Rates

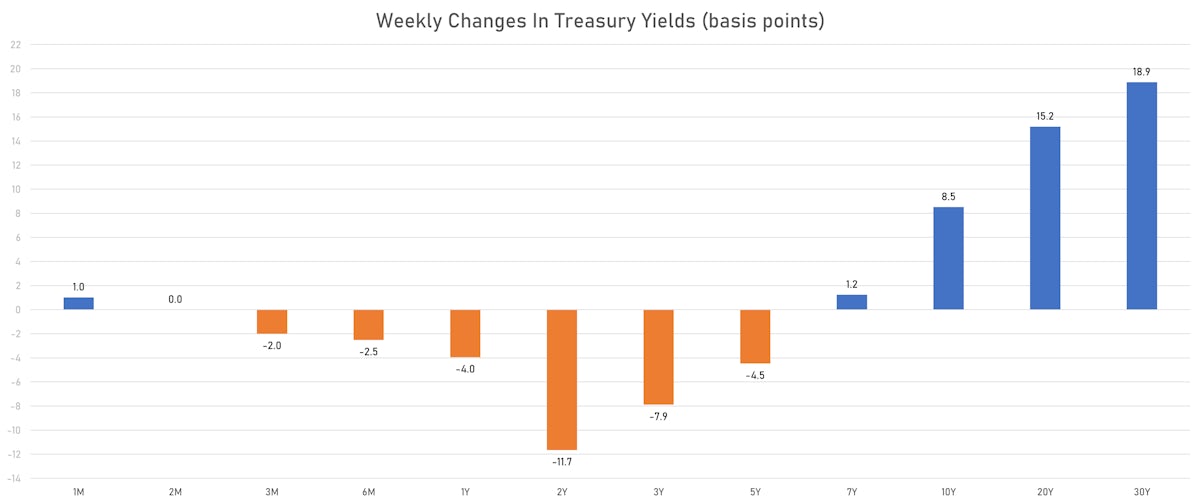

Duration Sold Off This Week, With 30Y Bond Yields Touching 4.3% For The First Time In 2023

The US economy has been able to withstand Fed hikes much better than anticipated, causing multiple investment banks to abandon their calls for a recession this year, and putting pressure on the level of the real neutral rate

Credit

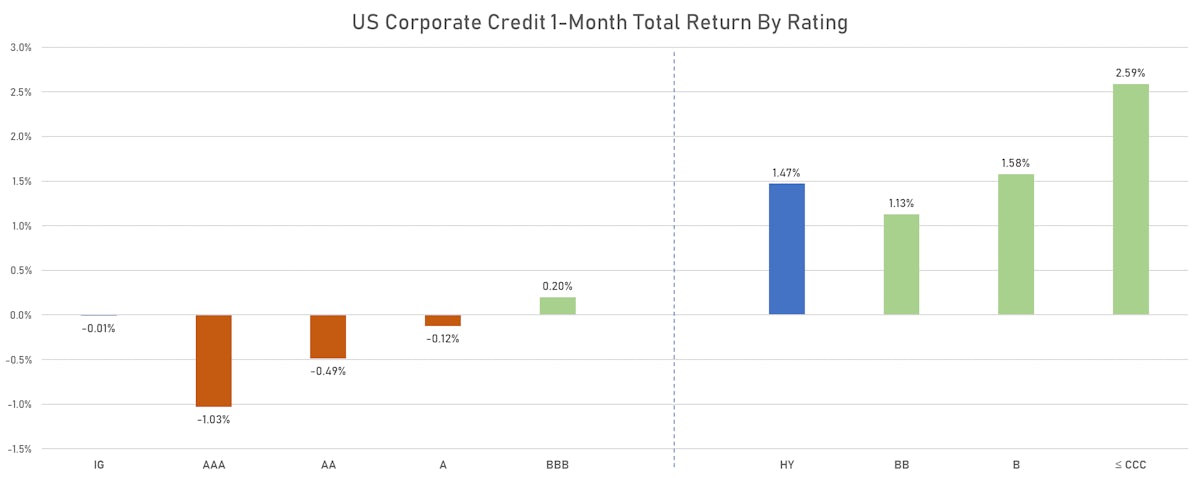

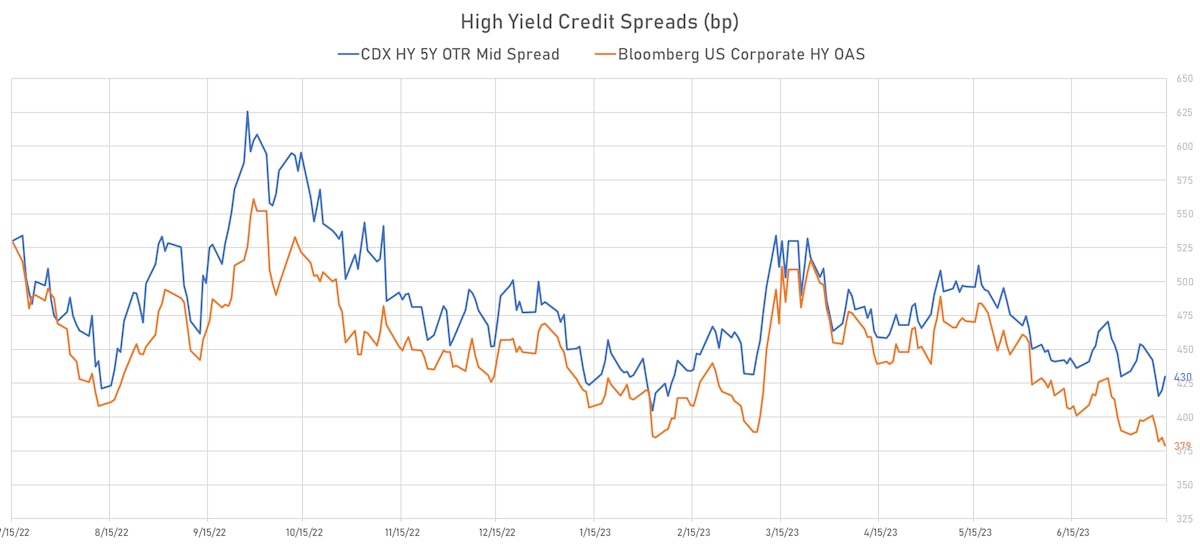

Spread Compression Across The Credit Complex, Led By The Riskiest Assets Classes

Limited supply of new corporate bonds this week: 18 tranches for $15.65bn in IG (2023 YTD volume $786.310bn vs 2022 YTD $824.091bn), 4 tranches for $2.61bn in HY (2023 YTD volume $99.952bn vs 2022 YTD $68.576bn)

Equities

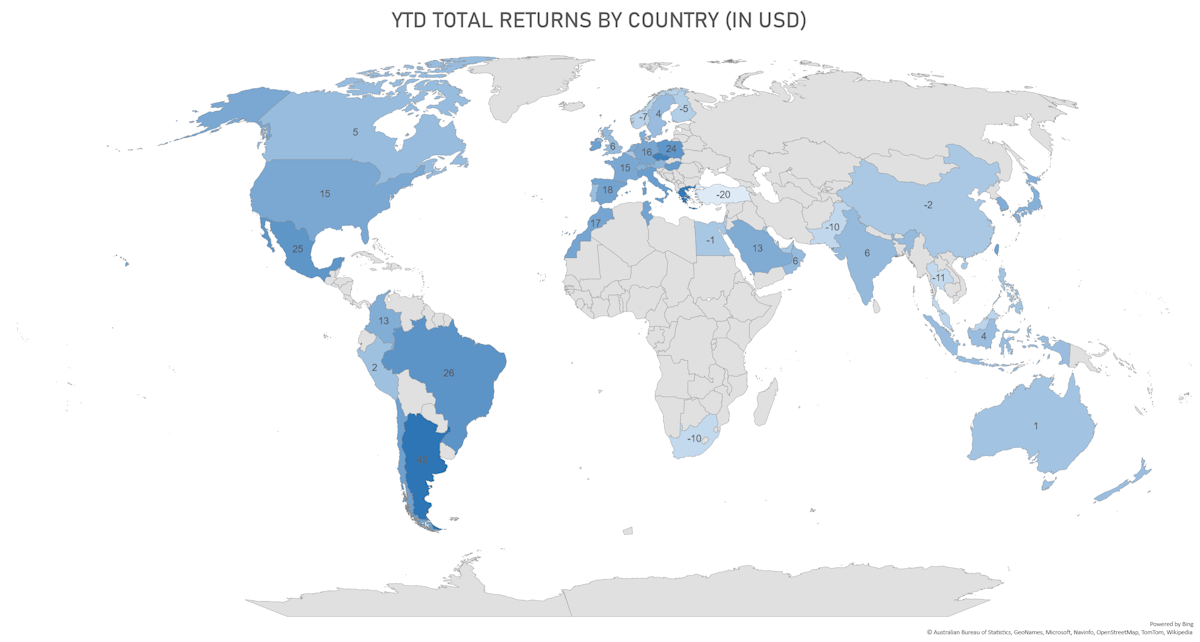

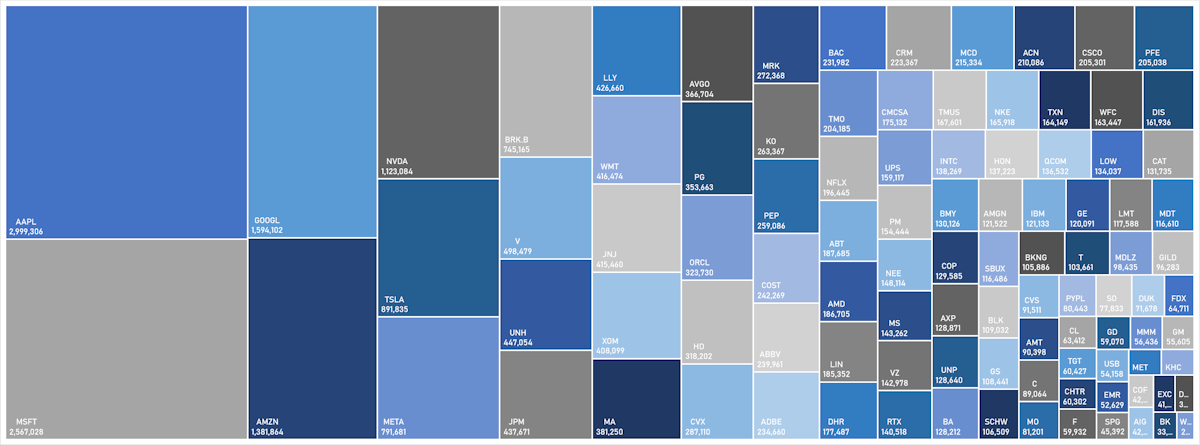

Although Momentum Remains Strong, The Performance Of US Tech Is Unlikely To Be Repeated in 2H23

At current levels, with the S&P 500 Technology sector up 46% YTD, a couple of things make sense: 1) hedging US equities with cheap gamma; 2) look for a continuation of the cycle in EM stocks that have underperformed (Chinese ADRs for example)

Rates

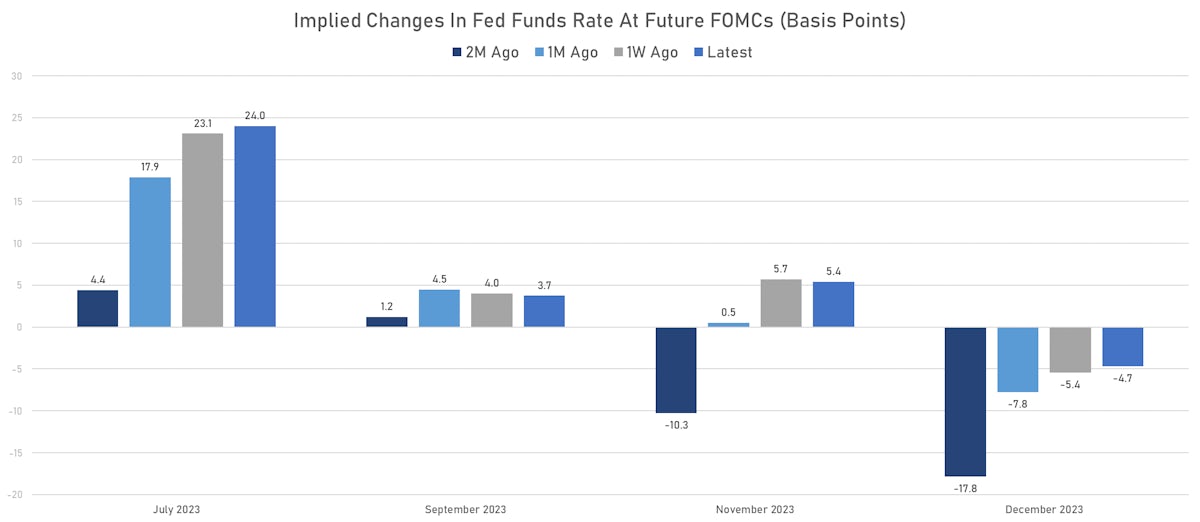

Strong US Macro Data Leads To Higher-For-Longer Shift In Forward Curve, With Fewer Cuts Priced In 2024

The low implied rates for the September and November FOMCs make sense (no clear asymmetry), as the inflation path is likely to stay favorable for the remainder of the year, putting little pressure on the Fed to tighten further

Credit

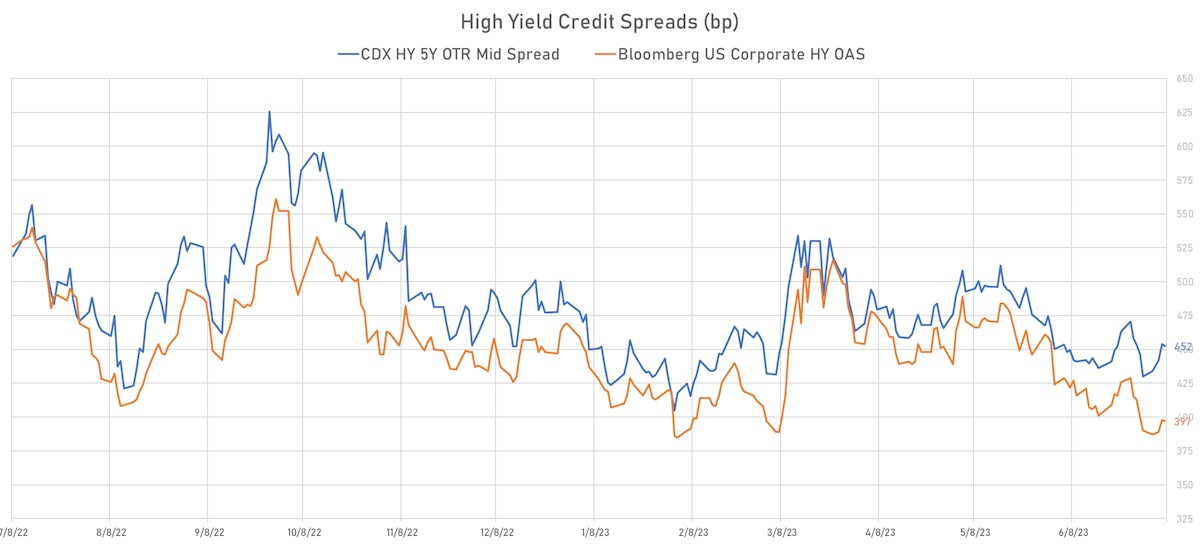

USD Credit Largely Unchanged This Week, With Slight HY-IG Spread Decompression

USD corporate bond issuance reopens with 2Q23 earnings season: 25 tranches for $30.575bn in IG this week (2023 YTD volume $770.66bn vs 2022 YTD $805.491bn, -4.3% YoY), 6 tranches for $2.835bn in HY (2023 YTD volume $97.342bn vs 2022 YTD $68.576bn, +41.9% YoY)

Equities

July Performance Unfazed Despite Mediocre Earnings So Far, Bolstered by Increase In Net Length From Fast Money Community

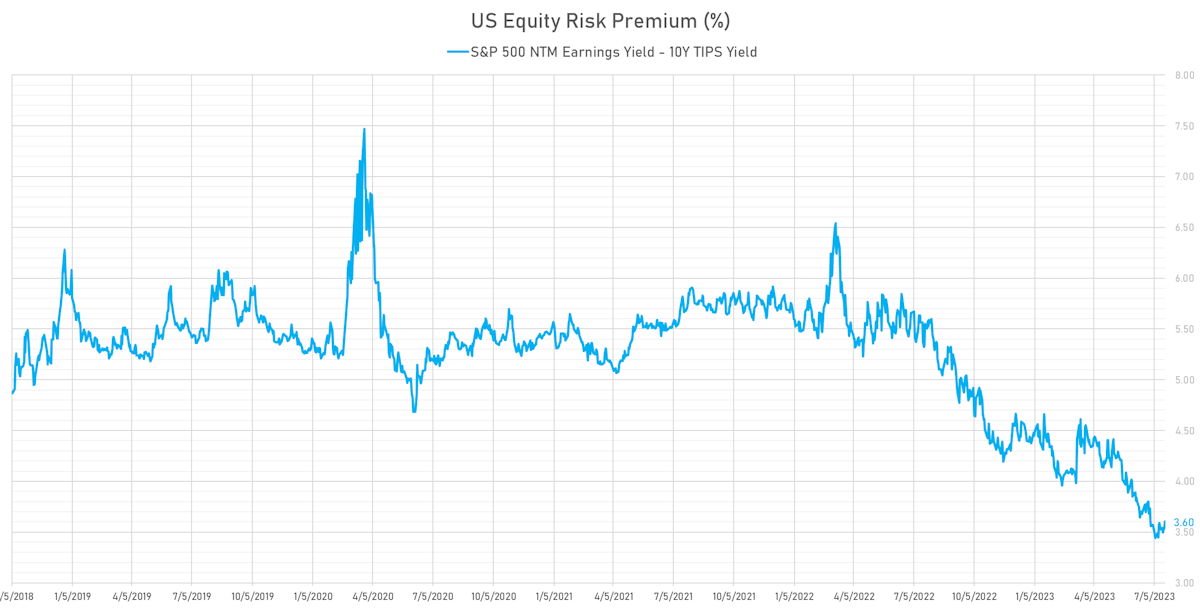

Though current levels of valuation for US equities look high, with the forward P/E on the S&P 500 close to 20, they are actually at a more reasonable 17 when you exclude the "magnificent seven" stocks (collectively trading at 32x)

Rates

Well-Telegraphed 25bp Hike Will Surprise No One, But The Fed Is Likely To Highlight Strength In US Data

In the triple whopper of monetary decisions macro markets will have to digest this week, the BoJ is probably the most interesting, as even a baby step towards ending YCC would have huge repercussions across the complex

Credit

Continued Hedging In USD HY Reflected In Wider Cash-CDX Basis And Payer-Receiver Swaptions Skew

Tepid weekly volumes for USD corporate issuance: 14 tranches for US$11.6bn in IG (2023 YTD volume US$740.085bn vs 2022 YTD US$759.641bn), 1 tranche for US$500m in HY (2023 YTD volume US$94.507bn vs 2022 YTD US$67.816bn)

Equities

Strong Performance Across US Equities As 2Q23 Earnings Season Gets Under Way

The improvement in market breadth could prove to be a headfake: if anything pulls equities higher from here, it will probably be more of the magnificent seven, rather than to a true broadening of the rally

Rates

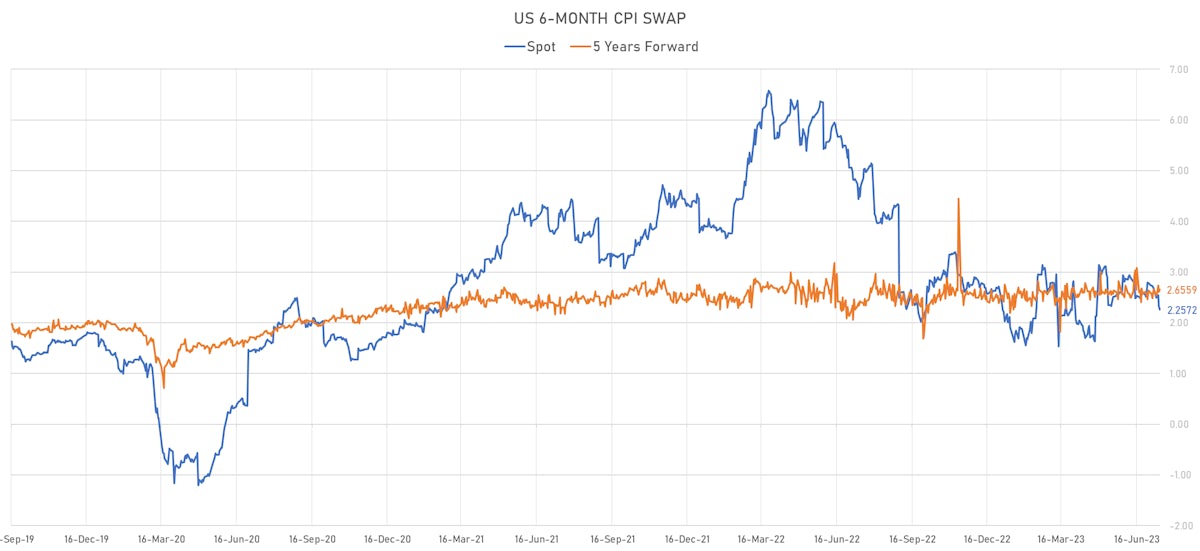

Soft CPI Surprise Pushes Down USD Forward Curves, Encourages Flows Into Carry Trades

It would be prudent for the Fed not to relax too much on the inflation front, as economic surprises have been mostly positive in the US over the past month, and it could take more efforts to win out this fight

Credit

Spreads Mixed This Week In The US Credit Complex, With Cash Outperforming Synthetics

Fairly quiet week of USD corporate bond issuance (IFR data): 17 tranches for US$12.8bn in IG (2023 YTD volume US$728bn vs 2022 YTD US$750bn), none in HY(2023 YTD volume US$94bn vs 2022 YTD US$68bn)

Equities

Risks Of Higher-For-Longer Fed Policy Took US Equities Lower For The Week After Solid Gains In June

The skew in the implied volatility of S&P 500 options is close to neutral, and the aggregated positioning of hedge funds is still prudent (very low long/short ratios) heading into earnings season, possibly setting up US stocks for further gains