Rates

Fairly Volatile Week In US Rates, With Squeezy Moves Higher In Yields On Mostly Stronger Data

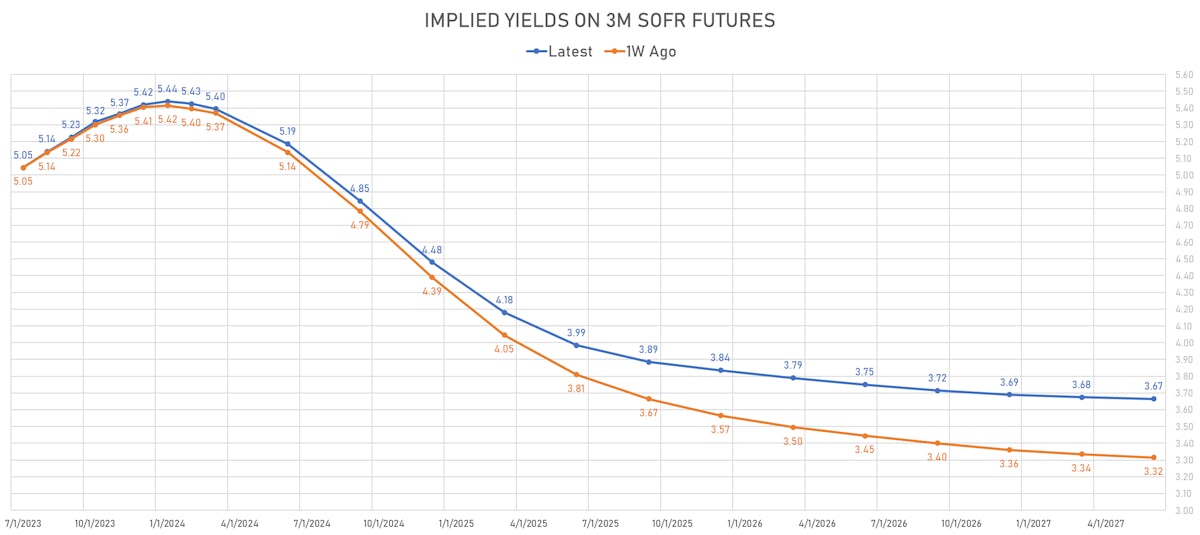

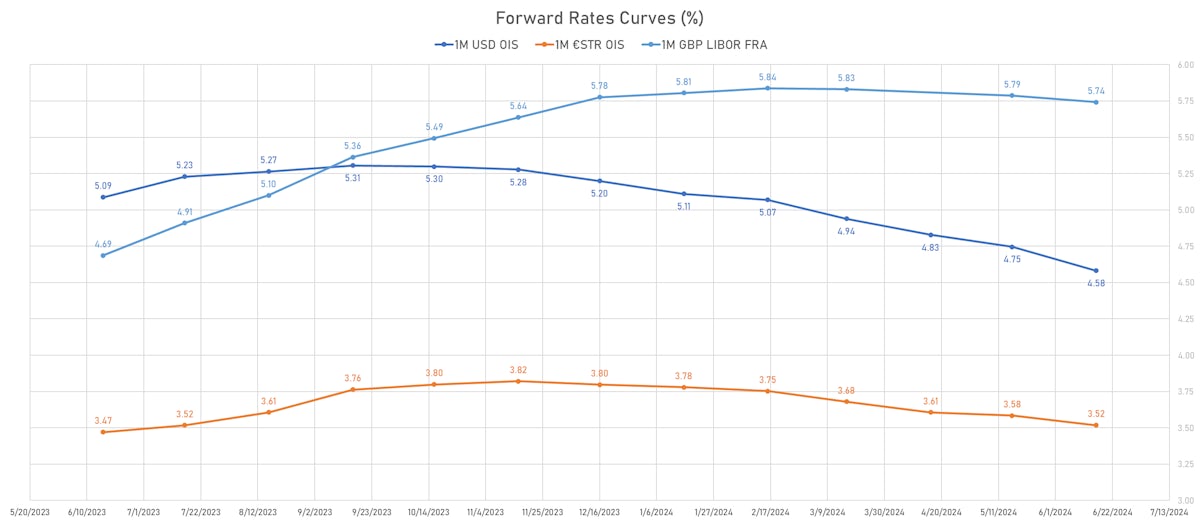

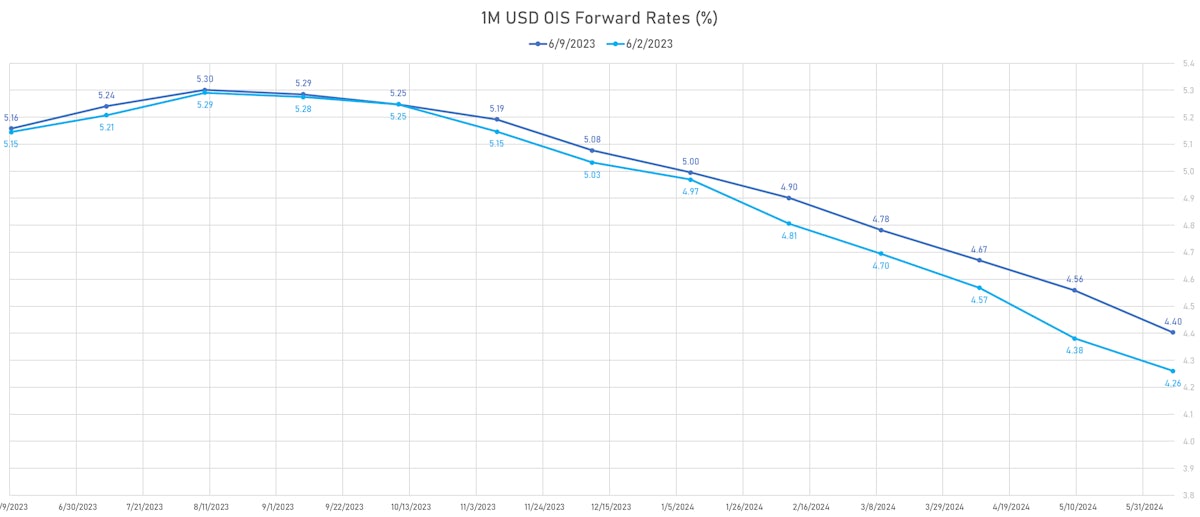

Recession pricing has been taken down, with a marked steepening in the USD forward curve: 3M SOFR 3 years forward rising by over 30bp over the week. The peak FF rate is not moving higher but the magnitude of the subsequent easing has been significantly marked down

Credit

Continued Spread Tightening Across The USD Credit Complex, As Distressed Bonds Total Returns Near 12% YTD

Pretty quiet week for USD corporate bond issuance: 13 tranches for $10.395bn in IG (2023 YTD volume $683.385bn vs 2022 YTD $716.791bn), and just 2 tranches for $895m in HY (2023 YTD volume $86.537bn vs 2022 YTD $67.366bn)

Equities

US Equities Keep Rising With Improved Breadth, Though Some Tactical Signals Point To Froth

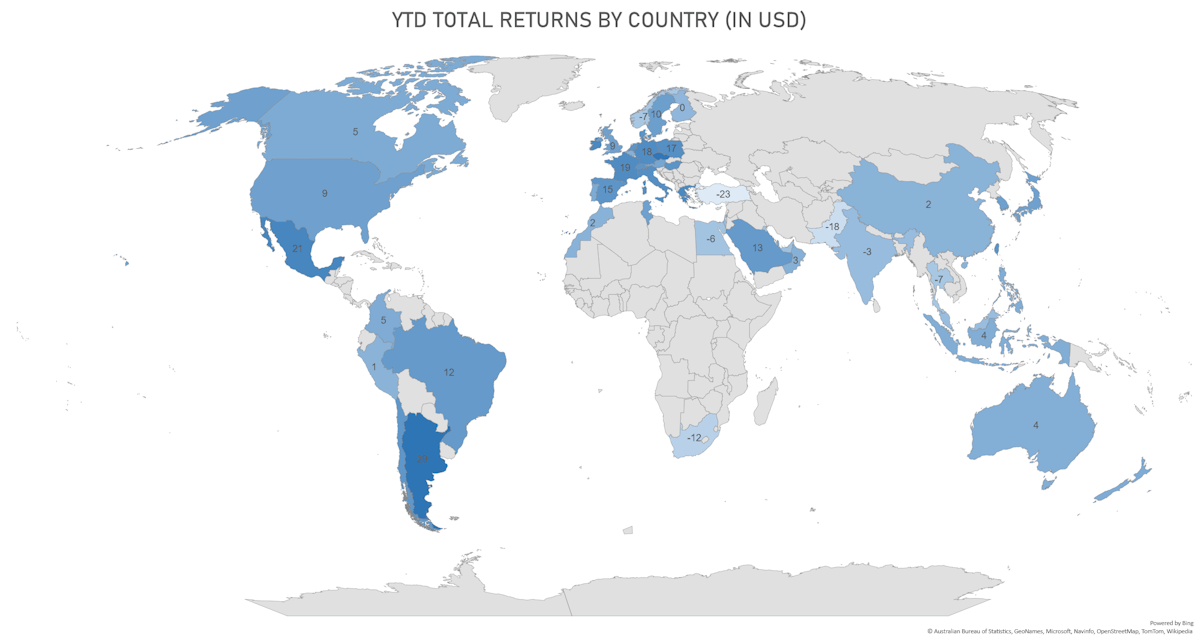

Easy to overlook after months of underperformance, Chinese equities have done well over the past week, generating US$ total returns of 4.3% (vs 2.6% for US equities)

Rates

The Fed's Current Plan Is To Hike In July, Skip September, And Announce A Pause In November

The FOMC decision on Wednesday confused the market, with the hawkish messaging largely ignored to focus on the decision not to hike in June despite strong recent data

Credit

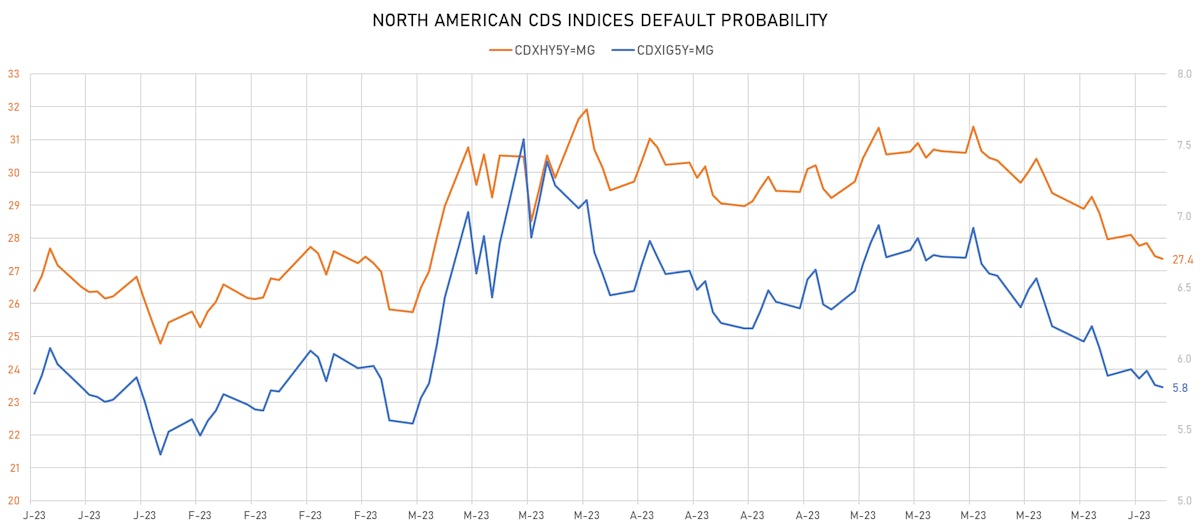

Lower Odds Of US Recession / Credit Crunch Continue To Support Spread Compression In High Yield

A good rebound in issuance volumes of US$ corporate bonds this week: 57 tranches for $48.45bn in IG (2023 YTD volume $672.99bn vs 2022 YTD $716.791bn), 4 tranches for $4.325bn in HY (2023 YTD volume $85.642.6bn vs 2022 YTD $66.071bn)

Equities

US Equities Continue To Rise, Now Led By Small Caps (up 6.7% MTD vs 2.9% for the S&P 500)

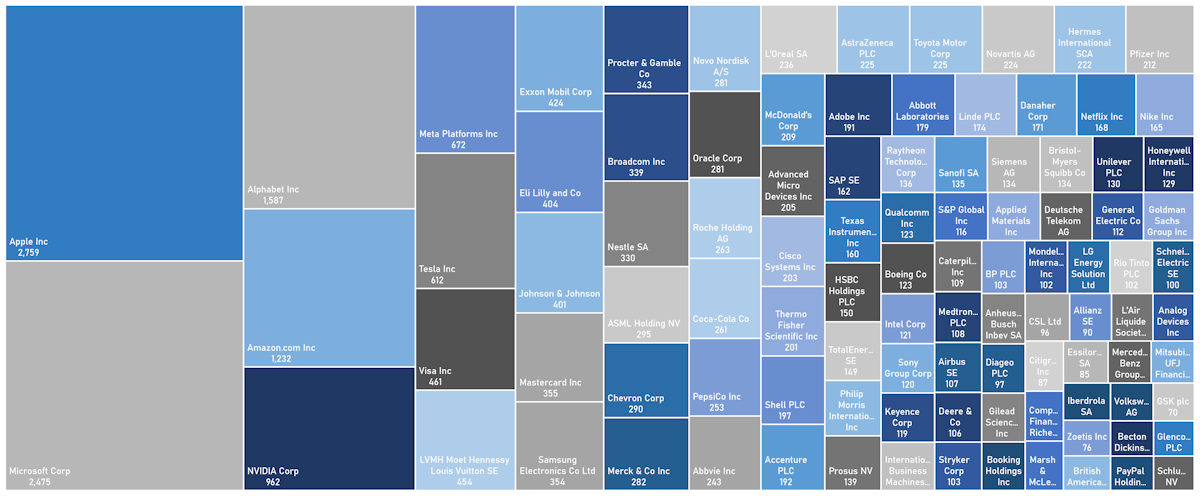

The extreme concentration of index returns around technology stocks is starting to broaden out, which should keep the rally intact for a while in the absence of a clear catalyst for a correction

Rates

The FOMC This Week Should Show A Patient Fed, Willing To Wait Until July For The Next Hike

US economic data has been consistently better than expected, and so far the credit impact from the regional financial crisis has been mininal, but Fed's leaders have expressed a desire to wait for more clarity before hiking further

Credit

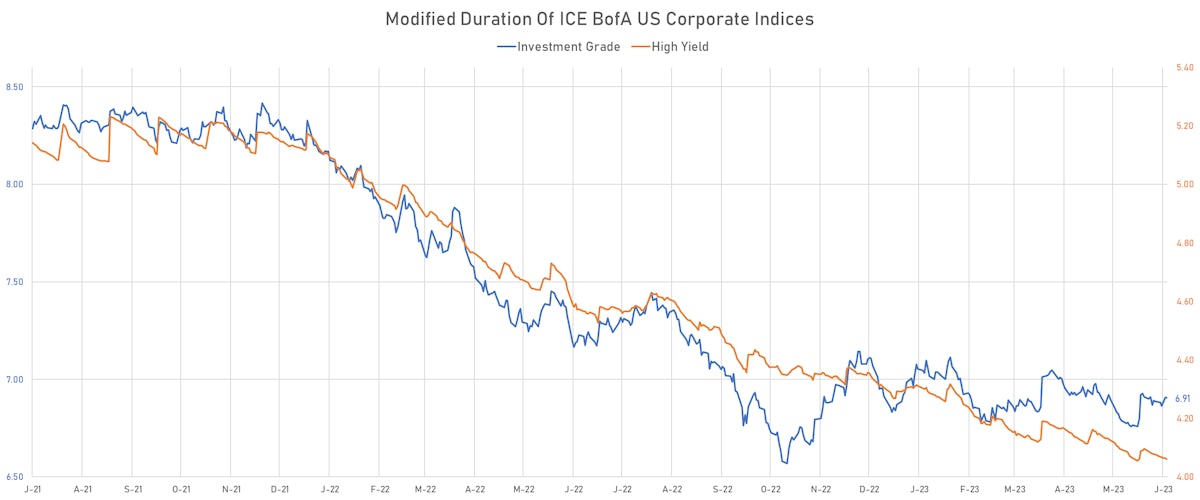

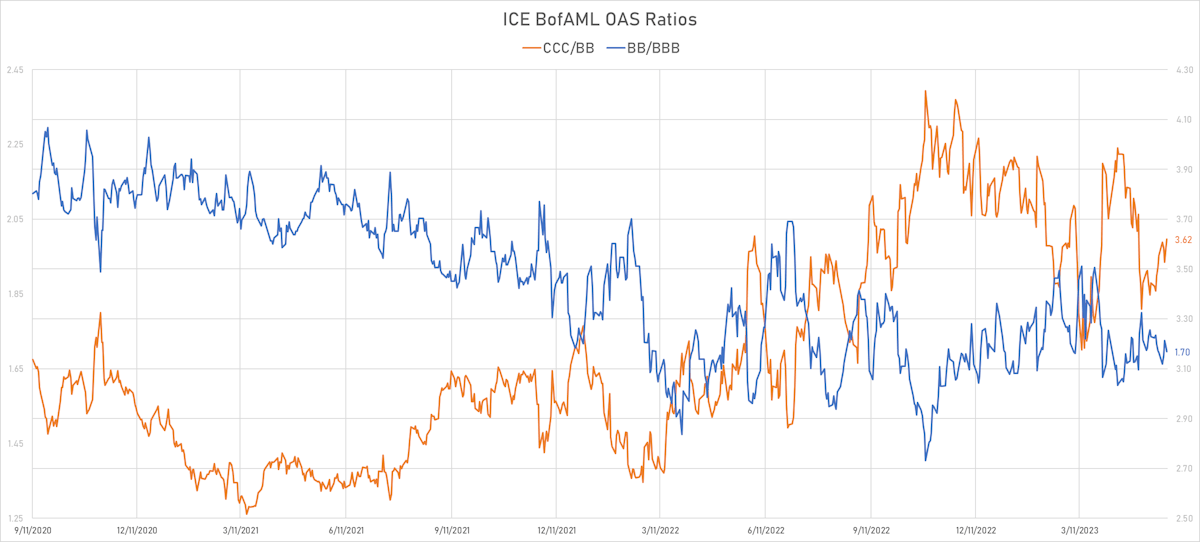

Decent Price Action In US Credit This Week Despite Duration Sell-Off, With Spreads Slightly Tighter

Modest amount of corporate bond issuance in the past week: 17 tranches for $14.45bn in IG (2023 YTD volume $610.04bn vs 2022 YTD $652.141bn), 9 tranches for $5.1bn (2023 YTD volume $80.692.6bn vs 2022 YTD $56.371bn)

Equities

US Equities Have Terrible Breadth: NDX Up 8% Month-To-Date, Equal-Weighted S&P 500 Down 3%

Active managers are still very lightly positioned, which could lead to further gains in the short term, with continued strength in economic data and a new debt ceiling deal

Rates

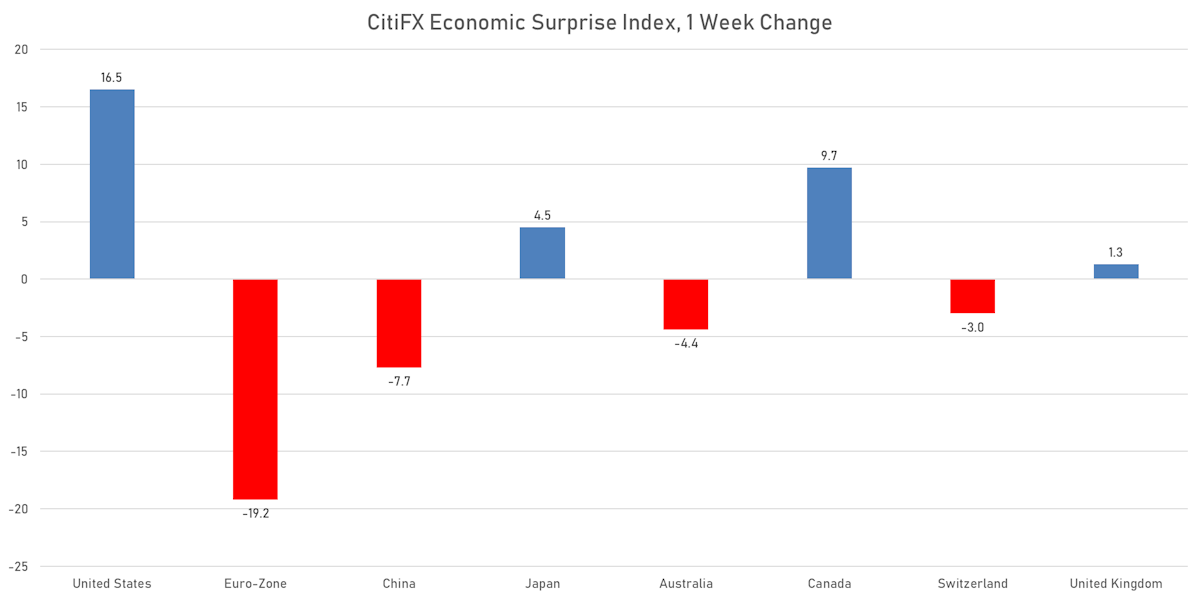

Sizable Bear Flattening Of US Yield Curve Over The Past Week, As Economic Data Surprises To The Upside

Against market expectations (based on the Fed's dovish forward guidance), the June FOMC is back in play, with about 2/3 chance of a 25bp hike now priced in

Credit

Decent Credit Spread Compression This Week, As Duration Sell-Off Hit The Complex

Solid levels of corporate bond issuance as 1Q23 earnings season ended: 51 tranches for $60.55bn in IG (2023 YTD volume $595.59bn vs 2022 YTD $651.441bn), 7 tranches for $7.48bn in HY (2023 YTD volume $75.592.6bn vs 2022 YTD $56.371bn)

Equities

US Equities Rose 160bp This Week, Still Led By Technology And Internet Services

Before falling on Friday, the S&P 500 toyed with 4,200 this week to make new YTD highs, and could break that level more convincingly in June with a debt ceiling resolution and still very light net speculative positioning