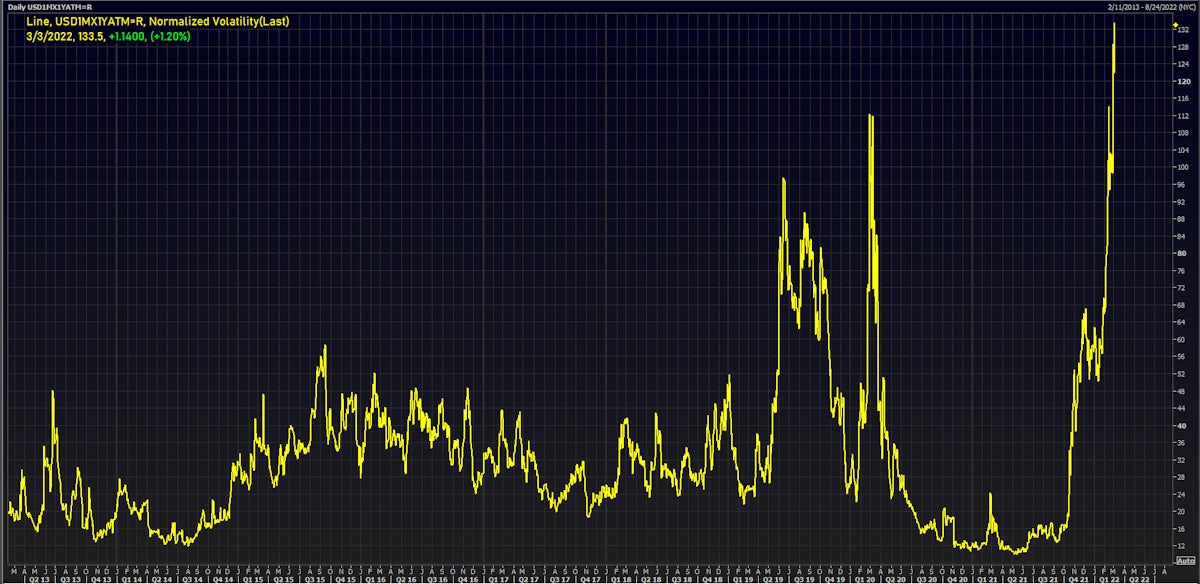

FX

Extreme Moves In Implied Volatilities, Particularly In Downside Euro Protection As Spot Price Falls Below 1.10

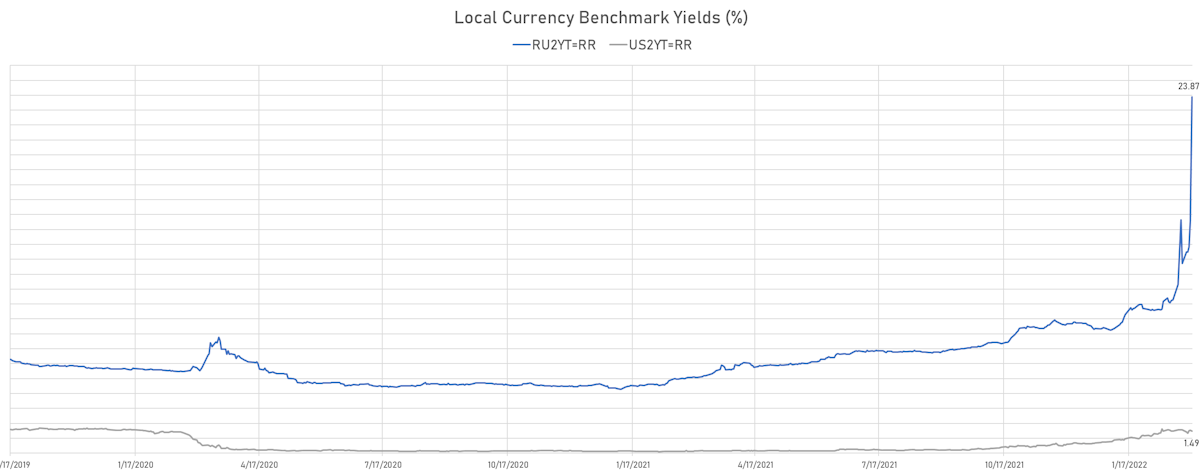

The Rouble ended the week down another 10% against the US Dollar, with the possibility of additional sanctions against Russia weighing enormously on its government debt and the cost of default protection

Rates

US Treasury Curve Continues To Bull Flatten, As Short-Term Rates Volatility Is Reaching Extraordinary Levels

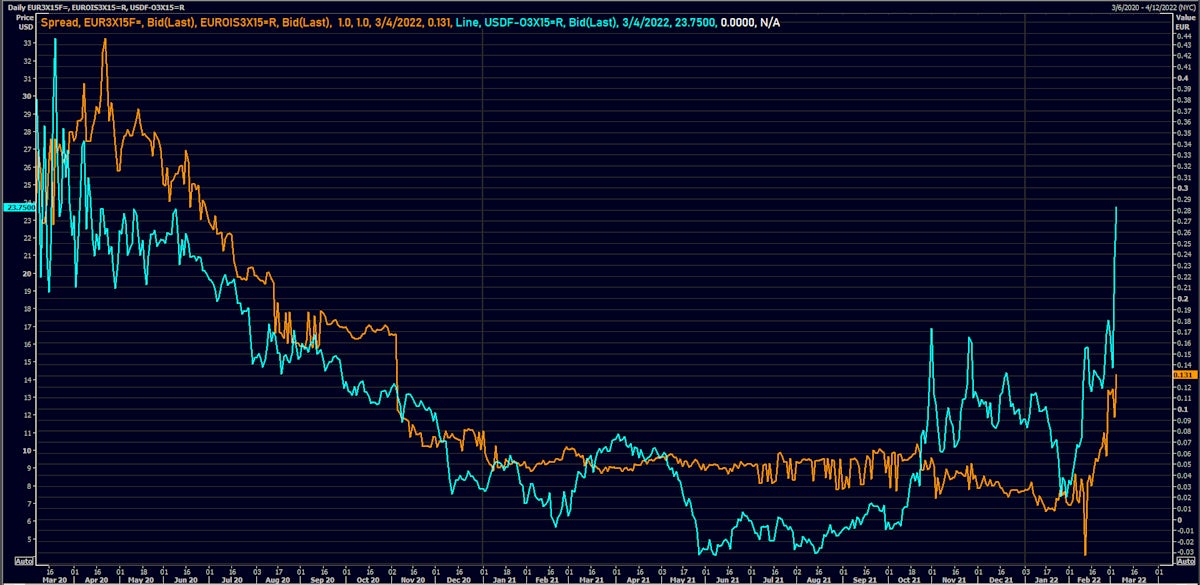

Funding markets have seen real tension since the last round of sanctions were announced: USD FRA-OIS and EUR FRA-EONIA spreads have risen significantly, with more pressure seen in dollar funding

Credit

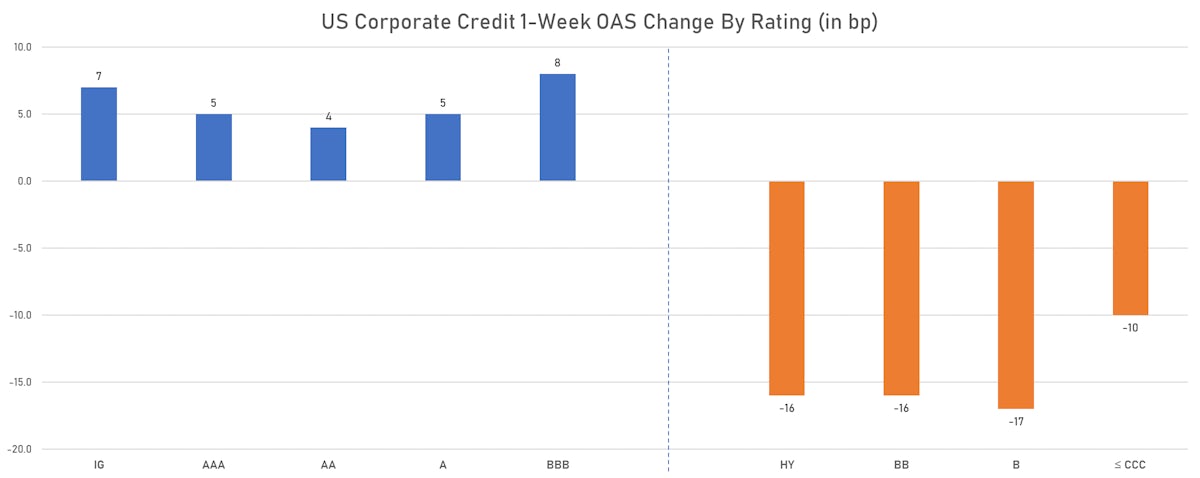

US Cash Spreads Slightly Wider, But The Rates Curve Flattening Helps Investment Grade Bonds Rise

Good day for IG US$ corporate bond issuance, with a number of deals priced, mostly from FIGs like BofA, CBA, BMO, Sumitomo, as well as companies like Roche and Mondelez

Macro

US Curve Flattens Further, 10Y Yield Down 4bp; Market Implied Hikes Down To 5 By The End Of The Year, With Just 1 Hike Priced For 2023

Fed policy uncertainty is driving short-term rates volatility to extreme levels, with many questions up in the air: how front-loaded can rate hikes be? will QT be used to steepen the curve? is inflation stabilizing or still getting worse? how will Ukraine, Iran and the prices of commodities impact inflation?

Credit

Risk-On Mood Tightened US Corporate Cash Spreads Markedly Today, With BBs Down 17bp And Single-Bs Down 19bp

The positive sentiment pushed equities up close to 2% and brought a slew of new corporate bond issuance in the US, with large offerings from Exelon, HCA Healthcare, John Deere, Progressive Insurance

Macro

Yields Rise As Powell Confirms Liftoff Is Now A Couple Weeks Away, More Worried About Inflation Than Economic Growth Impact Of Ukraine-Russia War

Energy commodities keep rising at a frightening pace, with European TTF natural gas up over 40% and Brent Forties up 6% today, with the historic gap with Urals crude now at around $19

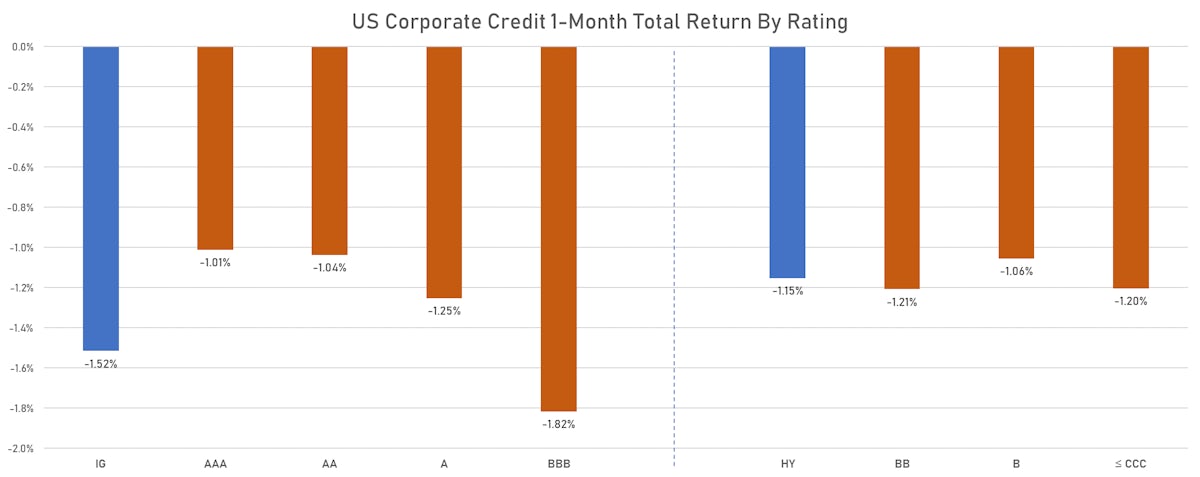

Credit

A Familiar Story Played Out Again Today: Wider Spreads, Lower Yields, Higher Cash Prices

Despite the tremendous volatility in rates, a bunch of issuers stepped forward with chunky new bond offerings, led by ING Bank's €9bn in 3 tranches, American Express' US$4bn in 3 tranches, and Charles Schwab's $3bn in 3 tranches

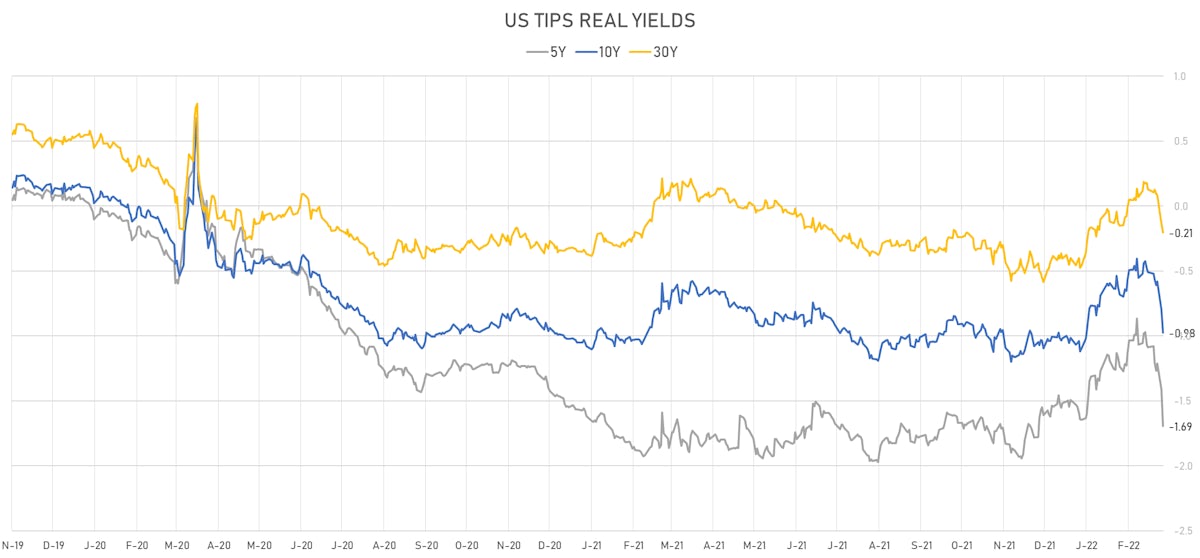

Macro

Inflation Breakevens And Rates Volatility Higher, But Risk Aversion Keeps Treasuries Well Bid; 5-Year TIPS Real Yield Now Down Over 60bp In The Past Week

Uncertainty around how Russian sanctions will be applied, and even possibly widened, is driving commodities higher, with Brent crude front month at $110/bbl to and European TTF natural gas up double digits to €114

Credit

Much Wider Spreads Across The Credit Complex, But Lower Yields Take Cash Prices Higher

The enormous level of rates volatility kept issuers on the sidelines today, with no pricing in the primary USD corporate bonds market

Macro

Strong Bid For US Rates Despite Higher Breakevens, With a Bull Flattening Curve, And One Full Hike Has Been Priced Out Over Past Week (5.4 Implied By End 2022)

On the Russian front, the Rouble has had the largest percentage drop since the 1998 financial crisis, the government's CDS implied 5Y US$ default probability has surged to 60%, but commodities are doing well (if they can be paid): palladium prices up 5%, European TTF natural gas up 12%, wheat up 10%

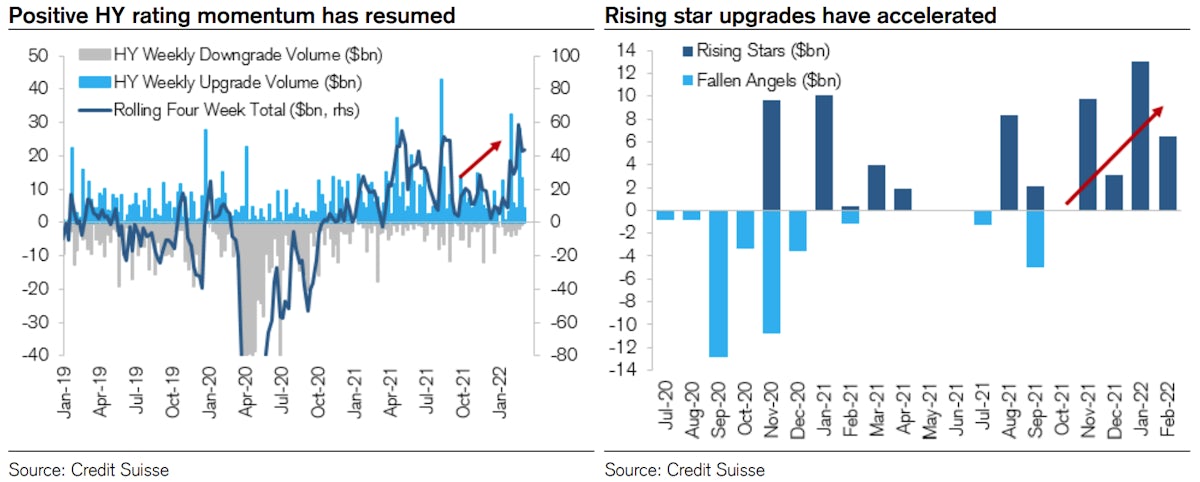

Credit

Good Rebound In High Yield Today, With Cash Spreads Down 28bp And CDX HY Down 10bp

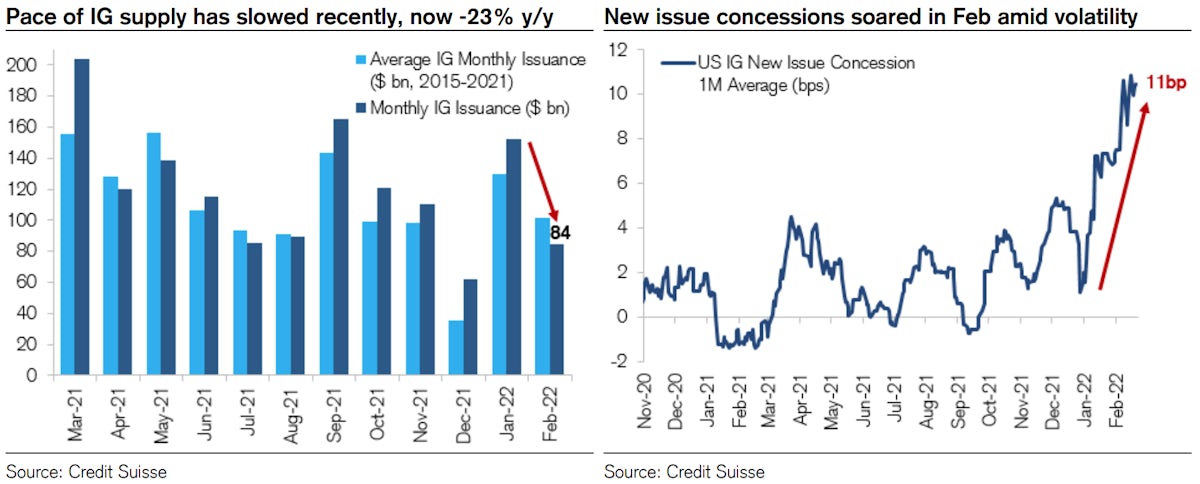

Mediocre volumes of for the week in the primary US$ bond market, with rates volatility at extreme levels (IFR Markets data): 25 tranches for $18.0bn in IG (2022 YTD $234.1bn vs 2021 YTD $255.4bn) and 1 tranche for $1bn in HY (2022 YTD volume $31.7bn vs 2021 YTD $US$87.9bn)