Rates

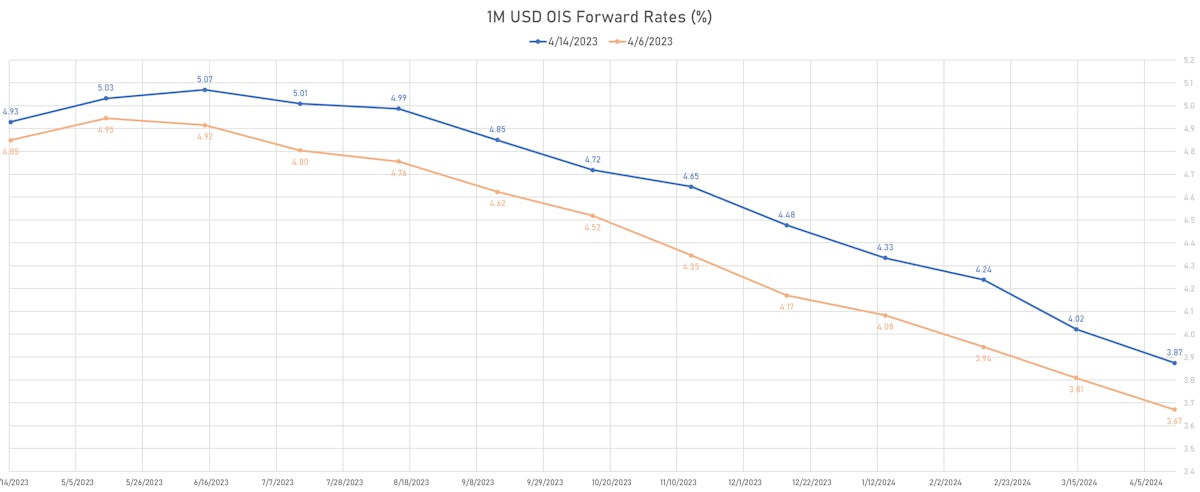

With A Hike At The May FOMC Now Locked In, June Pricing Drifts Higher On Hawkish Fed Speak

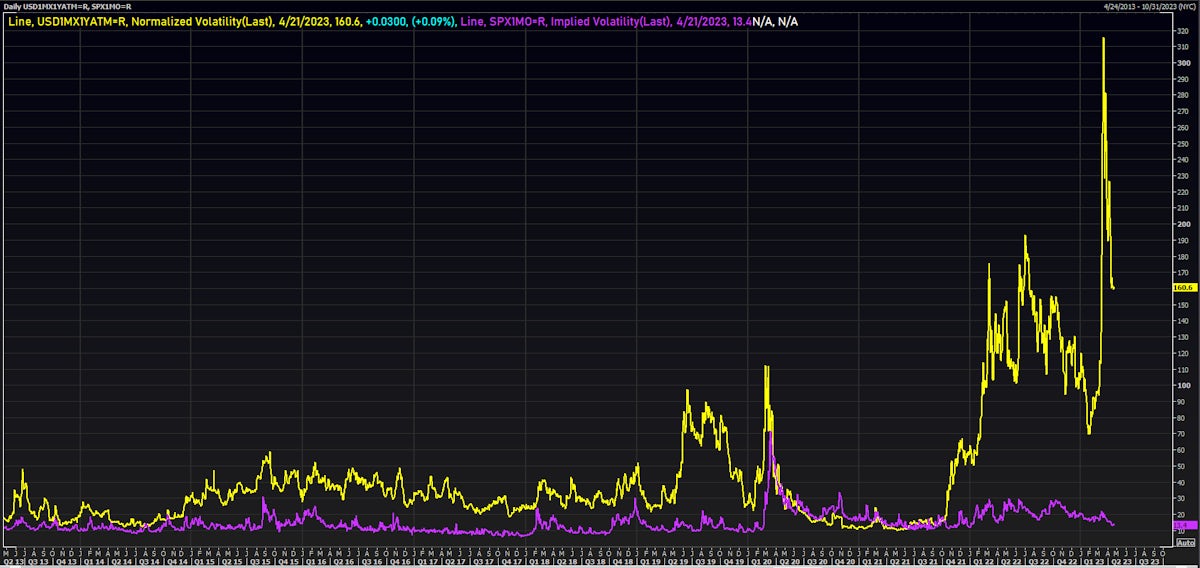

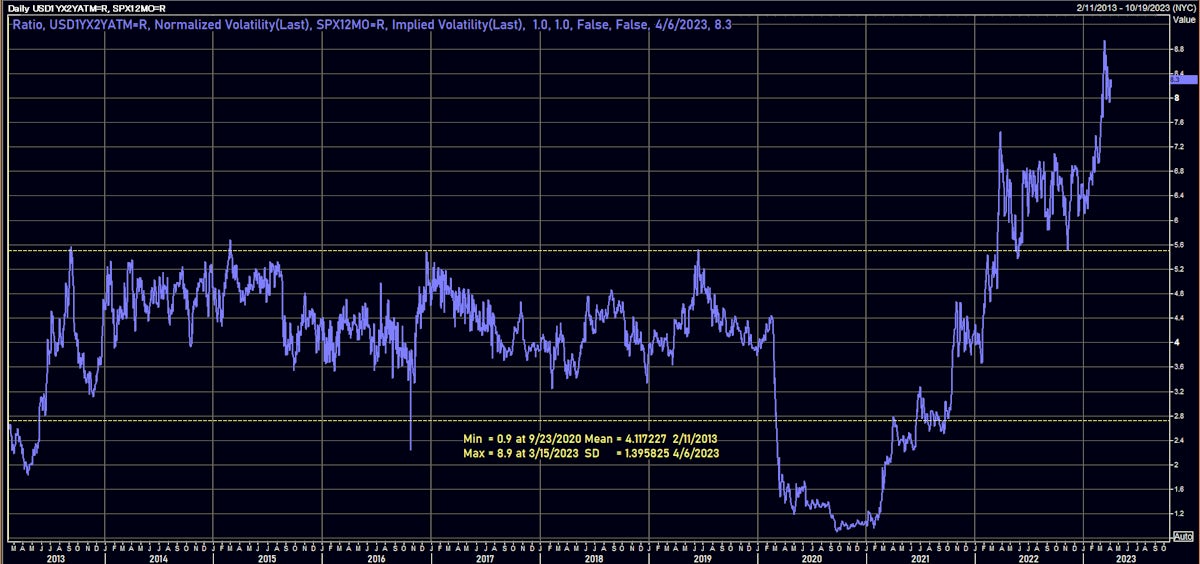

Volatility in US rates remains elevated, especially compared to the depressed level for equities, with considerable uncertainty surrounding the June FOMC hike and possible easing later this year

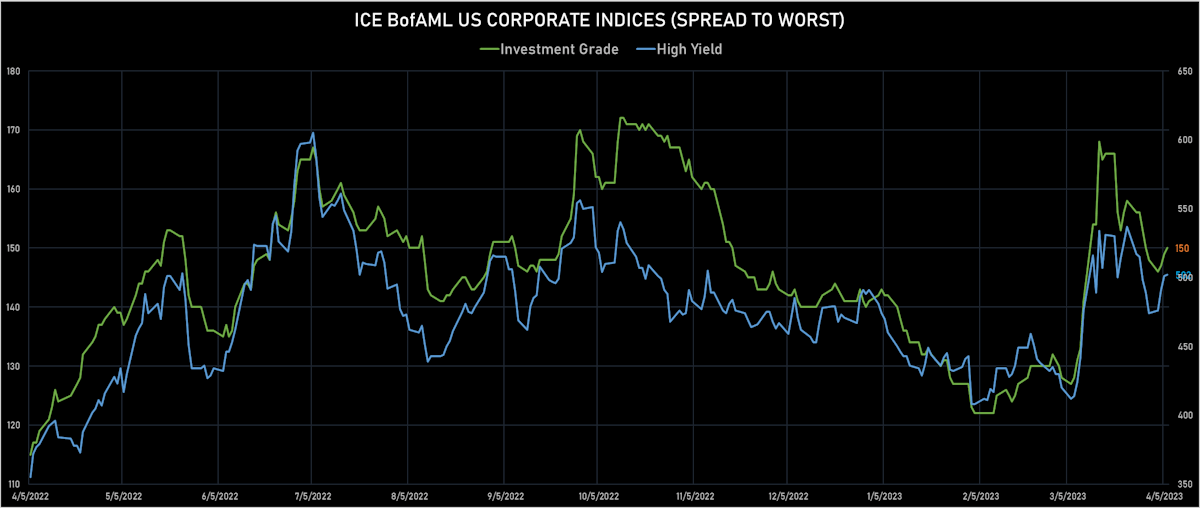

Credit

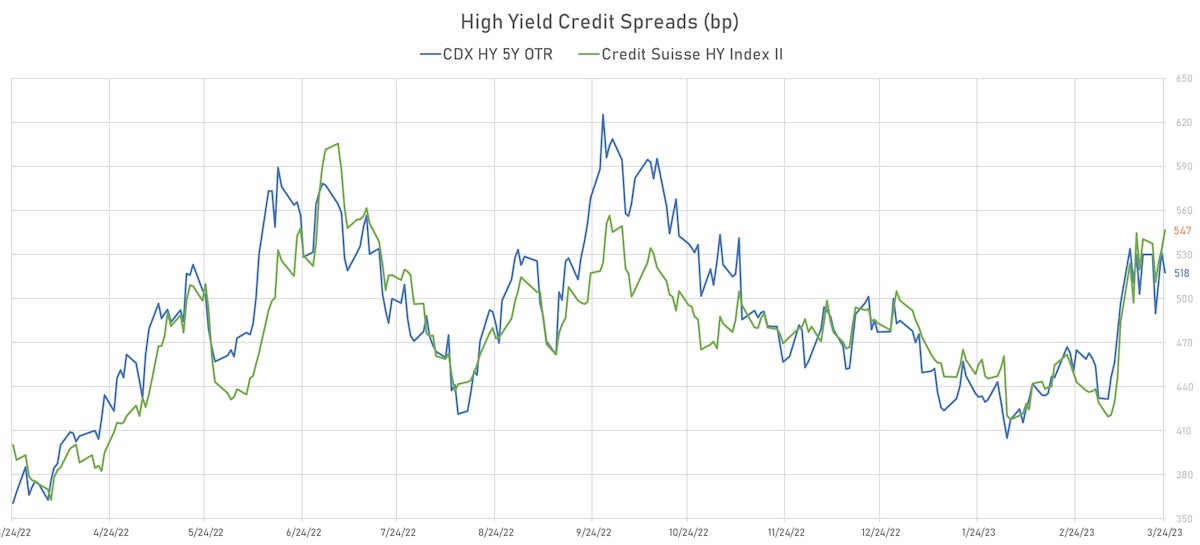

Solid Spread Compression Across The US Credit Complex, With Cash CCCs 65bp Tighter This Week

Weekly USD corporate bond issuance on the light side: 16 tranches for $10.95bn in IG (2023 YTD volume $421.29bn vs 2022 YTD $512.391bn, down 18 % YoY), 6 tranches for $3.325bn in HY (2023 YTD volume $51.837bn vs 2022 YTD $48.746bn, up 6%YoY)

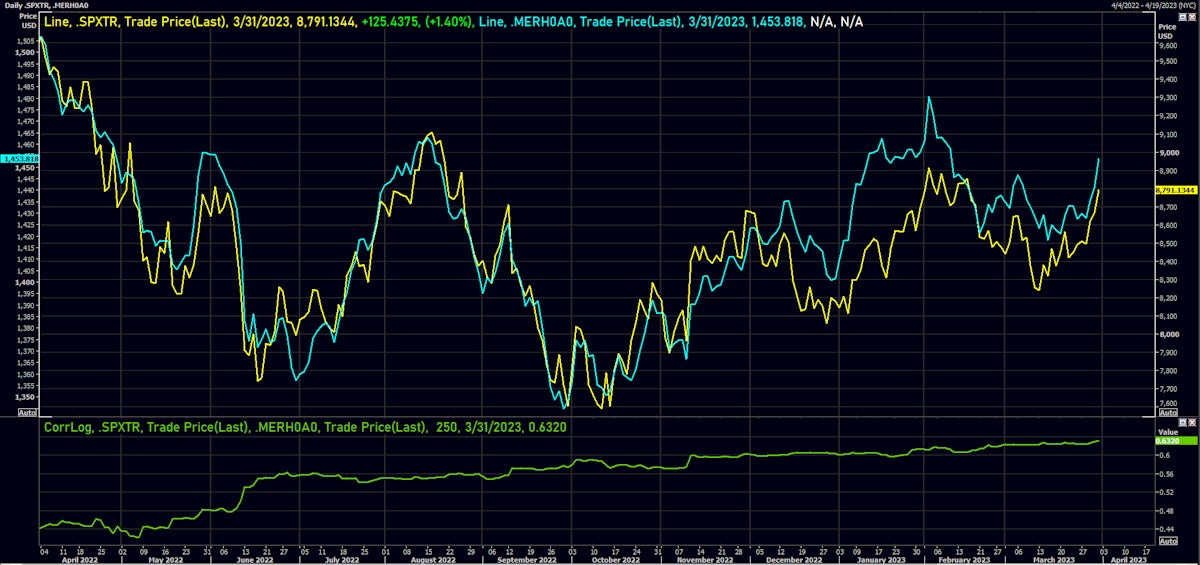

Equities

Winning Week For US Equities, With Large Banks Like Citi And JPM Beating EPS Estimates On Strong NII

Rerisking is definitely here, with Europe and EM seeing healthy inflows this week, but net length in US equity portfolios remains muted (hedge funds long/short ratios at multi-year lows)

Rates

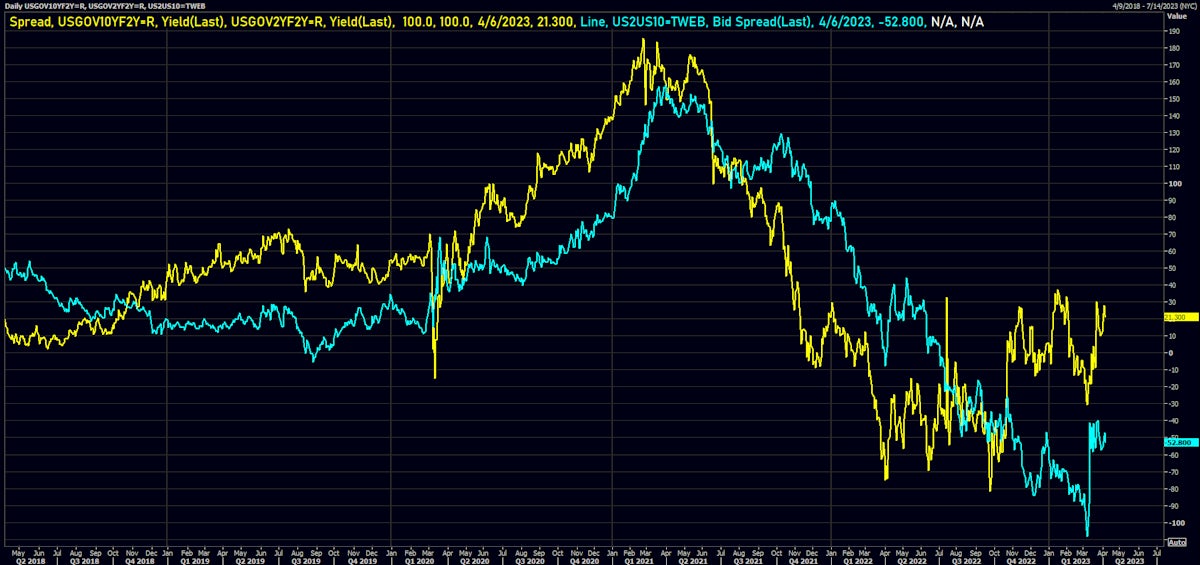

Bear Flattening After Busy Week Of US Data, Fed On Course To Raise By 25bp In Two Weeks

The most active debate in rates is the June FOMC, where market pricing has shifted to a small hike (from a hold last week), with the latest CPI print showing further indications of sticky inflation in core services

Credit

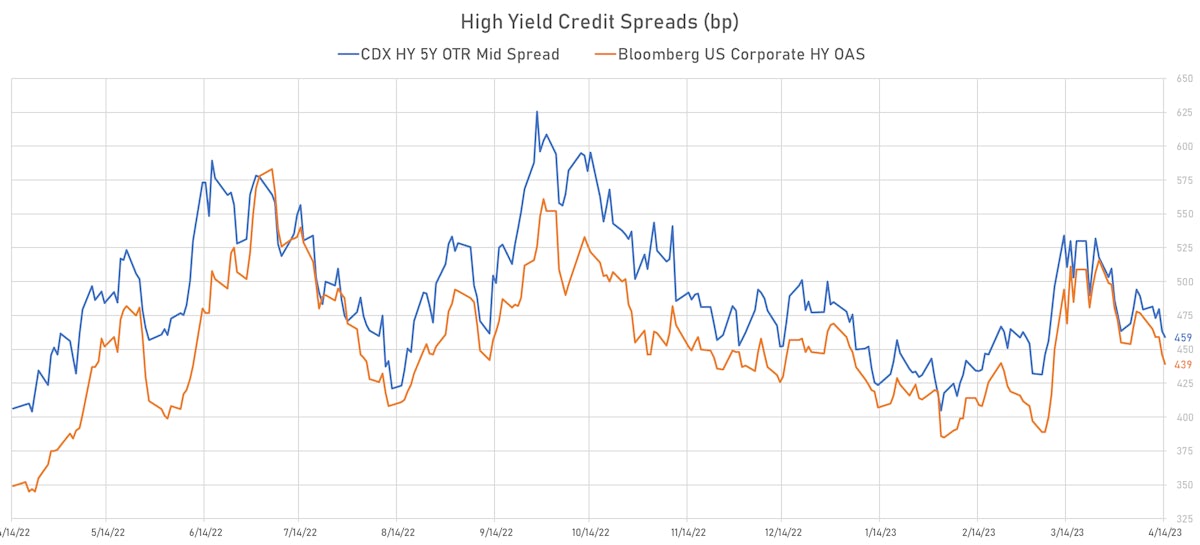

Despite The Significant Recent Widening Across The Complex, USD Credit Spreads Are Close To Unchanged YTD

Short week to kick off April after a very slow month of March: 15 tranches for $9.8bn in USD IG (2023 YTD volume $410.34bn vs 2022 YTD $480.291bn) in IG, 7 tranches for $8.337bn in HY (2023 YTD volume $48.512bn vs 2022 YTD $47.611bn)

Equities

4% of S&P 500 Companies Will Report 1Q23 Numbers In The Week Ahead, With EPS Expected To Fall 7% YoY

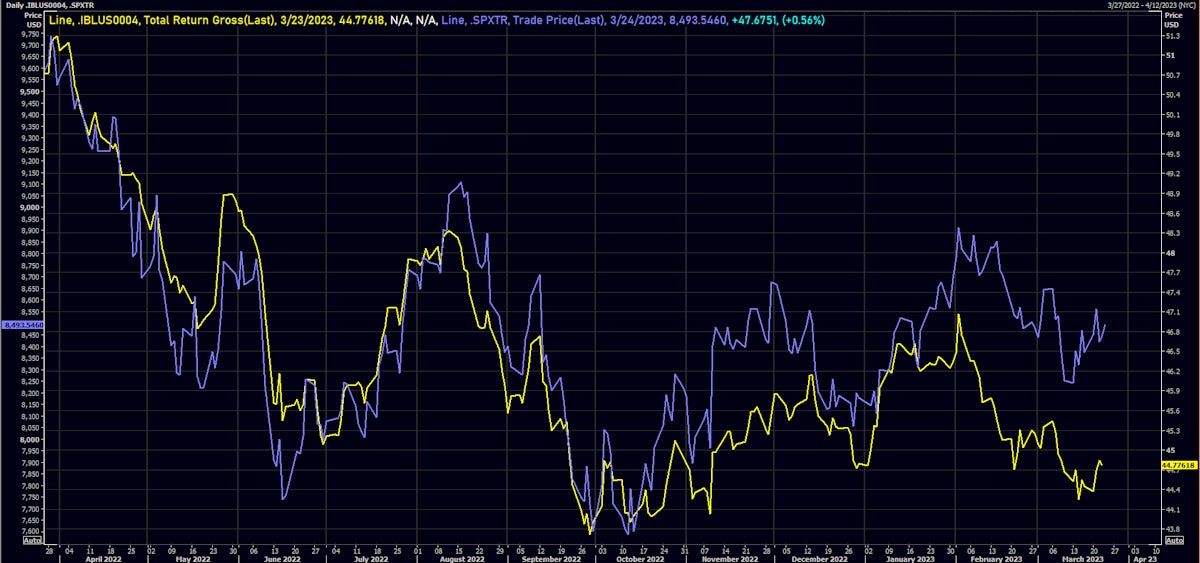

The compartmentalization of market risks has led to huge differences between the implied volatility of stocks compared to rates: 1Y into 2Y USD OIS swaptions are still around 3 standard deviations richer than 1Y ATM options on the S&P 500

Rates

US Front-End Inversion Deepens As Rates Expectations For May And June FOMCs Firm Up

After a quiet holiday week, it will be interesting to see whether the Treasury market returns to more normal liquidity and pricing, with volumes likely to rise into the latest CPI print on Wednesday

Credit

Strong Rebound In USD HY Credit, Led By BBs Overperformance (OAS -73bp WoW)

Decent week for US$ bond issuance: 39 tranches for $24.825bn in IG (2023 YTD volume $400.54bn vs 2022 YTD $466.941bn), 2 tranches for $600m in HY (2023 YTD volume $40.175bn vs 2022 YTD $41.626bn)

Equities

US Equities End Week Broadly Higher After A Good Squeeze; NDX Now Up 20.5% YTD, Best Quarter Since 2Q20

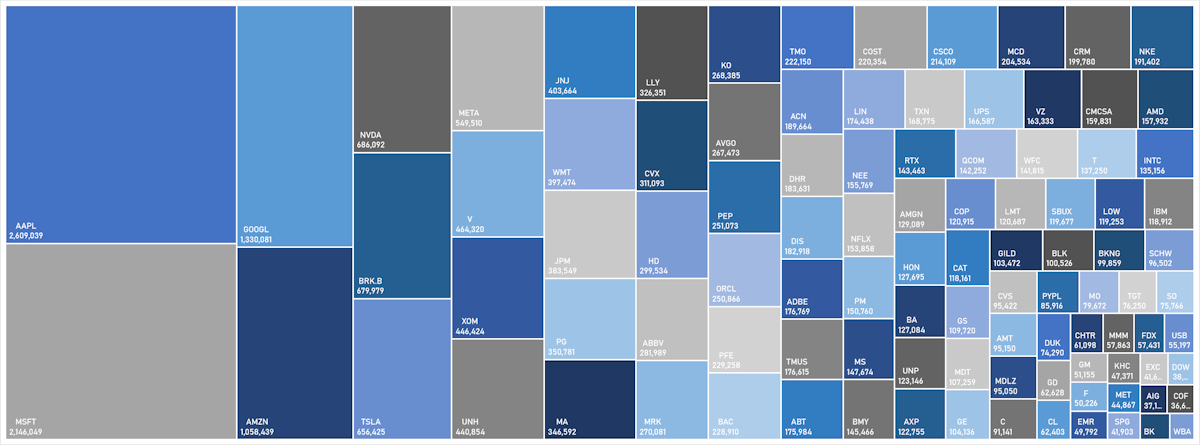

Despite the dispersion of returns across sectors recently, only 6 names (Microsoft, Apple, Nvidia, Google, Amazon, Meta) added up to 84% of the S&P 500's net market cap change this month ($1.1tn)

Rates

Reversal Of Short-Term Financial Stability Concerns Brought Front End Selloff, Bear Flattening Across US Rates

Most of the move this week can be traced to higher inflation breakevens, which simply reflects unease around the end of the hiking cycle while inflationary pressures are still very sticky

Credit

USD HY-IG Cash Spreads Over 100bp Wider In Past 3 weeks While Synthetics Do Slightly Better

The IG bond primary market reopened in the US this week with 28 Tranches for $21.05bn (2023 YTD volume $375.715bn vs 2022 YTD $430.541bn, down 12.7% YoY), while high yield issuance was nonexistent for the third straight week (2023 YTD volume $39.575bn vs 2022 YTD $38.676bn, up 2% YoY)

Equities

US Equities Rose Again This Week, Helped By A Stabilization Of Regional Financials

Despite the possible reversal of recent bearish positioning, we continue to see a challenged path ahead for US equities, with little upside to earnings and valuations